First Internet Bancorp (the “Company”) (Nasdaq: INBK), the

parent company of First Internet Bank (the “Bank”), announced today

financial and operational results for the third quarter ended

September 30, 2024.

Third Quarter 2024 Financial

Highlights

- Net income of $7.0 million, an increase of 21.0% from the

second quarter of 2024

- Diluted earnings per share of $0.80, an increase of 19.4%

from the second quarter of 2024

- Net interest income of $21.8 million and fully-taxable

equivalent net interest income1 of $22.9 million, increases of 2.1%

and 1.8%, respectively, from the second quarter of 2024

- Net interest margin of 1.62% and fully-taxable equivalent

net interest margin1 of 1.70%, compared to 1.67% and 1.76%,

respectively, for the second quarter of 2024

- Noninterest income of $12.0 million, a 9.0% increase from

the second quarter of 2024

- Loan growth of $74.7 million, a 1.9% increase from the

second quarter of 2024; Deposit growth of $523.8 million, a

12.3% increase from the second quarter of 2024; Loans to

deposits ratio of 84.1%

- Nonperforming loans to total loans of 0.56%; net charge-offs

to average loans of 0.15%; allowance for credit losses to total

loans of 1.13%

- Tangible common equity to tangible assets ratio1

of 6.54%, and 7.49% ex-AOCI and adjusted for normalized cash

balances1; CET1 ratio of 9.37%

- Tangible book value per share1 of $43.89, a 3.6% increase

from the second quarter of 2024, and a 10.9% increase from the

third quarter of 2023

“Our third quarter results demonstrated strong performance

virtually across the board,” said David Becker, Chairman and Chief

Executive Officer. “Growth in net interest income, driven by higher

earning asset yields and stable funding costs, along with record

gain-on-sale revenue from the continued expansion of our national

SBA platform, propelled an increase in operating revenues for the

fifth consecutive quarter, resulting in significant positive

operating leverage.

“Additionally, robust deposit growth and the ongoing strategic

shift in loan mix have increased balance sheet flexibility,

enhanced our interest rate risk profile, and improved our liquidity

position to its strongest level in recent history, as indicated by

our loans-to-deposits ratio.

“Looking ahead, we are well-positioned to deliver increased

earnings and profitability by continuing to execute our core

strategies of revenue diversification and balance sheet

optimization. Our balance sheet and capital position are solid, and

measures of asset quality remain sound. I want to thank our

employees for their dedication and hard work in driving increased

value for our stakeholders.”

Net Interest Income and Net Interest Margin

Net interest income for the third quarter of 2024 was $21.8

million, compared to $21.3 million for the second quarter of 2024,

and $17.4 million for the third quarter of 2023. On a fully-taxable

equivalent basis, net interest income for the third quarter of 2024

was $22.9 million, compared to $22.5 million for the second quarter

of 2024, and $18.6 million for the third quarter of 2023.

Total interest income for the third quarter of 2024 was $75.0

million, an increase of 5.7% compared to the second quarter of

2024, and an increase of 19.0% compared to the third quarter of

2023. On a fully- taxable equivalent basis, total interest income

for the third quarter of 2024 was $76.1 million, an increase of

5.5% compared to the second quarter of 2024, and an increase of

18.4% compared to the third quarter of 2023. The yield on average

interest-earning assets for the third quarter of 2024 increased to

5.58% from 5.54% for the second quarter of 2024, due to a 7 basis

point (“bp”) increase in the yield earned on loans, partially

offset by a 7 bp decrease in the yield earned on other earning

assets and a 1 bp decrease in the yield earned on securities.

Compared to the linked quarter, average loan balances, including

loans held-for-sale, increased $92.6 million, or 2.4%, while the

average balance of securities increased $47.9 million, or 6.4%, and

the average balance of other earning assets increased $57.3

million, or 12.2%.

Interest income earned on commercial loans was higher due

primarily to increased average balances within the investor

commercial real estate, construction and small business lending

portfolios. This was partially offset by lower average balances in

the commercial and industrial and public finance portfolios, both

of which were impacted by early payoffs which resulted in lower

interest income compared to the prior quarter. The continued shift

in the loan mix reflects the Company’s focus on higher-yielding

variable rate products, in part, to help improve the interest rate

risk profile of the balance sheet.

In the consumer loan portfolio, interest income was up due to

the combination of higher average balances and continued strong new

origination yields in the trailers, RV and other consumer loan

portfolios.

The yield on funded portfolio loan originations was 8.85% in the

third quarter of 2024, a decrease of 3 bps compared to the second

quarter of 2024, and a decrease of 7 bps compared to the third

quarter of 2023.

Interest income earned on securities during the third quarter of

2024 increased $0.5 million, or 7.4%, compared to the second

quarter of 2024, driven primarily by new purchases and relatively

stable yields on the portfolio. Interest income earned on other

earning asset balances increased $0.8 million, or 12.2%, in the

third quarter of 2024 compared to the linked quarter, due primarily

to higher average cash balances.

Total interest expense for the third quarter of 2024 was $53.2

million, an increase of $3.6 million, or 7.2%, compared to the

linked quarter as short-term rates remained stable throughout most

of the quarter while average interest-bearing deposits balances

increased $211.1 million, or 5.1%. Interest expense related to

interest-bearing deposits increased $2.9 million, or 6.6%, driven

primarily by higher balances of certificates of deposits (“CDs”),

interest-bearing demand deposits, fintech – brokered deposits and

brokered deposits. The cost of interest-bearing deposits was

relatively stable during the quarter at 4.30%, compared to 4.29%

for the second quarter of 2024.

