Form 425 - Prospectuses and communications, business combinations

January 16 2024 - 5:26PM

Edgar (US Regulatory)

Filed by FirstSun Capital Bancorp

(Commission File No.: 333-258176)

Pursuant to Rule 425 under the Securities Act of 1933

and deemed to be filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: HomeStreet, Inc.

Commission File No.: 001-35424

Date: January 16, 2024

Sent on Behalf of Neal Arnold and Mollie Carter

Dear Associates,

Today, we have an exciting announcement. FirstSun Capital Bancorp has entered into an agreement with Seattle-based HomeStreet, Inc. (“HomeStreet”) (Nasdaq: HMST), the holding company of HomeStreet Bank (“HomeStreet Bank”) in which HomeStreet and HomeStreet Bank will merge with and into FirstSun and Sunflower Bank, respectively. HomeStreet Bank will retain its name in its current markets of operation. Stock of the merged entity will be traded on Nasdaq under the FSUN symbol.

Once the merger is completed, Sunflower Bank will be a premier bank with $17 billion in total assets and 129 branch locations across some of the most attractive markets in the United States. Our expanded footprint will include HomeStreet’s strong presence in key markets in the Pacific Northwest, Southern California, and Hawaii, as well as lending offices in Idaho and Utah.

The strong strategic benefits for the transaction include:

•Operating in the largest and fastest growing markets

•Complementary business lines and lending expertise without geographic overlap

•Combination of two top-tier core deposit franchises

•Well-positioned balance sheet and revenue streams across a changing macro-environment

•Material and immediate upside to current valuation

This merger will be beneficial by providing a larger platform for our demonstrated successful business model; however, we also understand that it introduces a certain level of uncertainty. We, Neal and Mollie, will continue in our current roles leading FirstSun and Sunflower Bank. Mark Mason, who currently serves in leading roles, including CEO, of HomeStreet and HomeStreet Bank, will move to the role of Executive Vice Chairman of FirstSun and Sunflower Bank following the merger. Rob Cafera will continue as Chief Financial Officer of FirstSun and Sunflower Bank. Additional appointments will be announced in the coming weeks and months. We have attached frequently asked questions (FAQs) responding to common questions that we expect you may have regarding the effects of this merger.

The transaction is not expected to officially close until the the middle of 2024, due to the standard regulatory and shareholder approval processes. Until then, Sunflower Bank and HomeStreet Bank will continue to operate as separate, independent companies. We will, however, begin work on the integration of the two organizations at once. The integration process is critical to our merger’s success and will be spearheaded by a thoughtfully composed team with a clear, efficient plan.

Throughout the merger and integration, our number one focus must remain on our clients. While the combination is exciting, our ability to deliver a superior client experience is our greatest strength and is a large part of what led to this transformational merger opportunity. In case you receive questions from clients regarding the merger, we have provided frequently asked questions (FAQs) to help you respond that will be located on “Insight”. HR will compile general questions and continue to update any FAQs on Insight. As there is a lot of work ahead of us and announcements like this carry significant legal and regulatory considerations, we ask for your understanding that answers to every question may not be available immediately.

Thank for your dedication to creating possibility every day, we have so much to be proud of as we grow our special community bank. We look forward to continuing this journey with you.

Sincerely,

Neal and Mollie

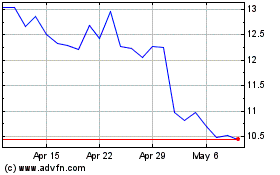

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Apr 2024 to May 2024

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From May 2023 to May 2024