false

0001083743

0001083743

2023-11-02

2023-11-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 2, 2023

FLUX

POWER HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-31543 |

|

92-3550089 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 2685

S. Melrose Drive, Vista, California |

|

92081 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

877-505-3589

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

FLUX |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement

On

November 2, 2023, Flux Power Holdings, Inc. (the “Company”) entered into a Credit Facility Agreement (the “Credit Facility”)

with Cleveland Capital, L.P., a Delaware limited partnership (the “Lender”). The Credit Facility provides the Company with

a line of credit of up to $2,000,000 for working capital purposes (“LOC”). In connection with the LOC, the Company issued

a subordinated unsecured promissory note for $2,000,000 (the “Commitment Amount”) in favor of the Lender (the “Note”).

Pursuant

to the terms of the Credit Facility, the Lender agreed to make loans (each such loan, an “Advance”) up to such Lender’s

Commitment Amount to the Company from time to time, until August 15, 2025 (the “Due Date”). The Note accrues interest at

Secured Overnight Financing Rate plus nine percent (9%) per annum on each Advance from and after the date of disbursement of such Advance.

All indebtedness, obligations and liabilities of the Company to the Lender is subject to the rights of Gibraltar Business Capital, LLC,

a Delaware limited liability company (together with its successors and assigns, “GBC”), pursuant to a Subordination Agreement

dated on or about November 2, 2023, by and between the Lender and GBC (the “Subordination Agreement”). Subject to the Subordination

Agreement, the Company may, from time to time, prior to the Due Date, draw down, repay, and re-borrow on the Note, by giving notice to

the Lenders of the amount to be requested to be drawn down. Subject to the Subordination Agreement, the Note is payable upon the earlier

of (i) the Due Date or (ii) on occurrence of an event of Default (as defined in the Note).

As

consideration of the Lender’s commitment to provide the Advances to the Company, the Company agreed to issue the Lender warrants

to purchase 41,196 shares of common stock (the “Warrants”) which rights are represented by a warrant certificate (“Warrant

Certificate”). Subject to certain ownership limitations, the Warrants are exercisable immediately from the date of issuance, expire

on the five (5) year anniversary of the date of issuance and have an exercise price of $3.24 per share. The exercise price of

the Warrants is subject to certain adjustments, including stock dividends, stock splits, combinations and reclassifications of the common

stock. In the event of a Triggering Event (as defined in the Warrant Certificate), the holder of the Warrants will be entitled to exercise

the Warrants and receive the same amount and kind of securities, cash or property as such holder would have been entitled to receive

upon the occurrence of such Triggering Event if such holder had exercised the rights represented by the Warrant Certificate immediately

prior to the Triggering Event. Additionally, upon the holder’s request, the continuing or surviving corporation as a result of

such Triggering Event will issue to such holder a new warrant of like tenor evidencing the right to purchase the adjusted amount of securities,

cash or property and the adjusted warrant price.

The

foregoing descriptions of the Credit Facility, the Note and the Warrant Certificate do not purport to be a complete statement of the

terms of the agreements and the parties’ rights under such agreements and are qualified in their entirety by reference to the full

text of the Credit Facility, Note and Warrant Certificate, which are attached hereto as Exhibits 10.1, 10.2 and 4.1 respectively, to

this Current Report on Form 8-K and incorporated by reference herein.

Item

1.02. Termination of a Material Definitive Agreement.

On

November 2, 2023, the Credit Facility Agreement dated May 11, 2022 (the “Subordinated LOC”) with Cleveland, Herndon Plant

Oakley, Ltd., and other lenders (collectively, the “Lenders”) for a line of credit for up to $4 million in commitment amount

(the “2022 LOC”) was terminated. There were no draws, amounts due and obligations owed to the Lenders as of the termination

date. In connection with such termination, the related promissory notes were cancelled.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The

information disclosed in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item

3.02 Unregistered Sales of Equity Securities.

The

information disclosed in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02. Pursuant to the

terms of the Warrant Certificate, the holder may, in its sole discretion and in lieu of making the cash payment otherwise contemplated

to be made to the Company upon such exercise in payment of the aggregate exercise price, elect instead to receive upon such exercise

(either in whole or in part) the net number of shares of Common Stock determined according to a formula set forth in the Warrant Certificate.

The

Lenders made representations to the Company that they met the accredited investor definition of Rule 501 of the Securities Act of 1933,

as amended (“Securities Act”), and the Company relied on such representations. The offer and sale of the underlying securities

pursuant to the Note and Warrant were made in reliance on the exemption from registration afforded by Section 4(a)(2) of the Securities

Act as provided in Rule 506(b) of Regulation D promulgated thereunder. The offering of the underlying securities was not conducted in

connection with a public offering, and no public solicitation or advertisement was made or relied upon by any investor in connection

with the offering.

This

Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall such securities be

offered or sold in the United States absent registration or an applicable exemption from the registration requirements.

Item

7.01 Regulation FD Disclosure.

On

November 3, 2023, the Company issued a press release announcing among other things, the new subordinated credit facility with Cleveland.

A copy of the press release is attached hereto as Exhibit 99.1, and is incorporated herein by reference.

The

information under Items 2.02 and 2.03 of this Current Report on Form 8-K is incorporated by reference in this Item 7.01. The information

reported under Item 7.01 in this Current Report on Form 8-K and Exhibit 99.1 attached hereto are being “furnished” and shall

not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or

otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933 ,as amended, or the Exchange Act, regardless of any general incorporation language in such filing. This Current Report on

Form 8-K will not be deemed an admission as to the materiality of any information contained herein.

Item

9.01 Financial Statements and Exhibits.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Flux

Power Holdings, Inc. |

| |

a

Nevada corporation |

| |

|

| |

By:

|

/s/

Ronald F. Dutt |

| |

|

Ronald

F. Dutt, Chief Executive Officer |

Dated:

November 3, 2023

Exhibit

4.1

THIS

WARRANT CERTIFICATE AND THE SECURITIES ISSUABLE UPON EXERCISE HEREOF HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED

(THE “SECURITIES ACT”), OR ANY STATE SECURITIES LAWS AND MAY NOT BE SOLD, TRANSFERRED OR OTHERWISE DISPOSED OF UNLESS REGISTERED

UNDER THE SECURITIES ACT AND UNDER APPLICABLE STATE SECURITIES LAWS OR THE ISSUER SHALL HAVE RECEIVED AN OPINION OF COUNSEL REASONABLY

SATISFACTORY TO THE ISSUER THAT REGISTRATION OF SUCH SECURITIES UNDER THE SECURITIES ACT AND UNDER THE PROVISIONS OF APPLICABLE STATE

SECURITIES LAWS IS NOT REQUIRED.

FLUX

POWER HOLDINGS, INC.

WARRANT

CERTIFICATE

Original

Date of Issuance: November 2, 2023

No:

2023 W-1

THIS

WARRANT CERTIFICATE is given in connection with the Credit Facility Agreement dated November 2, 2023 (“Agreement”)

by and among Flux Power Holdings, Inc., a Nevada corporation (the “Issuer”), and Cleveland Capital, L.P. under

the Agreement.

This

Warrant Certificate (“Warrant Certificate”) certifies that for value received, Cleveland

Capital, L.P., or its registered assigns (the “Holder”) is entitled to subscribe for and purchase,

during the Term (as hereinafter defined), the number of Warrants equal to 41,196 (“Warrants”) each of

which entitles the Holder thereof to purchase during the term, one fully paid and non-assessable share of common stock, $0.001 par value

per share, of the Issuer, at an exercise price per share equal to $3.24 [volume weighted average

price for the five (5) trading days immediately prior to the date of this Note] per (the “Warrant Price”),

as may be adjusted, subject, however, to the provisions and upon the terms and conditions hereinafter set forth. Capitalized terms used

in this Warrant Certificate and not otherwise defined herein shall have the respective meanings specified in Section 6 hereof.

