0001695295FALSE00016952952025-03-052025-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 5, 2025

Hydrofarm Holdings Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39773 | | 81-4895761 |

(State or other jurisdiction of

incorporation or organization) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

1510 Main Street

Shoemakersville, PA 19555

(Address of Principal Executive

Offices) (Zip Code)

Registrant’s telephone number, including area code: (707) 765-9990

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | HYFM | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On March 5, 2025, Hydrofarm Holdings Group, Inc. (the "Company") issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2024 and providing its full-year 2025 outlook. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02 (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure.

On March 5, 2025, the Company provided an earnings presentation that will be made available on the investor relations section of the Company’s website at https://investors.hydrofarm.com/. The earnings presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein solely for purposes of this Item 7.01 disclosure.

The information in this Item 7.01 (including Exhibit 99.2) shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act, or the Exchange Act, except as expressly set forth by specific reference in such a filing. Without limiting the generality of the foregoing, the text of the press release set forth under the heading entitled “Cautionary Note Regarding Forward-Looking Statements” is incorporated by reference into this Item 7.01.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| | | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Hydrofarm Holdings Group, Inc. |

| | |

Date: March 5, 2025 | By: | /s/ B. John Lindeman |

| | | Name: | B. John Lindeman |

| | | Title: | Chief Executive Officer |

| | | (Principal Executive Officer) |

Exhibit 99.1

Hydrofarm Holdings Group Announces Fourth Quarter and Full Year 2024 Results

Shoemakersville, PA — March 5, 2025 — Hydrofarm Holdings Group, Inc. (“Hydrofarm” or the “Company”) (Nasdaq: HYFM), a leading independent manufacturer and distributor of branded hydroponics equipment and supplies for controlled environment agriculture, today announced financial results for its fourth quarter and fiscal year ended December 31, 2024.

Fourth Quarter Highlights vs. Prior Year Period:

•Net sales decreased to $37.3 million compared to $47.2 million.

•Gross Profit and Adjusted Gross Profit(1) of $1.8 million and $3.6 million.

•Gross Profit Margin decreased to 4.9% of net sales compared to 17.9%.

•Adjusted Gross Profit Margin(1) decreased to 9.6% of net sales compared to 24.3%.

•SG&A expense and Adjusted SG&A(1) expense decreased by (14.7)% and (9.8)%, respectively.

•Net loss increased to $17.5 million compared to $15.2 million.

•Adjusted EBITDA(1) of $(7.3) million compared to $(0.6) million.

•Gross Profit, Net Loss, Adjusted Gross Profit(1) and Adjusted EBITDA(1) were negatively impacted by approximately $1.4 million, or 3.8% of net sales, due to inventory reserves and related changes.

•Cash generated from operating activities and Free Cash Flow(1) were $2.7 million and $2.4 million, respectively.

Fiscal Year 2024 Highlights vs. Prior Year Period:

•Net sales decreased to $190.3 million compared to $226.6 million.

•Gross Profit and Adjusted Gross Profit(1) of $32.1 million and $40.3 million, respectively.

•Gross Profit Margin increased to 16.9% of net sales compared to 16.6%.

•Adjusted Gross Profit Margin(1) decreased to 21.2% of net sales compared to 24.3%.

•SG&A expense and Adjusted SG&A(1) expense decreased by (16.6)% and (16.9)%, respectively.

•Net loss increased to $66.7 million compared to $64.8 million.

•Adjusted EBITDA(1) of $(5.2) million compared to $0.3 million.

•Cash used in operating activities and Free Cash Flow(1) were $(0.3) million and $(3.2) million, respectively.

(1) Adjusted Gross Profit, Adjusted Gross Profit Margin, Adjusted SG&A, Adjusted SG&A as a percent of net sales, Adjusted EBITDA, and Free Cash Flow are non-GAAP measures. For a description of our non-GAAP measures see the “Non-GAAP Measures” section accompanying this release; and for reconciliations of GAAP to non-GAAP measures see the “Reconciliation of Non-GAAP Measures” accompanying this release.

John Lindeman, Chief Executive Officer of Hydrofarm, said, "In 2024, we delivered over $9 million of Adjusted SG&A(1) expense savings, demonstrating our commitment to continued cost management to counter persistent challenging industry conditions. While fourth quarter industry headwinds affected our Adjusted EBITDA(1) and Free Cash Flow(1) performance, we successfully maintained annual sales to the mid-point of our full-year outlook. Our strategic focus on proprietary brands has successfully increased our sales mix of higher-margin proprietary brands from approximately 35% in 2020 to 56% in 2024. We've also reduced our manufacturing footprint by nearly 60% since early 2023 while maintaining excellent product quality. Looking ahead to 2025, we have a clear roadmap focused on reinvigorating our proprietary brand sales mix, optimizing our distribution network, and implementing additional cost-saving measures. We're encouraged by our e-commerce growth and revenue diversification efforts through geographic expansion and non-cannabis sales. We remain confident in our ability to execute on initiatives within our control and enhance long-term shareholder value."

Fourth Quarter 2024 Financial Results

Net sales in the fourth quarter of 2024 decreased 20.9% to $37.3 million compared to $47.2 million in the prior year period. This was primarily due to a 16.8% decline in volume/mix of products sold related to oversupply in the cannabis industry, and a 3.9% decrease in price.

