China Lodging Group, Limited Announces Its Preliminary Results for Hotel Operation in the Third Quarter of 2016

October 18 2016 - 4:00AM

China Lodging Group, Limited (NASDAQ:HTHT) (“China Lodging Group”,

“Huazhu”, or the “Company”), a leading and fast-growing multi-brand

hotel group in China, today announced its preliminary results for

the hotel operation in the third quarter ended September 30, 2016.

Operating Metrics

| |

For the quarter ended |

| |

September 30, |

June 30, |

September 30, |

| |

2015 |

2016 |

2016 |

|

Occupancy rate (as a percentage) |

|

|

|

|

Leased and owned hotels |

|

91 |

% |

|

87 |

% |

|

90 |

% |

|

Manachised hotels |

|

89 |

% |

|

85 |

% |

|

89 |

% |

|

Franchised hotels |

|

73 |

% |

|

71 |

% |

|

74 |

% |

|

Blended |

|

89 |

% |

|

85 |

% |

|

89 |

% |

| Average daily room rate (1) (in RMB) |

|

|

|

Leased and owned hotels |

|

207 |

|

|

210 |

|

|

217 |

|

|

Manachised hotels |

|

179 |

|

|

175 |

|

|

186 |

|

|

Franchised hotels |

|

187 |

|

|

181 |

|

|

194 |

|

|

Blended |

|

188 |

|

|

184 |

|

|

194 |

|

| RevPAR (1) (in

RMB) |

|

|

|

|

Leased and owned hotels |

|

188 |

|

|

182 |

|

|

195 |

|

|

Manachised hotels |

|

159 |

|

|

150 |

|

|

166 |

|

|

Franchised hotels |

|

137 |

|

|

128 |

|

|

144 |

|

|

Blended |

|

167 |

|

|

157 |

|

|

173 |

|

| (1) Value-added tax ("VAT") has been implemented for

hospitality industry to replace business tax in China, effective

May 1, 2016. The Company's room rates quoted and received from

customers are tax-inclusive (business tax or VAT) before and after

the implementation of VAT. For comparison purposes, the ADR and

RevPAR disclosed in this release are based on the tax-inclusive

rates. |

| Like-for-like performance for leased and manachised hotels

opened for at least 18 months during the current quarter |

|

|

| |

As of and for the quarter ended |

|

| |

September

30, |

yoy |

| |

2015 |

2016 |

change |

| Total |

|

2,050 |

|

|

2,050 |

|

|

|

Leased hotels |

|

588 |

|

|

588 |

|

|

|

Manachised and franchised hotels |

|

1,462 |

|

|

1,462 |

|

|

| Occupancy rate (as a

percentage) |

|

91 |

% |

|

91 |

% |

|

0.2 |

% |

| Average daily room rate

(in RMB) |

|

188 |

|

|

189 |

|

|

0.4 |

% |

| RevPAR

(in RMB) |

|

171 |

|

|

172 |

|

|

0.5 |

% |

|

|

Hotel Development

| |

Number of hotels in operation |

|

Number of rooms in operation |

| |

Opened |

Closed

(2) |

Net added |

As of |

|

Net added |

As of |

| |

in Q3 2016 |

in Q3 2016 |

in Q3 2016 |

September 30, 2016 |

|

in Q3 2016 |

September 30, 2016 |

| Leased and owned

hotels |

8 |

|

(10 |

) |

|

(2 |

) |

625 |

|

35 |

77,158 |

| Manachised and

franchised hotels |

163 |

|

(77 |

) |

|

86 |

|

2,573 |

|

7,939 |

245,627 |

|

Total |

171 |

|

(87 |

) |

|

84 |

|

3,198 |

|

7,974 |

322,785 |

|

|

|

|

|

|

|

|

|

| (2) The hotel closure in Q3 2016 was higher than the

previous quarters because:a) In order to increase the product

qualities, Huazhu removed 44 of the manachised and franchised

hotels related to HanTing, Hi Inn, Elan and Starway from Huazhu’s

network for incompliances with the brand and operating

standards. |

| b) Huazhu removed 15 franchised and 1 manachised hotels under

ibis and ibis Styles brands after completion of legal procedures

for termination. The financial impact from such removal is not

