UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 3)*

| INSPIRED

ENTERTAINMENT, INC. |

| (Name

of Issuer) |

| |

| Common

Stock, Par Value $0.0001 Per Share |

| (Title

of Class of Securities) |

| |

| 45782N108 |

| (CUSIP

Number) |

A.

Lorne Weil

250

West 57th Street, Suite 415

New

York, New York 10107

(646)

565-3861

Carly

Weil

3104

E. Camelback Road #2267

Phoenix,

Arizona 85106

(917)

941-2082

| (Name,

Address and Telephone Number of Person |

| Authorized

to Receive Notices and Communications) |

| |

| May

21, 2024 |

| (Date

of Event which Requires Filing of this Statement) |

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7

for other parties to whom copies are to be sent.

*The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| 1. |

Names

of Reporting Persons.

A.

Lorne Weil |

| |

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions): |

| |

(a)

(b) |

|

|

| |

|

|

|

| 3. |

SEC

Use Only

|

| 4. |

Source

of Funds (See Instructions): OO

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e):

Not

Applicable

|

| 6. |

Citizenship

or Place of Organization: Canada |

| |

Number

of Shares |

7. |

Sole

Voting Power: 896,179 |

|

| |

Beneficially

Owned by |

|

|

|

| |

Each

Reporting |

8. |

Shared

Voting Power: 1,955,537 |

|

| |

Person

With |

|

|

|

| |

|

9. |

Sole

Dispositive Power: 896,179 |

|

| |

|

|

|

|

| |

|

10. |

Shared

Dispositive Power: 1,955,537 |

|

| |

|

|

|

|

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person: 2,851,716 |

| |

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions): ☐ |

| |

|

| 13. |

Percent

of Class Represented by Amount in Row (11): 10.2% |

| |

|

| 14. |

Type

of Reporting Person (See Instructions): IN |

| |

|

| 1. |

Names

of Reporting Persons.

Carly

M. Weil

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions): |

| |

(a)

(b)

|

|

|

| 3. |

SEC

Use Only

|

| 4. |

Source

of Funds (See Instructions): OO

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e):

Not

Applicable

|

| 6. |

Citizenship

or Place of Organization: United States |

| |

Number

of Shares |

7. |

Sole

Voting Power: 0 |

|

| |

Beneficially

Owned by |

|

|

|

| |

Each

Reporting |

8. |

Shared

Voting Power: 1,462,522 |

|

| |

Person

With |

|

|

|

| |

|

9. |

Sole

Dispositive Power: 0 |

|

| |

|

|

|

|

| |

|

10. |

Shared

Dispositive Power: 1,462,522 |

|

| |

|

|

|

|

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person: 1,462,522 |

| |

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions): ☐ |

| |

|

| 13. |

Percent

of Class Represented by Amount in Row (11): 5.2% |

| |

|

| 14. |

Type

of Reporting Person (See Instructions): IN |

| |

|

Item

1. Security and Issuer.

This

Amendment No. 3 (this “Amendment”) amends and supplements the Schedule 13D filed by the Reporting Persons with the

Securities and Exchange Commission (the “SEC”) on June 9, 2017, as amended by Amendment No. 1 to the Schedule 13D

(“Amendment No. 1”) filed by certain of the Reporting Persons with the SEC on January 23, 2018 and Amendment No. 2

to the Schedule 13D (“Amendment No. 2”) filed by certain of the Reporting Persons with the SEC on November 29, 2021

(such Schedule 13D, as amended by Amendment No. 1 and Amendment No. 2, the “Schedule 13D”). The Schedule 13D, as amended

by this Amendment, relates to the common stock, par value $0.0001 per share (“Common Stock”), of Inspired Entertainment,

Inc., a corporation formed under the laws of the State of Delaware (the “Issuer”), whose principal executive offices

are located at 250 West 57th Street, Suite 415, New York, New York 10107.

As

further described herein, the Schedule 13D is hereby being amended to report the gifting of securities of the Issuer by A. Lorne Weil

(“Lorne Weil”) for estate planning purposes, and (ii) the addition of Carly M. Weil as a Reporting Person.

Capitalized

terms used herein and not otherwise defined in this Amendment shall have the meanings set forth in the Schedule 13D. Except as specifically

set forth herein, the Schedule 13D remains unmodified.

Item

2. Identity and Background.

Item

2 to the Schedule 13D is hereby amended to add the following information:

Carly

M. Weil is added as a Reporting Person to the Schedule 13D. The address for Carly M. Weil is 3104 E. Camelback Road #2267, Phoenix, Arizona

85106. Carly M. Weil is a U.S. Citizen. Carly Weil’s principal employment is Vice President of American Express located

at 18850 North 56th Street, Phoenix, Arizona 85054.

During

the last five years, Carly M. Weil has not been: (i) convicted in any criminal proceeding (excluding traffic violations or similar misdemeanors)

and (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws or finding any violation with respect to such laws.

Hydra

Industries Sponsor LLC (“Hydra Sponsor”) is removed as a Reporting Person. Hydra Sponsor’s beneficial ownership

is less than 5% of the Issuer’s outstanding shares of Common Stock.

Item

3. Source and Amount of Funds or Other Consideration.

The

information disclosed in Item 4 is incorporated herein by reference.

Item

4. Purpose of Transaction.

Item

4 to the Schedule 13D is hereby amended to add the following information:

On

May 17, 2024, Lorne Weil transferred 1,156,364 restricted stock units (“RSUs”) and 911,810 performance stock units

(“PSUs”) of the Issuer (collectively, the “Units”) to Hydralex Holdings LLC (“Hydralex

Transferee”) in exchange for all of the membership interests in Hydralex Transferee, pursuant to that certain Restricted Stock

Unit and Performance Stock Unit Transfer Agreement (the “Transfer Agreement”), effective May 17, 2024, by and among

Lorne Weil, Hydralex Transferee, and the Issuer. Carly M. Weil serves as manager of the Hydralex Transferee and Lorne Weil is the sole

member of Hydralex Transferee.

