UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

Under

the Securities Exchange Act of 1934

For

the Month of August 2023

001-36345

(Commission

File Number)

GALMED

PHARMACEUTICALS LTD.

(Exact

name of Registrant as specified in its charter)

16

Tiomkin St.

Tel

Aviv 6578317, Israel

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover

Form

20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Galmed

Pharmaceuticals Ltd. (the “Company”) announces that it will hold a Special General Meeting of Shareholders on Wednesday,

September 13, 2023, at 5:00 p.m. (Israel time) at the offices of the Company at 16 Tiomkin St., Tel Aviv, Israel. A copy of the Notice

of the Special General Meeting of Shareholders and Proxy Statement and the Proxy Card are attached hereto as Exhibit 99.1 and Exhibit

99.2, respectively, and are incorporated herein by reference.

This

Form 6-K is incorporated by reference into the Company’s Registration Statements on Form S-8 (Registration No. 333-206292

and 333-227441) and the Company’s Registration Statement on Form F-3 (Registration No. 333-254766).

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Galmed Pharmaceuticals Ltd. |

| |

|

|

| Date: August 9, 2023 |

By: |

/s/ Allen

Baharaff |

| |

|

Allen Baharaff |

| |

|

President and Chief Executive Officer |

Exhibit

99.1

GALMED

PHARMACEUTICALS LTD.

16

Tiomkin St.

Tel

Aviv 6578317, Israel

August

9, 2023

Dear

Shareholder:

You

are cordially invited to attend the Special General Meeting of Shareholders of Galmed Pharmaceuticals Ltd. (the “Company”)

to be held at 5:00 p.m., Israel time, on September 13, 2023, at the offices of the Company at 16 Tiomkin St., Tel Aviv 6578317, Israel

(the “Meeting”).

You

will be asked at this Meeting to take action on the matters set forth in the attached Notice of the Special General Meeting of Shareholders.

The Company’s board of directors is recommending that you vote “FOR” all of the Proposals on the agenda, each as specified

in the enclosed Proxy Statement.

A

discussion period will be provided at the Meeting for questions and comments of general interest to shareholders.

We

look forward to personally greeting those shareholders who are able to be present at the Meeting. If you do plan to attend, we ask that

you bring with you some form of personal identification and verification of your status as a shareholder as of the close of trading on

August 11, 2023, the record date for the Meeting. However, whether or not you will be with us at the Meeting, it is important that your

shares be represented. Accordingly, you are requested to complete, date, sign and mail the enclosed proxy in the envelope provided at

your earliest convenience and in any event so as to be received by the Company in a timely manner as set forth in the enclosed Proxy

Statement.

Thank

you for your cooperation.

| |

Very

truly yours, |

| |

Allen

Baharaff |

| |

President

and Chief Executive Officer |

GALMED

PHARMACEUTICALS LTD.

16

Tiomkin St.

Tel

Aviv 6578317, Israel

PROXY

STATEMENT

NOTICE

OF SPECIAL GENERAL MEETING OF SHAREHOLDERS

To

be held on Wednesday, September 13, 2023

This

Proxy Statement is furnished to the holders of ordinary shares, par value of 0.15 New Israeli

Shekel per share (the “Ordinary Shares” or “Shares”) of

Galmed Pharmaceuticals Ltd. (the “Company”, “Galmed”,

“us” or “our”) for use at the Special General Meeting of Shareholders (the “Meeting”)

to be held at the offices of the Company at 16 Tiomkin St., Tel Aviv 6578317, Israel on Wednesday, September 13, 2023, at 5:00 p.m. (Israel

time), and at each postponement or adjournment thereof.

The

agenda for the Meeting includes the following matters (the “Proposals”):

| |

1. |

To

approve equity grants to each of our named executive officers and directors, including to our Chief Executive Officer; and |

| |

|

|

| |

2. |

To

approve an amendment to the exercise period of outstanding options granted to our Chief Executive Officer. |

The

Company is not currently aware of any other matters to be presented at the Meeting. If other matters properly come before the Meeting,

it is the intention of the persons designated as proxies to vote in accordance with their judgment on such matters.

