CardioNet, Inc. (NASDAQ:BEAT), a leading wireless medical

technology company with an initial focus on the diagnosis and

monitoring of cardiac arrhythmias, today reported results for the

fourth quarter and full year ended December 31, 2008.

Fourth Quarter and Full Year 2008 Highlights and Recent

Developments

- Fourth quarter revenue increased

to $34.4 million, a 43.8% increase over the same period in the

prior year; full year revenue increased to $120.5 million, a 65.0%

increase over the prior year

- Adjusted operating margin of

18.9%, excluding one-time charges(1A), and GAAP operating margin of

18.6% in the fourth quarter 2008 compared to 8.0% in the fourth

quarter 2007; full year adjusted operating margin of 12.1%,

excluding one-time charges(1A), and GAAP operating margin of 8.0%

compared to 0.3% in 2007

- Successfully completed $82.8

million IPO in March and $152.4 million secondary offering in

August

- Strengthened management team,

including the appointment of Randy Thurman, our Executive Chairman,

as Interim President and Chief Executive Officer in January

2009

- Received Category I CPT codes

and reimbursement rates effective January 1, 2009

- Secured contracts with over 30

payors during the year, including two major national payors,

accounting for an additional 32.1 million lives covered by the

CardioNet System

� � �

Fourth Quarter Results December 31, December

31,

%

�

2008 � �

2007 �

Change

�

Earnings per diluted share - GAAP $ 0.29

$ (0.22 ) NA � Dividends on and

accretion of mandatorily redeemable convertible preferred stock and

Integration, restructuring and other nonrecurring charges - 0.34 �

Impact of full year effective tax

rate adjustment on prior quarters� integration, restructuring and

other nonrecurring charges

� 0.06 � � - � �

Adjusted earnings per diluted share

$ 0.35 $ 0.12 191.7 % �

Favorable impact of NOL utilization (0.19 ) - � �

Adjusted

earnings per diluted share excluding NOLs $ 0.16

�

$ 0.12 �

33.3 % � � �

Full Year

Results December 31, December 31,

%

�

2008 � �

2007 �

Change

�

Earnings per diluted share - GAAP $ 0.29

$ (2.89 ) NA � Dividends on and

accretion of mandatorily redeemable convertible preferred stock and

Integration, restructuring and other nonrecurring charges � 0.30 �

� 2.77 � �

Adjusted earnings per diluted share $

0.59 $ (0.12 ) NA � Favorable

impact of NOL utilization (0.20 ) - � �

Adjusted earnings per

diluted share excluding NOLs $ 0.39 �

$

(0.12 ) NA

President and CEO Commentary

Randy Thurman, Interim President and CEO, commented: �We are

pleased to report strong fourth quarter and full year results,

demonstrating CardioNet�s continued success in the wireless cardiac

monitoring and diagnostic market. During the year, our revenue grew

65% and we achieved fourth quarter adjusted earnings per diluted

share of $0.35 and full year adjusted earnings per diluted share of

$0.59, exceeding our expectations and marking our first year of

profitability.

�In 2008 we achieved a number of significant accomplishments

throughout the organization that positioned us for accelerated

growth in 2009. We secured Category I CPT codes and reimbursement

rates for the CardioNet System in October, a major milestone in

facilitating broader adoption. We also secured contracts with over

30 new payors during the year, including two major national payors,

accounting for an additional 32.1 million covered lives. We

strengthened the management team with several key hires and

successfully completed the integration of the PDSHeart acquisition

and the consolidation of our corporate functions to Pennsylvania.

We continued growing and developing our sales and marketing

organization, expanding our geographic footprint and elevating our

profile within the medical community. We also remained committed to

our research and development efforts, as demonstrated by the recent

launch of our enhanced atrial fibrillation reporting package.

Finally, we continued to benefit from the growing body of

peer-reviewed research highlighting the benefits of the CardioNet

System. We look forward to the future publication of additional

studies, supported by our ongoing clinical programs.