On

May 21, 2024, Lorne Weil gifted 493,015 shares of Common Stock to Kathy Angele, his wife. Kathy Angele intends to gift the 493,015 shares

of Common Stock to a limited liability company (the “Angele LLC”) in exchange for all of the membership interests

of the Angele LLC. Carly M. Weil is expected to become the manager of the Angele LLC when such transfer occurs.

Pursuant

to the Transfer Agreement, Hydralex Transferee agreed to be bound by the terms of the Issuer’s policy on trading in the Common

Stock as if it were Lorne Weil, including the requirement to obtain pre-authorization before selling or transferring any Common Stock.

Hydralex Transferee also agreed not to without the consent of the Issuer: (i) permit any person other than one or more trusts created

by Lorne Weil to be a member of Hydralex Transferee; (ii) engage in any business activity or operations other than holding and selling

securities of the Issuer subject to the Transfer Agreement; and (iii) directly or indirectly, purchase, acquire, sell, transfer, assign,

tender in any tender or exchange offer, pledge, grant, encumber, hypothecate or otherwise dispose of securities of the Issuer in any

manner. The Issuer agreed that the Common Stock transferred pursuant to the Transfer Agreement shall be treated as beneficially owned

by Lorne Weil for purposes of the Issuer’s stock ownership guidelines.

In

connection with the transactions set forth in this Item 4, Hydralex Transferee and Lorne Weil entered into a Voting Agreement (the “Voting

Agreement”) pursuant to which Hydralex Transferee agreed to timely vote such number of shares of Issuer’s Common Stock

that Hydralex Transferee may hold on the record date with respect to any annual or special meeting of stockholders of the Issuer, or

authorize a proxy or proxies to timely vote such shares, on each matter submitted to a vote of the stockholders of the Issuer at such

meeting, in proportion to the votes of all of the other stockholders of the Issuer represented in person or by proxy at such meeting

with respect to such matter (i.e., mirror voting). The Voting Agreement terminates on the earlier of (i) the dissolution and liquidation

of Hydralex Transferee in accordance with its terms, (ii) the sale or disposition of all of the Common Stock held by Hydralex Transferee

to third parties in bona fide sale transactions with a third party or distributions to members of Hydralex Transferee, and (iii) the

death of Lorne Weil. The Angele LLC and Kathy Angele are expected to enter into a similar voting agreement when the 493,015 shares of

Common Stock gifted to Kathy Angele are transferred to the Angele LLC.

The

descriptions of the Transfer Agreement and the Voting Agreement are qualified in their entirety by reference to the full text of such

agreements, copies of which are attached as Exhibit 99.3 and Exhibit 99.4, respectively, to this Amendment and are incorporated herein

by reference.

The

securities described in this Schedule 13D are held for investment purposes. Except in Lorne Weil’s capacity as the Executive Chairman

of the Issuer, no Reporting Person has any present plan or proposal which would relate to or result in any of the matters set forth in

subparagraphs (a) - (j) of Item 4 of Schedule 13D except as set forth herein. The Reporting Persons reserve the right to increase or

decrease their respective positions in the Issuer through, among other things, the purchase or sale of securities of the Issuer on the

open market or in private transactions or otherwise on such terms and at such times as the Reporting Persons may deem advisable. The

Reporting Persons reserve the right to change their intention with respect to all matters referred to in this Item 4.

Item

5. Interest in Securities of the Issuer.

| (a) and

(b) | The information set forth on the cover pages of this Amendment No. 3 is incorporated

herein by reference. |

The

aggregate percentage of shares of Common Stock reported owned by each person named herein is based upon 26,571,308 shares of Common Stock

outstanding as of May 7, 2024, as reported in the Quarterly Report on Form 10-Q filed by the Issuer with the SEC on May 10, 2024. The

number of shares that each Reporting Persons beneficially owns does not take into account shares of Common Stock held by the other stockholders

party to the Stockholders Agreement, pursuant to which such stockholders have agreed, in certain circumstances, to vote for Hydra Sponsor’s

designees to the board of directors of the Issuer as described in Item 6.

The

information set forth on the cover pages of this Amendment No. 3 for each Reporting Person includes 1,462,522 Units (comprising 1,006,272

RSUs and 456,250 PSUs), which were part of special sign-on awards granted to Lorne Weil between 2017 and 2023 under the Issuer’s

equity incentive plans, and which have satisfied the applicable vesting requirements. Settlement of such special sign-on awards shall

not occur until Lorne Weil’s services with the Issuer terminate or in the event of his death or disability, or upon a Change in

Control of the Issuer.

Lorne

Weil’s remaining Units under the Issuer’s equity incentive plans comprise an aggregate of 150,092 unvested RSUs and 455,560

unvested PSUs. As such Units are not vested or scheduled to vest within 60 days of the date hereof, the Reporting Persons are not deemed

to beneficially own such shares as of the date hereof for purposes of this Schedule 13D and such amounts are not included in the information

set forth on the cover pages of this Amendment No. 3. Such unvested Units are as follows:

● 8,373

RSUs subject to an award granted on February 14, 2022 which are scheduled to vest on December 31, 2024;

● 25,117

PSUs subject to an award granted on February 14, 2022 as to which vesting was conditioned on attainment of pre-established performance

criteria for 2022 (i.e., Adjusted EBITDA) and a time-based vesting schedule through December 31, 2024;

● 16,719

RSUs subject to an award granted on February 14, 2023 which are scheduled to vest in two equal installments on each of December 31, 2024

and December 31, 2025;

● 11,693

PSUs subject to an award granted on February 14, 2023 as to which vesting was conditioned on attainment of pre-established performance

criteria for 2023 (i.e., Adjusted EBITDA) and a time-based vesting schedule through December 31, 2025;

● 40,000

RSUs subject to an award granted on March 8, 2024 which are scheduled to vest in three equal installments on each of December 31, 2024,

December 31, 2025 and December 31, 2026;

● 40,000

PSUs subject to an award granted on March 8, 2024 as to which vesting is conditioned on attainment of pre-established performance criteria

for 2024 (i.e., Adjusted EBITDA) and a time-based vesting schedule through December 31, 2026; and

● 85,000

RSUs and 378,750 PSUs subject to special sign-on awards granted pursuant to Lorne Weil’s Employment Agreement, dated October 9,

2020, as amended on June 21, 2021 and January 12, 2023 (as so amended and as may be further amended from time to time, the “Employment

Agreement”). These special sign-on RSUs are scheduled to vest on December 31, 2024 and the special sign-on PSUs are subject

to performance criteria, comprising (i) 187,500 PSUs conditioned on attainment of Adjusted EBITDA targets for the years 2024 to 2027

(62,500 for 2024, 41,666 for 2025, 41,667 for 2026 and 41,667 for 2027); and (ii) 191,250 PSUs subject to attainment of price targets

(81,250 at $17.50, 78,750 at $20.00 and 31,250 at $22.50).

