Reaffirming Gen-Probe at Neutral - Analyst Blog

May 09 2011 - 2:13PM

Zacks

We maintain our Neutral recommendation on diagnostic products

maker Gen-Probe (GPRO). Revenues and earnings for

first-quarter fiscal 2011 beat the Zacks Consensus Estimates,

buoyed by healthy growth in the company’s clinical diagnostic

business. However, profit dipped year over year as revenue growth

was masked by higher costs.

Product revenues rose 6% on the back of higher sales from

clinical diagnostic products. However, the company’s blood

screening business (sales down 6%) remained lumpy, hit by lower

sales of TIGRIS systems to partner Novartis (NVS).

The California-based company backed its financial guidance for

fiscal 2011.

Gen-Probe is a dominant player in the rapidly expanding NAT

market, the fastest growing segment of the clinical diagnostic

market. It is a market leader in domestic gonorrhea and chlamydia

testing with its PACE and APTIMA assay product lines.

We believe

Gen-Probe is well placed with a slew of new products that are

expected to drive growth in the years ahead. Moreover, the

ongoing market shift away from traditional diagnostic methods

towards molecular testing represents a tailwind for the

company.

The company’s acquisition of specialty diagnostics firm GTI

Diagnostics in late 2010 represents a positive step, providing a

boost to its top line. Higher sales of GTI Diagnostics products

catalyzed double-digit growth in the clinical diagnostic business

in the first quarter.

Moreover, the company boasts a reasonably sound balance sheet

and is making prudent use of healthy free cash flows by means of

acquisitions and overseas expansion initiatives as well as

rewarding shareholders through share repurchases.

However, Gen-Probe competes with more established firms such as

Roche (RHHBY), Becton, Dickinson

(BDX) and Abbott Labs (ABT) in the maturing

molecular diagnostic industry. Moreover, the company’s clinical

diagnostics products are susceptible to reimbursement risk and its

international sales are subject to foreign exchange swings.

Gen-Probe’s struggling blood screening franchise may remain

under pressure due to a soft market condition and fewer TIGRIS

systems sold to Novartis. While new product development and

international expansions are vital for sustaining future growth,

associated high expenses (R&D investment and sales/marketing

expenses) may weigh on the company’s bottom line moving forward.

Our recommendation is supported by a short-term Zacks #3 Rank

(Hold).

ABBOTT LABS (ABT): Free Stock Analysis Report

BECTON DICKINSO (BDX): Free Stock Analysis Report

GEN-PROBE INC (GPRO): Free Stock Analysis Report

NOVARTIS AG-ADR (NVS): Free Stock Analysis Report

Zacks Investment Research

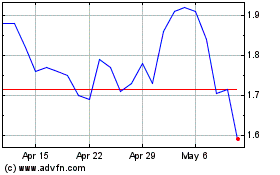

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jun 2024 to Jul 2024

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jul 2023 to Jul 2024