JAKKS Pacific, Inc. (NASDAQ: JAKK) today reported financial results

for the third quarter and nine months ended September 30, 2024.

Third Quarter 2024 Overview

- Net sales were $321.6 million, a

year-over-year increase of 4%

- Toys/Consumer Products net sales

were $264.3 million, a year-over-year increase of 7%

- Toys/Consumer Products net sales

year-to-date are $451.8 million, a year-over-year decrease of

2%

- Costumes net sales were $57.3

million, a year-over-year decrease of 10%

- Costumes net sales year-to-date are

$108.5 million, a year-over-year decrease of 11%

- Gross margin of 33.8%, down 70

basis points vs. Q3 2023

- Gross profit of $108.8 million, up

2% compared to $107.0 million in Q3 2023

- Year-to-date gross profit of $177.5

million, down 6% compared to $189.6 million in the comparable

period in 2023

- Operating income of $68.1 million

(21.2% of net sales) in Q3 2024 vs. $62.4 million (20.1% of net

sales) in Q3 2023

- Net income attributable to common

stockholders of $52.3 million or $4.64 per diluted share, compared

to net income attributable to common stockholders of $47.8 million

or $4.53 per diluted share in Q3 2023

- Adjusted net income attributable to

common stockholders (a non-GAAP measure) of $54.0 million or $4.79

per diluted share, compared to adjusted net income attributable to

common stockholders of $50.1 million or $4.75 per diluted share in

Q3 2023

- Adjusted EBITDA (a non-GAAP

measure) of $74.4 million vs. $67.1 million in Q3 2023

- Trailing twelve month Adjusted

EBITDA of $58.5 million (8.5% of trailing twelve months net sales)

down from $74.5 million (10.4% of net sales) in the trailing twelve

months ended September 2023.

Management Commentary“We’re

pleased to share the results of a very strong third quarter. For

many years, our largest shipping quarter has been the third driven

by our focus on the FOB selling model. This year is no exception,

with the US business having its biggest shipping quarter in ten

years. The yearly plan is on track to reach its goals. With some

difficult first-half revenue comparisons behind us, total company

sales increased 4% year-over-year in the quarter. Our gross margins

remained strong at 33.8%, and our overhead-related cost growth

slowed to deliver quarterly operating margin of 21.2%, a slight

improvement over last year. Each of our Toys/Consumer Products

divisions delivered sales growth in the quarter. Dolls, Role

Play/Dress-Up was up 5.5% to $146.9 million, Action Play &

Collectibles was up 5.4% to $98.8 million and Outdoor/Seasonal Toys

was up 42.4% to $18.7 million.

“Our Costumes business, as anticipated, reflected softness due

to customers recalibrating to lower Halloween consumer demand for

costumes versus prior year. Globally, Costumes were down 10.1% in

the quarter and 11.3% year-to-date.

We are encouraged by some of the early consumer reactions to our

new Fall 2024 products. We are now confident about finishing out

this year as planned while building on retail momentum to deliver a

robust 2025.”

Additional Third Quarter and Year-to-Date 2024

HighlightsThe Toys/Consumer Products segment sales were up

7% globally (6.4% North America; 11.5% International) and sales of

Disguise costumes were down 10% compared to last year (-11.6% North

America; 6.5% International).

Year-to-date adjusted net income attributable to common

stockholders (a non-GAAP measure) was $50.0 million ($4.50 per

diluted share), compared to $59.4 million ($5.66 per diluted share)

in the first nine months of 2023.

Year-to-date adjusted EBITDA of $69.4 million (12.4% of net

sales) declined from $86.6 million (14.8% of net sales) in the

comparable 2023 period.

Balance Sheet HighlightsThe

Company’s cash and cash equivalents (including restricted cash)

totaled $22.3 million as of September 30, 2024 compared to $96.4

million as of September 30, 2023, and $72.6 million as of December

31, 2023.

Inventory was $63.5 million, compared to $68.8 million as of

September 30, 2023 and $52.6 million as of December 31, 2023.

Use of Non-GAAP Financial Information and Reconciliation

of GAAP to Non-GAAP measures:In addition to the

preliminary results reported in accordance with U.S. GAAP included

in this release, the Company has provided certain non-GAAP

financial information including Adjusted EBITDA and Adjusted Net

Income (Loss) that exclude various items that are detailed in the

financial tables and accompanying footnotes reconciling GAAP to

non-GAAP results contained in this release. The non-GAAP financial

measures included in the press release are reconciled to the

corresponding GAAP financial measures below, as required under the

rules of the Securities and Exchange Commission regarding the use

of non-GAAP financial measures.

We define Adjusted EBITDA as income (loss) from operations

before depreciation, amortization and adjusted for certain

non-recurring and non-cash charges, such as reorganization expenses

and restricted stock compensation expense. Net income (loss) is

similarly adjusted and tax-effected to arrive at Adjusted Net

Income (Loss). Adjusted EBITDA and Adjusted Net Income (Loss) are

not recognized financial measures under GAAP, but we believe that

they are useful in measuring our operating performance, enhance an

overall understanding of the Company’s past financial performance,

and provides useful information to the investor by comparing our

performance across reporting periods on a consistent basis.

