UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

–––––––––––––––––––––––––––––––––––––

FORM 8-K

–––––––––––––––––––––––––––––––––––––

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report: November 4, 2015

(Date of earliest event reported)

–––––––––––––––––––––––––––––––––––––

Papa Murphy’s Holdings, Inc.

(Exact name of registrant as specified in its charter)

–––––––––––––––––––––––––––––––––––––

|

| | | | |

Delaware (State or Other Jurisdiction of Incorporation or Organization) | | 001-36432 (Commission File Number) | | 27-2349094 (IRS Employer Identification No.) |

|

| | |

8000 NE Parkway Drive, Suite 350

Vancouver, WA (Address of principal executive offices) | | 98662 (Zip Code) |

(360) 260-7272

(Registrant's telephone number, including area code)

–––––––––––––––––––––––––––––––––––––

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On November 4, 2015, Papa Murphy’s Holdings, Inc. issued a press release announcing its financial results for the quarter ended September 28, 2015. A copy of the press release is furnished as Exhibit 99.1 to this current report and is incorporated by reference herein.

The information furnished on this Form 8-K, including the exhibit attached, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed with this report:

|

| | | |

EXHIBIT NUMBER | | DESCRIPTION OF EXHIBITS | |

99.1 | | Press Release dated November 4, 2015. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

PAPA MURPHY’S HOLDINGS, INC. |

| | |

By: | | /s/ Mark Hutchens |

| | Name: | Mark Hutchens |

| | Title: | Chief Financial Officer |

Date: November 4, 2015

EXHIBIT INDEX

|

| | | |

EXHIBIT NUMBER | | DESCRIPTION OF EXHIBITS | |

99.1 | | Press Release dated November 4, 2015. | |

FOR IMMEDIATE RELEASE

Papa Murphy’s Holdings, Inc. Reports Third Quarter 2015 Results

- 19th Consecutive Quarter of Positive U.S. System Comparable Store Sales Growth -

- 23 New Store Openings in the U.S. -

Vancouver, WA, November 4, 2015 (Globe Newswire) - Papa Murphy’s Holdings, Inc. (NASDAQ: FRSH) today announced financial results for its third quarter ended September 28, 2015.

Key financial highlights for the third quarter of 2015 include:

| |

• | Revenue of $28.13 million, an increase of 26.9% compared to the third quarter of 2014. |

| |

• | Domestic system comparable store sales growth of 1.4%, including growth of 1.5% at domestic franchisee-owned stores and flat comparable store sales at company-owned stores. |

| |

• | Net income was $1.12 million, or $0.07 per diluted share, compared to pro forma net income (1) of $1.32 million, or $0.08 per diluted share, in the third quarter of 2014. |

| |

• | Adjusted EBITDA (1) was $6.1 million, an increase of 9.1% compared to the third quarter of 2014. |

| |

• | Papa Murphy’s opened 23 new domestic stores in the quarter, compared to 13 domestic new store openings in the third quarter of 2014. |

______________________

| |

(1) | Pro forma net income and Adjusted EBITDA are non-GAAP measures. For reconciliations of Adjusted EBITDA and pro forma net income to GAAP net income and discussions of why we consider Adjusted EBITDA and pro forma net income to be useful measures, see the financial tables accompanying this release and the paragraph below entitled “Non-GAAP Financial Measures.” |

Ken Calwell, President and Chief Executive Officer of Papa Murphy’s Holdings, Inc., stated, “We are pleased to report positive domestic comparable store sales growth for the 19th consecutive quarter, demonstrating the strength and consistency of our business. Comparable store sales growth at our portfolio of company-owned stores was disproportionately affected in certain markets where we have a large concentration of stores that were lapping an early launch of our highly successful Gourmet DeLites line. In some of our less developed markets where we are focused on building stores and achieving scale, comparable store sales growth was significantly higher than the overall system. In the quarter we also opened 23 new stores in the U.S., including 16 franchise stores and three stores opened under our pre-sale development test.”

Calwell added, “We’re also excited about the progress we’ve made with our digital strategy. We’ve recently launched our first mobile app, allowing customers in select markets to order our delicious products from the convenience of their smartphone. POS and on-line ordering roll-outs are entering the final phase and we are excited with the progress we’ve made in partnership with Deloitte Digital to enhance our customer-facing e-commerce platform, which will better reflect the Papa Murphy’s brand personality and include a state-of-the-art customer experience. We now expect to be in a

position to launch the new site by the end of the first quarter of next year, a full quarter ahead of our initial plan.”