1.

Term. The term of this Warrant Certificate shall commence on the Original Issue Date and shall expire at 6:00 p.m., Eastern Time,

on November 2, 2028 (such period being the “Term”).

2.

Method of Exercise; Payment; Issuance of New Warrant Certificate; Transfer and Exchange.

(a)

Time of Exercise. The purchase rights represented by this Warrant Certificate may be exercised at any time during the Term.

(b)

Method of Exercise. Each Warrant shall entitle the Holder to purchase one share of common stock of the Issuer at the Warrant Price.

The Holder hereof may exercise the Warrants, in whole or in part, by the surrender of the Warrant Certificate (with the exercise form

attached hereto duly executed) at the principal office of the Issuer, and by the payment to the Issuer of an amount of consideration

therefor equal to the Warrant Price in effect on the date of such exercise multiplied by the number of shares of Warrant Stock with respect

to which the Warrant Certificate is then being exercised, payable at such Holder’s election by certified or official bank check

or by wire transfer to an account designated by the Issuer.

(c)

The Holder may, at its election exercised in its sole discretion, exercise this Warrant and, in lieu of making the cash payment otherwise

contemplated to be made to the Company upon such exercise in payment of the Warrant Price for the Warrant Stock specified in this Warrant,

elect instead to receive upon such exercise the “Net Number” of shares of Common Stock determined according

to the following formula (a “Cashless Exercise”):

Net

Number = (A x B) - (A x C)

———————

B

For

purposes of the foregoing formula:

A=

the total number of shares with respect to which this Warrant Certificate is then being exercised.

B=

the Closing Price of the Common Stock on the trading day immediately preceding the date of the notification by the Holder to the Company

of a Cashless Exercise.

C=

the Warrant Price then in effect at the time of such exercise.

(d)

Issuance of Stock Certificates. In the event of any exercise of the Warrants in accordance with and subject to the terms and conditions

hereof, certificates for the shares of Warrant Stock so purchased shall be dated the date of such exercise and delivered to the Holder

hereof within a reasonable time.

(e)

Transferability of Warrant. Subject to Section 2(f) hereof, the Warrants may be transferred by a Holder, in whole or in

part, without the consent of the Issuer. If transferred pursuant to this paragraph, the Warrants may be transferred on the books of the

Issuer by the Holder hereof in person or by duly authorized attorney, upon surrender of this Warrant Certificate at the principal office

of the Issuer, properly endorsed (by the Holder executing an assignment in the form attached here to) and upon payment of any necessary

transfer tax or other governmental charge imposed upon such transfer. This Warrant Certificate is exchangeable at the principal office

of the Issuer for Warrants to purchase the same aggregate number of shares of Warrant Stock, each new Warrant to represent the right

to purchase such number of shares of Warrant Stock as the Holder hereof shall designate at the time of such exchange. All Warrants issued

on transfers or exchanges shall be dated the Original Issue Date and shall be identical with this Warrant Certificate except as to the

number of shares of Warrant Stock issuable pursuant thereto.

(f)

Compliance with Securities Laws.

(i)

The Holder of this Warrant Certificate, by acceptance hereof, acknowledges that the Warrants and the shares of Warrant Stock to be issued

upon exercise hereof are being acquired solely for the Holder’s own account and not as a nominee for any other party, and for investment,

and agrees that the Holder will not acquire the Warrant Stock, offer, sell or otherwise dispose of this Warrant Certificate or any shares

of Warrant Stock to be issued upon exercise hereof except pursuant to an effective registration statement, or an exemption from registration,

under the Securities Act and any applicable state securities laws.

(ii)

This Warrant Certificate and all certificates representing shares of Warrant Stock issued upon exercise hereof shall be stamped or imprinted

with a legend in substantially the following form:

THIS

WARRANT CERTIFICATE, THE WARRANTS, AND THE SECURITIES ISSUABLE UPON EXERCISE HEREOF HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT

OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY STATE SECURITIES LAWS AND MAY NOT BE SOLD, TRANSFERRED OR OTHERWISE DISPOSED

OF UNLESS REGISTERED UNDER THE SECURITIES ACT AND UNDER APPLICABLE STATE SECURITIES LAWS OR THE ISSUER SHALL HAVE RECEIVED AN OPINION

OF COUNSEL REASONABLY SATISFACTORY TO THE ISSUER THAT REGISTRATION OF SUCH SECURITIES UNDER THE SECURITIES ACT AND UNDER THE PROVISIONS

OF APPLICABLE STATE SECURITIES LAWS IS NOT REQUIRED.

(g)

Loss, Theft, Destruction of Warrants. Upon receipt of evidence satisfactory to the Issuer of the ownership of and the loss, theft,

destruction or mutilation of any Warrant and, in the case of any such loss, theft or destruction, upon receipt of indemnity or security

satisfactory to the Issuer or, in the case of any such mutilation, upon surrender and cancellation of such Warrant, the Issuer will make

and deliver, in lieu of such lost, stolen, destroyed or mutilated Warrant, a new Warrant of like tenor and representing the right to

purchase the same number of shares of Warrant Stock.

(h)

Beneficial Ownership Restrictions. In no event shall the Holder be entitled to exercise any portion of this Warrant if the number

of shares of Common Stock to be issued pursuant to such conversion or exercise, when aggregated with all other shares of Common Stock

owned by the Holder at such time, would result in the Holder beneficially owning (as determined in accordance with Section 13(d) of the

Securities and Exchange Act of 1934, and the rules thereunder) in excess of 9.99% of the then issued and outstanding shares of Common

Stock outstanding at such time; provided, however, that upon the Holder providing the Company with sixty-one (61) days’ notice

(the “Waiver Notice”) that the Holder would like to waive this Section 2(h) with regard to any or all shares

of Common Stock issuable upon conversion or exercise of this Warrant, this Section 2(h) shall be of no force or effect with regard to

those shares of Common Stock referenced in the Waiver Notice.

3.

Adjustment of Warrant Price and Number of Shares Issuable Upon Exercise. The Warrant Price and the Warrant Share Number shall

be subject to adjustment from time to time as set forth in this Section 3. The Issuer shall give the Holder notice of any event

described below that requires an adjustment pursuant to this Section 3 in accordance with the notice provisions set forth in Section

4.

