UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

–––––––––––––––––––––––––––––––––––––

FORM 8-K

–––––––––––––––––––––––––––––––––––––

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report: June 5, 2015

(Date of earliest event reported)

–––––––––––––––––––––––––––––––––––––

Papa Murphy’s Holdings, Inc.

(Exact name of registrant as specified in its charter)

–––––––––––––––––––––––––––––––––––––

|

| | | | |

Delaware (State or Other Jurisdiction of Incorporation or Organization) | | 001-36432 (Commission File Number) | | 27-2349094 (IRS Employer Identification No.) |

|

| | |

8000 NE Parkway Drive, Suite 350

Vancouver, WA (Address of principal executive offices) | | 98662 (Zip Code) |

(360) 260-7272

(Registrant's telephone number, including area code)

–––––––––––––––––––––––––––––––––––––

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.06 Material Impairments.

On June 5, 2015, Papa Murphy's Holdings, Inc. (the “Company”) determined that its 2015 second quarter financial results will include a one-time non-cash charge of approximately $2.7 million, net of tax and noncontrolling interests, reflecting the write-down of the carrying value of the Company’s investment in the Series A Convertible Preferred Units (the “Units”), as well as certain notes and accounts receivable, of the fast-casual pizza concept Project Pie, LLC (“Project Pie”). The write-down reduced the carrying value of the Company’s interests in Project Pie to net realizable value based on the circumstances and capital needs of Project Pie.

The Company issued a press release on June 8, 2015, regarding the preceding item. A copy of the press release is filed as Exhibit 99.1 hereto.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed with this report:

|

| | | |

EXHIBIT NUMBER | | DESCRIPTION OF EXHIBITS | |

99.1 | | Press Release dated June 8, 2015. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

PAPA MURPHY’S HOLDINGS, INC. | |

| | |

By: | | /s/ Mark Hutchens | |

| | Name: Mark Hutchens | |

| | Title: Chief Financial Officer | |

Date: June 8, 2015

EXHIBIT INDEX

|

| | | |

EXHIBIT NUMBER | | DESCRIPTION OF EXHIBITS | |

99.1 | | Press Release dated June 8, 2015. | |

FOR IMMEDIATE RELEASE

Papa Murphy’s Holdings, Inc. Announces Write-down of Interests in Project Pie, LLC

- Will focus 100% on significant growth opportunities inside core Papa Murphy’s brand -

Vancouver, WA, June 8, 2015 (Globe Newswire) - Papa Murphy’s Holdings, Inc. (NASDAQ: FRSH) today announced that its 2015 second quarter financial results will include a one-time non-cash charge of approximately $2.7 million, net of tax and noncontrolling interests, reflecting the write-down in the carrying value of the Company’s interests in the fast-casual pizza concept Project Pie, LLC ahead of the previously announced proposed divestiture. The write-down reduces the carrying value of the Company’s interests to the expected net realizable value based on the circumstances and capital needs of Project Pie. The Company’s decision to divest its interests in Project Pie is driven by the desire to focus efforts on the significant growth opportunities inside the core Papa Murphy’s brand.

“We have generated strong operating momentum over the last few years and that has accelerated since our IPO just over a year ago as demonstrated by our recently announced first-quarter results, including comparable store sales growth of 5.6%, our 17th straight quarter of positive comparable store sales growth”, stated Ken Calwell, President and Chief Executive Officer of Papa Murphy’s Holdings, Inc.

Calwell added, “We have a real opportunity to at least triple the number of fresh take and bake pizza stores that we have in the U.S. to at least 4,500 stores. Divesting our interest in Project Pie is an important step to ensure continued focus as we bring America’s best tasting pizza to customers across the country. While we continue to believe there is a lot of value to be created in the growing fast-casual category, my team and I want to be singularly focused on delivering the tremendous growth opportunities ahead for the Papa Murphy’s business and our shareholders.”

Calwell continued, “In addition to new store development, we are concentrating our efforts on the tremendous digital opportunities we have. We have been steadily rolling out a new POS system which is foundational for on-line ordering and digital precision marketing. The digital strategy brings significant opportunity to grow sales and expand unit-level margins for years to come.”

About Papa Murphy’s

Papa Murphy’s is a franchisor and operator of the largest Take ‘N’ Bake pizza chain in the United States, selling uncooked pizzas that customers bake at home. The Company was founded in 1981 and currently operates over 1,400 franchised and company-owned fresh pizza stores in 38 states, Canada and United Arab Emirates. Papa Murphy’s core purpose is to bring all families together through food people love with a goal to create fun, convenient and fulfilling family dinners. In addition to scratch-made pizzas, the Company offers a growing menu of grab ‘n’ go items, including salads, sides and desserts. For more information, visit www.papamurphys.com.

Forward-looking Statements

This news release contains forward looking statements that involve risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward looking statements. Forward-looking statements give the Company’s current expectations and projections relating to the Company’s financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “guidance,” “anticipate,” “estimate,” “expect,” “forecast,” “project,” “plan,” “intend,” “believe,” “confident,” “may,” “should,” “can have,” “likely,” “future” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events.

Forward-looking statements in this press release include statements relating to the Company’s expectations for growth in the fast-casual pizza category, future financial or operational results, projected new store openings and projected growth of sales and margins.

Any such forward-looking statements are not guarantees of performance or results, and involve risks, uncertainties (some of which are beyond the Company’s control) and assumptions. Although the Company believes any forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results and cause them to differ materially from those anticipated in any forward-looking statements. Please refer to the risk factors discussed in the Company’s current Annual Report on Form 10-K for the fiscal year ended December 29, 2014; each such risk factor is specifically incorporated into this news release. Should one or more of these risks or uncertainties materialize, the Company’s actual results may vary in material respects from those projected in any forward-looking statements.

Any forward-looking statement made by the Company in this news release speaks only as of the date on which it is made. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future developments or otherwise.

Investor Contact:

Fitzhugh Taylor, ICR

fitzhugh.taylor@icrinc.com

877-747-7272

Media Contact:

Jessica Liddell, ICR

jessica.liddell@icrinc.com

203-682-8208

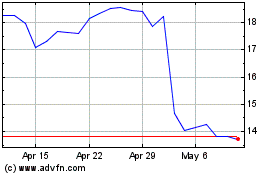

Freshworks (NASDAQ:FRSH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Freshworks (NASDAQ:FRSH)

Historical Stock Chart

From Jul 2023 to Jul 2024