Key Operating Metrics

|

| | | | | | | |

| Three Months Ended |

| September 28,

2015 | | September 29,

2014 |

Domestic comparable store sales growth | | | |

Franchised stores | 1.5 | % | | 4.4 | % |

Company-owned stores | 0.0 | % | | 8.4 | % |

System-wide | 1.4 | % | | 4.6 | % |

| | | |

System-wide sales ($’s in 000s) | $ | 203,078 |

| | $ | 194,033 |

|

| | | |

Adjusted EBITDA ($’s in 000s) | $ | 6,144 |

| | $ | 5,633 |

|

| | | |

Store Count | | | |

Franchised | 1,374 |

| | 1,361 |

|

Company-owned | 126 |

| | 76 |

|

System-wide | 1,500 |

| | 1,437 |

|

We use a variety of operating and performance metrics to evaluate the performance of its business. Below is a description of our key operating metrics:

Comparable Store Sales represents the change in year-over-year sales for domestic comparable stores. A comparable store is a store that has been open for at least 52 full weeks from the comparable date (the Tuesday following the opening date). As of the end of the third quarter of 2015 and 2014, we had 1,366 and 1,315 domestic comparable stores, respectively.

System-wide Sales include net sales by all of our company-owned and franchisee-owned stores.

Adjusted EBITDA is defined as net income (loss) before interest expense, provision for (benefit from) income taxes and depreciation and amortization, with further adjustments to reflect the additions and eliminations of various income statement items including non-cash charges, income and expenses that we consider not indicative of ongoing operations and various other adjustments. For a reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure, see the financial tables accompanying this release.

2015 Financial Outlook

Based on current information, Papa Murphy’s Holdings, Inc. is reiterating the following full-year guidance for fiscal year 2015, which ends on December 28, 2015:

| |

• | Domestic system-wide comparable store sales growth in the range of 2.5% to 3.0% (compared to prior guidance of growth of at least 3.0%); |

| |

• | Total system-wide sales of approximately $900 million (compared to prior guidance of $900 million to $920 million); |

| |

• | Domestic new store openings of approximately 110 stores (compared to previous guidance of 110 to 115); |

| |

• | Selling, general and administrative expenses of about $29 million, including a year-end deficit of approximately $580,000 in the consolidated national advertising fund (compared to previous guidance of $28 million to $30 million); |

| |

• | Depreciation and Amortization expense of about $10 million (compared to previous guidance of $10 million to $12 million); and |

| |

• | Capital expenditures totaling approximately $23 million (compared to previous guidance of $23 million to $25 million). |

Conference Call

Papa Murphy’s Holdings, Inc. will host a conference call to discuss the third quarter financial results on Wednesday, November 4, 2015 at 4:30 p.m. Eastern Time.

The conference call can be accessed live over the phone by dialing 877-407-3982 or for international callers by dialing 201-493-6780. A replay will be available after the call and can be accessed by dialing 877-870-5176 or for international callers by dialing 858-384-5517; the passcode is 13621084. The replay will be available until Wednesday, November 11, 2015. The conference call will also be webcast live from the Company’s corporate website at investors.papamurphys.com, under the “Events & Presentations” page. An archive of the webcast will be available at this location shortly after the call has concluded.

About Papa Murphy’s

Papa Murphy’s Holdings, Inc. (Nasdaq: FRSH) is a franchisor and operator of the largest Take ‘N’ Bake pizza chain in the United States, selling fresh, hand-crafted pizzas ready for customers to bake at home. The company was founded in 1981 and currently operates over 1,500 franchised and corporate-owned fresh pizza stores in 38 States, Canada and United Arab Emirates. Papa Murphy’s core purpose is to bring all families together through food people love with a goal to create fun, convenient and fulfilling family dinners. In addition to scratch-made pizzas, the company offers a growing menu of grab ‘n’ go items, including salads, sides and desserts. For more information, visit www.papamurphys.com. Find Papa Murphy’s on Facebook at www.facebook.com/papamurphyspizza.

Forward-looking Statements

This news release, as well as other information provided from time to time by Papa Murphy’s Holdings, Inc. or its employees, may contain forward looking statements that involve risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward looking statements. Forward-looking statements give the Company’s current expectations and projections relating to the Company’s financial condition, results of operations, plans, objectives, future

performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “guidance,” “anticipate,” “estimate,” “expect,” “forecast,” “project,” “plan,” “intend,” “believe,” “confident,” “may,” “should,” “can have,” “likely,” “future” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events.

