JPMorgan Chase (NYSE:JPM) – JPMorgan Chase is

looking to expand its wealth management and attract more investors

by introducing the Wealth Plan tool to its 54 million Chase retail

clients. This tool has recently seen about 10 million active users.

The bank has also named Rita Chan and Alan Ho as the new senior

co-heads for China. They will start their roles on April 1, taking

over from Mark Leung, who is retiring. Additionally, Dubravko

Lakos-Bujas, the Chief Global Equity Strategist at JPMorgan, has

warned investors about potential risks as markets could fluctuate,

encouraging portfolio diversification and risk management, while

pondering an imminent correction.

UBS Group AG (NYSE:UBS) – UBS is planning to

expand its shipping loans and wind down fossil fuel financing from

Credit Suisse, testing the sustainability impact of the merger.

This complex integration includes aligning environmental goals and

reassessing loan legacies. UBS also disclosed in a statement on

Thursday that its CEO, Sergio Ermotti, who is leading the Credit

Suisse integration, is considering extending his tenure. Ermotti,

who earned 14.4 million Swiss francs in 2023, has outpaced his

predecessor in compensation. Furthermore, UBS confirmed that it is

investigating potential irregularities in Credit Suisse’s financial

reporting and is in discussions with regulators to resolve the

issue. The risk of an undetected “material error” could distort

financial results.

Discover Financial Services (NYSE:DFS) –

Discover Financial Services announced on Wednesday the departure of

its CEO, Michael Rhodes, starting April 1, after just three months

at the company. Rhodes will serve as an advisor to the interim CEO,

J. Michael Shepherd, before taking over as CEO of Ally

Financial (NYSE:ALLY) starting April 29. Shepherd, who was

recently appointed, will continue as a director but will step down

from his position on the board’s risk oversight committee. Discover

indicated that it did not expect Rhodes to stay long-term following

the completion of the merger with Capital One Financial. Last

month, Capital One (NYSE:COF) and Discover

revealed merger plans, subject to intense antitrust scrutiny.

Ally Financial (NYSE:ALLY) – Michael Rhodes,

with 25 years of banking experience, will replace Jeffrey J. Brown

as CEO, who left the position in January.

Lloyd’s (NYSE:LYG) – John Neal, CEO of Lloyd’s

of London, highlighted that the insurance payouts for the collapse

of the Francis Scott Key bridge in Baltimore on Tuesday could

become some of the largest ever recorded, potentially reaching

billions of dollars in maritime losses. The financial impact, while

still uncertain, could be significant, with estimates ranging from

several hundred million to up to $3 billion.

Barclays Plc (NYSE:BCS) – Barclays agreed to

pay $20,200 in compensation to former analyst Anca Lacatus for

sexual discrimination, in contrast to her claim of over 1 million.

Lacatus alleged discrimination and the bank’s failure to

accommodate her health needs.

Bain Capital (NYSE:BCSF) – Bain Capital is

exploring the possibility of attracting new investors for

Chindata Group Holdings (NASDAQ:CD), aiming to

raise funds to expand its data center network. The firm seeks to

sell ownership rights of the assets to relieve the balance sheet,

while still collecting operational fees.

BlackRock (NYSE:BLK) – BlackRock faces a legal

warning from the state of Mississippi for alleged misleading

statements linked to ESG strategies. The New York-based firm

received a “summary order to cease and desist” and could face a

multimillion-dollar administrative penalty.

Coinbase Global (NASDAQ:COIN) – Federal Judge

Katherine Polk Failla in Manhattan allowed the U.S. Securities and

Exchange Commission’s lawsuit against Coinbase to proceed but

dismissed the SEC’s claim against the largest U.S. cryptocurrency

exchange for acting as an unregistered brokerage through its wallet

app. The decision largely supports the SEC’s approach to

cryptocurrency.

AMC Entertainment Holdings (NYSE:AMC) – AMC’s

shares closed up 6.6% on Wednesday, the largest daily percentage

gain since February 27, when they rose over 8%. CEO Adam Aron cited

industry challenges due to strikes and emphasized the importance of

the company’s robust financial management. AMC shares have seen a

29.1% decline this year, in contrast to the 10% gain of the S&P

500 index.

Fox Corp (NASDAQ:FOX) – On Wednesday, Fox Corp

announced the restructuring of its entertainment studio into three

main segments: entertainment, television and streaming platforms,

and global sales and licensing. Fernando Szew will lead the new Fox

Entertainment Studios. Michael Thorn will head the Fox Television

Network. Tony Vassiliadis will take over the sales unit on an

interim basis.

S&P Global (NYSE:SPGI) and

Paramount Global (NASDAQ:PARA) – S&P

downgraded Paramount Global’s credit rating to ‘BB+’ from ‘BBB-‘

due to streaming competition. The company has been under negative

watch since February. Paramount plans to launch streaming services

in Canada and Australia, seeking stabilization with events like the

Super Bowl and political spending.

Walt Disney (NYSE:DIS) – Walt Disney integrated

the Hulu streaming service into Disney+, offering a wide range of

titles from “The Bear” to “Moana” on a single platform. This merger

aims to simplify viewing and boost subscriptions as cable TV

consumption declines.

