0001846235false--03-31FY2023NJ0.0001500000000000.000150000000065469006546900654690019731182300000023000000182500118250003855412300000002P10D1076841110.75110.050.75151351448786848786848141150141150423450423450194500020000012851370.002P1YP5Y65469006546900654690000018462352022-04-012023-03-310001846235us-gaap:StateAndLocalJurisdictionMember2022-04-012023-03-310001846235us-gaap:DomesticCountryMember2022-04-012023-03-310001846235us-gaap:NewJerseyDivisionOfTaxationMember2021-01-012021-12-310001846235us-gaap:NewJerseyDivisionOfTaxationMember2021-04-012022-03-310001846235us-gaap:NewJerseyDivisionOfTaxationMember2022-04-012023-03-3100018462352021-08-032021-12-310001846235us-gaap:OverAllotmentOptionMember2021-01-162021-08-0200018462352021-01-162021-08-020001846235imaq:MeasurementInputFairValueMember2023-03-310001846235imaq:MeasurementInputFairValueMember2022-03-310001846235imaq:MeasurementInputFairValueMember2021-12-310001846235imaq:MeasurementInputFairValueMember2021-08-020001846235us-gaap:MeasurementInputSharePriceMember2023-03-310001846235us-gaap:MeasurementInputRiskFreeInterestRateMember2023-03-310001846235us-gaap:MeasurementInputSharePriceMember2022-03-310001846235us-gaap:MeasurementInputRiskFreeInterestRateMember2022-03-310001846235us-gaap:MeasurementInputSharePriceMember2021-12-310001846235us-gaap:MeasurementInputSharePriceMember2021-08-020001846235us-gaap:MeasurementInputRiskFreeInterestRateMember2021-12-310001846235us-gaap:MeasurementInputRiskFreeInterestRateMember2021-08-020001846235us-gaap:MeasurementInputPriceVolatilityMember2023-03-310001846235us-gaap:MeasurementInputPriceVolatilityMember2022-03-310001846235us-gaap:MeasurementInputPriceVolatilityMember2021-12-310001846235us-gaap:MeasurementInputPriceVolatilityMember2021-08-020001846235us-gaap:MeasurementInputExpectedTermMember2023-03-310001846235us-gaap:MeasurementInputExpectedTermMember2022-03-310001846235us-gaap:MeasurementInputExpectedTermMember2021-12-310001846235us-gaap:MeasurementInputExpectedTermMember2021-08-020001846235us-gaap:MeasurementInputExercisePriceMember2023-03-310001846235us-gaap:MeasurementInputExercisePriceMember2022-03-310001846235us-gaap:MeasurementInputExercisePriceMember2021-12-310001846235us-gaap:MeasurementInputExercisePriceMember2021-08-020001846235imaq:FairValueInputsLevelTwoMember2023-03-310001846235imaq:FairValueInputsLevelOneMember2023-03-310001846235imaq:FairValueInputsLevelThreeMemberimaq:PrivatePlacementWarrantsMember2023-03-310001846235imaq:RedemptionOfWarrantsWhenPricePerShareOfClassCommonStockEqualsOrExceedsMember2023-03-310001846235imaq:RedemptionOfWarrantsWhenPricePerShareOfClassCommonStockBelowMember2023-03-310001846235imaq:PrivateWarrantsMember2023-03-310001846235imaq:PublicWarrantsMember2023-03-310001846235imaq:AdditionalContingentFeeEqualToZeroPointFiveMember2022-03-012022-03-180001846235imaq:ContingentFeeEqualToFivePointFiveMember2022-03-012022-03-180001846235imaq:ContingentFeeEqualToFiveMember2022-03-012022-03-180001846235imaq:PrivateInvestmentInPublicEquityMember2022-03-012022-03-180001846235imaq:AggregateValueOfTargetGreaterThanTwoHundredMillionButLessThanThreeHundredMillionMember2022-04-012023-03-310001846235imaq:AggregateValueOfTargetGreaterThan100MillionButLessThan200MillionMember2022-04-012023-03-310001846235imaq:First100MillionAggregateValueOfTargetMember2022-04-012023-03-3100018462352021-02-012021-02-080001846235imaq:LetterOfEngagementWithHoulihanCapitalMember2022-07-012022-07-200001846235imaq:LetterOfEngagementWithBakerTillyDhcBusinessPrivateLimitedMember2022-07-012022-07-070001846235imaq:LetterOfEngagementWithBakerTillyDhcBusinessPrivateLimitedMember2022-06-012022-06-280001846235imaq:LetterOfEngagementWithMorrowSodaliMember2022-06-012022-06-240001846235imaq:LetterOfEngagementWithAdasCapitalPartnersAndLoneCypressHoldingsMember2022-04-012023-03-310001846235imaq:ConsultingAgreementWithPriyankaAgarwalMember2022-04-012023-03-310001846235imaq:LetterOfEngagementWithFNKIRMember2022-09-012022-09-130001846235imaq:PriyankaAgarwalMemberimaq:ConsultingAgreementsMember2022-04-012023-03-310001846235imaq:SterlingMediaMemberimaq:ConsultingAgreementsMember2022-04-012023-03-310001846235imaq:JacobCherianMemberimaq:ConsultingAgreementsMember2022-04-012023-03-310001846235imaq:OntogenyCapitalLTDMember2022-04-012023-03-310001846235imaq:LetterOfEngagementWithChardanCapitalMarketsLlcMember2022-04-012023-03-310001846235imaq:FebruaryTwoThousandAndTwentyThreePromissoryNoteMember2022-03-310001846235imaq:NovemberTwoThousandAndTwentyTwoPromissoryNoteMember2022-03-310001846235imaq:NovemberTwoThousandAndTwentyTwoPromissoryNoteMember2023-03-310001846235imaq:August2022PromissoryNoteMember2022-03-310001846235imaq:August2022PromissoryNoteMember2023-03-310001846235imaq:PromissoryNoteWithRelatedPartyMember2022-03-310001846235imaq:RelatedPartyLoansMember2023-03-310001846235imaq:AdministrativeSupportAgreementMember2022-03-310001846235imaq:AdministrativeSupportAgreementMember2023-03-310001846235imaq:AdministrativeSupportAgreementMember2021-04-012022-03-310001846235imaq:LoanTransferAgreementMember2023-01-012023-01-260001846235imaq:AdministrativeSupportAgreementMember2022-04-012023-03-310001846235imaq:FebruaryTwoThousandAndTwentyThreePromissoryNoteMemberus-gaap:SubsequentEventMember2023-07-310001846235imaq:FebruaryTwoThousandAndTwentyThreePromissoryNoteMemberus-gaap:SubsequentEventMember2023-04-300001846235imaq:August2022PromissoryNoteMember2023-01-310001846235imaq:PostPromissoryNoteWithRelatedPartyMember2022-09-300001846235imaq:FebruaryTwoThousandAndTwentyThreePromissoryNoteMember2023-03-310001846235imaq:August2022PromissoryNoteMember2022-10-310001846235imaq:PostPromissoryNoteWithRelatedPartyMember2022-04-300001846235imaq:PostPromissoryNoteWithRelatedPartyMember2021-06-300001846235imaq:FebruaryTwoThousandAndTwentyThreePromissoryNoteMember2023-02-280001846235imaq:August2022PromissoryNoteMember2022-07-310001846235imaq:PostPromissoryNoteWithRelatedPartyMember2022-03-310001846235imaq:PostPromissoryNoteWithRelatedPartyMember2022-02-280001846235imaq:PromissoryNoteWithRelatedPartyMember2023-03-310001846235imaq:PromissoryNoteMemberus-gaap:SubsequentEventMember2023-05-020001846235imaq:NovemberTwoThousandAndTwentyTwoPromissoryNoteMember2022-11-180001846235imaq:August2022PromissoryNoteMember2022-08-100001846235imaq:PromissoryNoteWithRelatedPartyMember2022-03-290001846235imaq:PostPromissoryNoteWithRelatedPartyMember2022-01-140001846235imaq:PromissoryNoteWithRelatedPartyMember2021-02-010001846235imaq:SixMonthsAfterDateOfConsummationOfInitialBusinessCombinationMemberimaq:FounderSharesMember2022-04-012023-03-310001846235imaq:EarlierOfSixMonthsAfterDateOfConsummationOfInitialBusinessCombinationAndOnDateOfClosingPriceMemberimaq:FounderSharesMember2022-04-012023-03-310001846235imaq:PrivatePlacementWarrantsMember2023-03-310001846235us-gaap:RightsMemberus-gaap:IPOMember2021-08-020001846235imaq:PublicWarrantsMemberus-gaap:IPOMember2021-08-020001846235imaq:PublicWarrantsMemberus-gaap:IPOMember2021-08-012021-08-020001846235us-gaap:RightsMemberus-gaap:IPOMember2021-08-012021-08-020001846235imaq:PublicWarrantsMember2022-04-012023-03-310001846235us-gaap:IPOMember2022-04-012023-03-3100018462352021-04-012022-03-3100018462352021-01-012021-12-310001846235imaq:CommonStockSubjectToRedemptionMember2022-03-310001846235imaq:CommonStockSubjectToRedemptionMember2022-12-310001846235imaq:CommonStockSubjectToRedemptionMember2023-03-310001846235imaq:CommonStockSubjectToRedemptionMember2022-04-012023-03-310001846235imaq:CommonStockSubjectToRedemptionMember2022-01-012022-12-310001846235imaq:CommonStockSubjectToRedemptionMember2021-04-012022-03-310001846235imaq:FebruaryTwoThousandAndTwentyThreePromissoryNoteMember2023-02-140001846235imaq:StockPurchaseAgreementMember2022-10-012022-10-220001846235imaq:StockPurchaseAgreementMember2022-10-2200018462352022-07-2600018462352022-08-012022-08-0200018462352021-08-020001846235us-gaap:SubsequentEventMember2023-07-012023-07-110001846235us-gaap:SubsequentEventMember2023-06-012023-06-230001846235us-gaap:SubsequentEventMember2023-06-012023-06-0200018462352022-10-012022-10-2800018462352022-07-012022-07-2600018462352021-04-012021-12-3100018462352023-02-012023-02-030001846235us-gaap:PrivatePlacementMember2022-04-012023-03-310001846235us-gaap:PrivatePlacementMemberimaq:PrivatePlacementWarrantMember2023-03-310001846235us-gaap:RightsMemberus-gaap:PrivatePlacementMember2023-03-310001846235us-gaap:PrivatePlacementMember2023-03-310001846235us-gaap:OverAllotmentOptionMemberimaq:PrivatePlacementWarrantMember2023-03-310001846235us-gaap:OverAllotmentOptionMember2021-08-060001846235us-gaap:IPOMember2023-03-310001846235us-gaap:PrivatePlacementMember2021-08-060001846235us-gaap:IPOMember2021-08-020001846235us-gaap:OverAllotmentOptionMemberimaq:PrivatePlacementWarrantMember2022-04-012023-03-310001846235us-gaap:PrivatePlacementMember2021-08-012021-08-060001846235us-gaap:OverAllotmentOptionMember2021-08-012021-08-060001846235us-gaap:IPOMember2021-08-012021-08-0200018462352021-01-012021-01-150001846235us-gaap:RetainedEarningsMember2023-03-310001846235us-gaap:AdditionalPaidInCapitalMember2023-03-310001846235imaq:CommonStocksMember2023-03-310001846235us-gaap:RetainedEarningsMember2022-04-012023-03-310001846235us-gaap:AdditionalPaidInCapitalMember2022-04-012023-03-310001846235us-gaap:RetainedEarningsMember2022-03-310001846235us-gaap:AdditionalPaidInCapitalMember2022-03-310001846235imaq:CommonStocksMember2022-03-310001846235us-gaap:RetainedEarningsMember2022-01-012022-03-310001846235us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001846235imaq:CommonStocksMember2022-01-012022-03-310001846235us-gaap:RetainedEarningsMember2021-12-310001846235us-gaap:AdditionalPaidInCapitalMember2021-12-310001846235imaq:CommonStocksMember2021-12-310001846235us-gaap:RetainedEarningsMember2021-01-162021-12-310001846235us-gaap:AdditionalPaidInCapitalMember2021-01-162021-12-310001846235imaq:CommonStocksMember2021-01-162021-12-3100018462352021-01-150001846235us-gaap:RetainedEarningsMember2021-01-150001846235us-gaap:AdditionalPaidInCapitalMember2021-01-150001846235imaq:CommonStocksMember2021-01-1500018462352021-01-162021-12-3100018462352022-01-012022-03-310001846235imaq:StockholdersDeficitMember2021-12-310001846235us-gaap:CommitmentsMember2021-12-310001846235us-gaap:CommitmentsMember2022-03-310001846235us-gaap:CommitmentsMember2023-03-310001846235imaq:StockholdersDeficitMember2022-03-310001846235imaq:StockholdersDeficitMember2023-03-3100018462352021-12-3100018462352022-03-3100018462352023-03-3100018462352023-07-1200018462352022-09-300001846235imaq:CommonStocksMember2022-04-012023-03-310001846235imaq:WarrantsMember2022-04-012023-03-310001846235us-gaap:RightsMember2022-04-012023-03-310001846235imaq:UnitsMember2022-04-012023-03-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesimaq:integerxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2023

