Filed by: HomeStreet, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: HomeStreet, Inc.

Commission File No.: 001-35424

The following transcript of an investor call was made in connection with the proposed transaction between HomeStreet, Inc. and FirstSun Capital Bancorp

TRANSCRIPT

01 - 16 - 2024

Joint FirstSun and HomeStreet IR Call

Joint FirstSun and HomeStreet IR Call

TOTAL PAGES: 12

CORPORATE SPEAKERS:

Laura Frazier

FirstSun, EVP, Chief Administrative Officer

Neal E. Arnold

FirstSun; President & Chief Executive Officer

Mark K. Mason

HomeStreet; Chief Executive Officer

Robert A. Cafera

FirstSun; Chief Financial Officer

PARTICIPANTS:

Matthew Clark

Piper Sandler; Analyst

Woody Lay

Stifel; Analyst

PRESENTATION:

Operator^ Good morning and welcome to the call with FirstSun and HomeStreet, discuss the exciting strategic merger announced earlier this morning. I’ll now hand the call over to the company.

Laura Frazier^ Thank you and good morning everyone. Earlier this morning, we issued a joint press release to announce the strategic merger of FirstSun Capital and HomeStreet.

On the call today we will discuss the merger announcement and we will answer questions from analysts.

We will not be commenting on either company's fourth quarter earnings.

And HomeStreet will release their earnings on their current schedule on Monday, January 29, after the market closes. And FirstSun will release its earnings on Friday, January 26.

Before we begin our remarks, I'd like to remind you that our detailed joint press release and an investor presentation were filed by each of us with the SEC on Form 8-K this morning and are available on our Investor Relations website.

Joint FirstSun and HomeStreet IR Call

In addition, a recording and transcript of this call will be available at the same location following our call.

Please note that during our call today we will make certain predictive statements that reflect our current views the expectations and uncertainties about the company's performance and our financial results.

These are likely forward-looking statements that are made subject to the safe harbor statements included in our release, our investor deck and the risk factors disclosed in our other public filings.

Additionally, reconciliations to any non-GAAP measures referred to on our call today can be found in the release and investor deck.

I'll now introduce FirstSun's President and CEO, Neal Arnold.

Neal Arnold^ Thank you, Laura.

Today on the call, you'll have myself, Rob Cafera, FirstSun's CFO; Mark Mason, the CEO of HomeStreet; and John Michel, the CFO of HomeStreet. So we'll be sharing our thoughts with you.

We are excited to announce this strategic merger with Home Street. I have said this is the right deal at the right time for a number of reasons. First of all, both our organizations were on the threshold of crossing the $10 billion mark, and this does it in a great way. Also FirstSun was working to become a more publicly traded company and this opportunity really provides both of us in that profile. Thirdly, as we've discussed with Mark and his team, the opportunity here at HomeStreet, I think we can all look back at the stress as our industry has been under in the last year.

But I have to say when it comes to HomeStreet, what we saw was a great deposit base where others have seen erosion given the uncertainty of the past year. We saw a very conservative credit profile given what's going on in the economy. We saw a very strong fee income profile and a very experienced management team that has stayed throughout the banking uncertainty of this past year. So we were very excited to put together this opportunity.

Page 6 in our deck, begins to underscore some of the profile going on. First of all, we've become a $17 billion combined organization. For 2025, we expect to be in the neighborhood of a $6 earnings per share, which says that we are trading at 5.5x pro forma price earnings ratio and in excess of 30% earnings accretion.

A couple of highlights. We clearly like the opportunity to continue the organization's growth in some of the largest, fastest-growing markets in the country. The two of us have very complementary business lines and lending expertise across the footprint. And I believe that the two combined core deposit franchises are very strong and certainly an important component to the value.

Joint FirstSun and HomeStreet IR Call

On the balance sheet side, we believe that we help each other. On our sensitivity, and we'll talk about that later. And then finally, as I said, the management teams here we both bring some depth. And so we think we'll have the expertise required as we cross $10 billion together.

Page 7 gets to the transaction summary. I think as you've all probably seen, it's a 100% common stock deal. An exchange ratio of 0.4345, and the expected entity will be listed on NASDAQ during this time period. In addition to this transaction, we have raised $175 million in capital commitments led by an investor Wellington Management and others. $80 million of this capital is coming in today on announcement as well as all the other commitments are fully subscribed.

