- Q2 2019 net revenue of $68.0 million at the mid-point of

guidance and pro forma EPS of $0.28, at high-end of guidance

- Q2 2019 GAAP EPS of $0.22 as compared to GAAP EPS of $0.36 in

the same period of the prior year, which included a favorable $0.14

per share acquisition liability adjustment

- Board of Directors declared $0.18 semi-annual dividend, an

increase of 6% from prior year, paid in July 2019

The Hackett Group, Inc. (NASDAQ: HCKT), a global intellectual

property-based strategic consultancy and leading enterprise

benchmarking and best practices digital transformation firm, today

announced its financial results for the second quarter, which ended

on June 28, 2019.

Q2 2019 net revenue (gross revenue less reimbursable expenses)

from continuing operations was $68.0 million, down 1%, as compared

to the same period in the prior year. Q2 2019 gross revenue from

continuing operations was $73.5 million, down 1% from the same

period in the prior year.

Q2 2019 pro forma diluted earnings per share were $0.28 per

share, as compared to $0.27 per share for the same period in the

prior year. Pro forma information is provided to enhance the

understanding of the Company’s financial performance and is

reconciled to the Company’s GAAP information in the accompanying

tables.

Q2 2019 GAAP diluted earnings per share were $0.22 per share, as

compared to $0.36 per share for the same period in the prior year.

During the second quarter of 2018, the Company recorded a $4.6

million, or $0.14 per diluted share, benefit due to the

remeasurement of an acquisition earnout liability.

At the end of the second quarter of 2019, the Company’s cash

balances were $16.7 million. During the quarter, the Company

utilized cash to pay down outstanding debt of $3.0 million. In

addition, during the second quarter of 2019, the Company

repurchased 93 thousand shares of the Company’s common stock at an

average price per share of $15.60 for a total of $1.5 million. At

the end of the second quarter of 2019, the Company’s remaining

stock repurchase program authorization was $3.9 million.

“As expected, we experienced strong sequential growth in nearly

all of our US groups as we saw increased momentum across client

cloud and digital transformation initiatives,” stated Ted A.

Fernandez, Chairman and CEO of The Hackett Group. “We expect our US

momentum to continue into the third quarter, which bodes well for

our prospects for the remainder of the year.”

Based on the current economic outlook, the Company estimates

total net revenue for the third quarter of 2019 to be in the range

of $66.5 million and $68.5 million or gross revenue (inclusive of

reimbursable expenses) to be in the range of $72.0 million and

$74.0 million. The Company estimates pro forma diluted earnings per

share for the third quarter of 2019 to be in the range of $0.27 and

$0.29.

Other Highlights

Digital Awards - The Hackett Group announced that Bayer and IBM

were the winners of its 2019 Digital Awards, which spotlight

companies that are on the cutting edge of digital transformation,

including smart automation, robotic process automation (RPA),

cognitive computing and advanced analytics. Bayer won the award in

the advanced analytics category for its Statistical Demand

Forecasting System, while IBM won in the smart automation category

for its Cognitive Support Platform. Four other companies were also

recognized as finalists: HCL/Manchester United Football Club, HP,

IBM and Indecomm. The Hackett Group’s Digital Awards spotlight and

celebrate companies on the cutting edge of using smart automation

and advanced analytics to solve business problems.

HR Key Issues Research – The Hackett Group issued its 2019 HR

Key Issues research, which found that HR organizations are making

progress on improving key capabilities. The research found that

improvements have been slow and gaps remain and HR organizations

find themselves challenged to address an array of areas that are

critical to helping the enterprise achieve its objectives. The

research found that most HR organizations remain behind the curve

in addressing areas that are central to achieving enterprise goals:

developing executives who can lead in volatile environments,

supporting enterprise digital transformation, and dealing with

critical talent/skill shortages.

IT Key Issues Research – The Hackett Group issued its 2019 IT

Key Issues research, which found that while IT organizations are

making progress with their own internal digital transformation,

they are still struggling to support the broader enterprise,

reallocate the technology portfolio, implement a more agile

technology infrastructure, drive innovation, and improve

customer-centricity. The research found that IT has limited

capability to address many of their highest priority objectives. In

addition, plans to address these deficiencies fall woefully short,

calling into question IT’s ability to live up to the business

expectation to serve as a true strategic business partner.