or

☐ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to ________________

Commission file number: 001-40687

INTERNATIONAL MEDIA ACQUISITION CORP. |

(Exact name of registrant as specified in its charter) |

Delaware | | 86-1627460 |

(State or other jurisdiction of | | (I.R.S. Employer Identification No.) |

incorporation or organization) | | |

| | |

1604 US Highway 130 North Brunswick, NJ | | 08902 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 960-3677

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

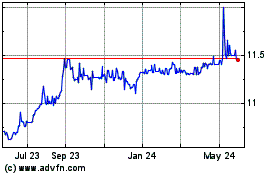

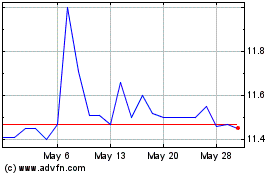

Common Stock | | IMAQ | | The Nasdaq Stock Market LLC |

Warrants | | IMAQW | | The Nasdaq Stock Market LLC |

Rights | | IMAQR | | The Nasdaq Stock Market LLC |

Units | | IMAQU | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ⌧

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ⌧

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ⌧ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ⌧ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging Growth Company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐ No ⌧

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ⌧ No ☐

As of September 30, 2022, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $88,191,269.25.

As of July 12, 2023, there were 8,520,018 shares of common stock, par value $0.0001 per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

INTERNATIONAL MEDIA ACQUISITION CORP.

Annual Report on Form 10-K for the Year Ended March 31, 2023

CERTAIN TERMS

References to “the Company,” “IMAQ,” “our,” “us” or “we” refer to International Media Acquisition Corp., a blank check company incorporated in Delaware on January 15, 2021. References to our “Sponsor” refer to Content Creation Media LLC, a Delaware limited liability company. References to our “IPO” refer to the initial public offering of International Media Acquisition Corp., which closed on August 2, 2021.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. The statements contained in this report that are not purely historical are forward-looking statements. Our forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this report may include, for example, statements about our:

| ● | ability to complete our initial business combination; |

| ● | success in retaining or recruiting, or changes required in, our officers, key employees or directors following our initial business combination; |

| ● | officers and directors allocating their time to other businesses and potentially having conflicts of interest with our business or in approving our initial business combination, as a result of which they would then receive expense reimbursements; |

| ● | potential ability to obtain additional financing to complete our initial business combination; |

| ● | the ability of our officers and directors to generate a number of potential investment opportunities; |

| ● | potential change in control if we acquire one or more target businesses for stock; |

| ● | the potential liquidity and trading of our securities; |

| ● | the lack of a market for our securities; |

| ● | use of proceeds not held in the trust account or available to us from interest income on the trust account balance; or |

| ● | financial performance following our IPO. |

The forward-looking statements contained in this report are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws and/or if and when management knows or has a reasonable basis on which to conclude that previously disclosed projections are no longer reasonably attainable.