Investors should not consider these measures in isolation or as a

substitute for net income, operating income, or any other measure

for determining the Company’s operating performance that is

calculated in accordance with GAAP. In addition, because these

measures are not calculated in accordance with GAAP, they may not

necessarily be comparable to similarly titled measures employed by

other companies.

The non-GAAP financial measures included in the press release

are reconciled to the corresponding GAAP financial measures below,

as required under the rules of the Securities and Exchange

Commission regarding the use of non-GAAP financial measures. See

“Use of Non-GAAP Financial Information” for additional disclosures

with respect to the use of non-GAAP financial information.

Conference Call Live WebcastJAKKS Pacific,

Inc. invites analysts, investors and media to listen to the

teleconference scheduled for 5:00 p.m. ET / 2:00

p.m. PT on October 30, 2024. A live webcast of the call

will be available on the “Investor Relations” page of the Company’s

website at www.jakks.com/investors. To access the call by phone,

please go to this link (3Q24 Registration link), and you will be

provided with dial-in details. To avoid delays, we encourage

participants to dial into the conference call fifteen minutes ahead

of the scheduled start time. A replay of the webcast will also be

available for a limited time at (www.jakks.com/investors).

About JAKKS Pacific, Inc.JAKKS Pacific, Inc. is

a leading designer, manufacturer and marketer of toys and consumer

products sold throughout the world, with its headquarters in Santa

Monica, California. JAKKS Pacific’s popular proprietary brands

include: AirTitans®, Disguise®, Fly Wheels®, JAKKS Wild Games®,

Moose Mountain®, Maui®, Perfectly Cute®, ReDo® Skateboard Co., Sky

Ball®, SportsZone™, Xtreme Power Dozer®, WeeeDo®, and Wild Manes™

as well as a wide range of entertainment-inspired products

featuring premier licensed properties. Through our products and our

charitable donations, JAKKS is helping to make a positive impact on

the lives of children. Visit us at www.jakks.com and follow us on

Instagram (@jakkspacific.toys), Twitter (@jakkstoys) and Facebook

(@jakkspacific.toys).

Forward Looking StatementsThis press release

may contain “forward-looking statements” (within the meaning of the

Private Securities Litigation Reform Act of 1995) that are based on

current expectations, estimates and projections about JAKKS

Pacific's business based partly on assumptions made by its

management. These statements are not guarantees of future

performance and involve risks, uncertainties and assumptions that

are difficult to predict. Therefore, actual outcomes and results

may differ materially from what is expressed or forecasted in such

statements due to numerous factors, including, but not limited to,

those described above, changes in demand for JAKKS Pacific's

products, product mix, the timing of customer orders and

deliveries, the impact of competitive products and pricing, or that

the Recapitalization transaction or any future transactions will

result in future growth or success of JAKKS. The “forward-looking

statements” contained herein speak only as of the date on which

they are made, and JAKKS undertakes no obligation to update any of

them to reflect events or circumstances after the date of this

release.

| CONTACT: |

| JAKKS Pacific Investor

Relations |

| (424) 268-9567 Lucas

Nataliniinvestors@jakks.net |

| JAKKS

Pacific, Inc. and Subsidiaries |

|

|

| Condensed

Consolidated Balance Sheets (Unaudited) |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

September 30, |

|

December 31, |

|

| |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

|

| |

|

|

|

|

(In thousands) |

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

| |

Cash and cash equivalents |

|

$ |

22,070 |

|

|

$ |

96,252 |

|

|

$ |

72,350 |

|

|

|

|

| |

Restricted cash |

|

|

214 |

|

|

|

195 |

|

|

|

204 |

|

|

|

|

| |

Accounts receivable, net |

|

|

290,424 |

|

|

|

206,751 |

|

|

|

123,797 |

|

|

|

|

| |

Inventory |

|

|

63,509 |

|

|

|

68,832 |

|

|

|

52,647 |

|

|

|

|

| |

Prepaid expenses and other assets |

|

|

8,082 |

|

|

|

6,721 |

|

|

|

6,374 |

|

|

|

|

| |

|

Total current assets |

|

|

384,299 |

|

|

|

378,751 |

|

|

|

255,372 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment |

|

|

144,072 |

|

|

|

135,821 |

|

|

|

135,956 |

|

|

|

|

|

Less accumulated depreciation and amortization |

|

|

128,947 |

|

|

|

121,193 |

|

|

|

121,357 |

|

|

|

|

| |

Property and equipment, net |

|

|

15,125 |

|

|

|

14,628 |

|

|

|

14,599 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating lease right-of-use assets, net |

|

|

19,242 |

|

|

|

25,743 |

|

|

|

23,592 |

|

|

|

|

|

Deferred income tax assets, net |

|

|

68,187 |

|

|

|

57,856 |

|

|

|

68,143 |

|

|

|

|

|

Goodwill |

|

|

35,102 |

|

|

|

35,083 |

|

|

|

35,083 |

|

|

|

|

|

Other long-term assets |

|

|

1,923 |

|

|

|

2,220 |

|

|

|

2,162 |

|

|

|

|

| |

|

Total assets |

|

$ |

523,878 |

|

|

$ |

514,281 |

|

|

$ |

398,951 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities,

Preferred Stock and Stockholders' Equity |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

