-- Company Posts Non-GAAP EPS of $0.52(1), Excluding

Transaction-Related Expenses, and GAAP EPS of $0.48 -- --

Acquisitions of Tepnel and Prodesse Contribute to New Quarterly and

Annual Records for Product Sales and Total Revenues -- -- Company

Generates $29.5 Million of Free Cash Flow in Quarter -- SAN DIEGO,

Feb. 18 /PRNewswire-FirstCall/ -- Gen-Probe Incorporated

(NASDAQ:GPRO) today reported financial results for the fourth

quarter of 2009, with record product sales and total revenues

driving non-GAAP earnings per share (EPS) of $0.52 and GAAP EPS of

$0.48. "Gen-Probe posted strong financial results in the fourth

quarter of 2009 based on balanced performance across our key

product areas: women's health, infectious diseases, blood screening

and transplant diagnostics," said Carl Hull, the Company's

president and chief executive officer. Key financial results for

the fourth quarter of 2009 were ($ in millions, except EPS):

Non-GAAP GAAP -------------------- ------------------- 2009 2008

Change 2009 2008 Change ---- ---- ------ ---- ---- ------ Product

sales $135.5 $105.8 +28% $135.5 $105.8 +28% Total revenues $138.9

$109.1 +27% $138.9 $109.1 +27% Operating profit $37.4 $27.2 +37%

$34.9 $27.2 +28% Net income $25.8 $21.1 +22% $24.0 $21.1 +14% EPS

$0.52 $0.39 +33% $0.48 $0.39 +23% Free cash flow(2) $29.5 $10.4

+184% $29.5 $10.4 +184% Key financial results for the full year

2009 were ($ in millions, except EPS): Non-GAAP GAAP

-------------------- ------------------- 2009 2008 Change 2009 2008

Change ---- ---- ------ ---- ---- ------ Product sales $483.8

$429.2 +13% $483.8 $429.2 +13% Total revenues $498.3 $472.7 +5%

$498.3 $472.7 +5% Operating profit $131.0 $145.4 -10% $120.1 $145.4

-17% Net income $99.8 $107.0 -7% $91.8 $107.0 -14% EPS $1.95 $1.95

0% $1.79 $1.95 -8% Free cash flow $112.7 $138.9 -19% $112.7 $138.9

-19% In 2008, Gen-Probe's total revenues, net income, EPS and free

cash flow benefited from a number of non-recurring items. The two

most significant benefits were: -- $16.4 million of royalty and

license revenue ($0.20 of EPS) recorded in the first quarter of

2008 based on the settlement of patent infringement litigation

against Bayer (now Siemens Healthcare Diagnostics). -- $10.0

million of collaborative research revenue ($0.12 of EPS) recorded

from the Company's commercial partner, Novartis Diagnostics, in the

third quarter of 2008 based on the full approval by the US Food and

Drug Administration (FDA) of the PROCLEIX® ULTRIO® assay on the

TIGRIS® system. In 2009, the Company's product sales, total

revenues, net income, EPS and free cash flow benefited from $8.2

million of one-time revenue ($0.10 of EPS) recorded in the first

quarter associated with the renegotiation of the Company's

collaboration agreement with Novartis. Revenue Detail In the fourth

quarter of 2009, clinical diagnostics sales growth was driven by

transplant diagnostics and influenza products, and the APTIMA Combo

2® assay for detecting Chlamydia and gonorrhea. Compared to the

prior year period, clinical diagnostics sales also benefited from

the weaker US dollar, which added an estimated $0.8 million, or 1%,

to growth.(3) In blood screening, fourth quarter sales growth was

driven mainly by higher sales of TIGRIS instruments to Novartis,

which generally are a precursor to future assay sales. Compared to

the prior year period, blood screening sales also benefited from

the weaker US dollar, which added an estimated $1.2 million, or 2%,

to growth. Sales of research products and services in the fourth

quarter of 2009 were $4.4 million. These sales, resulting from the

Tepnel acquisition, were not included in Gen-Probe's prior year

results. Fourth quarter product sales were ($ in millions): Three

Months Ended Dec. 31, Change --------------------------- ------ As

Constant 2009 2008 Reported Currency ---- ---- -------- --------

Clinical Diagnostics $77.6 $57.7 +34% +33% Blood Screening $53.4

