Increasing mix of enterprise revenue drives

expansion in gross margin

Next generation 5G hotspot launches with a tier

one carrier in North America and Telstra in Q3

Closed $50 million credit facility

Inseego Corp. (Nasdaq: INSG) (the “Company”), a leader in 5G

edge cloud solutions, today reported its results for the second

quarter ended June 30, 2022. The Company reported second quarter

net revenue of $61.9 million, GAAP operating loss of $10.0 million,

GAAP net loss of $12.4 million, GAAP net loss of $0.12 per share,

adjusted EBITDA of negative $1.0 million, and non-GAAP net loss of

$0.09 per share. Cash and cash equivalents at quarter end,

including restricted cash, was $24.4 million.

“We made great progress deploying 5G fixed wireless access (FWA)

for several enterprise customers in Q2. With our key carrier

partners now starting to turn their attention to 5G enterprise FWA,

and the successful launch of our next-generation of 5G products, we

are primed for a strong second half of 2022,” said Ashish Sharma,

CEO of Inseego. “As more of our enterprise trials move towards

deployment, we are experiencing higher recurring revenue from our

software solutions, which was reflected in our gross margin this

quarter. Expanding gross margin and prudent management of expenses

will enable us to approach cash flow breakeven by the end of the

year.”

Business Highlights

– 5G revenue up 39% year-over-year

– Consolidated gross margin 29.5%, up from 27.3% in Q1 and 28.0%

year-over year

– Several enterprise customers commencing deployment of 5G FWA

solutions

– 5G FWA portfolio now C-Band certified with Verizon and

AT&T

– Launched industry’s first 5G cloud networking solution for the

enterprise, Inseego 5G SD EDGE™

– Pilots with Fortune 500 companies

underway

– Launch of Inseego Wavemaker™ 5G indoor CPE FX2000 with Three

Sweden in July

– Next generation 5G mobile hotspot launches with a tier one

carrier in North America and Telstra in Q3

Corporate Highlights

– Jeffrey Tuder named Chairman of the Board of Inseego

– Entered into a $50.0 million secured revolving credit facility

on August 5, of which $4.5 million was drawn at closing

– The facility will mature on December 31,

2024 and will bear interest at the Secured Overnight Financing Rate

(SOFR) plus a margin of 3.50% per annum

“The gross margin improvement on both a sequential and

year-over-year basis reflects a higher mix of enterprise sales,”

said Bob Barbieri, CFO of Inseego. “We remain disciplined with our

investments and operating costs. For the balance of the year, we

expect our quarterly cash usage to be significantly lower than Q2

as our product mix changes to include more higher margin 5G

enterprise FWA business. Additionally, the recently announced $50MM

credit facility gives us ample capacity to fuel the growth we see

later this year and into 2023.”

Conference Call Information

Inseego will host a conference call and live webcast for

analysts and investors today at 5:00 p.m. ET. A Q&A session

with analysts will be held live directly after the prepared

remarks. To access the conference call:

- Online, visit

https://investor.inseego.com/events-presentations

- Phone-only participants can pre-register by navigating to

https://dpregister.com/sreg/10163574/f13398ce70

- Those without internet access or unable to pre-register may

dial-in by calling:

- In the United States, call 1-844-282-4463

- International parties can access the call at

1-412-317-5613

An audio replay of the conference call will be available

beginning one hour after the call through August 22, 2022. To hear

the replay, parties in the United States may call 1-877-344-7529

and enter access code 2162059 followed by the # key. International

parties may call 1-412-317-0088. In addition, the Inseego Corp.

press release will be accessible from the Company's website before

the conference call begins.

About Inseego Corp.

Inseego Corp. (Nasdaq: INSG) is an industry leader in smart

device-to-cloud solutions that extend the 5G network edge, enabling

broader 5G coverage, multi-gigabit data speeds, low latency and

strong security to deliver highly reliable internet access. Our

innovative mobile broadband, fixed wireless access (FWA) solutions,

and software platform incorporate the most advanced technologies

(including 5G, 4G LTE, Wi-Fi 6 and others) into a wide range of

products that provide robust connectivity indoors, outdoors and in

the harshest industrial environments. Designed and developed in the

USA, Inseego products and SaaS solutions build on the company’s

patented technologies to provide the highest quality wireless

connectivity for service providers, enterprises, and government

entities worldwide. www.inseego.com #Putting5GtoWork

©2022. Inseego Corp. All rights reserved. The Inseego name and

logo, MiFi, Inseego Wavemaker, and Inseego 5G SD EDGE are

registered trademarks and trademarks of Inseego Corp. Other

Company, product or service names mentioned herein are the

trademarks of their respective owners.