Amazon (NASDAQ:AMZN) – Amazon stated on

Wednesday that senior employees, whose compensation is mostly in

stock, may not receive a cash salary increase this year,

prioritizing those with more salary-based compensation. The company

emphasized the impact of stock price growth on total compensation.

In other news, Amazon lost the battle to suspend a requirement

related to its online advertising under the European Union’s tech

rules. The Court of Justice of the European Union supported EU

regulators, stating that the EU’s interests prevail over Amazon’s.

Additionally, Amazon is also expanding its investment in Anthropic,

adding $2.75 billion to its partnership with the AI startup. This

investment brings Amazon’s total investment in Anthropic to $4

billion, strengthening its collaboration in AI and cloud computing

infrastructure.

Walmart (NYSE:WMT) – Walmart notified two U.S.

antitrust agencies about withdrawing and subsequently refiling a

review request for its planned acquisition of Vizio

Holdings (NYSE:VZIO), aiming to give regulators more time

to review the deal.

Alibaba (NYSE:BABA) – Alibaba strengthens its

position by acquiring full control of its logistics subsidiary,

opting not to list Cainiao due to the “depressed” market.

Investments aim to compete with Shein and Temu, improving global

delivery times.

RH (NYSE:RH) – In the fiscal fourth quarter, RH

reported a net profit of $11.4 million, or $0.57 per share,

compared to $106.9 million, or $4.21 per share, in the same period

last year. Adjusted earnings per share were $0.72, below FactSet’s

estimate of $1.67. Revenue was $738 million, below analysts’

forecasts of $777.5 million. Shares rose 7.8% in pre-market

trading.

MillerKnoll (NASDAQ:MLKN) – MillerKnoll

reported a 17.3% drop in pre-market trading after announcing

financial performance forecasts below expectations for the fourth

quarter. The furniture company indicated that demand levels

remained low across several business areas. Its new projections for

fiscal year 2024 adjusted earnings are in the range of $1.90 to

$1.98 per share, below the previous estimates of $2 to $2.16 per

share.

Kimberly-Clark (NYSE:KMB) – Kimberly-Clark

announced a restructuring into three business units to simplify

operations and reduce costs, anticipating expenses of about $1.5

billion over the next three years, including job cuts.

Chemours (NYSE:CC) – Chemours shares fell 8.5%

in pre-market trading after announcing its collaboration with

information requests from the U.S. Securities and Exchange

Commission (SEC) and U.S. prosecutors in the Southern District of

New York. These requests are related to an internal review of its

accounting. Last month, the company sidelined three executives

while the investigation was ongoing.

Salesforce (NYSE:CRM) – About 900 people

dressed as Albert Einstein gathered in San Francisco to win the

Guinness World Records title, an event organized by

Salesforce. The company spent over $20 million to

use the scientist’s image in its artificial intelligence

products.

Sprinklr (NYSE:CXM) – The customer experience

software company reported last quarter results that exceeded

analysts’ forecasts, along with a 19% increase in subscription

revenue, reaching $177 million. As a result, shares saw a 9.5% rise

in pre-market trading.

DoorDash (NYSE:DASH) – DoorDash is recruiting

talent from the AI startup Standard AI to enhance its voice

ordering service for restaurants. The hires include former

executives like CEO Jordan Fisher. DoorDash aims to expand its AI

technology to assist restaurants in processing phone orders.

Braze (NASDAQ:BRZE) – The customer engagement

platform reported an adjusted loss of 4 cents per share in the last

fiscal quarter, which was better than analysts’ expectations of a

5-cent loss per share. The company’s revenue increased by 33%,

reaching $131 million, while subscription revenue grew to $125.9

million, compared to $94.8 million in the previous year. Despite

these positive results, the company’s shares fell by 3.1% during

pre-market trading.

DraftKings (NASDAQ:DKNG) – The NCAA president

announced efforts to ban college betting. DraftKings’ shares

dropped by 6.8% on Wednesday in response to the ban, leading the

downturn among mobile sports betting companies such as

Flutter Entertainment PLC (NYSE:FLUT) and

MGM Resorts International (NYSE:MGM). In

Thursday’s pre-market trading, DraftKings shares were down by

0.4%.

Trump Media & Technology Group (NASDAQ:DJT)

– Shares of Trump Media & Technology Group were down 2.6% in

Thursday’s pre-market trading at $64.53, after closing at $66.22 on

Wednesday. The company reported revenue of $3.4 million with a loss

of $49 million in the first nine months of 2023. The Truth Social

platform attracted five million visitors in February. With a

significantly high price-to-sales valuation, the company needs to

financially justify its valuation beyond Trump’s fame appeal.

Meanwhile, Musk has offered free premium features for X accounts

with more than 2,500 verified followers.

Spirent Communications (LSE:SPT) and

Keysight Technologies (NYSE:KEYS) – Spirent

Communications shares surged 11% following support for an

acquisition offer from Keysight Technologies, which exceeded the

proposal from Viavi Solutions. Keysight’s offer of $1.46 billion is

15% higher than that of Viavi.

