- Second Quarter Revenue Increases 18% to Record $30.5

Million; Net Income Rises to $6.9 Million

- Record Second Quarter Adjusted EBITDA of $11.2

Million

Gambling.com Group Limited (Nasdaq: GAMB) (“Gambling.com Group”

or the “Company”), a fast-growing provider of digital marketing

services for the global online gambling industry, today reported

financial results for the second quarter ended June 30, 2024. The

Company also raised its 2024 revenue and Adjusted EBITDA guidance

as detailed below.

“Our second quarter and year-to-date results highlight the

incredible power of our high-intent audience and the clear value we

create for our online gambling operator clients. Our team’s proven

ability to dynamically manage our owned and operated assets to

quickly address changes to the operating environment was evident in

the second quarter’s strong topline and Adjusted EBITDA growth, and

will continue to benefit us in the future,” commented Charles

Gillespie, Chief Executive Officer and Co-Founder of Gambling.com

Group. “As we continue to execute at a high level, expand our

footprint in the online gambling ecosystem and leverage industry

growth opportunities, we continue to see a clear path towards our

goal of $100 million in annual Adjusted EBITDA. Our significant

share repurchase activity in the first half of this year

underscores our confidence in the future of the business.”

Elias Mark, Chief Financial Officer of Gambling.com Group added,

“Our second quarter performance was driven by our team’s faster

than expected re-calibration of our portfolio, leading to

accelerated performance of our owned and operated assets.

Year-over-year second quarter revenue and Adjusted EBITDA growth of

18% and 19%, respectively, reflect very strong delivery of iGaming

NDCs across Europe, including the United Kingdom, as well as

resiliency in our North American business, against a challenging

comparative prior-year period.”

Second Quarter

2024 vs. Second Quarter 2023 Financial Highlights

(USD in thousands, except per share data,

unaudited)

Three Months Ended June

30,

Change

2024

2023

%

Revenue

30,541

25,972

18

%

Net income for the period attributable to

shareholders (1)

6,930

278

2393

%

Net income per share attributable to

shareholders, diluted (1)

0.19

0.01

1800

%

Net income margin (1)

23

%

1

%

Adjusted net income for the period

attributable to shareholders (1)(2)

7,356

6,535

13

%

Adjusted net income per share attributable

to shareholders, diluted (1)(2)

0.20

0.17

18

%

Adjusted EBITDA (1)(2)

11,211

9,424

19

%

Adjusted EBITDA Margin (1)(2)

37

%

36

%

Cash flows generated by operating

activities

193

4,586

(96

)%

Free Cash Flow (2)

5,983

8,653

(31

)%

__________

(1)

For the three months ended June 30, 2024,

Net income and Net income per share include, and Adjusted net

income and Adjusted net income per share exclude, adjustments

related to the Company's 2022 acquisition of BonusFinder of $0.4

million, or $0.01 per share. Similarly, these adjustments totaled

$6.1 million, or $0.16 per share, for the three months ended June

30, 2023. See “Supplemental Information - Non-IFRS Financial

Measures” and the tables at the end of this release for an

explanation of the adjustments.

(2)

Represents a non-IFRS measure. See

“Supplemental Information - Non-IFRS Financial Measures” and the

tables at the end of this release for reconciliations to the

comparable IFRS numbers.

Second Quarter 2024 and Recent Business

Highlights

- Delivered more than 108,000 new depositing customers

(“NDCs”)

- Completed highly accretive acquisition of Freebets.com and

related assets on April 1st, and made the initial consideration

payment of $20.0 million

- Repurchased 833,770 shares at an average price of $8.17 per

share. Subsequent to the end of the second quarter, repurchased an

additional 798,061 shares at an average price of $8.87 per

share

- Made final deferred consideration payment of $13.6 million for

BonusFinder.com

- Drew $18.0 million on the credit facility

- Authorized an additional $10.0 million for the Company's share

repurchase program on August 14th

Second Quarter 2024 Results Compared to

Second Quarter 2023

Revenue rose 18% year-over-year to a second quarter record $30.5

million. The Company delivered more than 108,000 NDCs to customers,

an increase of 19% year-over-year, even as the year-ago period

benefited from atypically strong growth in U.S. sports betting

NDCs, which did not recur this year.

Gross profit increased 16% to $29.1 million, including a $0.5

million increase in cost of sales related to the Company's media

partnerships.

