SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. )*

Papa

Murphy’s Holdings, Inc.

(Name of Issuer)

Common Stock, $.0001 par value

(Title of Class of Securities)

698814100

(CUSIP Number)

December 31, 2014

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to

designate the rule pursuant to which this Schedule is filed:

¨ Rule 13d-1(b)

¨ Rule 13d-1(c)

x Rule 13d-1(d)

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter the disclosures provided in a prior cover page. |

The information required in the remainder of this cover page shall not be

deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of the section of the Act but shall be subject to all other provisions of that Act

(however, see the Notes).

1 of 9

CUSIP No. 698814100

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS AI PM Holdings LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION State of Delaware |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

986,576 |

|

6 |

|

SHARED VOTING POWER

0 |

|

7 |

|

SOLE DISPOSITIVE POWER

986,576 |

|

8 |

|

SHARED DISPOSITIVE POWER

0 |

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

986,576 |

| 10 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 11 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (9) 5.82%1 |

| 12 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) PN |

| 1 |

Based on 16,941,265 outstanding shares of common stock as of November 7, 2014 as reported on the Issuer’s Form 10-Q for the period ended September 30, 2014 filed with the Securities and Exchange

Commission on November 11, 2014. |

2 of 9

CUSIP No. 698814100

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Access Industries, Inc. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION State of New York |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

|

6 |

|

SHARED VOTING POWER

986,576 |

|

7 |

|

SOLE DISPOSITIVE POWER

0 |

|

8 |

|

SHARED DISPOSITIVE POWER

986,576 |

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

986,576 |

| 10 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 11 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (9) 5.82%1 |

| 12 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) CO |

| 1 |

Based on 16,941,265 outstanding shares of common stock as of November 7, 2014 as reported on the Issuer’s Form 10-Q for the period ended September 30, 2014 filed with the Securities and Exchange

Commission on November 11, 2014. |

3 of 9

CUSIP No. 698814100

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Len Blavatnik |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States of America |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

|

6 |

|

SHARED VOTING POWER

986,576 |

|

7 |

|

SOLE DISPOSITIVE POWER

0 |

|

8 |

|

SHARED DISPOSITIVE POWER

986,576 |

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

986,576 |

| 10 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

¨ |

| 11 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (9) 5.82%1 |

| 12 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS) IN |

| 1 |

Based on 16,941,265 outstanding shares of common stock as of November 7, 2014 as reported on the Issuer’s Form 10-Q for the period ended September 30, 2014 filed with the Securities and Exchange Commission on

November 11, 2014. |

4 of 9

CUSIP No. 698814100

Papa Murphy’s Holdings, Inc. (the “Issuer”)

| |

(b) |

Address of Issuer’s Principal Executive Offices: |

8000 NE Parkway Drive, Suite 350

Vancouver, WA 98662

| |

(a) |

Name of Person Filing: |

This filing is being made on behalf of:

AI PM Holdings LP

Access

Industries, Inc.

Len Blavatnik

| |

(b) |

Address of Principal Business Office or, if none, Residence |

AI PM Holdings LP

c/o Access Industries, Inc.

730

Fifth Avenue, 20th Floor

New York, NY 10019

Access Industries, Inc.

730

Fifth Avenue, 20th Floor

New York, NY 10019

Len Blavatnik

c/o Access

Industries, Inc.

730 Fifth Avenue, 20th Floor

New York, NY 10019

AI PM Holdings LP is a partnership organized under the laws of the State

of Delaware.

Access Industries, Inc. is a corporation organized under the laws of the State of New York.

Mr. Blavatnik is a citizen of the United States of America.

| |

(d) |

Title of Class of Securities: |

Common Stock

698814100

5 of 9

| Item 3. |

If this statement is filed pursuant to §§240.13d-1(b), or 240.13d-2(b) or (c), check whether the person filing is a: |

|

|

|

|

|

|

|

|

| (a) |

|

¨ |

|

Broker or dealer registered under section 15 of the Act (15 U.S.C. 78o); |

|

|

|

| (b) |

|

¨ |

|

Bank as defined in section 3(a)(6) of the Act (15 U.S.C. 78c); |

|

|

|

| (c) |

|

¨ |

|

Insurance company as defined in section 3(a)(19) of the Act (15 U.S.C. 78c); |

|

|

|

| (d) |

|

¨ |

|

Investment company registered under section 8 of the Investment Company Act of 1940 (15 U.S.C 80a-8); |

