Revenue Growth of Approximately 7% on Constant

Currency Basis

IPG Photonics Corporation (NASDAQ: IPGP) today reported

financial results for the first quarter ended March 31,

2016.

Three Months Ended March 31,

(In millions, except per share data) 2016

2015 % Change Revenue $ 207.2 $ 199.0 4 %

Gross margin 55.2 % 54.2 % Operating income $ 70.0 $ 82.0 (15 )%

Operating margin 33.8 % 41.2 % Net income attributable to IPG

Photonics Corporation $ 49.3 $ 57.4 (14 )% Earnings per diluted

share $ 0.92 $ 1.08 (15 )%

Management Comments

"We reported revenue and EPS in-line with our guidance for the

first quarter as we continued to execute on our long-term growth

strategy," said Dr. Valentin Gapontsev, IPG Photonics' Chief

Executive Officer. "Revenues of $207.2 million increased 4%

year-over-year, or by approximately 7% on a constant currency

basis. First-quarter 2016 EPS of $0.92 included $0.07 per share

related to foreign exchange losses, compared with Q1 2015 EPS of

$1.08, which included an $0.11 foreign exchange gain."

Materials processing sales in the first quarter increased 3%

year-over-year, primarily reflecting solid growth in cutting

applications which is IPG's largest end-use, partially offset by a

decline in automotive welding, marking and engraving. In addition,

Q1 2015 benefited from several million dollars in revenue from a

one-time order for a novel surface patterning application.

Sales to Other Applications were up 30% from the first quarter

of 2015 with strong performances in advanced applications and

telecom. Geographically, IPG reported strong growth in North

America, China and Turkey, while sales were lower in Korea, Japan

and Russia. Despite foreign exchange headwinds and continuing

competition, sales growth in China was approximately 9% driven by

cutting and welding applications.

During the first quarter, IPG generated $64.0 million in cash

from operations and used $25.0 million to finance capital

expenditures. IPG ended the quarter with $740.0 million in cash and

cash equivalents and short-term investments, representing an

increase of $50.8 million from December 31, 2015.

Business Outlook and Financial Guidance

"We continue to see large opportunities to expand our business

through both existing and new OEMs and end-users as we develop

innovative products to address applications beyond our core

markets. We are making significant progress on the testing and

development of these new product lines and we look forward to their

launch," concluded Dr. Gapontsev.

IPG Photonics expects revenue in the range of $235 million to

$250 million for the second quarter of 2016. The Company

anticipates earnings per diluted share in the range of $1.10 to

$1.25 based on 53,621,000 diluted common shares, which includes

52,898,000 basic common shares outstanding and 723,000 potentially

dilutive options at March 31, 2016. As discussed in more

detail in the "Safe Harbor" passage of this news release, actual

results may differ from this guidance due to various factors

including, but not limited to, product demand, order cancellations

and delays, competition and general economic conditions. This

guidance is based upon current market conditions and expectations,

and is subject to the risks outlined in the Company's reports with

the SEC, and assumes exchange rates relative to the U.S. Dollar of

Euro 0.90, Russian Ruble 70, Japanese Yen 113 and Chinese Yuan

6.51, respectively.

Conference Call Reminder

The Company will hold a conference call today, April 28,

2016 at 10:00 a.m. ET. The conference call will be webcast live and

can be accessed on the "Investors" section of the Company's website

at www.ipgphotonics.com. The conference call also can be accessed

by dialing (877) 407-5790 or (201) 689-8328. An archived version of

the webcast will be available for approximately one year on IPG's

website.

About IPG Photonics Corporation

IPG Photonics Corporation is the world leader in high-power

fiber lasers and amplifiers. Founded in 1990, IPG pioneered the

development and commercialization of optical fiber-based lasers for

use in diverse applications, primarily materials processing. Fiber

lasers have revolutionized the industry by delivering superior

performance, reliability and usability at a lower total cost of

ownership compared with conventional lasers, allowing end users to

increase productivity and decrease operating costs. IPG has its

headquarters in Oxford, Massachusetts, and has additional plants

and offices throughout the world. For more information, please

visit www.ipgphotonics.com.

Safe Harbor Statement

Information and statements provided by IPG and its employees,

including statements in this press release, that relate to future

plans, events or performance are forward-looking

statements. These statements involve risks and uncertainties.

