false

0000749660

0000749660

2023-11-13

2023-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 13, 2023

iCAD, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| |

|

|

|

001-09341

|

|

02-0377419

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

| |

|

|

98 Spit Brook Road, Suite 100, Nashua, New Hampshire

|

|

03062

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(603) 882-5200

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.01 par value

|

|

ICAD

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition

|

On November 13, 2023, iCAD, Inc. (the “Company”) issued a press release announcing its financial results for the three and nine months ended September 30, 2023. The press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and exhibit

|

Exhibits 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

(d) Exhibits

|

99.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

iCAD, INC.

(Registrant)

|

| |

|

|

| |

By:

|

/s/ Dana Brown

|

| |

|

Dana Brown

Chief Executive Officer and President

|

Date: November 13, 2023

Exhibit 99.1

iCAD Reports Financial Results for Third Quarter Ended September 30, 2023

Company to host conference call and webcast today at 4:30 PM ET

NASHUA, N.H. – November 13, 2023 (GLOBE NEWSWIRE) -- iCAD, Inc. (NASDAQ: ICAD) a global leader on a mission to create a world where cancer can’t hide by providing clinically proven AI-powered breast health solutions, today reported its financial and operating results for the three and nine months ended September 30, 2023.

Highlights:

| |

●

|

Completed sale of Xoft, its therapy business line, to Elekta thereby enabling the Company to focus exclusively on its core business of AI-powered breast health solutions. |

| |

●

|

Company re-introduces Annual Recurring Revenue (ARR) metrics to highlight progress of subscription sales and growing recurring revenue model. |

| |

●

|

Company does not need to raise additional funding to pursue growth initiatives.

|

“With the divestiture of Xoft coupled with cost reductions earlier this year, we’ve completed our necessary steps to streamline operations and put all our focus into scaling the ProFound AI breast health business, immediately prioritizing expanding our sales and partnership models to grow revenue," said Dana Brown, President and CEO, iCAD. "We’re pursuing a large addressable market where significant patient need exists, with globally more than 31,000 mammography systems serving approximately 250 million women in the age range recommended for annual mammograms. Yet, recent research indicates only 37% of mammography sites are currently using artificial intelligence (AI). Backed by science, clinical evidence, and proven patient outcomes; our ProFound Breast Health Suite solutions – Cancer Detection, Density Assessment, and Risk Evaluation – provide an unmatched approach to accurately detecting more cancers earlier, providing certainty and peace of mind to providers and patients. Our mission is to see that these solutions are deployed universally as part of the standard of care for breast health in order to achieve our vision of a world where cancer can’t hide.”

“As noted in our previous earnings announcement, our plan was to bring back the Annual Recurring Revenue (ARR) metric once it had become a reliable and growing portion of our revenue mix. In addition to the previously disclosed Subscription-ARR metric, we will be introducing three new ARR metrics:

| |

1.

|

Total ARR (T-ARR) represents the annualized value of subscription license, maintenance contracts and active cloud services at the end of a reporting period.

|

| |

2.

|

Maintenance Services ARR (M-ARR) represents the annualized value of active perpetual license maintenance service contracts at the end of the reporting period.

|

| |

3.

|

Subscription ARR (S-ARR) represents the annualized value of active subscription or term licenses at the end of a reporting period.

|

| |

4.

|

Cloud ARR (C-ARR) represents the annualized value of active cloud services contracts at the end of a reporting period.

|

The steady shift to a recurring revenue model from a perpetual model has numerous benefits, including better business visibility, more efficient expense management and an improved ability to predict future cash flow,” added Brown. “Our ongoing transition to software subscriptions and other recurring revenue models demonstrates our ability to adapt to customer needs, and we are seeing increased demand from customers who want to adopt and scale our leading AI technology via this more flexible procurement approach, which is not only more efficient but also cost-effective compared to a traditional one-time license sale, especially given the current pressure on capital budgets. Overall demand for our technology is strong, and we are making clear and steady progress penetrating the market; therefore, we’re re-introducing and expanding this set of non-GAAP metrics to measure our recurring revenue progress and success.”