�Looking forward, CardioNet is uniquely positioned within the

healthcare industry and perhaps most industries today. We are

leading what we believe is a revolution in healthcare � wireless

medicine. The demand for our cardiac outpatient services is growing

at greater than 40% per year. Our services provide significant and

meaningful benefits to patients and prescribing physicians while

delivering improved cost/benefit outcomes to the payors. Every

indication is that CardioNet is positioned for years of exceptional

growth.

�We view 2009 as an inflection point. We believe it is a year to

make the necessary investments to lay the foundation for

accelerated growth, increased market share and the establishment of

the CardioNet brand as the clear leader in ambulatory cardiac

monitoring and diagnosis. We firmly believe that we can achieve

this incremental investment while reporting strong earnings growth

in 2009, and, more importantly, positioning ourselves for an

enhanced leadership position in the industry and higher levels of

shareholder return in 2010 and beyond. Long-term, CardioNet�s

success will be based upon our stakeholders viewing us as the

unquestioned leader by the quality of our devices, customer service

and patient support as well as the professionalism of our account

executives. These stakeholders include patients, physicians,

payors, our employees and our shareholders.

�To achieve these aims, we intend to make incremental

investments in 2009 focused on increasing our sales force and

ensuring the highest quality of customer service and monitoring

operations, including the necessary information technology that

underlies our business. We expect to invest in product development

and clinical research studies with a focus on continued innovation.

We anticipate that the single largest investment will be in our

field sales organization with a planned increase of approximately

70% in account executives and the enhancement of our national

coverage.

�As a result, we are establishing revenue guidance for 2009 of

$170.0 to $175.0 million, somewhat higher than expectations, and

over 40% growth compared to 2008. Based on the incremental

investments I have just outlined, which represent approximately

$0.08 to $0.10 per diluted share, we are providing earnings

guidance for 2009 of $0.69 to $0.73 per diluted share, excluding

any impact of NOLs, other tax related items and any nonrecurring

charges. This represents over 75% earnings growth year over year.

In addition, we currently anticipate a one-time benefit in 2009

related to NOLs and other tax related items which could favorably

impact earnings by approximately $1.00 to $1.30 per diluted share.

We do not anticipate any earnings per diluted share benefit from

NOLs and other tax related items in 2010 or 2011. We believe the

investment in 2009 is the foundation that will drive higher

revenues and earnings in 2010 and beyond. Our outlook for 2010 is

for revenue to increase at least 50% and earnings to increase 100%,

compared to the Company�s 2009 guidance excluding NOLs and other

tax related items. In 2011, we believe that earnings per diluted

share could reach $2.00. We expect that the increased investment in

2009 and the rapid revenue growth that we are targeting will result

in increased shareholder value over the long term.

�In summary, the convergence of healthcare and information

technology is resulting in one of the most important trends for the

next twenty years � wireless medicine � and CardioNet is uniquely

positioned to capitalize on this unprecedented opportunity over the

long term. Today, we are a leader in wireless medicine focused on

cardiac arrhythmia monitoring and diagnostics. Building market

share and making intelligent investments are our current focus.

Tomorrow, we aspire to be the unquestioned leader in a healthcare

revolution. We believe that our near-term and long-term goals are

in-sync and will drive great value for all of our

stakeholders.�

Financial Results

Revenues for the fourth quarter of 2008 increased to $34.4

million compared to $23.9 million in the fourth quarter of 2007, an

increase of $10.5 million, or 43.8%. Revenues for the year ended

December 31, 2008 increased to $120.5 million compared to $73.0

million in the prior year, an increase of 65.0%. After taking into

account the acquisition of PDSHeart, Inc. (�PDSHeart�), which the

Company acquired in March 2007, revenue in 2008 increased 56.3% to

$120.5 million compared to $77.1 million in the prior year(1B).