Any statements in this press release that are not statements of

historical fact are forward-looking statements, including, but not

limited to, expanding our business through existing and new OEMs

and end-users, developing innovative products to address

applications beyond our core markets, making significant progress

on the testing and development of these new product lines and

guidance for the second quarter of 2016. Factors that could cause

actual results to differ materially include risks and

uncertainties, including risks associated with the strength or

weakness of the business conditions in industries and geographic

markets that IPG serves, particularly the effect of downturns in

the markets IPG serves; uncertainties and adverse changes in the

general economic conditions of markets; IPG's ability to penetrate

new applications for fiber lasers and increase market share; the

rate of acceptance and penetration of IPG's products; inability to

manage risks associated with international customers and

operations; foreign currency fluctuations; high levels of fixed

costs from IPG's vertical integration; the appropriateness of IPG's

manufacturing capacity for the level of demand; competitive

factors, including declining average selling prices; the effect of

acquisitions and investments; inventory write-downs; intellectual

property infringement claims and litigation; interruption in supply

of key components; manufacturing risks; government regulations and

trade sanctions; and other risks identified in IPG's SEC

filings. Readers are encouraged to refer to the risk factors

described in IPG's Annual Report on Form 10-K (filed with the SEC

on February 26, 2016) and its periodic reports filed with the SEC,

as applicable. Actual results, events and performance may differ

materially. Readers are cautioned not to rely on the

forward-looking statements, which speak only as of the date hereof.

IPG undertakes no obligation to update the forward-looking

statements that may be made to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated

events.

IPG PHOTONICS CORPORATION

CONSOLIDATED STATEMENTS OF

INCOME

Three Months Ended March 31, 2016

2015 (in thousands, except per share

data) NET SALES $ 207,248 $ 198,960 COST OF SALES 92,838

91,133 GROSS PROFIT 114,410 107,827 OPERATING

EXPENSES: Sales and marketing 8,034 7,549 Research and development

17,489 14,230 General and administrative 13,901 12,778 Loss (gain)

on foreign exchange 4,967 (8,752 )

Total operating expenses

44,391 25,805 OPERATING INCOME 70,019 82,022

OTHER INCOME (EXPENSE), Net: Interest income (expense), net

192 (184 ) Other income, net 7 85 Total other income

(expense) 199 (99 ) INCOME BEFORE PROVISION FOR INCOME TAXES

70,218 81,923 PROVISION FOR INCOME TAXES (20,890 ) (24,577 ) NET

INCOME 49,328 57,346 LESS: NET INCOME (LOSS) ATTRIBUTABLE TO

NONCONTROLLING INTERESTS 2 (13 ) NET INCOME ATTRIBUTABLE TO

IPG PHOTONICS CORPORATION $ 49,326 $ 57,359 NET

INCOME ATTRIBUTABLE TO IPG PHOTONICS CORPORATION PER SHARE: Basic $

0.93 $ 1.09 Diluted $ 0.92 $ 1.08 WEIGHTED AVERAGE SHARES

OUTSTANDING: Basic 52,898 52,486 Diluted 53,621 53,267

IPG PHOTONICS CORPORATION

SUPPLEMENTAL SCHEDULE OF STOCK-BASED

COMPENSATION

Three Months Ended March 31, (In thousands)

2016 2015 Cost of sales $ 1,419 $ 1,156

Sales and marketing 415 435 Research and development 1,093 870

General and administrative 2,032 1,666 Total

stock-based compensation 4,959 4,127 Tax benefit recognized (1,584

) (1,343 ) Net stock-based compensation $ 3,375 $ 2,784

IPG PHOTONICS CORPORATION

SUPPLEMENTAL SCHEDULE OF ACQUISITION

RELATED COSTS IN COST OF SALES

Three Months Ended March 31, (In thousands)

2016 2015 Cost of sales Amortization of

intangible assets (1) 345 235 Total acquisition related

costs $ 345 $ 235

(1) Amount relates to intangible amortization expense during

periods presented including amortization of acquired patents.