Brown continued, "We’ve made solid progress in the past 6 months executing a three-phase transformation: 1) Realigning our Base, 2) Rebuilding our Foundation and 3) Investing in Growth Initiatives. We believe anchoring our growth efforts around monetizing our already significant demand is the best way to reach a meaningful revenue inflection point while managing our cash runway. We plan for revenue to grow and diversify in 2024, and as result of our recent streamlining actions, we have the cash needed to pursue our growth initiatives."

Three Months Ended September 30, 2023 Financial Results

Total revenue for our Detection business for the third quarter of 2023 was $4.1 million, a decrease of $0.3 million, or 7%, as compared to the third quarter of 2022.

|

(in 000’s)

|

|

Three months ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

$ Change

|

|

|

% Change

|

|

|

Product revenue

|

|

$ |

2,198 |

|

|

$ |

2,536 |

|

|

$ |

(338 |

) |

|

|

-13.3 |

% |

|

Service and supplies revenue

|

|

|

1,875 |

|

|

|

1,823 |

|

|

|

52 |

|

|

|

2.9 |

% |

|

Total revenue

|

|

$ |

4,073 |

|

|

$ |

4,359 |

|

|

$ |

(286 |

) |

|

|

-6.6 |

% |

Gross Profit: Gross profit for the third quarter of 2023 was $3.5 million, or 86% of revenue, as compared to $3.7 million, or 85% of revenue, in the third quarter of 2022.

Operating Expenses: Total operating expenses for the third quarter of 2023 were $4.7 million, a 31% decrease from $6.9 million in the third quarter of 2022.

GAAP Net Loss: Net loss for the third quarter of 2023 was ($1.4) million, or ($0.05) per diluted share, as compared to a net loss of ($3.9) million, or ($0.15) per diluted share, for the third quarter of 2022.

Non-GAAP Adjusted Net Loss: Non-GAAP Adjusted Net Loss, a non-GAAP financial measure as defined below, for the third quarter of 2023 was ($1.4) million, or ($0.05) per diluted share, as compared to a Non-GAAP Adjusted Net Loss of ($3.9) million, or ($0.15) per diluted share, for the third quarter of 2022. Please refer to the section entitled “Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Measures” and the accompanying financial table included at the end of this release for a reconciliation of GAAP Net Loss to Non-GAAP Adjusted Net Loss results for the three-month periods ended September 30, 2023 and 2022, respectively.

Non-GAAP Adjusted EBITDA: Non-GAAP Adjusted EBITDA, a non-GAAP financial measure as defined below, for the third quarter of 2023 was a loss of ($1.1) million compared to a loss of $(3.4) million in the third quarter of 2022. Please refer to the section entitled “Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Measures” and the accompanying financial table included at the end of this release for a reconciliation of GAAP Net Loss to Non-GAAP Adjusted EBITDA results for the three-month periods ended September 30, 2023 and 2022, respectively.

Nine Months Ended September 30, 2023 Financial Results

Total revenue for our Detection business for the nine months ended September 30, 2023 was $12.6 million, a decrease of $2.6 million, or 17%, as compared to the nine months ended September 30, 2022.

|

(in 000’s)

|

|

Nine months ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

$ Change

|

|

|

% Change

|

|

|

Product revenue

|

|

$ |

6,961 |

|

|

$ |

9,866 |

|

|

$ |

(2,905 |

) |

|

|

-29.4 |

% |

|

Service and supplies revenue

|

|

|

5,617 |

|

|

|

5,301 |

|

|

|

316 |

|

|

|

6.0 |

% |

|

Total revenue

|

|

$ |

12,578 |

|

|

$ |

15,167 |

|

|

$ |

(2,589 |

) |

|

|

-17.1 |

% |

Gross Profit: Gross profit for the nine months ended September 30, 2023 was $10.5 million, or 83% of revenue, as compared to $12.9 million, or 85% of revenue, for the nine months ended September 30, 2022.