$48.1 +11% +9% Research Products and Services $4.4 N/A N/A N/A

----------------- ---- --- --- --- Total Product Sales $135.5

$105.8 +28% +26% For the full year 2009, clinical diagnostics sales

were negatively affected by the stronger US dollar, which reduced

growth by an estimated $2.9 million, or 1%, compared to the prior

year. In blood screening, full year 2009 sales also were negatively

affected by the stronger US dollar, which reduced growth by an

estimated $6.1 million, or 3%, compared to the prior year. Product

sales for the full year 2009 were ($ in millions): 12 Months Ended

Dec. 31, Change ------------------------ ------ As Constant 2009

2008 Reported Currency ---- ---- -------- -------- Clinical

Diagnostics $274.2 $222.9 +23% +24% Blood Screening $197.5 $206.3

-4% -1% Research Products and Services $12.0 N/A N/A N/A

----------------- ----- --- --- --- Total Product Sales $483.8

$429.2 +13% +15% Collaborative research revenues in the fourth

quarter of 2009 were $2.0 million, compared to $2.1 million in the

prior year period. For the full year 2009, collaborative research

revenues were $7.9 million, compared to $20.6 million in the prior

year. As discussed, this decrease resulted primarily from the $10.0

million milestone earned from Novartis in 2008 based on the full

FDA approval of the PROCLEIX ULTRIO assay on the TIGRIS system.

Royalty and license revenues for the fourth quarter of 2009 were

$1.4 million, compared to $1.3 million in the prior year period.

For the full year 2009, royalty and license revenues were $6.6

million, compared to $22.9 million in the prior year. As discussed,

this decrease resulted primarily from $16.4 million of revenue that

was recorded in 2008 associated with the settlement of patent

infringement litigation against Bayer. Expense Detail Gross margin

on product sales in the fourth quarter of 2009 was 67.3% on a

non-GAAP basis that excludes $0.1 million of acquisition-related

depreciation expense, compared to 69.6% in the prior year period.

This decrease resulted mainly from increased sales of low-margin

TIGRIS instruments to Novartis. For the full year 2009, gross

margin on product sales was 68.6% on a non-GAAP basis that excludes

$0.3 million of acquisition-related depreciation expense, compared

to 70.2% in the prior year. On a GAAP basis, gross margin on

product sales was 67.2% in the fourth quarter of 2009, and 68.5%

for the full year. Acquisition-related amortization expenses were

$1.9 million in the fourth quarter of 2009 and $4.1 million for the

full year, compared to $0 in the comparable periods of the prior

year. Research and development (R&D) expenses in the fourth

quarter of 2009 were $27.4 million, compared to $24.2 million in

the prior year period, an increase of 13% that resulted primarily

from expenses associated with clinical trials of the Company's HPV,

PCA3 and trichomonas assays, and from the addition of Tepnel's

R&D activities. For the full year 2009, R&D expenses were

$106.0 million, compared to $101.1 million in the prior year, an

increase of 5%. R&D expenses represented 21.3% of total

revenues in 2009, and 21.4% of total revenues in 2008. Marketing

and sales expenses in the fourth quarter of 2009 were $15.2 million

on a non-GAAP basis that excludes $0.1 million of

acquisition-related expense, compared to $11.8 million in the prior

year period, an increase of 29% that resulted primarily from the

addition of Tepnel's cost structure, and European sales force

expansion and market development efforts. For the full year 2009,

marketing and sales expenses were $53.8 million on a non-GAAP basis

that excludes $0.1 million of acquisition-related expense, compared

to $45.9 million in the prior year, an increase of 17%. On a GAAP

basis, marketing and sales expenses were $15.3 million in the

fourth quarter of 2009, and $53.9 million for the full year.