| |

Accounts payable |

|

$ |

98,928 |

|

|

$ |

94,409 |

|

|

$ |

42,177 |

|

|

|

|

| |

Accounts payable - Meisheng (related party) |

|

|

35,011 |

|

|

|

27,977 |

|

|

|

12,259 |

|

|

|

|

| |

Accrued expenses |

|

|

71,748 |

|

|

|

65,609 |

|

|

|

45,102 |

|

|

|

|

| |

Reserve for sales returns and allowances |

|

|

40,837 |

|

|

|

43,512 |

|

|

|

38,531 |

|

|

|

|

| |

Income taxes payable |

|

|

- |

|

|

|

17,422 |

|

|

|

3,785 |

|

|

|

|

| |

Short term operating lease liabilities |

|

|

7,405 |

|

|

|

6,415 |

|

|

|

7,380 |

|

|

|

|

| |

|

Total current liabilities |

|

|

253,929 |

|

|

|

255,344 |

|

|

|

149,234 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Long term operating lease liabilities |

|

|

14,536 |

|

|

|

19,283 |

|

|

|

16,666 |

|

|

|

|

|

Accrued expenses - long term |

|

|

1,824 |

|

|

|

3,750 |

|

|

|

3,746 |

|

|

|

|

|

Preferred stock derivative liability |

|

|

- |

|

|

|

28,586 |

|

|

|

29,947 |

|

|

|

|

|

Income taxes payable |

|

|

3,523 |

|

|

|

2,994 |

|

|

|

3,245 |

|

|

|

|

| |

|

Total liabilities |

|

|

273,812 |

|

|

|

309,957 |

|

|

|

202,838 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock accrued dividends |

|

|

- |

|

|

|

5,608 |

|

|

|

5,992 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

|

| |

Common stock, $.001 par value |

|

|

11 |

|

|

|

10 |

|

|

|

10 |

|

|

|

|

| |

Additional paid-in capital |

|

|

295,400 |

|

|

|

277,546 |

|

|

|

278,642 |

|

|

|

|

| |

Accumulated deficit |

|

|

(30,579 |

) |

|

|

(62,744 |

) |

|

|

(73,612 |

) |

|

|

|

| |

Accumulated other comprehensive loss |

|

|

(15,266 |

) |

|

|

(16,808 |

) |

|

|

(15,627 |

) |

|

|

|

| |

|

Total JAKKS Pacific, Inc. stockholders' equity |

|

|

249,566 |

|

|

|

198,004 |

|

|

|

189,413 |

|

|

|

|

| |

Non-controlling interests |

|

|

500 |

|

|

|

712 |

|

|

|

708 |

|

|

|

|

| |

|

Total stockholders' equity |

|

|

250,066 |

|

|

|

198,716 |

|

|

|

190,121 |

|

|

|

|

| |

|

Total liabilities, preferred stock and stockholders' equity |

|

$ |

523,878 |

|

|

$ |

514,281 |

|

|

$ |

398,951 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental

Balance Sheet and Cash Flow Data (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

September 30, |

|

|

|

|

Key Balance Sheet Data: |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable days sales outstanding (DSO) |

|

|

|

|

83 |

|

|

|

61 |

|

|

|

|

|

Inventory turnover (DSI) |

|

|

|

|

27 |

|

|

|

31 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Condensed Cash Flow Data: |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows provided by (used in) operating activities |

|

|

|

$ |

(15,181 |

) |

|

$ |

89,421 |

|

|

|

|

|

Cash flows used in investing activities |

|

|

|

|

(8,989 |

) |

|

|

(7,427 |

) |

|

|

|

|

Cash flows used in financing activities and other |

|

|

|

|

(26,100 |

) |

|

|

(71,037 |

) |

|

|

|

|

Increase in cash, cash equivalents and restricted cash |

|

|

|

$ |

(50,270 |

) |

|

$ |

10,957 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

|

$ |

(7,344 |

) |

|

$ |

(7,464 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

JAKKS

Pacific, Inc. and Subsidiaries |

|

|

| |

|

Condensed

Consolidated Statements of Operations (Unaudited) |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

Three Months

Ended September 30, |

|

|

|

|

Nine Months

Ended September 30, |

|

|

|

| |

|

|

|

2024 |

|

|

|

|

2023 |

|

|

Δ (%) |

|

|

|

2024 |

|

|

|

|

2023 |

|

|

Δ (%) |

|

|

| |

|

|

(In

thousands, except per share data) |

|

|

|

|

(In

thousands, except per share data) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