Gross profit increased to $23.9 million in the fourth quarter of

2008, or 69.4% of revenues, compared to $15.3 million in the fourth

quarter of 2007, or 63.7% of revenues. The 69.4% gross margin in

the fourth quarter of 2008 also compares favorably to the 67.9%

gross margin in the third quarter of 2008. For the full year 2008,

gross profit increased to $80.5 million, or 66.9% of revenues,

compared to $47.5 million, or 65.0% of revenues, in the prior year.

After taking into account the acquisition of PDSHeart, the 66.9%

gross profit for the full year 2008 compares to 64.7% gross profit

in the prior year, an increase of 220 basis points(1B).

Marty Galvan, CardioNet�s Chief Financial Officer commented:

�Fourth quarter gross margin benefitted from productivity and

efficiency improvements that we instituted during the year. Also,

our revenue mix continues to shift toward our higher margin

CardioNet System, away from the legacy, lower margin event and

Holter monitoring business. Additionally, after performing an

internal evaluation related to the expected duration of our current

generation device, we adjusted the depreciable life from two to

three years, resulting in a 123 basis point improvement in gross

margin in the fourth quarter. The change in the C3 depreciable life

will also have a favorable impact on our 2009 gross margin.�

On a GAAP basis, operating income was $6.4 million in the fourth

quarter of 2008 compared to $1.9 million in the fourth quarter of

2007. Excluding $0.1 million of expense related to the integration

of PDSHeart and other restructuring efforts(1A), adjusted operating

income increased to $6.5 million in the fourth quarter of 2008, or

18.9% of revenue, compared to $1.9 million, or 8.0% of revenue, in

the fourth quarter of 2007.

On a GAAP basis, operating income for the full year 2008

increased to $9.7 million compared to $0.2 million in the prior

year. Excluding the impact of $4.9 million of integration,

restructuring and other nonrecurring charges(1A), adjusted

operating income increased to $14.6 million for the full year 2008,

or 12.1% of revenue, compared to $0.2 million in the prior

year.

Net income for the fourth quarter of 2008 was $6.9 million, or

$0.29 per diluted share, compared to $2.1 million, or $0.12 per

diluted share, for the same period last year. Net income for the

fourth quarter of 2008 includes a favorable impact of $0.19 per

diluted share due to the utilization of net operating loss

carryforwards (�NOLs�). Adjusted net income for the fourth quarter

of 2008 was $8.4 million, or $0.35 per diluted share, excluding the

impact of integration of PDSHeart and other restructuring

efforts(1A), compared to $2.1 million, or $0.12 per diluted share,

for the same period last year.

Net income for the full year 2008 increased to $9.2 million, or

$0.40 per diluted share, compared to a net loss of $0.4 million, or

a loss of $0.12 per diluted share, for the prior year. Net income

for 2008 includes a favorable impact of $0.20 per diluted share due

to the utilization of NOLs. Adjusted net income for the full year

2008 increased to $13.4 million, or $0.59 per diluted share,

excluding the impact of integration, restructuring, other

nonrecurring charges (1A), compared to a net loss of $0.4 million,

or a loss of $0.12 per diluted share, for the prior year.

Marty Galvan remarked: �With the assistance of tax consultants,

during the quarter we completed a study which clarified the extent

to which we could utilize our NOLs. As a result, we utilized $22.0

million of NOLs and adjusted our full year effective tax rate in

the fourth quarter. This had a positive impact of $0.19 on our

fourth quarter earnings per diluted share and a favorable impact of

$0.20 on our full year results. As a result of the NOL utilization,

our effective tax rate for 2008 was 13.9%. Additionally, the

utilization of the NOLs in 2008 resulted in the avoidance of a cash

payment for taxes of $8.8 million.�

On a GAAP basis, net income available to common shareholders,

which is derived by reducing net income by the accrued dividends

and accretion on mandatorily redeemable convertible preferred

stock, was $6.9 million, or $0.29 per diluted share, for the fourth

quarter of 2008, compared to a net loss of $0.7 million, or a loss

of $0.22 per diluted share, for the fourth quarter of 2007. The

mandatorily redeemable convertible preferred stock, which was

issued in part to finance the March 2007 PDSHeart acquisition, was

converted to common stock in connection with CardioNet's March 2008

initial public offering. Net income for the fourth quarter of 2008

includes a favorable impact of $0.19 per diluted share due to the

utilization of NOLs.