Average CD balances increased $137.7 million, or 7.7%, compared

to the linked quarter, driven by strong consumer demand, while the

cost of funds decreased 3 bps. CD pricing reached its inflection

point during the third quarter of 2024 as the weighted average cost

of new CDs was 4.77%, or 28 bps lower than the cost of maturing

CDs. As interest rates across the yield curve began falling ahead

of the expected cut in the Fed Funds rate in September, the Company

lowered CD rates significantly during the second half of the

quarter. As a result, the weighted average cost of CD production

during the month of September was 4.48%, or almost 30 bps lower

than the average cost of new CDs for the quarter, and is 53 bps

lower than the rates on CDs maturing in the fourth quarter of

2024.

The average balance of interest-bearing demand deposits

increased $37.3 million, or 7.9%, due to growth in fintech

partnership deposits, and the cost of funds increased 6 bps. The

average balance of fintech – brokered deposits increased $33.3

million, or 27.9%, due to higher payments volumes, while the cost

of funds remained flat. The average balance of brokered deposits

increased $21.3 million, or 4.1%, compared to the linked quarter,

and the cost of funds increased 19 bps.

Interest expense was also impacted by the cost of other borrowed

funds. The average balance of FHLB advances declined during the

third quarter of 2024; however, the cost of funds increased as

lower-cost advances matured. Additionally, one of the Company’s

subordinated debt issuances converted from fixed to floating rate

early in the third quarter of 2024. As a result, the cost of other

borrowed funds increased 56 bps.

Net interest margin (“NIM”) was 1.62% for the third quarter of

2024, down from 1.67% for the second quarter of 2024 and up from

1.39% for the third quarter of 2023. Fully-taxable equivalent NIM

(“FTE NIM”) was 1.70% for the third quarter of 2024, down from

1.76% for the second quarter of 2024 and up from 1.49% for the

third quarter of 2023. NIM and FTE NIM performance for the third

quarter was affected by carrying higher cash balances, which are

estimated to have had a negative impact of 6 bps. Furthermore, the

early loan payoff activity discussed above also had a negative

impact of 6 bps.

Noninterest Income

Noninterest income for the third quarter of 2024 was $12.0

million, compared to $11.0 million for the second quarter of 2024,

and $7.4 million for the third quarter of 2023. Gain on sale of

loans totaled $9.9 million in the third quarter of 2024, increasing

$1.6 million, or 19.8%, compared to the linked quarter. Gain on

sale revenue consisted almost entirely of sales of U.S. Small

Business Administration (“SBA”) 7(a) guaranteed loans during the

third quarter of 2024. Loan sale volume was up 22.1% while net

premiums decreased 65 bps compared to the linked quarter. Other

income decreased $0.7 million during the quarter due primarily to

lower distributions from fund investments. Net loan servicing

revenue increased by $0.1 million due to the growth in the

servicing portfolio, partially offset by the fair value adjustment

to the loan servicing asset.

Noninterest Expense

Noninterest expense totaled $22.8 million for the third quarter

of 2024, compared to $22.3 million for the second quarter of 2024,

and $19.8 million for the third quarter of 2023, representing

increases of 2.1% and 15.4%, respectively. Excluding non-recurring

costs of almost $0.6 million recognized in the second quarter of

2024, noninterest expense increased $1.0 million, or 4.7%, in the

third quarter of 2024 from the linked quarter. The increase was

driven mainly by higher salaries and employee benefits due to

higher small business lending incentive compensation as well as

staff additions in small business lending and risk management.

Income Taxes

The Company recorded income tax expense of $0.6 million and an

effective tax rate of 8.1% for the third quarter of 2024, compared

to income tax expense of $0.2 million and an effective tax rate of

3.6% for the second quarter of 2024, and an income tax benefit of

$0.4 million for the third quarter of 2023.

Loans and Credit Quality

Total loans as of September 30, 2024, were $4.0 billion, an

increase of $74.7 million, or 1.9%, compared to June 30, 2024, and

an increase of $300.8 million, or 8.1%, compared to September 30,

2023. Total commercial loan balances were $3.2 billion as of

September 30, 2024, an increase of $75.5 million, or 2.4%, compared

to June 30, 2024, and an increase of $295.2 million, or 10.2%,

compared to September 30, 2023. Compared to the linked quarter, the

increase in commercial loan balances was driven primarily by growth

in investor commercial real estate, small business lending and

construction balances. These items were partially offset by

decreases in the public finance, healthcare finance and commercial

and industrial portfolios. Quarter-end balances in the commercial

and industrial and public finance portfolios were impacted by early

payoffs. The increase in investor commercial real estate balances

included loans with strong variable rate pricing that converted

from construction loans upon project completion.

Total consumer loan balances were $803.4 million as of September

30, 2024, an increase of $2.9 million, or 0.4%, compared to June

30, 2024, and an increase of $16.9 million, or 2.1%, compared to

September 30, 2023. The increase compared to the linked quarter was

due primarily to a higher balance in the trailers portfolio,

partially offset by declines in the residential mortgage and home

equity portfolios.

Total delinquencies 30 days or more past due were 0.75% of total

loans as of September 30, 2024, compared to 0.56% at June 30, 2024,

and 0.22% as of September 30, 2023. The increase compared to the

linked quarter was due primarily to an increase in delinquencies in

franchise finance and small business lending loans. Nonperforming

loans were 0.56% of total loans as of September 30, 2024, up from

0.33% as of June 30, 2024, and 0.16% as of September 30, 2023.

Nonperforming loans totaled $22.5 million as of September 30, 2024,

up from $13.0 million as of June 30, 2024, and up from $5.9 million

as of September 30, 2023. The increase in nonperforming loans at

the end of the third quarter of 2024 was due primarily to franchise

finance and small business lending loans that were placed on

nonaccrual during the quarter. At quarter end, there were $10.1

million of specific reserves held against the balance of

nonperforming loans.