PART I

ITEM 1.BUSINESS

Overview

IMAQ is a Delaware blank check company established for the purpose of entering into a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or other similar business transaction with one or more businesses or entities.

If IMAQ does not consummate the Business Combination and fails to consummate an initial business combination by August 2, 2023 (unless IMAQ seeks stockholder approval to amend the Current Charter to extend the date by which an initial business combination may be consummated), then, pursuant to the amended and restated certificate of incorporation, IMAQ will be required to dissolve and liquidate as soon as reasonably practicable, unless IMAQ seeks stockholder approval to amend IMAQ’s certificate of incorporation to extend the date by which an initial business combination may be consummated.

Offering Proceeds Held in Trust

On August 2, 2021, IMAQ consummated the IPO of 20,000,000 units (the “Public Units”) at $10.00 per Public Unit, generating gross proceeds of $200,000,000. Simultaneously with the consummation of the initial public offering, IMAQ consummated the sale of 714,400 units (the “Private Units”) in a private placement transaction with Content Creation Media LLC, IMAQ’s sponsor, generating gross proceeds of $7,144,000.

On August 6, 2021, in connection with the underwriters’ exercise in full of their option to purchase up to 3,000,000 additional Public Units to cover over-allotments, if any, we consummated the sale of an additional 3,000,000 Units, at $10.00 per Public Unit, generating gross proceeds of $30,000,000. Simultaneously with the closing of the exercise of the over-allotment option, we consummated the sale of an additional 82,500 Private Units, at a price of $10.00 per Private Unit, in a private placement to the Sponsor, generating gross proceeds of $825,000.The Private Units were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended, as the transactions did not involve a public offering.

After deducting the underwriting discounts, offering expenses and commissions from the initial public offering and the sale of the Private Units, a total of $230,000,000 of the net proceeds from the initial public and the sale of the Private Units was deposited into IMAQ’s trust account (the “Trust Account”), which is invested in U.S. government securities, within the meaning set forth in Section 2(a)(16) of the Investment Company Act, with a maturity of 180 days or less or in any open-ended investment company that holds itself out as a money market fund meeting the conditions of Rule 2a-7 of the Investment Company Act, as determined by use, until the earlier of (i) the consummation of a business combination or (ii) the distribution of the funds in the Trust Account.

Extension of the Time to Consummate the Business Combination

On July 26, 2022, at a special meeting of the Company’s stockholders, the stockholders approved a proposal to amend the Company’s investment management trust agreement, dated as of July 28, 2021 (the “IMTA”), by and between the Company and Continental Stock Transfer & Trust Company, allowing the Company to extend the Combination Period two times for an additional three months each time, or from August 2, 2022 to February 2, 2023 by depositing into the Trust Account $350,000 for each three-month extension. On July 27, 2022, the Sponsor deposited an aggregate of $350,000 into IMAQ’s Trust Account in order to extend the time available to us to consummate our initial business combination from August 2, 2022 to November 2, 2022. On October 28, 2022, the Sponsor deposited an additional $350,000 into IMAQ’s Trust Account in order to extend the time available to us to consummate our initial business combination from November 2, 2022 to February 2, 2023.

On January 27, 2023, at a special meeting of the Company’s stockholders, the stockholders approved a proposal to amend the Company’s charter and the IMTA, allowing the Company to further extend the Combination Period by an additional three (3) months, from February 2, 2023 to May 2, 2023, with an ability to further extend by three (3) additional one (1) month periods until August 2, 2023, by depositing into the trust account $385,541.10 for the three-month extension and $128,513.70 for each subsequent one-month extension. As of the date hereof, the Company has made all the extension payments required under the IMTA to extend the Combination Period to August 2, 2023.

On June 29, 2023, the Company filed a preliminary proxy statement in connection with a special meeting for the stockholders to vote to further extend the Combination Period by up to twelve (12) additional one (1) month periods from August 2, 2023 to August 2, 2024. The Company will file a definitive proxy statement and other documents required by the SEC and under applicable law at the appropriate time.

Effecting a Business Combination

On October 22, 2022, IMAQ entered into the SPA with Risee Entertainment Holdings Private Limited, a company incorporated in India, and Reliance Entertainment Studios Private Limited, company incorporated in India. Pursuant to the terms of the SPA, a business combination between IMAQ and Reliance will be effected by the acquisition of 100% of the issued and outstanding share capital of Reliance from Seller in a series of transactions, the first of which (as further described in this proxy statement, the “Initial Business Combination”) satisfies the Nasdaq Capital Market requirement that the fair market value of the initial business combination target company must be at least 80% of the balance in IMAQ’s trust account (less any deferred underwriting commissions and interest released to pay franchise and income taxes) on the execution date of the SPA. The combined company following the consummation of the Initial Business Combination is referred to in this proxy statement as the “Combined Company”. The Business Combination is subject to the approval of the IMAQ stockholders as well as other closing conditions. If IMAQ does not consummate the Business Combination and fails to consummate an initial business combination by February 2, 2023, then, pursuant to the amended and restated certificate of incorporation, IMAQ will be required to dissolve and liquidate as soon as reasonably practicable, unless IMAQ seeks stockholder approval to amend IMAQ’s certificate of incorporation to extend the date by which an initial business combination may be consummated.

Satisfaction of 80% Test

The Nasdaq rules require that IMAQ’s initial business combination must occur with one or more operating businesses or assets with a fair market value equal to at least 80% of the net assets held in the Trust Account (excluding any deferred underwriter’s fees and taxes payable on the income earned on the Trust Account) at the time of IMAQ’s signing a definitive agreement in connection with its initial business combination. As of October 22, 2022, the date of the execution of the SPA, the value of the net assets held in the Trust Account was approximately $21,468,570 and 80% thereof represents approximately $17.17 million. In determining whether the consideration for the Company Shares under the SPA represents the fair market value of Reliance. On the date of the Initial Closing of the Business Combination, which is referred to herein as the Initial Business Combination, IMAQ will purchase the Tranche 1 Company Shares for $40,000,000. As a result, IMAQ concluded that the fair market value of the business to be acquired at the Initial Closing will be significantly in excess of 80% of the net assets held in the Trust Account (excluding any deferred underwriter’s fees and taxes payable on the income earned on the Trust Account).

Redemption Rights for Holders of the Public Shares

Pursuant to IMAQ’s amended and restated certificate of incorporation, holders of the public shares will be entitled to redeem their public shares for a pro rata share of the Trust Account (including interest earned on the pro rata portion of the Trust Account, net of taxes payable). IMAQ’s initial stockholders do not have redemption rights with respect to any shares of IMAQ Common Stock owned by them, directly or indirectly.