$ |

321,606 |

|

|

|

$ |

309,744 |

|

|

4 |

|

% |

|

$ |

560,301 |

|

|

|

$ |

584,161 |

|

|

(4 |

) |

% |

|

|

Less: Cost of sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cost of goods |

|

158,770 |

|

|

|

|

149,052 |

|

|

7 |

|

|

|

|

289,190 |

|

|

|

|

293,512 |

|

|

(1 |

) |

|

|

| |

Royalty expense |

|

50,011 |

|

|

|

|

51,141 |

|

|

(2 |

) |

|

|

|

86,181 |

|

|

|

|

95,074 |

|

|

(9 |

) |

|

|

| |

Amortization of tools and molds |

|

3,994 |

|

|

|

|

2,566 |

|

|

56 |

|

|

|

|

7,462 |

|

|

|

|

5,955 |

|

|

25 |

|

|

|

| |

Cost of sales |

|

212,775 |

|

|

|

|

202,759 |

|

|

5 |

|

|

|

|

382,833 |

|

|

|

|

394,541 |

|

|

(3 |

) |

|

|

| |

|

Gross profit |

|

108,831 |

|

|

|

|

106,985 |

|

|

2 |

|

|

|

|

177,468 |

|

|

|

|

189,620 |

|

|

(6 |

) |

|

|

|

Direct selling expenses |

|

7,552 |

|

|

|

|

10,684 |

|

|

(29 |

) |

|

|

|

21,904 |

|

|

|

|

22,405 |

|

|

(2 |

) |

|

|

|

General and administrative expenses |

|

33,101 |

|

|

|

|

33,821 |

|

|

(2 |

) |

|

|

|

100,887 |

|

|

|

|

92,492 |

|

|

9 |

|

|

|

|

Depreciation and amortization |

|

95 |

|

|

|

|

81 |

|

|

17 |

|

|

|

|

275 |

|

|

|

|

276 |

|

|

- |

|

|

|

| |

Selling, general and administrative expenses |

|

40,748 |

|

|

|

|

44,586 |

|

|

(9 |

) |

|

|

|

123,066 |

|

|

|

|

115,173 |

|

|

7 |

|

|

|

| |

|

Income from

operations |

|

68,083 |

|

|

|

|

62,399 |

|

|

9 |

|

|

|

|

54,402 |

|

|

|

|

74,447 |

|

|

(27 |

) |

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loss from joint ventures |

|

- |

|

|

|

|

- |

|

|

- |

|

|

|

|

- |

|

|

|

|

(565 |

) |

|

nm |

|

|

| |

Other income (expense), net |

|

84 |

|

|

|

|

(52 |

) |

|

nm |

|

|

|

294 |

|

|

|

|

424 |

|

|

(31 |

) |

|

|

| |

Change in fair value of preferred stock derivative liability |

|

- |

|

|

|

|

(793 |

) |

|

nm |

|

|

|

- |

|

|

|

|

(6,668 |

) |

|

nm |

|

|

| |

Loss on debt extinguishment |

|

- |

|

|

|

|

- |

|

|

- |

|

|

|

|

- |

|

|

|

|

(1,023 |

) |

|

nm |

|

|

| |

Interest income |

|

69 |

|

|

|

|

384 |

|

|

(82 |

) |

|

|

|

533 |

|

|

|

|

587 |

|

|

(9 |

) |

|

|

| |

Interest expense |

|

(539 |

) |

|

|

|

(1,436 |

) |

|

(62 |

) |

|

|

|

(938 |

) |

|

|

|

(5,741 |

) |

|

(84 |

) |

|

|

|

Income before provision for income taxes |

|

67,697 |

|

|

|

|

60,502 |

|

|

12 |

|

|

|

|

54,291 |

|

|

|

|

61,461 |

|

|

(12 |

) |

|

|

|

Provision for income taxes |

|

15,425 |

|

|

|

|

12,381 |

|

|

25 |

|

|

|

|

10,978 |

|

|

|

|

12,476 |

|

|

(12 |

) |

|

|

|

Net income |

|

52,272 |

|

|

|

|

48,121 |

|

|

9 |

|

|

|

|

43,313 |

|

|

|

|

48,985 |

|

|

(12 |

) |

|

|

|

Net income (loss) attributable to non-controlling interests |

|

- |

|

|

|

|

(11 |

) |

|

nm |

|

|

|

280 |

|

|

|

|

(289 |

) |

|

nm |

|

|

|

Net income attributable to JAKKS Pacific, Inc. |

$ |

52,272 |

|

|

|

$ |

48,132 |

|

|

9 |

|

% |

|

$ |

43,033 |

|

|

|

$ |

49,274 |

|

|

(13 |

) |

% |

|

|

Net income attributable to common stockholders |

$ |

52,272 |

|

|

|

$ |

47,754 |

|

|

9 |

|

% |

|

$ |

44,363 |

|

|

|

$ |

48,156 |

|

|

(8 |

) |

% |

|

| |

Earnings per share - basic |

$ |

4.78 |

|

|

|

$ |

4.77 |

|

|

|

|

|

$ |

4.14 |

|

|

|

$ |

4.85 |

|

|

|

|

|

| |

Shares used in earnings per share - basic |

|

10,942 |

|

|

|

|

10,021 |

|

|

|

|

|

|

10,704 |

|

|

|

|

9,922 |

|

|

|

|

|

| |

Earnings per share - diluted |

$ |

4.64 |

|

|

|

$ |

4.53 |

|

|

|

|

|

$ |

3.99 |

|

|

|

$ |

4.58 |

|

|

|

|

|

| |

Shares used in earnings per share - diluted |

|

11,275 |

|

|

|

|

10,542 |

|

|

|

|

|

|

11,106 |

|

|

|

|

10,503 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended September 30, |

|

|

|

|

Nine Months Ended September 30, |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