|

|

|

| (e) |

|

¨ |

|

An investment adviser in accordance with §240.13d-1(b) (1)(ii)(E); |

|

|

|

| (f) |

|

¨ |

|

An employee benefit plan or endowment fund in accordance with §240.13d-1(b) (1)(ii)(F); |

|

|

|

| (g) |

|

¨ |

|

A parent holding company or control person in accordance with §240.13d-1(b) (1)(ii)(G); |

|

|

|

| (h) |

|

¨ |

|

A savings associations as defined in Section 3(b) of the Federal Deposit Insurance Act (12 U.S.C. 1813); |

|

|

|

| (i) |

|

¨ |

|

A church plan that is excluded from the definition of an investment company under section 3(c)(14) of the Investment Company Act of 1940 (15 U.S.C. 80a-3); |

|

|

|

| (j) |

|

¨ |

|

A non-U.S. institution in accordance with § 240.13d-1(b)(1)(ii)(J); |

|

|

|

| (k) |

|

¨ |

|

Group, in accordance with § 240.13d-1(b)(1)(ii)(K). |

Not Applicable.

Provide the following information regarding the aggregate number and percentage of the class

of securities of the issuer identified in Item 1.

| (a) |

Amount beneficially owned: |

See the responses to Item 9 on the attached cover

pages.

986,576 shares of the Issuer’s Common Stock are owned directly by AI PM Holdings LP (“AIPM”). Each of Access

Industries, Inc. (“Access”) and Len Blavatnik may be deemed to beneficially own the shares of common stock held directly by AIPM. Access is the general partner of AIPM and, as a result, may be deemed to have voting and investment

control over the shares of common stock owned directly by AIPM. Len Blavatnik controls Access and, as a result, may be deemed to share voting and investment power over the shares of common stock held by AIPM. Access and Mr. Blavatnik, and each

of their affiliated entities and the officers, partners, members, and managers thereof, other than AIPM, disclaim beneficial ownership of the shares of common stock held by AIPM.

6 of 9

5.82%*

| (c) |

Number of shares as to which the person has: |

(i) Sole power to vote or to direct the

vote:

AIPM has sole power to vote or direct the vote of 986,576 shares.

(ii) Shared power to vote or to direct the vote:

Access and Len Blavatnik may be deemed to have shared power to vote or direct the vote of 986,576 shares. Each of Access and

Mr. Blavatnik disclaims such beneficial ownership of such shares.

(iii) Sole power to dispose or to direct the disposition:

AIPM has sole power to dispose or direct the disposition of 986,576 shares.

(iv) Shared power to dispose or to direct the disposition:

Access and Len Blavatnik may be deemed to have shared power to dispose or direct the disposition of 986,576 shares. Each of Access and

Mr. Blavatnik disclaims such beneficial ownership of such shares.

| Item 5. |

Ownership of Five Percent or Less of a Class. |

If this statement is being filed to report the fact that

as of the date hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of securities, check the following ¨:

| Item 6. |

Ownership of More than Five Percent on Behalf of Another Person. |

Not Applicable.

| Item 7. |

Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company or Control Person. |

Not Applicable.

| Item 8. |

Identification and Classification of Members of the Group. |

Not Applicable.

| Item 9. |

Notice of Dissolution of Group. |

Not Applicable.

| * |

Based on 16,941,265 outstanding shares of common stock as of November 7, 2014 as reported on the Issuer’s Form 10-Q for the period ended September 30, 2014 filed with the Securities and Exchange Commission on

November 11, 2014. |

7 of 9

Not Applicable.

8 of 9

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Date: February 12, 2015

|

|

|

|

|

|

|

| AI PM HOLDINGS LP |

|

|

|

|

|

By: Access Industries, Inc., its General Partner |

|

|

|

|

|

|

|

|

|

|

/s/ Alejandro Moreno |

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

Alejandro Moreno / Executive Vice President |

|

|

|

|

|

|

Name/Title |

|

|

|

|

| ACCESS INDUSTRIES, INC. |

|

|

|

|

|

/s/ Alejandro Moreno |

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

Alejandro Moreno / Executive Vice President |

|

|

|

|

|

|

Name/Title |

|

|

|

|

|

|

|

|

|

|

* |

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

Len Blavatnik |

|

|

|

|

|

|

Name |

| * |

The undersigned, by signing his name hereto, executes this Schedule 13G pursuant to the Power of Attorney executed on behalf of Mr. Blavatnik and filed herewith. |

|

|

|

| By: |

|

/s/ Alejandro Moreno |

| Name: |

|

Alejandro Moreno |

|

|

Attorney-in-Fact |

9 of 9

Exhibit 99.1

JOINT FILING AGREEMENT

The undersigned

agree that this Schedule 13G dated February 12, 2015 relating to the Common Stock, par value $0.01 of Papa Murphy’s, Inc. shall be filed on behalf of the undersigned.

