false

--12-31

0001743745

0001743745

2024-07-29

2024-07-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 29, 2024

GREENLANE

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38875 |

|

83-0806637 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 1095

Broken Sound Parkway Suite 100 |

|

|

| Boca

Raton FL |

|

33487 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (877) 292-7660

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A Common Stock, $0.01 par value per share |

|

GNLN |

|

Nasdaq

Global Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On

July 31, 2024, the Company filed a Certificate of Amendment (the “Certificate of Amendment”) to its Amended and Restated

Certificate of Incorporation with the Secretary of State of the State of Delaware, which will effect a 1-for-11 Reverse Split (as defined

below) of Greenlane’s issued and outstanding Class A common stock which will become effective at 12:01 AM Eastern Time on

August 5, 2024, prior to the opening of trading on The Nasdaq Global Market (“Nasdaq”). As a result of the

Reverse Split, every 11 shares of Class A common stock issued and outstanding will be converted into one share of Class A common stock.

No fractional shares will be issued in connection with the Reverse Split. All fractional shares will be rounded up to the nearest

whole number. The Reverse Split will not change the par value of the Class A common stock or the authorized number of shares of Class

A common stock. The Reverse Split will affect all shareholders uniformly and will not alter any stockholder’s percentage interest

in Greenlane’s equity (other than as a result of the rounding of fractional shares). All outstanding options, restricted

stock awards, warrants and other securities entitling their holders to purchase or otherwise receive shares of Class A common stock will

be adjusted as a result of the Reverse Split, as required by the terms of each security. Greenlane has requested that Greenlane’s

Class A common stock begin trading on August 5, 2024, on a post-reverse split basis on the Nasdaq under the existing symbol “GNLN.”

The new CUSIP number for the Class A common stock will be 395330400. The foregoing brief description is qualified in its entirety

by the text of the Certificate of Amendment, a copy of which is incorporated herein by reference as Exhibit 3.1 hereto.

Item

5.07. Submission of Matters to a Vote of Security Holders.

The

Special Meeting was held on July 29, 2024. As of the close of business on June 20, 2024, the record date for the Special Meeting, there

were 5,821,359 shares of Class A common stock, par value $0.01 per share. At the Special Meeting, the stockholders of the Company approved

the proposal presented below, which is described in detail in the Company’s Definitive Proxy Statement that was filed with the

Securities and Exchange Commission on June 28, 2024 (the “Proxy Statement”).

Holders

of 3,026,482 shares of Greenlane’s Class A common stock were present in person or represented by proxy at the Special Meeting.

The following are the voting results of the proposal submitted to Greenlane’s stockholders at the Special Meeting:

Proposal

1: To approve the adoption of an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Charter”),

to be filed not later than August 5, 2024, to effect a reverse stock split of our Class A Common Stock (as defined below) at a ratio

in the range of one-for-two to one-for-20 (collectively, the “Reverse Split”), with such ratio to be determined in the discretion

of the Board of Directors of the Company (the “Board”) and publicly disclosed prior to the effectiveness of the Reverse Split

(the “Reverse Split Proposal”).

| For |

|

Against |

|

Abstain |

| 1,837,144 |

|

1,163,604 |

|

25,734 |

Item 7.01 Regulation

FD Disclosure

On July 31, 2024, Greenlane

Holdings Inc. (the “Company”) issued a press release announcing that it has effected a 1-for-11 Reverse Split (as defined

below) of Greenlane’s issued and outstanding Class A common stock which will become effective at 12:01 AM Eastern Time on August

5, 2024, prior to the opening of trading on August 5, 2024, on the Nasdaq Capital Market (“Nasdaq”)

A copy of the press

release is furnished hereto as Exhibit 99.1 and incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

GREENLANE

HOLDINGS, INC. |

| |

|

|

| Dated:

July 31, 2024 |

By: |

/s/

Lana Reeve |

| |

|

Lana

Reeve |

| |

|

Chief

Financial and Legal Officer |

Exhibit

3.1

CERTIFICATE

OF AMENDMENT TO THE

AMENDED

AND RESTATED CERTIFICATE OF INCORPORATION OF

GREENLANE

HOLDINGS, INC.

Greenlane

Holdings, Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law

of the State of Delaware (the “General Corporation Law”), DOES HEREBY CERTIFY:

First:

The name of the corporation is Greenlane Holdings, Inc.

Second:

The date on which the Certificate of Incorporation of the Corporation was originally filed with the Secretary of State of the State of

Delaware is May 2, 2018, under the name of Greenlane Holdings, Inc.

