false

0000885462

0000885462

2024-12-17

2024-12-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act 1934

Date of Report (date of earliest event reported):

December 17, 2024

Gulf Resources, Inc.

(Exact name of registrant as specified in charter)

Nevada

(State or other jurisdiction of incorporation)

|

000-20936

(Commission File Number) |

13-3637458

(IRS Employer Identification No.) |

Level 11,Vegetable Building, Industrial Park

of the East City,

Shouguang City, Shandong, China 262700

________________________________________________

(Address of principal executive offices and zip

code)

+86 (536) 567 0008

________________________________________________

(Registrant's telephone number including area code)

________________________________________________

(Registrant's former name or former address, if

changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, $0.0005 par value |

|

GURE |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 17, 2024, a wholly owned subsidiary

of Gulf Resources, Inc. (the “Registrant” or the “Company”), Shouguang Hengde Salt Industry Co. Ltd ( “SHSI”

or “Party B”), entered into an amendment to the Crude Salt Field Acquisition Agreement (the “Acquisition Agreement 1”)

with Shouguang Qingshuibo Farm Co., LTD. (“Party A 1”), pursuant to which the Article 2. 2 of the Acquisition Agreement 1

has been amended as follows: Eighty percent (80%) of the total amount, equaling RMB103,577,600 had been paid on the date of signing the

contract by both parties. The remaining RMB25,894,400 shall be paid in a combination of common stock of Party B’s parent company,

Gulf Resources, Inc. (the “Shares”), and cash as follows: (1) RMB10,357,800 shall be paid in the Shares, calculated on a per

share price of US$1.5, using the exchange rate RMB/US$:7.27. These shares shall be issued by Gulf Resources, Inc. to Party A 1 or Party

A 1's designated parties within three months after Party B has inspected and accepted the crude salt field in writing; (2) the balance

shall be paid in cash by Party B to Party A 1 before December 31, 2028.

On December 17, 204, SHSI entered into an amendment

to the Crude Salt Field Acquisition Agreement (the “Acquisition Agreement 2”) with Shouguang city Yangkou Town Dingjia Zhuangzi

Village Stock Economic Cooperative (“Party A 2”), pursuant to which the Article 2. 2 of the Acquisition Agreement 2 has been

amended as follows: (80%) of the total amount, equaling RMB32,460,000 had been paid on the date of signing the contract by both parties.

The remaining RMB8,115,000 shall be paid in a combination of common stock of Party B’s parent company, Gulf Resources, Inc. (the

“Shares”), and cash as follows: (1) RMB3,246,000 shall be paid in the Shares, calculated on a per share price of US$1.5, using

the exchange rate RMB/US$:7.27. These shares shall be issued by Gulf Resources, Inc. to Party A 2 or Party A 2's designated parties within

three months after Party B has inspected and accepted the crude salt field in writing; (2) the balance shall be paid in cash by Party

B to Party A 2 before December 31, 2028.

On December 17, 204, SHSI entered into an amendment

to Crude Salt Field Acquisition Agreement (the “Acquisition Agreement 3”) with Shouguang city Yangkou town Renjia Zhuangzi

village stock economic cooperative (“Party A 3”), pursuant to which the Article 2. 2 of the Acquisition Agreement 3 has been

amended as follows: Eighty percent (80%) of the total amount, equaling RMB36,628,320 had been paid on the date of signing the contract

by both parties. The remaining RMB9,157,080 shall be paid in a combination of common stock of Party B’s parent company, Gulf Resources,

Inc. (the “Shares”), and cash as follows: (1) RMB3,662,832 shall be paid in the Shares, calculated on a per share price of

US$1.5, using the exchange rate RMB/US$:7.27. These shares shall be issued by Gulf Resources, Inc. to Party A 3 or Party A 3's designated

party within three months after Party B has inspected and accepted the crude salt field in writing; (2) the balance shall be paid in cash

by Party B to Party A 3 before December 31, 2028.

