Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the

first quarter ended March 31, 2023.

For the quarter ended March 31, 2023, Hudson

reported revenues of $77.2 million, a decrease of 8% compared to

revenues of $84.3 million in the first quarter of 2022. The

decrease is primarily related to decreased selling prices for

certain refrigerants during the period as well as lower sales

volume in the quarter as compared to the first quarter of 2022.

Gross margin in the first quarter of 2023 was 39%, compared to 54%

in the first quarter of 2022. Hudson reported operating income of

$22.7 million in the first quarter of 2023, compared to operating

income of $38.3 million in the prior year period. The Company

recorded net income of $15.5 million or $0.34 per basic and $0.33

per diluted share in the first quarter of 2023, compared to net

income of $29.6 million or $0.66 per basic and $0.63 diluted share

in the same period of 2022. 2023 and future periods will reflect a

statutory tax rate of approximately 26%, excluding certain

temporary and permanent tax adjustments, while the 2022 period

reflects a very low effective tax rate due to the use of then

existing NOL carryforwards.

Hudson reduced total outstanding debt from $46.8

million at December 31, 2022 to $43.6 million at March 31, 2023.

Stockholders’ equity improved to $191.5 million at March 31, 2023

as compared to $174.9 million at December 31,

2022.

Brian F. Coleman, President and Chief Executive

Officer of Hudson Technologies commented, “As we move through the

2023 selling season, we are focused on continuing to drive the

momentum we’ve built over the past eighteen months. As anticipated,

we faced a tough comparison to the extraordinary gross margin

performance during the 2022 selling season, and our first quarter

2023 results reflected this dynamic. During the first quarter of

last year, we saw significant sales price increases without a

corresponding increase in inventory price, which resulted in

unsustainably high gross margin. First quarter 2023 gross margin

moderated as expected compared to the first quarter of 2022, but

still came in ahead of our long-range target gross margin of 35%.

Additionally, we achieved strong profitability and generated cash

flow from operations that was two times greater than cash flow

generated in the first quarter of 2022. As the selling season gets

underway in earnest, we are confident that our leadership position

in the industry, operational excellence, proven distribution

network and longstanding customer relationships position us well to

drive continued strong performance.

“From a regulatory perspective, for 2023 a 10%

stepdown in virgin HFC production and consumption allowances

mandated by the AIM Act remains in place. In 2024, a 40% baseline

reduction in HFCs will begin, and as we’ve previously stated, we

believe the current phasedown schedule will benefit our business by

driving higher demand for our reclaimed refrigerants as virgin HFCs

become constrained. Longer term, we see a tremendous opportunity

for the increased use of reclaimed refrigerants as industry

stakeholders embrace the environmental benefits of using greener

refrigeration technology and equipment, and as federal and state

legislation increasingly mandates the use of recovered and

reclaimed refrigerants.

“With our industry-leading reclamation

technology and decades of experience, Hudson is ideally positioned

to provide sustainable and responsible refrigerant management to

support the industry transition to greener refrigerant and cooling

equipment utilizing lower global warming potential refrigerants. We

are energized by the opportunity to meet the refrigerant needs of

the growing installed base of cooling and refrigeration systems as

well as providing conversion and servicing options as equipment

requirements evolve,” Mr. Coleman concluded.

Conference Call Information

The Company will host a conference call and

webcast to discuss the first quarter results today, May 3, 2023 at

5:00 P.M. Eastern Time.

To access the live webcast, log onto the Hudson

Technologies website at www.hudsontech.com, and click on “Investor

Relations”.

To participate in the call by phone, dial (888)

506-0062 approximately five minutes prior to the scheduled start

time. International callers please dial (973) 528-0011. Callers

should use entry code: 448742

A replay of the teleconference will be available

until June 2, 2023 and may be accessed by dialing (877) 481-4010.

International callers may dial (919) 882-2331. Callers should use

conference ID: 48107.