Automatic Dissolution and Subsequent Liquidation of the Trust Account if No Business Combination

If IMAQ does not consummate the Business Combination and fails to consummate an initial business combination by February 2, 2023, then, pursuant to the amended and restated certificate of incorporation, IMAQ will be required to dissolve and liquidate as soon as reasonably practicable, unless IMAQ seeks stockholder approval to amend IMAQ’s certificate of incorporation to extend the date by which an initial business combination may be consummated. As a result, this has the same effect as if IMAQ had formally gone through a voluntary liquidation procedure under Delaware law. Accordingly, no vote would be required from the IMAQ stockholders to commence such a voluntary winding up, dissolution and liquidation. If IMAQ is unable to consummate the Business Combination and fails to consummate an initial business combination by February 2, 2023, it will, as promptly as possible but not more than ten business days thereafter, redeem 100% of IMAQ’s outstanding public shares for a pro rata share of the aggregate amount then on deposit in the Trust Account upon the consummation of the Initial Business Combination (including interest earned on the pro rata portion of the Trust Account, net of taxes payable) and then seek to liquidate and dissolve, unless IMAQ seeks stockholder approval to amend the Current Charter to extend the date by which an initial business combination may be consummated. In the event of its dissolution and liquidation, the IMAQ Warrants will expire and will be worthless.

The proceeds deposited in the trust account could, however, become subject to the claims of IMAQ’s creditors which would have higher priority than the claims of its public stockholders. IMAQ cannot guarantee that the actual per-share redemption amount received by stockholders will not be substantially less than $10.00. Under Section 281(b) of the DGCL, IMAQ’s plan of dissolution must provide for all claims against it to be paid in full or make provision for payments to be made in full, as applicable, if there are sufficient assets. These claims must be paid or provided for before IMAQ makes any distribution of its remaining assets to its stockholders. While IMAQ intends to pay such amounts, if any, IMAQ cannot guarantee that it will have funds sufficient to pay or provide for all creditors’ claims.

Although IMAQ will seek to have all vendors, service providers, prospective target businesses or other entities with which IMAQ does business execute agreements with it waiving any right, title, interest and claim of any kind in or to any monies held in the trust account for the benefit of IMAQ’s public stockholders, there is no guarantee that they will execute such agreements or even if they execute such agreements that they would be prevented from bringing claims against the trust account including but not limited to fraudulent inducement, breach of fiduciary responsibility or other similar claims, as well as claims challenging the enforceability of the waiver, in each case in order to gain an advantage with respect to a claim against IMAQ’s assets, including the funds held in the trust account. If any third party refuses to execute an agreement waiving such claims to the monies held in the trust account, IMAQ’s management will perform an analysis of the alternatives available to it and will only enter into an agreement with a third party that has not executed a waiver if management believes that such third party’s engagement would be significantly more beneficial to it than any alternative.

In addition, there is no guarantee that such entities will agree to waive any claims they may have in the future as a result of, or arising out of, any negotiations, contracts or agreements with IMAQ and will not seek recourse against the trust account for any reason. The Sponsor has agreed that it will be liable to IMAQ if and to the extent any claims by a third party for services rendered or products sold to IMAQ, or a prospective target business with which IMAQ has discussed entering into a transaction agreement, reduce the amount of funds in the trust account to below (i) $10.00 per public share or (ii) such lesser amount per public share held in the trust account as of the date of the liquidation of the trust account, due to reductions in value of the trust assets, in each case net of the amount of interest which may be withdrawn to pay taxes, except as to any claims by a third party who executed a waiver of any and all rights to seek access to the trust account and except as to any claims under IMAQ’s indemnity of the underwriters of IMAQ’s initial public offering against certain liabilities, including liabilities under the Securities Act. In the event that an executed waiver is deemed to be unenforceable against a third party, then the Sponsor will not be responsible to the extent of any liability for such third party claims. IMAQ has not independently verified whether the Sponsor has sufficient funds to satisfy its indemnity obligations and believes that the Sponsor’s only assets are securities of IMAQ. IMAQ has not asked the Sponsor to reserve for such indemnification obligations. Therefore, IMAQ cannot guarantee that the Sponsor would be able to satisfy those obligations. As a result, if any such claims were successfully made against the trust account, the funds available for IMAQ’s initial business combination and redemptions could be reduced to less than $10.00 per public share. In such event, IMAQ may not be able to complete its initial business combination, and IMAQ’s stockholders would receive such lesser amount per share in connection with any redemption of their public shares. None of IMAQ’s officers will indemnify IMAQ for claims by third parties including, without limitation, claims by vendors and prospective target businesses.

In the event that the proceeds in the trust account are reduced below (i) $10.00 per public share or (ii) such lesser amount per public share held in the trust account as of the date of the liquidation of the trust account, due to reductions in value of the trust assets, in each case net of the amount of interest which may be withdrawn to pay taxes, and the Sponsor asserts that it is unable to satisfy its indemnification obligations or that it has no indemnification obligations related to a particular claim, IMAQ’s independent directors would determine whether to take legal action against the Sponsor to enforce its indemnification obligations. While IMAQ expects that its independent directors would take legal action on its behalf against the Sponsor to enforce its indemnification obligations to IMAQ, it is possible that IMAQ’s independent directors in exercising their business judgment may choose not to do so if, for example, the cost of such legal action is deemed by the independent directors to be too high relative to the amount recoverable or if the independent directors determine that a favorable outcome is not likely. IMAQ has not asked the Sponsor to reserve for such indemnification obligations and IMAQ cannot guarantee that the Sponsor would be able to satisfy those obligations. Accordingly, IMAQ cannot guarantee that due to claims of creditors the actual value of the per-share redemption price will not be less than $10.00 per public share.

Under the DGCL, stockholders may be held liable for claims by third parties against a corporation to the extent of distributions received by them in a dissolution. The pro rata portion of IMAQ’s trust account distributed to its public stockholders upon the redemption of its public shares in the event IMAQ does not complete its business combination by February 2, 2023 may be considered a liquidating distribution under Delaware law. If the corporation complies with certain procedures set forth in Section 280 of the DGCL intended to ensure that it makes reasonable provision for all claims against it, including a 60-day notice period during which any third-party claims can be brought against the corporation, a 90-day period during which the corporation may reject any claims brought, and an additional 150-day waiting period before any liquidating distributions are made to stockholders, any liability of stockholders with respect to a liquidating distribution is limited to the lesser of such stockholder’s pro rata share of the claim or the amount distributed to the stockholder, and any liability of the stockholder would be barred after the third anniversary of the dissolution.

Furthermore, if the pro rata portion of IMAQ’s trust account distributed to its public stockholders upon the redemption of its public shares in the event IMAQ does not complete its business combination by February 2, 2023, is not considered a liquidating distribution under Delaware law and such redemption distribution is deemed to be unlawful, then pursuant to Section 174 of the DGCL, the statute of limitations for claims of creditors could then be six years after the unlawful redemption distribution, instead of three years, as in the case of a liquidating distribution. If IMAQ is unable to complete its business combination by February 2, 2023, IMAQ will: (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account including interest earned on the funds held in the trust account and not previously released to IMAQ to pay its taxes, divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidating distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of IMAQ’s remaining stockholders and their board of directors, dissolve and liquidate, subject in each case to IMAQ’s obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. Accordingly, it is IMAQ’s intention to redeem its public shares as soon as reasonably possible following its 18th month and, therefore, IMAQ does not intend to comply with those procedures. As such, IMAQ’s stockholders could potentially be liable for any claims to the extent of distributions received by them (but no more) and any liability of its stockholders may extend well beyond the third anniversary of such date.