Under

Lorne Weil’s Employment Agreement, in the event the Issuer elects to terminate Lorne Weil’s employment without cause, or

if Lorne Weil terminates his employment for good reason, the unvested RSUs and PSUs (excluding sign-on awards) would remain outstanding

subject to potential vesting in accordance with the time, performance or other conditions applicable to the awards; and, with respect

to the sign-on awards, if Lorne Weil’s employment terminates prior to the end of the Employment Agreement, the unvested portion

would lapse in circumstances other than death, a “change in control termination event” (as defined) or if the Company’s

stock is no longer publicly traded, in which case, all or a portion of the outstanding balance would vest.

Carly

M. Weil serves as manager of Hydralex Transferee and in such capacity has beneficial ownership over the Issuer securities held by Hydralex

Transferee. Lorne Weil is the uncle of Carly M. Weil. Because of his relationships with Carly M. Weil and Kathy Angele, and his ownership

of all of the membership interests of Hydralex Transferee, Lorne Weil may be deemed to share beneficial ownership with respect to the

493,015 shares of Common Stock gifted to his wife and with respect to the shares subject to the Units transferred to Hydralex Transferee

which are reported in this Amendment as being beneficially owned by Carly M. Weil.

The

information set forth on the cover page of this Amendment for Lorne Weil also includes 896,179 shares of Common Stock directly held by

Hydra Sponsor, whose membership interests are owned by Lorne Weil and his children or trusts for their benefit. Lorne Weil, the managing

member of Hydra Sponsor, has voting and dispositive power over such securities.

The

filing of this Schedule 13D shall not be deemed an admission that the Reporting Persons are, for purposes of Section 13(d) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), the beneficial owners of any securities of the Issuer that he or she

do not directly own. Each of the Reporting Persons specifically disclaims beneficial ownership of the securities of the Issuer reported

herein that he or she does not directly own, except to the extent of their pecuniary interest therein.

Each

of the Reporting Persons disclaim being part of a group, within the meaning of section 13(d)(3) of the Exchange Act.

| (c) | None

of the Reporting Persons has entered into any transactions in the Common Stock during the

past sixty days except for the transactions described in Item 4 of this Amendment. |

| (e) | Hydra

Sponsor’s beneficial ownership ceased to be in excess of 5% of the Issuer’s outstanding

shares of Common Stock as of November 23, 2021. |

Item

6. Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

Item

6 of the Schedule 13D is hereby amended to add the following information:

Employment

Agreement

On

January 12, 2023, the Issuer entered into a Second Addendum to the Employment Agreement with Lorne Weil (the “Weil Addendum”)

which extended the term of his employment with the Issuer to December 31, 2027 and provided for him to receive an aggregate of 250,000

PSUs upon approval of the Issuer’s 2023 Omnibus Incentive Plan by the Issuer’s stockholders which occurred on May 9, 2023

(comprising 125,000 PSUs conditioned on Adjusted EBITDA targets and 125,000 PSUs conditioned on stock price targets). The Employment

Agreement specifies the vesting schedule and applicable criteria for vesting of the awards as described in Item 5. The description of

the Weil Addendum is qualified in its entirety by reference to the full text of the Weil Addendum, a copy of which is attached as Exhibit

99.1 to this Amendment and is incorporated herein by reference.

In

addition, except as otherwise set forth in this Amendment and elsewhere in the Schedule 13D (and all amendments thereto), there are no

contracts, arrangements, understandings or similar relationships existing with respect to the securities of the Issuer between the Issuer

and any of the Reporting Persons.

Item

7. Material to be Filed as Exhibits.

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

DATE:

May 23, 2024

| |

/s/

A. Lorne Weil |

| |

A. Lorne Weil |

| |

/s/

Carly Weil |

| |

Carly

Weil |

Attention:

Intentional misstatements or omissions of fact constitute Federal criminal violations

(See

18 U.S.C. 1001)

Exhibit

99.2

JOINT

FILING AGREEMENT

In

accordance with Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended, the undersigned agree to the joint filing on behalf

of each of them of a Statement on Schedule 13D (including any and all amendments thereto) with respect to the shares of common stock,

$0.0001 par value per share, of Inspired Entertainment, Inc., and further agree that this Joint Filing Agreement shall be included as

an exhibit to such joint filings.

The

undersigned further agree that each party hereto is responsible for the timely filing of such Statement on Schedule 13D and any amendments

thereto, and for the accuracy and completeness of the information concerning such party contained therein; provided, however, that no

party is responsible for the accuracy or completeness of the information concerning any other party, unless such party knows or has reason

to believe that such information is inaccurate.

This

Joint Filing Agreement may be signed in counterparts with the same effect as if the signature on each counterpart were upon the same

instrument.

IN

WITNESS WHEREOF, the undersigned have executed this Agreement as of May 23, 2024.

| |

/s/

A. Lorne Weil |

| |

A.

Lorne Weil |

| |

/s/

Carly Weil |

| |

Carly

Weil |

Exhibit

99.3

EXECUTION

COPY

inspired

entertainment, Inc.

Restricted

stock unit and Performance stock Unit

TRANSFER

AGREEMENT

This

Restricted Stock Unit and Performance Stock Unit Transfer Agreement (this “Agreement”), effective May 17, 2024,

(the “Effective Date”), is made and entered into by and among A. Lorne Weil (“Transferor”),

Hydralex Holdings LLC (“Transferee”), and Inspired Entertainment, Inc., a Delaware corporation (the “Company”)

(collectively, the “Parties”).