The allowance for credit losses (“ACL”) as a percentage of total

loans was 1.13% as of September 30, 2024, compared to 1.10% as of

June 30, 2024, and 0.98% as of September 30, 2023. The increase in

the ACL reflects growth and higher coverage ratios in certain loan

portfolios, as well as additional reserves related to small

business lending and franchise finance, partially offset by the

positive impact of economic data on forecasted loss rates and

qualitative factors on other portfolios.

Net charge-offs of $1.5 million were recognized during the third

quarter of 2024, resulting in net charge-offs to average loans of

0.15%, compared to $1.4 million, or 0.14%, for the second quarter

of 2024, and $1.5 million, or 0.16%, for the third quarter of 2023.

Net charge-offs in the third quarter of 2024 were driven primarily

by small business lending.

The provision for credit losses in the third quarter of 2024 was

$3.4 million, compared to $4.0 million for the second quarter of

2024 and $1.9 million for the third quarter of 2023. The provision

for the third quarter of 2024 was driven primarily by growth and

changes in the loan composition, net charge-offs and an increase in

reserves related to franchise finance and small business lending,

partially offset by the positive impact of economic forecasts and

adjustments to qualitative factors on other portfolios.

Capital

As of September 30, 2024, total shareholders’ equity was $385.1

million, an increase of $13.2 million, or 3.5%, compared to June

30, 2024, and an increase of $37.4 million, or 10.8%, compared to

September 30, 2023. The increase in total shareholders’ equity

during the third quarter compared to the linked quarter was due

primarily to the net income earned during the quarter and a

decrease in accumulated other comprehensive loss. Book value per

common share increased to $44.43 as of September 30, 2024, up from

$42.91 as of June 30, 2024, and $40.11 as of September 30, 2023.

Tangible book value per share was $43.89 as of September 30, 2024,

up from $42.37 as of June 30, 2024, and $39.57 as of September 30,

2023.

The following table presents the Company’s and the Bank’s

regulatory and other capital ratios as of September 30, 2024.

As of September 30, 2024

Company

Bank

Total shareholders' equity to assets

6.61%

7.95%

Tangible common equity to tangible assets

1

6.54%

7.87%

Tier 1 leverage ratio 2

7.13%

8.53%

Common equity tier 1 capital ratio 2

9.37%

11.22%

Tier 1 capital ratio 2

9.37%

11.22%

Total risk-based capital ratio 2

12.79%

12.34%

1 This information represents a non-GAAP

financial measure. For a discussion of non-GAAP financial measures,

see the section below entitled "Non-GAAP Financial Measures."

2 Regulatory capital ratios are

preliminary pending filing of the Company's and the Bank's

regulatory reports.

Conference Call and Webcast

The Company will host a conference call and webcast at 2:00 p.m.

Eastern Time on Thursday, October 24, 2024, to discuss its

quarterly financial results. The call can be accessed via telephone

at (888) 259-6580; access code: 59135394. A recorded replay can be

accessed through November 24, 2024, by dialing (877) 674-7070;

access code: 135394#.

Additionally, interested parties can listen to a live webcast of

the call on the Company's website at www.firstinternetbancorp.com.

An archived version of the webcast will be available in the same

location shortly after the live call has ended.

About First Internet Bancorp

First Internet Bancorp is a bank holding company with assets of

$5.8 billion as of September 30, 2024. The Company’s subsidiary,

First Internet Bank, opened for business in 1999 as an industry

pioneer in the branchless delivery of banking services. First

Internet Bank provides consumer and small business deposit, SBA

financing, franchise finance, consumer loans, and specialty finance

services nationally as well as commercial real estate loans,

construction loans, commercial and industrial loans, and treasury

management services on a regional basis. First Internet Bancorp’s

common stock trades on the Nasdaq Global Select Market under the

symbol “INBK” and is a component of the Russell 2000® Index.

Additional information about the Company is available at

www.firstinternetbancorp.com and additional information about First

Internet Bank, including its products and services, is available at

www.firstib.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including statements with respect to

the financial condition, results of operations, trends in lending

policies and loan programs, plans and prospective business

partnerships, objectives, future performance and business of the

Company. Forward-looking statements are generally identifiable by

the use of words such as “anticipate,” “believe,” “continue,”

“could,” “enhance,” “estimate,” “expanding,” “expect,” “going

forward,” “growth,” ”improve,” “increase,” “may,” “ongoing,”

“opportunities,” “pending,” “plan,” “position,” “preliminary,”

“remain,” “should,” “stable,” “thereafter,” “well-positioned,”

“will,” or other similar expressions. Forward-looking statements

are not a guarantee of future performance or results, are based on

information available at the time the statements are made and

involve known and unknown risks, uncertainties and other factors

that could cause actual results to differ materially from the

information in the forward-looking statements. Such statements are

subject to certain risks and uncertainties including: our business

and operations and the business and operations of our vendors and

customers: general economic conditions, whether national or

regional, and conditions in the lending markets in which we

participate that may have an adverse effect on the demand for our

loans and other products; our credit quality and related levels of

nonperforming assets and loan losses, and the value and salability

of the real estate that is the collateral for our loans. Other

factors that may cause such differences include: failures or

breaches of or interruptions in the communications and information

systems on which we rely to conduct our business; failure of our

plans to grow our commercial and industrial, construction, and SBA

loan portfolios; competition with national, regional and community

financial institutions; the loss of any key members of senior

management; the anticipated impacts of inflation and rising

interest rates on the general economy; risks relating to the

regulation of financial institutions; and other factors identified

in reports we file with the U.S. Securities and Exchange

Commission. All statements in this press release, including

forward-looking statements, speak only as of the date they are

made, and the Company undertakes no obligation to update any

statement in light of new information or future events.