As a result of this transaction, our combined organizations FirstSun will represent about 64% of the ownership group, HomeStreet, about 22% and the rest being the other investors. The leadership team has been outlined, and we continue to expect to have great continuity of leadership and our Boards of Directors. We will have 12 directors, nine from FirstSun and three from HomeStreet.

Finally, on this page, I'd like to highlight that on FirstSun, for those of you who don't know us we have a strong amount of insider ownership and about 69% of the ownership group is considered insiders. So we have a strong group that will be in support of this transaction as it relates to future shareholder vote. We expect to close the transaction in mid-2024.

Page 8. Highlights some of the attractive markets in the Western part of the U.S. Certainly, we've enjoyed the economic growth that has been happening in these markets. We've certainly seen it at FirstSun in the Southwest but we are focused on the opportunities in the growth markets, both in the Pacific Northwest as well as Southern California.

Page 9. For those of you who aren't as familiar with our story, a lot of our growth has been driven by a focus on C&I lending, specifically across our footprint and with our specialty lending groups. We believe that this will be greatly supplemented with Mark’s team on the multifamily area and allow us to continue to leverage what they have as well. Mark, do you want to make some comments as it relates to your capabilities here?

Mark Mason^ Sure. Neal and I have already spent a meaningful amount of time together going over what the management structure and leadership of the company will be. And like everything else in this transaction is just really complementary. We have strengths in different lending lines of business or substantially in real estate lending of all types from permanent to construction lending. And of course, for FirstSun, their C&I expertise is well documented at this point.

We feel very, very good about how the company will come together. The complementary nature of the transaction, not just from a product line or management standpoint, but asset liability balance and we have a set of business regions to operate in that are arguably the best in the United States. And I'm just very excited about it.

Neal Arnold^ Great. Thank you, Mark. Page 10. I realized that one of the opportunities we looked at the challenges our industry went through with our Board, one of the things we spend time on is what I roughly called the opportunity of Bond Math, given what's happened with interest rates and its impact on our industry. The thing that's hard to wrap your head around is you take a company that's earning at one level and very quickly, you're able to see a significant change in the earnings stream here with limited execution risk.

Joint FirstSun and HomeStreet IR Call

So to me, the opportunity that the last 12 months have given us is the opportunity to be a participant in this Bond Math Exercise. Page 11. If you look at the graph on the right-hand side, I guess what I'd summarize is this, whether it's revenue or net interest margin or our returns, we won't just be a peer performer. We'll be a top-tier performer very quickly with this transaction.

And I think the compelling piece of it is the entry point for investors is you're talking about very reasonable valuations out of the gate for this transaction and compare very favorably to the peers.

Mark Mason^ Neal, I might add here, we have been I guess, I would say, extremely transparent. We're all used to dealing with commenting on analyst estimates or industry trends. We've shared with the Capital Markets today a reflection of our own inside forecast, which should be more accurate than analysts, in all due respect. And with that combination of those internal forecasts imply that the pro forma earnings of the company. Obviously, we can't assure these numbers are coming about.

There's lots of uncertainty in the markets and in the future. But given the simplicity of this combination, and in particular, everyone should assume that our internal forecast at HomeStreet assumes no growth and there are no synergies baked into those numbers. So we believe we have opportunities far beyond the numbers that we're hearing today.

Neal Arnold^ Agree Yes. Thank you.

Page 13. This is one of the most important value aspects from our standpoint. We believe the meaning of a truly great company starts with the durable franchise on the deposit side. And we've seen companies under stress, quite honestly, not do well on the deposit side in the past year. And I have to say HomeStreet has done a remarkable job.

Not just on uninsured deposits, as you can see, they are very low relative to peers. But if you look at their non-time deposit franchise, it's almost nine years weighted average age I can tell you, spending time looking at deals. This is quite rare. Mark, do you want to talk anything about the composition and...

Mark Mason^ Well, just one comment, really. Entering this interest rate cycle, particularly when it was clear that the Federal Reserve wasn't going to move slowly was going to put their foot down on the accelerator. We had a certain amount of anxiety at HomeStreet about how our depositors, our customers we're going to act and how loyal they really were. And you don't really know the value of your franchise and the quality of your customer relationships until you test them like they've been through. And I’ve got to share with you, Neal, even I was impressed and I'm supposed to be optimistic.

They've really hung in there with us because they want to continue banking with us. And all they ask me is everything going to be okay, Mark, and I say, absolutely, it's going to be okay. I think they're all going to be happy today.