On December 17, 204, SHSI entered into an amendment

to Crude Salt Field Acquisition Agreement (the “Acquisition Agreement 4”) with Shouguang city Yangkou town Shanjia Zhuangzi

village stock economic cooperative (“Party A 4”), pursuant to which the Article 2. 2 of the Acquisition Agreement 4 has been

amended as follows: Eighty percent (80%) of the total amount, equaling RMB35,311,680 had been paid on the date of signing the contract

by both parties. The remaining RMB8,827,920 shall be paid in a combination of common stock of Party B’s parent company, Gulf Resources,

Inc. (the “Shares”), and cash as follows: (1) RMB3,531,168 shall be paid in Shares, calculated on a per share price of US$1.5

per, using the exchange rate RMB/US$:7.27. These shares shall be issued by Gulf Resources, Inc. to Party A 4 or Party A 4's designated

parties within three months after Party B has inspected and accepted the crude salt field in writing; (2) the balance shall be paid in

cash by Party B to Party A 4 before December 31, 2028.

On December 17, 204, SHSI entered into an amendment

to Crude Salt Field Acquisition Agreement (the “Acquisition Agreement 5”) with Shouguang city Yangkou town Zhengjia Zhuangzi

village stock economic cooperative (“Party A 5”), pursuant to which the Article 2. 2 of the Acquisition Agreement 5 has been

amended as follows: Eighty percent (80%) of the total amount, equaling RMB 16,632,000 had been paid on the date of signing the contract

by both parties. The remaining RMB 4,158,000 shall be paid in a combination of common stock of Party B’s parent company, Gulf Resources,

Inc. (the “Shares”), and cash as follows: (1) RMB1,663,200 shall be paid in the Shares, calculated on a per share price ofUS$1.5,

using the exchange rate RMB/US$:7.27. These shares shall be issued by Gulf Resources, Inc. to Party A 5 or Party A 5's designated parties

within three months after Party B has inspected and accepted the crude salt field in writing; (2) the balance shall be paid in cash by

Party B to Party A 5 before December 31, 2028.

In accordance to each amendment, the parties to

each of the Acquisition Agreements also acknowledged and agreed that, in compliance with the NASDAQ Listing Rule 5635, the issuance of

Shares pursuant to this Agreement may not exceed 19.9% of the total outstanding shares of common stock of Gulf Resources, Inc. prior to

the issuance of the Shares (the “19.9% Threshold”), unless such issuance is approved by the shareholders of Gulf Resources,

Inc. in accordance with the NASDAQ rules and regulations. Party B shall cause Gulf Resources Inc. to take all necessary steps to obtain

such shareholder approval if the issuance of Shares under this Agreement exceeds the 19.9% Threshold.

The foregoing descriptions of agreements and the

transactions contemplated thereby are not complete and are subject to and qualified in their entirety by reference to the amendments,

copies of which are filed with this Current Report on Form 8-K as Exhibit 10.1, Exhibit 10.2, Exhibit 10.3, Exhibit 10.4, and Exhibit

10.5, respectively, the terms of which are incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

| Exhibit Number |

Description |

| 10.1 |

Amendment to Crude Salt Field Acquisition Agreement by and between Shouguang Hengde Salt Industry Co. Ltd and Shouguang Qingshuibo Farm Co., LTD, dated December 17, 2024. |

| 10.2 |

Amendment to Crude Salt Field Acquisition Agreement by and between Shouguang Hengde Salt Industry Co. Ltd and Shouguang city Yangkou town Dingjia Zhuangzi village stock economic cooperative, dated December 17, 2024. |

| 10.3 |

Amendment to Crude Salt Field Acquisition Agreement by and between Shouguang Hengde Salt Industry Co. Ltd and Shouguang city Yangkou town Shanjia Zhuangzi village stock economic cooperative, dated December 17, 2024. |

| 10.4 |

Amendment to Crude Salt Field Acquisition Agreement by and between Shouguang Hengde Salt Industry Co. Ltd and Shouguang City Yangkou town Zhengjia Zhuangzi village stock economic cooperative, dated December 17, 2024. |