Non-GAAP Financial Measures

This press release contains financial information determined by

methods other than in accordance with U.S. generally accepted

accounting principles (“GAAP”). Non-GAAP financial measures,

specifically tangible common equity, tangible assets, tangible book

value per common share, tangible common equity to tangible assets,

average tangible common equity, return on average tangible common

equity, total interest income – FTE, net interest income – FTE, net

interest margin – FTE, adjusted total revenue, adjusted noninterest

income, adjusted noninterest expense, adjusted income before income

taxes, adjusted income tax provision (benefit), adjusted net

income, adjusted diluted earnings per share, adjusted return on

average assets, adjusted return on average shareholders’ equity and

adjusted return on average tangible common equity are used by the

Company’s management to measure the strength of its capital and

analyze profitability, including its ability to generate earnings

on tangible capital invested by its shareholders. Although

management believes these non-GAAP measures are useful to investors

by providing a greater understanding of its business, they should

not be considered a substitute for financial measures determined in

accordance with GAAP, nor are they necessarily comparable to

non-GAAP performance measures that may be presented by other

companies. Reconciliations of these non-GAAP financial measures to

the most directly comparable GAAP financial measures are included

in the table at the end of this release under the caption

“Reconciliation of Non-GAAP Financial Measures.”

First Internet Bancorp Summary Financial

Information (unaudited) Dollar amounts in thousands, except per

share data

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

September 30,

September 30,

2024

2024

2023

2024

2023

Net income

$

6,990

$

5,775

$

3,409

$

17,946

$

4,274

Per share and share information Earnings per share -

basic

$

0.80

$

0.67

$

0.39

$

2.07

$

0.48

Earnings per share - diluted

0.80

0.67

0.39

2.05

0.48

Dividends declared per share

0.06

0.06

0.06

0.18

0.18

Book value per common share

44.43

42.91

40.11

44.43

40.11

Tangible book value per common share 1

43.89

42.37

39.57

43.89

39.57

Common shares outstanding

8,667,894

8,667,894

8,669,673

8,667,894

8,669,673

Average common shares outstanding: Basic

8,696,634

8,594,315

8,744,385

8,688,304

8,889,532

Diluted

8,768,731

8,656,215

8,767,217

8,756,544

8,907,748

Performance ratios Return on average assets

0.50

%

0.44

%

0.26

%

0.45

%

0.12

%

Return on average shareholders' equity

7.32

%

6.28

%

3.79

%

6.42

%

1.59

%

Return on average tangible common equity 1

7.41

%

6.36

%

3.84

%

6.51

%

1.61

%

Net interest margin

1.62

%

1.67

%

1.39

%

1.65

%

1.55

%

Net interest margin - FTE 1,2

1.70

%

1.76

%

1.49

%

1.74

%

1.66

%

Capital ratios 3 Total shareholders' equity to assets

6.61

%

6.96

%

6.73

%

6.61

%

6.73

%

Tangible common equity to tangible assets 1

6.54

%

6.88

%

6.64

%

6.54

%

6.64

%

Tier 1 leverage ratio

7.13

%

7.24

%

7.32

%

7.13

%

7.32

%

Common equity tier 1 capital ratio

9.37

%

9.47

%

9.56

%

9.37

%

9.56

%

Tier 1 capital ratio

9.37

%

9.47

%

9.56

%

9.37

%

9.56

%

Total risk-based capital ratio

12.79

%

13.13

%

13.13

%

12.79

%

13.13

%

Asset quality Nonperforming loans

$

22,478

$

12,978

$

5,885

$

22,478

$

5,885

Nonperforming assets

22,944

13,055

6,069

22,944

6,069

Nonperforming loans to loans

0.56

%

0.33

%

0.16

%

0.56

%

0.16

%

Nonperforming assets to total assets

0.39

%

0.24

%

0.12

%

0.39

%

0.12

%

Allowance for credit losses - loans to: Loans

1.13

%

1.10

%

0.98

%

1.13

%

0.98

%

Nonperforming loans

203.4

%

334.5

%

619.4

%

203.4

%

619.4

%

Net charge-offs to average loans

0.15

%

0.14

%

0.16

%

0.12

%

0.38

%

Average balance sheet information Loans

$

4,022,196

$

3,930,976

$

3,700,410

$

3,947,885

$

3,643,156

Total securities

792,409

744,537

622,220

746,985

604,026

Other earning assets

526,384

469,045

653,375

476,697

499,835

Total interest-earning assets

5,348,153

5,150,305

4,976,667

5,176,852

4,751,104

Total assets

5,523,910

5,332,776

5,137,474

5,355,491

4,905,910

Noninterest-bearing deposits

113,009

116,939

127,540

114,425

126,647

Interest-bearing deposits

4,384,078

4,172,976

3,911,696

4,182,094

3,680,746

Total deposits

4,497,087

4,289,915

4,039,236

4,296,519

3,807,393

Shareholders' equity

380,061

369,825

356,701

373,111

359,405

1 Refer to "Non-GAAP Financial Measures" section above and

"Reconciliation of Non-GAAP Financial Measures" below 2 On a

fully-taxable equivalent ("FTE") basis assuming a 21% tax rate 3

Regulatory capital ratios are preliminary pending filing of the

Company's regulatory reports

First Internet Bancorp

Condensed Consolidated Balance Sheets (unaudited) Dollar

amounts in thousands

September 30,

June 30,

September 30,

2024

2024

2023

Assets Cash and due from banks

$

6,539

$

6,162

$

3,595

Interest-bearing deposits

705,940

390,624

517,610

Securities available-for-sale, at fair value

575,257

488,572

450,827

Securities held-to-maturity, at amortized cost, net of allowance

for credit losses

263,320

270,349

231,928

Loans held-for-sale

32,996

19,384

31,669

Loans

4,035,880

3,961,146

3,735,068

Allowance for credit losses - loans

(45,721

)