Gross Profit decreased to $1.8 million, or 4.9% of net sales, compared to $8.4 million, or 17.9% of net sales, in the prior year period. Adjusted Gross Profit(1) decreased to $3.6 million, or 9.6% of net sales, compared to $11.5 million, or 24.3% of net sales, in the prior year period. The decreases in Gross Profit, Adjusted Gross Profit(1), Gross Profit Margin, Adjusted Gross Profit Margin(1) were primarily due to lower sales, lower proprietary brand sales mix, and approximately $1.4 million of inventory reserves and related charges.

Selling, general and administrative (“SG&A”) expense was $17.0 million, compared to $19.9 million in the prior year period, and Adjusted SG&A(1) expense was $10.8 million compared to $12.0 million in the prior year period. The reductions in SG&A and Adjusted SG&A(1) expenses were due to decreases in several areas, including compensation costs associated with headcount reductions and lower performance-based compensation expense, facility costs, insurance, and professional fees, driven by the Company's restructuring actions and related cost-saving initiatives.

Net loss was $17.5 million, or $(3.80) per diluted share, compared to a net loss of $15.2 million, or $(3.33) per diluted share, in the prior year period. The decline in net loss was primarily due to lower sales, partially offset by SG&A expense reductions.

Adjusted EBITDA(1) decreased to $(7.3) million, compared to $(0.6) million in the prior year period. The reduction was related to lower net sales and lower Adjusted Gross Profit Margin(1) partially offset by lower Adjusted SG&A(1) expense.

Balance Sheet, Liquidity and Cash Flow

As of December 31, 2024, the Company had $26.1 million in cash and approximately $13.0 million of available borrowing capacity on its Revolving Credit Facility. The Company ended the fourth quarter with $119.3 million in principal balance on its Term Loan outstanding, $8.3 million in finance leases, and $0.1 million in other debt outstanding. During 2024 and 2023, the Company maintained a zero balance on its Revolving Credit Facility. As of December 31, 2024, the Company was in compliance with debt covenants under its Revolving Credit Facility and Term Loan.

The Company generated net cash from operating activities of $2.7 million and invested $0.3 million in capital expenditures, yielding Free Cash Flow(1) of $2.4 million during the three months ended December 31, 2024.

For the full year 2024, cash used in operating activities was $0.3 million and the Company invested $2.9 million in capital expenditures, yielding Free Cash Flow(1) of $(3.2) million. Free Cash Flow(1) decreased from the prior year period, primarily due to lower earnings and working capital changes.

Full Year 2025 Outlook

The Company is providing the following outlook for the full fiscal year 2025:

•Net sales to decrease ten to twenty (10-20%) percent.

•Adjusted EBITDA(1) that is negative, but improved from 2024.

•Free Cash Flow(1) that is negative, but improved from 2024.

Hydrofarm’s 2025 outlook is predicated on several assumptions, including:

•Improved year-over-year Adjusted Gross Profit Margin resulting primarily from an expectation of (i) a higher full year proprietary brand sales mix, (ii) continued benefit from cost savings associated with 2024 restructuring and related productivity initiatives as well as new cost savings planned for 2025, (iii) minimal non-restructuring inventory reserves or related charges.

•Reduced year-over-year Adjusted SG&A expense resulting from full year benefit of reductions completed in 2024 and further reductions in professional and outside service fees, facilities and insurance expense.

•Further reduction in inventory and net working capital for the full year.

•Capital expenditures of less than $2 million.

(1) Adjusted Gross Profit, Adjusted Gross Profit Margin, Adjusted SG&A, Adjusted SG&A as a percent of net sales, Adjusted EBITDA, and Free Cash Flow are non-GAAP measures. For a description of our non-GAAP measures see the “Non-GAAP Measures” section accompanying this release; and for reconciliations of GAAP to non-GAAP measures see the “Reconciliation of Non-GAAP Measures” accompanying this release.

Conference Call and Presentation

The Company will host a conference call to discuss financial results for the fourth quarter and full year 2024 today at 8:30 a.m. Eastern Time. John Lindeman, Chief Executive Officer, and Kevin O'Brien, Chief Financial Officer, will host the call. An earnings presentation is also available for reference on the Hydrofarm investor relations website.

The conference call can be accessed live over the phone by dialing 1-800-343-5172 and entering the conference ID: HYFMQ4. The conference call will also be webcast live and archived on the Company's investor relations website at https://investors.hydrofarm.com/ under the “News & Events” section.

About Hydrofarm Holdings Group, Inc.

Hydrofarm is a leading independent manufacturer and distributor of branded hydroponics equipment and supplies for controlled environment agriculture, including grow lights, climate control solutions, grow media and nutrients, as well as a broad portfolio of innovative proprietary branded products. For over 40 years, Hydrofarm has helped growers make growing easier and more productive. The Company’s mission is to empower growers, farmers and cultivators with products that enable greater quality, efficiency, consistency and speed in their grow projects.

