-Revenue up 25% over Q3 and 88% over Q4 of FY2006- MILPITAS,

Calif., Oct. 23 /PRNewswire-FirstCall/ -- Phoenix Technologies Ltd.

(NASDAQ:PTEC) today reported its fourth quarter and full year

financial results for the fiscal year ended September 30, 2007.

(Logo: http://www.newscom.com/cgi-bin/prnh/20070410/SFTU048LOGO)

Net revenues for the fourth quarter of fiscal year 2007 were $15.7

million, which was a 25% increase over the $12.6 million in net

revenues reported for the third quarter of fiscal 2007 and an 88%

increase over the $8.3 million reported for the fourth quarter of

fiscal year 2006. The Company reported gross margin of $13.4

million in the quarter ended September 30, 2007, a 30% increase

from the $10.2 million of gross margin reported for the third

fiscal quarter and a 153% increase from the $5.3 million reported

for the fourth quarter of fiscal year 2006. The Company's September

quarter operating expenses (including restructuring charges) were

$13.1 million, an increase of $1.7 million from the $11.4 million

in operating expenses reported for the June quarter, but a decrease

of $7.7 million from $20.8 million reported for the quarter ended

September 30, 2006. On a GAAP basis, the Company reported a net

loss in the fourth quarter of fiscal 2007 of ($0.7) million, or

($0.02) per share, which reflected a 62% improvement when compared

to a net loss of ($1.8) million, or ($0.07) per share, for the

third quarter of fiscal 2007 and a 95% improvement compared to the

net loss of ($14.3) million, or ($0.56) per share, which had been

reported for the fourth quarter of fiscal 2006. On a non-GAAP

basis, in the fourth quarter of fiscal 2007, Phoenix reported a net

profit of $2.7 million, or $0.10 per share, compared to a non-GAAP

net loss of ($0.6) million, or ($0.02) per share for the third

quarter of fiscal 2007 and a non-GAAP net loss of ($10.7) million

or ($0.42) per share for the fourth quarter of fiscal year 2006.

Total non-GAAP adjustments in the fourth quarter of fiscal year

2007 were $3.3 million compared to $1.2 million in the third

quarter of fiscal year 2007 and $3.7 million in the fourth quarter

of fiscal year 2006. The adjustments in the current quarter consist

principally of $2.3 million in non-cash stock compensation expense

as required according to Statement of Financial Accounting

Standards (SFAS 123R) and $1.0 million of restructuring charges

primarily associated with the Company's previously announced

closure of its Norwood, MA office. These non-GAAP adjustments are

more fully described in the attached reconciliation between net

profit and loss on a GAAP basis and non-GAAP net profit and loss

provided in the accompanying financial statements. The Company also

reported $4.0 million in positive cash flow from operations for the

quarter ended September 30, 2007 which compared to $4.4 million in

positive cash flow from operations for the third quarter of fiscal

year 2007 and ($9.4) million of negative cash flow from operations

for the fourth quarter of fiscal year 2006. For the full fiscal

year ended September 30, 2007, revenue was $47.0 million, compared

with $60.5 million for the fiscal year ended September 30, 2006

(which had included $30.5 million of revenues associated with fully

paid-up licenses). Loss from operations for the fiscal year ended

September 30, 2007 was ($14.6) million, including restructuring

charges of $4.1 million, which compared with a loss from operations

of $(42.2) million in fiscal 2006 that had included restructuring

charges of $4.6 million. The net loss for the fiscal year ended

September 30, 2007 was ($16.4) million, or ($0.63) per share

compared with net loss of ($44.0) million or ($1.74) per share in

fiscal 2006. Phoenix Technologies' cash and short-term investment

balances, as of September 30, 2007, were $62.7 million compared to

$60.3 million at September 30, 2006. "Our new management team has

successfully merged with the talented skill-base of Phoenix and as

a result we have accomplished or exceeded every one of our key

objectives for our first year" said Woody Hobbs, President and

Chief Executive Officer, Phoenix Technologies. "In this single

year, we have increased quarterly revenue by almost 90%, improved

gross margins by over 150%, and have restored Phoenix to non-GAAP

profitability after a period of very substantial operating

deficits. Perhaps most important, we have now shown significant

positive cash flow from operations for two consecutive quarters and

have actually increased our cash balances during the full year even

while making a significant investment in new technology. Results

like these are truly a pleasure to announce." "We are now

completely focused on building long term growth in revenues and

profitability, and are still intent on achieving our announced

target of a market capitalization of a billion dollars or more

within the next four years," added Hobbs. "We expect to accomplish

this by delivering long-awaited improvements to personal computers;