General and administrative (G&A) expenses in the fourth quarter

of 2009 were $14.5 million on a non-GAAP basis that excludes $0.4

million of transaction-related expense, compared to $13.8 million

in the prior year period. This increase of 5% resulted primarily

from the addition of Tepnel's cost structure. For the full year

2009, G&A expenses were $55.5 million on a non-GAAP basis that

excludes $6.3 million of transaction-related expense, compared to

$52.3 million in the prior year, an increase of 6%. On a GAAP

basis, G&A expenses were $14.9 million in the fourth quarter of

2009, and $61.8 million for the full year. Total other income in

the fourth quarter of 2009 was $2.3 million, compared to $3.8

million in the prior year period. This decrease of 39% resulted

primarily from lower yields on the Company's municipal bond

portfolio, and lower investment balances following the completion

of the Company's $250 million share repurchase program and the

acquisitions of Tepnel and Prodesse. For the full year 2009, total

other income was $19.7 million, compared to $15.5 million in the

prior year, an increase of 27% that resulted primarily from

realized investment gains. In the fourth quarter of 2009, Gen-Probe

generated net cash of $39.6 million from operating activities,

substantially higher than GAAP net income of $24.0 million. The

Company spent $10.1 million on property, plant and equipment in the

quarter, leading to free cash flow of $29.5 million. Gen-Probe

continues to have a strong balance sheet. As of December 31, 2009,

the Company had $501.1 million of cash, cash equivalents and

marketable securities, and $240.8 million of short-term debt. The

Company pays interest on substantially all this debt at a rate 0.6%

above the one-month London Interbank Offered Rate (LIBOR), which

was recently below 0.3%. 2010 Financial Guidance "Based on the

midpoints of our non-GAAP 2010 guidance, we expect to show solid,

double-digit growth on both the top and bottom lines, as well as

improved operating profit and very strong free cash flow," said

Herm Rosenman, Gen-Probe's senior vice president - finance, and

chief financial officer. Gen-Probe 2010 financial guidance is

described in the table below: Non-GAAP GAAP -------- ---- Total

revenues $540 to $565 million $540 to $565 million Product gross

margins 68% to 70% 68% to 70% Acquisition-related amortization N/A

$9 to $10 million Fair value adjustment of acquisition-related

contingent consideration N/A $4 to $5 million Operating margin 27%

to 28% 24.5% to 25.5% Tax rate 34% to 35% 34% to 35% Diluted shares

~ 50 million ~ 50 million EPS $2.10 to $2.25 $1.90 to $2.05 Webcast

Conference Call A live webcast of Gen-Probe's fourth quarter 2009

conference call for investors can be accessed at

http://www.gen-probe.com/ beginning at 4:30 p.m. Eastern Time

today. The webcast will be archived for at least 90 days. A

telephone replay of the call also will be available for

approximately 24 hours. The replay number is 800-509-8621 for

domestic callers and 203-369-3807 for international callers. About

Gen-Probe Gen-Probe Incorporated is a global leader in the

development, manufacture and marketing of rapid, accurate and

cost-effective molecular diagnostic products and services that are

used primarily to diagnose human diseases, screen donated human

blood, and ensure transplant compatibility. Gen-Probe has

approximately 27 years of NAT expertise, and received the 2004

National Medal of Technology, America's highest honor for

technological innovation, for developing NAT assays for blood

screening. Gen-Probe is headquartered in San Diego and employs

approximately 1,300 people. For more information, go to

http://www.gen-probe.com/. About Non-GAAP Financial Measures To

supplement Gen-Probe's financial results for the fourth quarter of

2009 and its 2010 financial guidance, in each case presented in

accordance with GAAP, Gen-Probe uses the following financial

measures defined as non-GAAP by the SEC: non-GAAP net income,

non-GAAP gross margin, non-GAAP marketing and sales expenses,

non-GAAP G&A expenses, non-GAAP operating margin, non-GAAP

income tax rate, and non-GAAP EPS. Gen-Probe's management does not,

nor does it suggest that investors should, consider such non-GAAP

financial measures in isolation from, or as a substitute for,

financial information prepared and presented in accordance with

GAAP. Gen-Probe's management believes that these non-GAAP financial

measures provide meaningful supplemental information regarding the

Company's performance by excluding certain expenses that may not be

indicative of core business results. Gen-Probe believes that both

management and investors benefit from referring to these non-GAAP

financial measures in assessing Gen-Probe's performance and when

planning, forecasting and analyzing future periods. These non-GAAP

