Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

July 12 2022 - 8:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

Dated July 11, 2022

Commission File Number 001-38018

Integrated Media Technology Limited

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

Level 7, 420 King William Street

Adelaide SA 5000

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b) (1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b) (7): ☐

OTHER EVENTS

Disposal of subsidiary and exit from Lamination Glass Operation

in China

Further to the announcement dated January 4, 2022, on July 11, 2022,

Integrated Media Technology Limited ("IMTE" or "Company"), entered into

the Sales and Purchase Agreement (“SP Agreement”) with Capital Stone Holdings Limited (“Purchaser”), a corporation

incorporated in British Virgin Islands, pursuant to which the Company has conditionally agreed to sell to the Purchaser 100% equity interest

in eGlass Technologies Ltd (“eGlass”), a wholly-owned subsidiary of the Company holding all the assets of our switchable glass

business in China (the “Disposal”) for US$6.8 million (“Consideration”).

The Purchaser shall pay the Consideration

by issuance to IMTE a debt instrument (“Loan Agreement”) which bears interests of 5% per annum, repayable in 2 years and secured

against the shares of eGlass.

The Purchaser has the intention to

list eGlass on the Australia Securities Exchange (“ASX”) within the next 2 years. Pursuant to the SP Agreement, the Purchaser

has the right to pay the Loan by giving IMTE the number of shares in eGlass calculated by dividing the amount of outstanding loan by 10%

discount to the then 5 days volume weighted average closing price (“VWAP”) provided that such price shall not be greater than

the 120% of the IPO Price. Alternatively, the Company has the right to have the Purchaser pay the Loan by transferring to IMTE the number

of shares in eGlass calculated by dividing the amount of outstanding loan by the IPO Price. Any outstanding loan which could not be fully

repaid by the eGlass shares above will be settled by cash.

With the completion of this transaction,

IMTE will have no operation in China and very little operation in Hong Kong where it will focus on transferring all of its operation out

Hong Kong before the end of the year.

Fund Raising

On and around July 11, 2022, IMTE

is in discussion with investors outside the United States to raise up to US$10 million in relation to the above disposal. IMTE

will entered into Subscription Agreements (“Subscription Agreements”) where each Subscriber will subscribe to a convertible

note (“Note”). The Note is interest free, unsecured and convertible into eGlass shares on the date eGlass receives notice

from ASX that it will be admitted to the official list of ASX, at a conversion price equal to 25% discount to the IPO Price.

However, if by the first anniversary of the date of the Agreement,

eGlass has not received notice from ASX that it will be admitted to the official list of ASX, all Notes will convert to IMTE shares based

on then 30-day VWAP multiplied by 90% per Note.

In addition, each Subscriber shall receive warrants

(“Warrant”) equal to the amount of the Note. Each Warrant can subscribe, provided that eGlass is listed on the ASX, for one

share in eGlass at the IPO Price for a period of one year after the IPO. The Warrants are assignable and transferable prior to the IPO.

If eGlass is not listed on the ASX, the Warrants will automatically expire.

As at July 11, 2022, the Company has signed

Subscription Agreements for US$600,000.

The foregoing description of the SP Agreement and

Subscription Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the said

agreements, which is incorporated by reference and filed as an Exhibit 99.1 to 99.4 hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Dated: July 12, 2022

| |

Integrated Media Technology Limited |

| |

|

|

| |

By: |

/s/ Xiaodong Zhang |

| |

Name: |

Xiaodong Zhang |

| |

Title: |

Chief Executive Officer |

EXHIBIT INDEX

3

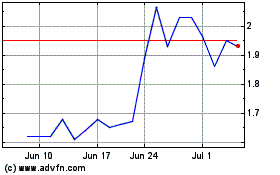

Intergrated Media Techno... (NASDAQ:IMTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

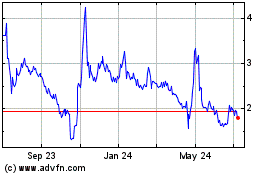

Intergrated Media Techno... (NASDAQ:IMTE)

Historical Stock Chart

From Apr 2023 to Apr 2024