Cautionary Note Regarding Forward-Looking Statements

Statements contained in this press release, other than statements of historical fact, which address activities, events and developments that the Company expects or anticipates will or may occur in the future, including, but not limited to, information regarding the future economic performance and financial condition of the Company, the plans and objectives of the Company’s management, and the Company’s assumptions regarding such performance and plans are “forward-looking statements” within the meaning of the U.S. federal securities laws that are subject to risks and uncertainties. These forward-looking statements generally can be identified as statements that include phrases such as “guidance,” “outlook,” “projected,” “believe,” “target,” “predict,” “estimate,” “forecast,” “strategy,” “may,” “goal,” “expect,” “anticipate,” “intend,” “plan,” “foresee,” “likely,” “will,” “should” or other similar words or phrases. Actual results could differ materially from the forward-looking information in this release due to a variety of factors, including, but not limited to:

The market in which the Company operates has been substantially adversely impacted by conditions of the agricultural and cannabis industries, including oversupply and decreasing prices of the products the Company's end customers sell, which, in turn, has materially adversely impacted the Company's sales and other results of operations and which may continue to do so in the future; If industry conditions worsen or are sustained for a lengthy period, the Company could be forced to take additional impairment charges and/or inventory and accounts receivable reserves, which could be substantial, and, ultimately, the Company may face liquidity challenges; The Company’s Revolving Credit Facility and future debt facilities may limit the operation of the Company’s business including restricting its ability to sell products directly to the cannabis industry; Although equity financing may be available, the Company's current stock prices are at depressed levels and any such financing would be dilutive; Interruptions in the Company's supply chain could adversely impact expected sales growth and operations; Increased prices and inflation could adversely impact the Company's performance and financial results; Global political and economic conditions including the imposition of potential tariffs could increase the costs of the Company's products and adversely impact the competitiveness of the Company's products and the Company's financial results; The Company may be unable to meet the continued listing standards of Nasdaq; The Company's

restructuring activities may increase our expenses and cash expenditures, and may not have the intended cost saving effects; The highly competitive nature of the Company’s markets could adversely affect its ability to maintain or grow revenues; Certain of the Company’s products may be purchased for use in new or emerging industries or segments, including the cannabis industry, and/or be subject to varying, inconsistent, and rapidly changing laws, regulations, administrative and enforcement approaches, and consumer perceptions which may adversely impact the market for the Company’s products; The market for the Company’s products has been impacted by conditions impacting its customers, including related crop prices, climate change, and other factors impacting growers; Compliance with government laws and regulations including environmental and other public health regulations or changes in such regulations or regulatory enforcement priorities could increase the Company’s costs of doing business or limit the Company’s ability to market all of its products; Damage to the Company’s reputation or the reputation of its products or products it markets on behalf of third parties could have an adverse effect on its business; If the Company is unable to effectively execute its e-commerce business, its reputation and operating results may be harmed; The Company’s operations may be impaired if its information technology systems fail to perform adequately or if it is the subject of a data breach or cyber-attack; The Company may not be able to adequately protect its intellectual property and other proprietary rights that are material to the Company’s business; Acquisitions, other strategic alliances and investments could result in operating and integration difficulties, dilution and other harmful consequences that may adversely impact the Company’s business and results of operations. Additional detailed information concerning a number of the important factors that could cause actual results to differ materially from the forward-looking information contained in this release is readily available in the Company’s annual, quarterly and other reports. The Company disclaims any obligation to update developments of these risk factors or to announce publicly any revision to any of the forward-looking statements contained in this release, or to make corrections to reflect future events or developments except as otherwise required by law.

Contacts:

Investor Contact

Anna Kate Heller / ICR

ir@hydrofarm.com

Hydrofarm Holdings Group, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(In thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended December 31, | | Twelve months ended December 31, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | | $ | 37,314 | | | $ | 47,184 | | | $ | 190,288 | | | $ | 226,581 | |

| Cost of goods sold | | 35,476 | | | 38,735 | | | 158,155 | | | 188,969 | |

| Gross profit | | 1,838 | | | 8,449 | | | 32,133 | | | 37,612 | |

| Operating expenses: | | | | | | | | |

| Selling, general and administrative | | 16,958 | | | 19,872 | | | 72,794 | | | 87,314 | |

| Loss on asset disposition | | — | | | — | | | 11,520 | | | — | |

| Loss from operations | | (15,120) | | | (11,423) | | | (52,181) | | | (49,702) | |

| Interest expense | | (3,585) | | | (4,019) | | | (15,237) | | | (15,442) | |

| Other income, net | | 1,196 | | | 96 | | | 1,570 | | | 118 | |

| Loss before tax | | (17,509) | | | (15,346) | | | (65,848) | | | (65,026) | |

| Income tax (expense) benefit | | (4) | | | 131 | | | (869) | | | 213 | |

| Net loss | | $ | (17,513) | | | $ | (15,215) | | | $ | (66,717) | | | $ | (64,813) | |

| | | | | | | | |

Net loss per share(1): | | | | | | | | |

| Basic | | $ | (3.80) | | | $ | (3.33) | | | $ | (14.51) | | | $ | (14.24) | |

| Diluted | | $ | (3.80) | | | $ | (3.33) | | | $ | (14.51) | | | $ | (14.24) | |

Weighted-average shares of common stock outstanding(1): | | | | | | |

| Basic | | 4,607,762 | | | 4,566,195 | | | 4,598,640 | | | 4,550,836 | |

| Diluted | | 4,607,762 | | | 4,566,195 | | | 4,598,640 | | | 4,550,836 | |

(1) Net loss per share and Weighted-average shares of common stock outstanding amounts have been adjusted to give retroactive effect to the 1-for-10 reverse stock split effected on February 12, 2025. |