Record

Date; Entitlement to Vote

The

record date for determining shareholders entitled to notice of, and to vote at, the Meeting has been established as of the close of trading

on the Nasdaq Capital Market on Friday, August 11, 2023 (the “Record Date”).

As

of August 8, 2023, the Company had outstanding 3,807,189 Ordinary Shares, each of which is entitled to one vote upon the matters to be

presented at the Meeting.

Quorum

Two

or more shareholders, present in person, by proxy or by proxy card, and holding Shares conferring in the aggregate more than 33.33% of

the voting power of the Company on the Record Date, shall constitute a quorum at the Meeting. Should no quorum be present within half

an hour from the time set for the Meeting, the Meeting shall be adjourned to Wednesday, September 20, 2023, at the same time and place.

No further notice will be given or publicized with respect to such adjourned meeting. If at such adjourned meeting a quorum is not present

within half an hour from the time stated for such meeting, any two shareholders present in person, by proxy or by proxy card, shall constitute

a quorum, even if they represent in the aggregate shares conferring 33.33% or less of the voting power of the Company on the Record Date.

Joint

holders of Shares should take note that, pursuant to Article 64 of the Company’s Amended and Restated Articles of Association (the

“Articles”), the vote of the senior holder who tenders a vote, in person, by proxy or by proxy card, will be accepted

to the exclusion of the vote(s) of the other joint holder(s), and for this purpose seniority will be determined by the order in which

the names appear in the Company’s shareholder register.

Required

Vote and Voting Procedures

The

affirmative vote of holders of a majority of the Shares participating and voting at the Meeting, in person, by proxy or by proxy card

is required to adopt each of the Proposals to be presented at the Meeting.

The

approval of Proposals 1 and 2 is also subject to the fulfillment of one of the following additional voting requirements, as required

under the Israeli Companies Law, 5759-1999 (the “Companies Law”): (i) the majority of the Shares that are voted at

the Meeting in favor of the Proposal, excluding abstentions, includes a majority of the votes of shareholders who are not controlling

shareholders or do not have a personal interest in the approval of the Proposal; or (ii) the total number of Shares of the shareholders

mentioned in clause (i) above that are voted against the Proposal does not exceed two percent (2%) of the total voting rights in the

Company (the “Special Majority”).

For

this purpose, a “controlling shareholder” is any shareholder that has the ability to direct the Company’s activities

(other than by means of being a director or office holder of the Company). A person is presumed to be a controlling shareholder if it

holds or controls, by himself or together with others, one half or more of any one of the “means of control” of a company.

“Means of control” is defined as any one of the following: (i) the right to vote at a general meeting of a company, or (ii)

the right to appoint directors of a company or its chief executive officer. For the purpose of Proposals 1 and 2, the term controlling

shareholder shall also include a person who holds 25% or more of the voting rights in the general meeting of the company if there is

no other person who holds more than 50% of the voting rights in the company; for the purpose of a holding, two or more persons holding

voting rights in the company each of which has a personal interest in the approval of the transaction being brought for approval of the

company will be considered to be joint holders.

A

“personal interest” of a shareholder in an action or transaction of a company includes a personal interest of any of the

shareholder’s relatives (i.e. spouse, brother or sister, parent, grandparent, child as well as child, brother, sister or parent

of such shareholder’s spouse or the spouse of any of the above) or an interest of a company with respect to which the shareholder

or the shareholder’s relative (as defined above) holds 5% or more of such company’s issued shares or voting rights, in which

any such person has the right to appoint a director or the chief executive officer or in which any such person serves as director or

the chief executive officer, including the personal interest of a person voting pursuant to a proxy which the proxy grantor has a personal

interest, whether or not the person voting pursuant to such proxy has discretion with regards to the vote; and excludes an interest arising

solely from the ownership of ordinary shares of a company

If

you do not state whether or not you are a controlling shareholder or have a personal interest with respect to Proposals 1 and 2,

by marking “YES” or “NO” on the proxy card or voting instruction form (or in your electronic submission), your

Shares will not be voted for Proposals 1 and 2.