Total operating expenses decreased 15% to $20.8 million,

reflecting the elimination of fair value movement in contingent

consideration and a modest decrease in general and administrative

expenses, partially offset by increases in sales and marketing and

technology expenses.

Net income attributable to shareholders rose from $0.3 million

to $6.9 million and net income per share rose from $0.01 to $0.19.

Adjusted net income increased 13% to $7.4 million and adjusted net

income per share increased 18% to $0.20.

Adjusted EBITDA was $11.2 million, reflecting an Adjusted EBITDA

margin of 37% as compared to Adjusted EBITDA of $9.4 million and an

Adjusted EBITDA margin of 36%, in the year-ago period.

Operating cash flow of $0.2 million included $7.2 million for

the final deferred consideration payment for the acquisition of

BonusFinder. Absent the deferred consideration payment, operating

cash flow would have been $7.4 million. Free Cash Flow was $6.0

million compared to $8.7 million in the year-ago period reflecting

working capital movements and increased capital expenditures.

2024 Outlook

Gambling.com Group today updated its 2024 full-year revenue and

Adjusted EBITDA guidance. The Company now expects full year revenue

of $123 million to $127 million and Adjusted EBITDA of $44 million

to $47 million. The midpoints of the new full year revenue and

Adjusted EBITDA guidance ranges represent year-over-year growth of

15% and 24%, respectively. The Company's updated outlook compares

to the guidance provided on May 16, 2024 for revenue of $118

million to $122 million and Adjusted EBITDA of $40 million to $44

million.

The Company’s guidance assumes:

- No additional North American markets come online over the

balance of 2024

- Apart from the completed acquisition of Freebets.com and

related assets, no benefit from any additional acquisitions in

2024

- Full year cost of sales of approximately $6.5 million, of which

$3.7 million was incurred in the first half of 2024

- An average EUR/USD exchange rate of 1.09 throughout 2024

First Half 2024

vs. First Half 2023 Financial Highlights

(USD in thousands, except per share data,

unaudited)

Six Months Ended June

30,

Change

2024

2023

%

Revenue

59,756

52,664

13

%

Net income for the period attributable to

shareholders (1)

14,229

6,873

107

%

Net income per share attributable to

shareholders, diluted (1)

0.38

0.18

111

%

Net income margin (1)

24

%

13

%

Adjusted net income for the period

attributable to shareholders (1)(2)

14,908

14,086

6

%

Adjusted net income per share attributable

to shareholders, diluted (1)(2)

0.40

0.37

8

%

Adjusted EBITDA (1)(2)

21,370

20,097

6

%

Adjusted EBITDA Margin (1)(2)

36

%

38

%

Cash flows generated by operating

activities

8,999

11,669

(23

)%

Free Cash Flow (2)

14,176

15,124

(6

)%

__________

(1)

For the six months ended June 30, 2024,

Net income and Net income per share include, and Adjusted net

income and Adjusted net income per share exclude, adjustments

related to the Company's 2022 acquisition of BonusFinder of $0.7

million, or $0.02 per share. Similarly, these adjustments totaled

$7.0 million, or $0.19 per share, for the six months ended June 30,

2023. See “Supplemental Information - Non-IFRS Financial Measures”

and the tables at the end of this release for an explanation of the

adjustments.

(2)

Represents a non-IFRS measure. See

“Supplemental Information - Non-IFRS Financial Measures” and the

tables at the end of this release for reconciliations to the

comparable IFRS numbers.

Conference Call Details

Date/Time:

Thursday, August 15, 2024, at 8:00 a.m.

ET

Webcast:

https://www.webcast-eqs.com/gamb20240815/en

U.S. Toll-Free Dial In:

877-407-0890

International Dial In:

1 201-389-0918

To access, please dial in approximately 10 minutes before the

start of the call. An archived webcast of the conference call will

also be available in the News & Events section of the Company’s

website at gambling.com/corporate/investors/news-events.

Information contained on the Company’s website is not incorporated

into this press release.

About Gambling.com Group Limited

Gambling.com Group Limited (Nasdaq: GAMB) (the “Group”) is a

fast-growing provider of digital marketing services for the global

online gambling industry. Founded in 2006, the Group has offices

globally, primarily operating in the United States and Ireland.

Through its proprietary technology platform, the Group publishes a

portfolio of premier branded websites including Gambling.com,

Bookies.com, Casinos.com, and RotoWire.com. Gambling.com Group owns

and operates more than 50 websites in seven languages across 15

national markets covering all aspects of the online gambling

industry, including iGaming and sports betting, and the fantasy

sports industry.