(43,405

)

(36,452

)

Net loans

3,990,159

3,917,741

3,698,616

Accrued interest receivable

27,750

28,118

23,761

Federal Home Loan Bank of Indianapolis stock

28,350

28,350

28,350

Cash surrender value of bank-owned life insurance

41,111

40,834

40,619

Premises and equipment, net

72,150

72,516

74,197

Goodwill

4,687

4,687

4,687

Servicing asset

14,662

13,009

9,579

Other real estate owned

251

-

106

Accrued income and other assets

60,087

62,956

53,479

Total assets

$

5,823,259

$

5,343,302

$

5,169,023

Liabilities Noninterest-bearing deposits

$

111,591

$

126,438

$

125,265

Interest-bearing deposits

4,686,119

4,147,484

3,958,280

Total deposits

4,797,710

4,273,922

4,083,545

Advances from Federal Home Loan Bank

515,000

575,000

614,933

Subordinated debt

105,071

104,993

104,761

Accrued interest payable

2,808

3,419

2,968

Accrued expenses and other liabilities

17,541

14,015

15,072

Total liabilities

5,438,130

4,971,349

4,821,279

Shareholders' equity Voting common stock

185,631

185,175

185,085

Retained earnings

223,824

217,365

203,856

Accumulated other comprehensive loss

(24,326

)

(30,587

)

(41,197

)

Total shareholders' equity

385,129

371,953

347,744

Total liabilities and shareholders' equity

$

5,823,259

$

5,343,302

$

5,169,023

First Internet Bancorp Condensed Consolidated

Statements of Income (unaudited) Dollar amounts in thousands,

except per share data

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

September 30,

September 30,

2024

2024

2023

2024

2023

Interest income Loans

$

59,792

$

57,094

$

48,898

$

172,321

$

139,647

Securities - taxable

6,953

6,476

4,301

19,123

11,742

Securities - non-taxable

1,042

970

912

2,981

2,570

Other earning assets

7,203

6,421

8,904

19,691

19,211

Total interest income

74,990

70,961

63,015

214,116

173,170

Interest expense Deposits

47,415

44,495

40,339

134,039

102,285

Other borrowed funds

5,810

5,139

5,298

16,251

15,788

Total interest expense

53,225

49,634

45,637

150,290

118,073

Net interest income

21,765

21,327

17,378

63,826

55,097

Provision for credit losses

3,390

4,031

1,946

9,869

13,059

Net interest income after provision for credit losses

18,375

17,296

15,432

53,957

42,038

Noninterest income Service charges and fees

245

246

208

711

635

Loan servicing revenue

1,570

1,470

1,064

4,363

2,699

Loan servicing asset revaluation

(846

)

(829

)

(257

)

(2,109

)

(670

)

Mortgage banking activities

-

-

-

-

76

Gain on sale of loans

9,933

8,292

5,569

24,761

14,498

Other

1,127

1,854

823

3,683

1,486

Total noninterest income

12,029

11,033

7,407

31,409

18,724

Noninterest expense Salaries and employee benefits

13,456

12,462

11,767

37,714

34,267

Marketing, advertising and promotion

548

609

500

1,893

2,049

Consulting and professional fees

902

1,022

552

2,777

2,189

Data processing

675

606

701

1,845

1,880

Loan expenses

1,524

1,597

1,336

4,566

4,385

Premises and equipment

2,918

3,154

2,315

8,898

7,753

Deposit insurance premium

1,219

1,172

1,067

3,536

2,546

Other

1,552

1,714

1,518

4,924

4,311

Total noninterest expense

22,794

22,336

19,756

66,153

59,380

Income before income taxes

7,610

5,993

3,083

19,213

1,382

Income tax provision (benefit)

620

218

(326

)

1,267

(2,892

)

Net income

$

6,990

$

5,775

$

3,409

$

17,946

$

4,274

Per common share data Earnings per share - basic

$

0.80

$

0.67

$

0.39

$

2.07

$

0.48

Earnings per share - diluted

$

0.80

$

0.67

$

0.39

$

2.05

$

0.48

Dividends declared per share

$

0.06

$

0.06

$

0.06

$

0.18

$

0.18

All periods presented have been reclassified to conform to

the current period classification

First Internet Bancorp

Average Balances and Rates (unaudited) Dollar amounts in

thousands

Three Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

Average

Interest /

Yield /

Average

Interest /

Yield /

Average

Interest /

Yield /

Balance

Dividends

Cost

Balance

Dividends

Cost

Balance

Dividends

Cost

Assets Interest-earning assets Loans, including loans

held-for-sale 1

$

4,029,360

$

59,792

5.90

%

$

3,936,723

$

57,094

5.83

%

$

3,701,072

$

48,898

5.24

%

Securities - taxable

713,992

6,953

3.87

%

670,502

6,476

3.88

%

550,208

4,301

3.10

%

Securities - non-taxable

78,417

1,042

5.29

%

74,035

970

5.27

%

72,012

912

5.02

%

Other earning assets

526,384

7,203

5.44

%

469,045

6,421

5.51

%

653,375

8,904

5.41

%

Total interest-earning assets

5,348,153

74,990

5.58

%

5,150,305

70,961

5.54

%

4,976,667

63,015

5.02

%

Allowance for credit losses - loans

(44,572

)

(41,362

)

(35,601

)