On a GAAP basis, net income available to common shareholders for

the year ended December 31, 2008 was $6.6 million, or $0.29 per

diluted share, compared to a loss of $8.7 million, or a loss of

$2.89 per diluted share, for the prior year. Net income for 2008

includes a favorable impact of $0.21 per diluted share due to the

utilization of NOLs.

Conference Call

CardioNet, Inc. will host an earnings conference call on

Tuesday, February 17, 2009, at 5:00 PM Eastern Time. The call will

be simultaneously webcast on the investor information page of our

website, www.cardionet.com. The call will be archived on our

website and will also be available for two weeks via phone at

888-286-8010, access code 56293026.

CardioNet, Inc. is a leading provider of ambulatory, continuous,

real-time outpatient management solutions for monitoring relevant

and timely clinical information regarding an individual's health.

CardioNet's initial efforts are focused on the diagnosis and

monitoring of cardiac arrhythmias with a solution that it markets

as the CardioNet System. More information can be found at

www.cardionet.com.

Forward Looking Statements

This press release includes certain forward-looking statements

within the meaning of the �Safe Harbor� provisions of the Private

Securities Litigation Reform Act of 1995 regarding, among other

things, our growth prospects, the prospects for our products and

our confidence in the Company�s future. These statements may be

identified by words such as �expect�, �anticipate�, �estimate�,

�intend�, �plan�, �believe�, and other words and terms of similar

meaning. Such forward-looking statements are based on current

expectations and involve inherent risks and uncertainties,

including important factors that could delay, divert, or change any

of them, and could cause actual outcomes and results to differ

materially from current expectations. These factors include, among

other things, the success of our sales and marketing initiatives,

our ability to attract and retain talented executive management and

sales personnel, the commercialization of new products, market

factors, internal research and development initiatives, partnered

research and development initiatives, competitive product

development, changes in governmental regulations and legislation,

changes to reimbursement levels for our products, the continued

consolidation of payors, acceptance of our new products and

services and patent protection and litigation. For further details

and a discussion of these and other risks and uncertainties, please

see our public filings with the Securities and Exchange Commission,

including our latest periodic report on Form 10-K or 10-Q. We

undertake no obligation to publicly update any forward-looking

statement, whether as a result of new information, future events,

or otherwise.

� �

Three Months Ended

Consolidated Statements of Operations (unaudited)

(In Thousands, Except Per Share Amounts) �

December 31,2008

December 31,2007

� Revenues $ 34,427 $ 23,943 Cost of revenues � 10,545 � � 8,683 �

Gross profit 23,882 15,260 Gross profit % 69.4 % 63.7 % � Operating

expenses: Research and development expense 983 962 General and

administrative expense 10,775 7,799 Sales and marketing expense

5,369 4,335 Amortization of intangibles 246 246 Integration,

restructuring and other nonrecurring charges � 105 � � - � Total

operating expenses 17,478 13,342 � � Operating income � 6,404 � �

1,918 � Interest income, net 295 174 � Income before income taxes

6,699 2,092 Benefit from income taxes � 226 � � - � Net income $

6,925 $ 2,092 Dividends on and accretion of mandatorily redeemable

convertible preferred stock � - � � (2,758 ) Net income (loss)

available to common shareholders $ 6,925 � $ (666 ) � Earnings

(loss) per share: Basic $ 0.30 $ (0.22 ) Diluted $ 0.29 $ (0.22 ) �

� Weighted average shares outstanding: Basic 23,434 3,012

Diluted

23,994 3,012 � �

�

�

Twelve Months Ended

Consolidated Statements of Operations (unaudited)