Use of Non-IFRS Measures

This press release contains certain non-IFRS financial measures,

such as Adjusted Net Income, EBITDA, Adjusted EBITDA, Adjusted

EBITDA Margin, Free Cash Flow, and related ratios. See

“Supplemental Information - Non-IFRS Financial Measures” and the

tables at the end of this release for an explanation of the

adjustments and reconciliations to the comparable IFRS numbers.

Cautionary Note Concerning Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, Section 21E of the Securities Exchange Act of 1934, as

amended, and the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995, that relate to our

current expectations and views of future events. All statements

other than statements of historical facts contained in this press

release, including statements relating to the ability of our owned

and operated websites to generate higher revenues and Adjusted

EBIDTA and otherwise benefit us in the future, whether we can

achieve $100 million in annual Adjusted EBITDA, and our 2024

outlook, are all forward-looking statements. These statements

represent our opinions, expectations, beliefs, intentions,

estimates or strategies regarding the future, which may not be

realized. In some cases, you can identify forward-looking

statements by terms such as “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “expect,”

“predict,” “potential,” “could,” “will,” “would,” “ongoing,”

“future” or the negative of these terms or other similar

expressions that are intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. Forward-looking statements are based

largely on our current expectations and projections about future

events and financial trends that we believe may affect our

financial condition, results of operations, business strategy,

short-term and long-term business operations and objectives and

financial needs. These forward-looking statements involve known and

unknown risks, uncertainties, contingencies, changes in

circumstances that are difficult to predict and other important

factors that may cause our actual results, performance, or

achievements to be materially and/or significantly different from

any future results, performance or achievements expressed or

implied by the forward-looking statement. Important factors that

could cause actual results to differ materially from our

expectations are discussed under “Item 3. Key Information - Risk

Factors” in Gambling.com Group’s annual report filed on Form 20-F

for the year ended December 31, 2023 with the U.S. Securities and

Exchange Commission (the “SEC”) on March 21, 2024, and Gambling.com

Group’s other filings with the SEC as such factors may be updated

from time to time. Any forward-looking statements contained in this

press release speak only as of the date hereof and accordingly

undue reliance should not be placed on such statements.

Gambling.com Group disclaims any obligation or undertaking to

update or revise any forward-looking statements contained in this

press release, whether as a result of new information, future

events or otherwise, other than to the extent required by

applicable law.

Consolidated Statements of Comprehensive

Income (Unaudited) (USD in thousands, except per share

amounts)

The following table details the consolidated statements of

comprehensive income for the three and six months ended June 30,

2024 and 2023 in the Company's reporting currency and constant

currency.

Reporting Currency

Constant Currency

Reporting Currency

Constant Currency

Three Months Ended June

30,

Change

Change

Six Months Ended June

30,

Change

Change

2024

2023

%

%

2024

2023

%

%

Revenue

30,541

25,972

18

%

19

%

59,756

52,664

13

%

14

%

Cost of sales

(1,436

)

(896

)

60

%

62

%

(3,669

)

(1,887

)

94

%

96

%

Gross profit

29,105

25,076

16

%

17

%

56,087

50,777

10

%

11

%

Sales and marketing expenses

(10,713

)

(8,744

)

23

%

24

%

(20,325

)

(17,008

)

20

%

20

%

Technology expenses

(3,094

)

(2,464

)

26

%

27

%

(6,309

)

(4,704

)

34

%

35

%

General and administrative expenses

(6,237

)

(6,928

)

(10

)%

(9

)%

(12,541

)

(12,466

)

1

%

1

%

Movements in credit losses allowance and

write-offs

(741

)

(118

)

528

%

533

%

(701

)

(767

)

(9

)%

(8

)%

Fair value movement on contingent

consideration

—

(6,087

)

(100

)%

(100

)%

—

(6,939

)

(100

)%

(100

)%

Operating profit

8,320

735

1032

%

1046

%

16,211

8,893

82

%

83

%

Finance income

230

606

(62

)%

(62

)%

1,174

706

66

%

67

%

Finance expenses

(897

)

(420

)

114

%

116

%

(1,351

)

(983

)

37

%

38

%

Income before tax

7,653

921

731

%

741

%

16,034

8,616

86

%

87

%

Income tax charge

(723

)

(643

)