As

of this date, we are not aware of any controlling shareholders as defined above, and therefore believe that other than our directors,

officers and their relatives, none of our shareholders should have a personal interest in Proposals 1 and 2. Such shareholders should

mark “NO” in the appropriate place on the proxy card or voting instruction form (or in their electronic submission).

To

be counted, a duly executed proxy or proxy card must be received by the Company prior to the Meeting. An instrument appointing a proxy

or a proxy card shall be in writing in a form approved by the Board of Directors of the Company (the “Board”), and

shall be delivered to the Company at its registered offices at 16 Tiomkin St. 4th floor, Tel Aviv, Israel 6578317, Attention:

Yohai Stenzler, CPA, Company Chief Accounting Officer, or to Broadridge Financial Solutions, Inc., in an enclosed envelope, not less

than four (4) hours before the time scheduled for the Meeting or adjourned meeting or presented to the chairperson of the Meeting at

the Meeting. Shares represented by proxies and proxy cards received after the times specified above will not be counted as present at

the Meeting and thus will not be voted.

Shareholders

may revoke the authority granted by their execution of a proxy or a proxy card at any time before the effective exercise thereof by voting

in person at the Meeting or by either written notice of such revocation or later-dated proxy or proxy card, in each case delivered either

to the Company or to Broadridge Financial Solutions, Inc., not less than four (4) hours before the time scheduled for the Meeting

or adjourned meeting or presented to the chairperson of the Meeting at the Meeting.

Ordinary

Shares represented by executed and unrevoked proxies will be voted in the manner instructed by the executing shareholder. If no specific

instructions are given, the Shares will not be voted and counted with respect to Proposals 1 and 2 set forth in the Notice of Special

General Meeting of Shareholders.

If

you are a record holder of Shares, and wish to vote via the internet, please follow the instructions indicated on the proxy card.

Position

Statements

In

accordance with the Companies Law and regulations promulgated thereunder, any shareholder of the Company may submit to the Company a

position statement on its behalf, expressing its position on an agenda item for the Meeting to the Company’s offices, 16 Tiomkin

St., Tel Aviv 6578317, Israel, Attention: Yohai Stenzler, CPA, Company Chief Accounting Officer, or by facsimile to +972-3-6938447, no

later than September 3, 2023 at 5:00 pm Israel time.

Meeting

Agenda

In

accordance with the Companies Law and regulations promulgated thereunder, any shareholder of the Company holding at least one percent

(1%) of the outstanding voting rights of the Company may submit to the Company a proposed additional agenda item for the Meeting, to

the Company’s offices, 16 Tiomkin St., Tel Aviv 6578317, Israel, Attention: Yohai Stenzler, CPA, Company Chief Accounting Officer,

or by facsimile to +972-3-6938447, no later than Wednesday, August 16, 2023 at 1:00 pm Israel time. To the extent that there are any

additional agenda items that the Board determines to add as a result of any such submission, the Company will publish an updated agenda

and proxy card with respect to the Meeting, no later than Wednesday, August 23 ,2023, which will be furnished to the U.S. Securities

and Exchange Commission (the “SEC”) on Form 6-K, and will be made available to the public on the SEC’s website

at http://www.sec.gov.

PROPOSAL

1

APPROVAL

OF EQUITY GRANTS TO EACH OF OUR NAMED EXECUTIVE OFFICERS AND DIRECTORS, INCLUDING TO OUR CHIEF EXECUTIVE OFFICER

Background

On

July 14, 2023, the Company entered into a definitive securities purchase agreement with certain investors for the purchase and sale in

a public offering (the “Offering”) of the Company’s Ordinary Shares, pre-funded warrants to purchase Ordinary

Shares and warrants to purchase Ordinary Shares. The net proceeds to the Company from the Offering,

which closed on July 18, 2023, were approximately $6.5 million before deducting estimated offering expenses payable by the Company.