Cautionary Note Regarding Forward-Looking Statements

Some of the information presented in this news release may

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. In this context,

forward-looking statements often address expected future business

and financial performance and often contain words such as “may,”

“estimate,” “anticipate,” “believe,” “expect,” “intend,” “plan,”

“project,” “will” and similar words and phrases indicating future

results. The information presented in this news release related to

our future business outlook, the future demand for our products, as

well as other statements that are not purely statements of

historical fact, are forward-looking in nature. These

forward-looking statements are made on the basis of management’s

current expectations, assumptions, estimates and projections and

are subject to significant risks and uncertainties that could cause

actual results to differ materially from those anticipated in such

forward-looking statements. We therefore cannot guarantee future

results, performance or achievements. Actual results could differ

materially from our expectations.

Factors that could cause actual results to differ materially

from the Company’s expectations include: (1) the future demand for

wireless broadband access to data and asset management software and

services; (2) the growth of wireless wide-area networking and asset

management software and services; (3) customer and end-user

acceptance of the Company’s current product and service offerings

and market demand for the Company’s anticipated new product and

service offerings; (4) increased competition and pricing pressure

from participants in the markets in which the Company is engaged;

(5) dependence on third-party manufacturers and key component

suppliers worldwide; (6) the impact that new or adjusted tariffs

may have on the cost of components or our products, and our ability

to sell products internationally; (7) the impact of fluctuations of

foreign currency exchange rates; (8) the impact of geopolitical

instability and supply chain challenges on our ability to source

components and manufacture our products; (9) unexpected liabilities

or expenses; (10) the Company’s ability to introduce new products

and services in a timely manner, including the ability to develop

and launch 5G products at the speed and functionality required by

our customers; (11) litigation, regulatory and IP developments

related to our products or components of our products; (12)

dependence on a small number of customers for a significant portion

of the Company’s revenues and accounts receivable; (13) the

Company’s ability to raise additional financing when the Company

requires capital for operations or to satisfy corporate

obligations; (14) the Company’s plans and expectations relating to

acquisitions, divestitures, strategic relationships, international

expansion, software and hardware developments, personnel matters,

and cost containment initiatives, including restructuring

activities and the timing of their implementations; (15) the global

semiconductor shortage and any related price increases or supply

chain disruptions, and (16) the potential impact of COVID-19 on the

business.

These factors, as well as other factors set forth as risk

factors or otherwise described in the reports filed by the Company

with the SEC (available at www.sec.gov), could cause actual results to differ

materially from those expressed in the Company’s forward-looking

statements. The Company assumes no obligation to update publicly

any forward-looking statements for any reason, even if new

information becomes available or other events occur in the future,

except as otherwise required pursuant to applicable law and our

on-going reporting obligations under the Securities Exchange Act of

1934, as amended.

Non-GAAP Financial Measures

Inseego Corp. has provided financial information in this news

release that has not been prepared in accordance with GAAP.

Adjusted EBITDA, non-GAAP net loss, non-GAAP net loss per share and

non-GAAP operating costs and expenses exclude preferred stock

dividends, share-based compensation expense, amortization of

intangible assets purchased through acquisitions, amortization of

discount and issuance costs related to the Company’s 2025 Notes,

fair value adjustments on derivative instruments, a one-time prior

period adjustment related to unamortized debt discount and loss on

debt extinguishment relating to the Company’s 2022 Notes, and other

non-recurring legal expenses. Adjusted EBITDA also excludes

interest, taxes, depreciation and amortization (unrelated to

acquisitions, the 2025 Notes), foreign exchange gains and losses,

and other.

Adjusted EBITDA, non-GAAP net loss, non-GAAP net loss per share

and non-GAAP operating costs and expenses are supplemental measures

of our performance that are not required by, or presented in

accordance with, GAAP. These non-GAAP financial measures have

limitations as an analytical tool and are not intended to be used

in isolation or as a substitute for operating expenses, net loss,

net loss per share or any other performance measure determined in

accordance with GAAP. We present these non-GAAP financial measures

because we consider each to be an important supplemental measure of

our performance.

Management uses these non-GAAP financial measures to make

operational decisions, evaluate the Company’s performance, prepare

forecasts and determine compensation. Further, management believes

that both management and investors benefit from referring to these

non-GAAP financial measures in assessing the Company’s performance

when planning, forecasting and analyzing future periods.