Operating Expenses: Total operating expenses for the nine months ended September 30, 2023 were $17.4 million, a 15% decrease from $20.5 million for the nine months ended September 30, 2022.

GAAP Net Loss: Net loss for the nine months ended September 30, 2023 was ($6.9) million, or ($0.27) per diluted share, as compared to a net loss of ($10.6) million, or ($0.42) per diluted share, for the nine months ended September 30, 2022.

Non-GAAP Adjusted Net Loss: Non-GAAP Adjusted Net Loss, a non-GAAP financial measure as defined below, for the nine months ended September 30, 2023 was ($6.7) million, or ($0.26) per diluted share, as compared to a Non-GAAP Adjusted Net Loss of ($10.6) million, or ($0.42) per diluted share, for the nine months ended September 30, 2022. Please refer to the section entitled “Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Measures” and the accompanying financial table included at the end of this release for a reconciliation of GAAP Net Loss to Non-GAAP Adjusted Net Loss results for the nine-month periods ended September 30, 2023 and 2022, respectively.

Non-GAAP Adjusted EBITDA: Non-GAAP Adjusted EBITDA, a non-GAAP financial measure as defined below, for the first nine months of 2023 was a loss of ($5.8) million compared to a loss of $(8.8) million in the first nine months of 2022. Please refer to the section entitled “Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Measures” and the accompanying financial table included at the end of this release for a reconciliation of GAAP Net Loss to Non-GAAP Adjusted EBITDA results for the nine-month periods ended September 30, 2023 and 2022, respectively.

Cash and cash equivalents: Cash and cash equivalents were $19.0 million as of September 30, 2023. During the third quarter, the Company generated net proceeds of approximately $1.8 million from the issuance of 958,248 shares of common stock in at-the-market (ATM) offerings at a weighted average price of $2.26 per share. In addition, the Xoft sale in October 2023 resulted in net cash proceeds of $4.8 million. Had the sale of Xoft occurred on September 30, 2023, the Company's cash balance would have been $23.8 million. Accordingly, iCAD believes it has sufficient cash resources to fund its planned operations with no need to raise additional funding.

Conference Call

Monday, November 13, 2023 at 4:30 PM ET

| |

|

|

|

Domestic:

|

|

888-506-0062

|

|

International:

|

|

973-528-0011

|

|

Conference ID:

|

|

393244

|

|

Webcast:

|

|

https://www.webcaster4.com/Webcast/Page/2879/46603 |

Use of Non-GAAP Financial Measures

In its quarterly news releases, conference calls, slide presentations or webcasts, the Company may use or discuss non-GAAP financial measures as defined by SEC Regulation G. The GAAP financial measures most directly comparable to each non-GAAP financial measure used or discussed, and a reconciliation of the differences between each non-GAAP financial measure and the comparable GAAP financial measure, are included in this press release after the condensed consolidated financial statements. When analyzing the Company’s operating performance, investors should not consider these non-GAAP measures as a substitute for the comparable financial measures prepared in accordance with GAAP. The Company’s quarterly news releases containing such non-GAAP reconciliations can be found on the Investors section of the Company’s website at www.icadmed.com.

About iCAD, Inc.

Headquartered in Nashua, NH, iCAD is a global medical technology leader providing innovative cancer detection and therapy solutions. For more information, visit www.icadmed.com.