| 10.5 |

Amendment to Crude Salt Field Acquisition Agreement by and between Shouguang Hengde Salt Industry Co. Ltd and Shouguang city Yangkou town Renjia Zhuangzi village stock economic cooperative, dated December 17, 2024. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GULF RESOURCES, INC. |

| |

|

|

| |

By: |

/s/ Min Li |

| |

Name: |

Min Li |

| |

Title: |

Chief Financial Officer |

Dated: December 19, 2024

Amendment to Crude Salt Field Acquisition Agreement

Transferor: Shouguang Qingshuibo Farm Co.,

LTD. (hereinafter referred to as Party A)

Registered address: 2000 meters north of the intersection

of Nanhai Road and Yangu Road, Shuangwang City Administrative Committee, Shouguang City, Weifang City, Shandong Province

Legal representative: Chang Maoming

Unified Social Credit code: Not applicable

Transferee: Shouguang Hengde Salt Industry

Co. Ltd (hereinafter referred to as Party B)

Registered address: Southwest of intersection

of Shenghai Road and Yandu Road, Yangkou Town, Shouguang City, Weifang City, Shandong Province

Legal representative: Li Min

Unified social credit code: 91370783MA7MLKPG9P

Party A and Party B hereby , through friendly

negotiation, agree to amend and modify the original contract dated June 26, 2024 (the “Original Contract”), entered into by

and between the parties as follows:

1. The original term included in the Original

Contract (the “Original Term”):

Article 2 Transfer price

and method of delivery

2. Terms of payment: 80%

of the total amount shall be paid on the date of signing the contract by both parties, that is, RMB103,577,600. The remaining amount of

RMB25,894,400 shall be paid in shares of common stock of Party B’s parent company, Gulf Resources, Inc. Pay to Party A or Party

A's designated personnel within three months after Party B has inspected and accepted the crude salt field in writing.

2. The Original Term is hereby deleted in its

entirety and replaced by the following term:

Article 2 Transfer price

and method of delivery

2. Terms of payment:

Eighty percent (80%) of the total amount, equaling RMB 103,577,600 had been paid on the date of signing the contract by both parties.

The remaining RMB 25,894,400 shall be paid in a combination of common stock of Party B’s parent company, Gulf Resources, Inc. (the

“Shares”), and cash as follows: (1) RMB10,357,800 shall be paid in the Shares, calculated on a per share price of US$1.5,

using the exchange rate RMB/US$:7.27. These shares shall be issued by Gulf Resources, Inc. to Party A or Party A's designated parties

within three months after Party B has inspected and accepted the crude salt field in writing; (2) the balance shall be paid in cash by

Party B to Party A before December 31, 2028.

Notwithstanding anything

to the contrary herein, the parties to the Agreement acknowledge and agree that, in compliance with the NASDAQ Listing Rule 5635, the

issuance of Shares pursuant to this Agreement may not exceed 19.9% of the total outstanding shares of common stock of Gulf Resources,

Inc. prior to the issuance of the Shares (the “19.9% Threshold”), unless such issuance is approved by the shareholders of

Gulf Resources, Inc. in accordance with the NASDAQ rules and regulations. Party B shall cause Gulf Resources Inc. to take all necessary

steps to obtain such shareholder approval if the issuance of Shares under this Agreement exceeds the 19.9% Threshold.

If Party B determines that

the issuance of the Shares would exceed the 19.9% Threshold and Shareholder Approval is not obtained, the parties shall limit the number

of Shares being issued to ensure that the number of Shares being issued does not exceed the 19.9% Threshold. In the event that Shareholder

Approval is not obtained, the parties shall adjust the transaction structure to comply with the NASDAQ Listing Rules, including reducing

the number of Shares to be issued or otherwise modifying the terms of the acquisition as necessary.

3. Except as specifically set forth herein, all

other terms and conditions of the Original Contract remain in full force and effect.