Noninterest-earning assets

220,329

223,833

196,408

Total assets

$

5,523,910

$

5,332,776

$

5,137,474

Liabilities Interest-bearing liabilities

Interest-bearing demand deposits

$

511,446

$

2,880

2.24

%

$

474,124

$

2,567

2.18

%

$

387,517

$

2,131

2.18

%

Savings accounts

22,774

48

0.84

%

22,987

48

0.84

%

26,221

56

0.85

%

Money market accounts

1,224,680

12,980

4.22

%

1,243,011

13,075

4.23

%

1,230,746

12,537

4.04

%

Fintech - brokered deposits

153,012

1,682

4.37

%

119,662

1,299

4.37

%

31,891

348

4.33

%

Certificates and brokered deposits

2,472,166

29,825

4.80

%

2,313,192

27,506

4.78

%

2,235,321

25,267

4.48

%

Total interest-bearing deposits

4,384,078

47,415

4.30

%

4,172,976

44,495

4.29

%

3,911,696

40,339

4.09

%

Other borrowed funds

620,032

5,810

3.73

%

652,176

5,139

3.17

%

719,655

5,298

2.92

%

Total interest-bearing liabilities

5,004,110

53,225

4.23

%

4,825,152

49,634

4.14

%

4,631,351

45,637

3.91

%

Noninterest-bearing deposits

113,009

116,939

127,540

Other noninterest-bearing liabilities

26,730

20,860

21,882

Total liabilities

5,143,849

4,962,951

4,780,773

Shareholders' equity

380,061

369,825

356,701

Total liabilities and shareholders' equity

$

5,523,910

$

5,332,776

$

5,137,474

Net interest income

$

21,765

$

21,327

$

17,378

Interest rate spread

1.35

%

1.40

%

1.11

%

Net interest margin

1.62

%

1.67

%

1.39

%

Net interest margin - FTE 2,3

1.70

%

1.76

%

1.49

%

1 Includes nonaccrual loans 2 On a fully-taxable equivalent

("FTE") basis assuming a 21% tax rate 3 Refer to "Non-GAAP

Financial Measures" section above and "Reconciliation of Non-GAAP

Financial Measures" below

First Internet Bancorp Average

Balances and Rates (unaudited) Dollar amounts in thousands

Nine Months Ended

September 30, 2024

September 30, 2023

Average

Interest /

Yield /

Average

Interest /

Yield /

Balance

Dividends

Cost

Balance

Dividends

Cost

Assets Interest-earning assets Loans, including loans

held-for-sale 1

$

3,953,170

$

172,321

5.82

%

$

3,647,243

$

139,647

5.12

%

Securities - taxable

670,728

19,123

3.81

%

531,197

11,742

2.96

%

Securities - non-taxable

76,257

2,981

5.22

%

72,829

2,570

4.72

%

Other earning assets

476,697

19,691

5.52

%

499,835

19,211

5.14

%

Total interest-earning assets

5,176,852

214,116

5.52

%

4,751,104

173,170

4.87

%

-

Allowance for credit losses - loans

(41,526

)

(35,784

)