Forward-Looking Statements

Certain statements contained in this News Release constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about the expansion of access to the Company’s products, improvement of performance, acceleration of adoption, expected benefits of ProFound AI®, the benefits of the Company’s products, and future prospects for the Company’s technology platforms and products. Such forward-looking statements involve a number of known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited, to the Company’s ability to achieve business and strategic objectives, the willingness of patients to undergo mammography screening in light of risks of potential exposure to Covid-19, whether mammography screening will be treated as an essential procedure, whether ProFound AI will improve reading efficiency, improve specificity and sensitivity, reduce false positives and otherwise prove to be more beneficial for patients and clinicians, the impact of supply and manufacturing constraints or difficulties on our ability to fulfill our orders, uncertainty of future sales levels, to defend itself in litigation matters, protection of patents and other proprietary rights, product market acceptance, possible technological obsolescence of products, increased competition, government regulation, changes in Medicare or other reimbursement policies, risks relating to our existing and future debt obligations, competitive factors, the effects of a decline in the economy or markets served by the Company; and other risks detailed in the Company’s filings with the Securities and Exchange Commission. The words “believe,” “demonstrate,” “intend,” “expect,” “estimate,” “will,” “continue,” “anticipate,” “likely,” “seek,” and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date the statement was made. The Company is under no obligation to provide any updates to any information contained in this release. For additional disclosure regarding these and other risks faced by iCAD, please see the disclosure contained in our public filings with the Securities and Exchange Commission, available on the Investors section of our website at http://www.icadmed.com and on the SEC’s website at http://www.sec.gov.

Media Inquiries:

Jeremy Bennett, Vice President Marketing, iCAD

+1-801-244-0564

jbennett@icadmed.com

Investor Inquiries:

iCAD Investor Relations

ir@icadmed.com

iCAD, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In thousands, except for share data)

(Unaudited)

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

19,046 |

|

|

$ |

21,313 |

|

|

Trade accounts receivable, net of allowance for credit losses of $230 and $100 as of September 30, 2023 and December 31, 2022, respectively

|

|

|

4,865 |

|

|

|

5,769 |

|

|

Inventory, net

|

|

|

992 |

|

|

|

2,054 |

|

|

Prepaid expenses and other current assets

|

|

|

1,603 |

|

|

|

1,571 |

|

|

Current assets held for sale

|

|

|

5,837 |

|

|

|

7,534 |

|

|

Total current assets

|

|

$ |

32,343 |

|

|

$ |

38,241 |

|

|

Property and equipment, net of accumulated depreciation of $991 and $851 as of September 30, 2023 and December 31, 2022, respectively

|

|

|

1,285 |

|

|

|

704 |

|

|

Operating lease assets

|

|

|

514 |

|

|

|

670 |

|

|

Other assets

|

|

|

47 |

|

|

|

19 |

|

|

Intangible assets, net of accumulated amortization of $8,459 and $8,372 as of September 30, 2023 and December 31, 2022, respectively

|

|

|

177 |

|

|

|

264 |

|

|

Goodwill

|

|

|

8,362 |

|

|

|

8,362 |

|

|

Deferred tax assets

|

|

|

104 |

|

|

|

116 |

|

|

Noncurrent assets held for sale

|

|

|

2,996 |

|

|

|

3,329 |

|

|

Total assets

|

|

$ |

45,828 |

|

|

$ |

51,705 |

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

1,098 |

|

|

$ |

1,446 |

|

|

Accrued and other expenses

|

|

|

2,385 |

|

|

|

2,541 |

|

|

Lease payable—current portion

|

|

|

197 |

|

|

|

217 |

|

|

Deferred revenue—current portion

|

|

|

3,343 |

|

|

|

3,653 |

|

|

Current liabilities held for sale

|

|

|

4,389 |

|

|

|

5,595 |

|

|

Total current liabilities

|

|

|

11,412 |

|

|

|

13,452 |

|

|

Lease payable, net of current

|

|

|

317 |

|

|

|

455 |

|

|

Deferred revenue, net of current

|

|

|

844 |

|

|

|

393 |

|

|

Deferred tax

|

|

|

6 |

|

|

|

6 |

|

|

Deferred tax

|

|

|

2,214 |

|

|

|

2,497 |

|

|

Total liabilities

|

|

|

14,793 |

|

|

|

16,803 |

|

|

Commitments and Contingencies

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value: authorized 1,000,000 shares; none issued.