12

%

14

%

(1,805

)

(1,743

)

4

%

4

%

Net income for the period attributable

to shareholders

6,930

278

2393

%

2429

%

14,229

6,873

107

%

108

%

Other comprehensive income

(loss)

Exchange differences on translating

foreign currencies

(921

)

(676

)

36

%

38

%

(3,515

)

692

(608

)%

(611

)%

Total comprehensive income for the

period attributable to shareholders

6,009

(398

)

1610

%

1621

%

10,714

7,565

42

%

43

%

Consolidated Statements of

Financial Position (Unaudited)

(USD in thousands)

JUNE 30, 2024

DECEMBER 31,

2023

ASSETS

Non-current assets

Property and equipment

1,687

908

Right-of-use assets

5,272

1,460

Intangible assets

133,164

98,000

Deferred tax asset

6,694

7,134

Total non-current assets

146,817

107,502

Current assets

Trade and other receivables

20,807

21,938

Cash and cash equivalents

7,523

25,429

Total current assets

28,330

47,367

Total assets

175,147

154,869

EQUITY AND LIABILITIES

Equity

Share capital

—

—

Capital reserve

75,778

74,166

Treasury shares

(12,916

)

(3,107

)

Share-based compensation reserve

8,900

7,414

Foreign exchange translation deficit

(7,722

)

(4,207

)

Retained earnings

58,887

44,658

Total equity

122,927

118,924

Non-current liabilities

Lease liability

4,344

1,190

Deferred tax liability

2,208

2,008

Borrowings

17,032

—

Total non-current liabilities

23,584

3,198

Current liabilities

Trade and other payables

6,958

10,793

Deferred income

1,869

2,207

Deferred consideration

17,092

18,811

Contingent consideration

1,317

—

Borrowings and accrued interest

145

—

Other liability

—

308

Lease liability

1,217

533

Income tax payable

38

95

Total current liabilities

28,636

32,747

Total liabilities

52,220

35,945

Total equity and liabilities

175,147

154,869

Consolidated Statements of

Cash Flows (Unaudited)

(USD in thousands)

Three months ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Cash flow from operating

activities

Income before tax

7,653

921

16,034

8,616

Finance expense, net

667

(187

)

177

277

Adjustments for non-cash items:

Depreciation and amortization

1,621

480

2,245

1,025

Movements in credit loss allowance and

write-offs

741

118

701

767

Fair value movement on contingent

consideration

—

6,087

—

6,939

Share-based payment expense

1,720

1,253

2,557

2,099

Income tax paid

(1,654

)

(1,899

)

(1,440

)

(1,789

)

Payment of contingent consideration

—

(4,621

)

—

(4,621

)

Payment of deferred consideration

(7,156

)

—

(7,156

)

—

Cash flows from operating activities

before changes in working capital

3,592

2,152

13,118

13,313

Changes in working capital

Trade and other receivables

(2,204

)

1,971

36

(1,892

)

Trade and other payables

(1,195

)

401

(4,155

)

186

Inventories

—

62

—

62

Cash flows generated by operating

activities

193

4,586

8,999

11,669

Cash flows from investing

activities

Acquisition of property and equipment

(842

)

(51

)

(914

)

(204

)

Acquisition of intangible assets

(20,605

)

(127

)

(20,605

)

(392

)

Capitalization of internally developed

intangibles

(524

)

(503

)

(1,065

)

(962

)

Interest received from bank deposits

30

—

104

—

Payment of deferred consideration

(5,594

)

—

(10,044

)

(2,390

)

Payment of contingent consideration

—

(5,557

)

—

(5,557

)

Cash flows used in investing

activities

(27,535

)

(6,238

)

(32,524

)

(9,505

)

Cash flows from financing

activities

Exercise of options

451

—

557

—

Treasury shares acquired

(6,666

)

(759

)

(9,750

)

(759

)

Proceeds from borrowings

18,000

—

18,000

—

Transaction costs related to

borrowings

(847

)

—

(847

)

—

Interest payment attributable to third

party borrowings

(174

)

—

(174

)

—

Interest payment attributable to deferred

consideration settled

(832

)

—

(1,382

)

(110

)

Principal paid on lease liability

(154

)

(94

)

(254

)

(199

)

Interest paid on lease liability

(55

)

(40

)

(89

)

(87

)

Cash flows generated by (used in)

financing activities

9,723

(893

)

6,061

(1,155

)

