Dusan Senkypl - Co-Founder of Pale Fire Capital

- Appointed Interim CEO, Effective Immediately

Focus On Operational Excellence to Unlock

Groupon’s Potential

Groupon, Inc. (NASDAQ: GRPN), a leading destination for local

services & experiences, announced that its Board of Directors

(Board) has appointed Dusan Senkypl, co-founder of Pale Fire

Capital and a member of the Board, to the role of interim Chief

Executive Officer, effective immediately. Mr. Senkypl, who will be

based in the Czech Republic, will remain on the Groupon Board of

Directors. Mr. Senkypl succeeds Kedar Deshpande, who has stepped

down as CEO and Director of Groupon and will serve as an advisor to

the company for 60 days to aid in a smooth transition.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230330005803/en/

Dusan Senkypl, co-founder of Pale Fire

Capital and a member of the Groupon Board of Directors, has been

appointed to the role of Groupon's interim Chief Executive Officer,

effective immediately. (Photo: Business Wire)

“Dusan is a proven leader and operator and his experiences

leading transformations, building successful internet products and

helping grow a marketplace similar to Groupon uniquely position him

to step in as our interim CEO at this critical time,” said Ted

Leonsis, Chairman of the Groupon Board of Directors. “Since he

joined the Board, Dusan has been very engaged as a director,

providing important oversight on Groupon’s strategy and strengths

and helping the company identify areas in need of improvement.

Given this, we believe that he will seamlessly transition into this

new leadership role and help the company execute against and

continue to refine the supply-led transformation strategy we

announced during our fourth quarter earnings call. The Board is

focused on accelerating Groupon’s transformation and we are

confident that Dusan can help us reach this important goal. We are

very excited to see the progress the company can make this year

with Dusan as interim CEO.”

“I have a deep appreciation for the dedication that has gone

into building this company and am honored to guide Groupon through

its transformation and turnaround,” said Mr. Senkypl. “With unique

local inventory, over 14 million active local customers and

millions of visitor sessions per month, Groupon has valuable assets

capable of fueling significant growth when paired with operational

excellence. I am excited to build on that foundation to further

scale the company’s marketplace and drive increased value for all

stakeholders. I have built multiple businesses from the ground up

that operated at scale with hundreds of millions of users, and I

believe I know what we need to do at Groupon to take the company to

the next level.”

Mr. Senkypl added, “After the January restructuring announcement

and with the recent amendment to our credit facility, the company

has a solid financial foundation to support our transformation this

year. From my perspective, Groupon has a clear target environment

where the business can compete and win. Our vision is to become the

ultimate destination for local services and experiences, a

marketplace where trust and value are core to our consumer and

merchant value propositions. We operate in a large and attractive

market and Groupon is uniquely positioned to extend its market

leadership. I believe that we have the right assets in place to

transform, but we need to do a much better job of incorporating

operational excellence into everything we do. We are taking steps

to ensure that we have the strong management team and operating

systems in place to empower Groupon to make bolder decisions more

quickly and ensure that our global team has the utmost clarity on

our initiatives and goals. As we improve our execution by following

a comprehensive transformation plan, I believe we can increase the

value we deliver to our customers and merchant partners, and return

the company to growth. I look forward to working closely with the

Board and the talented team at Groupon to delight customers, help

hard working merchant-partners grow their businesses and build an

enduring brand and category leader.”

“It has been a tremendous honor to serve as the CEO of Groupon

and I am proud of the goals our team has accomplished together,

including a significant reduction of our fixed cost structure. I

look forward to watching the company continue to transform into the

ultimate destination for local services and experiences under

Dusan’s leadership,” said Kedar Deshpande.

About Dusan Senkypl

Dusan Senkypl is joining Groupon from Pale Fire Capital,

Groupon’s largest shareholder that holds nearly 22% of shares

outstanding. Pale Fire is an entrepreneurial investment firm with

~$1 billion in AUM and two established investment strategies in

technology private equity and global macro hedge fund. Its private

equity portfolio includes ~30 B2C and marketplace companies. Dusan

co-founded Pale Fire Capital in 2015 and serves as Chairman and

CEO. In conjunction with his appointment to Groupon CEO, Dusan will

be stepping down from day-to-day responsibilities at Pale Fire

Capital.

Dusan is an entrepreneur by trade. Prior to Pale Fire, Dusan

created several global ecommerce and technology projects used by

more than 250 million of users. He built ePojisteni.cz and

NetBrokers Holding, a dominant fintech player with more than 500

employees, which was bought by German media group Bauer Media in

2018. He enjoys sports and dedicates a portion of his time to

non-profit projects.

About Groupon

Groupon (www.groupon.com) (NASDAQ: GRPN) is a trusted local

marketplace where consumers go to buy services and experiences that

make life more interesting and deliver boundless value. To find out

more about Groupon, please visit

https://about.groupon.com/press.