Neal Arnold^ No. And I can tell you, I having met with the folks who run the retail franchise here, the sense of pride of really executing in this environment. I told them they felt like we have the same company with the same pride that we have in our footprint. So thank you.

Joint FirstSun and HomeStreet IR Call

Page 14. We focus on the loan portfolio. And all I'd say here is the diversification and the credit profile. For those of you who spent time on understanding the differences within CRE. I can tell you on the multifamily portfolio, I've been a long-time believer because the credit profile is the best in the industry.

So if you're worried about the economy, to me, having a well-seasoned multifamily portfolio, very granular. For those of you who are less familiar with it, I would just say this feels like a portfolio that will perform very well going forward. You see the geographic distribution on the right-hand side of our portfolio as well as the product pieces. So again, we think we help each other diversify those pieces. They are very low concentrations in office and retail in some of the areas that people have worried about within the CRE categories generally.

Page 15. We've all learned a lot more about asset liability or at least outside people have to the industry. What I would tell you is one of the unique things that HomeStreet and FirstSun saw was we help each other from liability and asset sensitivity, there's an incredible match that happens as a result of that. In addition, we've prided ourselves at FirstSun on having an extreme focus on driving fee income. We call it financial service revenue.

But I would say HomeStreet has some capability there that we will look to continue to bring forward. The other thing I would say, I know some people have a concern about the mortgage business. The resulting company has less than 5% of its pro forma revenue in gain on sale or the mortgage piece of that business. So we feel very good about the variability of the fee income going forward and our ability to leverage that working together with Mark's team's capability and ours across this new footprint. With that, I'm going to turn it over to Rob, who's going to lead us through some of the more financial pieces and components of this transaction.

Robert Cafera^ Thanks, Neal. Page 17, I think, sums up the economics and the model assumptions very nicely. As Neal and Mark highlighted earlier, great operating profile for the pro forma company here. We've got 30% plus accretion, 6.5% dilution at close, a fully loaded TBV earn back of just shy of two years. On the cost synergy side, we worked collaboratively to develop those, and we appreciate that being an approaching $20 billion bank, there are certainly some add backs to the gross amount of cost saves that we can achieve here and we factored all that in.

Flipping to the next page. A couple of additional points of emphasis in terms of the balance sheet, I wanted to touch on. You can see that our estimated capital ratios at closing are above where actual recent deals have closed on. Additionally, you can see the capital build in '25 is well over 100 basis points. So rapid capital accumulation here and will continue into 2026.

Also importantly, the combined reserves will be well above peer and even more so when you adjust for the multifamily piece of the book, which historically has had a super low loss rate. One benefit of the mark-to-market on the Home Street balance sheet is the AOCI goes away. It gives the combined company further capital flexibility. So that unrealized loss component for us will continue to be quite favorable in comparison to peers.

Flipping to the next page. We love scorecards here in our bank. And I'd say this one paints a pretty darn compelling picture. As you look at the combined company's projected performance to our new peer group. We check all the right boxes in terms of profitability here.

Joint FirstSun and HomeStreet IR Call

And in terms of trading multiples, I don't know, Neal, would it be an understatement to say the upside opportunity here is considerable.

Neal Arnold^ Yes. As Rob and I looked at this deal and as we spent time with our board, I've been in banking for 40 years and I've probably executed on over 35 deals. I have never, and let me underscore, never seen the kind of upside for our combined shareholder group as in this transaction. It's incredible. And it's hard to put that into the context when people have kind of looked back in the last 12 months and seen what's been going on in the industry.

I often like to say to people, be fearful when people are greedy in this industry, but be greedy when people are fearful and this is a kind of transaction that fits that bill.

Rob, do you want to, Page 21.

Robert Cafera^ Yes. On the diligence side, very comprehensive diligence process followed on both banks side. This wasn't a short process. Both teams were heavily involved, both teams had already been in the process of planning for that crossing the $10 billion threshold. So some natural synergies in the ramp-up efforts there that we'll all be able to benefit from certainly on the enterprise risk management side.

Mark, would you like to add?

Mark Mason^ Sure.

I would just add, this diligence effort is not one directional, right? This is a true merger. We both did substantial diligence, we’ve had third-party loan review for both loan portfolios, and we’ve had the benefit of looking at all of that. We spent a fair amount of time looking at all of the risk factors and really understanding whether there was any potholes or future risks on both sides, whether they be operational, credit, compliance, et cetera.