2024 |

|

|

|

|

2023 |

|

|

Δ bps |

|

|

|

2024 |

|

|

|

|

2023 |

|

|

Δ bps |

|

|

| |

|

|

|

|

|

|

|

Fav/(Unfav) |

|

|

|

|

|

|

Fav/(Unfav) |

|

|

Net sales |

|

100.0 |

|

% |

|

|

100.0 |

|

% |

- |

|

|

|

|

100.0 |

|

% |

|

|

100.0 |

|

% |

- |

|

|

|

|

Less: Cost of sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cost of goods |

|

49.4 |

|

|

|

|

48.2 |

|

|

(120 |

) |

|

|

|

51.6 |

|

|

|

|

50.2 |

|

|

(140 |

) |

|

|

| |

Royalty expense |

|

15.6 |

|

|

|

|

16.5 |

|

|

90 |

|

|

|

|

15.4 |

|

|

|

|

16.3 |

|

|

90 |

|

|

|

| |

Amortization of tools and molds |

|

1.2 |

|

|

|

|

0.8 |

|

|

(40.0 |

) |

|

|

|

1.3 |

|

|

|

|

1.0 |

|

|

(30 |

) |

|

|

| |

Cost of sales |

|

66.2 |

|

|

|

|

65.5 |

|

|

(70 |

) |

|

|

|

68.3 |

|

|

|

|

67.5 |

|

|

(80 |

) |

|

|

| |

|

Gross

profit |

|

33.8 |

|

|

|

|

34.5 |

|

|

(70 |

) |

|

|

|

31.7 |

|

|

|

|

32.5 |

|

|

(80 |

) |

|

|

|

Direct selling expenses |

|

2.3 |

|

|

|

|

3.5 |

|

|

120 |

|

|

|

|

3.9 |

|

|

|

|

3.8 |

|

|

(10 |

) |

|

|

|

General and administrative expenses |

|

10.3 |

|

|

|

|

10.9 |

|

|

60 |

|

|

|

|

18.1 |

|

|

|

|

15.9 |

|

|

(220 |

) |

|

|

|

Depreciation and amortization |

|

- |

|

|

|

|

- |

|

|

- |

|

|

|

|

- |

|

|

|

|

0.1 |

|

|

10 |

|

|

|

| |

Selling, general and administrative expenses |

|

12.6 |

|

|

|

|

14.4 |

|

|

180 |

|

|

|

|

22.0 |

|

|

|

|

19.8 |

|

|

(220 |

) |

|

|

| |

|

Income from

operations |

|

21.2 |

|

|

|

|

20.1 |

|

|

110 |

|

|

|

|

9.7 |

|

|

|

|

12.7 |

|

|

(300 |

) |

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loss from joint ventures |

|

- |

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

(0.1 |

) |

|

|

|

|

| |

Other income (expense), net |

|

- |

|

|

|

|

- |

|

|

|

|

|

|

0.1 |

|

|

|

|

0.1 |

|

|

|

|

|

| |

Change in fair value of preferred stock derivative liability |

|

- |

|

|

|

|

(0.3 |

) |

|

|

|

|

|

- |

|

|

|

|

(1.1 |

) |

|

|

|

|

| |

Loss on debt extinguishment |

|

- |

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

(0.2 |

) |

|

|

|

|

| |

Interest income |

|

- |

|

|

|

|

0.1 |

|

|

|

|

|

|

0.1 |

|

|

|

|

0.1 |

|

|

|

|

|

| |

Interest expense |

|

(0.2 |

) |

|

|

|

(0.4 |

) |

|

|

|

|

|

(0.2 |

) |

|

|

|

(1.0 |

) |

|

|

|

|

|

Income before provision for income taxes |

|

21.0 |

|

|

|

|

19.5 |

|

|

|

|

|

|

9.7 |

|

|

|

|

10.5 |

|

|

|

|

|

|

Provision for income taxes |

|

4.7 |

|

|

|

|

4.0 |

|

|

|

|

|

|

2.0 |

|

|

|

|

2.1 |

|

|

|

|

|

|

Net income |

|

16.3 |

|

|

|

|

15.5 |

|

|

|

|

|

|

7.7 |

|

|

|

|

8.4 |

|

|

|

|

|

|

Net income (loss) attributable to non-controlling interests |

|

- |

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

Net income attributable to JAKKS Pacific, Inc. |

|

16.3 |

|

% |

|

|

15.5 |

|

% |

|

|

|

|

7.7 |

|

% |

|

|

8.4 |

|

% |

|

|

|

|

Net income attributable to common stockholders |

|

16.3 |

|

% |

|

|

15.4 |

|

% |

|

|

|

|

7.9 |

|

% |

|

|

8.2 |

|

% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| JAKKS