As

of August 6, 2023, the Company had 196,276 Ordinary Shares subject to outstanding equity awards granted or available for grant, of which:

(i) 175,035 Ordinary Shares are allocated and issuable upon exercise of outstanding awards granted under the Company’s 2013 Incentive

Share Option Plan (the “2013 Plan”) and (ii) 21,241 Ordinary shares are reserved for future issuance of awards under

the 2013 Plan.

On

August 7, 2023, the Board approved to authorize and reserve for purposes of future issuance under the 2013 Plan, an additional 1,803,274

Ordinary Shares, such that the aggregate Ordinary Shares reserved under the 2013 Plan will be 2,000,000. The Company believes that the

increased number of Shares is necessary to incentivize the Company’s executive officers and directors and to provide the Board

with flexibility to incentivize other employees and consultants. Under Israeli Law, the increase to the number of shares available for

issuance under an equity incentive plan, may be approved by the Board and does not require further shareholder approval.

Accordingly,

following the consummation of the Offering and in order to appropriately incentivize the Company’s directors and officers to continue

to deliver value to the shareholders, the remuneration committee and Board approved equity grants to each of our executive officers and

directors named below, including to our Chief Executive Officer.

The

proposed equity grants for the executive officers and directors are as set forth below (the “Proposed Equity Grant”):

| |

● |

Mr.

Allen Baharaff, President, Chief Executive Officer and Director, a grant of 640,000

Restricted Share Units (“RSUs”). |

| |

|

|

| |

● |

Mr.

Doron Cohen, Chief Financial Officer; Mr. Yohai Stenzler, Chief Accounting Officer and Mr. Guy Nehemya, Chief Operating Officer,

a grant of 150,000 RSUs each. |

| |

|

|

| |

● |

Non-management

directors (as such term is defined in the Compensation Policy): Dr. David Sidransky, Mr. Amir Pushinski and Mr. Shmuel Nir, a

grant of 75,000 RSUs each and Dr. Carol L. Brosgart, a grant of options to purchase up to 75,000 Ordinary Shares. |

The

Proposed Equity Grant would be granted under the 2013 Plan and would vest over a period of three (3) years, such that 1/3 of the Shares

underlying the Proposed Equity Grant shall vest on the first anniversary of the grant (i.e., the date of the Board’s approval on

August 7, 2023), and thereafter, the Proposed Equity Grant will vest with respect to the additional 2/3 of the underlying Shares equally

every 6 months thereafter, provided that each executive officer or director continues to serve as an executive officer or a director

of the Company or its affiliates, as applicable, throughout each such vesting date. All of the unvested Shares under the Proposed Equity

Grant shall automatically vest and become exercisable upon the consummation of a Transaction (as defined in the 2013 Plan).

The

grant is subject to the execution by each grantee of an appropriate equity agreement with the Company confirming the terms and conditions

applying to the grant and will expire on August 6, 2033. The Proposed Equity Grant to our executive officers, Mr. Baharaff, Mr. Cohen,

Mr. Stenzler and Mr. Nehemya would be granted in accordance with Section 102 of the Income Tax Ordinance (New Version), 5721-1961 (the

“Tax Ordinance”). The Proposed Equity Grant to our non-management directors would be granted in accordance with Section

102 of the Tax Ordinance, other than with respect to Dr. Brosgart, a resident of the United States, who would be granted Non-Qualified

Stock Options. Dr. Brosgart’s options will vest under the same schedule and terms described above and will have an exercise price

of $0.92, the closing price of the Company’s Ordinary Shares on the Nasdaq Stock Market on

August 6, 2023, the day prior to the Board’s meeting.