Spirit AeroSystems (NYSE:SPR) – Airbus

highlights the importance of maintaining a stable relationship with

supplier Spirit AeroSystems, while rival Boeing (NYSE:BA) considers

acquiring the company. CFO Thomas Toepfer emphasizes the

uncertainty surrounding Boeing’s timeline.

Toyota Motor (NYSE:TM) – Toyota Motor’s global

sales fell by 7% in February compared to the previous year, due to

a significant decline in China owing to Lunar New Year holidays and

a decrease in Japan following a safety testing scandal.

Stellantis (NYSE:STLA) – The car manufacturer

Fiat, part of Stellantis, signed new agreements with unions in

Italy on Wednesday for voluntary layoffs, potentially reducing its

workforce by over 3,000 positions in the country as part of the

transition to cleaner energies in the industry.

Fisker (NYSE:FSR) – Fisker has implemented

drastic price cuts for its sole model, the Ocean SUV, in an effort

to remain competitive in the electric vehicle market. The discounts

reach up to $24,000, aiming to make the Ocean a more affordable and

attractive EV option.

Polestar Automotive (NASDAQ:PSNY) – Polestar

Automotive CEO Thomas Ingenlath stands out in the automotive scene,

unveiling the new Polestar 4 at the New York Auto Show. Priced

between $50,000 and $80,000, the luxury electric vehicle brings

innovations such as the absence of a rear window, challenging

conventional design.

Carnival (NYSE:CCL) – Carnival raised its

annual profit forecasts on Wednesday, predicting a record year for

bookings due to growing interest in cruises. In the first quarter,

the company’s revenue jumped 22%, reaching $5.41 billion, in line

with analysts’ expectations. Carnival reported an adjusted net loss

per share of 14 cents, compared to analysts’ expectations of an

18-cent loss. Bookings for 2024 continue to grow, with customer

deposits totaling $7 billion for the quarter. Carnival also

communicated that it likely won’t sail in the Red Sea region until

early 2025, due to ongoing hostilities. Regarding the impact of the

Francis Scott Key bridge collapse in Baltimore, the CEO expects the

cost to be less than $10 million, affecting less than 1% of the

expected profit for fiscal year 2024. The company secured a

temporary port in Norfolk, Virginia, to minimize operational

issues. Shares were down 0.6% in Thursday’s pre-market trading

after closing up 0.9% the previous day.

UnitedHealth Group (NYSE:UNH) – The American

insurer UnitedHealth Group announced on Wednesday that it advanced

more than $3.3 billion to healthcare providers affected by a

cyberattack on the Change Healthcare insurance claims system.

Walgreens (NASDAQ:WBA) – In the second quarter,

Walgreens’ sales exceeded expectations, though it reduced its

annual profit outlook due to retail challenges and recorded a

significant net loss due to depreciation expenses related to the

primary care provider VillageMD. Adjusted earnings per share were

$1.20, with revenue reaching $37.05 billion, surpassing the

expected $35.86 billion. The adjusted profit outlook for 2024 was

revised down to $3.20-$3.35 per share. With Tim Wentworth as the

new CEO, the focus is on cost reduction to overcome challenges.

Johnson & Johnson (NYSE:JNJ) – Johnson

& Johnson is seizing a new opportunity to challenge the links

between talcum powder and ovarian cancer, according to a federal

judge. The case, involving more than 53,000 lawsuits, is being

revisited due to changes in the law and new scientific

evidence.

Novo Nordisk (NYSE:NVO) – A study revealed that

the monthly production cost of Ozempic could be as low as 89 cents

to $4.73, starkly contrasting with its nearly $1,000 price in the

U.S. Novo Nordisk has not disclosed production costs, emphasizing

its investments.

Canopy Growth Corp (NASDAQ:CGC) – Canopy

Growth’s shares jumped to their highest level since September on

Wednesday. The surge followed comments from the Biden

administration about reclassifying cannabis. The company will hold

a shareholder vote in April to create a U.S. business unit.

GE Vernova (GEV) – GE Vernova shares started

trading high, opening at $115 and closing at $131.25 on the first

day. The initial success boosted shares of General

Electric (NYSE:GE) by 3.8% on Wednesday. Vernova’s

valuation is estimated between $100 and $130 per share.

HB Fuller (NYSE:FUL) – In the fiscal first

quarter, the adhesive manufacturer HB Fuller’s adjusted profits

exceeded analysts’ expectations. Revenue during this period rose to

$810.4 million, compared to $809.2 million the previous year.

However, it fell short of Wall Street’s expectations of $823

million. Shares dropped by 2.23% in pre-market trading.

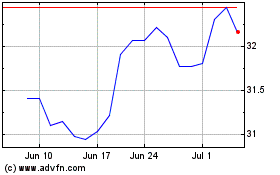

Fox (NASDAQ:FOX)

Historical Stock Chart

From Oct 2024 to Nov 2024

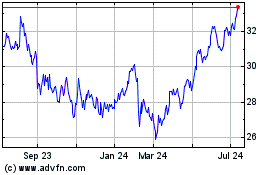

Fox (NASDAQ:FOX)

Historical Stock Chart

From Nov 2023 to Nov 2024