Net movement in cash and cash

equivalents

(17,619

)

(2,545

)

(17,464

)

1,009

Cash and cash equivalents at the

beginning of the period

25,318

33,564

25,429

29,664

Net foreign exchange differences on

cash and cash equivalents

(176

)

292

(442

)

638

Cash and cash equivalents at the end of

the period

7,523

31,311

7,523

31,311

Earnings Per Share

Below is a reconciliation of basic and diluted earnings per

share as presented in the Consolidated Statement of Comprehensive

Income for the period specified, stated in USD thousands, except

per share amounts (unaudited):

Three Months Ended June

30,

Reporting Currency

Change

Constant Currency

Change

Six Months Ended June

30,

Reporting Currency

Change

Constant Currency

Change

2024

2023

%

%

2024

2023

%

%

Net income for the period attributable

to shareholders

6,930

278

2393

%

2429

%

14,229

6,873

107

%

108

%

Weighted-average number of ordinary

shares, basic

36,724,946

37,082,794

(1

)%

(1

)%

36,906,748

36,757,214

—

%

—

%

Net income per share attributable to

shareholders, basic

0.19

0.01

1800

%

1800

%

0.39

0.19

105

%

105

%

Net income for the period attributable

to shareholders

6,930

278

2393

%

2429

%

14,229

6,873

107

%

108

%

Weighted-average number of ordinary

shares, diluted

36,990,785

38,462,183

(4

)%

(4

)%

37,212,252

38,123,560

(2

)%

(2

)%

Net income per share attributable to

shareholders, diluted

0.19

0.01

1800

%

1800

%

0.38

0.18

111

%

111

%

Disaggregated Revenue

Revenue is disaggregated based on how the nature, amount, timing

and uncertainty of the revenue and cash flows are affected by

economic factors.

The Company presents revenue as disaggregated by market based on

the location of end user as follows:

Three Months Ended June

30,

Change

Six Months Ended June

30,

Change

2024

2023

2024 vs 2023

2024

2023

2024 vs 2023

North America

12,257

13,361

(8

)%

27,073

27,504

(2

)%

U.K. and Ireland

9,911

8,364

18

%

18,831

16,891

11

%

Other Europe

5,931

2,812

111

%

9,792

5,582

75

%

Rest of the world

2,442

1,435

70

%

4,060

2,687

51

%

Total revenues

30,541

25,972

18

%

59,756

52,664

13

%

The Company presents disaggregated revenue by monetization type

as follows:

Three Months Ended June

30,

Change

Six Months Ended June

30,

Change

2024

2023

2024 vs 2023

2024

2023

2024 vs 2023

Performance marketing

24,219

20,776

17

%

47,592

42,537

12

%

Subscription and content syndication

1,946

1,712

14

%

3,905

3,575

9

%

Advertising and other

4,376

3,484

26

%

8,259

6,552

26

%

Total revenues

30,541

25,972

18

%

59,756

52,664

13

%

The Company also tracks its revenues based on the product type

from which it is derived. Revenue disaggregated by product type was

as follows:

Three Months Ended June

30,

Change

Six Months Ended June

30,

Change

2024

2023

2024 vs 2023

2024

2023

2024 vs 2023

Casino

22,073

17,541

26

%

41,883

34,613

21

%

Sports

8,180

8,394

(3

)%

17,317

17,588

(2

)%

Other

288

37

678

%

556

463

20

%

Total revenues

30,541

25,972

18

%

59,756

52,664

13

%

Supplemental Information

Rounding

We have made rounding adjustments to some of the figures

included in the discussion and analysis of our financial condition

and results of operations together with our consolidated financial

statements and the related notes thereto. Accordingly, numerical

figures shown as totals in some tables may not be an arithmetic

aggregation of the figures that preceded them.

Non-IFRS Financial Measures

Management uses several financial measures, both IFRS and

non-IFRS financial measures in analyzing and assessing the overall

performance of the business and for making operational

decisions.

Adjusted Net Income and Adjusted Net Income Per Share

Adjusted net income is a non-IFRS financial measure defined as

net income attributable to equity holders excluding the fair value

gain or loss related to contingent consideration, unwinding of

deferred consideration, and certain employee bonuses related to

acquisitions. Adjusted net income per diluted share is a non-IFRS

financial measure defined as adjusted net income attributable to

equity holders divided by the diluted weighted average number of

common shares outstanding.