our new computing architectures have so far been enthusiastically

received by our customers and partners and we believe that

consumers and enterprises of all sizes will welcome the dramatic

improvements in ease-of-use and peace-of-mind that will be derived

from these designs," concluded Hobbs. Conference Call The Company

will conduct its regularly scheduled financial announcement

conference call on Tuesday, October 23, 2007 at 5:30 a.m. PDT.

Investors are invited to listen to a live audio web cast of the

quarterly conference call on the investor relations section of the

Company's website at http://www.phoenix.com/, which will also

contain supplemental financial information related to the

conference call. A replay of the web cast will be available two

hours after the conclusion of the call and will be available for 30

calendar days. Alternatively investors can listen to the conference

call via telephone at: 877-857-6173 (U.S/Canada) or 719-325-4801

(international). An audio replay of the conference call will also

be available approximately two hours after the conclusion of the

call and will be available until 8:59 p.m. PDT on Tuesday, October

30, 2007. The audio replay can be accessed by dialing 888-203-1112

(U.S./Canada) or 719-457-0820 (international) and entering

conference call ID 3407308. About Phoenix Technologies Phoenix

Technologies Ltd. (NASDAQ:PTEC) is the global market leader in

system firmware that provides the most secure foundation for

today's computing environments. The Company established industry

leadership with its original BIOS product in 1983, and today has

155 technology patents, has shipped in over one billion systems,

and continues to ship in over 125 million new systems each year.

The PC industry's top builders and specifiers trust Phoenix to

pioneer open standards and deliver innovative solutions to help

them accelerate time to market, differentiate products and increase

profits. Phoenix is headquartered in Milpitas, California with

offices worldwide. For more information, visit

http://www.phoenix.com/. Phoenix, Phoenix Technologies, and the

Phoenix Technologies logo are trademarks and/or registered

trademarks of Phoenix Technologies Ltd. All other trademarks are

the property of their respective owners. Safe Harbor: With the

exception of historical information, the statements set forth above

include forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, regarding the

Company's business prospects and development intentions. These

statements involve risk and uncertainties, including: our

dependence on certain key customers; technical challenges and

delays relating to our new products; our ability to successfully

continue to enhance existing products and develop and market new

products and technologies; our ability to increase the number of

volume purchase agreements and pay-as-you-go arrangements with

customers; the product and service offerings of competitors; our

ability to attract and retain key personnel; market demand for our

products; the ability of our customers to introduce and market new

products that incorporate our products; risks associated with any

acquisition strategy that we might employ, including integration

risks; our ability to protect our patents and intellectual

property; our ability to defend against third party infringement

claims, other litigation and contingent liabilities; our ability to

maintain sufficient liquidity to operate our business; any

unidentified weaknesses or deficiencies in our internal controls

over financial reporting; and risks relating to operating

internationally. For a further list and description of risks and

uncertainties that could cause actual results to differ materially

from those contained in the forward looking statements in this

release, we refer you to the Company's filings with the Securities

and Exchange Commission, including, but not limited to, its annual

report on Form 10-K and quarterly reports on Form 10-Q. All

forward-looking statements included in this document are based upon

assumptions, forecasts and information available to the Company as

of the date hereof, and the Company assumes no obligation to update

any such forward-looking statements. Investor Inquiry Contacts:

Richard Arnold Chief Operating Officer and Chief Financial Officer

Tel. +1 408 570 1256 E-mail: Erica Mannion, Sapphire Investor

Relations, LLC Tel. +1 212 766 1800 E-mail: PHOENIX TECHNOLOGIES

LTD. CONSOLIDATED BALANCE SHEETS (in thousands) September 30,

September 30, 2007 2006 Assets Current assets: Cash and cash

equivalents $62,705 $34,743 Marketable Securities - 25,588 Accounts

receivable, net of allowances of $83 and $463 at September 30, 2007

and September 30, 2006, respectively 6,383 8,434 Other current

assets 3,496 4,163 Total current assets 72,584 72,928 Property and

equipment, net 2,791 4,247 Purchased technology and Intangible

assets, net 3,571 1,458 Goodwill 14,497 14,433 Other assets 1,037

2,094 Total assets $94,480 $95,160 Liabilities and stockholders'

equity Current liabilities: Accounts payable $1,185 $3,072 Accrued

compensation and related liabilities 3,922 3,844 Deferred revenue

11,805 7,584 Income taxes payable 11,733 9,041 Accrued

restructuring charges - current 1,905 3,287 Other accrued

liabilities 1,745 3,605 Total current liabilities 32,295 30,433

Accrued restructuring charges - noncurrent 358 1,166 Other

liabilities 2,055 3,385 Total liabilities 34,708 34,984

Stockholders' equity: Preferred stock, $0.100 par value, 500 shares

authorized, none issued or outstanding - - Common stock, $0.001 par

value, 60,000 shares authorized, 34,396 and 32,851 shares issued,

26,982 and 25,437 shares outstanding at September 30, 2007 and

September 30, 2006, respectively 28 34 Additional paid-in capital

206,800 191,519 Retained earnings / (deficit) (55,311) (38,899)

Accumulated other comprehensive loss (67) (800) Less: Cost of

treasury stock (7,414 shares at September 30, 2007 and 7,414 shares

at September 30, 2006) (91,678) (91,678) Total stockholders' equity

59,772 60,176 Total liabilities and stockholders' equity $94,480

$95,160 PHOENIX TECHNOLOGIES LTD. CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands, except per share amounts) Three months

ended September June September Twelve months ended 30, 30, 30,

September 30, 2007 2007 2006 2007 2006 Revenues: License fees

$13,578 $10,678 $7,000 $39,655 $55,942 Services fees 2,087 1,902

1,344 7,362 4,553 Total revenues 15,665 12,580 8,344 47,017 60,495

Cost of revenues: License fees 234 201 639 927 4,727 Services fees

1,609 1,811 2,130 7,377 10,073 Amortization of purchased technology

471 333 292 1,387 3,110 Total cost of revenues 2,314 2,345 3,061

9,691 17,910 Gross Margin 13,351 10,235 5,283 37,326 42,585

Operating expenses: Research and development 5,137 5,204 5,130

19,193 22,865 Sales and marketing 2,593 2,554 7,170 11,992 35,428

General and administrative 4,357 3,615 5,463 16,611 21,488

Amortization of acquired intangible assets - - 316 - 368

Restructuring 1,036 (14) 2,731 4,118 4,618 Total operating expenses

13,123 11,359 20,810 51,914 84,767 Income / (loss) from operations

228 (1,124) (15,527) (14,588) (42,182) Interest and other income,

net 470 479 542 1,984 1,867 Loss before income taxes 698 (645)

(14,985) (12,604) (40,315) Income tax expense 1,366 1,129 (664)

3,805 3,654 Net loss $(668) $(1,774) $(14,321) $(16,409) $(43,969)

Loss per share: Basic and diluted $(0.02) $(0.07) $(0.56) $(0.63)

$(1.74) Shares used in loss per share calculation: Basic and

diluted 26,736 26,001 25,423 25,976 25,220 See notes to unaudited

condensed consolidated financial statements PHOENIX TECHNOLOGIES

LTD. CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) Three

months ended September June September Twelve months ended 30, 30,

30, September 30, 2007 2007 2006 2007 2006 Cash flows from

operating activities: Net loss $(668) $(1,774) $(14,321) $(16,409)

$(43,969) Reconciliation to net cash provided by (used in)

operating activities: Depreciation and amortization 944 932 1,177

3,588 6,002 Stock-based compensation 2,311 1,169 938 6,235 4,819

Loss from disposal of fixed assets 4 24 9 55 11 Deferred income tax

- - 61 851 Change in operating assets and liabilities: Accounts

receivable (1,165) 1,629 2,951 2,067 14,429 Prepaid royalties and

maintenance (13) 18 96 73 2,187 Other assets (235) 745 621 1,600

850 Accounts payable 305 (618) 688 (1,872) 964 Accrued compensation

and related liabilities 644 162 148 (230) 258 Deferred revenue 109

1,924 (1,932) 4,257 (712) Income taxes 1,435 938 (1,404) 2,715

(2,354) Accrued restructuring charges 1,015 (910) 1,281 (2,171)