financial measures also facilitate management's internal

comparisons to Gen-Probe's historical performance and our

competitors' operating results. Gen-Probe believes these non-GAAP

financial measures are useful to investors in allowing for greater

transparency with respect to supplemental information used by

management in its financial and operational decision making.

Further, our reconciliations of non-GAAP to GAAP operating results,

which are included on the attached tables, are presented in the

format of consolidated statements of income solely to assist a

reader in understanding the impact of the various adjustments to

our GAAP operating results, individually and in the aggregate, and

are not intended to place any undue prominence on our non-GAAP

operating results. Trademarks APTIMA, APTIMA COMBO 2 and TIGRIS are

trademarks of Gen-Probe. PROCLEIX and ULTRIO are trademarks of

Novartis. All other trademarks are the property of their owners.

Caution Regarding Forward-Looking Statements Any statements in this

news release about our expectations, beliefs, plans, objectives,

assumptions or future events or performance, including those under

the heading "2010 Financial Guidance," are not historical facts and

are forward-looking statements. These statements are often, but not

always, made through the use of words or phrases such as believe,

will, expect, anticipate, estimate, intend, plan and would. For

example, statements concerning Gen-Probe's financial condition,

possible or expected results of operations, regulatory approvals,

future milestones, growth opportunities, and plans of management

are all forward-looking statements. Forward-looking statements are

not guarantees of performance. They involve known and unknown

risks, uncertainties and assumptions that may cause actual results,

levels of activity, performance or achievements to differ

materially from those expressed or implied. Some of these risks,

uncertainties and assumptions include but are not limited to: (i)

the risk that we may not achieve our expected 2010 financial

targets, (ii) the risk that we may not integrate acquisitions, such

as Tepnel and Prodesse, successfully, (iii) the possibility that

the market for the sale of our new products, such as our PANTHER

system and PROGENSA PCA3, APTIMA HPV and APTIMA trichomonas assays,

may not develop as expected, (iv) the enhancement of existing

products and the development of new products may not proceed as

planned, (v) the risk that investigational products, including

those now in US clinical trials, may not be approved by regulatory

authorities or become commercially available in the time frame we

anticipate, or at all, (vi) the risk that we may not be able to

compete effectively, (vii) the risk that we may not be able to

maintain our current corporate collaborations and enter into new

corporate collaborations or customer contracts, (viii) our

dependence on Novartis and other third parties for the distribution

of some of our products, (ix) our dependence on a small number of

customers, contract manufacturers and single source suppliers of

raw materials, (x) changes in third-party reimbursement policies

regarding our products could adversely affect sales, (xi) changes

in government regulation or tax policy affecting our diagnostic

products could harm our sales, increase our development costs or

increase our taxes, (xii) the risk that our intellectual property

may be infringed by third parties or invalidated, and (xiii) our

involvement in patent and other intellectual property and

commercial litigation could be expensive and could divert

management's attention. This list includes some, but not all, of

the factors that could affect our ability to achieve results

described in any forward-looking statements. For additional

information about risks and uncertainties we face and a discussion

of our financial statements and footnotes, see documents we file

with the SEC, including our most recent annual report on Form 10-K

and all subsequent periodic reports. We assume no obligation and

expressly disclaim any duty to update forward-looking statements to

reflect events or circumstances after the date of this news release

or to reflect the occurrence of subsequent events. (1) In this

press release, all per share amounts are calculated on a fully

diluted basis. Non-GAAP EPS for the fourth quarter of 2009 excludes

$2.5 million of pre-tax expenses ($0.04 per share) related mainly

to the Company's acquisitions of Tepnel and Prodesse. Some totals

may not foot due to rounding. (2) Cash from operations less

purchases of property, plant and equipment. (3) In this press

release, all estimates of "constant currency" growth exclude

foreign currency fluctuations associated with revenues from

acquired companies, which were not part of Gen-Probe in 2008.

