false--12-31000164566600016456662024-10-282024-10-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 28, 2024 |

Kezar Life Sciences, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38542 |

47-3366145 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4000 Shoreline Court, Suite 300 |

|

South San Francisco, California |

|

94080 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 650 822-5600 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

KZR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders.

As previously reported, on June 18, 2024, Kezar Life Sciences, Inc. (the “Company”) held its annual stockholder meeting (the “Annual Meeting”) at which the Company’s stockholders approved a proposal, described in detail in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on April 26, 2024, to amend the Company’s amended and restated certificate of incorporation to effect, at the discretion of the Company's board of directors (the “Board”), a reverse stock split of the Company’s issued and outstanding common stock at a ratio in the range of one-for-two to one-for-twenty, such ratio to be determined at the discretion of the Board, and with such reverse stock split to be effected within the 12-month period following the Annual Meeting, if at all, as determined by the Board in its sole discretion. On September 23, 2024, the Board approved a reverse stock split of the Company’s common stock at a ratio of one-for-ten (the “Reverse Stock Split”).

On October 28, 2024, the Company filed with the Secretary of State of the State of Delaware a Certificate of Amendment of its Amended and Restated Certificate of Incorporation (the “Charter Amendment”) to effect the Reverse Stock Split. The Charter Amendment will become effective at 5:00 p.m. Eastern Time on October 29, 2024 (the “Effective Time”). The Charter Amendment provides that, at the Effective Time, every ten shares of the Company’s issued and outstanding common stock will automatically be combined into one issued and outstanding share of common stock. There will be no change in total number of shares of common stock authorized for issuance by the Company, nor a change in par value per share. No fractional shares will be issued as a result of the Reverse Stock Split. Instead, stockholders who would otherwise be entitled to receive a fractional share will be entitled to the rounding up of the fractional share to the nearest whole share. The Reverse Stock Split is primarily intended to bring the Company into compliance with the minimum bid price requirement necessary to maintain its listing on The Nasdaq Capital Market.

As a result of the Reverse Stock Split, proportional adjustments will also be made to the per-share exercise price and the number of shares issuable upon the exercise or vesting of all Company stock options issued and outstanding immediately prior to the Effective Time, which will result in (i) a proportionate decrease in the number of shares of the Company’s common stock reserved for issuance upon exercise or vesting of such stock options, (ii) a proportionate increase in the exercise price of all such stock options, and (iii) a proportionate decrease in the number of shares authorized for future grant under the Company’s equity incentive and compensation plans immediately prior to the Effective Time.

In addition, as a result of the Reverse Stock Split, proportional adjustments will be made to the rights (the “Rights”) that were declared as a dividend on the shares of the Company’s issued and outstanding common stock at the close of business on October 28, 2024, which will result in (i) a proportionate increase in the number of one-thousandths of one share of the Company’s Series A Junior Participating Preferred Stock that may be purchased on the exercise of each Right and (ii) a proportionate increase in the exercise price of each Right. For additional information on the Rights, see the Current Report on Form 8-K filed by the Company with the Securities Exchange Commission on October 17, 2024 and the amendment to the registration statement on Form 8-A that will be filed by the Company with the Securities Exchange Commission on October 29, 2024.

The Company’s common stock is expected to begin trading on the Nasdaq Capital Market on a split-adjusted basis when the market opens on October 30, 2024. The new CUSIP number for the Company’s common stock following the Reverse Stock Split will be 49372L 209. No change will be made to the trading symbol for the common stock, “KZR,” in connection with the Reverse Stock Split.

The foregoing summary of the Charter Amendment is qualified in its entirety by reference to the Charter Amendment, which is attached to this Current Report on Form 8-K as Exhibit 3.1 and is incorporated herein by reference. On October 28, 2024, the Company issued a press release announcing the Reverse Stock Split. A copy of the press release is filed herewith as Exhibit 99.1 hereto.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information set forth in Item 3.03 of this Current Report on Form 8-K is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

KEZAR LIFE SCIENCES, INC. |

|

|

|

|

Date: |

October 28, 2024 |

By: |

/s/ Marc L. Belsky |

|

|

|

Marc L. Belsky

Chief Financial Officer and Secretary |

CERTIFICATE OF AMENDMENT TO THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF KEZAR LIFE SCIENCES, INC.

Kezar Life Sciences, Inc., a corporation organized and existing under the General Corporation Law of the State of Delaware, does hereby certify as follows:

First: The name of the Corporation is Kezar Life Sciences, Inc.

Second: The date of filing the original Certificate of Incorporation of the Corporation with the Secretary of State of the State of Delaware was February 19, 2015.

Third: The Board of Directors of the Corporation, acting in accordance with the provisions of Sections 141 and 242 of the General Corporation Law of the State of Delaware, adopted resolutions amending its Amended and Restated Certificate of Incorporation as follows:

The first paragraph of Article IV is hereby deleted in its entirety and replaced as follows:

“A. The Corporation is authorized to issue two classes of stock to be designated, respectively, “Common Stock” and “Preferred Stock.” The total number of shares which the Corporation is authorized to issue is two hundred sixty million (260,000,000) shares. Two hundred fifty million (250,000,000) shares shall be Common Stock, each having a par value of one-tenth of one cent ($0.001) and ten million (10,000,000) shares shall be Preferred Stock, each having a par value of one-tenth of one cent ($0.001).