(a)

Recapitalization, Reorganization, Reclassification, Consolidation, Merger or Sale. In case the Issuer after the Original Issue

Date shall do any of the following (each, a “Triggering Event”): (A) consolidate or merge with or into any

other Person and the Issuer shall not be the continuing or surviving corporation of such consolidation or merger, or (B) permit any other

Person to consolidate with or merge into the Issuer and the Issuer shall be the continuing or surviving Person but, in connection with

such consolidation or merger, any Capital Stock of the Issuer shall be changed into or exchanged for Securities of any other Person or

cash or any other property, or (C) transfer all or substantially all of its properties or assets to any other Person, or (D) effect a

capital reorganization or reclassification of its Capital Stock, then, and in the case of each such Triggering Event, proper provision

shall be made to the Warrant Price and the number of shares of Warrant Stock that may be purchased upon exercise of this Warrant Certificate

so that, upon the basis and the terms and in the manner provided in this Warrant Certificate the Holder of this Warrant Certificate shall

be entitled upon the exercise hereof at any time after the consummation of such Triggering Event, to the extent the Warrants are not

exercised prior to such Triggering Event, to receive at the Warrant Price as adjusted to take into account the consummation of such Triggering

Event, in lieu of the Warrant Stock issuable upon such exercise of the Warrants prior to such Triggering Event, the Securities, cash

and property to which such Holder would have been entitled upon the consummation of such Triggering Event if such Holder had exercised

the rights represented by this Warrant Certificate immediately prior thereto subject to adjustments (subsequent to such corporate action)

as nearly equivalent as possible to the adjustments provided for elsewhere in this Section 3. Upon the occurrence of a Triggering

Event, the Issuer shall notify the Holder in writing of such Triggering Event and provide the calculations in determining the amount

of issuable Securities, cash or property issuable upon exercise of the new warrant and the adjusted Warrant Price. Upon the Holder’s

request, the continuing or surviving corporation as a result of such Triggering Event shall issue to the Holder a new warrant of like

tenor evidencing the right to purchase the adjusted amount of Securities, cash or property and the adjusted Warrant Price pursuant to

the terms and provisions of this Section 3(a)(i).

(b)

Stock Dividends, Subdivisions and Combinations. If at any time the Issuer shall:

(i)

make or issue or set a record date for the holders of the Common Stock for the purpose of entitling them to receive a dividend payable

in, or other distribution of, shares of Common Stock,

(ii)

subdivide its outstanding shares of Common Stock into a larger number of shares of Common Stock, or

(iii)

combine its outstanding shares of Common Stock into a smaller number of shares of Common Stock,

then

(A) the number of shares of Warrant Stock for which this Warrant Certificate is exercisable immediately after the occurrence of any such

event shall be adjusted to equal the number of shares of Warrant Stock which a record holder of the same number of shares of Warrant

Stock for which this Warrant Certificate is exercisable immediately prior to the occurrence of such event would own or be entitled to

receive after the happening of such event, and (B) the Warrant Price then in effect shall be adjusted to equal (1) the Warrant Price

then in effect multiplied by the number of shares of Warrant Stock for which this Warrant is exercisable immediately prior to the adjustment

divided by (2) the number of shares of Warrant Stock for which this Warrant is exercisable immediately after such adjustment.

4.

Notice of Adjustments. Whenever the Warrant Price or Warrant Share Number is adjusted pursuant to Section 3 hereof (for

purposes of this Section 4, each an “Adjustment”), the Issuer shall cause its Chief Financial Officer

to prepare and execute a certificate setting forth, in reasonable detail, the event requiring the Adjustment, the amount of the Adjustment,

the method by which such Adjustment was calculated (including a description of the basis on which the Board made any determination hereunder),

and the Warrant Price and Warrant Share Number after giving effect to such Adjustment, and shall cause copies of such certificate to

be delivered to the Holder of this Warrant Certificate promptly after each Adjustment.

5.

Fractional Shares. No fractional shares of Warrant Stock will be issued in connection with any exercise hereof, but in lieu of

such fractional shares, the Issuer shall round the number of shares to be issued upon exercise up to the nearest whole number of shares.

6.

Definitions. For the purposes of this Warrant Certificate, the following terms have the following meanings:

“Board”

shall mean the Board of Directors of the Issuer.

“Capital

Stock” means and includes (i) any and all shares, interests, participations or other equivalents of or interests in (however

designated) corporate stock, including, without limitation, shares of preferred or preference stock, (ii) all partnership interests (whether

general or limited) in any Person which is a partnership, (iii) all membership interests or limited liability company interests in any

limited liability company, and (iv) all equity or ownership interests in any Person of any other type.

“Closing

Price” means, on any particular date, (a) the last reported closing bid price per share of Common Stock on such date on

the Trading Market, or (b) if there is no such price on such date, the closing bid price on the Trading Market on the date nearest preceding

such date, or (c) if the Common Stock is not then listed or quoted for the Trading Market and if prices for the Common Stock are then

reported in the “pink sheets” published by Pink Sheets LLC (or a similar organization or agency succeeding to its functions

of reporting prices), the most recent bid price per share of the Common Stock so reported, or (d) if the shares of Common Stock are not

publicly traded, the fair market value of a share of Common Stock as determined by a qualified, independent appraiser selected in good

faith by the Company and reasonably acceptable to the Holder.

“Commitment

Amount” shall have the meaning ascribed to it in the Agreement.

“Common

Stock” means the common stock, $0.001 par value per share, of the Issuer and any other Capital Stock into which such stock

may hereafter be changed.

“Issuer”

means Flux Power Holdings, Inc., a Nevada corporation, and its successors.

“Original

Issue Date” means date set forth on face of this Warrant Certificate.

“Person”

means an individual, corporation, limited liability company, partnership, joint stock company, trust, unincorporated organization, joint

venture, Governmental Authority or other entity of whatever nature.

“Securities”

means any debt or equity securities of any Person, whether now or hereafter authorized, any instrument convertible into or exchangeable

for Securities or a Security, and any option, warrant or other right to purchase or acquire any Security. “Security”

means one of the Securities.

“Securities

Act” means the Securities Act of 1933, as amended, or any similar federal statute then in effect.

“Term”

has the meaning specified in Section 1 hereof.

“Trading

Market” means any nationally recognized securities exchange, inter-dealer quotation system or over-the-counter market on

which the Common Stock is listed or quoted for trading on the date in question.

“Warrant

Share Number” means at any time the aggregate number of shares of Warrant Stock which may at such time be purchased upon

exercise of this Warrant Certificate, after giving effect to all prior adjustments and increases to such number made or required to be

made under the terms hereof.

“Warrant

Stock” means Common Stock issued or issuable upon exercise of any Warrant or Warrants or otherwise issuable pursuant to

any Warrant or Warrants.

7.

Amendment and Waiver. Any term, covenant, agreement or condition in this Warrant Certificate may be amended or waived (either

generally or in a particular instance and either retroactively or prospectively) only with the written consent of the Issuer and the

Holder.

8.

Governing Law. This Warrant Certificate shall be construed and enforced in accordance with the laws of the State of California

without reference to principles of conflict of law and, in the event of any litigation or other dispute in connection with this Warrant

Certificate or any of the exhibits attached hereto, the venue and jurisdiction of which shall be in Los Angeles County, California.

9.

Notices. All notices and other communications given or made pursuant to this Warrant Certificate shall be in writing and shall

be deemed effectively given upon the earlier of actual receipt or: (i) personal delivery to the party to be notified, (ii) when sent,

if sent by electronic mail or facsimile during normal business hours of the recipient, and if not sent during normal business hours,

then on the recipient’s next business day, (iii) five (5) days after having been sent by registered or certified mail, return receipt

requested, postage prepaid, or (iv) one (1) business day after deposit with a nationally recognized overnight courier, freight prepaid,

specifying next business day delivery, with written verification of receipt. All communications shall be sent to the respective parties

at the address indicated for such party in the Agreement, or at such other address as such party may designate by ten (10) days advance

written notice to the other party given in the foregoing manner.

10.

Successors and Assigns. This Warrant Certificate and the rights evidenced hereby shall inure to the benefit of and be binding

upon the successors and assigns of the Issuer, the Holder hereof and (to the extent provided herein) the holders of Warrant Stock issued

pursuant hereto, and shall be enforceable by any such Holder or holder of Warrant Stock.

11.