Contact: -------- Michael Watts Vice president, investor relations

and corporate communications 858-410-8673 Gen-Probe Incorporated

Consolidated Balance Sheets - GAAP (In thousands, except share and

per share data) December 31, December 31, 2009 2008 ---- ----

Assets Current assets: Cash and cash equivalents, including

restricted cash of $17 and $0 at December 31, 2009 and December 31,

2008, respectively $82,616 $60,122 Marketable securities 402,990

371,276 Trade accounts receivable, net of allowance for doubtful

accounts of $516 and $700 at December 31, 2009 and December 31,

2008, respectively 55,305 33,397 Accounts receivable - other 4,707

2,900 Inventories 61,071 54,406 Deferred income tax - short-term

16,082 7,269 Prepaid income tax 7,317 2,306 Prepaid expenses 14,747

15,094 Other current assets 4,708 6,135 ----- ----- Total current

assets 649,543 552,905 Marketable securities, net of current

portion 15,472 73,780 Property, plant and equipment, net 157,437

141,922 Capitalized software, net 12,560 13,409 Goodwill 122,247

18,621 Deferred income tax, net of current portion 8,692 12,286

Purchased intangibles, net 108,015 298 Licenses, manufacturing

access fees and other assets, net 64,601 56,310 ------ ------ Total

assets $1,138,567 $869,531 ========== ======== Liabilities and

stockholders' equity Current liabilities: Accounts payable $26,750

$16,050 Accrued salaries and employee benefits 27,093 25,093 Other

accrued expenses 18,027 4,027 Short-term borrowings 240,841 -

Deferred income tax 2,123 - Deferred revenue 3,527 1,278 -----

----- Total current liabilities 318,361 46,448 Non-current income

tax payable 5,958 4,773 Deferred income tax, net of current portion

31,912 55 Deferred revenue, net of current portion 1,978 2,333

Other long-term liabilities 13,183 2,162 Commitments and

contingencies Stockholders' equity: Preferred stock, $0.0001 par

value per share, 20,000,000 shares authorized, none issued and

outstanding - - Common stock, $0.0001 par value per share;

200,000,000 shares authorized, 49,143,798 and 52,920,971 shares

issued and outstanding at December 31, 2009 and December 31, 2008,

respectively 5 5 Additional paid-in capital 242,615 382,544

Accumulated other comprehensive income 4,616 3,055 Retained

earnings 519,939 428,156 ------- ------- Total stockholders' equity

767,175 813,760 ------- ------- Total liabilities and stockholders'