(In Thousands, Except Per Share Amounts) �

December 31,2008

December 31,2007

� Revenues $ 120,454 $ 72,992 Cost of revenues � 39,913 � � 25,526

� Gross profit 80,541 47,466 Gross profit % 66.9 % 65.0 % �

Operating expenses: Research and development expense 3,999 3,782

General and administrative expense 39,876 26,674 Sales and

marketing expense 21,111 15,969 Amortization of intangibles 984 799

Integration, restructuring and other nonrecurring charges � 4,880 �

� - � Total operating expenses 70,850 47,224 � � Operating income

(loss) � 9,691 � � 242 � Interest income (expense), net 997 (600 )

� Income (loss) before income taxes 10,688 (358 ) Provision for

income taxes � (1,483 ) � - � Net income (loss) $ 9,205 $ (358 )

Dividends on and accretion of mandatorily redeemable convertible

preferred stock � (2,597 ) � (8,346 ) Net income (loss) available

to common shareholders $ 6,608 � $ (8,704 ) � Earnings (loss) per

share: Basic $ 0.36 $ (2.89 ) Diluted $ 0.29 $ (2.89 ) � Weighted

average shares outstanding: Basic 18,349 3,012 Diluted 22,659 3,012

� The following table presents detail of the stock based

compensation expense that is included in each functional line item

in the Condensed Statements of Operations above (000�s): �

Three Months Ended

Stock based compensation expense (unaudited) (In

Thousands) �

December 31, December 31,

2008 2007 � Stock based compensation expense included

in: Cost of revenues $ 13 $ 6 Research and development expense 18 2

General and administrative expense 768 359 Sales and marketing

expense 113 91 Integration, restructuring and other nonrecurring

charges � - � - � Total stock based compensation expense $ 912

�

$ 458 �

Twelve Months Ended Stock based

compensation expense (unaudited) (In Thousands) �

December 31, December 31, 2008 2007 (a)

� Stock based compensation expense included in: Cost of revenues $

37 $ 14 Research and development expense 68 8 General and

administrative expense 2,041 621 Sales and marketing expense 475

136 Integration, restructuring and other nonrecurring charges � 768

� - � Total stock based compensation expense $ 3,389

�

$ 779 (a) � We began assigning stock compensation expense to the

individual cost centers in the third quarter of 2007. Prior to the

third quarter, all stock compensation expense was recorded under

general and administrative. �

Summary Consolidated Balance Sheet

Data (In Thousands) �

December 31, December

31, 2008 2007 (unaudited) � Cash and cash

equivalents $ 58,171 $ 18,091 Accounts receivable, net 39,430

22,854 Working capital 84,003 29,375 Total assets 165,773 103,040

Total debt 72 2,744 Mandatorily redeemable convertible preferred

stock - 115,302 Total shareholders� equity (deficit) 150,116

(26,865) Reconciliation of Non-GAAP Financial Measures (In

Thousands, Except Per Share Amounts) � In accordance with

Regulation G of the Securities and Exchange Commission, the tables

set forth below reconcile certain financial measures used in this

press release that were not calculated in accordance with generally

accepted accounting principles, or GAAP, with the most directly

comparable financial measure calculated in accordance with GAAP. �

� � (1A) � The following tables reconcile certain financial

measures used in this press release that were not calculated in

accordance with GAAP. �

Three Months Ended

�

(unaudited) December 31, �

December 31,

2008 2007 Operating income � GAAP $ 6,404 $ 1,918

Integration, restructuring and other nonrecurring charges (a) � 105

�

-

Adjusted operating income $ 6,509 $

1,918 �

Net income (loss) available to common

shareholders � GAAP $ 6,925 $ (666)

Dividends on and accretion of

mandatorily redeemable convertible preferred stock which converted

to common stock in the first quarter of 2008

� - � 2,758

Net income $ 6,925 $

2,092 � Integration, restructuring and other nonrecurring

charges (net of income taxes of $15) (a) 90 -

Impact of full year effective tax

rate adjustment on prior quarters� integration, restructuring and

other nonrecurring charges

� 1,386 � -

Adjusted net income $ 8,401

$ 2,092 Impact of NOL utilization (b) � (4,688) � -

Adjusted net income excluding NOL utilization $

3,713 $ 2,092 �

Diluted earnings (loss)

available to common shareholders per share � GAAP $

0.29 $ (0.22)