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

Common stock, $0.01 par value: authorized 60,000,000 shares; issued 26,440,464 and 25,446,407 as of September 30, 2023 and December 31, 2022, respectively; outstanding 26,254,633 and 25,260,576 as of September 30, 2023 and December 31, 2022, respectively.

|

|

|

264 |

|

|

|

254 |

|

|

Additional paid-in capital

|

|

|

305,924 |

|

|

|

302,899 |

|

|

Accumulated deficit

|

|

|

(273,738 |

) |

|

|

(266,836 |

) |

|

Treasury stock at cost, 185,831 shares as of both September 30, 2023 and December 31, 2022

|

|

|

(1,415 |

) |

|

|

(1,415 |

) |

|

Total stockholders’ equity

|

|

|

31,035 |

|

|

|

34,902 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

45,828 |

|

|

$ |

51,705 |

|

iCAD, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(In thousands, except for per share data)

(Unaudited)

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Products

|

|

$ |

2,198 |

|

|

$ |

2,536 |

|

|

$ |

6,961 |

|

|

$ |

9,866 |

|

|

Service and supplies

|

|

|

1,875 |

|

|

|

1,823 |

|

|

|

5,617 |

|

|

|

5,301 |

|

|

Total revenue

|

|

|

4,073 |

|

|

|

4,359 |

|

|

|

12,578 |

|

|

|

15,167 |

|

|

Cost of revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Products

|

|

|

263 |

|

|

|

348 |

|

|

|

1,099 |

|

|

|

1,253 |

|

|

Service and supplies

|

|

|

267 |

|

|

|

280 |

|

|

|

951 |

|

|

|

916 |

|

|

Amortization and depreciation

|

|

|

22 |

|

|

|

27 |

|

|

|

65 |

|

|

|

81 |

|

|

Total cost of revenue

|

|

|

552 |

|

|

|

655 |

|

|

|

2,115 |

|

|

|

2,250 |

|

|

Gross profit

|

|

|

3,521 |

|

|

|

3,704 |

|

|

|

10,463 |

|

|

|

12,917 |

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Engineering and product development

