Stemming from SEC Guidance Concerning Accounting Treatment of Warrants, Golden Arrow Merger Corp. Announces Receipt of Nasdaq...

June 04 2021 - 4:45PM

Golden Arrow Merger Corp. (the “Company”) today announced

that on May 28, 2021 it received a deficiency letter (the “Notice”)

from the Nasdaq Capital Market (“Nasdaq”) relating to the Company’s

failure to timely file its Quarterly Report on

Form 10-Q for the quarter ended March 31, 2021 (the

“Form 10-Q”) as required under Section 5250(c) of

the Nasdaq Rules and Regulations.

On April 12, 2021, the staff of the

Securities and Exchange Commission (“SEC”) issued “Staff Statement

on Accounting and Reporting Considerations for Warrants Issued by

Special Purpose Acquisition Companies (“SPACs”)” (the “Statement”),

which clarified guidance for all SPAC-related companies regarding

the accounting and reporting for their warrants. The immediacy of

the effective date of the new guidance set forth in the Statement

has resulted in a significant number

of SPACs re-evaluating the accounting treatment

for their warrants with their professional advisors, including

auditors and other advisors responsible for assisting SPACs in the

preparation of financial statements. This, in turn, has

resulted in the Company’s delay in preparing and finalizing its

financial statements as of and for the quarter ended March 31,

2021 and filing its Form 10-Q with the SEC by the

prescribed deadline. Since receiving the Notice, the Company has

filed its Form 10-Q with the SEC on June 4, 2021 and is in

compliance with all other Nasdaq continued listing standards.

About Golden Arrow Merger

Corp.

Golden Arrow Merger Corp. is a blank check company formed as a

Delaware corporation for the purpose of effecting a merger, capital

stock exchange, asset acquisition, stock purchase, reorganization

or similar business combination with one or more businesses. While

the Company may pursue an acquisition opportunity in any business,

industry, sector, or geography, it intends to initially focus its

search on identifying a prospective target business in the

healthcare or healthcare-related infrastructure industries in the

United States and other developed countries.

Forward Looking Statements

This press release contains statements that constitute

“forward-looking statements.” Forward-looking statements are

subject to numerous conditions, many of which are beyond the

control of the Company, including those set forth in the Risk

Factors section of the Company’s final prospectus filed with the

SEC on March 18, 2021, the Company’s Form 10-Q filed with the SEC

on June 4, 2021, and subsequent reports filed with the SEC. Copies

are available on the SEC’s website, www.sec.gov. The Company

undertakes no obligation to update these statements for revisions

or changes after the date of this release, except as required by

law.

Media Contact: Golden Arrow Merger Corp.

Valerie Toomey info@goldenarrowspac.com

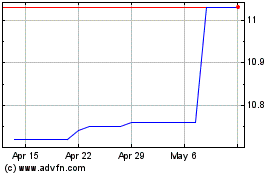

Golden Arrow Merger (NASDAQ:GAMC)

Historical Stock Chart

From Aug 2024 to Sep 2024

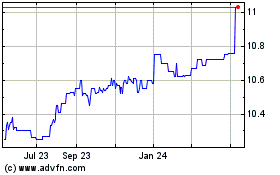

Golden Arrow Merger (NASDAQ:GAMC)

Historical Stock Chart

From Sep 2023 to Sep 2024