RECITALS

A. The

Company has granted to Transferor 1,156,364 restricted stock units (“RSUs”) and 911,810 performance stock units

(“PSUs”) under the Inspired Entertainment, Inc. 2023 Omnibus Incentive Plan, the Inspired Entertainment 2021

Omnibus Incentive Plan and the 2016 Second Long Term Incentive Plan (collectively, the “Plans”), as further

described in Exhibit A hereto.

B. The

RSUs and PSUs are subject to the terms and conditions of the Plans and, as applicable, the terms contained in award agreements and/or

the Transferor’s employment agreement, as approved by the Compensation Committee of the Company’s Board of Directors (the

“Committee”), which are referred to in this Agreement collectively as the “Award Agreements”,

and are subject to such policies and procedures approved by the Committee in connection with the administration of the Plans and awards

thereunder.

C. The

RSU Agreements provide that the RSUs are subject to vesting based on Transferor’s continuous service with the Company (the “RSU

Vesting Requirement”).

D. The

PSU Award Agreements provide that the PSUs are subject to vesting based on both attaining performance goals and Transferor’s continuous

service with the Company (the “PSU Vesting Requirement”).

E. As

of the date hereof, 1,006,272 RSUs have satisfied the RSU Vesting Requirement (the “Vested RSUs”) and 456,250

PSUs have satisfied the PSU Vesting Requirement (the “Vested PSUs”).

F. Section

14 of each of the Plans provides that the Committee may, in its sole discretion, permit RSUs and PSUs to be transferred by Transferor

to a family member or other third person or entity, for no consideration, subject to such rules as the Committee may adopt consistent

with Award Agreement to preserve the purposes of the Plans.

G. Transferor

has given the Committee advance written notice describing the terms and conditions of the proposed transfer and the Committee has determined

that the proposed transfer can be made under the Plans subject to the terms and conditions set forth in this Agreement.

H. In

accordance with the terms and conditions of the Award Agreements, Transferor desires to transfer 1,156,364 of the RSUs and 911,810 of

the PSUs, as identified in Exhibit A (collectively, the “Transferred Units”) to Transferee in exchange

for membership interests in Transferee, as indicated below subject to the terms and conditions of this Agreement.

I. As

of the date of this Agreement, Transferor owns, outright, 493,015 Common Shares issued by the Company.

Now,

therefore, the Parties hereby agree as follows:

1. TRANSFER

OF UNITS.

1.1 On

the Effective Date and subject to the terms and conditions of this Agreement, Transferor hereby transfers to Transferee for no consideration,

and Transferee hereby acquires from Transferor, the Transferred Units. The Committee hereby consents to the foregoing transfers by Transferor

of the Transferred Units to the Transferee on the terms and conditions set forth in this Agreement pursuant to Section 14 of each of

the Plans.

1.2 As

used in this Agreement, “Transferred Units” shall include all the Units transferred under this Agreement and

all securities received (a) in replacement or settlement of the Units, (b) as a result of stock dividends or stock splits in respect

of the Units and (c) as substitution for the Units in a recapitalization, merger, reorganization or the like.

2. REPRESENTATIONS

AND WARRANTIES OF TRANSFEREE. Transferee represents

and warrants to Transferor and the Company that:

2.1 No

Consideration. No consideration is being furnished to Transferor in exchange for, or in connection with, transferring the Units

pursuant to this Agreement.

2.2 Compliance

with Underlying Agreements. Transferee hereby acknowledges and agrees that the Transferred Units were granted pursuant to the

respective Plans and that they are subject to the terms and conditions of the respective Plans and the applicable Award Agreements (which

include the provisions of Transferor’s employment agreement with the Company dated October 9, 2020, as clarified on April 12, 2021,

and amended on June 21, 2021 and January 12, 2023 (the “Employment Agreement”)). Transferee further agrees

and acknowledges that the Transferred Units shall remain subject to the terms of the respective Plans and the applicable Award Agreements

in the same manner with respect to Transferee as if such Transferred Units had continued to be held by Transferor (copies of which are

attached hereto as Exhibit B and Exhibit C, respectively).

2.3 Authority.

Transferee has full legal right, power and authority to enter into and perform its obligations under this Agreement and to accept

title to the Units pursuant to the terms and conditions of this Agreement. Transferee’s activities shall be limited to holding

cash, Transferred Units, Common Shares and other publicly traded securities for investment purposes only or otherwise as specifically

provided under this Agreement. Transferee shall not engage in any other activities, including but not limited to incurring any indebtedness

or using the Common Shares as collateral for any indebtedness.

2.4 Rule

144. The Transferee acknowledges that the Common Shares to be issued upon settlement of the Transferred Units will, and Common

Shares issued by the Company transferred by Transferor to Transferee may, contain a restrictive legend, as determined by the Company,

until such time as legal counsel to the Company opines in a letter to the Company’s transfer agent that the Transferee has sold

any such Common Shares in compliance with the conditions applicable to Rule 144 promulgated under the Securities Act of 1933, including,

as applicable, the Rule 144 holding period requirement, the volume limitations condition and the “current reporting” condition

applicable to former blank check companies under Rule 144(i). Transferee has been advised that Rule 144 may not be available with respect

to certain of the Common Shares for a period of six (6) months after issuance, and in certain cases one (1) year.

2.5 Investment

Intent. Any securities issued to Transferee pursuant to the settlement of the Units will be acquired solely for Transferee’s

own account, for investment purposes only and not with a view to, or for resale in connection with, any distribution or public offering

of such securities within the meaning of the Securities Act of 1933, as amended.

2.6 LLC

Member. The sole members of the Transferee shall at all times be one or more trusts created under the Agreement, dated May 17,

2024, between A. Lorne Weil, as Settlor, and Brown Advisory Trust Company of Delaware, LLC, as Trustee (the “Trust Agreement”)

(collectively, the “Trust”). Transferee represents and warrants that the trustee of the Trust has certified

under penalties of perjury that the Trust qualifies as a “family member” under the instructions to SEC Form S-8 (a “Family

Member”) for purposes of registering the transfer of the Transferred Units to the Transferee.