significant because these hotels have not been integrated into

Huazhu's operating platform for operation and management fee

purposes. |

| Other common reasons for hotel closure including contract

expiration, rezoning and others. |

| |

Number of hotels in pipeline as of

September 30, 2016 |

| Leased hotels |

23 |

| Manachised and

franchised hotels |

482 |

|

Total(3) |

505 |

| (3) Including 38 hotels under brands of ibis, ibis

Styles and Mercure. |

|

|

Business Update by Segment

|

Hotel breakdown by segment |

|

| |

|

| |

Number of hotels in operation |

| |

Net added |

As of |

| |

in Q3 2016 |

September 30, 2016 |

| Economy

hotels |

|

45 |

|

2,771 |

| HanTing

Hotel |

|

44 |

|

2,149 |

| Leased

hotels |

|

- |

|

492 |

|

Manachised hotels |

|

43 |

|

1,656 |

|

Franchised hotels |

|

1 |

|

1 |

| Hi

Inn |

|

15 |

|

373 |

| Leased

hotels |

|

(1 |

) |

36 |

|

Manachised hotels |

|

8 |

|

293 |

|

Franchised hotels |

|

8 |

|

44 |

| Elan

Hotel |

|

(1 |

) |

179 |

|

Manachised hotels |

|

(3 |

) |

146 |

|

Franchised hotels |

|

2 |

|

33 |

| ibis

Hotel |

|

(13 |

) |

70 |

| Leased

hotels |

|

- |

|

13 |

|

Manachised hotels |

|

1 |

|

14 |

|

Franchised hotels |

|

(14 |

) |

43 |

|

Midscale and upscale hotels |

|

39 |

|

427 |

| JI

Hotel |

|

27 |

|

256 |

| Leased

hotels |

|

- |

|

78 |

|

Manachised hotels |

|

27 |

|

176 |

|

Franchised hotels |

|

- |

|

2 |

| Starway

Hotel |

|

5 |

|

141 |

| Leased

hotels |

|

(1 |

) |

2 |

|

Manachised hotels |

|

10 |

|

94 |

|

Franchised hotels |

|

(4 |

) |

45 |

| Joya

Hotel |

|

- |

|

5 |

| Leased

hotels |

|

- |

|

2 |

|

Manachised hotels |

|

- |

|

3 |

| Manxin

Hotels & Resorts |

|

1 |

|

3 |

| Leased

hotels |

|

(1 |

) |

- |

|

Manachised hotels |

|

2 |

|

3 |

| ibis

Styles Hotel |

|

2 |

|

8 |

|

Manachised hotels |

|

3 |

|

5 |

|

Franchised hotels |

|

(1 |

) |

3 |

| Mercure

Hotel |

|

3 |

|

11 |

| Leased

hotels |

|

1 |

|

2 |

|

Manachised hotels |

|

2 |

|

8 |

|

Franchised hotels |

|

- |

|

1 |

| Novotel

Hotel |

|

1 |

|

2 |

|

Manachised hotels |

|

- |

|

1 |

|

Franchised hotels |

|

1 |

|

1 |

| Grand

Mercure |

|

- |

|

1 |

|

Franchised hotels |

|

- |

|

1 |

|

Total |

|

84 |

|

3,198 |

| Same-hotel

operational data by segment |

|

|

|

|

|

|

|

|

|

|

|

| |

Number of hotels in operation |

Same-hotel RevPAR |

|

Same-hotel ADR |

|

Same-hotel Occupancy |

|

| |

As of |

For the quarter ended |

|

For the quarter ended |

|

For the quarter ended |

|

| |

September 30, |

September 30, |

yoychange |

September 30, |

yoychange |

September 30, |

yoychange |

|

|

2015 |

2016 |

2015 |

2016 |

2015 |

2016 |

|

2015 |

|

|

2016 |

|

|

Economy hotels |

1,868 |

1,868 |

161 |

160 |

|

-0.8 |

% |

177 |

175 |

|

-0.8 |

% |

|

91 |

% |

|

91 |

% |

|

0.0 |

% |

| Leased

hotels |

518 |

518 |

167 |

165 |

|

-0.9 |

% |

184 |

183 |

|

-0.5 |

% |

|

91 |

% |

|

90 |

% |

|

-0.3 |

% |

|

Manachised and franchised hotels |

1,350 |

1,350 |

159 |

157 |

|

-0.8 |

% |

173 |

171 |

|

-0.9 |

% |

|

92 |

% |

|

92 |

% |

|

0.1 |

% |

|

Midscale and upscale hotels |

182 |

182 |

245 |

263 |

|

7.5 |

% |

284 |

299 |

|

5.5 |

% |

|

86 |

% |

|

88 |

% |

|

1.6 |

% |

| Leased