And basically, we have a great scorecard going in both directions. So very comfortable with that. These are two very solid and well-run institutions with very strong risk management systems already in place. So we feel comfortable that the transition to an over $10 billion institution will be well prepared for and smooth. It makes me feel very comfortable about completing this merger but also the follow-on challenges of size.

Neal Arnold^ And I might just add, the – Mark and I started visiting back early last summer. I can tell you their process has been very thoughtful, very thorough throughout as they step through the options that they looked at. I can tell you every time we turn the corner, as we looked at the deposit base, I can tell you having looked at other banks, we expected to see stress and I can tell you this one did not have the stress that we’ve seen. On the credit side, we liked it on the outside the composition that as we went through stress testing, and we were very impressed with fee income.

So every time we went through the pieces it just proved out the durable income statement opportunity here as we work together. So sometimes people focus on stock price. I can tell you that's not the best indicator when you look at the underlying franchise here.

Joint FirstSun and HomeStreet IR Call

So as we try to wrap up our thoughts, I guess a couple of things on Page 23. We think this is going to be a top-notch differentiated regional bank with the ability to continue to grow as we've expected and we've seen in our past. We believe we're in some very strong and diverse markets to continue. We love what the balance sheet looks like together, both from a risk profile and from interest rates. We think the financial benefits are incredible for both sets of shareholders.

And we're always a fan of having a situation where both people win. We're not opposed to that. We think that's kind of a nice attribute. And then finally, I think the final thing I'd point out is the ownership group and the shareholder context here, we believe we have a very strong structure that will give us certainty as we go to the next steps.

Mark Mason^ Just to put a fine point on that, Neal. The FirstSun Board controls -- correct me if I'm wrong, in excess of 70%?

Neal Arnold^ Yes

Mark Mason^ And so the vote for the transaction on the FirstSun side is assured. In fact, all of the directors on both sides have signed voting agreements to that end. And the capital in this transaction part of which is coming in today. The remainder is fully committed by strong institutional investors. And I think when people see the details of that, they're going to be equally impressed.

Neal Arnold^ Yes. Thank you, Mark.

That kind of covers the topics that we are planning on stepping through. We've provided you the details.

I appreciate you guys listening.

And we'll open it up for questions.

QUESTION & ANSWER:

Operator^ Thank you. (Operator Instructions) Our first question comes from Matthew Clark of Piper Sandler. Matthew, please go ahead.

Matthew Clark^ Hey, good morning everyone. My first question is around (multiple speakers) -- hey, how are you? My first question is around the stand-alone HomeStreet earnings assumption. I think $33 million, again, stand-alone. I think the Street was at $18 million it sounds like you're not assuming any growth, but can you give us some more color on what your rate assumptions are kind of balance -- overall balance sheet size maybe the contribution from NII. Just trying to get more color behind that $33 million of earnings.

Mark Mason^ Sure. And these are 2025 earnings you were speaking of, right?

Our balance sheet starts to heal itself significantly toward the end of this year. And obviously, more significantly in 2025. And so our net interest margin recovery drives the lion's share of those earnings. Our interest rate assumption this year ties closely to the guidance that the Federal Reserve has given on rate cuts, though we assume them to occur in the last three meetings of the

Joint FirstSun and HomeStreet IR Call

year at 25 basis points each. And then we transition our rate forecast essentially to what the yield curve is expecting in 2025.

The activity otherwise in our base forecast is really very limited growth in the balance sheet, continuing to primarily originate variable rate loans as we have the last year or so, HELOCs, homebuilding loans, C&I loans and still experiencing limited -- very limited prepayments in the multifamily portfolio, the single-family portfolio. So it looks a lot like the same balance sheet we have today, Matt. It just earns more as we start getting more asset repricing. And given the rate forecast, a little relief on deposit costs.

Matthew Clark^ Okay. Great. And then just on a kind of go-forward basis, you guys have ceased originating new multifamily production. How should we think about kind of the go-forward plan, should we just expect multifamily, single-family resi to shrink over time on a combined basis and kind of going after C&I? Just trying to get a sense for the kind of targeted mix of the loan portfolio.