2,810 Other accrued liabilities (730) 139 314 (2,347) 34 Net cash

provided by (used in) operating activities 3,956 4,378 (9,373)

(2,439) (13,820) Cash flows from investing activities: Proceeds

from sales of marketable securities - 1,779 56,289 105,214 283,939

Proceeds from maturities of marketable securities - 1,000 - 9,500

8,100 Purchases of marketable securities - - (42,075) (89,125)

(270,604) Purchases of property and equipment (427) (274) (751)

(800) (2,233) Acquisition of businesses, net of cash acquired

(3,500) - - (3,500) (500) Net cash provided by investing activities

(3,927) 2,505 13,463 21,289 18,702 Cash flows from financing

activities: Proceeds from stock purchases under stock option and

stock purchase plans 3,839 3,582 11 8,993 3,247 Repurchase of

common stock - - - - (1,235) Net cash provided by financing

activities 3,839 3,582 11 8,993 2,012 Effect of changes in exchange

rates 83 (4) (12) 119 44 Net increase in cash and cash equivalents

3,951 10,461 4,089 27,962 6,938 Cash and cash equivalents at

beginning of period 58,754 48,293 30,654 34,743 27,805 Cash and

cash equivalents at end of period $62,705 $58,754 $34,743 $62,705

$34,743 See notes to unaudited condensed consolidated financial

statements PHOENIX TECHNOLOGIES LTD. RECONCILIATION OF GAAP TO

NON-GAAP NET INCOME AND NET LOSS PER SHARE (in thousands, except

per share data) (unaudited) Three months ended September June

September Twelve months ended 30, 30, 30, September 30, 2007 2007

2006 2007 2006 GAAP net loss $(668) $(1,774) $(14,321) $(16,409)

$(43,969) (1)Equity-based compensation expense under SFAS 123(R)

2,311 1,169 938 6,183 4,819 (2)Restructuring 1,036 (14) 2,731 4,118

4,618 (3)Severance and other related cost - - - - 855 Non-GAAP net

profit (loss) $2,679 $(619) $(10,652) $(6,108) $(33,677) Non-GAAP

loss per share: Basic $0.10 $(0.02) $(0.42) $(0.24) $(1.34) Diluted

$0.10 $(0.02) $(0.42) $(0.24) $(1.34) Shares used in loss per share

calculation: Basic 26,736 26,001 25,423 25,976 25,220 Diluted

27,681 26,001 25,423 25,976 25,220 These adjustments reconcile the

Company's GAAP results of operations to the reported non-GAAP

results of operations. The Company believes that presentation of

net income and net income per share excluding non-cash equity-based

compensation, restructuring, and severance cost provides meaningful

supplemental information to investors, as well as management, that

is indicative of the Company's core operating results and

facilitates comparison of operating results across reporting

periods. The Company uses these non-GAAP measures when evaluating

its financial results as well as for internal planning and

budgeting purposes. Equity-based compensation is excluded from

non-GAAP financial results since it is a non-cash based charge.

Restructuring and severance costs are excluded from non-GAAP

financial results since these are infrequent and non-recurring and

therefore may not be considered directly related to our on-going

business operations. These non-GAAP measures should not be viewed

as a substitute for the Company's GAAP results, and may be

different than non-GAAP measures used by other companies. (1) This

number represents non-cash equity-based compensation expense

related to the Company's adoption of SFAS No. 123(R) beginning

October 1, 2005. For the three months ended September 30, 2007,

non-cash equity-based compensation was $2.3 million, allocated as

follows: $0.5 million to research and development, $0.3 million to

sales and marketing and $1.5 million to general and administrative.