2.7 Transferee

Operations. The Transferee covenants and agrees that, except as expressly provided in this Agreement or with the Committee’s

advance written consent, it shall not (a) permit any person other than the Trust to be a sole member of the Transferee, (b) admit any

new member of the Transferee other than a trust created under the Trust Agreement; (c) engage in any business activity or operations

other than holding and selling securities of the Company subject to this Agreement (“Company Securities”),

any other publicly traded securities, cash or cash equivalents, (d) incur any indebtedness or guaranty any obligation to third parties;

(e) execute any proxy or other voting instruction with respect to the Company Securities, or any written consent with respect to the

Company Securities in lieu of a meeting of stockholders of the Company (other than in accordance with Section 5), (f) directly or indirectly,

purchase, acquire, sell, transfer, assign, tender in any tender or exchange offer, pledge, grant, encumber, hypothecate or otherwise

dispose of Company Securities in any manner (collectively, “Transfer”), it being understock that the Company

will not unreasonably withhold, condition, or delay consent to Rule 10b5-1 plans consistent with its Insider Trading Policy, (g) enter

into any contract, option or other arrangement or understanding with respect to the Transfer of any Company Securities or any interest

therein, including, without limitation, any swap transaction, option, warrant, forward purchase or sale transaction, futures transaction,

cap transaction, floor transaction, collar transaction or any other similar transaction (including any option with respect to any such

transaction) or combination of any such transactions, in each case involving any Company Securities (each of the foregoing, a “Derivative

Transaction”), (h) deposit any Company Securities into a voting trust or enter into a voting agreement or arrangement or

grant any proxy or power of attorney with respect thereto that is inconsistent with this Agreement (i) permit its operating agreement

to be amended in any material respect other than to change the identity of beneficiaries that enables the Transferee and its members

to remain a Family Member (as defined in Section 2.6 above; (j) knowingly take any action that would, or would reasonably be expected

to, make any representation or warranty of the Transferee set forth in this Agreement untrue or incorrect or have the effect of preventing

or delaying Transferee from performing any of its obligations under this Agreement, and (i) agree (whether or not in writing) to take

any of the actions referred to in the foregoing clauses (a) through (h). Any purported action taken in violation of this Section shall

be null and void.

2.8 Insider

Trading Policy. Transferee acknowledges and agrees that Transferor is an “insider” for purposes of the Company’s

policy on trading in the Common Shares (as defined in each of the Plans) and that Transferee is bound by the terms of such policy as

if it were the Transferor, including the requirement to obtain pre-authorization before selling or transferring any Common Shares.

2.9 Securities

Disclosure. Transferee acknowledges the Company has a class of securities registered with the Securities and Exchange Commission

(“SEC”) pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (“Exchange Act”)

and is a former shell company. Transferee agrees that it shall comply (at its own expense) with all obligations imposed upon it and its

affiliates pursuant to the Exchange Act and the rules and regulations of the SEC promulgated pursuant thereto, including, without limitation,

its obligation to make all required beneficial ownership filings in accordance with Regulation 13D-G and Section 16 of the Exchange Act.

2.10 Clawback

Policy. Transferee acknowledges and agrees that Transferor is subject to any compensation recovery or “clawback”

policies as may be in effect from time to time with respect to incentive compensation that may be earned by the Transferor from the Company

and that Transferee is bound by the terms of any such policy.

2.11 Cooperation.

Transferee shall reasonably cooperate with the Company, including but not limited to (i) providing information and documentation from

time to time regarding the holdings, activities and structure of Transferee and the Trust as the Company determines in good faith to

be necessary or appropriate to comply with applicable law, (ii) to enter into any agreement necessary for the Company or any of its affiliates

to obtain or retain any regulatory approval, consent, license or other regulatory authorization or (iii) to ensure compliance with the

terms of this Agreement and any Company policy referenced herein.

3. REPRESENTATIONS

AND WARRANTIES OF Transferor.

Transferor represents and warrants to the Company and Transferee that:

3.1 No

Consideration. No consideration is being furnished to Transferor in exchange for transferring the Units pursuant to this Agreement.

3.2 Participant.

Transferor is a “Participant,” as defined in each of the Plans.

3.3 Title.

Transferor has valid title to the Transferred Units, free and clear of any pledge, lien, security interest, encumbrance, claim or

equitable interest other than pursuant to the Plan and the Award Agreements.

3.4 Consents.

All consents, approvals, authorizations and orders required for the execution and delivery of this Agreement and the transfer of

the Units under this Agreement have been obtained and are in full force and effect.

3.5 Authority.

Transferor has full legal right, power and authority to enter into and perform its obligations under this Agreement and to transfer

the Units pursuant to the terms and conditions of this Agreement.

3.6 Taxes.

Transferor shall continue to be solely liable for any tax liability with respect to the Transferred Units at all times, including

but not limited to federal and state income and employment taxes, interest and penalties (collectively, the “Tax Liability”);

provided, however, that the Company acknowledges and agrees that, in the instrument effectuating the transfer of the Transferred Units,

Transferor and Transferee may agree that Transferee shall assume the responsibility of discharging the Tax Liability; and provided further,

that, if Transferee assumes the responsibility of discharging the Tax Liability, the Parties agree that such assumption of liability

shall not be treated as consideration for any purpose of this Agreement. Except as otherwise may be agreed to among the Parties in writing,

the Company shall collect from Transferor applicable withholding taxes (as determined by the Company in accordance with applicable law

and applicable Company procedures) on any compensation taxable to Transferor in connection with the Transferred Units. Any sell-to-cover

transactions, if permitted under the terms of an applicable Award Agreement, are subject to the approval of the Company, including under

the terms of the Insider Trading Policy, and any such instructions must be duly submitted to the Company by the Transferee in accordance

with the Company’s applicable requirements.

3.7 Stock

Ownership Guidelines. Common Shares transferred under this Agreement shall be treated as beneficially owned by Transferor for

purposes of the Company’s stock ownership guidelines.

3.8 Additional

Stock Transfers. Transferor agrees that any additional transfers of Company’s equity securities transferred from by the

Transferor to the Transferee shall be subject to the voting provisions as set forth in Section 5 below.