|

|

|

|

|

|

|

| AI PM HOLDINGS LP |

|

|

|

|

|

By: Access Industries, Inc., its General Partner |

|

|

|

|

|

|

|

|

|

|

/s/ Alejandro Moreno |

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

Alejandro Moreno / Executive Vice President |

|

|

|

|

|

|

Name/Title |

|

|

|

|

| ACCESS INDUSTRIES, INC. |

|

|

|

|

|

/s/ Alejandro Moreno |

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

Alejandro Moreno / Executive Vice President |

|

|

|

|

|

|

Name/Title |

|

|

|

|

|

|

|

|

|

|

* |

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

Len Blavatnik |

|

|

|

|

|

|

Name |

| * |

The undersigned, by signing his name hereto, executes this Schedule 13G pursuant to the Power of Attorney executed on behalf of Mr. Blavatnik and filed herewith. |

|

|

|

| By: |

|

/s/ Alejandro Moreno |

| Name: |

|

Alejandro Moreno |

|

|

Attorney-in-Fact |

Exhibit 99.2

POWER OF ATTORNEY

Know all by these

presents, that the undersigned hereby constitutes and appoints each of Lincoln Benet, Alejandro Moreno and Richard Storey, and each of them individually, the undersigned’s true and lawful attorney-in-fact to:

| |

(1) |

execute for and on behalf of the undersigned, in the undersigned’s capacity as a beneficial owner of Papa Murphy’s Holdings, Inc. (the “Company”), (i) all forms and schedules in accordance with

Section 13(d) or Section 13(g) of the Exchange Act and the rules thereunder, including all amendments thereto (a “Section 13 Schedule”, and collectively, the “Schedules”); |

| |

(2) |

do and perform any and all acts for and on behalf of the undersigned which may be necessary or desirable to complete and execute any such Schedules, complete and execute any amendment or amendments thereto, and timely

file such Schedules with the United States Securities and Exchange Commission and any stock exchange or similar authority; and |

| |

(3) |

take any other action of any type whatsoever in connection with the foregoing which, in the opinion of each such attorney-in-fact, may be of benefit to, in the best interest of, or legally required by, the undersigned,

it being understood that the documents executed by each such attorney-in-fact on behalf of the undersigned pursuant to this Power of Attorney shall be in such form and shall contain such terms and conditions as he or she may approve in his or her

discretion. |

The undersigned hereby grants to each such attorney-in-fact full power and authority to do and perform any and every act and

thing whatsoever requisite, necessary or proper to be done in the exercise of any of the rights and powers herein granted, as fully to all intents and purposes as the undersigned might or could do if personally present, with full power of

substitution or revocation, hereby ratifying and confirming all that each such attorney-in-fact, or his or her substitute or substitutes, shall lawfully do or cause to be done by virtue of this Power of Attorney and the rights and powers herein

granted. The undersigned acknowledges that each such attorney-in-fact is serving in such capacity at the request of the undersigned, and is not assuming, nor is the Company assuming, any of the undersigned’s responsibilities to comply with

Section 13 of the Exchange Act.

The Power of Attorney shall remain in full force and effect until the undersigned is no longer required to file any

Schedules with respect to the undersigned’s holdings of and transactions in securities issued by the Company, unless earlier revoked by the undersigned in a signed writing delivered to each such attorney-in-fact.

IN WITNESS WHEREOF, the undersigned has caused this Power of Attorney to be executed as of this 21st day of January, 2015.

|

|

|

| By: |

|

/s/ Leonard Blavatnik |

|

|

Leonard Blavatnik |

2

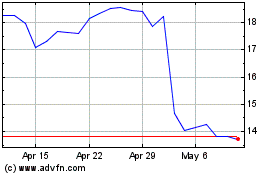

Freshworks (NASDAQ:FRSH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Freshworks (NASDAQ:FRSH)

Historical Stock Chart

From Jul 2023 to Jul 2024