equity $1,138,567 $869,531 ========== ======== Gen-Probe

Incorporated Consolidated Statements of Income - GAAP (In

thousands, except per share data) Three Months Ended Twelve Months

Ended December 31, December 31, ------------ ------------ 2009 2008

2009 2008 ---- ---- ---- ---- Revenues: Product sales $135,470

$105,759 $483,759 $429,220 Collaborative research revenue 2,049

2,128 7,911 20,581 Royalty and license revenue 1,351 1,254 6,632

22,894 ----- ----- ----- ------ Total revenues 138,870 109,141

498,302 472,695 Operating expenses: Cost of product sales

(excluding acquisition- related intangible amortization) 44,454

32,202 152,393 128,029 Acquisition- related intangible amortization

1,894 - 4,144 - Research and development 27,428 24,158 105,970

101,099 Marketing and sales 15,306 11,780 53,853 45,850 General and

administrative 14,925 13,806 61,828 52,322 ------ ------ ------

------ Total operating expenses 104,007 81,946 378,188 327,300

------- ------ ------- ------- Income from operations 34,863 27,195

120,114 145,395 Other income/ (expense): Investment and interest

income 1,923 4,527 21,603 16,801 Interest expense (392) - (1,857) -

Other income/ (expense) 769 (683) (58) (1,333) --- ---- --- ------

Total other income, net 2,300 3,844 19,688 15,468 ----- -----

------ ------ Income before income tax 37,163 31,039 139,802

160,863 Income tax expense 13,138 9,899 48,019 53,909 ------ -----

------ ------ Net income $24,025 $21,140 $91,783 $106,954 =======

======= ======= ======== Net income per share: Basic $0.49 $0.40

$1.82 $1.98(4) ===== ===== ===== ====== Diluted $0.48 $0.39 $1.79

$1.95 ===== ===== ===== ===== Weighted average shares outstanding:

Basic 48,923 53,191 50,356 53,740 ====== ====== ====== ======

Diluted 49,458 53,823 50,965 54,785 ====== ====== ====== ====== (4)

Effective January 1, 2009, Gen-Probe adopted Financial Accounting

Standards Board guidance that addresses whether restricted stock

grants to employees have a dilutive effect on EPS. The guidance was

applied retroactively to prior periods, resulting in a $0.01

decrease in basic EPS for full year 2008. Gen-Probe Incorporated

Consolidated Statements of Income - Non-GAAP (In thousands, except

per share data) Three Months Ended December 31, 2009

----------------- Non-GAAP Adjustments GAAP -------- -----------

---- Revenues: Product sales $135,470 $- $135,470 Collaborative

research revenue 2,049 - 2,049 Royalty and license revenue 1,351 -

1,351 ----- --- ----- Total revenues 138,870 - 138,870 Operating

expenses: Cost of product sales (excluding acquisition-related

intangible amortization) 44,361 93 44,454 Acquisition-related

intangible amortization - 1,894 1,894 Research and development

27,428 - 27,428 Marketing and sales 15,209 97 15,306 General and

administrative 14,479 446 14,925 ------ --- ------ Total operating

expenses 101,477 2,530 104,007 ------- ----- ------- Income from

operations 37,393 (2,530) 34,863 Other income/(expense): Investment

and interest income 1,923 - 1,923 Interest expense (392) - (392)

Other income/(expense) 769 - 769 --- --- --- Total other income,

net 2,300 - 2,300 ----- --- ----- Income before income tax 39,693

(2,530) 37,163 Income tax expense 13,890 (752) 13,138 ------ ----

------ Net income $25,803 $(1,778) $24,025 ======= ======= =======

Net income per share: Basic $0.53 $(0.04) $0.49 ===== ====== =====

Diluted $0.52 $(0.04) $0.48 ===== ====== ===== Weighted average

shares outstanding: Basic 48,923 48,923 48,923 ====== ====== ======

Diluted 49,458 49,458 49,458 ====== ====== ====== Gen-Probe

Incorporated Consolidated Statements of Income - Non-GAAP (In

thousands, except per share data) Twelve Months Ended December 31,

2009 ----------------- Non-GAAP Adjustments GAAP --------

----------- ---- Revenues: Product sales $483,759 $- $483,759

Collaborative research revenue 7,911 - 7,911 Royalty and license

revenue 6,632 - 6,632 ----- --- ----- Total revenues 498,302 -

498,302 Operating expenses: Cost of product sales (excluding

acquisition-related intangible amortization) 152,118 275 152,393

Acquisition-related intangible amortization - 4,144 4,144 Research

and development 105,970 - 105,970 Marketing and sales 53,756 97

53,853 General and administrative 55,497 6,331 61,828 ------ -----

------ Total operating expenses 367,341 10,847 378,188 -------

------ ------- Income from operations 130,961 (10,847) 120,114

Other income/(expense): Investment and interest income 21,603 -

21,603 Interest expense (1,857) - (1,857) Other income/(expense)