Compensation

Advisor and Analysis

The

Company engaged the services of Laor Consulting and Investments Ltd. (“Laor Consulting”), a provider of consulting

services relating to economic-financial consultation and independent professional valuation, to review the Proposed Equity Grants and

advise as to whether they are aligned with, and competitive relative to market practices. Laor Consulting declared to the remuneration

committee that it has no personal interest or affiliation with the Company.

Based

on Laor Consulting’s report and recommendations, the remuneration committee approved a list of eight (8) companies as our peer

group, for the purpose of supporting the process of determining the Proposed Equity Grants and providing analysis of it as part of this

Notice of Special General Meeting and Proxy Statement. Our peer group is made up of companies which are most comparable to us on a range

of criteria, including industry, revenue, market capitalization and other qualitative and business-related factors. In accordance with

Laor Consulting’s compensation analysis, the Proposed Equity Grants are between the 25th and 50th percentiles

of our peer group.

The

remuneration committee and the Board believe the Proposed Equity Grants are designed to appropriately incentivize our executive officers

and directors to realize and maximize the benefits of the Offering, the initiation of the Company’s Primary Sclerosing Cholangitis

(PSC) clinical development program and promote the Company’s long-term advancement. As a result, the Company believes that the

Proposed Equity Grants aligns the proposed compensation with shareholder interests.

Israeli

Companies Law Requirement

Under

the Companies Law, terms of compensation of a public company’s office holders (other than the Chief Executive Officer) must be

approved by the remuneration committee and thereafter by the Board, provided that such compensation arrangement is consistent with the

compensation policy. If such compensation arrangement is inconsistent with the compensation policy, shareholder approval is required,

with the approval of the Special Majority. Arrangements between a public company and directors or with a Chief Executive Officer, relating

to their compensation, must also be consistent with the compensation policy, and requires the approval of the remuneration committee,

Board, and shareholders by a simple majority (in that order). If such compensation arrangement is inconsistent with the compensation

policy, shareholder approval is required, with the approval of the Special Majority.

Our

compensation policy for directors and officers (the “Compensation Policy”), was approved and adopted by the remuneration

committee and the Board on May 30, 2023, after concluding that such approval is in the Company’s best interest and in accordance

with the mechanism set forth in the Companies Law, which allows the Board to approve the Compensation Policy, notwithstanding the resolution

of the general meeting on May 11, 2023.

Our

Compensation Policy allows us to offer equity-based compensation in a form of share options and/or other equity-based awards, such as

RSUs or performance share units in order to attract and retain officers and to align their interests with shareholders’ interests

to maximize creation of long-term economic value for the Company. The Compensation Policy limits the value of equity-based awards granted

to any executive officer (including to the Chief Executive Officer), calculated as of the date of grant, during any calendar year, to

six (6) times the monthly base salary and benefits of such executive officer. With respect to directors, the value of equity-based awards

during any calendar year is limited to nine (9) times the fees of such director on an annual basis.

The

value of equity-based awards, according to our Compensation Policy, is calculated as of the date of grant. The

Company views August 7, 2023, the date of approval of the Proposed Equity Grants by the remuneration committee and the Board, as the

date of grant for purposes of determining the value of an award for purposes of the Compensation Policy.

Accordingly, the value of each Share underlying the Proposed Equity Grant is $0.92, the

closing price of the Company’s Ordinary Shares on the Nasdaq Stock Market on August 6, 2023, the day prior to the Board’s

meeting.

The

remuneration committee and the Board have reviewed, discussed and approved the Proposed Equity Grants as detailed hereunder and determined

that these grants exceed the limits described above and are therefore inconsistent with the terms and conditions of our Compensation

Policy.

Accordingly,

at the Meeting shareholders will be asked to approve the Proposed Equity Grants to our executive officers and directors, including to

our Chief Executive Officer.

When

considering the Proposed Equity Grants, the remuneration committee and the Board considered numerous factors, as required by the Companies

Law, including each executive officer’s and director’s performance and contribution to the Company.