For the three months ended June 30, 2007, non-cash equity-based

compensation was $1.2 million, allocated as follows: $0.1 million

to cost of goods sold, $0.4 million to research and development,

$0.2 million to sales and marketing and $0.5 million to general and

administrative. For the three months ended September 30, 2006,

non-cash equity-based compensation was $0.9 million, allocated as

follows: $0.1 to cost of goods sold, $0.2 million to research and

development, $0.3 million to sales and marketing and $0.3 million

to general and administrative. For the twelve months ended

September 30, 2007, non-cash equity-based compensation was $6.2

million, allocated as follows: $0.2 million to cost of goods sold,

$1.4 million to research and development, $1.0 million to sales and

marketing and $3.6 million to general and administrative. For the

twelve months ended September 30, 2006, non-cash equity-based

compensation was $4.8 million, allocated as follows: $0.3 million

to cost of goods sold, $0.9 million to research and development,

$1.9 million to sales and marketing and $1.7 million to general and

administrative. Management believes that it is useful to investors

to understand how the expenses associated with the adoption of SFAS

123(R) are reflected in net income. (2) The Company has incurred

restructuring expenses, included in its GAAP presentation of

operating expense, primarily due to workforce related charges such

as payments for severance and benefits and estimated costs of

exiting and terminating facility lease commitments related to

formal restructuring plans approved by the Board of Directors in

June 2006, in September 2006, November 2006 and September 2007. For

the three months ended September 30, 2007, severance and benefits

totaled $0.4 million and cost related to exiting and terminating 2

facility lease totaled $0.5 million. In addition , for the three

months ended September 30, 2007, the Company increased the fiscal

year 2003 restructuring reserve for the Irvine facility by $0.1

million due to projected increased operating expenses over the

remaining term of the lease. For the three months ended June 30,

2007, no restructuring costs were incurred, and the Company paid

all remaining obligations for severance and benefits and costs of

exiting and terminating facility lease commitments related to the

formal restructuring plans approved by the Board of Directors in

June 2006, in September 2006, and November 2006. For the three

months ended September 30, 2006, restructuring costs were $2.7

million. Severance and benefits totaled $2.2 million, cost related

to exiting and terminating two facility leases totaled $0.1 million

and costs related to the fiscal year 2003 restructuring reserve for

the Irvine facility increased by $0.5 million due to projected

increased operating expenses over the remaining term of the lease.

For the twelve months ended September 30, 2007, restructuring costs

were $4.1 million. The severance and benefits costs totaled $2.2

million. Costs related to terminating facility leases totaled $1.9

million. For the twelve months ended September 30, 2006, severance

and benefits totaled $4.0 million and cost related to exiting and

terminating two facility lease totaled $0.2 million. In addition ,

the Company, as mentioned above in the discussion regarding the

three months ended September 30, 2006, increased the fiscal year

2003 restructuring reserve for the Irvine facility by $0.5 million

due to projected increased operating expenses over the remaining

term of the lease. The Company believes that these items do not

reflect expected future operating expenses nor does the Company

believe that they provide a meaningful evaluation of current versus

past operational performance. (3) For the twelve months ended

September 30, 2006, the Company had incurred severance and benefits

cost of $0.9 million related to the voluntary termination of the

Company's prior Chairman and Chief Executive Officer, Albert E.

Sisto. The Company does not believe that these items reflect

expected future operating expenses nor does the Company believe

that they provide a meaningful evaluation of current versus past

operational performance. Net income for the three months ended

September 30, 2007, June 30, 2007, and September 30, 2006,

respectively, did not include similar expenses.

http://www.newscom.com/cgi-bin/prnh/20070410/SFTU048LOGO

http://photoarchive.ap.org/ DATASOURCE: Phoenix Technologies Ltd.

CONTACT: Investor Inquiry, Richard Arnold of Phoenix Technologies

Ltd., Chief Operating Officer and Chief Financial Officer,

+1-408-570-1256, ; or Erica Mannion of Sapphire Investor Relations,

LLC, +1-212-766-1800, , for Phoenix Technologies Ltd. Web site:

http://www.phoenix.com/

Copyright

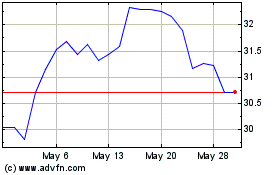

Global X PropTech ETF (NASDAQ:PTEC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Global X PropTech ETF (NASDAQ:PTEC)

Historical Stock Chart

From Jul 2023 to Jul 2024