(58) - (58) --- --- --- Total other income, net 19,688 - 19,688

------ --- ------ Income before income tax 150,649 (10,847) 139,802

Income tax expense 50,825 (2,806) 48,019 ------ ------ ------ Net

income $99,824 $(8,041) $91,783 ======= ======= ======= Net income

per share: Basic $1.98 $(0.16) $1.82 ===== ====== ===== Diluted

$1.95 $(0.16) $1.79 ===== ====== ===== Weighted average shares

outstanding: Basic 50,356 50,356 50,356 ====== ====== ======

Diluted 50,965 50,965 50,965 ====== ====== ====== Gen-Probe

Incorporated Consolidated Statements of Cash Flows - GAAP (In

thousands) Twelve Months Ended December 31, ------------ 2009 2008

---- ---- Operating activities: Net income $91,783 $106,954

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 40,382 34,715

Amortization of premiums on investments, net of accretion of

discounts 5,868 6,908 Stock-based compensation charges 23,420

20,663 Stock-based compensation income tax benefits 3,343 3,276

Excess tax benefit from employee stock- based compensation (2,005)

(2,493) Deferred revenue 812 (3,831) Deferred income tax (5,786)

(2,788) Gain on sale of investment in MPI - (1,600) Gain on sale of

food safety business (291) - Impairment of intangible assets -

5,086 Loss on disposal of property and equipment 221 55 Changes in

assets and liabilities: Trade and other accounts receivable

(11,303) 7,421 Inventories 2,315 (5,367) Prepaid expenses 1,218

2,325 Other current assets 1,912 (1,260) Goodwill - - Other

long-term assets (4,123) (173) Accounts payable 3,500 4,377 Accrued

salaries and employee benefits (676) 4,125 Other accrued expenses

(806) 101 Income tax payable (5,714) (499) Other long-term

liabilities 961 258 --- --- Net cash provided by operating

activities 145,032 178,253 ------- ------- Investing activities:

Proceeds from sales and maturities of marketable securities 438,601

105,994 Purchases of marketable securities (419,019) (198,691)

Purchases of property, plant and equipment (32,364) (39,348)

Capitalization of software development costs (1,290) - Purchases of

intangible assets, including licenses and manufacturing access fees

(7,341) (11,970) Net cash paid for business combinations (183,725)

- Proceeds from sale of food safety business 6,357 - Proceeds from

sale of investment in MPI - 4,100 Other assets 403 27 --- --- Net

cash used in investing activities (198,378) (139,888) --------

-------- Financing activities: Excess tax benefit from stock-based

compensation 2,005 2,493 Repurchase and retirement of restricted

stock for payment of taxes (1,716) (1,529) Repurchase and

retirement of common stock (174,847) (74,970) Proceeds from

issuance of common stock and ESPP 10,923 20,472 Borrowings, net

238,450 - ------- --- Net cash provided by (used in) financing

activities 74,815 (53,534) ------ ------- Effect of exchange rate

changes on cash and cash equivalents 1,024 (672) ---- ---- Net

increase (decrease) in cash and cash equivalents 22,494 (15,841)

Cash and cash equivalents at the beginning of year 60,122 75,963

------ ------ Cash and cash equivalents at the end of year $82,616

$60,122 ======= ======= DATASOURCE: Gen-Probe Incorporated CONTACT:

Michael Watts, Vice president, investor relations and corporate

communications of Gen-Probe Incorporated, +1-858-410-8673 Web Site:

http://www.gen-probe.com/

Copyright

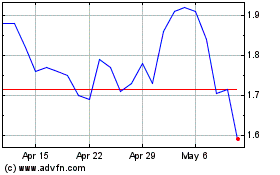

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jun 2024 to Jul 2024

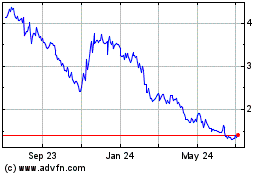

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jul 2023 to Jul 2024