Pacific, Inc. and Subsidiaries |

|

|

Reconciliation of Non-GAAP Financial Information

(Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

2024 |

|

|

|

2023 |

|

|

Δ ($) |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Δ ($) |

|

|

|

|

| |

|

(In

thousands) |

|

|

|

|

|

(In

thousands) |

|

|

|

|

|

|

|

EBITDA and Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

52,272 |

|

|

$ |

48,121 |

|

|

$ |

4,151 |

|

|

|

|

$ |

43,313 |

|

|

$ |

48,985 |

|

|

$ |

(5,672 |

) |

|

|

|

|

|

Interest expense |

|

|

539 |

|

|

|

1,436 |

|

|

|

(897 |

) |

|

|

|

|

938 |

|

|

|

5,741 |

|

|

|

(4,803 |

) |

|

|

|

|

|

Interest income |

|

|

(69 |

) |

|

|

(384 |

) |

|

|

315 |

|

|

|

|

|

(533 |

) |

|

|

(587 |

) |

|

|

54 |

|

|

|

|

|

|

Provision for income taxes |

|

|

15,425 |

|

|

|

12,381 |

|

|

|

3,044 |

|

|

|

|

|

10,978 |

|

|

|

12,476 |

|

|

|

(1,498 |

) |

|

|

|

|

|

Depreciation and amortization |

|

|

4,089 |

|

|

|

4,398 |

|

|

|

(309 |

) |

|

|

|

|

7,737 |

|

|

|

7,982 |

|

|

|

(245 |

) |

|

|

|

|

| EBITDA |

|

|

72,256 |

|

|

|

65,952 |

|

|

|

6,304 |

|

|

|

|

|

62,433 |

|

|

|

74,597 |

|

|

|

(12,164 |

) |

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

joint ventures (JAKKS Pacific, Inc. - 51%) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

- |

|

|

|

276 |

|

|

|

(276 |

) |

|

|

|

|

| Loss from

joint ventures (Meisheng - 49%) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

- |

|

|

|

289 |

|

|

|

(289 |

) |

|

|

|

|

| Other

(income) expense, net |

|

|

(84 |

) |

|

|

52 |

|

|

|

(136 |

) |

|

|

|

|

(294 |

) |

|

|

(424 |

) |

|

|

130 |

|

|

|

|

|

| Restricted

stock compensation expense |

|

|

2,186 |

|

|

|

2,025 |

|

|

|

161 |

|

|

|

|

|

7,280 |

|

|

|

5,970 |

|

|

|

1,310 |

|

|

|

|

|

| Change in

fair value of preferred stock derivative liability |

|

|

- |

|

|

|

793 |

|

|

|

(793 |

) |

|

|

|

|

- |

|

|

|

6,668 |

|

|

|

(6,668 |

) |

|

|

|

|

| Loss on debt

extinguishment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

- |

|

|

|

1,023 |

|

|

|

(1,023 |

) |

|

|

|

|

| Adjusted

EBITDA |

|

$ |

74,358 |

|

|

$ |

67,071 |

|

|

$ |

7,287 |

|

|

|

|

$ |

69,419 |

|

|

$ |

86,648 |

|

|

$ |

(17,229 |

) |

|

|

|

|

| Adjusted

EBITDA/Net sales % |

|

|

23.1 |

|

% |

|

21.7 |

|

% |

140 bps |

|

|

|

|

12.4 |

|

% |

|

14.8 |

|

% |

-240 bps |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Trailing Twelve Months Ended September 30, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

2024 |

|

|

|

2023 |

|

|

Δ ($) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(In

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TTM

EBITDA and TTM Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TTM net

income |

|

$ |

32,441 |

|

|

$ |

87,094 |

|

|

$ |

(54,653 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

1,648 |

|

|

|

8,035 |

|

|

|

(6,387 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

(1,290 |

) |

|

|

(650 |

) |

|

|

(640 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for (benefit from) income taxes |