The

shareholders’ vote on this Proposal 1 is binding under Israeli law and not merely advisory, unlike the

“say-on-pay” votes found in some proxy statements for U.S. domestic companies. Notwithstanding the foregoing, and solely

with respect to the Proposed Equity Grants to our executives (other than the Chief Executive Officer and members of our Board), the

Companies Law allows our remuneration committee and our Board to approve this Proposal even if at the Meeting the shareholders vote

against it, provided that the remuneration committee and thereafter the Board have concluded, following further and detailed

discussion of the matter and for specified reasons, that such approval is in the Company’s best interests.

Proposed

Resolution

It

is proposed that the following resolution be adopted at the Meeting:

“RESOLVED,

to approve equity grants to each of our named executive officers and directors, including to our Chief Executive Officer, as detailed

in the Proxy Statement, dated August 9, 2023.”

The

approval of the above resolution requires approval by a Special Majority.

The

Board recommends that the shareholders vote “FOR” the proposed resolution.

PROPOSAL

2

AMENDMENT

TO THE EXERCISE PERIOD OF OUTSTANDING OPTIONS

GRANTED TO OUR CHIEF EXECUTIVE OFFICER

Background

In

order to retain and motivate our Chief Executive Officer, President and director, Mr. Allen Baharaff, and to incentivize his continuous

contribution to the Company’s success and results of operations, our remuneration committee and Board approved to amend the exercise

period of outstanding options previously granted to Mr. Baharaff under the 2013 Plan.

At

the Meeting, shareholders will be asked to approve the

extension of the exercise period of options to purchase 21,654 Ordinary Shares (adjusted from 324,784 Ordinary Shares, following the

reverse split of the Company’s Ordinary Shares at a ratio of 1 for 15 on May 15, 2023) (the “Prior Awards”)

which were previously granted to Mr. Allen Baharaff. The Prior Awards were granted to Mr. Baharaff on December 20, 2013, prior to and

in connection with the Company’s initial public offering and have a nominal exercise price of NIS 0.15 per share and would expire

on December 30, 2023. Accordingly, the remuneration committee and Board approved to extend the exercise period of the Prior Awards by

approximately five (5) years, to December 31, 2028, if not exercised prior thereto (the “Extended Exercised Period”).

The Proposal to approve the Extended Exercise Period was included in the agenda for the Annual General Meetings of Shareholder, which

was held on May 11, 2023, however it was withdrawn prior to such meeting by unanimous consent of the Board.

The

Extended Exercise Period is inconsistent with our Compensation Policy, which limits the exercise period of equity awards granted to executive

officers, including to the Chief Executive Officer, to ten (10) years from the date of grant.

Therefore,

in approving the Extended Exercise Period, our remuneration committee and Board also considered the following factors, as required by

the Companies Law:

| ● |

advancement

of the Company’s objectives, the Company’s business plan and its long-term strategy; |

| |

|

| ● |

creation

of appropriate incentives for Mr. Baharaff, considering the Company’s risk management

policy; |

| |

|

| ● |

the

size and the nature of the Company’s operations; |

| |

|

| ● |

Mr.

Baharaff’s knowledge, skills, expertise and accomplishments; |

| |

|

| ● |

Mr.

Baharaff’s role and responsibility in 2023 as the Chief Executive Officer, President

and as a director; |

| |

|

| ● |

previous

terms of compensation provided to Mr. Baharaff as well as compensation granted to the

Company’s other employees and weighing the disparity between Mr. Baharaff’s

compensation terms and the Company’s employees’ average and median salary as well as the effect of any such disparity

on the working environment in the Company, while taking into account his leadership role at the Company; and |

| |

|

| ● |

other

relevant factors as required under the Companies Law. |

Our

remuneration committee and the Board also considered Mr. Baharaff’s extensive experience

and command of the business and role in the successful Offering, which

are critical to the advancement of the Company. As a result, the remuneration committee and Board believe that the proposed Extended

Exercise Period is in the best interest of our shareholders and the Company.