Because IMAQ does not comply with Section 280, Section 281(b) of the DGCL requires IMAQ to adopt a plan, based on facts known to IMAQ at such time that will provide for its payment of all existing and pending claims or claims that may be potentially brought against it within the subsequent 10 years. However, because IMAQ is a blank check company, rather than an operating company, and its operations are limited to searching for prospective target businesses to acquire, the only likely claims to arise would be from its vendors (such as lawyers, investment bankers, etc.) or prospective target businesses. Pursuant to the obligation contained in IMAQ’s underwriting agreement dated July 28, 2021, IMAQ required that all vendors, service providers, prospective target businesses or other entities with which it does business execute agreements with it waiving any right, title, interest or claim of any kind in or to any monies held in the trust account. As a result of this obligation, the claims that could be made against IMAQ are significantly limited and the likelihood that any claim that would result in any liability extending to the trust account is remote. Further, the Sponsor may be liable only to the extent necessary to ensure that the amounts in the trust account are not reduced below (i) $10.00 per public share or (ii) such lesser amount per public share held in the trust account as of the date of the liquidation of the trust account, due to reductions in value of the trust assets, in each case net of the amount of interest withdrawn to pay taxes and will not be liable as to any claims under IMAQ’s indemnity of the underwriters of the initial public offering against certain liabilities, including liabilities under the Securities Act. In the event that an executed waiver is deemed to be unenforceable against a third party, the Sponsor will not be responsible to the extent of any liability for such third-party claims.

If IMAQ files a bankruptcy petition or an involuntary bankruptcy petition is filed against it that is not dismissed, the proceeds held in the trust account could be subject to applicable bankruptcy law, and may be included in IMAQ’s bankruptcy estate and subject to the claims of third parties with priority over the claims of its stockholders. To the extent any bankruptcy claims deplete the trust account, IMAQ cannot guarantee that it will be able to return $10.00 per share to its public stockholders. Additionally, if IMAQ files a bankruptcy petition or an involuntary bankruptcy petition is filed against IMAQ that is not dismissed, any distributions received by stockholders could be viewed under applicable debtor/creditor and/or bankruptcy laws as either a “preferential transfer” or a “fraudulent conveyance.” As a result, a bankruptcy court could seek to recover some or all amounts received by IMAQ’s stockholders. Furthermore, IMAQ’s board of directors may be viewed as having breached its fiduciary duty to its creditors and/or may have acted in bad faith, thereby exposing itself and IMAQ to claims of punitive damages, by paying public stockholders from the trust account prior to addressing the claims of creditors. IMAQ cannot guarantee that claims will not be brought against it for these reasons.

IMAQ’s public stockholders will be entitled to receive funds from the trust account only (i) in the event of the redemption of its public shares if IMAQ does not complete its business combination by February 2, 2023, subject to applicable law, (ii) (a) in connection with a stockholder vote to approve an amendment to its amended and restated certificate of incorporation to modify the substance or timing of its obligation to allow redemption in connection with the Business Combination or to redeem 100% of its public shares if IMAQ has not consummated an initial business combination by February 2, 2023, or (b) with respect to any other provision relating to stockholders’ rights or pre-initial business combination activity or (iii) IMAQ’s completion of an initial business combination, and then only in connection with those public shares that such stockholder properly elected to redeem, subject to the limitations described in the final prospectus IMAQ filed with the SEC on July 29, 2021. In no other circumstances will a stockholder has any right or interest of any kind to or in the trust account.

Each of IMAQ’s initial stockholders has agreed to waive its rights to participate in any liquidation of the Trust Account or other assets with respect to any shares of IMAQ common stock they hold.

Employees

IMAQ currently has two officers, Messrs. Sarkar and Joshi, who serve as the Chief Executive Officer and Chief Financial Officer, respectively. The officers are not obligated to devote any specific number of hours to IMAQ’s matters. The amount of time the officers will devote to IMAQ in any time period will vary based on whether a target business has been selected and the stage of the Business Combination process IMAQ is in. IMAQ does not have any other employees.

Facilities

IMAQ’s executive offices are located at 1604 US Highway 130, North Brunswick, NJ 08902 and its telephone number is (212) 960-3677. The cost for IMAQ’s use of this space is included in the $10,000 per month fee it pays to the Sponsor for office space, administrative and support services. IMAQ considers its current office space adequate for its current operations.

Legal Proceedings

There is no material litigation, arbitration or governmental proceeding currently pending against IMAQ or any members of its management team in their capacity as such.

ITEM 1A.RISK FACTORS

As of the date of this Annual Report on Form 10-K, there have been no material changes to the risk factors disclosed in our prospectus filed with the SEC on July 29, 2021. Any of these factors could result in a significant or material adverse effect on our results of operations or financial condition. In addition to these risk factors, the Company has identified the following additional risk factors:

We may not be able to complete the Business Combination since such initial business combination may be subject to U.S. foreign investment regulations and review by a U.S. government entity such as the Committee on Foreign Investment in the United States (“CFIUS”), or ultimately prohibited.

The Sponsor, Content Creation Media LLC, is a Delaware limited liability company, is controlled by Shibasish Sarkar, an individual who resides in and is a citizen of India. We are therefore likely considered a “foreign person” under the regulations administered by CFIUS and will continue to be considered as such in the future for so long as the Sponsor has the ability to exercise control over us for purposes of CFIUS’s regulations. While we believe that the nature of IMAQ’s business, and the nature of the businesses of Reliance should not make the transaction subject to U.S. foreign regulations or review by a U.S. government entity, it is possible that the Business Combination may be subject to CFIUS review, the scope of which was expanded by the Foreign Investment Risk Review Modernization Act of 2018 (“FIRRMA”), to include certain non-passive, non-controlling investments in sensitive U.S. businesses and certain acquisitions of real estate even with no underlying U.S. business. FIRRMA, and subsequent implementing regulations that are now in force, also subjects certain categories of investments to mandatory filings. If the Business Combination falls within CFIUS’s jurisdiction, we may determine that we are required to make a mandatory filing or that we will submit a voluntary notice to CFIUS, or to proceed with the Business Combination without notifying CFIUS and risk CFIUS intervention, before or after closing the Business Combination. CFIUS may decide to block or delay the Business Combination, impose conditions to mitigate national security concerns with respect to the Business Combination or order us to divest all or a portion of a U.S. business of the combined company without first obtaining CFIUS clearance, which may limit the attractiveness of or prevent us from consummating the Business Combination.

Moreover, the process of government review, whether by the CFIUS or otherwise, could be lengthy and we have limited time to complete the Business Combination. If we fail to consummate an initial business combination prior to February 2, 2023 because the review exceeds such timeframe or because our initial business combination is ultimately prohibited by CFIUS or another U.S. government entity, we may be required to liquidate. If we liquidate, our public stockholders may only receive their pro rata share of the funds in the trust account, and our warrants and rights will expire worthless. This will also cause you to lose the investment opportunity in a target company and the chance of realizing future gains on your investment through any price appreciation in the combined company.

ITEM 1B.UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2.PROPERTIES

We currently maintain our principal executive offices at 1604 US Highway 130, North Brunswick, NJ 08902, and our telephone number is (212) 960-3677. The cost for this space is included in the $10,000 per-month fee (subject to deferral as described herein) payable to the Sponsor, for office space, utilities and secretarial services. We consider our current office space adequate for our current operations.

ITEM 3.LEGAL PROCEEDINGS

We may be subject to legal proceedings, investigations and claims incidental to the conduct of our business from time to time. We are not currently a party to any material litigation or other legal proceedings brought against us. We are also not aware of any legal proceeding, investigation or claim, or other legal exposure that has a more than remote possibility of having a material adverse effect on our business, financial condition or results of operations.

ITEM 4.MINE SAFETY DISCLOSURES

Not Applicable.

PART II

ITEM 5.MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our units began to trade on The Nasdaq Global Market, or Nasdaq, under the symbol “IMAQU” on or about July 29, 2021, and the shares of common stock, rights and warrants began separate trading on Nasdaq under the symbols “IMAQ,” “IMAQR” and “IMAQW,” respectively, on or about August 17, 2021.

Holders of Record

As of March 31, 2023, there were 8,520,018 of our shares of common stock issued and outstanding held by approximately nine stockholders of record. The number of record holders was determined from the records of our transfer agent and does not include beneficial owners of shares of common stock whose shares are held in the names of various security brokers, dealers, and registered clearing agencies.