Forward-looking statements in this press release include statements relating to the Company’s projected sales growth, projected system-wide sales, projected new store openings, projected selling, general, and administrative expenses, the timing of projected marketing expenses, projected pre-opening expenses, projected depreciation expenses, projected capital expenditures, projected increases in margins, projected diluted share count, strategic, operational, and technological initiatives, future financial or operational results, and speed of consumer acceptance.

Any such forward-looking statements are not guarantees of performance or results, and involve risks, uncertainties (some of which are beyond the Company’s control) and assumptions. Although the Company believes any forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results and cause them to differ materially from those anticipated in any forward-looking statements. Please refer to the risk factors discussed in the Company’s annual report on Form 10-K for the fiscal year ended December 29, 2014 and the Company’s current report on Form 10-Q for the quarter ended June 29, 2015 (both of which can be found at the SEC’s website www.sec.gov); each such risk factor is specifically incorporated into this press release. Should one or more of these risks or uncertainties materialize, the Company’s actual results may vary in material respects from those projected in any forward-looking statements.

Any forward-looking statement made by the Company in this press release speaks only as of the date on which it is made. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future developments or otherwise.

Non-GAAP Financial Measures

To supplement its financial information presented in accordance with generally accepted accounting principles (GAAP), the Company is also providing with this press release the non-GAAP financial measures of EBITDA, Adjusted EBITDA and pro forma net income. EBITDA, Adjusted EBITDA and pro forma net income are not derived in accordance with GAAP and should not be considered by the reader as an alternative to net income (the most comparable GAAP financial measure to each of EBITDA, Adjusted EBITDA and pro forma net income). The Company’s management believes that EBITDA and Adjusted EBITDA are helpful as indicators of the current financial performance of the Company because EBITDA and Adjusted EBITDA reflect the additions and eliminations of various income statement items that management does not consider indicative of ongoing operating results. Management believes that pro forma net income is also helpful as an indicator of the financial performance of the Company during fiscal year 2015 and prior periods because it adjusts net income to reflect the Company’s performance as if the Company’s initial public offering and secondary offering, repayment of a portion of its long-term debt, write-down of its interest in Project Pie, LLC, and partial expensing of market vesting stock compensation had occurred at the beginning of the period and removes specific costs that are not indicative of ongoing operations. We have provided reconciliations of EBITDA, Adjusted EBITDA and pro forma net income to GAAP net income in the financial tables accompanying this release.

PAPA MURPHY’S HOLDINGS, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(In thousands of dollars, except share and per share data)

|

| | | | | | | |

| Three Months Ended |

| September 28,

2015 | | September 29,

2014 |

| Unaudited |

REVENUES | | | |

Franchise royalties | $ | 9,124 |

| | $ | 8,965 |

|

Franchise and development fees | 1,123 |

| | 1,088 |

|

Company-owned store sales | 17,604 |

| | 11,626 |

|

Lease and other | 281 |

| | 490 |

|

Total revenues | 28,132 |

| | 22,169 |

|

| | | |

COSTS AND EXPENSES | | | |

Store operating costs: | | | |

Cost of food and packaging | 6,409 |

| | 4,667 |

|

Compensation and benefits | 4,918 |

| | 3,000 |

|

Advertising | 1,806 |

| | 1,286 |

|

Occupancy | 1,210 |

| | 715 |

|

Other store operating costs | 2,061 |

| | 1,069 |

|

Total company-owned store operating costs | 16,404 |

| | 10,737 |

|

| | | |

Selling, general, and administrative | 6,038 |

| | 5,915 |

|

Depreciation and amortization | 2,641 |

| | 2,007 |

|

Loss (gain) on disposal of property and equipment | 4 |

| | (15 | ) |

Total costs and expenses | 25,087 |

| | 18,644 |

|

| | | |

OPERATING INCOME | 3,045 |

| | 3,525 |

|

| | | |

Interest expense | 1,137 |

| | 1,539 |

|

Interest income | (4 | ) | | (14 | ) |

Loss on early retirement of debt | — |

| | 3,428 |

|

Other expense, net | 44 |

| | 63 |

|

INCOME (LOSS) BEFORE INCOME TAXES | 1,868 |

| | (1,491 | ) |

| | | |

Provision for (benefit from) income taxes | 746 |

| | (703 | ) |

NET INCOME (LOSS) | 1,122 |

| | (788 | ) |

| | | |

Earnings (Loss) per share of common stock | | | |

Basic | $ | 0.07 |

| | $ | (0.05 | ) |

Diluted | $ | 0.07 |

| | $ | (0.05 | ) |

Weighted average common stock outstanding | | | |

Basic | 16,672,327 |

| | 16,584,724 |

|

Diluted | 16,919,504 |

| | 16,584,724 |

|

PAPA MURPHY’S HOLDINGS, INC. AND SUBSIDIARIES

Selected Balance Sheet Data

(In thousands of dollars)