Hydrofarm Holdings Group, Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(In thousands, except share and per share amounts)

| | | | | | | | | | | | | | |

| | December 31, |

| | | 2024 | | 2023 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 26,111 | | | $ | 30,312 | |

| Accounts receivable, net | | 14,756 | | | 16,890 | |

| Inventories | | 50,633 | | | 75,354 | |

| Prepaid expenses and other current assets | | 3,712 | | | 5,510 | |

| Total current assets | | 95,212 | | | 128,066 | |

| Property, plant and equipment, net | | 37,545 | | | 47,360 | |

| Operating lease right-of-use assets | | 42,869 | | | 54,494 | |

| Intangible assets, net | | 249,002 | | | 275,881 | |

| Other assets | | 1,476 | | | 1,842 | |

| Total assets | | $ | 426,104 | | | $ | 507,643 | |

| Liabilities and stockholders’ equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 12,279 | | | $ | 12,613 | |

| Accrued expenses and other current liabilities | | 10,647 | | | 9,529 | |

| Deferred revenue | | 2,611 | | | 3,231 | |

| Current portion of operating lease liabilities | | 7,731 | | | 8,336 | |

| Current portion of finance lease liabilities | | 459 | | | 954 | |

| Current portion of long-term debt | | 1,260 | | | 2,989 | |

| Total current liabilities | | 34,987 | | | 37,652 | |

| Long-term operating lease liabilities | | 37,553 | | | 47,506 | |

| Long-term finance lease liabilities | | 7,830 | | | 8,734 | |

| Long-term debt | | 114,693 | | | 115,412 | |

| Deferred tax liabilities | | 3,047 | | | 3,232 | |

| Other long-term liabilities | | 4,272 | | | 4,497 | |

| Total liabilities | | 202,382 | | | 217,033 | |

| Commitments and contingencies | | | | |

| Stockholders’ equity | | | | |

| Common stock ($0.0001 par value; 300,000,000 shares authorized; 4,614,279 and 4,578,841 shares issued and outstanding at December 31, 2024, and December 31, 2023, respectively, giving retroactive effect to the 1-10 reverse split effected on February 12, 2025) | | — | | | — | |

| Additional paid-in capital | | 790,094 | | | 787,851 | |

| Accumulated other comprehensive loss | | (8,911) | | | (6,497) | |

| Accumulated deficit | | (557,461) | | | (490,744) | |

| Total stockholders’ equity | | 223,722 | | | 290,610 | |

| Total liabilities and stockholders’ equity | | $ | 426,104 | | | $ | 507,643 | |

Hydrofarm Holdings Group, Inc.

RECONCILIATION OF NON-GAAP MEASURES

(In thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | Twelve months ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of Adjusted Gross Profit: | | | | | | | | |

| Gross Profit (GAAP) | | $ | 1,838 | | | $ | 8,449 | | | $ | 32,133 | | | $ | 37,612 | |

| Depreciation, depletion and amortization | | 1,362 | | | 1,677 | | | 6,222 | | | 6,584 | |

Restructuring expenses1 | | 388 | | | 1,263 | | | 1,946 | | | 10,664 | |

Severance and other2 | | 5 | | | 79 | | | 5 | | | 155 | |

| Adjusted Gross Profit (Non-GAAP) | | $ | 3,593 | | | $ | 11,468 | | | $ | 40,306 | | | $ | 55,015 | |

| | | | | | | | |

| As a percent of net sales: | | | | | | | | |

| Gross Profit Margin (GAAP) | | 4.9 | % | | 17.9 | % | | 16.9 | % | | 16.6 | % |

| Adjusted Gross Profit Margin (Non-GAAP) | | 9.6 | % | | 24.3 | % | | 21.2 | % | | 24.3 | % |

Gross Profit (GAAP) and Adjusted Gross Profit (Non-GAAP) for the three months and year ended December 31, 2024, were negatively impacted by $1.4 million of inventory reserves and related charges.

Gross Profit (GAAP) and Adjusted Gross Profit (Non-GAAP) for the year ended December 31, 2023, were negatively impacted by $1.2 million of certain inventory charges.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | Twelve months ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of Adjusted SG&A: | | | | | | | | |

| Selling, general and administrative (GAAP) | | $ | 16,958 | | | $ | 19,872 | | | $ | 72,794 | | | $ | 87,314 | |

| Depreciation, depletion and amortization | | 6,005 | | | 6,233 | | | 24,469 | | | 25,491 | |

Restructuring expenses1 | | 114 | | | 204 | | | 277 | | | 605 | |

Severance and other2 | | (99) | | | 348 | | | 165 | | | 1,304 | |

Stock-based compensation3 | | 93 | | | 1,057 | | | 2,399 | | | 5,114 | |

| Acquisition and integration expenses | | — | | | 12 | | | — | | | 51 | |

| Adjusted SG&A (Non-GAAP) | | $ | 10,845 | | | $ | 12,018 | | | $ | 45,484 | | | $ | 54,749 | |

| | | | | | | | |

| As a percent of net sales: | | | | | | | | |

| SG&A (GAAP) | | 45.4 | % | | 42.1 | % | | 38.3 | % | | 38.5 | % |

| Adjusted SG&A (Non-GAAP) | | 29.1 | % | | 25.5 | % | | 23.9 | % | | 24.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | Twelve months ended December 31, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of Adjusted EBITDA: | | | | | | | | |

| Net loss (GAAP) | | $ | (17,513) | | | $ | (15,215) | | | $ | (66,717) | | | $ | (64,813) | |

| Interest expense | | 3,585 | | | 4,019 | | | 15,237 | | | 15,442 | |

| Income tax expense (benefit) | | 4 | | | (131) | | | 869 | | | (213) | |

| Depreciation, depletion and amortization | | 7,367 | | | 7,910 | | | 30,691 | | | 32,075 | |

