Buyer Consortium Led by Recco Control Technology and Dazheng Group Issues Statement on Hollysys’ Formal Sale Process

October 05 2023 - 9:04AM

Business Wire

Reiterates All-Cash Offer of US$25 Per

Share

Welcomes Formation of Special Committee to Lead

Sale Process

Looks Forward to Discussions and Due Diligence

Process

Buyer consortium (“the consortium”) led by Recco Control

Technology Pte. Ltd. (“Recco Control Technology”) and Dazheng Group

(Hong Kong) Investment Holdings Company Limited (“Dazheng Group”)

today issued a statement regarding Hollysys Automation Technologies

Ltd.’s (NASDAQ: HOLI) (“Hollysys”) announcement that it has

launched a formal sale process. Members of the consortium also

include TFI Asset Management Limited, and Great Wall Capital Co.,

Ltd, who have entered into a memorandum of strategic cooperation

with Recco Control Technology and Dazheng Group in connection with

the proposed acquisition of Hollysys.

The consortium welcomes Hollysys’ decision to explore strategic

options to maximize value for its shareholders. The formation of a

Special Committee is a step forward to realization of the true

value of Hollysys and the consortium looks forward to engaging with

the Special Committee in a full, transparent, and genuine due

diligence process. A swift and thorough process will enable the

consortium, with the insight of full due diligence, to solidify its

non-binding indicative all-cash offer of US$25 per share, or

approximately US$1.55 Billion.

“Today’s announcement that Hollysys is launching a full sale

process is a step in the right direction for the shareholders of

Hollysys,” commented Mr. Ke Lei, director of Recco Control

Technology Pte. Ltd “A transparent and full process is clearly in

the best interest of Hollysys shareholders and we look forward to

discussing our US$25 all-cash offer with the Special Committee. We

remain motivated to move into due diligence and subsequent

negotiations with the Special Committee and be in a position to

sign a definitive agreement shortly after access to full due

diligence.”

Separately, the consortium notes the reference to the notices of

intention to request a special meeting of the shareholders of

Hollysys. The Board has been aware that approximately 32.3% of the

shareholders of Hollysys have requested the Board to convene a

meeting of all Hollysys shareholders since August 24. While the

Special Committee leads the formal sale process, the consortium is

hopeful the Board will act in accordance with the wishes of

Hollysys shareholders and will convene the special meeting without

further delay. The consortium is surprised that the Board has not

voluntarily convened a special meeting already, given that nearly

one third of the shareholders want a special meeting to be

held.

Lei continued, “It appears the pressure applied by shareholders

to request a special meeting has brought the Board to take actions

which should have been taken a long time ago. As the sale process

proceeds, we encourage shareholders to continue to hold the Board

accountable and encourage the Board to convene the special meeting

in line with its shareholders’ wishes.”

Advisors

UBS Investment Bank is serving as sole financial advisor to the

consortium and Sullivan & Cromwell LLP and DLA Piper LLP are

serving as U.S. legal advisors to the consortium. Conyers Dill

& Pearman is advising the consortium on BVI law.

About Recco

Recco Control Technology Pte. Ltd is a Singapore-incorporated

investor in the automation industry and was founded by Mr. Ke Lei,

a veteran in the automation industry in China.

About Dazheng

Dazheng Group (Hong Kong) Investment Holdings Company Limited is

a Hong Kong-incorporated financial investor founded by

sophisticated entrepreneurs and investment banking

professionals.

About TFI

TFI Asset Management Limited is a Hong Kong-based asset

management firm which is an indirect subsidiary of Tianfeng

Securities Co., Ltd. (also known as TF Securities, SH: 601162).

About Great Wall Capital

Great Wall Capital Co., Ltd. is a Beijing-based private equity

investment firm under China Great Wall Asset Management Co., Ltd.,

one of the four Chinese state-owned asset management companies.

Cautionary Statement Regarding Forward-looking

Statements

This press release contains forward-looking statements as

defined in the Private Securities Litigation Reform Act of 1995, as

amended. Forward-looking statements are statements that are not

historical facts. These statements include projections and

estimates and their underlying assumptions, statements regarding

plans, objectives, intentions and expectations with respect to

future financial results, events, operations, services, product

development and potential, and statements regarding future

performance. Forward-looking statements are generally identified by

the words “believe,” “envision,” “will,” “expect,” “anticipate,”

“intend,” “estimate,” “plan” and similar expressions. Although the

management of Recco, Dazheng, TFI and Great Wall Capital believe

that the expectations reflected in such forward-looking statements

are reasonable, investors are cautioned that forward-looking

information and statements are subject to various risks and

uncertainties, many of which are difficult to predict and generally

beyond the control of any of Recco, Dazheng, TFI and Great Wall

Capital, that could cause actual results and developments to differ

materially from those expressed in, or implied or projected by, the

forward-looking information and statements. Other than as required

by applicable law, none of Recco, Dazheng, TFI and Great Wall

Capital undertakes any obligation to update or revise any

forward-looking information or statements. The information and

opinions contained herein do not take into account the particular

investment objectives, financial situation, or needs of any

recipient and should not be construed as an offer to buy or sell or

the solicitation of an offer to buy or sell the securities

mentioned or an invitation to the public. Under no circumstances

shall the information contained herein or the opinions expressed

herein constitute a personal recommendation to anyone.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231005226018/en/

Mr. Ke LEI E-Mail: ke.lei@reccogroup.com

Investor Contact Okapi Partners LLC Chuck Garske / Bruce

Goldfarb +1 (212) 297-0720 info@okapipartners.com

Media Contact FTI Consulting

recco.dazheng.consortium@fticonsulting.com

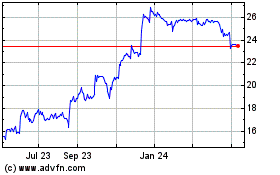

Hollysys Automation Tech... (NASDAQ:HOLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

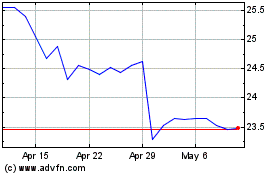

Hollysys Automation Tech... (NASDAQ:HOLI)

Historical Stock Chart

From Apr 2023 to Apr 2024