(Unaudited)

|

| | | | | | | |

| September 28,

2015 | | December 29,

2014 |

Cash and cash equivalents | $ | 5,483 |

| | $ | 5,056 |

|

Total current assets | 14,823 |

| | 16,329 |

|

Total assets | 270,913 |

| | 265,464 |

|

Total current liabilities | 23,473 |

| | 18,558 |

|

Long-term debt, net of current portion | 108,156 |

| | 110,715 |

|

Total Papa Murphy’s Holdings Inc. shareholders’ equity | 94,697 |

| | 91,298 |

|

PAPA MURPHY’S HOLDINGS, INC. AND SUBSIDIARIES

Reconciliation of Net Income (Loss) to EBITDA and Adjusted EBITDA

(In thousands of dollars)

|

| | | | | | | |

| Three Months Ended |

| September 28,

2015 | | September 29,

2014 |

Net income (loss) as reported | $ | 1,122 |

| | $ | (788 | ) |

Depreciation and amortization | 2,641 |

| | 2,007 |

|

Income tax provision (benefit) | 746 |

| | (703 | ) |

Interest expense, net | 1,133 |

| | 1,525 |

|

EBITDA | 5,642 |

| | 2,041 |

|

Loss (gain) on disposal of property and equipment (a) | 4 |

| | (15 | ) |

Expenses not indicative of future operations (b) | — |

| | (29 | ) |

Transaction costs (c) | 1 |

| | 10 |

|

New store pre-opening expenses (d) | 218 |

| | — |

|

Non-cash expenses and non-income based state taxes (e) | 279 |

| | 198 |

|

Loss on early retirement of debt (f) | — |

| | 3,428 |

|

Adjusted EBITDA | $ | 6,144 |

| | $ | 5,633 |

|

| | | |

Adjusted EBITDA margin (1) | 21.8 | % | | 25.4 | % |

| |

(1) | Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA by total revenues. |

| |

(a) | Represents non-cash (gains) and losses resulting from disposal of property and equipment, including divested Company-owned stores |

| |

(b) | Represents adjustment to non-recurring accrued management transition and restructuring costs |

| |

(c) | Represents transaction costs relating to the acquisition of franchised stores. |

| |

(d) | Represents expenses directly associated with the opening of new stores and incurred primarily in advance of the store opening, including wages, benefits, travel for training of opening teams, grand opening marketing costs and other store operating costs. |

| |

(e) | Represents (i) non-cash expenses related to equity-based compensation; (ii) non-cash expenses related to the difference between GAAP and cash rent expense; and (iii) state revenue taxes levied in lieu of an income tax. |

| |

(f) | Represents losses resulting from refinancing of long-term debt. |

PAPA MURPHY’S HOLDINGS, INC. AND SUBSIDIARIES

Reconciliation of Net Income (Loss) to Pro Forma Net Income

(In thousands of dollars, except share and per share data)

|

| | | | | | | |

| Three Months Ended |

| September 28,

2015 | | September 29,

2014 |

Net income (loss) as reported | $ | 1,122 |

| | $ | (788 | ) |

Loss on early retirement of debt (1) | — |

| | 3,428 |

|

Income tax expense on adjustments (2) | — |

| | (1,320 | ) |

Pro forma net income | $ | 1,122 |

| | $ | 1,320 |

|

| | | |

Earnings per share - pro forma: | | | |

Basic | $ | 0.07 |

| | $ | 0.08 |

|

Diluted | $ | 0.07 |

| | $ | 0.08 |

|

| | | |

Weighted-average shares outstanding - pro forma: | | | |

Basic | 16,672,327 |

| | 16,584,724 |

|

Diluted | 16,919,504 |

| | 16,712,234 |

|

| |

(1) | Represents losses resulting from refinancing of long-term debt. |

| |

(2) | Reflects the tax expense associated with the adjustments 1 above at a normalized tax rate in line with our estimated long-term effective tax rate. |

Investor Contact:

Fitzhugh Taylor, ICR

fitzhugh.taylor@icrinc.com

877-747-7272

Media Contact:

Christine Beggan, ICR

Christine Beggan@icrinc.com

203-682-8329

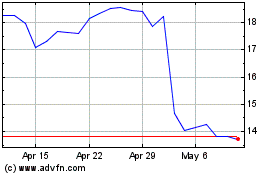

Freshworks (NASDAQ:FRSH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Freshworks (NASDAQ:FRSH)

Historical Stock Chart

From Jul 2023 to Jul 2024