Modification and Severability. If, in any action before any court or agency legally empowered to enforce any provision contained

herein, any provision hereof is found to be unenforceable, then such provision shall be deemed modified to the extent necessary to make

it enforceable by such court or agency. If any such provision is not enforceable as set forth in the preceding sentence, the unenforceability

of such provision shall not affect the other provisions of this Warrant Certificate, but this Warrant Certificate shall be construed

as if such unenforceable provision had never been contained herein.

12.

Titles and Subtitles. The titles and subtitles used in this Warrant Certificate are used for convenience only and are not to be

considered in construing or interpreting this Warrant Certificate.

13.

Force Majeure. Neither party shall be liable for any delays or failures in performance resulting from acts beyond its reasonable

control including, without limitation, acts of God, terrorist acts, shortage of supply, breakdowns or malfunctions, interruptions or

malfunction of computer facilities, or loss of data due to power failures or mechanical difficulties with information storage or retrieval

systems, labor difficulties, war, or civil unrest.

IN

WITNESS WHEREOF, the Issuer has executed this Warrant Certificate as of the day and year first above written.

| |

FLUX POWER HOLDINGS, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

Ronald

Dutt |

| |

Title: |

Chief

Executive Officer |

| Acknowledged and Agreed Upon By: |

| |

|

|

| HOLDER |

|

| |

|

|

| CLEVELAND

CAPITAL, L.P. |

|

| |

|

|

| Name:

|

|

|

| Title:

|

|

|

Exhibit

10.1

CREDIT

FACILITY AGREEMENT

CREDIT

FACILITY AGREEMENT (this “Agreement”), dated as of November 2, 2023 (“Effective Date”), by

and among Flux Power Holdings, Inc., a Nevada corporation (the “Borrower”), and Cleveland Capital, L.P., a Delaware

limited partnership (“Cleveland” or the “Lender”).

RECITALS

WHEREAS,

the Borrower has requested that the Lender make available to the Borrower a line of credit of up to $2,000,000 from time to time, the

proceeds of which shall be used by the Borrower for working capital purpose; and

WHEREAS,

the Lender is willing to advance funds to the Borrower upon the terms and subject to the conditions set forth herein.

AGREEMENT

NOW,

THEREFORE, in consideration of the above recitals and for other good and valuable consideration, the receipt and adequacy of which

is hereby acknowledged, the Borrower and the Lender hereby agree as follows:

1.

Credit Facility.

(a)

Subject to the terms and conditions set forth herein, the Lender agrees to make loans (each such loan, an “Advance”)

up to $2,000,000 (the “Commitment Amount”), to the Borrower from time to time from the Effective Date until the maturity

date of the Note (as defined below); provided, however, that after given effect to any Advances, the aggregate outstanding principal

amount shall not exceed the Commitment Amount.

(b)

The Advances shall be evidenced by a subordinated unsecured promissory note of the Borrower in substantially the form of Exhibit A

attached hereto dated of even date with this Agreement ( the “Note”) which shall also evidence the Lender’s

Commitment Amount. The Note shall be payable to the order of the Lender in the principal amount equal to such Lender’s Commitment

Amount or, if less, the outstanding amount of all Advances made by such Lender, plus interest accrued thereon, as set forth below. All

Advances shall be made pursuant the terms and obligations set forth in the Note. All obligations under the Note shall be subordinated

to the obligations owed to Gibraltar Business Capital, LLC pursuant to the terms and conditions of that Subordination Agreement dated

November 2, 2023.

(c)

For the purposes of the Advances, subject to the limitations, terms and conditions set forth in the Note, the Borrower may, from time

to time, prior to the Due Date (as defined in the Note), draw down, repay, and re-borrow on the Note, by giving notice to the Lender

of the amount to be requested to be drawn down.

(d)

All Advances shall be used by the Borrower for general working capital purposes.

(e)

The Agreement, Note and Warrants (as defined below), together with all of the other agreements, documents, and instruments heretofore

or hereafter executed in connection therewith or with the Advances to be made under this Agreement, as the same may be amended, supplemented

or modified from time to time, shall collectively be referred to herein as the “Loan Documents.”

2.

Interest Rate. Interest shall accrue and be payable on the Advances as set forth in the Note.

3.

[Reserved].

4.

Warrants. In consideration of the Lender’s commitment to provide the Advances to the Borrower, the Borrower shall issue

a warrant to the Lender in the form attached hereto as Exhibit B (the “Warrant”).

5.

Representations and Warranties of the Borrower. As a material inducement to the Lender to enter into and execute this Agreement

and to perform its covenants, agreements, duties and obligations hereunder, and in consideration therefore, the Borrower hereby makes

the following representations and warranties, each of which (a) is material and is being relied upon by the Lender as a material inducement

to enter into this Agreement, and (b) is true at and as of the date hereof.

5.1

Authorization. All corporate action on the part of the Borrower, its officers, directors and shareholders necessary for the authorization,

execution and delivery of this Agreement, the Note and the Warrant, the sale and issuance of the Note, the Warrant and the shares issuable

upon exercise of the Warrant and the performance of the Borrower’s obligations hereunder and under the Note and the Warrant has

been taken. The Borrower has the requisite corporate power to enter into the Loan Documents and carry out and perform its obligations

under the terms of the Loan Documents. The Borrower will have the requisite corporate power to issue and sell the Note and the Warrant,

and shares of Common Stock issued upon exercise of the Warrant (collectively, the “Securities”). The Loan Documents

have been duly executed and delivered by the Borrower and constitute the valid and binding obligation of the Borrower, enforceable against

it in accordance with its terms, except (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization,

moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws

relating to the availability of specific performance, injunctive relief or other equitable remedies, and (iii) insofar as indemnification

and contribution provisions may be limited by applicable law.

5.2

Organization and Good Standing. The Borrower is a corporation duly organized, validly existing and in good standing under the

laws of the State of Nevada and has all requisite corporate power and authority to carry on its business as now conducted.

5.3

Delivery of SEC Documents; Business. The Borrower has made available to the Lender through the Securities and Exchange Commission’s

(“SEC”) EDGAR system, true and complete copies of the Borrower’s most recent Annual Report on Form 10-K for

the fiscal year ended June 30, 2023 (“Form 10-K”) and all other reports filed by the Borrower pursuant to the Exchange Act

since the filing of the Form 10-K , and prior to the date hereof (collectively, the “SEC Documents”). The Borrower

is engaged in all material respects only in the business described in the SEC Documents and the SEC Documents contain a complete and

accurate description of the business of the Borrower in all material respects.

5.4

No Conflict with Other Instruments. The execution, delivery and performance of this Agreement, the issuance and sale of the Securities

to be sold by the Borrower under this Agreement and the consummation of the actions contemplated by this Agreement will not (a) result

in any violation of, be in conflict with, or constitute a material default under, with or without the passage of time or the giving of

notice (i) any provision of the Borrower’s Articles of Incorporation, as amended, or Bylaws, as amended (or similar governing documents),

(ii) any provision of any judgment, arbitration ruling, decree or order to which the Borrower is a party or by which the Borrower is

bound, or (iii) any bond, debenture, note or other evidence of indebtedness, or any material lease, contract, mortgage, indenture, deed

of trust, loan agreement, joint venture or other agreement, instrument or commitment to which the Borrower is a party or by which the

Borrower or its properties is bound, or (b) result in the creation or imposition of any lien, encumbrance, claim, security interest or

restriction whatsoever upon any of the properties or assets of the Borrower or any acceleration of indebtedness pursuant to any obligation,

agreement or condition contained in any bond, debenture, note or any other evidence of indebtedness or any indenture, mortgage, deed

of trust or any other agreement or instrument to which the Borrower is a party or by which the Borrower is bound or to which any of the

property or assets of the Borrower is subject.

