EUROPE MARKETS: European Markets Climb As China Sets New Growth Targets

March 05 2019 - 7:35AM

Dow Jones News

By Emily Horton

Europe's markets rose on Tuesday, after China's government set

new growth targets for its economy. Although these dipped slightly,

they still remain at an ambitious rate.

How are markets performing?

The Stoxx Europe 600 added 0.2% to 375.66 after finishing Monday

up 0.2%.

The FTSE 100 led the region's top gainers, climbing 0.4% to

7,159.47, with Italy's FTSE MIB the second top climber, adding 0.2%

to 20,767.80.

Meanwhile, the German DAX (DAX) rose by 0.1% to 11,609.42,

France's CAC 40 jumped by 0.1% to 5,291.48 and Spain's IBEX 35 rose

0.2% to 9274.60.

The pound remained mostly flat at $1.3184, while the euro

slipped to $1.1329 from $1.1340 late in New York on Monday

night.

What's driving the markets?

China lowered its growth target to between a range of 6% to 6.5%

(http://www.marketwatch.com/story/china-sets-economic-growth-target-vows-foreign-companies-will-get-equal-treatment-2019-03-04)

on Monday, placing it below last year's 6.6% growth target. The

lower bound of the target would mark a three decade low for China's

economic growth, but it would still be among the world's strongest

economies.

Alongside this announcement Premier Li Keqiang said that China

was aim to achieve nearly 2 trillion yuan ($298 billion) of cuts in

taxes and other economic measures.

Meanwhile, in Europe, February's PMI data showed Italy's service

sector unexpectedly returned to growth last month, but a GDP

release confirmed the country went into technical recession at the

end of last year. Both will be in the mix ahead of Thursday's

European Central Bank meeting

(http://www.marketwatch.com/story/opinion-ecb-has-a-plan-for-markets-and-is-looking-for-reasons-to-act-2019-03-05).

In the U.K., services PMI came in above forecast, showing a modest

increase in activity.

In Brexit news, U.K. banks will be able to borrow in euros from

the Bank of England from next week

(http://www.marketwatch.com/story/bank-of-england-activates-euro-swap-line-2019-03-05-5485614),

the latest move to support the U.K.'s financial system in the event

of an abrupt and messy break from the European Union.

The BoE warned, however, that investors should still prepare for

severe disruption in financial markets if the U.K. tumbles out of

the EU March 29 with no deal.

What stocks are active?

Vodafone Group PLC (VOD.LN) added 3% after the group announced

plans to sell $4.5 billion of convertible bonds to help fund its

acquisition of some of Liberty Global PLC's European business. The

telecommunications giant is also considering buybacks to reduce

share dilution.

Intertek Group PLC (ITRK.LN) lost 3%, with UBS analysts raising

concerns about a slowdown, despite the company reporting a pretax

profit rise of 2.8%.

Meanwhile, Ashtead Group PLC (AHT.LN), which makes 90% of its

profit from its U.S. operation Sunbelt, dropped by nearly 2%

despite well received results. The company's management said that

its strong performance appears to have translated into "some short

term profit-taking on recent advances", and Russ Mould, an

investment director at stockbroker AJ Bell, said it "probably

reflects concern that the U.S. economy is slowing down".

(END) Dow Jones Newswires

March 05, 2019 07:20 ET (12:20 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

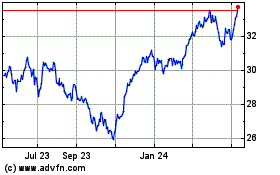

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

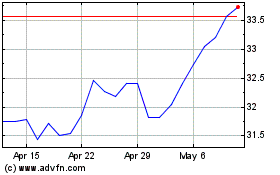

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024