We believe adjusted net income and adjusted net income per

diluted share are useful to our management as a measure of

comparative performance from period to period as these measures

remove the effect of the fair value gain or loss related to the

contingent consideration, unwinding of deferred consideration, and

certain employee bonuses, all associated with our acquisitions,

during the limited period where these items are incurred. The

unwinding of deferred consideration during the three and six months

ended June 30, 2024 is mainly associated with the unwinding of the

discount applied to the valuation of deferred consideration for the

acquisition of the Freebets.com assets. The unwinding of deferred

consideration and employee bonuses incurred until April 2024 relate

to the Company’s acquisition of RotoWire and BonusFinder. See Note

5 of the consolidated financial statements for the year ended

December 31, 2023 filed on March 21, 2024 for a description of the

contingent and deferred considerations associated with our 2022

acquisitions.

Below is a reconciliation to Adjusted net income attributable to

equity holders and Adjusted net income per share, diluted from net

income for the period attributable to the equity holders and net

income per share attributed to ordinary shareholders, diluted as

presented in the Consolidated Statements of Comprehensive Income

and for the period specified stated in the Company's reporting

currency and constant currency (unaudited):

Reporting Currency

Constant Currency

Reporting Currency

Constant Currency

Three months ended June

30,

Change

Change

Six Months Ended June

30,

Change

Change

2024

2023

%

%

2024

2023

%

%

Revenue

30,541

25,972

18

%

19

%

59,756

52,664

13

%

14

%

Net income for the period attributable

to shareholders

6,930

278

2393

%

2429

%

14,229

6,873

107

%

108

%

Net income margin

23

%

1

%

24

%

13

%

Net income for the period attributable

to shareholders

6,930

278

2393

%

2429

%

14,229

6,873

107

%

108

%

Fair value movement on contingent

consideration (1)

—

6,087

(100

)%

(100

)%

—

6,939

(100

)%

(100

)%

Unwinding of deferred consideration

(1)

426

55

675

%

689

%

679

109

523

%

529

%

Employees' bonuses related to

acquisition(1)

—

115

(100

)%

(100

)%

—

165

(100

)%

(100

)%

Adjusted net income for the period

attributable to shareholders

7,356

6,535

13

%

14

%

14,908

14,086

6

%

7

%

Net income per share attributable to

shareholders, basic

0.19

0.01

1800

%

1800

%

0.39

0.19

105

%

105

%

Effect of adjustments for fair value

movements on contingent consideration, basic

0.00

0.16

(100

)%

(100

)%

0.00

0.19

(100

)%

(100

)%

Effect of adjustments for unwinding on

deferred consideration, basic

0.01

0.00

100

%

100

%

0.02

0.00

100

%

100

%

Effect of adjustments for bonuses related

to acquisition, basic

0.00

0.00

—

%

—

%

0.00

0.00

—

%

—

%

Adjusted net income per share

attributable to shareholders, basic

0.20

0.17

18

%

11

%

0.41

0.38

8

%

8

%

Net income per share attributable to

ordinary shareholders, diluted

0.19

0.01

1800

%

1800

%

0.38

0.18

111

%

111

%

Adjusted net income per share attributable

to shareholders, diluted

0.20

0.17

18

%

18

%

0.40

0.37

8

%

8

%

__________

(1)

There is no tax impact from fair value

movement on contingent consideration, unwinding of deferred

consideration or employee bonuses related to acquisition.

EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin

EBITDA is a non-IFRS financial measure defined as earnings

excluding interest, income tax (charge) credit, depreciation, and

amortization. Adjusted EBITDA is a non-IFRS financial measure

defined as EBITDA adjusted to exclude the effect of non-recurring

items, significant non-cash items, share-based payment expense,

foreign exchange gains (losses), fair value of contingent

consideration, and other items that our board of directors believes

do not reflect the underlying performance of the business,

including acquisition related expenses, such as acquisition related

costs and bonuses. Adjusted EBITDA Margin is a non-IFRS measure

defined as Adjusted EBITDA as a percentage of revenue.

We believe Adjusted EBITDA and Adjusted EBITDA Margin are useful

to our management team as a measure of comparative operating

performance from period to period as those measures remove the

effect of items not directly resulting from our core operations

including effects that are generated by differences in capital

structure, depreciation, tax effects and non-recurring events.