Noninterest-earning assets

220,165

190,590

Total assets

$

5,355,491

$

4,905,910

Liabilities Interest-bearing liabilities

Interest-bearing demand deposits

$

467,054

$

7,538

2.16

%

$

360,573

$

4,540

1.68

%

Savings accounts

22,760

144

0.85

%

31,494

202

0.86

%

Money market accounts

1,228,538

38,727

4.21

%

1,293,728

37,151

3.84

%

Fintech - brokered deposits

119,470

3,912

4.37

%

23,246

716

4.12

%

Certificates and brokered deposits

2,344,272

83,718

4.77

%

1,971,705

59,676

4.05

%

Total interest-bearing deposits

4,182,094

134,039

4.28

%

3,680,746

102,285

3.72

%

Other borrowed funds

662,824

16,251

3.28

%

719,577

15,788

2.93

%

Total interest-bearing liabilities

4,844,918

150,290

4.14

%

4,400,323

118,073

3.59

%

Noninterest-bearing deposits

114,425

126,647

Other noninterest-bearing liabilities

23,037

19,535

Total liabilities

4,982,380

4,546,505

Shareholders' equity

373,111

359,405

Total liabilities and shareholders' equity

$

5,355,491

$

4,905,910

Net interest income

$

63,826

$

55,097

Interest rate spread

1.38

%

1.28

%

Net interest margin

1.65

%

1.55

%

Net interest margin - FTE 2,3

1.74

%

1.66

%

1 Includes nonaccrual loans 2 On a fully-taxable equivalent

("FTE") basis assuming a 21% tax rate 3 Refer to "Non-GAAP

Financial Measures" section above and "Reconciliation of Non-GAAP

Financial Measures" below

First Internet Bancorp

Loans and Deposits (unaudited) Dollar amounts in thousands

September 30, 2024 June 30, 2024

September 30, 2023 Amount Percent

Amount Percent Amount Percent

Commercial loans Commercial and industrial

$

111,199

2.8

%

$

115,585

2.9

%

$

114,265

3.1

%

Owner-occupied commercial real estate

56,461

1.4

%

58,089

1.5

%

58,486

1.6

%

Investor commercial real estate

260,614

6.5

%

188,409

4.8

%

129,831

3.5

%

Construction

340,954

8.4

%

328,922

8.3

%

252,105

6.7

%

Single tenant lease financing

932,148

23.1

%

927,462

23.4

%

933,873

25.0

%

Public finance

462,730

11.5

%

486,200

12.3

%

535,960

14.3

%

Healthcare finance

190,287

4.7

%

202,079

5.1

%

235,622

6.3

%

Small business lending

298,645

7.4

%

270,129

6.8

%

192,996

5.2

%

Franchise finance

550,442

13.6

%

551,133

13.9

%

455,094

12.2

%

Total commercial loans

3,203,480

79.4

%

3,128,008

79.0

%

2,908,232

77.9

%

Consumer loans Residential mortgage

378,701

9.4

%

382,549

9.7

%

393,501

10.5

%

Home equity

20,264

0.5

%

21,405

0.5

%

23,544

0.6

%

Trailers

205,230

5.1

%

197,738

5.0

%

186,424

5.0

%

Recreational vehicles

150,378

3.7

%

150,151

3.8

%

140,205

3.8

%

Other consumer loans

48,780

1.2

%

48,638

1.2

%

42,822

1.1

%

Total consumer loans

803,353

19.9

%

800,481

20.2

%

786,496

21.0

%

Net deferred loan fees, premiums, discounts and other 1

29,047

0.7

%

32,657

0.8

%

40,340

1.1

%

Total loans

$

4,035,880

100.0

%

$

3,961,146

100.0

%

$

3,735,068

100.0

%

September 30, 2024 June 30, 2024

September 30, 2023 Amount Percent

Amount Percent Amount Percent

Deposits Noninterest-bearing deposits

$

111,591

2.3

%

$

126,438

3.0

%

$

125,265

3.1

%

Interest-bearing demand deposits

538,484

11.2

%

480,141

11.2

%

374,915

9.2

%

Savings accounts

21,712

0.5

%

22,619

0.5

%

23,811

0.6

%

Money market accounts

1,230,707

25.7

%

1,222,197

28.6

%

1,222,511

29.9

%

Fintech - brokered deposits

211,814

4.4

%

140,180

3.3

%

41,884

1.0

%

Certificates of deposits

2,110,618

44.0

%

1,829,644

42.8

%

1,624,447

39.8

%

Brokered deposits

572,784

11.9

%

452,703

10.6

%

670,712

16.4

%

Total deposits

$

4,797,710

100.0

%

$

4,273,922

100.0

%

$

4,083,545

100.0

%

1 Includes carrying value adjustments of $24.1 million,

$25.6 million and $29.0 million related to terminated interest rate

swaps associated with public finance loans as of September 30,

2024, June 30, 2024 and September 30, 2023, respectively.

First

Internet Bancorp Reconciliation of Non-GAAP Financial

Measures Dollar amounts in thousands, except per share data

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

September 30,

September 30,

2024

2024

2023

2024

2023

Total equity - GAAP

$

385,129

$

371,953

$

347,744

$

385,129

$

347,744

Adjustments: Goodwill

(4,687

)

(4,687

)

(4,687

)

(4,687

)

(4,687

)

Tangible common equity

$

380,442

$

367,266

$

343,057

$

380,442

$

343,057

Total assets - GAAP

$

5,823,259

$

5,343,302

$

5,169,023

$

5,823,259

$

5,169,023

Adjustments: Goodwill

(4,687

)

(4,687

)

(4,687

)

(4,687

)

(4,687

)

Tangible assets

$

5,818,572

$

5,338,615

$

5,164,336

$

5,818,572

$

5,164,336

Common shares outstanding

8,667,894

8,667,894

8,669,673

8,667,894

8,669,673

Book value per common share

$

44.43

$

42.91

$

40.11

$

44.43

$

40.11

Effect of goodwill

(0.54

)

(0.54

)

(0.54

)

(0.54

)

(0.54

)

Tangible book value per common share

$

43.89

$

42.37

$

39.57

$

43.89

$

39.57

Total shareholders' equity to assets

6.61

%

6.96

%

6.73

%

6.61

%

6.73

%

Effect of goodwill

(0.07

%)

(0.08

%)

(0.09

%)

(0.07

%)

(0.09

%)

Tangible common equity to tangible assets

6.54

%

6.88

%

6.64

%

6.54

%

6.64

%

Total average equity - GAAP

$

380,061

$

369,825

$

356,701

$

373,111

$

359,405

Adjustments: Average goodwill

(4,687

)

(4,687

)

(4,687

)

(4,687

)

(4,687

)

Average tangible common equity

$

375,374

$

365,138

$

352,014

$

368,424

$

354,718

Return on average shareholders' equity

7.32

%

6.28

%

3.79

%

6.42

%

1.59

%

Effect of goodwill

0.09

%

0.08

%

0.05

%

0.09

%

0.02

%

Return on average tangible common equity

7.41

%

6.36

%

3.84

%

6.51

%

1.61

%

Total interest income

$

74,990

$

70,961

$

63,015

$

214,116

$

173,170

Adjustments: Fully-taxable equivalent adjustments 1

1,133

1,175

1,265

3,498

3,995

Total interest income - FTE

$

76,123

$

72,136

$

64,280

$

217,614

$

177,165

Net interest income

$

21,765

$

21,327

$

17,378

$

63,826

$

55,097

Adjustments: Fully-taxable equivalent adjustments 1

1,133

1,175

1,265

3,498

3,995

Net interest income - FTE

$

22,898

$

22,502

$

18,643

$

67,324

$

59,092

Net interest margin

1.62

%

1.67

%

1.39

%

1.65

%

1.55

%

Effect of fully-taxable equivalent adjustments 1

0.08

%

0.09

%

0.10

%

0.09

%

0.11

%

Net interest margin - FTE

1.70

%

1.76

%

1.49

%

1.74

%

1.66

%

1 Assuming a 21% tax rate

First Internet

Bancorp Reconciliation of Non-GAAP Financial Measures

Dollar amounts in thousands, except per share data

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

September 30,

September 30,

2024

2024

2023

2024

2023

Total revenue - GAAP

$

33,794

$

32,360

$

24,785

$

95,235

$

73,821

Adjustments: Mortgage-related revenue

-

-

-

-

(65

)

Adjusted total revenue

$

33,794

$

32,360

$

24,785

$

95,235

$

73,756

Noninterest income - GAAP

$

12,029

$

11,033

$

7,407

$

31,409

$

18,724

Adjustments: Mortgage-related revenue

-

-

-

-

(65

)