4. transferee’s

rightS and restrictions

4.1 No

Additional Rights. The transfer of the Transferred Units does not create in Transferee, and shall not be construed to create,

any greater rights than were held by Transferor under the terms of the respective Plans and the Employment Agreement. Except as hereafter

amended, the Transferred Units remain subject to the terms of the respective Plans and Employment Agreement at the time of this transfer,

including without limitation the terms controlling tax withholding, transfer, and termination.

4.2 Transferability.

A Transferee may not transfer any portion of the Transferee’s rights, title or interest in the Transferred Units or the Common

Shares received upon settlement of Transferred Units other than by will or the laws of descent and distribution, either with consideration

to a third party or without consideration to a beneficiary of Transferee, without the express prior written consent of the Committee,

which may be withheld for any or no reason in the Committee’s sole discretion.

4.3 Amendments.

The power to consent to an amendment to this Agreement by the Company that impairs the rights of Transferee with respect to the Transferred

Units shall lie exclusively with Transferee.

4.4 Condition

Precedent to Issuing Shares. No Common Shares shall be issued by the Company pursuant to the Transferred Units to the Transferee

unless and until adequate provision has been made (whether by payment from Transferor or Transferee in accordance with Section 3.6),

in the sole opinion of the Company, for any federal, state, local and foreign withholding obligations of the Company or an affiliate

of the Company that may arise in connection with the Transferred Units.

4.5 Valuation.

The Company is under no obligation at any time to aid Transferor or Transferee in establishing the value of the Transferred Unit

for any purpose.

5. Voting

Agreement

As

a condition for entering into this Agreement, the Transferee shall enter into a Voting Agreement in substantially the same form as attached

hereto as Exhibit D. Transferor shall provide such evidence of compliance with the Voting Agreement as may reasonably be requested by

the Company.

6. GENERAL

PROVISIONS.

6.1 Acknowledgment

of Risks. Transferee acknowledges that the acquisition of the Transferred Units involves a risk in that Transferee may not be

able to liquidate Transferee’s investment in the Common Shares at convenient times or at desired market prices, and that the transferability

of the Transferred Units is extremely limited. Transferee represents that Transferee can bear the Tax Liability and economic risk of

the investment in the acquisition of Common Shares to be received upon the settlement of the Transferred Units.

6.2 Tax

Acknowledgments. Transferor and Transferee further acknowledge each has consulted with their own attorney and tax and estate

planning professionals regarding the transfer of the Transferred Units pursuant to the terms and conditions of this Agreement. Transferor

and Transferee have each reviewed with its own tax advisors the federal, state, local and foreign tax consequences of the transfer of

the Transferred Units and the vesting and settlement thereof, including but not limited to federal and applicable state gift taxes and

compliance with Section 409A of the Code. Transferor and Transferee are each relying solely on such advisors and not on any statements

or representations of the Company or any counsel, advisor or agent of the Company. Transferee and Transferor assume sole responsibility

for the Tax Liability or other liability that arise as a result of the transfer of the Transferred Units under this Agreement, the settlement

of the Transferred Units, or any other liability that arises as a result of the Transferred Units.

6.3 Indemnity.

Transferor individually and jointly with Transferee agrees to indemnify and hold the Company harmless against any and all liabilities

resulting from any inaccuracy in or breach of any of the representations and warranties contained in this Agreement or resulting from

the Company participating in effecting this Agreement.

6.4 Entire

Agreement. The Plans and the Award Agreements are incorporated herein by reference. The Plans, the Employment Agreement, the

Voting Agreement and this Agreement constitute the entire agreement of the parties with respect to the subject matter hereof and supersede

in their entirety all prior undertakings and agreements of Transferee and Transferor with respect to the subject matter hereof, and may

not be modified by either party hereto except by means of a writing signed by both Transferee and Transferor, in accordance with the

terms of the Plan, the Award Agreements and the Voting Agreement. No provisions in the trust agreement applicable to Transferee shall

be binding on the Company.

6.5 Counterparts.

This Agreement may be executed in any number of counterparts, each of which when so executed and delivered will be deemed an original,

and all of which together shall constitute one and the same agreement.

6.6 Severability.

If any provision of this Agreement is determined by any court or arbitrator of competent jurisdiction to be invalid, illegal or unenforceable

in any respect, such provision will be enforced to the maximum extent possible given the intent of the parties hereto. If such clause

or provision cannot be so enforced, such provision shall be stricken from this Agreement and the remainder of this Agreement shall be

enforced as if such invalid, illegal or unenforceable clause or provision had (to the extent not enforceable) never been contained in

this Agreement. Notwithstanding the forgoing, if the value of this Agreement based upon the substantial benefit of the bargain for any

party is materially impaired, which determination as made by the presiding court or arbitrator of competent jurisdiction shall be binding,

then all parties agree to substitute such provision(s) through good faith negotiations.

6.7 Confidentiality.

Each of Transferor and Transferee agrees that it will keep confidential and will not disclose or use for any purpose any information

about the terms of this Agreement and the transactions contemplated hereby and any confidential information obtained from the Company

in connection herewith, unless any such information (a) is known or becomes known to the public in general (other than as a result of

a breach of this Agreement by the disclosing party), such as is required to comply with federal securities laws or (b) is or has been

made known or disclosed to the disclosing party by a third party without a breach of any confidentiality obligations by such third party;

provided, however, that either Transferor or Transferee may disclose such information (i) to its attorneys, accountants, consultants

and other professionals to the extent necessary to obtain their services in connection with the transfer and ownership of the Units,

provided that such persons agree to maintain the confidentiality of such information in accordance herewith; (ii) to any affiliate in

the ordinary course of business, provided that such affiliate agrees to maintain the confidentiality of such information in accordance

herewith; or (iii) as may be required by law, provided that the disclosing party promptly notifies the other parties hereto in advance

of such disclosure and agrees to cooperate to take reasonable steps to minimize the extent of any such required disclosure.

6.8 Actions

by the Transferee. Unless otherwise agreed to by the Parties, the managing member of the Transferee shall possess the sole power

to take actions on behalf of the Transferee with respect to the Transferred Units, the shares of the Company’s common stock received

on settlement of Transferred Units and this Agreement. Any written instruction from the managing member of the Transferee shall include

representations that such action is duly authorized under the Transferee’s operating agreement and instructions received from Brown

Advisory Trust Company of Delaware, LLC.