Robert Cafera^ Yes. I'll give you a sense of that, Matthew. This is Rob Cafera. We will see some remixing in the sheet as the C&I piece of the business rolls out further in the Pacific Northwest and Southern California. So we will see a remix there within the loan categories between the historical legacy concentrations that you're familiar with on the HomeStreet side, multifamily and to a lesser extent on the resi side, we'll see that shift and look more and more like the concentration mix that you see on the FirstSun side as we continue to evolve over the next many years.

Neal Arnold^ The other point I would make is we don't anticipate any bulk sales of the multifamily asset class. That's important. We think we have plenty of balance sheet flexibility with our combined companies. So there's no need to do bulk sale. The refresh accounting is our friend here.

Robert Cafera^ And we certainly love the DUS license and will continue to leverage that strategic benefit that HomeStreet has always enjoyed.

Matthew Clark^ Okay. And then how many warrants are being issued to the new investors and what's the strike price?

Neal Arnold^ That will be filed in the 8-K...

Robert Cafera^ Correct.

Matthew Clark^ Okay. And then can you provide some additional color on the other investor in the deal other than Wellington? And I believe Castle Creek is involved. I'm just wondering how the other investor is and what the background is in?

Neal Arnold^ That will also be in the 8-K.

Matthew Clark^ Okay, fair enough. Thank you.

Operator^ Thank you. (Operator Instructions) Our next question comes from Woody Lay of Stifel. Woody, please go ahead.

Joint FirstSun and HomeStreet IR Call

Woody Lay^ Hey, good morning guys.

Mark Mason^ Hey, Woody.

Woody Lay^ Wanted to start with the loan to deposit ratio. If I look at the two balance sheets where they stand today, that puts the ratio at about 105%. Where do you see that ratio maybe going to with the pro forma company? And what levers do you have to pull to lower the ratio?

Robert Cafera^ Yes. At close, we would project and expect to see that loan to deposit to be right around the 100% neighborhood slightly in excess. Over time, we would certainly expect to see that come back down. We want to see that get down into the mid- to low 90s so that will be where our focus is. We actually think we've got an incredible competitive advantage with the retail deposit franchises that we have, both on the HomeStreet side and the FirstSun side we'll continue to lever the strengths that we have in each of those branch networks as we bring these two great organizations together.

So I'd say I'd point you to the next couple of years and the continued improvement in the loan to deposit ratio that we'll be pursuing there.

Neal Arnold^ I think if you look at our combined balance sheet, there's a lot of flexibility with our two books, there's not a huge, I'll call it, less liquid components that you'd see in some banks.

Woody Lay^ Got it. That's helpful. Maybe next, just for FirstSun. You've been very successful over the past several years on shifting the focus of the company from CRE to C&I. C&I was less of a focus for Home Street.

So you've touched on it a couple of times, but can you just expand on the opportunity to sort of build out the C&I portfolio in the Pacific Northwest and Southern California markets.

Neal Arnold^ Yes. Our experience, whether that's in Phoenix, whether it's in Denver or Dallas or Houston now, we've had success in recruiting teams and building a core C&I franchise in those markets. So I'd expect that there's plenty of opportunity to continue to do that. Mark’s team has a good start in the Pacific Northwest. Our focus is probably going to be building out Southern Cal.

Just the diversity economically of that market in size. And certainly, a lot of our competitors have been wounded. And so we see the opportunity to build the team and grow that organically. So we like fishing in big ponds.

Woody Lay^ Yes. And I'm assuming any hiring associated with that initiative, it's sort of already built into the cost save number?

Neal Arnold^ Yes.

Woody Lay^ Okay. And then last for me, feels like a valuable time to have that comprehensive third-party credit review. I know we touched on the multifamily portfolio. But how are you feeling about credit outside of that portfolio?

Joint FirstSun and HomeStreet IR Call

Neal Arnold^ So who knows what the economy is going to look like. I think we've all been surprised by how strong the economy has stayed given the uncertainties that have been going on. So I feel good. C&I portfolio is more event driven. It's not one single macro event.

So I feel good there. And let me say as it relates to going forward, the bulk of both of our focus is continuing to build within our footprint. And there's just -- there's a lot that's going on that's good. I tell people Dallas, Houston, you could build a $20 billion bank in each of those markets alone from where we started. And if you now go to Southern California, there's an opportunity to do that.

One of the hidden gems, we believe, is in Phoenix. Phoenix is in the process of becoming a much more diverse economy as they've seen growth in the last five to six years. So we're very bullish on the economic regions that we have. And then the Pacific Northwest, it's not just the big companies, it's the spin-off that happens from all the next tier companies around that.