Dividends on and accretion of

mandatorily redeemable convertible preferred stock which converted

to common stock in the first quarter of 2008

� - � 0.34

Diluted earnings per

share

$ 0.29 $ 0.12 � Integration,

restructuring and other nonrecurring charges per share (a) and

Impact of full year effective tax rate adjustment on prior

quarters� integration, restructuring and other nonrecurring charges

� 0.06 � -

Adjusted diluted earnings per share $

0.35 $ 0.12 Impact of NOL utilization (b) �

(0.19) � -

Adjusted diluted earnings per share excluding NOL

utilization $ 0.16 $ 0.12 (a) � In

the fourth quarter of 2008, we incurred $0.1 million of

integration, restructuring and other nonrecurring charges. (b) In

the fourth quarter of 2008, we were able to utilize $22.0 million

of net operating loss carryforwards for the full year 2008. �

Twelve Months Ended

�

(unaudited) �

December 31, December 31,

2008 2007 Operating income (loss) � GAAP $ 9,691 $

242 Integration, restructuring and other nonrecurring charges (a) �

4,880 � �

-

�

Adjusted operating income (loss) $ 14,571 �

$ 242 � � Net (loss) available to common shareholders

� GAAP $ 6,608 $ (8,704 ) � Dividends on and accretion of

mandatorily redeemable convertible preferred stock which converted

to common stock in the first quarter of 2008 � 2,597 � � 8,346 �

Net income (loss) $ 9,205 $ (358

) � Integration, restructuring and other nonrecurring

charges (net of income taxes of $677) (a) � 4,203 � � - �

Adjusted net income (loss) $ 13,408 $

(358 ) Impact of NOL utilization (b) � (4,688 ) � - �

Adjusted net income (loss) excluding NOL utilization

$ 8,720 �

$ (358 ) �

Diluted

earnings (loss) available to common shareholders per share �

GAAP $ 0.29 $ (2.89 )

Dividends on and accretion of

mandatorily redeemable convertible preferred stock which converted

to common stock in the first quarter of 2008

� 0.11 � � 2.77 �

Diluted earnings (loss) per

share

$ 0.40 $ (0.12 ) � Integration,

restructuring and other nonrecurring charges per share (a) � 0.19 �

� - �

Adjusted diluted earnings (loss) per share $

0.59 $ (0.12 ) Impact of NOL

utilization (b) � (0.20 ) � - �

Adjusted diluted earnings (loss)

per share excluding NOL utilization $ 0.39 �

$ (0.12 ) � � (a) For the year ending December

31, 2008, we incurred $3.9 million of integration, restructuring

and other nonrecurring charges and $1.0 million of expense related

to the resolution of litigation. (b) For the year ending December

31, 2008, we were able to utilize $22.0 million of net operating

loss carryforwards. � � � (1B) The following table provides a

reconciliation of year to date 2007 results as if the PDSHeart

acquisition had been completed as of January 1, 2007. � �

Twelve Months Ended

�

(unaudited) �

December 31, 2007 � Total revenue �

GAAP $ 72,992 PDSHeart revenue prior to acquisition � January 1 to

March 7, 2007 � 4,069 � Adjusted revenue $ 77,061 � Total gross

profit � GAAP $ 47,466 PDSHeart gross profit prior to acquisition �

January 1 to March 7, 2007 � 2,423 � Adjusted gross profit $ 49,889

� Adjusted gross profit % 64.7 % �

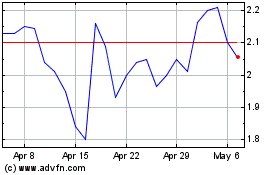

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

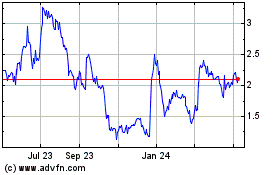

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jul 2023 to Jul 2024