4. This Agreement shall come into force upon being

signed and sealed by both parties.

| Party A (Seal): |

Party B (seal) : |

| |

|

| Signature: /s/ Chang Maomin |

Signature: /s/ Min Li |

| |

|

| Date: December 17, 2024 |

Date: December 17, 2024 |

Amendment to Crude Salt Field Acquisition Agreement

Transferor: Shouguang city Yangkou town Dingjia

Zhuangzi village stock economic cooperative (hereinafter referred to as Party A)

Registered address: Shouguang City Dingjia

Zhuangzi village yard

Legal representative: Ding Zhanxian

Unified Social Credit code: Not applicable

Transferee: Shouguang Hengde Salt Industry

Co. Ltd (hereinafter referred to as Party B)

Registered address: Southwest of intersection

of Shenghai Road and Yandu Road, Yangkou Town, Shouguang City, Weifang City, Shandong Province

Legal representative: Li Min

Unified social credit code: 91370783MA7MLKPG9P

Party A and Party B hereby, through friendly negotiation,

agree to amend and modify the original contract dated June 27, 2024 (the “Original Contract”), entered into by and between

the parties as follows:

1. The original term included in the Original

Contract (the “Original Term”):

Article 2 Transfer price

and method of delivery

2. Terms of payment: 80%

of the total amount shall be paid on the date of signing the contract by both parties, that is, RMB 32,460,000. The remaining amount of

RMB 8,115,000 shall be paid in shares of common stock of Party B’s parent company, Gulf Resources, Inc. Pay to Party A or Party

A's designated personnel within three months after Party B has inspected and accepted the crude salt field in writing.

2. The Original Term is hereby deleted in its

entirety and replaced by the following term:

Article 2 Transfer price

and method of delivery

2.Terms of payment: Eighty

percent (80%) of the total amount, equaling RMB 32,460,000 had been paid on the date of signing the contract by both parties. The remaining

RMB8,115,000 shall be paid in a combination of common stock of Party B’s parent company, Gulf Resources, Inc. (the “Shares”),

and cash as follows: (1) RMB3,246,000 shall be paid in the Shares, calculated on a per share price of US$1.5, using the exchange rate

RMB/US$:7.27. These shares shall be issued by Gulf Resources, Inc. to Party A or Party A's designated parties within three months after

Party B has inspected and accepted the crude salt field in writing; (2) the balance shall be paid in cash by Party B to Party A before

December 31, 2028.

Notwithstanding anything

to the contrary herein, the parties to the Agreement acknowledge and agree that, in compliance with the NASDAQ Listing Rule 5635, the

issuance of Shares pursuant to this Agreement may not exceed 19.9% of the total outstanding shares of common stock of Gulf Resources,

Inc. prior to the issuance of the Shares (the “19.9% Threshold”), unless such issuance is approved by the shareholders of

Gulf Resources, Inc. in accordance with the NASDAQ rules and regulations. Party B shall cause Gulf Resources Inc. to take all necessary

steps to obtain such shareholder approval if the issuance of Shares under this Agreement exceeds the 19.9% Threshold.

If Party B determines that

the issuance of the Shares would exceed the 19.9% Threshold and Shareholder Approval is not obtained, the parties shall limit the number

of Shares being issued to ensure that the number of Shares being issued does not exceed the 19.9% Threshold. In the event that Shareholder

Approval is not obtained, the parties shall adjust the transaction structure to comply with the NASDAQ Listing Rules, including reducing

the number of Shares to be issued or otherwise modifying the terms of the acquisition as necessary.

3. Except as specifically set forth herein, all

other terms and conditions of the Original Contract remain in full force and effect.