Woody Lay^ Got it. That’s all for me. Thanks for taking my questions and congrats on the deal.

Mark Mason^ Thanks, Woody.

Robert Cafera^ Thank you.

Operator^ We have no further questions on the phone line.

So I'll hand back to the team for any closing remarks.

Neal Arnold^ So thank you all for joining us.

Obviously we're excited about this opportunity. Thank you for participating in the call. Now the hard work begins.

And we're excited to get to work.

So thank you.

Operator^ Ladies and gentlemen, this concludes today's call.

Thank you for joining.

You may now disconnect.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In general, forward-looking statements can be identified through use of words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, and include statements related to the expected timing, completion, financial benefits, and other effects of the proposed merger (the "Merger"). Forward-looking statements are not historical facts and represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial conditions to differ materially from those expressed in or implied by such statements.

Factors that could cause or contribute to such differences include, but are not limited to, (1) expected cost savings, synergies and other financial benefits from the Merger not being realized within the expected time frames and costs or difficulties relating to integration matters being greater than expected, (2) the ability of HomeStreet, Inc. (“HomeStreet”) and FirstSun Capital Bancorp (“FirstSun”) to obtain the necessary approval by its shareholders, (3) the ability of FirstSun and HomeStreet to obtain required governmental approvals of the Merger, (4) the ability of FirstSun to consummate their investment agreements to obtain the necessary capital to support the transaction, (5) the failure of the closing conditions in the definitive Agreement and Plan of Merger (the “Merger Agreement”), dated as of January 16, 2024, by and between HomeStreet and FirstSun to be satisfied, or any unexpected delay in closing the Merger. Further information regarding additional factors that could affect the forward-looking statements can be found in the cautionary language included under the headings “Cautionary Note Regarding Forward-Looking Statements” (in the case of FirstSun), “Forward-Looking Statements” (in the case of HomeStreet), and “Risk Factors” in FirstSun’s and HomeStreet’s Annual Reports on Form 10-K for the year ended December 31, 2022, and other documents subsequently filed by FirstSun and HomeStreet with the U.S. Securities and Exchange Commission (“SEC”).

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the Merger between FirstSun, a Delaware corporation, and HomeStreet, a Washington corporation, FirstSun will file with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement of Homestreet and a Prospectus of FirstSun, as well as other relevant documents concerning the proposed transaction. Investors and security holders, prior to making any investment or voting decision, are urged to read the registration statement and proxy statement/prospectus when it becomes available (and any other documents filed with the SEC in connection with the Merger or incorporated by reference into the proxy statement/prospectus) because such documents will contain important information regarding the Merger.

Investors and security holders may obtain free copies of these documents and other documents filed with the SEC on its website at www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with the SEC by (i) FirstSun on its website at https://ir.firstsuncb.com/investor-relations/default.aspx, and (ii) HomeStreet on its website at https://ir.homestreet.com/sec-filings/all-filings/default.aspx.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

PARTICIPANTS IN THE SOLICITATION

FirstSun, HomeStreet and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from shareholders of HomeStreet in connection with the proposed Merger. Information regarding the directors and executive officers of FirstSun and HomeStreet and other persons who may be deemed participants in the solicitation of the shareholders of HomeStreet in connection with the proposed Merger will be included in the joint proxy statement/prospectus for HomeStreet’s special meeting of shareholders, which will be filed by FirstSun with the SEC. Information about the directors and officers of FirstSun and their ownership of FirstSun’s common stock can be found in FirstSun’s

annual report on Form 10-K, as filed with the SEC on March 16, 2023, and other documents subsequently filed by FirstSun with the SEC. Information about the directors and officers of HomeStreet and their ownership of HomeStreet’s common stock can be found in HomeStreet’s definitive proxy statement in connection with its 2023 annual meeting of shareholders, as filed with the SEC on April 11, 2023, and other documents subsequently filed by HomeStreet with the SEC. Additional information regarding the interests of such participants will be included in the proxy statement/prospectus and other relevant documents regarding the proposed Merger filed with the SEC when they become available.

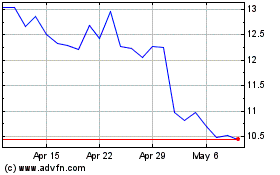

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Apr 2024 to May 2024

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From May 2023 to May 2024