Adjusted noninterest income

$

12,029

$

11,033

$

7,407

$

31,409

$

18,659

Noninterest expense - GAAP

$

22,794

$

22,336

$

19,756

$

66,153

$

59,380

Adjustments: Mortgage-related costs

-

-

-

-

(3,052

)

IT termination fees

-

(452

)

-

(452

)

-

Anniversary expenses

-

(120

)

-

(120

)

-

Adjusted noninterest expense

$

22,794

$

21,764

$

19,756

$

65,581

$

56,328

Income before income taxes - GAAP

$

7,610

$

5,993

$

3,083

$

19,213

$

1,382

Adjustments:1 Mortgage-related revenue

-

-

-

-

(65

)

Mortgage-related costs

-

-

-

-

3,052

Partial charge-off of C&I participation loan

-

-

-

-

6,914

IT termination fees

-

452

-

452

-

Anniversary expenses

-

120

-

120

-

Adjusted income before income taxes

$

7,610

$

6,565

$

3,083

$

19,785

$

11,283

Income tax provision (benefit) - GAAP

$

620

$

218

$

(326

)

$

1,267

$

(2,892

)

Adjustments:1 Mortgage-related revenue

-

-

-

-

(14

)

Mortgage-related costs

-

-

-

-

641

Partial charge-off of C&I participation loan

-

-

-

-

1,452

IT termination fees

-

95

-

95

-

Anniversary expenses

-

25

-

25

-

Adjusted income tax provision (benefit)

$

620

$

338

$

(326

)

$

1,387

$

(813

)

Net income - GAAP

$

6,990

$

5,775

$

3,409

$

17,946

$

4,274

Adjustments: Mortgage-related revenue

-

-

-

-

(51

)

Mortgage-related costs

-

-

-

-

2,411

Partial charge-off of C&I participation loan

-

-

-

-

5,462

IT termination fees

-

357

-

357

-

Anniversary expenses

-

95

-

95

-

Adjusted net income

$

6,990

$

6,227

$

3,409

$

18,398

$

12,096

1 Assuming a 21% tax rate

First Internet

Bancorp Reconciliation of Non-GAAP Financial Measures

Dollar amounts in thousands, except per share data

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

September 30,

September 30,

2024

2024

2023

2024

2023

Diluted average common shares outstanding

8,768,731

8,656,215

8,767,217

8,756,544

8,907,748

Diluted earnings per share - GAAP

$

0.80

$

0.67

$

0.39

$

2.05

$

0.48

Adjustments: Effect of mortgage-related revenue

-

-

-

-

(0.01

)

Effect of mortgage-related costs

-

-

-

-

0.27

Effect of partial charge-off of C&I participation loan

-

-

-

-

0.61

Effect of IT termination fees

-

0.04

-

0.04

-

Effect of anniversary expenses

-

0.01

-

0.01

-

Adjusted diluted earnings per share

$

0.80

$

0.72

$

0.39

$

2.10

$

1.35

Return on average assets

0.50

%

0.44

%

0.26

%

0.45

%

0.12

%

Effect of mortgage-related revenue

0.00

%

0.00

%

0.00

%

0.00

%

0.00

%

Effect of mortgage-related costs

0.00

%

0.00

%

0.00

%

0.00

%

0.07

%

Effect of partial charge-off of C&I participation loan

0.00

%

0.00

%

0.00

%

0.00

%

0.15

%

Effect of IT termination fees

0.00

%

0.03

%

0.00

%

0.01

%

0.00

%

Effect of anniversary expenses

0.00

%

0.01

%

0.00

%

0.00

%

0.00

%

Adjusted return on average assets

0.50

%

0.48

%

0.26

%

0.46

%

0.34

%

Return on average shareholders' equity

7.32

%

6.28

%

3.79

%

6.42

%

1.59

%

Effect of mortgage-related revenue

0.00

%

0.00

%

0.00

%

0.00

%

(0.02

%)

Effect of mortgage-related costs

0.00

%

0.00

%

0.00

%

0.00

%

0.90

%

Effect of partial charge-off of C&I participation loan

0.00

%

0.00

%

0.00

%

0.00

%

2.03

%

Effect of IT termination fees

0.00

%

0.39

%

0.00

%

0.13

%

0.00

%

Effect of anniversary expenses

0.00

%

0.10

%

0.00

%

0.03

%

0.00

%

Adjusted return on average shareholders' equity

7.32

%

6.77

%

3.79

%

6.58

%

4.50

%

Return on average tangible common equity

7.41

%

6.36

%

3.84

%

6.51

%

1.61

%

Effect of mortgage-related revenue

0.00

%

0.00

%

0.00

%

0.00

%

(0.02

%)

Effect of mortgage-related costs

0.00

%

0.00

%

0.00

%

0.00

%

0.91

%

Effect of partial charge-off of C&I participation loan

0.00

%

0.00

%

0.00

%

0.00

%

2.06

%

Effect of IT termination fees

0.00

%

0.39

%

0.00

%

0.13

%

0.00

%

Effect of anniversary expenses

0.00

%

0.10

%

0.00

%

0.03

%

0.00

%

Adjusted return on average tangible common equity

7.41

%

6.85

%

3.84

%

6.67

%

4.56

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022889835/en/

Investors/Analysts Paula Deemer

Director of Corporate Administration (317) 428-4628

investors@firstib.com

Media PANBlast Zach Weismiller

firstib@panblastpr.com

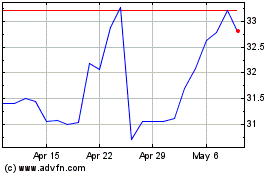

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Nov 2024 to Dec 2024

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Dec 2023 to Dec 2024