5.5

Capitalization. As of October 25, 2023, the authorized capital stock of the Borrower consists of (a) 30,000,000 shares of Common

Stock, $0.001 par value per share, of which 16,487,237 shares are issued and outstanding, (b) 2,503,294 shares reserved for issuance

upon the vesting, exercise or conversion, as the case may be, of outstanding restricted stock units, options, warrants or other convertible

securities (excluding the Note and Warrants), and (c) 500,000 shares of preferred stock, $0.001 par value per share, none of which are

outstanding or reserved for issuance upon the exercise or conversion, as the case may be, of outstanding options, warrants or other convertible

securities. Except as disclosed in the Borrower’s SEC Documents and set forth in the Borrower’s Articles of Incorporation,

as amended and contemplated in the Transaction Documents, there are no anti-dilution or price adjustment provisions, co-sale rights,

registration rights, rights of first refusal or other similar rights contained in the terms governing any outstanding security of the

Borrower that will be triggered by the issuance of the Securities.

5.6

Valid Issuance of Securities. The Note and the Warrant, and shares of Common Stock issued upon exercise of the Warrant, when issued

in compliance with the provisions of this Agreement, the Note and the Warrant will be validly issued and will be free of any liens or

encumbrances provided, however, that the Securities may be subject to restrictions on transfer under state and/or federal securities

laws as set forth herein, and as may be required by future changes in such laws. The Borrower has reserved a sufficient number of shares

of Common Stock for issuance upon exercise of the Warrant.

5.7

Litigation. Except as set forth in the Borrower’s SEC Documents, there is no action, suit, proceeding or investigation pending

or, to the Borrower’s knowledge, currently threatened against the Borrower that (a) if adversely determined would reasonably be

expected to have a Material Adverse Effect, or (b) would be required to be disclosed in the Borrower’s Annual Report on Form 10-K

under the requirements of Item 103 of Regulation S-K. The foregoing includes, without limitation, any action, suit, proceeding or investigation,

pending or threatened, that questions the validity of this Agreement or the right of the Borrower to enter into such Agreement and perform

its obligations hereunder. The Borrower is not subject to any injunction, judgment, decree or order of any court, regulatory body, arbitral

panel, administrative agency or other governmental body. For the purpose of this Agreement “Material Adverse Effect”

means (i) a material adverse effect on the results of operations, assets, business, prospects or financial condition of the Borrower,

or (ii) material and adverse impairment of the Borrower’s ability to perform its obligations under any of the Loan Documents.

5.8

Governmental Consents. No consent, approval, order or authorization of, or registration, qualification, designation, declaration

or filing with any federal, state, local or provincial governmental authority on the part of the Borrower is required in connection with

the consummation of the transactions contemplated by this Agreement, except for notices required or permitted to be filed with certain

state and federal securities commissions, which notices will be filed on a timely basis.

5.9

No Material Changes. Except as disclosed in the Borrower’s SEC Documents, since December 31, 2021, there has not been any

material change that has had a Material Adverse Effect.

5.10

Investment Company. The Borrower is not an “investment company” or an “affiliated person” of, or “promoter”

or “principal underwriter” for an investment company, within the meaning of the Investment Company Act of 1940 and will not

be deemed an “investment company” as a result of the transactions contemplated by this Agreement.

5.11

No General Solicitation. Neither the Borrower, nor any of its affiliates, nor any person acting on its own or their behalf, has

engaged or will engage in any form of general solicitation or general advertising (within the meaning of Regulation D promulgated under

the Securities Act of 1933, as amended (“Securities Act”)) in connection with the offer or sale of the Securities.

6.

Representations and Warranties of the Lender. The Lender represents and warrants to Borrower that:

6.1

Organization, Authority The Lender is a limited partnership duly organized, validly existing and in good standing under the laws

of the jurisdiction of its organization with the requisite partnership or other power and authority to enter into and to consummate the

transactions contemplated by the Transaction Documents and otherwise to carry out its obligations hereunder and thereunder. The purchase

by such Lender of the Securities hereunder has been, to the extent such Lender is an entity, duly authorized by all necessary partnership

or other action on the part of such Lender. This Agreement has been duly executed and delivered by such Lender and constitutes the valid

and binding obligation of such Lender, enforceable against it in accordance with its terms, except (i) as limited by general equitable

principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement

of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance, injunctive relief

or other equitable remedies, and (iii) insofar as indemnification and contribution provisions may be limited by applicable law.

6.2

Investment Representations. In connection with the sale and issuance of the Securities, the Lender makes the following representations:

(a)

Investment for Own Account. The Lender is acquiring the Securities for its own account, not as nominee or agent, and not with

a view to, or for resale in connection with, any distribution or public offering thereof within the meaning of the Securities Act. The

Lender has no present intention of selling, granting any participation in, or otherwise distributing the Securities. The Lender does

not have any contract, undertaking, agreement or arrangement with any person to sell, transfer or grant participation in any of the Securities

to such person or to any third person.

(b)

SEC Documents; Disclosure Materials. The Lender has received, read and fully understands the SEC Documents and Loan Documents.

The Lender acknowledges that the Lender is basing its decision to invest in the Securities Documents on the SEC Documents and has relied

only on the information contained in said material and has not relied upon any representations made by any other person. The Lender recognizes

that an investment in the Securities involves substantial risks and is fully cognizant of and understands all of the risk factors related

to the purchase of the Securities, including but not limited to, those risks set forth in the section of the SEC Documents entitled “RISK

FACTORS.”

(c)

Lender Status. At the time such Lender was offered the Securities, it was, at the date hereof it is, and on the date which it

exercises any Warrants, it will be an “accredited investor” as defined in Rule 501(a) under the Securities Act or a “qualified

institutional buyer” as defined in Rule 144A(a) under the Securities Act. Such Lender is not a registered broker dealer registered

under Section 15(a) of the Exchange Act, or a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”)

or an entity engaged in the business of being a broker dealer. Such Lender is not affiliated with any broker dealer registered under

Section 15(a) of the Exchange Act or a member of FINRA, or an entity engaged in the business of being a broker dealer.

(d)

Representations and Reliance. The Lender understands that the Securities are being offered and sold to it in reliance on specific

exemptions from the registration requirements of the United States federal and state securities laws and that the Borrower is relying

upon the truth and accuracy of the representations, warranties, agreements, acknowledgments and understandings of the Lender set forth

herein, and in the Investor Suitability Questionnaire to determine the applicability of such exemptions and the suitability of the Lender

to acquire the Securities. All information which the Lender has provided to the Borrower, including but not limited to, all information

given herein and in the Investor Suitability Questionnaire or otherwise, concerning itself, investor status, address, residence, financial

position and knowledge and experience of financial and business matters are correct and complete, and that if there should be any material

change in such information, the Lender will immediately provide the Borrower with such information. The Lender will promptly notify the

Borrower of any material fact or circumstance that would cause any of the foregoing representations to be untrue, incomplete, or misleading.

(e)

Restricted Securities. The Lender understands that the Securities the Lender is purchasing are characterized as “restricted

securities” under the federal securities laws inasmuch as they are being acquired from the Borrower in a transaction not involving

a public offering and that under such laws and regulations such securities may be resold without registration under the Securities Act

only in certain limited circumstances. The Lender is familiar with Rule 144, as presently in effect, and understands the resale limitations

imposed thereby and by the Securities Act. The Lender also acknowledges that the Borrower was a former “shell company” (as

defined in Rule 12b-2 under the Exchange Act) and as such the Lender understands that Rule 144 is not currently available for the sale

of the Securities and may never be so available.

