First Internet Bancorp (the “Company”) (Nasdaq: INBK), the

parent company of First Internet Bank (the “Bank”), announced today

financial and operational results for the first quarter ended March

31, 2024.

First Quarter 2024 Financial

Highlights

- Net income of $5.2 million and diluted earnings per share of

$0.59, increases of 25.1% and 22.9%, respectively, from the fourth

quarter of 2023

- Net interest income of $20.7 million and fully-taxable

equivalent net interest income of $21.9 million, increases of 4.7%

and 4.2%, respectively, from the fourth quarter of 2023

- Net interest margin of 1.66% and fully-taxable equivalent

net interest margin of 1.75%, increases of 8 basis points and 7

basis points, respectively, from the fourth quarter of

2023

- Loan growth of $69.6 million, a 1.8% increase from the

fourth quarter of 2023

- Deposit growth of $206.8 million, a 5.1% increase from the

fourth quarter of 2023

- Loans to deposits ratio decreased to 91.5% from 94.4% in the

fourth quarter of 2023

- Nonperforming loans to total loans of 0.33%; net charge-offs

to average loans of 0.05%; office real estate exposure remains less

than 1% of total loans

- Tangible common equity to tangible assets of 6.79%;

excluding AOCI and adjusting for normalized cash balances, adjusted

TCE / TA was 7.61%; CET1 ratio of 9.52%

- Repurchased 10,500 shares at an avg. price of $26.94;

repurchased 513,025 shares at an avg. price of $18.58 since the

beginning of 2023, reducing share count by 5.7%

- Tangible book value per share of $41.83, a 1.0% increase

from the fourth quarter of 2023

“On our third quarter 2023 earnings conference call, we

indicated that net interest margin and net interest income had

likely bottomed and would soon trend higher,” said David Becker,

Chairman and Chief Executive Officer. “Since then, while the rate

environment has remained quite volatile, our net interest margin

and net interest income have improved by 27 basis points and 19%,

respectively, over the past two quarters, driving higher earnings

and improved profitability.

“At the same time, we’ve improved the risk profile of our

balance sheet by optimizing our loan portfolio, and further

diversifying our revenue and earnings streams. Our balance sheet

liquidity position has strengthened, our capital position remains

sturdy, and asset quality has been maintained. This strong

foundation has also positioned us to remain on offense, as we

continue to drive positive momentum in our SBA business, with

strong production and another record level of gain on sale income

during the first quarter. Amidst continued macroeconomic

uncertainty, these developments leave us confident in our ability

to drive further improvement in earnings and profitability over the

remainder of the year.”

Net Interest Income and Net Interest Margin

Net interest income for the first quarter of 2024 was $20.7

million, compared to $19.8 million for the fourth quarter of 2023,

and $19.6 million for the first quarter of 2023. On a fully-taxable

equivalent basis, net interest income for the first quarter of 2024

was $21.9 million, compared to $21.0 million for both the fourth

and first quarters of 2023.

Total interest income for the first quarter of 2024 was $68.2

million, an increase of 2.9% compared to the fourth quarter of

2023, and an increase of 31.0% compared to the first quarter of

2023. On a fully-taxable equivalent basis, total interest income

for the first quarter of 2024 was $69.4 million, an increase of

2.7% compared to the fourth quarter of 2023, and an increase of

29.8% compared to the first quarter of 2023. The yield on average

interest-earning assets for the first quarter of 2024 increased to

5.45% from 5.28% for the fourth quarter of 2023, due to a 23 basis

point (“bp”) increase in the yield earned on loans and a 9 bp

increase in the yield earned on securities, partially offset by a 6

bp decrease in the yield earned on other earning assets. Compared

to the linked quarter, average loan balances increased $92.7

million, or 2.4%, and the average balance of securities increased

$20.0 million, or 2.9%, while the average balance of other earning

assets decreased $66.6 million, or 13.3%.