Restructuring expenses1 | | 502 | | | 1,467 | | | 2,223 | | | 11,269 | |

Severance and other2 | | (94) | | | 427 | | | 170 | | | 1,459 | |

Stock-based compensation3 | | 93 | | | 1,057 | | | 2,399 | | | 5,114 | |

| Acquisition and integration expenses | | — | | | 12 | | | — | | | 51 | |

Other income, net4 | | (1,196) | | | (96) | | | (1,570) | | | (118) | |

Loss on asset disposition5 | | — | | | — | | | 11,520 | | | — | |

| Adjusted EBITDA (Non-GAAP) | | $ | (7,252) | | | $ | (550) | | | $ | (5,178) | | | $ | 266 | |

| | | | | | | | |

| As a percent of net sales: | | | | | | | | |

| Net loss (GAAP) | | (46.9) | % | | (32.2) | % | | (35.1) | % | | (28.6) | % |

| Adjusted EBITDA (Non-GAAP) | | (19.4) | % | | (1.2) | % | | (2.7) | % | | 0.1 | % |

Net loss (GAAP) and Adjusted EBITDA (Non-GAAP) for the three months and year ended December 31, 2024, were negatively impacted by $1.4 million of inventory reserves and related charges.

Net loss (GAAP) and Adjusted EBITDA (Non-GAAP) for the year ended December 31, 2023, were negatively impacted by $1.2 million of certain inventory charges.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | Twelve months ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Reconciliation of Free Cash Flow6: | | | | | | | | |

Net cash (used in) from operating activities (GAAP)6: | | $ | 2,656 | | | $ | (1,585) | | | $ | (324) | | | $ | 7,044 | |

| Capital expenditures of Property, plant and equipment (GAAP) | | (270) | | | (159) | | | (2,892) | | | (4,215) | |

Free Cash Flow (Non-GAAP)6: | | $ | 2,386 | | | $ | (1,744) | | | $ | (3,216) | | | $ | 2,829 | |

Notes to GAAP to Non-GAAP reconciliations presented above (Adjusted Gross Profit, Adjusted SG&A, Adjusted EBITDA, and Free Cash Flow):

1.For the three and twelve months ended December 31, 2024, and December 31, 2023, Restructuring expenses related primarily to non-cash inventory markdowns associated with manufacturing facility consolidations, and the charges incurred to relocate and terminate certain facilities.

2.For the three and twelve months ended December 31, 2024, Severance and other charges primarily related to estimated net legal costs related to certain litigation and severance charges. For the three and twelve months ended December 31, 2023, Severance and other charges primarily related to workforce reductions and charges in conjunction with a sale-leaseback transaction during the first quarter of 2023.

3.Includes stock-based compensation and related employer payroll taxes on stock-based compensation for the periods presented.

4.Other income, net related primarily to foreign currency exchange rate gains and losses and other non-operating income and expenses. For the three and twelve months ended December 31, 2024, Other income, net also included a cash settlement arising from an outstanding litigation matter of a previously acquired entity. For the twelve months ended December 31, 2023, Other income, net also included charges from Amendment No. 1 to the Company's Term Loan.

5.Loss on asset disposition for the twelve months ended December 31, 2024, relates to the sale in the second quarter of 2024 of the inventories, and property, plant and equipment associated with the Company's Innovative Growers Equipment ("IGE") branded products to CM Fabrication, LLC (the "Asset Sale").

6.The total gross proceeds associated with the IGE Asset Sale were $8.7 million, of which the Company estimated and classified $5.0 million in Net cash from operating activities, and $3.7 million in Investing activities, as these cash flows were associated with the sale of inventory and property, plant and equipment, respectively. The cash proceeds classified within Net cash from operating activities were partially offset by $1.3 million cash paid to terminate the associated facility lease and cash transaction costs paid during the period. As a result, the Asset Sale contributed an estimated $3.5 million to Net cash from operating activities and Free Cash Flow during the twelve months ended December 31, 2024. In addition, in connection with the Asset Sale, the Company paid $0.7 million to terminate certain equipment finance leases and classified this cash outflow within Financing activities for the twelve months ended December 31, 2024. In total, the IGE Asset Sale contributed net cash proceeds, after repayment of certain lease liabilities and transaction expenses, of an estimated $6.3 million. In 2023, gross proceeds of $8.6 million received during the twelve months ended December 31, 2023, from a sale-leaseback of real estate located in Eugene, Oregon, was classified as a Financing activity and is not reflected in Net cash from operating activities or Free Cash Flow in the prior year period.

Non-GAAP Financial Measures

We report our financial results in accordance with generally accepted accounting principles in the U.S. (“GAAP”). Management believes that certain non-GAAP financial measures provide investors with additional useful information in evaluating our performance and that excluding certain items that may vary substantially in frequency and magnitude period-to-period from net loss provides useful supplemental measures that assist in evaluating our ability to generate earnings and to more readily compare these metrics between past and future periods. These non-GAAP financial measures may be different than similarly titled measures used by other companies.

To supplement our condensed consolidated financial statements which are prepared in accordance with GAAP, we use "Adjusted EBITDA", "Adjusted Gross Profit", "Adjusted SG&A", "Free Cash Flow", "Net Debt", and "Liquidity" which are non-GAAP financial measures. We also present certain of these non-GAAP metrics as a percentage of net sales. Our non-GAAP financial measures should not be considered in isolation from, or as substitutes for, financial information prepared in accordance with GAAP. There are several limitations related to the use of our non-GAAP financial measures as compared to the closest comparable GAAP measures.

