0001612630

false

0001612630

2023-09-06

2023-09-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): September 6, 2023

The Joint Corp.

(Exact name of registrant as specified in its charter)

| Delaware |

001-36724 |

90-0544160 |

| (State or other jurisdiction of incorporation |

(Commission file number) |

(IRS employer identification number) |

16767 N. Perimeter Drive, Suite 110

Scottsdale, AZ 85260

(Address of principal executive offices)

Registrant’s telephone number, including area code:

(480) 245-5960

Check the appropriate box below if the Form 8-K is intended to simultaneously

satisfy the filing obligations of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock,

$0.001 Par Value Per Share |

JYNT |

The NASDAQ Capital Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule

405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ☐

Item 2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or

an Obligation under an Off-Balance Sheet Arrangement.

On September 8, 2023, JP Morgan Chase waived, on a one-time only basis, a

default that has occurred under the Credit Agreement, dated February 28, 2020 between The Joint Corp. (the “Company”) as borrower,

and JPMorgan Chase Bank, N.A., individually, and as Administrative Agent and Issuing Bank (“JPMorgan Chase”), as amended on

February 28, 2022 (the “Credit Agreement”). The default occurred as of the close of business on September 6, 2023. The default

resulted from the Company’s inability to deliver in a timely manner the financial statements in its Quarterly Report on Form 10-Q

for the quarter ended June 30, 2023 (the “2023 Q2 10-Q”). As previously reported in the Company’s Current Report on

Form 8-K filed with the SEC on September 6, 2023, the Company’s inability to produce and file its 2023 Q2 10-Q in a timely manner

(which filing constitutes delivery to JP Morgan Chase of the Company’s financial statements) was the result of the discovery of

errors in the US GAAP accounting treatment for re-acquired regional developer rights and for transfer pricing for its variable interest

entities. JP Morgan Chase waived this default until September 30, 2023. A failure to deliver the 2023 Q2 10-Q on or before September 30,

2023, will constitute an immediate default.

Under the Credit Agreement, the Company’s senior secured revolving

line of credit (the “Revolver”) is $20,000,000, the portion of the Revolver available for letters of credit is $5,000,000

and the uncommitted additional line of credit is $30,000,000 (collectively, the “2022 Credit Facilities”). All outstanding

principal and interest on the 2022 Credit Facilities are due and payable on February 28, 2027. The Company currently has an outstanding

principal balance of $2 million under the Revolver, plus accrued interest of $36,150 as of September 6, 2023. The loans are secured by

all assets of the Company.

Upon the Company’s default (absent the waiver of the default), JP Morgan

Chase may, and at the request of the Required Lenders (as that term is defined in the Credit Agreement) shall, terminate the lenders’

commitments and/or declare the loans then outstanding to be due and payable in whole or in part. Additionally, JP Morgan Chase may,

and at the request of the Required Lenders shall, increase the rate of interest applicable to the outstanding loans and other obligations

by 2% and exercise any rights and remedies provided to JP Morgan Chase, including all remedies provided under the UCC.

As of August 31, 2023, the Company has approximately $14.8 million dollars

of unrestricted cash, including the $2 million borrowed under the Credit Agreement. The Company has not breached any covenant (including

its financial covenants), other than the covenant to timely provide its quarterly financial statement.

The Company has no material obligations that may arise, increase, be accelerated

or become direct financial obligations as a result of the default under the Credit Agreement described herein or the resulting acceleration

of the outstanding loans or increase in interest rates should they occur at a later date, other than as described above.

Forward-Looking Statements

This Periodic Report on Form 8-K contains statements about future events

and expectations that constitute forward-looking statements. Forward-looking statements, including expectations about the timing of the

completion and filing of the Form 10-Q for the period ended June 30, 2023 and the provision of the financial statements therein to JP

Morgan Chase, are based on our beliefs, assumptions and expectations of industry trends, our future financial and operating performance

and our growth plans, taking into account the information currently available to us. These statements are not statements of historical

fact. Forward-looking statements involve risks and uncertainties that may cause our actual results to differ materially from the expectations

of future results we express or imply in any forward-looking statements, and you should not place undue reliance on such statements. Factors

that could contribute to these differences include, but are not limited to; increases in our borrowing costs under our credit facility,

given that borrowings under the credit facility bear interest at rates tied to certain rising benchmark interest rates; state laws limiting

the use our business model, including prohibitions on advance payment for chiropractic services, which recently caused us to elect not

to offer franchises in South Dakota and Wyoming; increased costs to comply with a new SEC reporting rule enhancing and standardizing disclosures

regarding cybersecurity incidents and cybersecurity risk management, the factors described in our filings with the SEC, including in the

section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC

on March 10, 2023 and subsequently-filed current and quarterly reports. Words such as, "anticipates," "believes,"

"continues," "estimates," "expects," "goal," "objectives," "intends," "may,"

"opportunity," "plans," "potential," "near-term," "long-term," "projections,"

"assumptions," "projects," "guidance," "forecasts," "outlook," "target," "trends,"

"should," "could," "would," "will," and similar expressions are intended to identify such forward-looking

statements. We qualify any forward-looking statements entirely by these cautionary factors. We assume no obligation to update or revise

any forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in

these forward-looking statements, even if new information becomes available in the future. Comparisons of results for current and any

prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should

only be viewed as historical data.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 12, 2023.

| |

The Joint Corp. |

| |

|

|

| |

By |

/s/ Peter D. Holt |

| |

|

Peter D. Holt |

| |

|

President and Chief Executive Officer |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

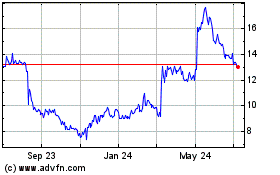

Joint (NASDAQ:JYNT)

Historical Stock Chart

From Apr 2024 to May 2024

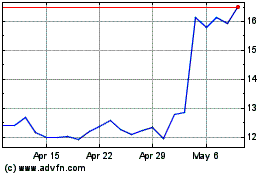

Joint (NASDAQ:JYNT)

Historical Stock Chart

From May 2023 to May 2024