The Hackett Group: U.S. Companies See Worsening Performance Of Payables, Collections and Inventory in Q2 2023

November 02 2023 - 10:00AM

Business Wire

The largest U.S. companies saw their ability to extend payments

to suppliers, collect from customers and manage inventory degrade

in the first half of 2023, according to new working capital

research from The Hackett Group, Inc. (NASDAQ: HCKT). The research

provides further evidence of the trend that has been emerging over

the past year – that buyers have lost leverage with suppliers and

can no longer simply delay payments to improve their own balance

sheet. Rising inventories for utility and semiconductor and

equipment companies played a major role in the degraded inventory

performance.

An analysis of data from 1,000 of the largest U.S. public

companies by The Hackett Group® comparing performance in Q2 2023

with Q2 2022 found the most significant decline in days inventory

outstanding (DIO), which deteriorated by 7.1% (from 47.2 to 50.5

days). Oil and gas, telecommunication equipment, utilities, and

recreational products showed the greatest degradation in inventory

performance. Days payables outstanding (DPO) performance declined

by 2% (from 55.8 to 54.7 days), led by degraded purchase-to-pay

performance in textiles, apparel and footwear, machinery, and

consumer durables. Days sales outstanding (DSO) showed marginal

degradation of 1% (from 39.8 to 40.2 days), with pharmaceuticals,

biotechnology and medical specialties, and services leading the

list of industries where performance worsened the most. Overall

cash conversion cycle, which aggregates DIO, DPO and DSO

performance, deteriorated by 15.4% (from 31.2 to 36 days).

Companies also saw liquidity metrics stabilize after hitting

record highs in Q2 2022. Operating cash flow as a percentage of

revenue increased by 12.1% in the first half of 2023, while

earnings before interest, taxes, depreciation and amortization

(EBITDA) margin declined by 8.7%. Net income margin declined by

12.6%. An analysis of operational metrics found that despite the

increasing cost of debt, companies increased cash on hand as a

percentage of revenue by 1.7% and capital expenditures as a

percentage of revenue rose by 15.1%, despite the increasing cost of

debt.

The Q2 2023 Working Capital Survey update is produced by The

Hackett Group’s Working Capital Management Solutions practice. More

information on the practice is available at

https://www.thehackettgroup.com/working-capital-management/. An

infographic detailing the survey results is also available on a

complimentary basis, with registration, here:

https://go.poweredbyhackett.com/iv6.

According to The Hackett Group Director James Ancius, “Looking

at the overall survey, it’s highly unusual to see all three

elements of working capital degrading at the same time. It’s

clearly a sign that companies are not highly focused on working

capital management. On payables, we’re now seeing even more

evidence that the leverage has shifted from the buyer to the

seller. Supply assurance has become more important to buyers, and

pricing is more critical to them than payment terms. We believe

we’ll likely see payables performance at large companies continue

to degrade over the coming year.”

The Hackett Group Director István Bodó added, “The significant

degradation in inventory performance was also a bit surprising. The

balance is likely to change in the second half of 2023, with gas

exports picking up. But we’re also seeing increases in inventory in

areas like recreational products, which is likely tied to reduced

consumer demand, and could be an indication of future

softening.”

About The Hackett Group

The Hackett Group, Inc. (NASDAQ: HCKT) is a leading

benchmarking, research advisory and strategic consultancy firm that

enables organizations to achieve Digital World Class®

performance.

Drawing upon our unparalleled intellectual property from more

than 25,000 benchmark studies and our Hackett-Certified® best

practices repository from the world’s leading businesses –

including 97% of the Dow Jones Industrials, 93% of the Fortune 100,

73% of the DAX 40 and 52% of the FTSE 100 – captured through our

leading benchmarking platform Quantum Leap® and our Digital

Transformation Platform, we accelerate digital transformations,

including enterprise cloud implementations.

For more information on The Hackett Group, visit:

https://www.thehackettgroup.com/; email info@thehackettgroup.com;

or call (770) 225-3600.

The Hackett Group, Hackett-Certified, quadrant logo, World Class

Defined and Enabled, Quantum Leap, Digital World Class and Hackett

Value Matrix are the registered marks of The Hackett Group.

Cautionary Statement Regarding “Forward-Looking”

Statements

This release contains “forward-looking” statements within the

meaning of Section 27A of the Securities Act of 1933 as amended and

Section 21E of the Securities Exchange Act of 1934, as amended.

Statements including without limitation, words such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” seeks,” “estimates,”

or other similar phrases or variations of such words or similar

expressions indicating, present or future anticipated or expected

occurrences or outcomes are intended to identify such

forward-looking statements. Forward-looking statements are not

statements of historical fact and involve known and unknown risks,

uncertainties and other factors that may cause the Company’s actual

results, performance or achievements to be materially different

from the results, performance or achievements expressed or implied

by the forward-looking statements. Factors that may impact such

forward-looking statements include without limitation, the ability

of The Hackett Group to effectively market its digital

transformation and other consulting services, competition from

other consulting and technology companies that may have or develop

in the future, similar offerings, the commercial viability of The

Hackett Group and its services as well as other risk detailed in

The Hackett Group’s reports filed with the United States Securities

and Exchange Commission. The Hackett Group does not undertake any

duty to update this release or any forward-looking statements

contained herein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231102910337/en/

Gary Baker, Global Communications Director - (917) 796-2391 or

gbaker@thehackettgroup.com

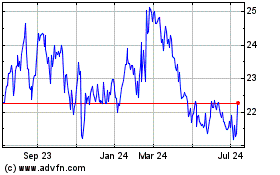

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Oct 2024 to Nov 2024

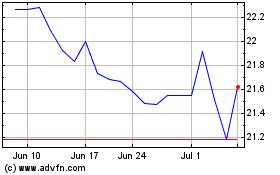

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Nov 2023 to Nov 2024