|

|

5,335 |

|

|

|

(41,855 |

) |

|

|

47,190 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

10,091 |

|

|

|

9,934 |

|

|

|

157 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| TTM

EBITDA |

|

|

48,225 |

|

|

|

62,558 |

|

|

|

(14,333 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

joint ventures (JAKKS Pacific, Inc. - 51%) |

|

|

- |

|

|

|

276 |

|

|

|

(276 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

joint ventures (Meisheng - 49%) |

|

|

- |

|

|

|

289 |

|

|

|

(289 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Other

(income) expense, net |

|

|

(433 |

) |

|

|

(701 |

) |

|

|

268 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restricted

stock compensation expense |

|

|

9,337 |

|

|

|

7,616 |

|

|

|

1,721 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in

fair value of preferred stock derivative liability |

|

|

1,361 |

|

|

|

5,239 |

|

|

|

(3,878 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Molds and

tooling capitalization |

|

|

- |

|

|

|

(1,751 |

) |

|

|

1,751 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss on debt

extinguishment |

|

|

- |

|

|

|

1,023 |

|

|

|

(1,023 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| TTM Adjusted

EBITDA |

|

$ |

58,490 |

|

|

$ |

74,549 |

|

|

$ |

(16,059 |

) |

|

(22 |

) |

% |

|

|

|

|

|

|

|

|

|

| TTM Adjusted

EBITDA/TTM Net sales % |

|

|

8.5 |

|

% |

|

10.4 |

|

% |

-190 bps |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months

Ended September 30, |

|

|

|

|

|

Nine Months

Ended September 30, |

|

|

|

|

|

|

| |

|

|

2024 |

|

|

|

2023 |

|

|

Δ ($) |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Δ ($) |

|

|

|

|

| |

|

(In

thousands, except per share data) |

|

|

|

|

|

(In

thousands, except per share data) |

|

|

|

|

|

|

|

Adjusted net income attributable to common

stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

attributable to common stockholders |

|

$ |

52,272 |

|

|

$ |

47,754 |

|

|

$ |

4,518 |

|

|

|

|

$ |

44,363 |

|

|

$ |

48,156 |

|

|

$ |

(3,793 |

) |

|

|

|

|

| Restricted

stock compensation expense |

|

|

2,186 |

|

|

|

2,025 |

|

|

|

161 |

|

|

|

|

|

7,280 |

|

|

|

5,970 |

|

|

|

1,310 |

|

|

|

|

|

| Change in

fair value of preferred stock derivative liability |

|

|

- |

|

|

|

793 |

|

|

|

(793 |

) |

|

|

|

|

- |

|

|

|

6,668 |

|

|

|

(6,668 |

) |

|

|

|

|

| Loss on debt

extinguishment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

- |

|

|

|

1,023 |

|

|

|

(1,023 |

) |

|

|

|

|

| Loss from

joint ventures (JAKKS Pacific, Inc. - 51%) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

- |

|

|

|

276 |

|

|

|

(276 |

) |

|

|

|

|

| 2021 BSP

Term Loan prepayment penalty |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

- |

|

|

|

150 |

|

|

|

(150 |

) |

|

|

|

|

| Molds and

Tooling capitalization |

|

|

- |

|

|

|

(1,751 |

) |

|

|

1,751 |

|

|

|

|

|

- |

|

|

|

(1,751 |

) |

|

|

1,751 |

|

|

|

|

|

| Tax impact

of additional charges |

|

|

(494 |

) |

|

|

1,268 |

|

|

|

(1,762 |

) |

|

|

|

|

(1,681 |

) |

|

|

(1,079 |

) |

|

|

(602 |

) |

|

|

|

|

| Adjusted net

income attributable to common stockholders |

|

$ |

53,964 |

|

|

$ |

50,089 |

|

|

$ |

3,875 |

|

|

|

|

$ |

49,962 |

|

|

$ |

59,413 |

|

|

$ |

(9,451 |

) |

|

|

|

|

|

Adjusted earnings per share - basic & diluted |

|

$ |

4.93 |

|

|

$ |

5.00 |

|

|

$ |

(0.07 |

) |

|

|

|

$ |

4.67 |

|

|

$ |

5.99 |

|

|

$ |

(1.32 |

) |

|

|

|

|

|

Shares used in adjusted earnings per share - basic |

|

|

10,942 |

|

|

|

10,021 |

|

|

|

921 |

|

|

|

|

|

10,704 |

|

|

|

9,922 |

|

|

|

782 |

|

|

|

|

|

|

Adjusted earnings per share - diluted |

|

$ |

4.79 |

|

|

$ |

4.75 |

|

|

$ |

0.04 |

|

|

|

|

$ |

4.50 |

|

|

$ |

5.66 |

|

|

$ |

(1.16 |

) |

|

|

|

|

|

Shares used in adjusted earnings per share - diluted |

|

|

11,275 |

|

|

|

10,542 |

|

|

|

733 |

|

|

|

|

|

11,106 |

|

|

|

10,503 |

|

|

|

603 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| JAKKS

Pacific, Inc. and Subsidiaries |

| Net Sales by

Division and Geographic Region |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (In