Dividends

We have not paid any cash dividends on our common stock to date and do not intend to pay cash dividends prior to the completion of an initial business combination. The payment of cash dividends in the future will be dependent upon our revenues and earnings, if any, capital requirements and general financial condition subsequent to completion of a business combination. The payment of any dividends subsequent to a business combination will be within the discretion of our board of directors at such time. It is the present intention of our board of directors to retain all earnings, if any, for use in our business operations and, accordingly, our board of directors does not anticipate declaring any dividends in the foreseeable future. In addition, our board of directors is not currently contemplating and does not anticipate declaring any share dividends in the foreseeable future. Further, if we incur any indebtedness, our ability to declare dividends may be limited by restrictive covenants we may agree to in connection therewith.

Securities Authorized for Issuance Under Equity Compensation Plans

None.

Recent Sales of Unregistered Securities

There were no unregistered securities to report which have not been previously included in a Quarterly Report on Form 10-Q or a Current Report on Form 8-K.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

None.

ITEM 6.[RESERVED]

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Annual Report includes “forward-looking statements” that are not historical facts and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical fact included in this Annual Report including, without limitation, statements in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding the Company’s financial position, business strategy and the plans and objectives of management for future operations, are forward-looking statements. Words such as “expect,” “believe,” “anticipate,” “intend,” “estimate,” “seek” and variations and similar words and expressions are intended to identify such forward-looking statements. Such forward-looking statements relate to future events or future performance, but reflect management’s current beliefs, based on information currently available. A number of factors could cause actual events, performance or results to differ materially from the events, performance and results discussed in the forward-looking statements. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to “Cautionary Note Regarding Forward-Looking Statements” elsewhere in this Annual Report on Form 10‑K. The Company’s securities filings can be accessed on the EDGAR section of the SEC’s website at www.sec.gov. Except as expressly required by applicable securities law, the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Fiscal Year End Change

As previously disclosed, we changed our fiscal year end from December 31 to March 31, effective for the fiscal year beginning April 1, 2022. Our current fiscal year began on April 1, 2022 and ended on March 31, 2023 ("Fiscal 2023"). We refer to the period beginning on January 1, 2022 and ending on March 31, 2022 as the "transition period". We filed a Transition Report on Form 10-QT that included financial information for the transition period with the SEC on September 29, 2022. Our 2021 fiscal year began on January 1, 2021 and ended on December 31, 2021 ("Fiscal 2021"). There was no Fiscal 2022.

We have presented the twelve months ended March 31, 2022 as a comparison to our results for Fiscal 2023 as we believe this comparison is more meaningful to a reader’s understanding of our Fiscal 2023 results of operations than a comparison to Fiscal 2021. A comparison of the three-months ended March 31, 2022 to the three-months ended March 31, 2021 may be found in Part I, Item 2, of our Transition Report on Form 10-QT for the three-months ended March 31, 2022 filed with the SEC on September 29, 2022.

Overview

We are a blank check company incorporated on January 15, 2021, in Delaware and formed for the purpose of effectuating a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses, which we refer to throughout this Annual Report as our “initial business combination”. We intend to effectuate our initial business combination using cash from the proceeds of our initial public offering (the “Initial Public Offering”) and the private placement of the Private Units (as defined below), the proceeds of the sale of our shares in connection with our initial business combination (pursuant to forward purchase agreements or backstop agreements we may enter into following the consummation of the Initial Public Offering or otherwise), shares issued to the owners of the target, debt issued to bank or other lenders or the owners of the target, or a combination of the foregoing.

The issuance of additional shares in connection with an initial business combination:

| · | may significantly dilute the equity interest of our investors who would not have pre-emption rights in respect of any such issuance; |

| | |

| · | may subordinate the rights of holders of shares of common stock if we issue shares of preferred stock with rights senior to those afforded to our shares of common stock; |

| | |

| · | could cause a change in control if a substantial number of shares of our common stock is issued, which may affect, among other things, our ability to use our net operating loss carry forwards, if any, and could result in the resignation or removal of our present officers and directors; |

| | |

| · | may have the effect of delaying or preventing a change of control of us by diluting the stock ownership or voting rights of a person seeking to obtain control of us; and |

| · | may adversely affect prevailing market prices for our common stock, rights and/or warrants. |

Similarly, if we issue debt securities or otherwise incur significant debt, it could result in:

| · | default and foreclosure on our assets if our operating revenues after an initial business combination are insufficient to repay our debt obligations; |

| | |

| · | acceleration of our obligations to repay the indebtedness even if we make all principal and interest payments when due if we breach certain covenants that require the maintenance of certain financial ratios or reserves without a waiver or renegotiation of that covenant; |

| | |

| · | our immediate payment of all principal and accrued interest, if any, if the debt security is payable on demand; |

| | |

| · | our inability to obtain necessary additional financing if the debt security contains covenants restricting our ability to obtain such financing while the debt security is outstanding; |

| | |

| · | using a substantial portion of our cash flow to pay principal and interest on our debt, which will reduce the funds available for dividends on our common stock if declared, our ability to pay expenses, make capital expenditures and acquisitions, and fund other general corporate purposes; |

| | |

| · | limitations on our flexibility in planning for and reacting to changes in our business and in the industry in which we operate; |

| | |

| · | increased vulnerability to adverse changes in general economic, industry and competitive conditions and adverse changes in government regulation; |

| | |

| · | limitations on our ability to borrow additional amounts for expenses, capital expenditures, acquisitions, debt service requirements, and execution of our strategy; and |

| | |

| · | other purposes and other disadvantages compared to our competitors who have less debt. |

We expect to continue to incur significant costs in the pursuit of our initial business combination plans. We cannot assure you that our plans to raise capital or to complete our initial business combination will be successful.

Stock Purchase Agreement

On October 22, 2022, we entered into a Stock Purchase Agreement (the “SPA”) with Risee Entertainment Holdings Private Limited, a company incorporated in India (the “Seller”), and Reliance Entertainment Studios Private Limited, company incorporated in India (the “Target Company”). Pursuant to the terms of the SPA, a business combination between us and the Target Company will be effected by the acquisition of 100% of the issued and outstanding share capital of the Target Company from Seller in a series of transactions (collectively, the “Stock Acquisition”). Our board of directors has (i) approved and declared advisable the SPA and the other transactions contemplated thereby, and (ii) resolved to recommend approval of the SPA and related transactions by our stockholders.

In accordance with the terms and subject to the conditions of the SPA, the Seller will, in exchange for the consideration set forth in the SPA, sell, transfer, convey, assign and deliver, all rights, title and interest in and to the shares of the Target Company (the “Company Shares”), free and clear of all liens, excepting only restrictions on the subsequent transfer of the Company Shares by us imposed under applicable laws, our organizational documents, and the shareholders’ agreement entered into in connection with the SPA. Such purchases will be made in four separate tranches as described in the SPA, with the final purchase to be made on or prior to 18 months from the initial closing. The aggregate purchase price for the Company Shares under the SPA is $102,000,000, and in addition, we also agreed to make a primary investment into the Target Company in the amount of $38,000,000.

The SPA contains customary representations, warranties and covenants of the parties thereto. The consummation of the proposed Stock Acquisition is subject to certain conditions as further described in the SPA.

Please see the Current Report on Form 8-K we filed with the SEC on October 24, 2022 for additional information.

Results of Operations

We have neither engaged in any operations nor generated any operating revenues to date. Our only activities for the period from January 15, 2021 (inception), through March 31, 2023, were organizational activities, after IPO related to identifying a target company for a business combination. We do not expect to generate any operating revenues until after the completion of our initial business combination. We generate non-operating income in the form of interest income on cash and cash equivalents held after the Initial Public Offering. We incur expenses as a result of being a public company (for legal, financial reporting, accounting and auditing compliance), as well as for due diligence expenses.