6.9 Termination

Agreement. This Agreement shall terminate and have no further force or effect upon the earlier to occur of (i) the dissolution

and liquidation of Transferee in accordance with its terms, (ii) the sale or disposition of all RSUs, PSUs, and Common Shares to third

parties in bona fide sale transactions with a third party or distributions to members of Transferee, and (iii) the death of Transferor.

6.10 Effective

Date. This Agreement shall become effective upon its execution by all parties here.

6.11 Governing

Law. This Agreement shall be governed by the laws of the State of Delaware, except for that body of law pertaining to conflicts

of laws.

IN

WITNESS WHEREOF, the Company has caused this Agreement to be executed by its duly authorized representative and Transferor and Transferee

have each executed this Agreement, as of the Effective Date.

| TRANSFEROR:

|

|

TRANSFEREE:

|

| |

|

|

|

|

| By: |

/s/

A. Lorne Weil |

|

By: |

/s/

Carly M. Weil |

| Address: |

|

|

Name: |

Carly

M. Weil |

| |

|

|

Title: |

Manager |

| |

|

|

Address: |

|

| |

|

|

|

|

| |

|

|

|

|

| COMPANY: INSPIRED ENTERTAINMENT, INC. |

|

|

|

| |

|

|

|

| By: |

/s/

Carys Damon |

|

|

|

| Name: |

Carys

Damon |

|

|

|

| Its: |

General

Counsel |

|

|

|

| Address: |

250

West 57th Street, Suite 415 |

|

|

|

| |

New

York, NY 10107 |

|

|

|

Attachments

Exhibit

A - Transferor’s Outstanding RSUs and PSUs and Transferred Units

Exhibit

B - RSU Provisions for Transferred Units

Exhibit

C - PSU Provisions for Transferred Units

Exhibit

D - Voting Agreement

EXHIBIT

A

Transferor’s

Outstanding RSUs and PSUs and Transferred Units

Restricted

Stock Units

| Grant Date | |

Total RSUs | | |

Transferred RSUs | | |

Transferred RSUs that are Vested RSUs | |

| December 21, 2017 | |

| 926,272 | | |

| 926,272 | | |

| 926,272 | |

| May 11, 2021 | |

| 165,000 | | |

| 165,000 | | |

| 80,000 | |

| February 14, 2022 | |

| 8,373 | | |

| 8,373 | | |

| 0 | |

| February 14, 2023 | |

| 16,719 | | |

| 16,719 | | |

| 0 | |

| March 8, 2024 | |

| 40,000 | | |

| 40,000 | | |

| 0 | |

Performance

Stock Units

Target

Type | |

Grant Date | |

Total PSUs | | |

Transferred PSUs | | |

Transferred PSUs that are Vested PSUs | |

| (1) | |

May 11, 2021 | |

| 187,500 | | |

| 187,500 | | |

| 125,000 | |

| (2) | |

May 11, 2021 | |

| 397,500 | | |

| 397,500 | | |

| 300,000 | |

| (1) | |

February 14, 2022 | |

| 25,117 | | |

| 25,117 | | |

| 0 | |

| (1) | |

February 14, 2023 | |

| 11,693 | | |

| 11,693 | | |

| 0 | |

| (1) | |

May 9, 2023 | |

| 125,000 | | |

| 125,000 | | |

| 0 | |

| (2) | |

May 9, 2023 | |

| 125,000 | | |

| 125,000 | | |

| 31,250 | |

| (1) | |

March 8, 2024 | |

| 40,000 | | |

| 40,000 | | |

| 0 | |

(1)

Adjusted EBITDA

(2)

Stock Price

EXHIBIT

B

RSU

Provisions

for

Transferred Units

Restricted

Stock Unit Award Agreement dated December 21, 2017

Restricted

Stock Unit Award Agreement dated February 14, 2022

Restricted

Stock Unit Award Agreement dated February 14, 2023

Restricted

Stock Unit Award Agreement dated March 8, 2024

Section

6 of the Employment Agreement

EXHIBIT

C

PSU Provisions

for

Transferred Units

Performance

Unit Award Agreement dated February 14, 2022

Performance

Unit Award Agreement dated February 14, 2023

Performance

Unit Award Agreement dated March 8, 2024

Section

6 of the Employment Agreement

EXHIBIT

D

Voting Agreement

Exhibit

99.4

EXECUTION

COPY

VOTING

AGREEMENT

This

Agreement is hereby this 17th day of May 2024 by and between A. Lorne Weil (“Weil”) and Hydralex Holdings LLC (the “LLC”).

Capitalized terms used but not defined in this Agreement shall have the meanings ascribed thereto in Restricted Stock Unit and Performance

Stock Units Transfer Agreement by and between the Company and LLC dated May 17, 2024 (the “Transfer Agreement”). As a condition

for transferring equity awards granted by Inspired Entertainment, Inc. (“Inspired”) under the Transfer Agreement, the LLC

hereby agrees with Weil, as follows:

1. Mirror

Voting

(a) At

each annual or special meeting of the stockholders of Inspired at which a vote will be taken after the date of this Agreement, the LLC

will timely vote such number of shares of Inspired’s common stock that are held by LLC (collectively, the “Covered Shares”)

as it may hold on the record date with respect to such meeting, or authorize a proxy or proxies to timely vote such shares, on each matter

submitted to a vote of the stockholders at such meeting, in proportion to the votes of all of the other stockholders of Inspired represented

in person or by proxy at such meeting with respect to such matter (i.e., mirror voting). In determining the vote of such other stockholders,

abstentions or “broker non-votes” with respect to any matter shall not be deemed to have been voted with respect to such

matter.

(b) The

LLC hereby agrees to provide to the transfer agent and registrar of the common stock of Inspired (the “Transfer Agent’) with

such information, authorizations and directions as the Transfer Agent may reasonably request in order to effectuate the purposes of clause

(a) above.