IPG PHOTONICS CORPORATION

CONSOLIDATED BALANCE SHEETS

March 31, December 31, 2016 2015

(In thousands, except share and per

share data)

ASSETS CURRENT ASSETS: Cash and cash equivalents $ 613,692 $

582,532 Short-term investments 126,273 106,584 Accounts receivable,

net 146,505 150,479 Inventories 226,907 203,738 Prepaid income

taxes 37,159 33,692 Prepaid expenses and other current assets

24,577 25,564 Deferred income taxes, net 22,526 20,346

Total current assets 1,197,639 1,122,935 DEFERRED INCOME

TAXES, NET 11,889 9,386 GOODWILL 502 505 INTANGIBLE ASSETS, NET

11,066 11,904 PROPERTY, PLANT AND EQUIPMENT, NET 309,206 288,604

OTHER ASSETS 19,798 20,095 TOTAL $ 1,550,100 $

1,453,429

LIABILITIES AND EQUITY CURRENT LIABILITIES:

Revolving line-of-credit facilities $ — $ — Current portion of

long-term debt 2,000 2,000 Accounts payable 20,277 26,314 Accrued

expenses and other liabilities 70,987 75,667 Deferred income taxes,

net 3,751 3,190 Income taxes payable 53,656 37,809

Total current liabilities 150,671 144,980 DEFERRED INCOME TAXES AND

OTHER LONG-TERM LIABILITIES 35,264 30,117 LONG-TERM DEBT, NET OF

CURRENT PORTION 17,167 17,667 Total liabilities

203,102 192,764 COMMITMENTS AND CONTINGENCIES IPG PHOTONICS

CORPORATION STOCKHOLDERS' EQUITY:

Common stock, $0.0001 par value,

175,000,000 shares authorized; 52,966,460shares issued and

outstanding at March 31, 2016; 52,883,902 shares issued

andoutstanding at December 31, 2015

5 5 Additional paid-in capital 616,156 607,649 Retained earnings

882,682 833,356 Accumulated other comprehensive loss (152,987 )

(181,482 ) Total IPG Photonics Corporation stockholders' equity

1,345,856 1,259,528 NONCONTROLLING INTERESTS 1,142 1,137

Total equity $ 1,346,998 $ 1,260,665 TOTAL $

1,550,100 $ 1,453,429

IPG PHOTONICS CORPORATION

CONSOLIDATED STATEMENTS OF CASH

FLOWS

Three Months Ended March 31,

2016 2015 (In thousands) CASH FLOWS

FROM OPERATING ACTIVITIES: Net income $ 49,328 $ 57,346

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 11,394 9,743

Provisions for inventory, warranty & bad debt 8,927 8,017 Other

7,195 4,470 Changes in assets and liabilities that used cash:

Accounts receivable/payable 1,391 (13,116 ) Inventories (19,365 )

(13,898 ) Other 5,123 (554 ) Net cash provided by operating

activities 63,993 52,008

CASH FLOWS FROM INVESTING

ACTIVITIES: Purchases of property, plant and equipment (24,960

) (14,027 ) Proceeds from sales of property, plant and equipment

129 131 Purchases of short-term investments (29,899 ) — Proceeds

from short-term investments 10,000 — Acquisition of businesses, net

of cash acquired — (4,958 ) Other 46 60 Net cash used

in investing activities (44,684 ) (18,794 )

CASH FLOWS FROM

FINANCING ACTIVITIES: Line-of-credit facilities (9 ) (1,872 )

Principal payments on long-term borrowings (500 ) (833 ) Exercise

of employee stock options and issuances under employee stock

purchase plan 2,644 4,409 Tax benefits from exercise of employee

stock options 904 4,773 Net cash provided by

financing activities 3,039 6,477 EFFECT OF CHANGES IN

EXCHANGE RATES ON CASH AND CASH EQUIVALENTS 8,812 (20,367 )

NET INCREASE IN CASH AND CASH EQUIVALENTS 31,160 19,324 CASH AND

CASH EQUIVALENTS — Beginning of period 582,532 522,150

CASH AND CASH EQUIVALENTS — End of period $ 613,692 $

541,474 SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION:

Cash paid for interest $ 171 $ 293 Cash paid for

income taxes $ 11,955 $ 11,889

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160428005870/en/

IPG Photonics CorporationTim Mammen, 508-373-1100Chief Financial

OfficerorSharon MerrillDavid Calusdian, 617-542-5300Executive Vice

President

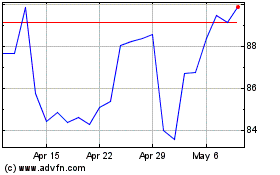

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

From Sep 2024 to Oct 2024

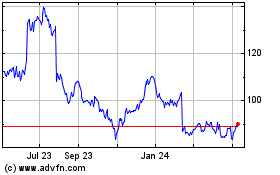

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

From Oct 2023 to Oct 2024