Forward Looking Statements

The statements contained in this release that refer to plans and

expectations for the next quarter, the full year or the future are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, including statements

regarding our future results of operations and financial position,

business strategy and plans and our objectives for future

operations and future liquidity. The words "may," "will," "should,"

"could," "expect," "anticipate," "believe," "estimate," "intend,"

"continue" and other similar expressions are intended to identify

forward-looking statements. We have based these forward looking

statements largely on current expectations and projections about

future events and financial trends that we believe may affect our

financial condition, results of operations, business strategy,

short-term and long-term business operations and objectives, and

financial needs. These forward-looking statements involve risks and

uncertainties that could cause our actual results to differ

materially from those expressed or implied in our forward-looking

statements. Such risks and uncertainties include, but are not

limited to, our ability to execute, and achieve the expected

benefits of our go-forward strategy; execution of our business and

marketing strategies; volatility in our operating results;

challenges arising from our international operations, including

fluctuations in currency exchange rates, legal and regulatory

developments in the jurisdictions in which we operate and

geopolitical instability resulting from the conflict in Ukraine;

global economic uncertainty, including as a result of inflationary

pressures, ongoing impacts from the COVID-19 pandemic and labor and

supply chain challenges; retaining and adding high quality

merchants and third-party business partners; retaining existing

customers and adding new customers; competing successfully in our

industry; providing a strong mobile experience for our customers;

managing refund risks; retaining and attracting members of our

executive and management teams and other qualified employees and

personnel; customer and merchant fraud; payment-related risks; our

reliance on email, internet search engines and mobile application

marketplaces to drive traffic to our marketplace; cybersecurity

breaches; maintaining and improving our information technology

infrastructure; reliance on cloud-based computing platforms;

completing and realizing the anticipated benefits from

acquisitions, dispositions, joint ventures and strategic

investments; lack of control over minority investments; managing

inventory and order fulfillment risks; claims related to product

and service offerings; protecting our intellectual property;

maintaining a strong brand; the impact of future and pending

litigation; compliance with domestic and foreign laws and

regulations, including the CARD Act, GDPR, CPRA, other

privacy-related laws and regulation of the Internet and e-commerce;

classification of our independent contractors, agency workers or

employees; our ability to remediate our material weakness over

internal control over financial reporting; risks relating to

information or content published or made available on our websites

or service offerings we make available; exposure to greater than

anticipated tax liabilities; adoption of tax laws; our ability to

use our tax attributes; impacts if we become subject to the Bank

Secrecy Act or other anti-money laundering or money transmission

laws or regulations; our ability to raise capital if necessary; our

ability to continue as a going concern; risks related to our access

to capital and outstanding indebtedness, including our convertible

senior notes; our common stock, including volatility in our stock

price; our ability to realize the anticipated benefits from the

capped call transactions relating to our convertible senior notes;

difficulties, delays or our inability to successfully complete all

or part of the announced restructuring actions or to realize the

operating efficiencies and other benefits of such restructuring

actions; higher than anticipated restructuring charges or changes

in the timing of such restructuring charges; and those risks and

other factors discussed in Part I, Item 1A. "Risk Factors" of our

Annual Report on Form 10-K for the year ended December 31, 2022,

and our other filings with the Securities and Exchange Commission

(the "SEC"), copies of which may be obtained by visiting the

company's Investor Relations web site at investor.groupon.com or

the SEC's web site at www.sec.gov. Groupon's actual results could

differ materially from those predicted or implied and reported

results should not be considered an indication of future

performance.

You should not rely upon forward-looking statements as

predictions of future events. Although Groupon believes that the

expectations reflected in the forward-looking statements are

reasonable, it cannot guarantee that the future results, levels of

activity, performance or events and circumstances reflected in the

forward-looking statements will be achieved or occur. Moreover,

neither Groupon nor any other person assumes responsibility for the

accuracy and completeness of the forward-looking statements. The

forward-looking statements reflect our expectations as of the date

of this release. We undertake no obligation to update publicly any

forward looking statements for any reason after the date of this

release to conform these statements to actual results or to changes

in our expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230330005803/en/

Investor Relations Contacts: Jennifer Beugelmans Megan Petrous

ir@groupon.com

Media Relations Contacts: Nick Halliwell Alia Lewis

press@groupon.com

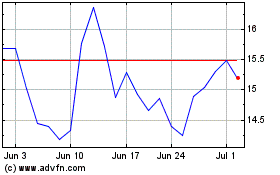

Groupon (NASDAQ:GRPN)

Historical Stock Chart

From Apr 2024 to May 2024

Groupon (NASDAQ:GRPN)

Historical Stock Chart

From May 2023 to May 2024