(c) Nothing

herein shall be deemed to bind a purchaser of the Covered Shares from the LLC following the transfer of such shares by the LLC in a bona

fide sale transaction with a third party. The provisions of this Agreement shall continue to apply to the Covered Shares at all times,

except as provided in the foregoing sentence of this paragraph 1(c) and in paragraph 2(n) hereof.

2. Other

Agreements.

(a) Further

Assurances. Weil and the LLC agree to execute such further instruments and to take such further action as may reasonably be necessary

to carry out the intent of this Agreement.

(b) Notices.

All notices, statements or other documents which are required or contemplated by this Agreement shall be: (i) in writing and

delivered personally or sent by first class registered or certified mail or overnight courier service, (ii) by facsimile and (iii)

by electronic mail, in each case to the address, facsimile number or email address as each party shall have provided to the other in

connection with this Agreement. Any notice or other communication so transmitted shall be deemed to have been given on the day of

delivery, if delivered personally, on the business day following receipt of written confirmation, if sent by facsimile or

electronic transmission, one (1) business day after delivery to an overnight courier service or five (5) days after mailing if sent

by mail.

(c) Entire

Agreement. This Agreement embodies the entire agreement and understanding between the LLC and Weil with respect to the subject matter

hereof and supersedes all prior oral or written agreements and understandings relating to the subject matter hereof. No statement, representation,

warranty, covenant or agreement of any kind not expressly set forth in this Agreement shall affect, or be used to interpret, change or

restrict, the express terms and provisions of this Agreement.

(d) Modifications

and Amendments. The terms and provisions of this Agreement may be modified or amended only by written agreement executed by all parties

hereto.

(e) Waivers

and Consents. The terms and provisions of this Agreement may be waived, or consent for the departure therefrom granted, only by written

document executed by both parties hereto. No such waiver or consent shall be deemed to be or shall constitute a waiver or consent with

respect to any other terms or provisions of this Agreement, whether or not similar. Each such waiver or consent shall be effective only

in the specific instance and for the purpose for which it was given, and shall not constitute a continuing waiver or consent.

(f) Assignment.

The rights and obligations under this Agreement may not be assigned by either of the parties hereto without the prior written consent

of the other party; provided that the obligations of the LLC hereunder shall be binding upon any successor of the LLC.

(g) Benefit.

All statements, representations, warranties, covenants and agreements in this Agreement shall be binding on the parties hereto and shall

inure to the benefit of the respective successors and permitted assigns of each party hereto. Nothing in this Agreement shall be construed

to create any rights or obligations except among the parties hereto, and no person or entity shall be regarded as a third-party beneficiary

of this Agreement.

(h) Governing

Law; Jurisdiction. This Agreement and the rights and obligations of the parties hereunder shall be construed in accordance with and

governed by the laws of the State of Delaware applicable to contracts wholly performed within the borders of such state, without giving

effect to the conflict of law principles thereof. The parties consent to exclusive jurisdiction and venue in the federal and state courts

sitting in the State of Delaware, and waive any objection to such venue, including any objection based upon forum non conveniens or other

grounds.

(i) Injunctive

Relief. The LLC acknowledges and agrees that, in the event of a breach or threatened breach of this Agreement, Weil will suffer irreparable

harm and will therefore be entitled to injunctive relief to enforce this Agreement.

(j)

Severability. If any court of competent jurisdiction shall determine that any provision,

or any portion thereof, contained in this Agreement shall be unreasonable or unenforceable in any respect, then such provision shall

be deemed limited to the extent that such court deems it reasonable and enforceable, and as so limited shall remain in full force and

effect. If such court shall deem any such provision, or portion thereof, wholly unenforceable, the remaining provisions of this Agreement

shall nevertheless remain in full force and effect.

(k) No

Waiver of Rights, Powers and Remedies. No failure or delay by either party hereto in exercising any right, power or remedy under

this Agreement, and no course of dealing between the parties hereto, shall operate as a waiver of any such right, power or remedy of

such party.

(l) Headings

and Captions. The headings and captions of the various subdivisions of this Agreement are for convenience of reference only and shall

in no way modify or affect the meaning or construction of any of the terms or provisions hereof.

(m) Counterparts.

This Agreement may be executed in one or more counterparts, all of which when taken together shall be considered one and the same agreement

and shall become effective when counterparts have been signed by each party and delivered to the other party, it being understood that

both parties need not sign the same counterpart. If signature is delivered by facsimile transmission or any other form of electronic

delivery, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed)

with the same force and effect as if such signature page were an original thereof.

(n) Term.

The obligations of the LLC hereunder shall terminate on the earlier of (i) the dissolution and liquidation of the LLC in accordance with

its terms, (ii) the sale or disposition of all of the Covered Shares to third parties in bona fide sale transactions with a third party

or distributions to members of the LLC, and (iii) the death of A. Lorne Weil.

(o) Disclosure.

The parties hereto hereby acknowledge that (i) the terms of this Agreement will be publicly disclosed by Inspired, and (ii) this Agreement

will be filed with the Securities and Exchange Commission as an exhibit to a Form 8-K of Inspired.

Remainder

of this Page is Left Blank

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

| Hydralex Holdings LLC |

|

| |

|

|

| /s/

Carly Weil |

|

| By: |

Carly

Weil, Manager |

|

| |

|

|

| /s/

A. Lorne Weil |

|

| A. Lorne Weil |

|

| |

|

|

| Voting Agreement accepted by Inspired Entertainment, Inc. |

|

| |

|

|

| By: |

/s/

Carys Damon |

|

| |

Carys

Damon |

|

| Title: |

General

Counsel |

|

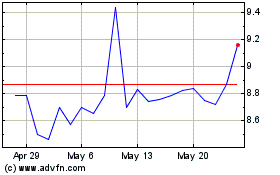

Inspired Entertainment (NASDAQ:INSE)

Historical Stock Chart

From May 2024 to Jun 2024

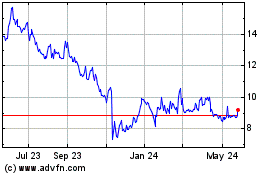

Inspired Entertainment (NASDAQ:INSE)

Historical Stock Chart

From Jun 2023 to Jun 2024