Effective as of the effective time of 5:00 p.m., Eastern Time, on October 29, 2024 (the “Effective Time”), each ten (10) shares of Common Stock issued and outstanding immediately prior to the Effective Time shall, automatically and without any action on the part of the Company or the respective holders thereof, be combined into one (1) share of Common Stock without increasing or decreasing the par value of each share of Common Stock (the “Reverse Stock Split”); provided, however, no fractional shares of Common Stock shall be issued as a result of the Reverse Stock Split and, in lieu thereof, at the Effective Time, any stockholder who would otherwise be entitled to a fractional share of post-Reverse Stock Split Common Stock as a result of the Reverse Stock Split, following the Effective Time (after taking into account all fractional shares of post-Reverse Stock Split Common Stock otherwise issuable to such stockholder), shall be entitled to one full share of post-Reverse Stock Split Common Stock for such fractional share of Common Stock. The Reverse Stock Split shall be effected on a record holder-by-record holder basis, such that any fractional shares of post-Reverse Stock Split Common Stock resulting from the Reverse Stock Split and held by a single record holder shall be aggregated.”

Fourth: The foregoing amendment was submitted to the stockholders of the Corporation for their approval, and was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

[Signature Page Follows]

In Witness Whereof, Kezar Life Sciences, Inc. has caused this Certificate of Amendment to be signed by its Chief Executive Officer on this 28th day of October, 2024.

KEZAR LIFE SCIENCES, INC.

By: /s/Christopher Kirk

Christopher Kirk, Ph.D.

Chief Executive Officer

Kezar Life Sciences Announces 1-for-10 Reverse Stock Split

SOUTH SAN FRANCISCO, Calif., Oct. 28, 2024 – Kezar Life Sciences, Inc. (Nasdaq: KZR), a clinical-stage biotechnology company developing novel small molecule therapeutics to treat unmet needs in immune-mediated diseases, today announced that it will conduct a reverse stock split of its outstanding shares of common stock at a ratio of one-for-ten (the “Reverse Stock Split”). The Reverse Stock Split will become effective at 5:00 p.m. Eastern Time on October 29, 2024 (the “Effective Time”). The Company's common stock will begin trading on a post-split basis at the market open on October 30, 2024. The Reverse Stock Split is part of the Company's plan to regain compliance with the minimum bid price requirement of $1.00 per share required to maintain continued listing on The Nasdaq Capital Market, among other benefits.

The Reverse Stock Split was approved by the Company's stockholders at the Company's Annual Meeting of Stockholders held on June 18, 2024 (the “Annual Meeting”) to be effected at the Board's discretion within approved parameters. Following the Annual Meeting, the final ratio was approved by the Company's Board on September 23, 2024.

The Reverse Stock Split reduces the number of shares of the Company's outstanding common stock from 72,962,220 shares to 7,296,222 shares, subject to adjustment due to the issuance of full shares in lieu of fractional shares. As a result of the Reverse Stock Split, proportionate adjustments will be made to the number of shares of the Company's common stock underlying the Company's outstanding equity awards and the number of shares issuable under the Company's equity incentive plans and other existing agreements, as well as the exercise or conversion price, as applicable. There will be no change to the number of authorized shares or the par value per share.

Information for KZR Stockholders

As a result of the reverse stock split, every ten pre-split shares of common stock outstanding will become one share of common stock. The Company's transfer agent, Computershare Trust Company, N.A., will serve as the exchange agent for the reverse stock split.

Stockholders of record holding pre-split shares of the Company's common stock electronically in book-entry form are not required to take any action to receive post-split shares. Those stockholders who hold their shares in brokerage accounts or in "street name" will have their positions automatically adjusted to reflect the reverse stock split, subject to each broker's particular processes, and will not be required to take any action in connection with the reverse stock split.

No fractional shares will be issued as a result of the reverse stock split. Stockholders of record who would otherwise be entitled to receive a fractional share will be entitled to the rounding up of the fractional share to the nearest whole number.

About Kezar Life Sciences

Kezar Life Sciences is a clinical-stage biopharmaceutical company developing novel small molecule therapeutics to treat unmet needs in immune-mediated diseases. For more information, visit www.kezarlifesciences.com, and follow us on LinkedIn, Facebook, Twitter and Instagram.

Investor and Media Contact:

Gitanjali Jain

Senior Vice President, Investor Relations and External Affairs

Kezar Life Sciences, Inc.

gjain@kezarbio.com

v3.24.3

Document And Entity Information

|

Oct. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--12-31

|

| Document Period End Date |

Oct. 28, 2024

|

| Entity Registrant Name |

Kezar Life Sciences, Inc.

|

| Entity Central Index Key |

0001645666

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38542

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

47-3366145

|

| Entity Address, Address Line One |

4000 Shoreline Court, Suite 300

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

650

|

| Local Phone Number |

822-5600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

KZR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

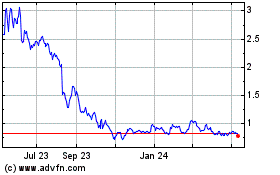

Kezar Life Sciences (NASDAQ:KZR)

Historical Stock Chart

From Dec 2024 to Jan 2025

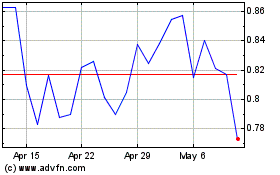

Kezar Life Sciences (NASDAQ:KZR)

Historical Stock Chart

From Jan 2024 to Jan 2025