hotels |

70 |

70 |

285 |

311 |

|

8.9 |

% |

317 |

339 |

|

6.9 |

% |

|

90 |

% |

|

92 |

% |

|

1.6 |

% |

|

Manachised and franchised hotels |

112 |

112 |

207 |

218 |

|

5.7 |

% |

250 |

259 |

|

3.7 |

% |

|

83 |

% |

|

84 |

% |

|

1.6 |

% |

|

Total |

2,050 |

2,050 |

171 |

172 |

|

0.5 |

% |

188 |

189 |

|

0.4 |

% |

|

91 |

% |

|

91 |

% |

|

0.2 |

% |

About China Lodging Group, Limited

China Lodging Group, Limited is a leading hotel

operator and franchisor in China under 12 brand names. As of

September 30, 2016, the Company had 3,198 hotels or 322,785 rooms

in operation in 365 cities. With a primary focus on economy and

midscale hotel segments, China Lodging Group’s brands include Hi

Inn, HanTing Hotel, Elan Hotel, JI Hotel, Starway Hotel, Joya

Hotel, and Manxin Hotels & Resorts. The Company also has the

rights as master franchisee for Mercure, Ibis and Ibis Styles, and

co-development rights for Grand Mercure and Novotel, in Pan-China

region.

The Company’s business includes leased,

manachised and franchised models. Under the lease model, the

Company directly operates hotels typically located on leased

properties. Under the manachise model, the Company manages

manachised hotels through the on-site hotel managers it appoints

and collects fees from franchisees. Under the franchise model, the

Company provides training, reservation and support services to the

franchised hotels and collects fees from franchisees but does not

appoint on-site hotel managers. The Company applies a consistent

standard and platform across all of its hotels. As of September 30,

2016, China Lodging Group operates 24 percent of its hotel rooms

under lease model, 76 percent under manachise and franchise

models.

For more information, please visit the Company’s

website: http://ir.huazhu.com.

Safe Harbor Statement Under the Private

Securities Litigation Reform Act of 1995: The information in this

release contains forward-looking statements which involve risks and

uncertainties. Such factors and risks include our anticipated

growth strategies; our future results of operations and financial

condition; the economic conditions of China; the regulatory

environment in China; our ability to attract customers and leverage

our brand; trends and competition in the lodging industry; the

expected growth of the lodging market in China; and other factors

and risks detailed in our filings with the Securities and Exchange

Commission. Any statements contained herein that are not statements

of historical fact may be deemed to be forward-looking statements,

which may be identified by terminology such as “may,” “should,”

“will,” “expect,” “plan,” “intend,” “anticipate,” “believe,”

“estimate,” “predict,” “potential,” “forecast,” “project,” or

“continue,” the negative of such terms or other comparable

terminology. Readers should not rely on forward-looking statements

as predictions of future events or results.

The Company undertakes no obligation to update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, unless required by

applicable law.

Contact Information

Ida Yu

Sr. Manager of Investor Relations

Tel: 86 (21) 6195 9561

Email: ir@huazhu.com

http://ir.huazhu.com

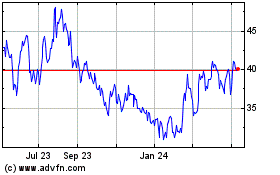

H World (NASDAQ:HTHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

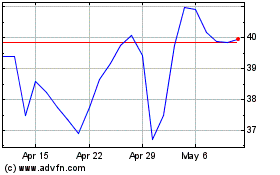

H World (NASDAQ:HTHT)

Historical Stock Chart

From Apr 2023 to Apr 2024