4. This Agreement shall come into force upon being

signed and sealed by both parties.

| Party A (Seal) : |

Party B (seal) : |

| |

|

| Signature: /s/ Ding Zhanxian |

Signature: /s/ Min Li |

| |

|

| Date: December 17, 2024 |

Date: December 17, 2024 |

Amendment to Crude Salt Field Acquisition Agreement

Transferor: Shouguang city Yangkou town Shanjia

Zhuangzi village stock economic cooperative (hereinafter referred to as Party A)

Registered address: Shouguang City Yangkou

town Shanjia Zhuangzi village yard

Legal representative: Ding Huasong

Unified Social Credit code: Not applicable

Transferee: Shouguang Hengde Salt Industry

Co. Ltd (hereinafter referred to as Party B)

Registered address: Southwest of intersection

of Shenghai Road and Yandu Road, Yangkou Town, Shouguang City, Weifang City, Shandong Province

Legal representative: Li Min

Unified social credit code: 91370783MA7MLKPG9P

Party A and Party B hereby, through friendly negotiation,

agree to amend and modify the original contract dated June 27, 2024 (the “Original Contract”), entered into by and between

the parties, as follows:

1. The original term included in the Original

Contract (the “Original Term”):

Article 2 Transfer price

and method of delivery

2. Terms of payment: 80%

of the total amount shall be paid on the date of signing the contract by both parties, that is, RMB 35,311,680. The remaining amount of

RMB 8,827,920 shall be paid in shares of common stock of Party B’s parent company, Gulf Resources, Inc. Pay to Party A or Party

A's designated personnel within three months after Party B has inspected and accepted the crude salt field in writing.

2. The Original Term is hereby deleted in its

entirety and replaced by the following term:

Article 2 Transfer price

and method of delivery

2.Terms of payment: Eighty

percent (80%) of the total amount, equaling RMB 35,311,680 had been paid on the date of signing the contract by both parties. The remaining

RMB8,827,920 shall be paid in a combination of common stock of Party B’s parent company, Gulf Resources, Inc. (the “Shares”),

and cash as follows: (1) RMB3,531,168 shall be paid in Shares, calculated on a per share price of US$1.5 per, using the exchange rate

RMB/US$:7.27. These shares shall be issued by Gulf Resources, Inc. to Party A or Party A's designated parties within three months after

Party B has inspected and accepted the crude salt field in writing; (2) the balance shall be paid in cash by Party B to Party A before

December 31, 2028.

Notwithstanding anything

to the contrary herein, the parties to the Agreement acknowledge and agree that, in compliance with the NASDAQ Listing Rule 5635, the

issuance of Shares pursuant to this Agreement may not exceed 19.9% of the total outstanding shares of common stock of Gulf Resources,

Inc. prior to the issuance of the Shares (the “19.9% Threshold”), unless such issuance is approved by the shareholders of

Gulf Resources, Inc. in accordance with the NASDAQ rules and regulations. Party B shall cause Gulf Resources Inc. to take all necessary

steps to obtain such shareholder approval if the issuance of Shares under this Agreement exceeds the 19.9% Threshold.

If Party B determines that

the issuance of the Shares would exceed the 19.9% Threshold and Shareholder Approval is not obtained, the parties shall limit the number

of Shares being issued to ensure that the number of Shares being issued does not exceed the 19.9% Threshold. In the event that Shareholder

Approval is not obtained, the parties shall adjust the transaction structure to comply with the NASDAQ Listing Rules, including reducing

the number of Shares to be issued or otherwise modifying the terms of the acquisition as necessary.

3. Except as specifically set forth herein, all

other terms and conditions of the Original Contract remain in full force and effect.

4. This Agreement shall come into force upon being

signed and sealed by both parties.

| Party A (Seal) : |

Party B (seal) : |

| |

|

| Signature: /s/ Ding Huasong |

Signature: /s/ Min Li |

| |

|

| Date: December 17, 2024 |

Date: December 17, 2024 |

Amendment to Crude Salt Field Acquisition Agreement

Transferor: Shouguang city Yangkou town Zhengjia

Zhuangzi village stock economic cooperative (hereinafter referred to as Party A)

Registered address: Shouguang City Zhengjia

Zhuangzi village yard

Legal representative: Zhang Yugang

Unified Social Credit code: Not applicable

Transferee: Shouguang Hengde Salt Industry

Co. Ltd (hereinafter referred to as Party B)