We define Adjusted EBITDA (non-GAAP) as net loss (GAAP) excluding interest expense, income taxes, depreciation, depletion and amortization, stock-based compensation including employer payroll taxes on stock-based compensation, restructuring expenses, impairments, severance, loss on asset disposition, other income/expense, net, and other non-cash, unusual and/or infrequent costs (i.e., acquisition and integration expenses), which we do not consider in our evaluation of ongoing operating performance.

We define Adjusted EBITDA (non-GAAP) as a percent of net sales as Adjusted EBITDA (as defined above) divided by net sales in the respective period.

We define Adjusted Gross Profit (non-GAAP) as Gross Profit (GAAP) excluding depreciation, depletion, and amortization, restructuring expenses, severance and other expenses, and other non-cash, unusual and/or infrequent costs, which we do not consider in our evaluation of ongoing operating performance.

We define Adjusted Gross Profit Margin (non-GAAP) as a percent of net sales as Adjusted Gross Profit (as defined above) divided by net sales in the respective period.

We define Adjusted SG&A (non-GAAP) as SG&A (GAAP) excluding depreciation, depletion, and amortization, stock-based compensation including employer payroll taxes on stock-based compensation, restructuring expenses, severance and other expenses, and other non-cash, unusual and/or infrequent costs (i.e., acquisition and integration expenses), which we do not consider in our evaluation of ongoing operating performance.

We define Adjusted SG&A (non-GAAP) as a percent of net sales as Adjusted SG&A (as defined above) divided by net sales in the respective period.

We define Free Cash Flow (non-GAAP) as Net cash from (used in) operating activities less capital expenditures for property, plant and equipment. We believe this provides additional insight into the Company's ability to generate cash and maintain liquidity. However, Free Cash Flow does not represent funds available for investment or other

discretionary uses since it does not deduct cash used to service our debt or other cash flows from financing activities or investing activities.

We define Liquidity as total cash, cash equivalents and restricted cash, if applicable, plus available borrowing capacity on our Revolving Credit Facility.

We define Net Debt as total debt principal outstanding plus finance lease liabilities and other debt, less cash, cash equivalents and restricted cash, if applicable.

Four th Quar ter 2024 Earnings Presentat ion March 5th, 2025

Disclaimer Forward-Looking Statements. This presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different from the statements made herein. All statements other than statements of historical fact included in this presentation are forward-looking statements, including, but not limited to, the Company’s financial results, future financial position, expected growth of cash flows, business strategy, budgets, projected costs, projected capital expenditures, taxes, plans, objectives, potential synergies, industry trends and growth opportunities. Forward-looking statements discuss the Company’s current expectations and projections relating to its financial operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “aim,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “future,” “intend,” “outlook,” “potential,” “project,” “projection,” “plan,” “seek,” “may,” “could,” “would,” “will,” “should,” “can,” “can have,” “likely,” the negatives thereof and other similar expressions. All forward- looking statements are expressly qualified in their entirety by these cautionary statements. These forward-looking statements are only predictions, not historical fact, and involve certain risks and uncertainties, as well as assumptions. While Hydrofarm believes that its assumptions are reasonable, it is very difficult to predict the impact of known factors, and, of course, it is impossible to anticipate all factors that could affect actual results. There are many risks and uncertainties that could cause actual results to differ materially from forward-looking statements made herein including, most prominently, the risks discussed under the heading “Risk Factors” in the Company’s latest annual report on Form 10-K and quarterly reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”). Such forward-looking statements are made only as of the date of this presentation. All of the Company’s SEC filings are available online at www.sec.gov. Hydrofarm undertakes no obligation to publicly update or revise any forward-looking statement because of new information, future events or otherwise, except as otherwise required by law. If we do update one or more forward- looking statements, no inference should be made that we will make additional updates with respect to those or other forward-looking statements. Projected Financial Information. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions, and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. Non-GAAP Financial Information. This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Company’s performance. Management believes these non-GAAP financial measures allow for better comparability of period to period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation of the non-GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation, and in our related press release attached as an exhibit to our Current Report on Form 8-K filing available online at www.sec.gov. 2

Business Over v iew

Fourth Quarter and Full-Year 2024 Financial Results Net Sales within our Full-Year Expectations • Reached the midpoint of our full-year outlook range • Revenue streams were more diversified in 2024 compared to 2023 Significant Reductions in Adjusted SG&A • Effective cost savings and restructuring actions • Adjusted SG&A decreased 10% in Q4’ 24 and 17% for Full-Year ’24 compared to prior year Challenging Q4 ’24 Adjusted EBITDA and Free Cash Flow Results • Adjusted Gross Profit Margin (AGPM%) declined in Q4’ 24 driven by reduced sales, lower proprietary brand mix, and inventory reserves and related charges of $1.4 million • Free Cash Flow ($3.2) million in 2024. Investment in new distributed brands during 2024 improved sales but pressured cash flows Adjusted Gross Profit, Adjusted SG&A, Adjusted EBITDA, and Free Cash Flow are non-GAAP measures. AGPM% refers to 'Adjusted Gross Profit Margin’. ASG&A$ refers to ‘Adjusted Selling General & Admin in USD’. Please see appendix for reconciliation of GAAP to non-GAAP measures. 4

✓ Drive Diverse, High-Quality Revenue Streams • Improve Proprietary Brand Mix • Targeted Investments and New Proprietary Product Innovations • Expand Non-US/CAN and Non-Cannabis Sales ✓ Improve Profit Margins • Increase Production and Efficiency in our Manufacturing Operations • Further Optimize our Distribution Center Network • Reduce SG&A Expenses ✓ Strengthen Financial Position • Improve Free Cash Flow • Maintain Strong Liquidity Strategic Priorities 5 Adjusted Gross Profit, Adjusted SG&A, Adjusted EBITDA, and Free Cash Flow are non-GAAP measures. AGPM% refers to 'Adjusted Gross Profit Margin’. ASG&A$ refers to ‘Adjusted Selling General & Admin in USD’. Please see appendix for reconciliation of GAAP to non-GAAP measures.