On Tuesday, August 6, 2019 senior management will discuss second

quarter results in a conference call at 5:00 P.M. ET. (800)

593-0486, [Passcode: Second Quarter]. For International callers,

please dial (517) 308-9371.

Please dial in at least 5-10 minutes prior to start time. If you

are unable to participate on the conference call, a rebroadcast

will be available beginning at 8:00 P.M. ET on Tuesday, August 6,

2019 and will run through 5:00 P.M. ET on Tuesday, August 20, 2019.

To access the rebroadcast, please dial (888) 397-5659. For

International callers, please dial (203) 369-3145.

In addition, The Hackett Group will also be webcasting this

conference call live through the StreetEvents.com service. To

participate, simply visit http://www.thehackettgroup.com

approximately 10 minutes prior to the start of the call and click

on the conference call link provided. An online replay of the call

will be available after 8:00 P.M. ET on Tuesday, August 6, 2019 and

will run through 5:00 P.M. ET on Tuesday, August 20, 2019. To

access the replay, visit www.thehackettgroup.com or

http://www.streetevents.com.

About The Hackett Group

The Hackett Group (NASDAQ: HCKT) is an intellectual

property-based strategic consultancy and leading enterprise

benchmarking and best practices digital transformation firm to

global companies, with offerings that include robotic process

automation and enterprise cloud application implementation.

Services include business transformation, enterprise analytics and

global business services. The Hackett Group also provides dedicated

expertise in business strategy, operations, finance, human capital

management, strategic sourcing, procurement and information

technology, including its award-winning Oracle and SAP

practices.

The Hackett Group has completed more than 16,500 benchmarking

studies with major corporations and government agencies, including

93% of the Dow Jones Industrials, 89% of the Fortune 100, 83% of

the DAX 30 and 57% of the FTSE 100. These studies drive Hackett’s

Digital Transformation Platform which includes the firm's

benchmarking metrics, best practices repository and best practice

configuration guides and process flows, which enable The Hackett

Group’s clients and partners to achieve world-class

performance.

More information on The Hackett Group is available at:

www.thehackettgroup.com, info@thehackettgroup.com, or by calling

(770) 225-3600.

This press release contains "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of 1995

and involve known and unknown risks, uncertainties and other

factors that may cause The Hackett Group's actual results,

performance or achievements to be materially different from the

results, performance or achievements expressed or implied by the

forward-looking statements. Factors that impact such

forward-looking statements include, among others, the ability of

our products, services, or offerings mentioned in this release to

deliver the desired effect, our ability to effectively integrate

acquisitions into our operations, our ability to retain existing

business, our ability to attract additional business, our ability

to effectively market and sell our product offerings and other

services, including those referenced above, the timing of projects

and the potential for contract cancellations by our customers,

changes in expectations regarding the business consulting and

information technology industries, our ability to attract and

retain skilled employees, possible changes in collections of

accounts receivable due to the bankruptcy or financial difficulties

of our customers, risks of competition, price and margin trends,

foreign currency fluctuations, the impact of Brexit on our

business, changes in general economic conditions and interest

rates, our ability to obtain debt financing through additional

borrowings under an amendment to our existing credit facility as

well as other risks detailed in our Company's Annual Report on Form

10-K for the most recent fiscal year filed with the Securities and

Exchange Commission. We undertake no obligation to update or revise

publicly any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

The Hackett Group, Inc. CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands, except per share data)

(unaudited) Quarter Ended Six Months Ended

June 28, June 29, June 28, June 29,

2019

2018

2019

2018

Revenue: Revenue before reimbursements ("net revenue")

$

67,976

$

68,706

$

130,346

$

134,745

Reimbursements

5,545

5,821

10,330

10,889

Total revenue from continuing operations

73,521

74,527

140,676

145,634

Costs and expenses: Cost of service: Personnel costs before

reimbursable expenses

40,820

42,148

79,754

82,752

Non-cash stock compensation expense

1,022

977

1,942

2,000

Acquisition-related compensation benefit

(159

)

(204

)

(288

)

(789

)

Acquisition-related non-cash stock compensation expense

289

(79

)