Registered address: Southwest of intersection

of Shenghai Road and Yandu Road, Yangkou Town, Shouguang City, Weifang City, Shandong Province

Legal representative: Li Min

Unified social credit code: 91370783MA7MLKPG9P

Party A and Party B hereby, through friendly negotiation,

agree to amend and modify the original contract dated June 27, 2024 (the “Original Contract”), entered into by and between

the parties as follows:

1. The original term included in the Original

ContractModify the Content (the “Original Term”):

Article 2 Transfer price

and method of delivery

2. Terms of payment: 80%

of the total amount shall be paid on the date of signing the contract by both parties, that is, RMB 16,632,000. The remaining amount of

RMB 4,158,000 shall be paid in shares of common stock of Party B’s parent company, Gulf Resources, Inc. Pay to Party A or Party

A's designated personnel within three months after Party B has inspected and accepted the crude salt field in writing.

2. The Original Term is hereby deleted in its

entirety and replaced by the following term:

Article 2 Transfer price

and method of delivery

2.Terms of payment: Eighty

percent (80%) of the total amount, equaling RMB 16,632,000 had been paid on the date of signing the contract by both parties. The remaining

RMB 4,158,000 shall be paid in a combination of common stock of Party B’s parent company, Gulf Resources, Inc. (the “Shares”),

and cash as follows: (1) RMB1,663,200 shall be paid in the Shares, calculated on a per share price ofUS$1.5, using the exchange rate RMB/US$:7.27.

These shares shall be issued by Gulf Resources, Inc. to Party A or Party A's designated parties within three months after Party B has

inspected and accepted the crude salt field in writing; (2) the balance shall be paid in cash by Party B to Party A before December 31,

2028.

Notwithstanding anything

to the contrary herein, the parties to the Agreement acknowledge and agree that, in compliance with the NASDAQ Listing Rule 5635, the

issuance of Shares pursuant to this Agreement may not exceed 19.9% of the total outstanding shares of common stock of Gulf Resources,

Inc. prior to the issuance of the Shares (the “19.9% Threshold”), unless such issuance is approved by the shareholders of

Gulf Resources, Inc. in accordance with the NASDAQ rules and regulations. Party B shall cause Gulf Resources Inc. to take all necessary

steps to obtain such shareholder approval if the issuance of Shares under this Agreement exceeds the 19.9% Threshold.

If Party B determines that

the issuance of the Shares would exceed the 19.9% Threshold and Shareholder Approval is not obtained, the parties shall limit the number

of Shares being issued to ensure that the number of Shares being issued does not exceed the 19.9% Threshold. In the event that Shareholder

Approval is not obtained, the parties shall adjust the transaction structure to comply with the NASDAQ Listing Rules, including reducing

the number of Shares to be issued or otherwise modifying the terms of the acquisition as necessary.

3. Except as specifically set forth herein, all

other terms and conditions of the Original Contract remain in full force and effect.

4. This Agreement shall come into force upon being

signed and sealed by both parties.

| Party A (Seal) : |

Party B (seal) : |

| |

|

| Signature: /s/ Zhang

Yugang |

Signature: /s/ Min Li |

| |

|

| Date: December 17, 2024 |

Date: December 17, 2024 |

Amendment to Crude Salt Field Acquisition Agreement

Transferor: Shouguang city Yangkou town Renjia

Zhuangzi village stock economic cooperative (hereinafter referred to as Party A)

Registered address: Shouguang City Renjia Zhuangzi

village yard

Legal representative: Ren Zhenyi

Unified Social Credit code: Not applicable

Transferee: Shouguang Hengde Salt Industry

Co. Ltd (hereinafter referred to as Party B)

Registered address: Southwest of intersection

of Shenghai Road and Yandu Road, Yangkou Town, Shouguang City, Weifang City, Shandong Province