While we use Adjusted EBITDA and Adjusted EBITDA Margin as tools

to enhance our understanding of certain aspects of our financial

performance, we do not believe that Adjusted EBITDA and Adjusted

EBITDA Margin are substitutes for, or superior to, the information

provided by IFRS results. As such, the presentation of Adjusted

EBITDA and Adjusted EBITDA Margin is not intended to be considered

in isolation or as a substitute for any measure prepared in

accordance with IFRS. The primary limitations associated with the

use of Adjusted EBITDA and Adjusted EBITDA Margin as compared to

IFRS results are that Adjusted EBITDA and Adjusted EBITDA Margin as

we define them may not be comparable to similarly titled measures

used by other companies in our industry and that Adjusted EBITDA

and Adjusted EBITDA Margin may exclude financial information that

some investors may consider important in evaluating our

performance.

Below is a reconciliation to EBITDA, Adjusted EBITDA from net

income for the period attributable to shareholders as presented in

the Consolidated Statements of Comprehensive Income and for the

period specified (unaudited):

Reporting Currency

Constant Currency

Reporting Currency

Constant Currency

Three Months Ended June

30,

Change

Change

Six Months Ended June

30,

Change

Change

2024

2023

%

%

2024

2023

%

%

(USD in thousands)

(USD in thousands)

Net income (loss) for the period

attributable to shareholders

6,930

278

2393

%

2429

%

14,229

6,873

107

%

108

%

Add back (deduct):

Interest expenses on borrowings and lease

liability

445

44

911

%

911

%

479

87

451

%

457

%

Income tax charge

723

643

12

%

14

%

1,805

1,743

4

%

4

%

Depreciation expense

71

63

13

%

15

%

141

120

18

%

18

%

Amortization expense

1,550

417

272

%

275

%

2,104

905

132

%

134

%

EBITDA

9,719

1,445

573

%

580

%

18,758

9,728

93

%

94

%

Share-based payment and related

expense

1,720

1,253

37

%

39

%

2,557

2,099

22

%

23

%

Fair value movement on contingent

consideration

—

6,087

(100

)%

(100

)%

—

6,939

(100

)%

(100

)%

Interest income

(30

)

(60

)

(50

)%

(49

)%

(104

)

(79

)

32

%

33

%

Unwinding of deferred consideration

426

55

675

%

689

%

679

109

523

%

529

%

Foreign currency translation losses

(gains), net

(198

)

(243

)

(19

)%

(18

)%

(917

)

103

(990

)%

(999

)%

Other finance results

24

18

33

%

33

%

40

57

(30

)%

(30

)%

Secondary offering related costs

—

733

(100

)%

(100

)%

—

733

(100

)%

(100

)%

Acquisition related costs (1)(2)

(450

)

21

(2243

)%

(2243

)%

357

243

47

%

48

%

Employees' bonuses related to

acquisition

—

115

(100

)%

(100

)%

—

165

(100

)%

(100

)%

Adjusted EBITDA

11,211

9,424

19

%

20

%

21,370

20,097

6

%

7

%

__________

(1)

The acquisition costs are related to

historical and contemplated business combinations of the Group.

(2)

During the three months ended June 30,

2024, accounting treatment related to the asset acquisition in

April 2024 was finalized which resulted in capitalization of $0.5

million acquisition related costs incurred during the three months

ended March 31, 2024

Below is the Adjusted EBITDA Margin calculation for the period

specified stated in the Company's reporting currency and constant

currency (unaudited):

Reporting Currency

Constant Currency

Reporting Currency

Constant Currency

Three Months Ended June

30,

Change

Change

Six Months Ended June

30,

Change

Change

2024

2023

%

%

2024

2023

%

%

(USD in thousands, except

margin)

(in thousands USD, except

margin)

Revenue

30,541

25,972

18

%

19

%

59,756

52,664

13

%

14

%

Adjusted EBITDA

11,211

9,424

19

%

20

%

21,370

20,097

6

%

7

%

Adjusted EBITDA Margin

37

%

36

%

36

%

38

%

In regard to forward looking non-IFRS guidance, we are not able

to reconcile the forward-looking non-IFRS Adjusted EBITDA measure

to the closest corresponding IFRS measure without unreasonable

efforts because we are unable to predict the ultimate outcome of

certain significant items including, but not limited to, fair value

movements, share-based payments for future awards,

acquisition-related expenses and certain financing and tax

items.

Free Cash Flow

Free Cash Flow is a non-IFRS liquidity financial measure defined

as cash flow from operating activities less capital expenditures.