For the year ended March 31, 2023, we had net loss of $1,235,409, which consists of interest income on investments held in the trust account of $1,088,765 and change in warrant liability of $119,535, offset by operating costs of $2,236,076, and income tax provision of $207,632.

For the year ended March 31, 2022, we had a net loss of $2,198,385, which consists of interest income on investments held in the trust account of $29,938 and change in warrant liability of $318,760, offset by operating costs of $2,547,083.

Liquidity and Capital Resources

As of March 31, 2023, we had $302 in our operating bank account available for working capital needs. All remaining cash was held in the trust account and is generally unavailable for our use prior to an initial business combination.

On August 2, 2021, we consummated the Initial Public Offering of 20,000,000 units (the “Units”), at $10.00 per Unit, generating gross proceeds of $200,000,000. Each Unit consists of one share of common stock (“Public Share”), one right (“Public Right”) and one redeemable warrant (“Public Warrant”). Each Public Right entitles the holder to receive one-twentieth of one share of common stock at the closing of our initial business combination. Each Public Warrant entitles the holder to purchase three-fourths of one share of common stock at an exercise price of $11.50 per whole share.

Simultaneously with the closing of the Initial Public Offering, the Sponsor purchased an aggregate of 714,400 units (the “Private Units”), at a price of $10.00 per Private Unit ($7,144,000 in the aggregate). Each Private Unit consists of one share of common stock (“Private Share”), one right (“Private Right”) and one warrant (“Private Warrant”). Each Private Right entitles the holder to receive one-twentieth of one share of common stock at the closing of our initial business combination. Each Private Warrant entitles the holder to purchase three-fourths of one share of common stock at an exercise price of $11.50 per whole share.

The proceeds from the Private Units was added to the proceeds from the Initial Public Offering to be held in the trust account. If we do not complete our initial business combination within 15 months (or up to 18 months if our time to complete a business combination is extended), the proceeds of the sale of the Private Units will be used to fund the redemption of the Public Shares (subject to the requirements of applicable law) and the Private Units and all underlying securities will be worthless. There will be no redemption rights or liquidating distributions from the trust account with respect to the rights and warrants included in the Private Units.

On August 6, 2021, in connection with the underwriters’ exercise in full of their option to purchase up to 3,000,000 additional Units to cover over-allotments, if any, we consummated the sale of an additional 3,000,000 Units, at $10.00 per Unit, generating gross proceeds of $30,000,000.

Simultaneously with the closing of the exercise of the over-allotment option, we consummated the sale of an additional 82,500 Private Units, at a price of $10.00 per Private Unit, in a private placement to our Sponsor, generating gross proceeds of $825,000.

We intend to use substantially all of the net proceeds of the Initial Public Offering and the private placement, including the funds held in the trust account, in connection with our initial business combination and to pay our expenses relating thereto, including deferred underwriting commissions payable to the underwriters in an amount equal to 3.5% ($8,050,000) of the total gross proceeds raised in the Initial Public Offering upon consummation of our initial business combination. To the extent that our capital stock is used in whole or in part as consideration to effect our initial business combination, the remaining proceeds held in the trust account as well as any other net proceeds not expended will be used as working capital to finance the operations of the target business. Such working capital funds could be used in a variety of ways including continuing or expanding the target business’ operations, for strategic acquisitions and for marketing, research and development of existing or new products. Such funds could also be used to repay any operating expenses or finders’ fees which we had incurred prior to the completion of our initial business combination if the funds available to us outside of the trust account were insufficient to cover such expenses.

In connection with the Company’s assessment of going concern considerations in accordance with FASB’s Accounting Standards Update (“ASU”) 2014-15, “Disclosures of Uncertainties about an Entity’s Ability to Continue as a Going Concern,” the Company has until February 2, 2023, to consummate a Business Combination. The Company elected to take second extension, Sponsor deposited into the Trust Account $350,000 to extend the deadline from November 2, 2022, to February 2, 2023. On January 27, 2023, IMAQ held a special meeting of stockholders (the “Special Meeting”). As approved by its stockholders at the Special Meeting, the Company filed a certificate of amendment to its amended and restated certificate of incorporation (the “Charter Amendment”) which became effective upon filing. The Charter Amendment changed the date by which IMAQ must consummate an initial business combination for an additional three (3) months, from February 2, 2023 to May 2, 2023, with an ability to further extend by three (3) additional one (1) month periods until August 2, 2023 (the “Amended Combination Period”). On February 3, 2023, third extension payment of $385,541 was deposited by the Sponsor into the Company’s Trust Account to extend the February 2, 2023, deadline to May 2, 2023. between June and July 2023 further three extension payment amounting to $385,539 was deposited by the Sponsor into the Company’s Trust Account to extend the May 2, 2023, deadline to August 2, 2023

If a Business Combination is not consummated by August 2, 2023, there will be a mandatory liquidation and subsequent dissolution of the Company. Management has determined that the mandatory liquidation, if a Business Combination not occur, raises substantial doubt about the Company’s ability to continue as a going concern. No adjustments have been made to the carrying amounts of assets or liabilities should the Company be required to liquidate after August 2, 2023.

Management has determined that if the Company is unable to raise additional funds to alleviate liquidity needs as well as complete a Business Combination by August 2, 2023, then the Company will cease all operations except for the purpose of liquidating. The liquidity condition and date for mandatory liquidation raise substantial doubt about the Company’s ability to continue as a going concern. No adjustments have been made to the carrying amounts of assets or liabilities should the Company be required to liquidate after August 2, 2023.Management plans to continue to draw down the funds on its promissory notes, repayable only if there is a Business Combination. The Company intends to complete a Business Combination before the mandatory liquidation date.

We believe that the balance in our operating bank account as of March 31, 2023; available promissory note, off balance sheet loan arrangement and commitment from sponsor to provide further loan as and when required, will be insufficient to allow us to operate for at least the next 12 months, assuming that a business combination is not consummated during that time. Over this time period, we will be using these funds for target business to consummate our initial business combination with and structuring, negotiating and consummating the business combination.

We expect our primary liquidity requirements during that period to include approximately $134,950 for accounting, audit and other third-party expenses attendant to the structuring and negotiation of a business combination; $568,150 for due diligence, consulting, travel and miscellaneous expenses incurred during search for initial business combination target; $385,000 SEC extension fee; $182,000 for franchise tax payment and approximately $45,000 for working capital that will be used for miscellaneous expenses and reserves.

These amounts are estimates and may differ materially from our actual expenses. In addition, we could use a portion of the funds not being placed in trust to pay commitment fees for financing, fees to consultants to assist us with our search for a target business or as a down payment or to fund a “no-shop” provision (a provision designed to keep target businesses from “shopping” around for transactions with other companies on terms more favorable to such target businesses) with respect to a particular proposed business combination, although we do not have any current intention to do so. If we entered into an agreement where we paid for the right to receive exclusivity from a target business, the amount that would be used as a down payment or to fund a “no-shop” provision would be determined based on the terms of the specific business combination and the amount of our available funds at the time. Our forfeiture of such funds (whether as a result of our breach or otherwise) could result in our not having sufficient funds to continue searching for, or conducting due diligence with respect to, prospective target businesses.

We may need to raise additional funds following the Initial Public Offering in order to meet the expenditures required for operating our business. However, if our estimates of the costs of identifying a target business, undertaking in-depth due diligence and negotiating an initial business combination are less than the actual amount necessary to do so, we may have insufficient funds available to operate our business prior to our initial business combination. Moreover, we may need to obtain additional financing either to complete our initial business combination or because we become obligated to redeem a significant number of our Public Shares upon completion of our initial business combination, in which case we may issue additional securities or incur debt in connection with such business combination. Subject to compliance with applicable securities laws, we would only complete such financing simultaneously with the completion of our business combination. If we are unable to complete our initial business combination because we do not have sufficient funds available to us, we will be forced to cease operations and liquidate the trust account. In addition, following our initial business combination, if cash on hand is insufficient, we may need to obtain additional financing in order to meet our obligations.