About Hudson Technologies

Hudson Technologies, Inc. is a leading provider

of innovative and sustainable refrigerant products and services to

the Heating Ventilation Air Conditioning and Refrigeration

industry. For nearly three decades, we have demonstrated our

commitment to our customers and the environment by becoming one of

the first in the United States and largest refrigerant reclaimers

through multimillion dollar investments in the plants and advanced

separation technology required to recover a wide variety of

refrigerants and restoring them to Air-Conditioning, Heating, and

Refrigeration Institute standard for reuse as certified EMERALD

Refrigerants™. The Company's products and services are

primarily used in commercial air conditioning, industrial

processing and refrigeration systems, and include refrigerant and

industrial gas sales, refrigerant management services consisting

primarily of reclamation of refrigerants and RefrigerantSide®

Services performed at a customer's site, consisting of system

decontamination to remove moisture, oils and other contaminants.

The Company’s SmartEnergy OPS® service is a web-based real time

continuous monitoring service applicable to a facility’s

refrigeration systems and other energy systems. The Company’s

Chiller Chemistry® and Chill Smart® services are also predictive

and diagnostic service offerings. As a component of the Company’s

products and services, the Company also generates carbon offset

projects.

Safe Harbor Statement under the Private Securities

Litigation Reform Act of 1995

Statements contained herein which are not

historical facts constitute forward-looking statements. Such

forward-looking statements involve a number of known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors include, but are not limited to,

changes in the laws and regulations affecting the industry, changes

in the demand and price for refrigerants (including unfavorable

market conditions adversely affecting the demand for, and the price

of, refrigerants), the Company's ability to source refrigerants,

regulatory and economic factors, seasonality, competition,

litigation, the nature of supplier or customer arrangements that

become available to the Company in the future, adverse weather

conditions, possible technological obsolescence of existing

products and services, possible reduction in the carrying value of

long-lived assets, estimates of the useful life of its assets,

potential environmental liability, customer concentration, the

ability to obtain financing, the ability to meet financial

covenants under existing credit facilities, any delays or

interruptions in bringing products and services to market, the

timely availability of any requisite permits and authorizations

from governmental entities and third parties as well as factors

relating to doing business outside the United States, including

changes in the laws, regulations, policies, and political,

financial and economic conditions, including inflation, interest

and currency exchange rates, of countries in which the Company may

seek to conduct business, the Company’s ability to successfully

integrate any assets it acquires from third parties into its

operations, the impact of the current COVID-19 pandemic, and other

risks detailed in the Company's 10-K for the year ended December

31, 2022 and other subsequent filings with the Securities and

Exchange Commission. The words "believe", "expect",

"anticipate", "may", "plan", "should" and similar expressions

identify forward-looking statements. Readers are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date the statement was made.