Third:

That Article IV of the Amended and Restated Certificate of the Corporation (the “Certificate of Incorporation”),

is hereby amended by deleting Subsection A in its entirety and inserting the following in lieu thereof:

The

total number of shares of all classes of stock that the Corporation is authorized to issue is six hundred forty million (640,000,000),

consisting of (i) six hundred million (600,000,000) shares of Class A common stock, with a par value of $0.01 per share (the “Class

A Common Stock”); and (ii) thirty million (30,000,000) shares of Class B common stock, with a par value of $0.0001 per

share (the “Class B Common Stock”, and together with the Class A Common Stock, the “Common Stock”);

and (iii) ten million (10,000,000) shares of preferred stock, with a par value of $0.0001 per share (the “Preferred Stock”).

Upon this Certificate of Amendment to the Amended and Restated Certificate of Incorporation of the Corporation (this “Certificate

of Amendment”) becoming effective pursuant to the DGCL (the “Effective Time”), the shares of

Class A Common Stock issued and outstanding or held in treasury immediately prior to the Effective Time (the “Existing Class

A Common Stock”) shall be reclassified and combined into a different number of shares of Class A Common Stock (the “New

Class A Common Stock”) such that each eleven (11) shares of Existing Class A Common Stock shall, at the Effective Time,

be automatically reclassified and combined into one share of New Class A Common Stock (such reclassification and combination of shares,

the “Reverse Split”). The par value of the Class A Common Stock following the Reverse Split shall remain at

$0.01 per share. No fractional shares of Class A Common Stock shall be issued as a result of the Reverse Split, and stockholders who

otherwise would be entitled to receive fractional shares of New Class A Common Stock shall be entitled to receive the number of shares

of New Class A Common Stock rounded up to the next whole number. Each stock certificate that, immediately prior to the Effective Time,

represented shares of Existing Class A Common Stock shall, from and after the Effective Time, automatically and without any action on

the part of the Corporation or the respective holders thereof, represent that number of whole shares of New Class A Common Stock into

which the shares of Existing Class A Common Stock represented by such certificate shall have been combined (subject to rounding for fractional

shares as set forth above). Each holder of record of a certificate that represented shares of Existing Class A Common Stock shall be

entitled to receive, upon surrender of such certificate, a new certificate representing the number of whole shares of New Class A Common

Stock into which the shares of Existing Class A Common Stock represented by such certificate shall have been combined pursuant to the

Reverse Split (subject to rounding for fractional shares as set forth above), provided that the Corporation may request such stockholder

to exchange such stockholder’s certificate or certificates that represented shares Existing Class A Common Stock for shares held

in book-entry form through the Depository Trust Company’s Direct Registration System representing the appropriate number of whole

shares of New Class A Common Stock into which the shares of Existing Class A Common Stock represented by such certificate or certificates

shall have been combined. The Reverse Split shall be effected on a record holder-record holder basis, such that any fractional shares

of New Class A Common Stock resulting from the Reverse Split and held by a single record holder shall be aggregated.

Fourth:

The foregoing amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State

of Delaware.

Fifth:

That this Certificate of Amendment to the Restated Certificate of Incorporation shall be effective as of 12:01 a.m. New York City time

on the 5th day of August, 2024.

IN

WITNESS WHEREOF, this Corporation has caused this Certificate of Amendment to Amended and Restated Certificate of Incorporation to be

signed by its Chief Financial and Legal Officer this 31st day of July, 2024.

| GREENLANE HOLDINGS, INC. |

|

| |

|

|

| By: |

/s/ Lana Reeve |

|

| Name: |

Lana Reeve |

|

| Title: |

Chief Finance and Legal Officer |

|

Exhibit

99.1

GREENLANE

ANNOUNCES BOARD’S APPROVAL OF REVERSE STOCK SPLIT RATIO

July 31, 2024

BOCA

RATON, FL / ACCESSWIRE / July 31, 2024 / Greenlane Holdings, Inc. (NASDAQ:GNLN) (“Greenlane”), a global seller of premium

cannabis accessories, child-resistant packaging, and specialty vaporization products, today announced that it will effect a one-for-11

reverse stock split (“reverse split”) of its Class A common stock, par value $0.01 per share (“Class A common stock”),

that will become effective on August 5, 2024 at 12:01 AM Eastern Time, before the opening of trading on The Nasdaq Capital Market (“Nasdaq”).

Greenlane has requested that Greenlane’s Class A common stock begin trading on August 5, 2024, on a post-reverse split basis on

the Nasdaq under the existing symbol “GNLN.”

The

reverse split is primarily intended to bring Greenlane into compliance with the minimum bid price requirement for maintaining its listing

on the Nasdaq. The new CUSIP number for the Class A common stock following the reverse split will be 395330400.