(f)

Transfer Restrictions, Legends. The Lender understands that (i) the Securities have not been registered under the Securities Act,

(ii) the Securities are being offered and sold pursuant to an exemption from registration, based in part upon the Borrower’s reliance

upon the statements and representations made by the Lender, and that the Securities must be held by the Lender indefinitely and that

the Lender must, therefore, bear the economic risk of such investment indefinitely, unless a subsequent disposition thereof is registered

under the Securities Act or is exempt from such registration, and (iii) each Certificate representing the Securities will be endorsed

with a legend substantially in the following form until the earlier of (1) such date as the Securities have been registered for resale

by the Lender, or (2) the date the Securities are eligible for sale under Rule 144.

THE

SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”),

OR UNDER THE SECURITIES LAWS OF ANY STATES. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE

TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE SECURITIES ACT AND THE APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION

OR EXEMPTION THEREFROM. UNLESS SOLD PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT, THE ISSUER OF THESE SECURITIES

MAY REQUIRE AN OPINION OF COUNSEL IN FORM AND SUBSTANCE SATISFACTORY TO THE ISSUER TO THE EFFECT THAT ANY PROPOSED TRANSFER OR RESALE

IS IN COMPLIANCE WITH THE SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS.

(g)

No Transfer. The Lender covenants not to dispose of any of the Securities other than in conjunction with an effective registration

statement under the Securities Act, or in compliance with Rule 144 or pursuant to another exemption from registration, or to an entity

affiliated with the Lender, other than in compliance with the applicable securities regulations laws of any state.

(h)

Investment Experience. The Lender acknowledges that the Lender is able to bear the economic risk of the Lender’s investment,

including the complete loss thereof. The Lender has a preexisting personal or business relationship with the Borrower or one or more

of its officers, directors or other persons in control of the Borrower, and the Lender has such knowledge and experience in financial

or business matters that it is capable of evaluating the merits and risks of the investment in the Securities.

(i)

Financial Sophistication; Due Diligence. The Lender has such knowledge and experience in financial or business matters that it

is capable of evaluating the merits and risks of the investment in connection with the transactions contemplated in this Agreement. Such

Lender has, in connection with its decision to purchase the Securities, relied only upon the representations and warranties contained

herein and the information contained in the Borrower’s SEC Documents. Further, the Lender has had such opportunity to obtain additional

information and to ask questions of, and receive answers from, the Borrower concerning the terms and conditions of the investment and

the business and affairs of the Borrower as the Lender considers necessary in order to form an investment decision.

(j)

General Solicitation. The Lender is not purchasing the Securities as a result of any advertisement, article, notice or other communication

regarding the Securities published in any newspaper, magazine or similar media or broadcast over the television or radio or presented

at any seminar or any other general solicitation or general advertisement. Prior to the time that the Lender was first contacted by the

Borrower or either of the Agents, such Lender had a preexisting and substantial relationship with the Borrower or one of the Agents.

The Lender will not issue any press release or other public statement with respect to the transactions contemplated by this Agreement

without the prior written consent of the Borrower. Other than to other parties to this Agreement, the Lender has maintained and will

continue to maintain the confidentiality of all disclosures made to Lender in connection with this transaction, including the existence

and terms of this transaction.

6.3

No Investment, Tax or Legal Advice. The Lender understands that nothing in the Borrower’s SEC Documents, this Agreement,

or any other materials presented to the Lender in connection with the purchase and sale of the Securities constitutes legal, tax or investment

advice. The Lender has consulted such legal, tax and investment advisors as it, in its sole discretion, has deemed necessary or appropriate

in connection with its purchase of Securities.

6.4

Disclosure of Information. The Lender understands that no United States federal or state agency or any other government or governmental

agency has passed upon or made any recommendation or endorsement of the Securities. The Lender has reviewed the documents publicly filed

by the Borrower with the SEC and has read and understands the risk factors disclosed therein. The Lender has received all the information

it considers necessary or appropriate for deciding whether to purchase the Securities. The Lender is solely responsible for conducting

its own due diligence investigation of the Borrower.

6.5

Additional Acknowledgement. The Lender acknowledges that it has independently evaluated the merits of the transactions contemplated

by this Agreement, that it has independently determined to enter into the transactions contemplated hereby, that it is not relying on

any advice from or evaluation by any other person. The Lender acknowledges that, if it is a client of an investment advisor registered

with the SEC, the Lender has relied on such investment advisor in making its decision to purchase Securities pursuant hereto.

6.6

No Short Position. As of the date hereof, and from the date hereof through the date of the closing, the Lender acknowledges and

agrees that it does not and will not (between the date hereof and the date of the closing) engage in any short sale of the Borrower’s

voting stock or any other type of hedging transaction involving the Borrower’s securities (including, without limitation, depositing

shares of the Borrower’s securities with a brokerage firm where such securities are made available by the broker to other customers

of the firm for purposes of hedging or short selling the Borrower’s securities).

7.

Notices. Any notice, request, instruction, or other document to be given hereunder by any party hereto to any other party will

be in writing and will be given by delivery in person, by facsimile transmission, by email or other electronic communication, by overnight

courier or by registered or certified mail, postage prepaid (and will be deemed given when delivered if delivered by hand, when transmission

confirmation is received if delivered by facsimile, three (3) days after mailing if mailed by United States mail, and one (1) business

day after deposited with an overnight courier service if delivered by overnight courier), as follows:

| |

If to Borrower: |

|

Flux Power Holdings, Inc. |

| |

|

|

Attn: President |

| |

|

|

2685

S. Melrose Drive

|

| |

|

|

Vista, CA 92081 |

| |

|

|

rdutt@fluxpwr.com

|

| |

|

|

|

| |

If to Lender: |

|

Cleveland Capital, L.P. |

| |

|

|

Attn: Wade Massad |

| |

|

|

1250

Linda Street, Suite 304

|

| |

|

|

Rocky

River, OH 44116

|

| |

|

|

wade@clevelandcapital.com |

or

at such other address of which any party may, from time to time, advise the other party by notice in writing given in accordance with

the foregoing. The date of receipt of any such notice shall be deemed to be the date of delivery or facsimile (with confirmation) thereof.

8.

Entire Agreement. This Agreement, the Loan Documents, and the other agreements entered into in connection herewith supersede all

prior negotiations and agreements (whether written or oral) and constitute the entire understanding among the parties hereto.

9.

Successors. This Agreement shall inure to the benefit of and be binding upon the parties named herein and their respective successors

and assigns.

10.

Headings. The section headings contained in this Agreement are for convenience only and shall not control or affect the meaning

or construction of any of the provisions of this Agreement.

11.

Governing Law. This Agreement shall be construed and enforced in accordance with the laws of the State of California without reference

to principles of conflict of law and, in the event of any litigation or other dispute in connection with this Agreement or any of the

exhibits attached hereto, the venue and jurisdiction of which shall be in San Diego County, California.

12.

Delay, Etc. No delay or omission to exercise any right, power or remedy accruing to any party hereto shall impair any such right,

power or remedy of such party nor be construed to be a waiver of any such right, power or remedy, nor constitute any course of dealing

or performance hereunder.

13.

Costs and Attorneys’ Fees. If any action, suit, arbitration proceeding or other proceeding is instituted arising out of

this Agreement, the prevailing party shall recover all of such party’s costs, including, without limitation, the court costs and

reasonable attorneys’ fees incurred therein, including any and all appeals or petitions therefrom.

14.

Waiver and Amendment. Any of the terms and provisions of this Agreement may be waived at any time by the party that is entitled

to the benefit thereof, but only by a written instrument executed by such party. This Agreement may be amended only by an agreement in

writing executed by the parties hereto.