Share-based compensation expenses are expected to vary depending on

the number of new incentive award grants issued to both current and

new employees, the number of such grants forfeited by former

employees, and changes in the Company’s stock price, stock market

volatility, expected option term and risk-free interest rates, all

of which are difficult to estimate. In calculating non-GAAP

financial measures, management excludes certain non-cash and

one-time items in order to facilitate comparability of the

Company’s operating performance on a period-to-period basis because

such expenses are not, in management’s view, related to the

Company’s ongoing operating performance. Management uses this view

of the Company’s operating performance for purposes of comparison

with its business plan and individual operating budgets and in the

allocation of resources.

The Company further believes that these non-GAAP financial

measures are useful to investors in providing greater transparency

to the information used by management in its operational

decision-making. The Company believes that the use of these

non-GAAP financial measures also facilitates a comparison of our

underlying operating performance with that of other companies in

our industry, which use similar non-GAAP financial measures to

supplement their GAAP results.

In the future, the Company expects to continue to incur expenses

similar to the non-GAAP adjustments described above, and exclusion

of these items in the presentation of our non-GAAP financial

measures should not be construed as an inference that these costs

are unusual, infrequent or non-recurring. Investors and potential

investors are cautioned that there are material limitations

associated with the use of non-GAAP financial measures as an

analytical tool. The limitations of relying on non-GAAP financial

measures include, but are not limited to, the fact that other

companies, including other companies in our industry, may calculate

non-GAAP financial measures differently than we do, limiting their

usefulness as a comparative tool.

Investors and potential investors are encouraged to review the

reconciliation of our non-GAAP financial measures contained within

this news release with our GAAP financial results.

INSEEGO CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except share and

per share data)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2022

2021

2022

2021

Net revenues:

IoT & Mobile Solutions

$54,990

$51,836

$109,495

$94,795

Enterprise SaaS Solutions

6,866

13,857

13,745

28,495

Total net revenues

61,856

65,693

123,240

123,290

Cost of net revenues:

IoT & Mobile Solutions

40,694

39,740

83,597

73,178

Enterprise SaaS Solutions

3,270

5,604

6,503

11,288

Total cost of net revenues

43,964

45,344

90,100

84,466

Gross profit

17,892

20,349

33,140

38,824

Operating costs and expenses:

Research and development

13,619

11,773

32,179

26,328

Sales and marketing

7,721

9,821

17,494

20,825

General and administrative

6,142

7,414

14,380

16,058

Amortization of purchased intangible

assets

443

664

887

1,130

Impairment of capitalized software

—

1,197

—

1,197

Total operating costs and expenses

27,925

30,869

64,940

65,538

Operating loss

(10,033)

(10,520)

(31,800)

(26,714)

Other (expense) income:

Loss on debt conversion and

extinguishment, net

—

—

(450)

(432)

Interest expense, net

(1,664)

(1,678)

(4,587)

(3,523)

Other (expense) income, net

(982)

(617)

(1,387)

1,117

Loss before income taxes

(12,679)

(12,815)

(38,224)

(29,552)

Income tax (benefit) provision

(303)

228

(625)

449

Net loss

(12,376)

(13,043)

(37,599)

(30,001)

Less: Net income attributable to

noncontrolling interests

—

—

—

(214)

Net loss attributable to Inseego Corp.

(12,376)

(13,043)

(37,599)

(30,215)

Series E preferred stock dividends

(677)

(886)

(1,338)

(1,753)

Net loss attributable to common

stockholders

$(13,053)

$(13,929)

$(38,937)

$(31,968)

Per share data:

Net loss per common share:

Basic and diluted

$(0.12)

$(0.14)

$(0.37)

$(0.31)

Weighted-average shares used in

computation of net loss per common share:

Basic and diluted

107,511,660

102,935,213

106,585,684

102,157,146

INSEEGO CORP.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

June 30,

December 31,

2022

2021

ASSETS

Current assets:

Cash and cash equivalents

$21,090

$46,474

Restricted cash

3,270

3,338

Accounts receivable, net

22,491

26,781

Inventories

46,977

37,402

Prepaid expenses and other

10,424

13,624

Total current assets

104,252

127,619

Property, plant and equipment, net

6,930

8,102

Rental assets, net

4,613

4,575

Intangible assets, net

46,008

46,995

Goodwill

21,922

20,336

Right-of-use assets, net

6,985

7,839

Other assets

566

377

Total assets

$191,276

$215,843

LIABILITIES AND STOCKHOLDERS’