368

721

Reimbursable expenses

5,545

5,821

10,330

10,889

Total cost of service

47,517

48,663

92,106

95,573

Selling, general and administrative costs

15,159

14,779

29,201

29,242

Non-cash stock compensation expense

787

804

1,492

1,645

Amortization of intangible assets

254

591

553

1,204

Acquisition-related contingent consideration liability

45

(4,553

)

(1,025

)

(4,553

)

Total selling, general, and administrative expenses

16,245

11,621

30,221

27,538

Total costs and operating expenses

63,762

60,284

122,327

123,111

Income from operations

9,759

14,243

18,349

22,523

Other expense: Interest expense

(105

)

(178

)

(206

)

(357

)

Income from continuing operations before income taxes

9,654

14,065

18,143

22,166

Income tax expense

2,614

2,393

4,054

3,193

Income from continuing operations

7,040

11,672

14,089

18,973

Loss from discontinued operations (2)

(51

)

(151

)

(6

)

(85

)

Net income

$

6,989

$

11,521

$

14,083

$

18,888

Weighted average common shares outstanding: Basic

29,823

29,430

29,753

29,260

Diluted

32,374

32,235

32,334

32,025

Basic net income per common share: Income per common share

from continuing operations

$

0.23

$

0.40

$

0.47

$

0.65

Loss per common share from discontinued operations (2)

(0.00

)

(0.01

)

(0.00

)

(0.00

)

Net income per common share

$

0.23

$

0.39

$

0.47

$

0.65

Diluted net income per common share: Income per common share

from continuing operations

$

0.22

$

0.36

$

0.44

$

0.59

Loss per common share from discontinued operations (2)

(0.00

)

(0.00

)

(0.00

)

(0.00

)

Net income per common share

$

0.22

$

0.36

$

0.44

$

0.59

Pro forma data (1): Income from continuing operations

before income taxes

$

9,654

$

14,065

$

18,143

$

22,166

Non-cash stock compensation expense

1,809

1,781

3,434

3,645

Acquisition-related compensation benefit

(159

)

(204

)

(288

)

(789

)

Acquisition-related non-cash stock compensation expense

289

(79

)

368

721

Acquisition-related contingent consideration liability

45

(4,553

)

(1,025

)

(4,553

)

Amortization of intangible assets

254

591

553

1,204

Pro forma income before income taxes

11,892

11,601

21,185

22,394

Pro forma income tax expense

2,973

2,900

5,296

5,599

Pro forma net income

$

8,919

$

8,701

$

15,889

$

16,795

Pro forma basic net income per common share

$

0.30

$

0.30

$

0.53

$

0.57

Weighted average common shares outstanding

29,823

29,430

29,753

29,260

Pro forma diluted net income per common share

$

0.28

$

0.27

$

0.49

$

0.52

Weighted average common and common equivalent shares outstanding

32,374

32,235

32,334

32,025

(1) The Company provides pro forma earnings results (which

exclude the amortization of intangible assets, stock compensation

expense, acquisition-related one-time expense (benefit), and

includea normalized tax rate, which is our long-term projected cash

tax rate) as a complement to results provided in accordance with

Generally Accepted Accounting Principles (GAAP). These

non-GAAPresults are provided to enhance the overall users'

understanding of the Company's current financial performance and

its prospects for the future. The Company believes the non-GAAP

results provideuseful information to both management and investors

by excluding certain expenses that it believes are not indicative

of its core operating results. The non-GAAP measures are included

to provideinvestors and management with an alternative method for

assessing operating results in a manner that is focused on the

performance of ongoing operations and to provide a more consistent

basis forcomparison between quarters. Further, these non-GAAP

results are one of the primary indicators management uses for

planning and forecasting in future periods. In addition, since the

Company hashistorically reported non-GAAP results to the investment

community, it believes the continued inclusion of non-GAAP results

provides consistency in its financial reporting. The presentationof

this additional information should not be considered in isolation

or as a substitute for results prepared in accordance with GAAP.

(2) Discontinued operations relate to the

discontinuance of the Company's European Working Capital Group.