15.

Fees and Expenses. All fees and expenses incurred in connection with this Agreement and the LOC shall be paid by the party incurring

such fees or expenses.

16.

Counterparts; Electronic Transmission. This Agreement may be executed in one or more counterparts (any of which may be delivered

by fax or electronic mail transmission), each of which will for all purposes be deemed to be an original and all of which will constitute

the same instrument.

[SIGNATURE

PAGE TO FOLLOW]

IN

WITNESS WHEREOF, the undersigned parties hereto have duly executed this Agreement effective as of the date first above written.

| |

BORROWER: |

| |

|

|

| |

Flux

Power Holdings, Inc., |

| |

a

Nevada corporation |

| |

|

|

| |

By: |

|

| |

|

Ronald

F. Dutt, Chief Executive Officer |

| |

|

|

| |

LENDER: |

| |

|

|

| |

Cleveland

Capital, L.P. |

| |

|

|

| |

By: |

|

| |

Name: |

Wade

Massad |

| |

Title: |

|

| |

Date: |

|

EXHIBIT

A

FORM

OF SUBORDINATED UNSECURED PROMISSORY NOTE

EXHIBIT

B

FORM

OF WARRANTS

Exhibit

10.2

IN

ACCORDANCE WITH THE TERMS OF A SUBORDINATION AGREEMENT, DATED AS OF NOVEMBER 2, 2023 (THE “SUBORDINATION AGREEMENT”), BY

AND AMONG THE COMPANY (AS DEFINED HEREIN), THE LENDER (AS DEFINED HEREIN), CERTAIN OTHER PARTIES TO THE SUBORDINATION AGREEMENT, AND

GIBRALTAR BUSINESS CAPITAL, LLC (THE “SENIOR LENDER”), THE LENDER HAS SUBORDINATED THE INDEBTEDNESS EVIDENCED BY THIS SUBORDINATED

UNSECURED PROMISSORY NOTE (AND ALL PAYMENT AND ENFORCEMENT PROVISIONS HEREIN)(THE “NOTE”) AND ANY SECURITY INTEREST OR LIEN

THAT THE LENDER MAY HAVE IN ANY PROPERTY OF THE COMPANY TO THE INDEBTEDNESS OWED BY THE COMPANY TO SENIOR LENDER AND THE SECURITY INTEREST

OF SENIOR LENDER IN THE ASSETS OF THE COMPANY, NOTWITHSTANDING THE RESPECTIVE DATES OF ATTACHMENT OR PERFECTION OF THE SECURITY INTEREST

OF THE LENDER AND SENIOR LENDER. IN THE EVENT OF ANY INCONSISTENCY BETWEEN THE NOTE AND THE SUBORDINATION AGREEMENT, THE TERMS OF THE

SUBORDINATION AGREEMENT SHALL CONTROL.

SUBORDINATED

UNSECURED PROMISSORY NOTE

| US$2,000,000 |

November 2, 2023 |

| |

Vista,

California |

Pursuant

to the terms of the Credit Facility Agreement (“Credit Facility”), by and between Flux Power Holdings, Inc.,

a Nevada corporation (the “Company”) and Cleveland Capital, L.P. (the “Lender”) dated

as of the date hereof, the Company HEREBY UNCONDITIONALLY PROMISES TO PAY to the order of the Lender, the aggregate unpaid principal

amount of all advances (the “Advances”) made by the Lender to the Company under the terms of this Subordinated

Unsecured Promissory Note (the “Note”), up to a maximum principal amount of Two Million Dollars ($2,000,000)

(“Commitment Amount”). The Company shall also pay interest on the aggregate unpaid principal amount of such

Advances at the rates and in accordance with the terms of this Note. Subject to the subordination provisions, the entire principal amount

and all and unpaid accrued interest shall be due and payable on August 15, 2025 (the “Due Date”). All payments

under this Note shall be made only in lawful money of the United States of America, at such place as the Lender hereof may designate

in writing from time to time. Payment shall be credited first to the accrued interest then due and payable and the remainder to principal.

1. Advances.

Subject to the terms and conditions of this Note, the Lender shall provide Advances in increments of up to One Hundred Thousand Dollars

($100,000), hereunder so long as the total of all unpaid Advances at the time of such request does not exceed the Commitment Amount,

to the Company at such times as the Company may from time to time request from the date of this Note until the Due Date. If, at any time

or for any reason, the amount of Advances pursuant to this Note owed by the Company to the Lender exceeds the Commitment Amount, the

Company shall immediately pay to the Lender, in cash, the amount of such excess. The Lender is hereby authorized to record the date and

amount of each Advance on the grid attached hereto as Attachment A and incorporated herein and any such recordation shall constitute

prima facie evidence of the accuracy of the information so recorded.

2. Interest.

Interest shall accrue on each Advance from and after the date of disbursement of such advance at the Secured Overnight Financing Rate

for one (1) month displayed on the Market Data Platform of CME GroupBenchmark Administration Limited (CBA) (or any other commercially

available source providing such quotations as may be selected by Lender from time to time), plus nine percent (9%) per annum (the “Interest

Rate”). The accrued but unpaid interest on the Advances shall be payable on the Due Date in cash.

3. Subordination.

The Lender acknowledges that the indebtedness evidenced by this Note is subject to that certain Subordination Agreement by and among

the Company, the other lenders under the Credit Facility, and Gibraltar Business Capital, LLC, a Delaware limited liability company.

4. Prepayment.

Subject to the subordination provisions, Advances may be prepaid, in whole or in part, at any time prior to the Maturity Date without

penalty.

5. Default. The occurrence of any of the following events shall constitute an “Event

of Default” hereunder:

(a) The non-payment of any principal and/or interest due and owing to the Lender under this Note, or other promissory notes as

provided in the Credit Facility, and such failure to make payment shall continue for a period of five (5) days or longer from the

due date; or

(b)

Violation by the Company of any covenant or obligation contained in the Credit Facility or this Note, or breach of any

representation or warranty contained in the Credit Facility or herein; or

(c)

The Company (i) admits in writing its inability to pay its debts as they become due, (ii) files a petition under any chapter of the

Federal Bankruptcy Code or similar law, state or federal, not or hereafter existing, (iii) makes an assignment for the benefit of

its creditors, or (iv) is adjudged as bankrupt or insolvent.

Upon

occurrence of an Event of Default, the Lender shall notify the Company in writing. If the Event of Default is not cured within ten (10)

days after the giving of such notice of default, the Company shall be deemed to be in default under this Note (a “Default”).

6. Default

and Acceleration. Upon the occurrence of a Default as set forth in Section 5, at the option of the Lender hereof (i) the entire

outstanding principal balance, all accrued but unpaid interest and/or Late Charges (as defined below) at once shall become due and

payable upon written notice to the Company, and (ii) the Lender may pursue all other rights and remedies available under this Note

or by law.

7. Late Charge. If the Company shall fail to make any payment due under this Note, within

five (5) days after the date the same is due and payable, the Lender, at its option, may require the payment of a late charge (“Late

Charge”) in the amount of two percent (2%) of the delinquent sum.

8.

Remedies Cumulative. The rights or remedies of the Lender as provided in this Note shall be cumulative and concurrent and may

be pursued at the sole discretion of the Lender singularly, successively or together against the Company. The failure to exercise any

such right or remedy shall in no event be construed as a waiver or release of such rights or remedies or the right to exercise them at

any later time.

9.