At

Greenlane’s special meeting of stockholders on July 29, 2024 (the “Special Meeting”), Greenlane’s stockholders

approved the proposal to authorize Greenlane’s board of directors (the “Board”), in its sole and absolute discretion,

to file a certificate of amendment (the “Amendment”) to Greenlane’s amended and restated certificate of incorporation

to effect the reverse split at a ratio to be determined by the Board, ranging from one-for-two to one-for-20. On July 23, 2024, the Board

approved the reverse split at a ratio of one-for-11 and the Amendment has been filed with the Secretary of State of the State of Delaware,

which will become effective on August 5, 2024 at 12:01 AM Eastern Time, before the opening of trading on the Nasdaq.

The

reverse split will affect all issued and outstanding shares of Class A common Stock. All outstanding options, restricted stock awards,

warrants and other securities entitling their holders to purchase or otherwise receive shares of Class A common stock will be adjusted

as a result of the reverse split, as required by the terms of each security. The number of shares available to be awarded under Greenlane’s

Third Amended and Restated 2019 Equity Incentive Plan, will also be appropriately adjusted. Following the reverse split, the par value

of the Class A common stock will remain unchanged at $0.01 per share. The reverse split will not change the authorized number of shares

of Class A common stock or preferred stock. No fractional shares of Class A Common Stock shall be issued as a result of the Reverse Split,

and stockholders who otherwise would be entitled to receive fractional shares of New Class A Common Stock shall be entitled to receive

the number of shares of New Class A Common Stock rounded up to the next whole number. The reverse split will affect all stockholders

uniformly and will not alter any stockholder’s percentage interest in Greenlane’s equity (other than as a result of the rounding

of fractional shares, as set forth above).

The

reverse split will reduce the number of shares of Class A common stock issued and outstanding from approximately 5.8 million to approximately

..5 million.

About

Greenlane Holdings, Inc.

Founded

in 2005, Greenlane is a premier global platform for the development and distribution of premium smoking accessories, vape devices, and

lifestyle products to thousands of producers, processors, specialty retailers, smoke shops, convenience stores, and retail consumers.

We operate as a powerful family of brands, third-party brand accelerator, and an omnichannel distribution platform.

We

proudly offer our own diverse brand portfolio including Higher Standards and Groove, and our exclusively licensed Marley Natural and

K.Haring branded products. We also offer a carefully curated set of third-party products such as DaVinci Vaporizers, Storz & Bickel,

Eyce, Pax, VIBES, and CCELL through our direct sales channels and our proprietary, owned and operated e-commerce platforms which include

Vapor.com, PuffItUp.com, HigherStandards.com, and MarleyNaturalShop.com.

For

additional information, please visit: https://investor.gnln.com.

Forward

Looking Statements

Certain

matters within this press release are discussed using forward-looking language as specified in the Private Securities Litigation Reform

Act of 1995, and, as such, may involve known and unknown risks, uncertainties and other factors that may cause the actual results or

performance to differ from those projected in the forward-looking statements. These forward-looking statements include, among others,

statements relating to: the current and future performance of the Company’s business, the Company’s ability to satisfy the

various rules and requirements imposed by The Nasdaq Stock Market, unforeseen technical issues that could result in Greenlane’s

Class A common stock not trading on The Nasdaq Stock Market on a post-reverse stock split basis on August 5, 2024 as expected and the

Company’s financial outlook and expectations. For a description of factors that may cause the Company’s actual results or

performance to differ from its forward-looking statements, please review the information under the heading “Risk Factors”

included in the Company’s most recent Annual Report on Form 10-K for the year ended December 31, 2023, the Company’s Quarterly

Report on Form 10-Q for the quarterly period ended March 31, 2024, and the Company’s other filings with the SEC, which are accessible

on the SEC’s website at www.sec.gov. Undue reliance should not be placed on the forward-looking statements in this press release,

which are based on information available to Greenlane on the date hereof. Greenlane undertakes no duty to update this information unless

required by law.

Investor

Contact

ir@greenlane.com

v3.24.2

Cover

|

Jul. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 29, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-38875

|

| Entity Registrant Name |

GREENLANE

HOLDINGS, INC.

|

| Entity Central Index Key |

0001743745

|

| Entity Tax Identification Number |

83-0806637

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1095

Broken Sound Parkway

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Boca

Raton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33487

|

| City Area Code |

(877)

|

| Local Phone Number |

292-7660

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class

A Common Stock, $0.01 par value per share

|

| Trading Symbol |

GNLN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

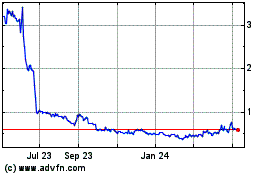

Greenlane (NASDAQ:GNLN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Greenlane (NASDAQ:GNLN)

Historical Stock Chart

From Jan 2024 to Jan 2025