EUROPE MARKETS: Europe Stocks Slip As Investors Wait To Hear From ECB's Draghi, Global Growth Fears Fester

March 07 2019 - 8:36AM

Dow Jones News

By Barbara Kollmeyer, MarketWatch , Emily Horton

Rio Tinto drops sharply on an analyst downgrade

European markets fell Thursday as the European Central Bank said

it expected to leave interest rates unchanged at least through the

end of this year and laid out a new round of long-term loans.

Investors are now waiting to hear from ECB President Mario

Draghi.

Meanwhile, mounting concerns about global economic growth

weighed on the region's equities, while Rio Tinto PLC fell on a

downgrade.

How are markets performing?

The Stoxx Europe 600 lost 0.2% to 374.78 after finishing flat on

Wednesday.

Germany's DAX (DAX) slipped 0.2% to 11,568.61, with the U.K.'s

FTSE 100 off by 0.3% to 7,174.67 and France's CAC 40 flat at

5,285.22.

Italy's FTSE MIB index rose 0.2% to 20,891.69, while Spain's

IBEX 35 was the region's top gainer, up 0.4% to 9,340.40.

The pound fell 0.3% to $1.3128, while the euro fell 0.1% to

$1.12943.

What's driving the markets?

The ECB, which had previously pledged to maintain rates at

current, ultralow levels through at least this summer, said it

expected rates to remain on hold

(http://www.marketwatch.com/story/ecb-expects-to-leave-rates-unchanged-until-at-least-2020-sets-new-round-of-long-term-loans-2019-03-07)

"at least through the end of 2019, and as necessary to ensure the

continued sustained convergence of inflation" toward its target of

near but just below 2% over the medium term.

The bank also said it would launch a new series of quarterly,

targeted long-term loans beginning in September and ending in March

2021. ECB President Mario Draghi's news conference, set to begin at

2:30 p.m. CET,

Following a retreat in Asian and U.S. markets on concerns that

global growth might be slowing, Europe pulled back as hopes for an

imminent trade deal between the U.S. and China recede.

What stocks are active?

French bank Société Générale downgraded both Rio Tinto PLC

(RIO.LN) and BHP PLC(BHP.LN), with Rio Tinto rebounding to gain

0.2%, but BHP off 0.4%.

NMC Health PLC (NMC.LN) plunged 7% after the health-care chain

reported results slightly below expectations, citing wider macro

challenges in a number of its business, and said these are also

expected to continue into 2019.

Melrose Industries PLC (MRO.LN) announced its first steps toward

breaking up engineering company GNK, after its hostile take over in

2018. This led to a 3% rise in share price, despite the FTSE 100

company announcing its losses had deepened after the

acquisition.

(END) Dow Jones Newswires

March 07, 2019 08:21 ET (13:21 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

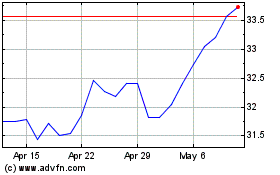

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

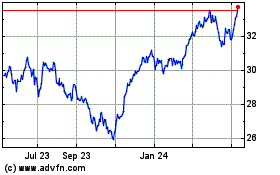

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024