|

|

|

1,147 |

|

|

|

1,407 |

|

|

|

3,909 |

|

|

|

4,359 |

|

|

Marketing and sales

|

|

|

1,495 |

|

|

|

2,761 |

|

|

|

5,690 |

|

|

|

8,206 |

|

|

General and administrative

|

|

|

2,042 |

|

|

|

2,649 |

|

|

|

7,650 |

|

|

|

7,804 |

|

|

Amortization and depreciation

|

|

|

56 |

|

|

|

52 |

|

|

|

186 |

|

|

|

169 |

|

|

Total operating expenses

|

|

|

4,740 |

|

|

|

6,869 |

|

|

|

17,435 |

|

|

|

20,538 |

|

|

Loss from operations

|

|

|

(1,219 |

) |

|

|

(3,165 |

) |

|

|

(6,972 |

) |

|

|

(7,621 |

) |

|

Other income/ (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

— |

|

|

|

(7 |

) |

|

|

(2 |

) |

|

|

(7 |

) |

|

Interest income

|

|

|

195 |

|

|

|

71 |

|

|

|

528 |

|

|

|

89 |

|

|

Other income (expense), net

|

|

|

(9 |

) |

|

|

(2 |

) |

|

|

(8 |

) |

|

|

(45 |

) |

|

Other income (expense), net

|

|

|

186 |

|

|

|

62 |

|

|

|

518 |

|

|

|

37 |

|

|

Loss before provision for income taxes

|

|

|

(1,033 |

) |

|

|

(3,103 |

) |

|

|

(6,454 |

) |

|

|

(7,584 |

) |

|

Provision for income taxes

|

|

|

(4 |

) |

|

|

— |

|

|

|

(13 |

) |

|

|

— |

|

|

Loss from continuing operations

|

|

|

(1,037 |

) |

|

|

(3,103 |

) |

|

|

(6,467 |

) |

|

|

(7,584 |

) |

|

Loss from discontinued operations, net of tax

|

|

|

(337 |

) |

|

|

(795 |

) |

|

|

(435 |

) |

|

|

(2,977 |

) |

|

Net loss and comprehensive loss

|

|

$ |

(1,374 |

) |

|

$ |

(3,898 |

) |

|

$ |

(6,902 |

) |

|

$ |

(10,561 |

) |

|

Net loss per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations, basic and diluted

|

|

$ |

(0.04 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.30 |

) |

|

Loss from discontinued operations, basic and diluted

|

|

$ |

(0.01 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.12 |

) |

|

Net loss per share, basic and diluted

|

|

$ |

(0.05 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.42 |

) |

|

Weighted average number of shares used in computing loss per share:

|

|

|

25,597 |

|

|

|

25,204 |

|

|

|

25,374 |

|

|

|

25,183 |

|

iCAD, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| |

|

For the Nine Months ended

|

|

| |

|

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Cash flow from operating activities:

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(6,902 |

) |

|

$ |

(10,561 |

) |

|

Adjustments to reconcile net loss to net cash used for operating activities:

|

|

|

|

|

|

|

|

|

|

Amortization

|

|

|

142 |

|

|

|

158 |

|

|

Depreciation

|

|

|

202 |

|

|

|

246 |

|

|

Non-cash lease expense

|

|

|

409 |

|

|

|

549 |

|

|

Bad debt provision

|

|

|

189 |

|

|

|

510 |

|

|

Stock-based compensation

|

|

|

1,114 |

|

|

|

1,369 |

|

|

Deferred tax

|

|

|

12 |

|

|

|

— |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

1,903 |

|

|

|

(91 |

) |

|

Inventory

|

|

|

1,472 |

|

|

|

(1,459 |

) |

|

Prepaid and other assets

|

|

|

38 |

|

|

|

7 |

|

|

Accounts payable

|

|

|

(509 |

) |

|

|

(351 |

) |

|

Accrued and other expenses

|

|

|

(1,022 |

) |

|

|

(98 |

) |

|

Lease liabilities

|

|

|

(420 |

) |

|

|

(602 |

) |

|

Deferred revenue

|

|

|

(141 |

) |

|

|

663 |

|

|

Total adjustments

|

|

|

3,389 |

|

|

|

901 |

|

|

Net cash used for operating activities

|

|

|

(3,513 |

) |

|

|

(9,660 |

) |

|

Cash flow from investing activities:

|

|

|

|

|

|

|

|

|

|

Additions to patents, technology and other

|

|

|

— |

|

|

|

(10 |

) |

|

Additions to property and equipment

|

|

|

(487 |

) |

|

|

(355 |

) |

|

Capitalization of internal-use software

|

|

|

(188 |

) |

|

|

— |

|

|

Net cash used for investing activities

|

|

|

(675 |

) |

|

|

(365 |

) |

|

Cash flow from financing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from option exercises pursuant to stock option plans

|

|

|

80 |

|

|

|

206 |

|

|

Proceeds from issuances of common stock, net of issuance costs

|

|

|

1,841

|

|

|

|

—

|

|

|

Proceeds from issuance of common stock pursuant to Employee Stock Purchase Plans

|

|

|

— |

|

|

|

127 |

|

|

Net cash provided by financing activities

|

|

|

1,921 |

|

|

|

333 |

|

|

(Decrease) increase in cash and cash equivalents

|

|

|

(2,267 |

) |

|

|

(9,692 |

) |

|

Cash and cash equivalents, beginning of period

|

|

|

21,313 |

|

|

|

34,282 |

|

|

Cash and cash equivalents, end of period

|

|

$ |

19,046 |

|

|

$ |

24,590 |

|

|

Supplemental disclosure of cash flow information:

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

|

$ —

|

|

|

|

$ 7

|

|

|

Amendment to right-of-use assets obtained in exchange for operating lease liabilities

|

|

|

$ 2,434

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Measures

The Company reports its financial results in accordance with United States generally accepted accounting principles, or GAAP. However, management believes that in order to understand the Company’s short-term and long-term financial and operational trends, investors may wish to consider the impact of certain non-cash or non-recurring items, when used as a supplement to financial performance measures in accordance with GAAP. These items result from facts and circumstances that vary in frequency and/or impact on continuing operations. Management also uses results of operations before such items to evaluate the operating performance of the Company and compare it against past periods, make operating decisions, and serve as a basis for strategic planning. These non-GAAP financial measures provide management with additional means to understand and evaluate the operating results and trends in the Company’s ongoing business by eliminating certain non-cash expenses and other items that management believes might otherwise make comparisons of the Company’s ongoing business with prior periods more difficult, obscure trends in ongoing operations or reduce management’s ability to make useful forecasts. Management believes that these non-GAAP financial measures provide additional means of evaluating period-over-period operating performance. In addition, management understands that some investors and financial analysts find this information helpful in analyzing the Company’s financial and operational performance and comparing this performance to its peers and competitors.

Management defines “Non-GAAP Adjusted EBITDA” as the sum of GAAP Net Loss before provisions for interest expense, other income, stock-based compensation expense, depreciation and amortization, tax expense, severance, gain on sale of assets, loss on disposal of assets, acquisition and litigation related expenses. Management considers this non-GAAP financial measure to be an indicator of the Company’s operational strength and performance of its business and a good measure of its historical operating trends, in particular the extent to which ongoing operations impact the Company’s overall financial performance.

The non-GAAP financial measures do not replace the presentation of the Company’s GAAP financial results and should only be used as a supplement to, not as a substitute for, the Company’s financial results presented in accordance with GAAP. The Company has provided a reconciliation of each non-GAAP financial measure used in its financial reporting and investor presentations to the most directly comparable GAAP financial measure.

Management excludes each of the items identified below from the applicable non-GAAP financial measure referenced above for the reasons set forth with respect to that excluded item:

| |

•

|

Interest expense: The Company excludes interest expense which includes interest from the facility agreement, interest on capital leases and interest on the convertible debentures from its non-GAAP Adjusted EBITDA calculation.

|

| |

•

|

Stock-based compensation expense: excluded as these are non-cash expenses that management does not consider part of ongoing operating results when assessing the performance of the Company’s business, and also because the total amount of expense is partially outside of the Company’s control as it is based on factors such as stock price volatility and interest rates, which may be unrelated to our performance during the period in which the expense is incurred.

|

| |

•

|

Amortization and Depreciation: Purchased assets and intangibles are amortized over a period of several years and generally cannot be changed or influenced by management after they are acquired. Accordingly, these non-cash items are not considered by management in making operating decisions, and management believes that such expenses do not have a direct correlation to future business operations. Thus, including such charges does not accurately reflect the performance of the Company’s ongoing operations for the period in which such charges are incurred.

|

| |

•

|

Severance and Furlough: The Company has incurred severance and furlough expenses in connection with restructuring and in connection with the separation of its former CEO. The Company excludes these items from its non-GAAP financial measures when evaluating its continuing business performance as such items can vary significantly and do not reflect expected future operating expenses. In addition, management believes that such items do not have a direct correlation to future business operations.

|

| |

•

|

Loss on fair value of convertible debentures. The Company excludes this non-cash item as it is not considered by management in making operating decisions, and management believes that such item does not have a direct correlation to future business operations.

|

| |

•

|

Litigation related: These expenses consist primarily of settlement, legal and other professional fees related to litigation. The Company excludes these costs from its non-GAAP measures primarily because the Company believes that these costs have no direct correlation to the core operations of the Company.

|

| |

•

|

Loss on extinguishment of debt: The Company excludes this non-cash item as it is not considered by management in making operating decisions, and management believes that such item does not have a direct correlation to future business operations.

|

On occasion in the future, there may be other items, such as loss on extinguishment of debt, significant asset impairments, restructuring charges or significant gains or losses from contingencies that the Company may exclude if it believes that doing so is consistent with the goal of providing useful information to investors and management.