thousands) |

QTD Q3 |

|

(In

thousands) |

YTD Q3 |

|

Divisions |

|

2024 |

|

2023 |

|

2022 |

% Change 2024 v 2023 |

% Change 2023 v 2022 |

|

Divisions |

|

2024 |

|

2023 |

|

2022 |

% Change 2024 v 2023 |

% Change 2023 v 2022 |

|

Toys/Consumer Products |

$ |

264,306 |

$ |

246,004 |

$ |

269,607 |

7.4 |

% |

-8.8 |

% |

|

Toys/Consumer Products |

$ |

451,786 |

$ |

461,831 |

$ |

529,590 |

-2.2 |

% |

-12.8 |

% |

|

Dolls, Role-Play/Dress Up |

|

146,893 |

|

139,177 |

|

190,452 |

5.5 |

% |

-26.9 |

% |

|

Dolls, Role-Play/Dress Up |

|

251,075 |

|

246,689 |

|

354,644 |

1.8 |

% |

-30.4 |

% |

|

Action Play & Collectibles |

|

98,750 |

|

93,717 |

|

65,752 |

5.4 |

% |

42.5 |

% |

|

Action Play & Collectibles |

|

168,313 |

|

184,134 |

|

134,620 |

-8.6 |

% |

36.8 |

% |

|

Outdoor/Seasonal Toys |

|

18,663 |

|

13,110 |

|

13,403 |

42.4 |

% |

-2.2 |

% |

|

Outdoor/Seasonal Toys |

|

32,398 |

|

31,008 |

|

40,326 |

4.5 |

% |

-23.1 |

% |

|

Costumes |

$ |

57,300 |

$ |

63,740 |

$ |

53,391 |

-10.1 |

% |

19.4 |

% |

|

Costumes |

$ |

108,515 |

$ |

122,330 |

$ |

134,711 |

-11.3 |

% |

-9.2 |

% |

|

Total |

$ |

321,606 |

$ |

309,744 |

$ |

322,998 |

3.8 |

% |

-4.1 |

% |

|

Total |

$ |

560,301 |

$ |

584,161 |

$ |

664,301 |

-4.1 |

% |

-12.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (In

thousands) |

QTD Q3 |

|

(In

thousands) |

YTD Q3 |

|

Regions |

|

2024 |

|

2023 |

|

2022 |

% Change 2024 v 2023 |

% Change 2023 v 2022 |

|

Regions |

|

2024 |

|

2023 |

|

2022 |

% Change 2024 v 2023 |

% Change 2023 v 2022 |

|

United States |

$ |

255,278 |

$ |

244,931 |

$ |

253,854 |

4.2 |

% |

-3.5 |

% |

|

United States |

$ |

451,545 |

$ |

461,561 |

$ |

543,388 |

-2.2 |

% |

-15.1 |

% |

|

Europe |

|

30,034 |

|

31,676 |

|

38,075 |

-5.2 |

% |

-16.8 |

% |

|

Europe |

|

46,033 |

|

58,476 |

|

65,911 |

-21.3 |

% |

-11.3 |

% |

|

Latin America |

|

22,632 |

|

15,319 |

|

9,504 |

47.7 |

% |

61.2 |

% |

|

Latin America |

|

33,867 |

|

27,590 |

|

15,712 |

22.8 |

% |

75.6 |

% |

|

Canada |

|

7,068 |

|

11,453 |

|

12,804 |

-38.3 |

% |

-10.6 |

% |

|

Canada |

|

16,726 |

|

22,306 |

|

21,720 |

-25.0 |

% |

2.7 |

% |

|

Asia |

|

2,345 |

|

3,192 |

|

4,294 |

-26.5 |

% |

-25.7 |

% |

|

Asia |

|

4,578 |

|

6,403 |

|

8,733 |

-28.5 |

% |

-26.7 |

% |

|

Australia & New Zealand |

|

3,339 |

|

2,692 |

|

3,941 |

24.0 |

% |

-31.7 |

% |

|

Australia & New Zealand |

|

6,292 |

|

6,056 |

|

7,014 |

3.9 |

% |

-13.7 |

% |

|

Middle East & Africa |

|

910 |

|

481 |

|

526 |

89.2 |

% |

-8.6 |

% |

|

Middle East & Africa |

|

1,260 |

|

1,769 |

|

1,823 |

-28.8 |

% |

-3.0 |

% |

|

Total |

$ |

321,606 |

$ |

309,744 |

$ |

322,998 |

3.8 |

% |

-4.1 |

% |

|

Total |

$ |

560,301 |

$ |

584,161 |

$ |

664,301 |

-4.1 |

% |

-12.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (In

thousands) |

QTD Q3 |

|

(In

thousands) |

YTD Q3 |

|

Regions |

|

2024 |

|

2023 |

|

2022 |

% Change 2024 v 2023 |

% Change 2023 v 2022 |

|

Regions |

|

2024 |

|

2023 |

|

2022 |

% Change 2024 v 2023 |

% Change 2023 v 2022 |

|

North America |

$ |

262,346 |

$ |

256,384 |

$ |

266,658 |

2.3 |

% |

-3.9 |

% |

|

North America |

$ |

468,271 |

$ |

483,867 |

$ |

565,108 |

-3.2 |

% |

-14.4 |

% |

|

International |

|

59,260 |

|

53,360 |

|

56,340 |

11.1 |

% |

-5.3 |

% |

|

International |

|

92,030 |

|

100,294 |

|

99,193 |

-8.2 |

% |

1.1 |

% |

|

Total |

$ |

321,606 |

$ |

309,744 |

$ |

322,998 |

3.8 |

% |

-4.1 |

% |

|

Total |

$ |

560,301 |

$ |

584,161 |

$ |

664,301 |

-4.1 |

% |

-12.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

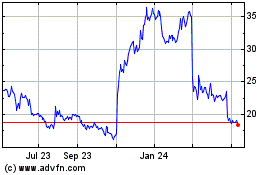

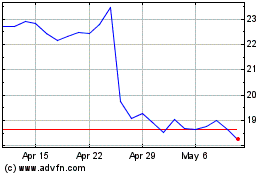

JAKKS Pacific (NASDAQ:JAKK)

Historical Stock Chart

From Oct 2024 to Nov 2024

JAKKS Pacific (NASDAQ:JAKK)

Historical Stock Chart

From Nov 2023 to Nov 2024