Form 8-K/A - Current report: [Amend]

September 26 2023 - 4:16PM

Edgar (US Regulatory)

true 0001419041 0001419041 2023-09-19 2023-09-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 19, 2023

FORTE BIOSCIENCES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-38052 |

|

26-1243872 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 3060 Pegasus Park Dr. Building 6 Dallas, Texas |

|

|

|

75247 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (310) 618-6994

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.001 par value |

|

FBRX |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This Current Report on Form 8-K/A is being filed by Forte Biosciences, Inc. (the “Company”) as an amendment (the “Amendment”) to the Current Report on Form 8-K filed by the Company with the U.S. Securities and Exchange Commission (the “SEC”) on September 20, 2023 (the “Original 8-K”) to report the preliminary voting results of the Company’s 2023 annual meeting of stockholders (the “Annual Meeting”) held on September 19, 2023. This Amendment is being filed to report the final voting results as certified by the independent inspector of elections for the Annual Meeting.

| Item 5.07 |

Submission of Matters to a Vote of Security Holders. |

The Company held the Annual Meeting on September 19, 2023. As of the close of business on August 17, 2023, the record date of the Annual Meeting, 36,281,772 shares of the Company’s common stock were outstanding and entitled to vote.

Set forth below are the final voting results for the Annual Meeting as certified by the independent inspector of elections for the Annual Meeting, as well as a brief description of the proposals voted on at the Annual Meeting. The results remain unchanged from the preliminary results the Company previously disclosed on the Original 8-K. 27,582,102 shares the Company’s common stock were voted in person or by proxy at the Annual Meeting, representing 76.02% percent of the shares entitled to be voted.

| 1. |

Election of Class III Directors. Lawrence Eichenfield, M.D. and Paul A. Wagner, Ph.D. were elected to serve as Class III directors, to hold office until the Company’s 2026 annual meeting of stockholders or until his respective successor is duly elected and qualified. The final votes for each nominee to serve as a Class III director are set forth below: |

|

|

|

|

|

|

|

|

|

| Nominee |

|

Votes For |

|

|

Votes Withheld |

|

| Lawrence Eichenfield, M.D. |

|

|

16,396,500 |

|

|

|

11,097,526 |

|

| Paul A. Wagner, Ph.D. |

|

|

16,831,738 |

|

|

|

10,662,288 |

|

| Chris McIntyre |

|

|

10,627,041 |

|

|

|

16,348,276 |

|

| Michael G. Hacke |

|

|

11,064,021 |

|

|

|

15,911,296 |

|

| 2. |

Advisory Vote on Executive Compensation. The Company’s stockholders advised that they were not in favor of the named executive officers’ compensation for 2022 as disclosed in the proxy statement. The votes regarding the proposal were as follows: |

|

|

|

|

|

| Votes For |

|

Votes Against |

|

Abstentions |

| 9,907,983 |

|

11,751,111 |

|

5,835,028 |

| 3. |

Frequency of Advisory Vote on Executive Compensation. The Company’s stockholders advised that they were in favor of future advisory votes on named executive officers’ compensation every year. The votes regarding the proposal were as follows: |

|

|

|

|

|

|

|

| One Year |

|

Two Years |

|

Three Years |

|

Abstentions |

| 13,958,000 |

|

35,449 |

|

9,869,970 |

|

3,630,703 |

The Board will meet to discuss the stockholder’s recommendation and make a determination regarding the frequency of future say-on-pay votes. Such determination will be disclosed on an amendment to this Current Report on Form 8-K once approved by the Board.

| 4. |

Ratification of Appointment of Independent Registered Public Accounting Firm. The appointment of Mayer Hoffman McCann P.C. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 was ratified based on the following results of voting: |

|

|

|

|

|

| Votes For |

|

Votes Against |

|

Abstentions |

| 17,303,222 |

|

3,776,436 |

|

6,502,444 |

| 5. |

Approval of the Amended and Restated 2021 Equity Incentive Plan. The Company’s stockholders approved the adoption of the Amended and Restated 2021 Equity Incentive Plan. The votes regarding the proposal were as follows: |

|

|

|

|

|

| Votes For |

|

Votes Against |

|

Abstentions |

| 16,838,182 |

|

8,502,806 |

|

2,103,978 |

| 6. |

Shareholder Proposal to Amend the Amended and Restated Bylaws. The Company’s stockholders voted against the amendment of the Company’s Amended and Restated Bylaws. The votes regarding the proposal were as follows: |

|

|

|

|

|

| Votes For |

|

Votes Against |

|

Abstentions |

| 10,813,380 |

|

14,810,177 |

|

1,870,565 |

| 7. |

Advisory Vote on Shareholder Proposal to Remove the Company’s Preferred Stock Rights Agreement. The Company’s stockholders voted against the removal of the Company’s Preferred Stock Rights Agreement. The votes regarding the proposal were as follows: |

|

|

|

|

|

| Votes For |

|

Votes Against |

|

Abstentions |

| 11,096,793 |

|

14,525,586 |

|

1,871,743 |

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit |

|

Description |

|

|

| 104 |

|

The cover page of this Current Report on Form 8-K, formatted in inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

FORTE BIOSCIENCES, INC. |

|

|

|

|

| Date: September 26, 2023 |

|

|

|

By: |

|

/s/ Antony Riley |

|

|

|

|

|

|

Antony Riley Chief Financial Officer |

Document and Entity Information

|

Sep. 19, 2023 |

| Cover [Abstract] |

|

| Amendment Flag |

true

|

| Entity Central Index Key |

0001419041

|

| Document Type |

8-K/A

|

| Document Period End Date |

Sep. 19, 2023

|

| Entity Registrant Name |

FORTE BIOSCIENCES, INC.

|

| Entity Incorporation State Country Code |

DE

|

| Entity File Number |

001-38052

|

| Entity Tax Identification Number |

26-1243872

|

| Entity Address, Address Line One |

3060 Pegasus Park Dr.

|

| Entity Address, Address Line Two |

Building 6

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75247

|

| City Area Code |

(310)

|

| Local Phone Number |

618-6994

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Security 12b Title |

Common Stock, $0.001 par value

|

| Trading Symbol |

FBRX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Description |

This Current Report on Form 8-K/A is being filed by Forte Biosciences, Inc. (the “Company”) as an amendment (the “Amendment”) to the Current Report on Form 8-K filed by the Company with the U.S. Securities and Exchange Commission (the “SEC”) on September 20, 2023 (the “Original 8-K”) to report the preliminary voting results of the Company’s 2023 annual meeting of stockholders (the “Annual Meeting”) held on September 19, 2023. This Amendment is being filed to report the final voting results as certified by the independent inspector of elections for the Annual Meeting.

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

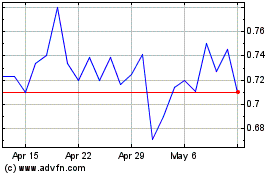

Forte Biosciences (NASDAQ:FBRX)

Historical Stock Chart

From Apr 2024 to May 2024

Forte Biosciences (NASDAQ:FBRX)

Historical Stock Chart

From May 2023 to May 2024