Off-Balance Sheet Arrangements

We did not have any off-balance sheet arrangements as of March 31, 2023.

Contractual Obligations

Promissory Notes - Related Party

On February 1, 2021, we issued an unsecured promissory note to the Sponsor (the “Initial Promissory Note”), pursuant to which we could borrow up to an aggregate of $300,000 to cover expenses related to the Initial Public Offering. On April 6, 2021 and June 17, 2021, we issued additional unsecured promissory notes to the Sponsor (the “Additional Promissory Notes” and, together with the “Initial Promissory Note”, the “IPO Promissory Notes”), pursuant to which we may borrow up to an additional aggregate principal amount of $200,000. The IPO Promissory Notes were non-interest bearing and payable on the earlier of (i) December 31, 2021 or (ii) the consummation of the Initial Public Offering. The outstanding balance under the Promissory Notes was repaid on August 6, 2021.

On January 14, 2022, we issued an unsecured promissory note to the Sponsor (the “Post-IPO Promissory Note”), pursuant to which we could borrow up to an aggregate of $500,000 in two installments of (i) up to $300,000 during the month of March 2022, and (ii) up to $200,000 during the month of June 2022 at our discretion. The Post-IPO Promissory Note is non-interest bearing and payable promptly after the date on which we consummate an initial business combination.

On March 29, 2022, we amended and restated the Post-IPO Promissory Note, such that the aggregate amount we can borrow at our discretion under the note increased from $500,000 in two installments as described above, to up to $750,000 in three installments of (i) up to $195,000 no later than February 28, 2022, (ii) up to $355,000 no later than April 30, 2022, and (iii) up to $200,000 no later than June 30, 2022. No other terms were amended pursuant to this amendment and restatement. As of March 31, 2023 and March 31, 2022, the amount outstanding on the promissory note was $750,000 and $195,000 respectively.

On August 10, 2022, the Company issued an unsecured promissory note to the Sponsor (the “August 2022 Promissory Note”), pursuant to which the Company may borrow up to an aggregate of $895,000 in three installments of (i) up to $195,000 no later than July 31, 2022, (ii) up to $500,000 no later than October 31, 2022, and (iii) up to $200,000 no later than January 31, 2023 at the Company’s discretion. The August 2022 Promissory Note is non-interest bearing and payable promptly after the date on which the Company consummates an initial Business Combination. As of March 31, 2023 and March 31, 2022, the amount outstanding on the August 2022 Promissory Note was $895,000 and $0 respectively.

On November 18, 2022, the Company issued an unsecured promissory note to the Sponsor (the “November 2022 Promissory Note”), pursuant to which the Company may borrow up to an aggregate of $300,000 no later than March 31, 2023, at the Company’s discretion. The November 2022 Promissory Note is non-interest bearing and payable promptly after the date on which the Company consummates an initial Business Combination. As of March 31, 2023, and March 31, 2022, the amount outstanding on the November 2022 Promissory Note was $300,000 and $0 respectively.

On February 14, 2023, the Company issued an unsecured promissory note to the Sponsor (the “February 2023 Promissory Note”), pursuant to which the Company may borrow up to an aggregate amount of up to $500,000 in four installments of (i) up to $150,000 no later than February 28, 2023, (ii) up to $200,000 no later than March 31, 2023, (iii) up to $50,000 no later than April 30, 2023, and (iv) up to $100,000 no later than July 31, 2023, upon the request by the Company at the Company’s discretion. The February 2023 Promissory Note is non-interest bearing and payable promptly after the date on which the Company consummates an initial Business Combination. As of March 31, 2023, and March 31, 2022, the amount outstanding on the February 2023 Promissory Note was $180,541 and $0 respectively.

Loan Transfer Agreement

On January 26, 2023, International Media Acquisition Corp., a Delaware corporation (the “Company”),entered into a Loan and Transfer Agreement, dated as of the date hereof (the “Loan Agreement”), by and among the Company, Content Creation Media, LLC (the “Sponsor”), and the lender named therein (the “Lender”), pursuant to which the Sponsor is permitted to borrow $385,541 (the “Initial Loan”) and $128,513 per month, at the Company’s discretion (each a “Monthly Loan” and collectively with the Initial Loan, the “Loan”) which will in turn be loaned by the Sponsor to the Company, to cover certain extension payments to the trust account of the Company. Pursuant to the Loan Agreement, the Loan shall be payable within five (5) days of the date on which Company consummates its de-SPAC transaction.

As additional consideration for the Lender making the Initial Loan available to Sponsor, the Company shall issue 500,000 shares of Common Stock to the Lender (the “Initial Securities”), and as additional consideration for the lender making each Monthly Loan available to Sponsor, the Company shall issue 166,700 shares of Common Stock to Lender for each Monthly Loan. Such securities shall be subject to no transfer restrictions or any other lock-up provisions, earn outs or other contingencies, and shall promptly be registered pursuant to the first registration statement filed by the Company or the surviving entity following the de-SPAC Closing in connection with the de-SPAC Closing, or if no such registration statement is filed in connection with the de-SPAC Closing, the first registration statement filed subsequent to the de-SPAC Closing, which will be filed no later than 45 days after the de-SPAC Closing and declared effective no later than 90 days after the de-SPAC Closing.

The proceeds of the Loan will be used for the Company to fund amounts deposited into the Company’s trust account in connection with each extension.

Underwriting Agreement

On July 28, 2021, in connection with the Initial Public Offering, we entered into an underwriting agreement with Chardan Capital Markets, LLC, as representative of the underwriters named therein.

Pursuant to the underwriting agreement, the underwriters were paid a cash underwriting discount of $0.20 per Unit sold in the Initial Public Offering, or $4,600,000 in the aggregate, upon the closing of the Initial Public Offering and full exercise of the over-allotment option. In addition, $0.35 per Unit sold in the Initial Public Offering, or $8,050,000 in the aggregate will be payable to the underwriters for deferred underwriting commissions. The deferred fee will become payable to the underwriters from the amounts held in the trust account solely in the event that we complete an initial business combination, subject to the terms of the underwriting agreement.

Right of First Refusal

Subject to certain conditions, we granted Chardan, the representative of the underwriters in the Initial Public Offering, for a period of 18 months after the date of the consummation of our business combination, a right of first refusal to act as book-running manager, with at least 30% of the economics, for any and all future public and private equity and debt offerings. In accordance with FINRA Rule 5110(f)(2)(E)(i), such right of first refusal shall not have a duration of more than three years from the effective date of the registration statement for the Initial Public Offering.

Chief Financial Officer Agreement

On February 8, 2021, we entered into an agreement with Vishwas Joshi to act as our Chief Financial Officer for a period of twenty-four months from the date of listing of the Company on NASDAQ. We have agreed to pay Mr. Joshi up to $400,000, subject to successfully completing our initial business combination. If we do not complete a business combination, we have agreed to pay Mr. Joshi $40,000. As of March 31, 2023, we have accrued $40,000 as expense.

Consulting Agreements

We have engaged Ontogeny Capital L T D (“Ontogeny”) to act as a management consulting and corporate advisor in the preparation of corporate strategies, management support and business plans for us. We paid Ontogeny $40,000 at the time of signing the engagement agreement and $35,000 upon the filing of the registration statement relating to the Initial Public Offering. We paid Ontogeny an aggregate of $1,650,000 upon the closing of the Initial Public Offering and exercise of the underwriters’ over-allotment option. In addition, upon the consummation of our initial business combination, we have agreed to pay Ontogeny $2,875,000 for certain management consulting and corporate advisory services.