DEFICIT

Current liabilities:

Accounts payable

$45,640

$48,577

Accrued expenses and other current

liabilities

24,298

26,253

Total current liabilities

69,938

74,830

Long-term liabilities:

2025 Notes, net

157,708

157,866

Deferred tax liabilities, net

864

852

Other long-term liabilities

6,456

7,149

Total liabilities

234,966

240,697

Commitments and contingencies

Stockholders’ deficit:

Preferred stock

—

—

Common stock

108

105

Additional paid-in capital

787,283

770,619

Accumulated other comprehensive loss

(5,097)

(8,531)

Accumulated deficit

(825,984)

(787,047)

Total stockholders’ deficit

(43,690)

(24,854)

Total liabilities and stockholders’

deficit

$191,276

$215,843

INSEEGO CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2022

2021

2022

2021

Cash flows from operating activities:

Net loss

$(12,376)

$(13,043)

$(37,599)

$(30,001)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

6,712

6,821

13,955

13,051

Fair value adjustment on derivative

instrument

(293)

128

(902)

(1,823)

(Recoveries) provision for bad debts

(1)

165

(15)

266

Impairment of capitalized software

—

1,197

—

1,197

Provision for excess and obsolete

inventory

649

669

896

496

Share-based compensation expense

2,287

2,307

13,486

11,405

Amortization of debt discount and debt

issuance costs

372

372

2,022

746

Loss on debt conversion and

extinguishment, net

—

—

450

432

Deferred income taxes

(285)

(288)

(96)

38

Right-of-use assets

728

371

1,070

883

Other

—

(437)

—

(330)

Changes in assets and liabilities, net of

effects of divestiture:

Accounts receivable

(238)

3,815

5,239

6,483

Inventories

(9,793)

4,580

(10,148)

(834)

Prepaid expenses and other assets

399

(40)

3,100

1,158

Accounts payable

4,193

(14,079)

(6,207)

(16,015)

Accrued expenses, income taxes, and

other

(8,559)

(4,718)

(1,740)

2,180

Operating lease liabilities

(755)

(825)

(1,109)

(1,362)

Net cash (used in) provided by operating

activities

(16,960)

(13,005)

(17,598)

(12,030)

Cash flows from investing activities:

Acquisition of noncontrolling interest

—

—

—

(116)

Purchases of property, plant and

equipment

(296)

(1,131)

(1,059)

(2,455)

Proceeds from the sale of property, plant

and equipment

—

485

—

506

Additions to capitalized software

development costs

(3,095)

(7,392)

(6,222)

(15,369)

Net cash used in investing activities

(3,391)

(8,038)

(7,281)

(17,434)

Cash flows from financing activities:

Net borrowing of bank and overdraft

facilities

(85)

35

(139)

295

Principal payments under finance lease

obligations

—

(936)

(62)

(2,173)

Proceeds from a public offering, net of

issuance costs

—

(59)

—

29,369

Principal financed other assets

(224)

—

(1,231)

—

Proceeds from stock option exercises and

employee stock purchase plan, net of taxes paid on vested

restricted stock units

52

924

115

2,020

Net cash (used in) provided by financing

activities

(257)

(36)

(1,317)

29,511

Effect of exchange rates on cash

(213)

1,912

744

321

Net (decrease) increase in cash, cash

equivalents and restricted cash

(20,821)

(19,167)

(25,452)

368

Cash, cash equivalents and restricted

cash, beginning of period

45,181

59,550

49,812

40,015

Cash, cash equivalents and restricted

cash, end of period

$24,360

$40,383

$24,360

$40,383

INSEEGO CORP.

Reconciliation of GAAP Net

Loss Attributable to Common Shareholders to Non-GAAP Net

Loss

(In thousands, except per share

data)

(Unaudited)

Three Months Ended

June 30, 2022

Six Months Ended

June 30, 2022

Net Loss

Net Loss Per Share

Net Loss

Net Loss Per Share

GAAP net loss attributable to common

shareholders

$(13,053)

$(0.12)

$(38,937)

$(0.37)

Adjustments:

Preferred stock dividends(a)

677

0.01

1,338

0.02

Share-based compensation expense

2,287

0.02

13,486

0.12

Purchased intangibles amortization

529

—

1,093

0.01

Debt discount and issuance costs

amortization(b)

372

—

2,022

0.02

Fair value adjustment on derivative

instrument(c)

(293)

—

(902)

—

Loss on debt conversion and

extinguishment, net (d)

—

—

450

—

Other

—

—

(109)

—

Non-GAAP net loss

$(9,481)

$(0.09)

$(21,559)

$(0.20)

(a) Includes accrued dividends on Series E Preferred Stock. (b)

Includes the debt discount and issuance costs amortization related

to the 2025 Notes. (c) Includes the fair value adjustment related

to the Company’s interest make-whole derivative instrument. (d)

Includes the loss on debt conversion and extinguishment of the 2025

Notes.