F inancia l Over v iew

Financial Summary 7 AGPM% refers to 'Adjusted Gross Profit Margin’. ASG&A$ refers to ‘Adjusted Selling General & Administrative expenses in USD’. Adjusted Gross Profit, Adjusted SG&A, Adjusted EBITDA, and Free Cash Flow are non-GAAP measures. Please see appendix for reconciliation of GAAP to non-GAAP measures.

Trend in AGPM% and Adjusted SG&A$ Quarterly 2024 AGPM% Trend • In Q4’ 24 lower sales, proprietary brand mix decline, and ~$1.4 million of inventory reserves and related charges impacted AGPM% • Actions to re-emphasize our proprietary brand focus in 2025 to improve AGPM% Continued Favorable Adjusted SG&A Savings • Significant reductions in Adjusted SG&A over the past two years • Reductions in headcount, facility costs, insurance, professional & outside services 8 Quarterly Adjusted SG&A Expense % indicates year-over-year savings percentage 16.2M 14.6M 12.0M 12.0M 12.3M 11.6M 10.7M 10.8M Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 -16% -9% -29% -31% -24% -20% -11% -10% AGPM% refers to 'Adjusted Gross Profit Margin’. ASG&A$ refers to ‘Adjusted Selling General & Administrative expenses in USD’. Adjusted Gross Profit, Adjusted SG&A, Adjusted EBITDA, and Free Cash Flow are non-GAAP measures. Please see appendix for reconciliation of GAAP to non-GAAP measures. P ro p ri e ta ry M ix % A G P M % Proprietary Brand Sales Mix and AGPM% 57% 58% 56% 52% 23.4% 24.4% 24.3% 9.6% 0% 5% 10% 15% 20% 25% 30% 50% 52% 54% 56% 58% 60% Q1'24 Q2'24 Q3'24 Q4'24 Proprietary Mix % AGPM %

Liquidity Remains Strong 'Total Debt' is defined as Term Loan debt principal outstanding plus finance leases and other debt. Net Debt, Liquidity and Free Cash Flow are non-GAAP measures. Please see appendix for reconciliation of GAAP to non-GAAP measures. Cash and cash equivalents $26.1 Total Debt $127.7 Net Debt $101.6 Net Cash From Operations $2.7 Capital Expenditures $(0.3) Free Cash Flow $2.4 9 Balance Sheet Highlights as of December 31, 2024 Cash Flow Highlights 3 months ended December 31, 2024 Cash Flow Highlights 12 months ended December 31, 2024 Net Cash From Operations $(0.3) Capital Expenditures $(2.9) Free Cash Flow $(3.2) USD millions USD millions USD millions

Revolving Line of Credit ✓ $35 million Total Facility Size (effective in Q4’ 24) ✓ $0M Drawn and $13 million available as of 12/31/24 ✓ Adjusted Term SOFR Rate + grid-based spread ✓ Availability varies with borrowing base ✓ Matures 6/30/2026 Senior Secured Term Loan ✓ $119.3 million in principal outstanding as of 12/31/24 ✓ Adjusted Term SOFR Rate + 5.50% ✓ No financial maintenance covenants ✓ Principal amortizes 0.25% per quarter until maturity ✓ Net proceeds from asset sales subject to debt payment provisions * $6.3 million of net proceeds from IGE Asset Sale in Q2 2024 requires ‘permitted investment’ or principal repayment in 2025 ✓ 0% call premium ✓ Matures 10/25/2028 * The 2024 IGE Asset Sale is subject to the Term Loan reinvestment provisions, further described in our Form 10-K filing. 10 Debt Details Un-utilized Revolving Credit facility and Covenant-light Term Loan that does not mature until 2028

Net Sales1 Adjusted EBITDA 2 Free Cash Flow 3 Decline 10-20% Improve Adjusted EBITDA Improve Free Cash Flow • Increase proprietary brand mix • Improve revenue diversity • AGPM% benefit from proprietary brand mix and productivity • SG&A reductions in professional & outside service fees, facilities and insurance • Savings from 2024 restructuring and related cost saving initiatives • Rightsizing distribution network to further consolidate and reduce inventory levels • Better working capital management • Capital expenditures less than $2 million 11 Fiscal 2025 Outlook on Key Metrics 2025 Outlook on Key Metrics Compared to 2024 AGPM% refers to 'Adjusted Gross Profit Margin’. ASG&A$ refers to ‘Adjusted Selling General & Administrative expenses in USD’. Adjusted Gross Profit, Adjusted SG&A, Adjusted EBITDA, and Free Cash Flow are non-GAAP measures. Please see appendix for reconciliation of GAAP to non-GAAP measures.

