EUROPE MARKETS: Europe Markets Mixed As Banks And Autos Feel The Heat

March 06 2019 - 6:03AM

Dow Jones News

By Emily Horton

Europe's markets were mixed on Wednesday, with banking and autos

sectors under pressure and investors waiting for further details on

a potential U.S./ China trade deal.

How are markets performing?

The Stoxx Europe 600 was flat on at 375.69, after finishing up

0.15% on Tuesday.

The German DAX (DAX) and France's CAC 40 both fell by 0.1%,

dropping to 11,606.12 and 5,294.02, respectively.

But the FTSE 100 rose by 0.1% to 7,190.46, Italy's FTSE MIB

index was up by 0.2% to 20,752.10 and Spain's IBEX 35 lifted 0.1%

to 9,268.30.

The pound fell to $1.3147 from $1.3177 late in New York on

Tuesday. While the euro remained mostly flat fetching $1.1307.

What's driving the markets?

The auto sector was under the investor microscope on after

German auto parts maker Schaeffler AG (SHA.XE) adjusted targets for

2020

(http://www.marketwatch.com/story/schaeffler-reports-lower-profit-looks-to-cut-cost-2019-03-06).

Meanwhile, banks came under heavy pressure after Tuesday's

reports

(https://www.bloomberg.com/news/articles/2019-03-05/dirty-money-scandal-widens-with-reports-on-nordea-and-lithuania)

that billions of Russian funds have allegedly been channeled via

Lithuanian financial institutions to banks that include those in

the Netherlands. Shares of Dutch lenders ABN AMRO (ABN.AE) and ING

(ING), among others, fell.

Elsewhere, investors are anticipating further trade deal

developments after Monday's media flurry that an agreement between

U.S. and China will soon be reached.

What stocks are active?

Legal & General Group PLC (LGEN.LN) lost 4%, despite

announcing a profit rise in 2018

(http://www.marketwatch.com/story/legal-general-profit-rises-in-2018-2019-03-06).

"Shares have slid back from three year highs in early trading, no

doubt due to some profit-taking, after a 24% rise from the lows we

saw in December," said Michael Hewson, chief market analyst at CMC

Markets U.K., in a note.

Another of Europe's biggest losers was the online food-deliver

company Just Eat PLC(JE.LN), which fell by 4% amid increasing

delivery costs outlined in the group's earnings

(http://www.marketwatch.com/story/just-eat-swings-to-profit-sees-more-growth-in-19-2019-03-06).

"Just Eat are trying to work with the same sort of branded

restaurants their rivals are targeting, and offering their own

delivery offering. None of this comes cheaply, and the costs are

holding profits back," said Steve Clayton, manager of the

Hargreaves Lansdown's select funds.

British American Tobacco PLC (BATS.LN) added 4%, reclaiming some

of its loses after Monday's dip, while in Tullow Oil PLC(TLW.LN)

rose 3%.

(END) Dow Jones Newswires

March 06, 2019 05:48 ET (10:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

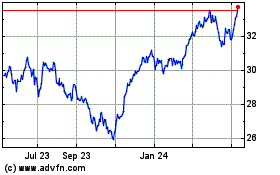

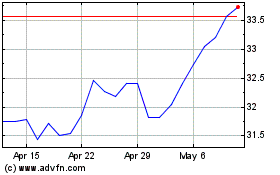

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024