The Hackett Group, Inc. CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands) (unaudited) June 28,

December 28,

2019

2018

ASSETS Current assets: Cash and cash equivalents

$

16,682

$

13,808

Accounts receivable and unbilled revenue, net

54,547

54,807

Prepaid expenses and other current assets

4,086

4,339

Assets related to discontinued operations (3)

-

137

Total current assets

75,315

73,091

Restricted cash Property and equipment, net

21,112

19,750

Other assets

3,116

3,704

Goodwill, net

84,213

84,207

Operating lease right-of-use assets

7,613

-

Total assets

$

191,369

$

180,752

LIABILITIES AND SHAREHOLDERS' EQUITY Current

liabilities: Accounts payable

$

6,767

$

7,429

Accrued expenses and other liabilities

33,114

34,498

Operating lease liabilities

2,376

-

Liabilities related to discontinued operations (3)

31

2,300

Total current liabilities

42,288

44,227

Long-term deferred tax liability, net

8,143

6,435

Long-term debt

4,500

6,500

Operating lease liabilities

5,237

-

Total liabilities

60,168

57,162

Shareholders' equity

131,201

123,590

Total liabilities and shareholders' equity

$

191,369

$

180,752

(3) The assets and liabilities related to discontinued operations

relate to the discontinuance of the Company's European Working

Capital Group.

The Hackett Group, Inc. SUPPLEMENTAL

FINANCIAL DATA (unaudited) Quarter Ended

June 28, June 29, March 29,

2019

2018

2019

Revenue Breakdown by Group: (in thousands) Global S&BT

(4)

$

35,718

$

37,816

$

33,270

EEA (5)

32,258

30,890

29,100

Net revenue from continuing operations (6)

$

67,976

$

68,706

$

62,370

Revenue Concentration: (% of total revenue) Top

customer

4

%

6

%

5

%

Top 5 customers

16

%

18

%

18

%

Top 10 customers

25

%

25

%

26

%

Key Metrics and Other Financial Data: Total

Company: Consultant headcount (7)

999

1,020

979

Total headcount (7)

1,240

1,268

1,222

Days sales outstanding (DSO) (7)

68

69

76

Cash provided by (used in) operating activities (in thousands)

$

11,273

$

(2,368

)

$

6,759

Pro forma return on equity (8)

26

%

31

%

27

%

Depreciation (in thousands)

$

830

$

624

$

606

Amortization (in thousands)

$

255

$

591

$

299

Remaining Plan authorization: Shares purchased (in

thousands)

92

-

101

Cost of shares repurchased (in thousands)

$

1,440

$ —

$

1,616

Average price per share of shares purchased

$

15.59

$ —

$

15.99

Remaining Plan authorization (in thousands)

$

3,878

$

7,174

$

5,318

Shares Purchased to Satisfy Employee Net Vesting

Obligations: Shares purchased (in thousands)

1

11

123

Cost of shares purchased (in thousands)

$

14

$

182

$

2,370

Average price per share of shares purchased

$

16.39

$

16.22

$

19.24

(4) Strategy and Business Transformation

Group (S&BT) includes the results of our IP as-a-service

offerings, which includes our Executive Advisory Programs and our

Benchmarking Services, our Business Transformation Practices and

the international portion of our EPM revenue.

(5) ERP, EPM and Analytics Solutions (EEA)

includes the results of our Oracle EEA and SAP Solutions

Practices.

(6) Net revenue excludes reimbursable

expenses which are primarily travel-related expenses passed through

to a client with no associated margin.

(7) Prior periods have been restated to

exclude the discontinuance of the Company's European Working

Capital Group.

(8) Twelve months of pro forma net income

divided by average shareholder's equity.

(9) Certain reclassifications have been

made to conform with current reporting requirements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190806005903/en/

Robert A. Ramirez, CFO, 305-375-8005 or

rramirez@thehackettgroup.com

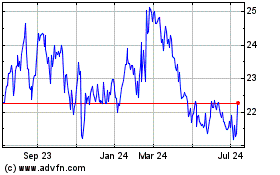

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Oct 2024 to Nov 2024

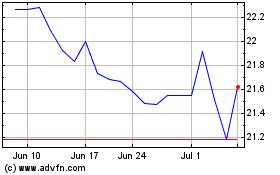

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Nov 2023 to Nov 2024