In the second quarter of 2024, the Company changed its definition

of free cash flow to exclude from capital expenditures the cash

flows related to acquisitions accounted for as business

combinations and asset acquisitions. Previously, capital

expenditures only excluded cash flows related to business

combinations. The Company believes that this more appropriately

reflects the measurement of free cash flow as it limits the

adjustments to capital expenditures that relate to ongoing

maintenance capital expenditure.

We believe Free Cash Flow is useful to our management team as a

measure of financial performance as it measures our ability to

generate additional cash from our operations. While we use Free

Cash Flow as a tool to enhance our understanding of certain aspects

of our financial performance, we do not believe that Free Cash Flow

is a substitute for, or superior to, the information provided by

IFRS metrics. As such, the presentation of Free Cash Flow is not

intended to be considered in isolation or as a substitute for any

measure prepared in accordance with IFRS.

The primary limitation associated with the use of Free Cash Flow

as compared to IFRS metrics is that Free Cash Flow does not

represent residual cash flows available for discretionary

expenditures because the measure does not deduct the payments

required for debt payments and other obligations or payments made

for acquisitions. Free Cash Flow as we define it also may not be

comparable to similarly titled measures used by other companies in

the online gambling affiliate industry.

Below is a reconciliation to Free Cash Flow from cash flows

generated by operating activities as presented in the Consolidated

Statement of Cash Flows for the period specified in the Company's

reporting currency (unaudited):

Three Months Ended June

30,

Change

Six Months Ended June

30,

Change

2024

2023

%

2024

2023

%

(in thousands USD,

unaudited)

(USD in thousands,

unaudited)

Cash flows generated by operating

activities

193

4,586

(96

)%

8,999

11,669

(23

)%

Adjustment for items presented in

operating activities:

Payment of contingent consideration

—

4,621

(100

)%

—

4,621

(100

)%

Payment of deferred consideration

7,156

—

100

%

7,156

—

100

%

Adjustment for items presenting in

investing activities:

Capital Expenditures (1)

(1,366

)

(554

)

147

%

(1,979

)

(1,166

)

(70

)%

Free Cash Flow

5,983

8,653

(31

)%

14,176

15,124

(6

)%

__________

(1)

Capital expenditures are defined as the

acquisition of property and equipment, and capitalized research and

development costs, and excludes cash flows related to acquisitions

accounted for as business combinations and asset acquisitions, as

described above. Accordingly, capital expenditures presented above

for the six months ended June 30, 2024 and 2023 exclude $20.6

million (related to the Freebets.com Asset acquisition) and $0.4

million, respectively.

Due to the change in the definition of free cash flow, as

discussed above, the Company has recast its full year 2023, 2022

and 2021 free cash flow in the following tables.

The table below provides free cash flow in accordance with the

changed definition of free cash flow, which excludes capital

expenditures related to the acquisition of intangible assets:

Year Ended December

31,

2023

2022

2021

(USD in thousands)

Cash flows generated by operating

activities

17,910

18,755

13,997

Adjustment for items presented in

operating activities:

Payment of contingent consideration

4,621

—

—

Payment of deferred consideration

2,897

—

—

Adjustment for items presenting in

investing activities:

Capital Expenditures

(2,365

)

(2,323

)

(1,964

)

Free Cash Flow

23,063

16,432

12,033

Capital expenditures presented above for the years ended

December 31, 2023, 2022 and 2021 have been recast to exclude cash

flows related to intangible asset acquisitions $6.9 million, $7.0

million and $3.6 million, respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240815580067/en/

For further information, please contact:

Investors: Peter McGough, Gambling.com Group,

investors@gdcgroup.com Richard Land, Norberto Aja, JCIR,

GAMB@jcir.com, 212-835-8500

Media: Eddie Motl, Gambling.com Group,

media@gdcgroup.com

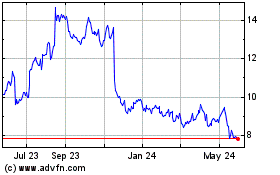

Gambling com (NASDAQ:GAMB)

Historical Stock Chart

From Dec 2024 to Jan 2025

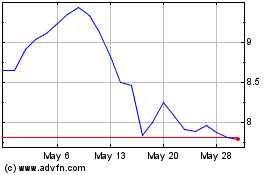

Gambling com (NASDAQ:GAMB)

Historical Stock Chart

From Jan 2024 to Jan 2025