Non-GAAP Adjusted EBITDA

Set forth below is a reconciliation of the Company’s “Non-GAAP Adjusted EBITDA”

(Unaudited)

(In thousands except for per share data)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

GAAP Net Loss

|

|

$ |

(1,374 |

) |

|

$ |

(3,898 |

) |

|

$ |

(6,902 |

) |

|

$ |

(10,561 |

) |

|

Interest expense

|

|

|

— |

|

|

|

7 |

|

|

|

2 |

|

|

|

1 |

|

|

Interest income

|

|

|

(195 |

) |

|

|

(73 |

) |

|

|

(528 |

) |

|

|

(89 |

) |

|

Other expense

|

|

|

9 |

|

|

|

3 |

|

|

|

8 |

|

|

|

45 |

|

|

Stock compensation

|

|

|

303 |

|

|

|

405 |

|

|

|

1,114 |

|

|

|

1,369 |

|

|

Depreciation & amortization

|

|

|

112 |

|

|

|

130 |

|

|

|

344 |

|

|

|

404 |

|

|

Severance and Furlough

|

|

|

— |

|

|

|

— |

|

|

|

178 |

|

|

|

— |

|

|

Tax expense

|

|

|

2 |

|

|

|

— |

|

|

|

13 |

|

|

|

— |

|

|

Non-GAAP Adjusted EBITDA

|

|

$ |

(1,143 |

) |

|

$ |

(3,426 |

) |

|

$ |

(5,771 |

) |

|

$ |

(8,831 |

) |

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

GAAP Net Loss

|

|

$ |

(1,374 |

) |

|

$ |

(3,898 |

) |

|

$ |

(6,902 |

) |

|

$ |

(10,561 |

) |

|

Adjustments to Net Loss:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Severance and Furlough

|

|

|

— |

|

|

|

— |

|

|

|

178 |

|

|

|

— |

|

|

Non-GAAP Adjusted Net Loss

|

|

$ |

(1,374 |

) |

|

$ |

(3,898 |

) |

|

$ |

(6,724 |

) |

|

$ |

(10,561 |

) |

|

Net Loss per share—basic and diluted

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Net Loss per share

|

|

$ |

(0.05 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.42 |

) |

|

Adjustments to Net Loss (as detailed above)

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

Non-GAAP Adjusted Net Loss per share

|

|

$ |

(0.05 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.42 |

) |

v3.23.3

Document And Entity Information

|

Nov. 13, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

iCAD, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 13, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-09341

|

| Entity, Tax Identification Number |

02-0377419

|

| Entity, Address, Address Line One |

98 Spit Brook Road, Suite 100

|

| Entity, Address, City or Town |

Nashua

|

| Entity, Address, State or Province |

NH

|

| Entity, Address, Postal Zip Code |

03062

|

| City Area Code |

603

|

| Local Phone Number |

882-5200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ICAD

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000749660

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

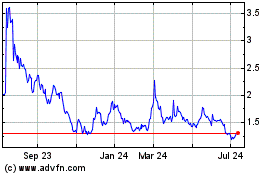

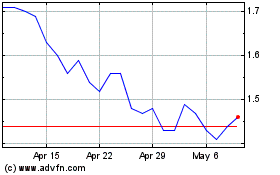

Icad (NASDAQ:ICAD)

Historical Stock Chart

From Apr 2024 to May 2024

Icad (NASDAQ:ICAD)

Historical Stock Chart

From May 2023 to May 2024