|

Investor Relations Contact: |

Company Contact: |

|

John Nesbett/Jennifer Belodeau |

Brian F. Coleman, President &

CEO |

|

IMS Investor Relations |

Hudson Technologies, Inc. |

|

(203) 972-9200 |

(845) 735-6000 |

|

jnesbett@institutionalms.com |

bcoleman@hudsontech.com |

|

Hudson Technologies, Inc. and

Subsidiaries |

|

Consolidated Balance Sheets |

|

(unaudited) |

|

(Amounts in thousands, except for share and per share amounts) |

| |

|

March 31, |

|

December 31, |

| |

|

2023 |

|

2022 |

| |

|

(unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

12,322 |

|

$ |

5,295 |

|

Trade accounts receivable – net |

|

|

38,764 |

|

|

20,872 |

|

Inventories |

|

|

137,007 |

|

|

145,377 |

|

Prepaid expenses and other current assets |

|

|

6,726 |

|

|

5,289 |

| Total current

assets |

|

|

194,819 |

|

|

176,833 |

| |

|

|

|

|

|

|

| Property, plant and equipment,

less accumulated depreciation |

|

|

20,229 |

|

|

20,568 |

| Goodwill |

|

|

47,803 |

|

|

47,803 |

| Intangible assets, less

accumulated amortization |

|

|

16,866 |

|

|

17,564 |

| Right of use asset |

|

|

7,713 |

|

|

7,339 |

| Other assets |

|

|

2,387 |

|

|

2,386 |

| Total

Assets |

|

$ |

289,817 |

|

$ |

272,493 |

| |

|

|

|

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Trade accounts payable |

|

$ |

15,156 |

|

$ |

14,165 |

|

Accrued expenses and other current liabilities |

|

|

32,716 |

|

|

27,908 |

|

Accrued payroll |

|

|

2,599 |

|

|

6,303 |

|

Current maturities of long-term debt |

|

|

4,250 |

|

|

4,250 |

| Total current

liabilities |

|

|

54,721 |

|

|

52,626 |

|

Deferred tax liability |

|

|

1,601 |

|

|

244 |

|

Long-term lease liabilities |

|

|

6,062 |

|

|

5,763 |

|

Long-term debt, less current maturities, net of deferred financing

costs |

|

|

35,934 |

|

|

38,985 |

| Total

Liabilities |

|

|

98,318 |

|

|

97,618 |

| |

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Stockholders’

equity: |

|

|

|

|

|

|

|

Preferred stock, shares authorized 5,000,000: Series A Convertible

preferred stock, $0.01 par value ($100 liquidation preference

value); shares authorized 150,000; none issued or outstanding |

|

|

— |

|

|

— |

|

Common stock, $0.01 par value; shares authorized 100,000,000;

issued and outstanding 45,328,892 and 45,287,619, respectively |

|

|

453 |

|

|

453 |

|

Additional paid-in capital |

|

|

117,535 |

|

|

116,442 |

|

Accumulated retained earnings |

|

|

73,511 |

|

|

57,980 |

| Total Stockholders’

Equity |

|

|

191,499 |

|

|

174,875 |

| |

|

|

|

|

|

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

289,817 |

|

$ |

272,493 |

|

Hudson Technologies, Inc. and

Subsidiaries |

|

Consolidated Income Statements |

|

(unaudited) |

|

|

|

(Amounts in thousands, except for share and per share amounts) |

|

|

|

Three-month period |

|

|

|

ended March 31, |

|

|

|

2023 |

|

2022 |

|

Revenues |

|

$ |

77,199 |

|

$ |

84,338 |

| Cost of

sales |

|

|

46,869 |

|

|

38,518 |

| Gross

profit |

|

|

30,330 |

|

|

45,820 |

| |

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

6,977 |

|

|

6,824 |

|

Amortization |

|

|

698 |

|

|

698 |

|

Total operating expenses |

|

|

7,675 |

|

|

7,522 |

| |

|

|

|

|

|

|

| Operating

income |

|

|

22,655 |

|

|

38,298 |

| |

|

|

|

|

|

|

| Interest

expense |

|

|

1,849 |

|

|

7,305 |

| |

|

|

|

|

|

|

| Income before income

taxes |

|

|

20,806 |

|

|

30,993 |

| |

|

|

|

|

|

|

| Income tax

expense |

|

|

5,275 |

|

|

1,438 |

| |

|

|

|

|

|

|

| Net

income |

|

$ |

15,531 |

|

$ |

29,555 |

| |

|

|

|

|

|

|

| Net income per common share –

Basic |

|

$ |

0.34 |

|

$ |

0.66 |

| Net income per common share –

Diluted |

|

$ |

0.33 |

|

$ |

0.63 |

| Weighted average number of

shares outstanding – Basic |

|

|

45,298,514 |

|

|

44,779,822 |

| Weighted average number of

shares outstanding – Diluted |

|

|

47,311,027 |

|

|

46,736,471 |

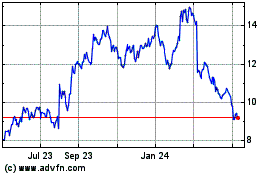

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Nov 2023 to Nov 2024