Forbearance. Any forbearance of the Lender in exercising any right or remedy hereunder or under the Credit Facility, or otherwise

afforded by applicable law, shall not be a waiver of or preclude the exercise of any right or remedy. The acceptance by the Lender of

payment of any sum payable hereunder after the due date of such payment shall not be a waiver of the Lender’s right to either require

prompt payment when due of all other sums payable hereunder or to declare a Default for failure to make prompt payment. No delay or omission

on the part of the Lender in exercising any right hereunder shall operate as a waiver of such right or of any other right under this

Note.

10.

Application of Payments. All payments made on this Note shall be applied first to any collection costs the Lender may have incurred

by procuring the Company’s performance hereunder, then to payment of the Late Charges, then to payment of accrued but unpaid, interest

and the remainder of all such payments shall be applied to the reduction of the outstanding principal balance on this Note.

11. Costs

and Expenses. The Company shall reimburse the Lender for all actual attorneys’ fees, costs and expenses arising from and after

the date hereof, incurred by the Lender in connection with the enforcement of the Lender’s rights under this Note and each of the

documents referred to therein, including, without limitation, actual attorneys’ fees, costs and expenses for trial, appellate proceedings,

out of court negotiations, workouts and settlements, or for enforcement of rights under any state or federal statute, including, without

limitation, actual attorneys’ fees, costs and expenses incurred in bankruptcy and insolvency proceedings such as, but not limited

to, in connection with seeking relief from stay in a bankruptcy proceeding. The term “expenses,” as used herein, means any

expenses incurred by the Lender in connection with any of the out of court, state, federal or bankruptcy proceedings referenced above,

including but not limited to, the fees and expenses of any appraisers, consultants and expert witnesses retained or consulted by the

Lender in connection therewith. The Lender shall also be entitled to its attorneys’ fees, costs and expenses incurred in any post

judgment proceedings to collect and enforce the judgment. This provision is separate and several and shall survive the merger of this

Note into any judgment on this Note.

12. Usury.

In the event the interest provisions hereof, any exactions provided for herein or in the Credit Facility, shall result in an effective

rate of interest which exceeds the limit of the usury or any other applicable law, all sums in excess of those lawfully collectible as

interest for the period in question shall, without further agreement or notice between or by any party hereto, be applied upon the outstanding

principal balance of this Note immediately upon receipt of such moneys by the Lender, and any such amount in excess of such outstanding

principal balance shall be returned to the Company.

13. Severance.

Whenever possible, each provision of this Note shall be interpreted in such a manner as to be effective and valid under all applicable

laws and regulations. However, if any provision of this Note shall be prohibited by or invalid under any such law or regulation in any

jurisdiction, it shall, as to such jurisdiction, be deemed modified to conform to the minimum requirements of such law or regulation,

or if for any reason it is not deemed so modified, it shall be ineffective and invalid only to the extent of such prohibition or invalidity

without affecting the remaining provisions of this Note, or the validity or effectiveness of such provision in any other jurisdiction.

14. No

Amendment or Waiver Except in Writing. This Note may be amended or modified only by a writing duly executed by the Company and the

Lender, which expressly refers to this Note and the intent of the parties so to amend this Note. No provision of this Note will be deemed

waived by the Lender, unless waived in writing executed by the Lender, which expressly refers to this Note, and no such waiver shall

be implied from any act or conduct of the Lender or any omission by the Lender to take action with respect to any provision of this Note.

No such express written waiver shall affect any other provision of this Note or cover any default or time period or event, other than

the matter as to which an express written waiver has been given. The Company may not assign or delegate this Note without the prior written

consent of the Lender.

15. Governing

Law. This Note shall be construed and enforced in accordance with the laws of the State of California without reference to principles

of conflict of law and, in the event of any litigation or other dispute in connection with this Note or any of the exhibits attached

hereto, the venue and jurisdiction of which shall be in San Diego County, California.

16. No

Benefit. Nothing expressed in or to be implied from this Note is intended to give, or shall be construed to give, any person or entity,

other than the parties hereto and their permitted successors and assigns hereunder, any benefit or legal or equitable right, remedy or

claim under or by virtue of this Note, or under or by virtue of any provision herein.

17. Agreement

in Counterparts; Facsimile Signatures. This Note may be executed in several counterparts and all so executed shall constitute

one Note, binding on all parties hereto, notwithstanding that all the parties are not signatories to the original or the same counterpart.

A signature transmitted by facsimile or other electronic means shall have the same effect as an original signature.

18. Notices.

Notices under this Note shall be in writing and shall be valid and sufficient if transmitted as provided in the Credit Facility.

19. Miscellaneous.

(a) The

meaning of defined terms shall be equally applicable to both the singular and plural forms of the terms defined.

(b) References

to agreements and other contractual instruments shall be deemed to include all subsequent amendments and other modifications thereto.

(c) References

to statutes or regulations are to be construed as including all statutory and regulatory provisions consolidating, amending or replacing

the statute or regulation referred to.

(d) Any

captions and headings are for convenience of reference only and shall not affect the construction of this Note.

[Signature

page follows]

IN

WITNESS WHEREOF, the undersigned duly authorized officer of the Company has executed this Note as of the date first set forth above.

| |

Company |

| |

|

|

| |

Flux

Power Holdings, Inc., |

| |

a

Nevada corporation |

| |

|

|

| |

By: |

|

| |

Name: |

Ronald

Dutt |

| |

Title: |

Chief

Executive Officer |

ATTACHMENT

A

SCHEDULE

OF ADVANCES

Date

of Advance

|

Amount

Advanced |

Amount

Repaid |

Amount

Available |

| |

|

|

|

| |

|

|

|

Exhibit

99.1

Flux

Power Announces Capital Structure Update Including New Credit Facility with Cleveland Capital

VISTA,

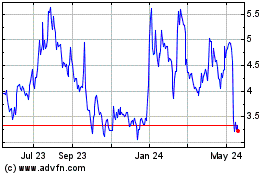

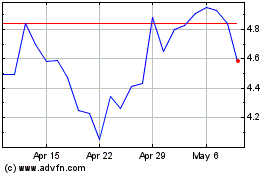

Calif. – November 3, 2023 – Flux Power Holdings, Inc. (NASDAQ: FLUX), a developer of advanced lithium-ion

energy storage solutions for electrification of commercial and industrial equipment, today announced a new credit facility with

Cleveland Capital L.P. (“CCLP”) and provided an update on its capital structure.

The

Company has taken the following recent actions to strengthen its capital structure:

| |

● |

Secured

a $15 million credit facility with Gibraltar

Business Capital (“GBC”) with a term to July 28, 2025, with no warrants, that can be expanded to $20 million. |

| |

|

|

| |

● |

Entered

into a new $2 million subordinated credit facility with Cleveland Capital, L.P. (“CCLP”) which includes a duration

to August 15, 2025. |

| |

|

|

| |

● |

Terminated

an at-the-market (“ATM”) offering program. |

| |

|

|

| |

● |

Filed

a universal shelf registration statement on

Form-3, which became effective on October 6, 2023, having a three-year term to provide flexibility with respect to capital

structure. |

New

$15.0 Million Gibraltar Business Capital Credit Facility

On

July 28, 2023, the Company secured a new $15.0 million credit facility from GBC to fund working capital and to refinance its existing

credit facility with Silicon Valley Bank. The $15.0 million credit facility is designed for working capital requirements. The

facility is secured by the existing assets of the Company, matures on July 28, 2025, and includes no warrants. The agreement allows the

Company to increase the facility to $20.0 million at the Company’s request subject to approval by GBC. The Company has also chosen

to work with Bank of America for cash management and other operational banking services.

Cleveland