Appendix

Source: Company Information Specialty hydroponic retailers Garden centers / retail eCommerce Greenhouse / channel partners Selling to a fragmented customer base… Branded manufacturer and distributor serving the CEA (Controlled Environment Agriculture) market Hydrofarm’s Value Proposition Proprietary brands Preferred & Distributed brands Approx. 35 brands, including: Complete Range of CEA Products Exceptional Service Manufacturing Capabilities Supplier Relationships and Geographic Footprint Solution-Based Approach to Serve Our Customers …that reaches an evolving mix of end users Commercial growers Individuals Consumer gardeners & hobbyists Cannabis Food & floral Over 50 brands, including: 13

We have end-to-end category coverage through innovative, well-recognized proprietary and preferred brands Strong proprietary brand portfolio with solutions across key categories Illustrative margin benefit as we improve proprietary brand mix Distributed Brands Preferred Brands Proprietary Brands Consumables Durables Nutrients Grow Media Supplies Lighting Equipment 14

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures ($ in thousands) We define Adjusted EBITDA (non-GAAP) as net loss (GAAP) excluding interest expense, income taxes, depreciation, depletion and amortization, stock-based compensation including employer payroll taxes on stock-based compensation, restructuring expenses, impairments, severance, loss on asset disposition, other income/expense, net, and other non-cash, unusual and/or infrequent costs (i.e., acquisition and integration expenses), which we do not consider in our evaluation of ongoing operating performance. We define Adjusted Gross Profit (non-GAAP) as Gross Profit (GAAP) excluding depreciation, depletion, and amortization, restructuring expenses, severance and other expenses, and other non-cash, unusual and/or infrequent costs, which we do not consider in our evaluation of ongoing operating performance. We define Adjusted SG&A (non-GAAP) as SG&A (GAAP) excluding depreciation, depletion, and amortization, stock-based compensation including employer payroll taxes on stock-based compensation, restructuring expenses, severance and other expenses, and other non-cash, unusual and/or infrequent costs (i.e., acquisition and integration expenses), which we do not consider in our evaluation of ongoing operating performance. We define Free Cash Flow (non-GAAP) as Net cash from (used in) operating activities less capital expenditures for property, plant and equipment. We believe this provides additional insight into the Company's ability to generate cash and maintain liquidity. However, Free Cash Flow does not represent funds available for investment or other discretionary uses since it does not deduct cash used to service our debt or other cash flows from financing activities or investing activities. We define Liquidity as total cash, cash equivalents and restricted cash, if applicable, plus available borrowing capacity on our Revolving Credit Facility. We define Net Debt as total debt principal outstanding plus finance lease liabilities and other debt, less cash, cash equivalents and restricted cash, if applicable. 1. For the three and twelve months ended December 31, 2024, and December 31, 2023, Restructuring expenses related primarily to non-cash inventory markdowns associated with manufacturing facility consolidations, and the charges incurred to relocate and terminate certain facilities. 2. For the three and twelve months ended December 31, 2024, Severance and other charges primarily related to estimated legal costs related to certain litigation and severance charges. For the three and twelve months ended December 31, 2023, Severance and other charges primarily related to workforce reductions and charges in conjunction with a sale-leaseback transaction during the first quarter of 2023. 3. Includes stock-based compensation and related employer payroll taxes on stock-based compensation for the periods presented. 4. Other income, net related primarily to foreign currency exchange rate gains and losses and other non-operating income and expenses. For the three and twelve months ended December 31, 2024, Other income, net also included a cash settlement arising from an outstanding litigation matter of a previously acquired entity. For the twelve months ended December 31, 2023, Other income, net also included charges from Amendment No. 1 to the Company's outstanding Term Loan. 5. Loss on asset disposition for the twelve months ended December 31, 2024, relates to the sale in the second quarter of 2024 of the inventories, and property, plant and equipment associated with the Company's Innovative Growers Equipment branded products to CM Fabrication, LLC (the "Asset Sale"). 6. The total gross proceeds associated with the IGE Asset Sale were $8.7 million, of which the Company estimated and classified $5.0 million in Net cash from operating activities, and $3.7 million in Investing activities, as these cash flows were associated with the sale of inventory and property, plant and equipment, respectively. The cash proceeds classified within Net cash from operating activities were partially offset by $1.3 million cash paid to terminate the associated facility lease and cash transaction costs paid during the period. As a result, the Asset Sale contributed an estimated $3.5 million to Net cash from operating activities and Free Cash Flow during the twelve months ended December 31, 2024. In addition, in connection with the Asset Sale, the Company paid $0.7 million to terminate certain equipment finance leases and classified this cash outflow within Financing activities for the twelve months ended December 31, 2024. In total, the IGE Asset Sale contributed net cash proceeds, after repayment of certain lease liabilities and transaction expenses, of an estimated $6.3 million. In 2023, gross proceeds of $8.6 million received during the twelve months ended December 31, 2023, from a sale-leaseback of real estate located in Eugene, Oregon, was classified as a Financing activity and is not reflected in Net cash from operating activities or Free Cash Flow in the prior year period. 15 SG&A (GAAP), Adjusted SG&A (Non-GAAP), Gross Profit (GAAP) and Adjusted Gross Profit (Non-GAAP) for the three months and year ended December 31, 2024, were negatively impacted by $1.4 million of inventory reserves and related charges. SG&A (GAAP), Adjusted SG&A (Non-GAAP), Gross Profit (GAAP) and Adjusted Gross Profit (Non-GAAP) for the year ended December 31, 2024, were negatively impacted by $1.2 million of certain inventory charges.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

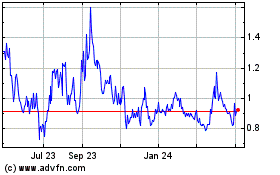

Hydrofarm (NASDAQ:HYFM)

Historical Stock Chart

From Feb 2025 to Mar 2025

Hydrofarm (NASDAQ:HYFM)

Historical Stock Chart

From Mar 2024 to Mar 2025