See “Non-GAAP Financial Measures” for information regarding our

use of Non-GAAP financial measures.

INSEEGO CORP.

Reconciliation of GAAP

Operating Costs and Expenses to Non-GAAP Operating Costs and

Expenses

Three Months Ended June 30,

2022

(In thousands)

(Unaudited)

GAAP

Share-based compensation

expense

Purchased intangibles

amortization

Non-GAAP

Cost of net revenues

$43,964

$259

$86

$43,619

Operating costs and expenses:

Research and development

13,619

428

—

13,191

Sales and marketing

7,721

554

—

7,167

General and administrative

6,142

1,046

—

5,096

Amortization of purchased intangible

assets

443

—

443

—

Total operating costs and expenses

$27,925

$2,028

$443

$25,454

Total

$2,287

$529

See “Non-GAAP Financial Measures” for information regarding our

use of Non-GAAP financial measures.

INSEEGO CORP.

Reconciliation of GAAP

Operating Costs and Expenses to Non-GAAP Operating Costs and

Expenses

Six Months Ended June 30,

2022

(In thousands)

(Unaudited)

GAAP

Share-based compensation

expense

Purchased intangibles

amortization

Non-GAAP

Cost of net revenues

$90,100

$1,674

$206

$88,220

Operating costs and expenses:

Research and development

32,179

4,498

—

27,681

Sales and marketing

17,494

2,597

—

14,897

General and administrative

14,380

4,717

—

9,663

Amortization of purchased intangible

assets

887

—

887

—

Total operating costs and expenses

$64,940

$11,812

$887

$52,241

Total

$13,486

$1,093

See “Non-GAAP Financial Measures” for information regarding our

use of Non-GAAP financial measures

INSEEGO CORP.

Reconciliation of GAAP Net

Loss Attributable to Common Shareholders to Adjusted EBITDA

(In thousands)

(Unaudited)

Three Months Ended

June 30, 2022

Six Months Ended June 30,

2022

GAAP net loss attributable to common

shareholders

(13,053)

$(38,937)

Preferred stock dividends(a)

677

1,338

Income tax provision

(303)

(625)

Depreciation and amortization

6,712

13,955

Share-based compensation expense

2,287

13,486

Fair value adjustment of derivative(b)

(293)

(902)

Interest expense, net(c)

1,664

4,587

Loss on debt conversion and

extinguishment(d)

—

450

Other(e)

1,275

2,334

Adjusted EBITDA

$(1,034)

$(4,314)

(a) Includes accrued dividends on Series E Preferred Stock. (b)

Includes the fair value adjustment related to the Company’s

interest make-whole derivative instrument. (c) Includes the debt

discount and issuance costs amortization related to the 2025 Notes.

(d) Includes the loss on debt conversion and extinguishment of the

2025 Notes. (e) Primarily includes a benefit recorded related to

non-recurring legal settlements and foreign exchange gains and

losses.

See “Non-GAAP Financial Measures” for information regarding our

use of Non-GAAP financial measures.

INSEEGO CORP.

Quarterly Net Revenues by

Product Grouping

(In thousands)

(Unaudited)

Three Months Ended

June 30, 2022

March 31, 2022

December 31, 2021

September 30, 2021

June 30, 2021

IoT & Mobile Solutions

$54,990

$54,505

$66,214

$56,975

$51,836

Enterprise SaaS Solutions

6,866

6,678

6,678

9,242

13,857

Total net revenues

$61,856

$61,183

$72,892

$66,217

$65,693

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220808005678/en/

Inseego Corp. Media Contact: Anette Gaven +1 (619)

993-3058 Anette.Gaven@inseego.com

Investor Relations Contact: Kevin Liu (626) 657-0013

Investor.Relations@inseego.com

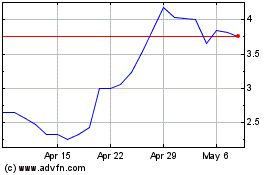

Inseego (NASDAQ:INSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Inseego (NASDAQ:INSG)

Historical Stock Chart

From Apr 2023 to Apr 2024