The

shareholders’ vote on this Proposal 2 is binding under Israeli law and not merely advisory, unlike the “say-on-pay”

votes found in some proxy statements for U.S. domestic companies.

Proposed

Resolution

It

is proposed that the following resolution be adopted at the Meeting:

“RESOLVED,

to approve the extension to the exercise period of 21,654 outstanding options previously granted to our Chief Executive Officer (and

director), by approximately five years, as described in the Proxy Statement dated August 9, 2023.”

The

approval of the above resolution requires approval by a Special Majority.

The

Board recommends that the shareholders vote “FOR” the proposed resolution.

OTHER

BUSINESS

Other

than as set forth above, management knows of no business to be transacted at the Meeting. If any other matters are properly presented

at the Meeting, Ordinary Shares represented by executed and unrevoked proxies will be voted by the persons named in the enclosed form

of proxy upon such matters in accordance with their best judgment.

| |

By Order of the

Board of Directors, |

| |

Dr.

David Sidransky

Lead

Independent Director |

Tel

Aviv, Israel

August

9, 2023

Exhibit

99.2

EACH

SHAREHOLDER IS URGED TO COMPLETE, DATE,

SIGN AND PROMPTLY

RETURN THE ENCLOSED PROXY

Special

General Meeting of Shareholders of

GALMED

PHARMACEUTICALS LTD.

September

13, 2023

NOTICE

OF INTERNET AVAILABILITY OF PROXY MATERIAL:

The

notice of the meeting, proxy statement and proxy card

are

available at http://galmedpharma.investorroom.com/

THIS

PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The

undersigned hereby constitutes and appoints each of Mr. Yohai Stenzler, the Company’s Chief Accounting Officer, and Mr. Guy Nehemya,

the Company’s Chief Operating Officer, and anyone on their behalf as the true and lawful attorneys, agents and proxies of the undersigned,

with full power of substitution, to vote with respect to all ordinary shares, par value NIS 0.15 per share, of Galmed Pharmaceuticals

Ltd. (the “Company”), standing in the name of the undersigned at the close of trading on August 11, 2023, at a Special

General Meeting of Shareholders of the Company to be held at the offices of the Company at 16 Tiomkin St., Tel Aviv 6578317, Israel on

Wednesday, September 13, 2023, at 5:00 p.m., Israel time, and at any and all adjournments thereof, with all the power that the undersigned

would possess if personally present and especially (but without limiting the general authorization and power hereby given) to vote as

specified on the reverse side.

Capitalized

terms used but not defined herein shall have the meanings given to them in the enclosed Proxy Statement.

The

shares represented by this proxy will be voted in the manner directed herein. If no specific instructions are given, the shares will

not be voted and counted with respect to Proposals 1 and 2 set forth in the enclosed Proxy Statements.

If

you do not state whether or not you are a controlling shareholder or have a personal interest with respect to Proposals 1 and 2, your

shares will not be voted for such Proposals.

The

undersigned hereby acknowledges receipt of the Notice of Special General Meeting of Shareholders and the Proxy Statement furnished therewith.

(Continued

and to be Signed on Reverse Side)

| |

VOTE

BY MAIL |

| |

|

| |

Mark,

sign and date your proxy card and return it in the envelope we have provided. |

| |

|

| |

VOTE

IN PERSON |

| |

|

| |

If

you would like to vote in person, please attend the Special General Meeting to be held at 16 Tiomkin St., Tel Aviv 6578317, Israel

on Wednesday, September 13, 2023, at 5:00 p.m. Israel time.

|

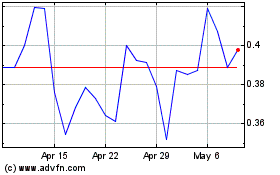

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

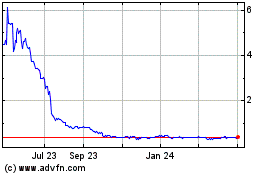

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Apr 2023 to Apr 2024