Legal representative: Li Min

Unified social credit code: 91370783MA7MLKPG9P

Party A and Party B hereby , through friendly

negotiation, agree to amend and modify the original contract dated June 27, 2024 (the “Original Contract”), entered into by

and between the parties as follows:

1. The original term included in the Original

Contract (the “Original Term”):

Article 2 Transfer price

and method of delivery

2. Terms of payment: 80%

of the total amount shall be paid on the date of signing the contract by both parties, that is, RMB 36,628,320. The remaining amount of

RMB 9,157,080 shall be paid in shares of common stock of Party B’s parent company, Gulf Resources, Inc. Pay to Party A or Party

A's designated personnel within three months after Party B has inspected and accepted the crude salt field in writing.

2. The Original Term is hereby deleted in its

entirety and replaced by the following term:

Article 2 Transfer price

and method of delivery

2. Terms of payment: Eighty

percent (80%) of the total amount, equaling RMB36,628,320 had been paid on the date of signing the contract by both parties. The remaining

RMB9,157,080 shall be paid in a combination of common stock of Party B’s parent company, Gulf Resources, Inc. (the “Shares”),

and cash as follows: (1) RMB3,662,832 shall be paid in the Shares, calculated on a per share price of US$1.5, using the exchange rate

RMB/US$:7.27. These shares shall be issued by Gulf Resources, Inc. to Party A or Party A's designated party within three months after

Party B has inspected and accepted the crude salt field in writing; (2) the balance shall be paid in cash by Party B to Party A before

December 31, 2028.

Notwithstanding anything

to the contrary herein, the parties to the Agreement acknowledge and agree that, in compliance with the NASDAQ Listing Rule 5635, the

issuance of Shares pursuant to this Agreement may not exceed 19.9% of the total outstanding shares of common stock of Gulf Resources,

Inc. prior to the issuance of the Shares (the “19.9% Threshold”), unless such issuance is approved by the shareholders of

Gulf Resources, Inc. in accordance with the NASDAQ rules and regulations. Party B shall cause Gulf Resources Inc. to take all necessary

steps to obtain such shareholder approval if the issuance of Shares under this Agreement exceeds the 19.9% Threshold.

If Party B determines that

the issuance of the Shares would exceed the 19.9% Threshold and Shareholder Approval is not obtained, the parties shall limit the number

of Shares being issued to ensure that the number of Shares being issued does not exceed the 19.9% Threshold. In the event that Shareholder

Approval is not obtained, the parties shall adjust the transaction structure to comply with the NASDAQ Listing Rules, including reducing

the number of Shares to be issued or otherwise modifying the terms of the acquisition as necessary.

3. Except as specifically set forth herein, all

other terms and conditions of the Original Contract remain in full force and effect.

4. This Agreement shall come into force upon being

signed and sealed by both parties.

| Party A (Seal) : |

Party B (seal) : |

| |

|

| Signature: /s/ Ren

Zhenyi |

Signature: /s/ Min Li |

| |

|

| Date: December 17, 2024 |

Date: December 17, 2024 |

v3.24.4

Cover

|

Dec. 17, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 17, 2024

|

| Entity File Number |

000-20936

|

| Entity Registrant Name |

Gulf Resources, Inc.

|

| Entity Central Index Key |

0000885462

|

| Entity Tax Identification Number |

13-3637458

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

Level 11,Vegetable Building

|

| Entity Address, Address Line Two |

Industrial Park

of the East City

|

| Entity Address, City or Town |

Shouguang City

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

262700

|

| City Area Code |

+86 (536)

|

| Local Phone Number |

567 0008

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0005 par value

|

| Trading Symbol |

GURE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

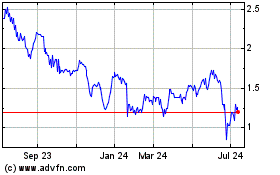

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Dec 2024 to Jan 2025

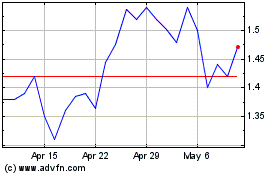

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Jan 2024 to Jan 2025