Interest income earned on commercial loans was higher due to

increased average balances and the positive impact of higher rates

in the variable rate construction and small business lending

portfolios, as well as growth in the higher-yielding franchise

finance portfolio. This was partially offset by lower average

balances in the public finance and healthcare finance portfolios.

The continued shift in the loan mix reflects our focus on variable

rate and higher-yielding products, in part, to help improve the

interest rate risk profile of our balance sheet.

In the consumer loan portfolio, interest income was up modestly

due to the combination of slightly higher average balances and

continued higher new origination yields in the trailers, RV and

other consumer loan portfolios.

The yield on funded portfolio loan originations was 8.84% in the

first quarter of 2024, relatively stable with the fourth quarter of

2023, and an increase of 108 bps compared to the first quarter of

2023.

Interest income earned on securities during the first quarter of

2024 increased $0.3 million, or 4.0%, compared to the fourth

quarter of 2023 as the yield on the portfolio increased 9 bps to

3.81%, driven primarily by higher yields on new purchases and

continued slower prepayment speeds on mortgage-backed securities.

Additionally, the average balance of securities increased $20.0

million, or 2.9%, during the first quarter of 2024. Interest earned

on other earning asset balances decreased $1.1 million, or 15.4%,

in the first quarter of 2024 compared to the linked quarter, due

primarily to lower average cash balances and slightly lower

yields.

Total interest expense for the first quarter of 2024 was $47.4

million, an increase of $1.0 million, or 2.1%, compared to the

linked quarter as short-term rates remained stable throughout the

quarter while average interest-bearing deposit balances increased

$51.5 million, or 1.3%. Interest expense related to

interest-bearing deposits increased $1.1 million, or 2.6%, driven

primarily by higher costs on certificates of deposits (“CDs”),

interest-bearing demand deposits and BaaS – brokered deposits. The

cost of interest-bearing deposits was 4.25% for the first quarter

of 2024, compared to 4.14% for the fourth quarter of 2023.

Average CD balances increased $22.6 million, or 1.4%, compared

to the linked quarter, driven by strong consumer demand, while the

cost of funds increased 15 bps. The increase in the cost of CDs is

the lowest in the past seven quarters, reflecting the narrowing gap

between rates on new production and maturities. The average balance

of interest-bearing demand deposits increased $32.7 million, or

8.5%, due to growth in fintech partnership deposits, while the cost

of funds increased 32 bps. The average balance of BaaS – brokered

deposits increased $23.3 million, or 37.5%, due to higher payments

volumes, while the cost of funds increased 1 bp.

These increases were partially offset by lower average brokered

deposit balances, which decreased $19.4 million, or 3.1%, as excess

liquidity was used to redeem $17.9 million of callable brokered

CDs.

Net interest margin (“NIM”) was 1.66% for the first quarter of

2024, up from 1.58% for the fourth quarter of 2023 and down from

1.76% for the first quarter of 2023. Fully-taxable equivalent NIM

(“FTE NIM”) was 1.75% for the first quarter of 2024, up from 1.68%

for the fourth quarter of 2023 and down from 1.89% for the first

quarter of 2023. The increases in NIM and FTE NIM compared to the

linked quarter were driven primarily by higher yields on loans and

securities, as well as higher average loan and securities balances,

partially offset by higher interest-bearing deposit costs and lower

average cash balances.

Noninterest Income

Noninterest income for the first quarter of 2024 was $8.3

million, compared to $7.4 million for the fourth quarter of 2023,

and $5.4 million for the first quarter of 2023. Gain on sale of

loans totaled $6.5 million in the first quarter of 2024, increasing

$0.5 million, or 8.4%, compared to the linked quarter. Gain on sale

revenue consisted almost entirely of sales of U.S. Small Business

Administration (“SBA”) 7(a) guaranteed loans during the first

quarter of 2024. Loan sale volume was down seasonally, decreasing

11.5% compared to the linked quarter, but was more than offset by a

158 bp increase in net premiums. Net loan servicing revenue

increased $0.5 million during the quarter due to growth in the

servicing portfolio and the change in the fair value adjustment to

the loan servicing asset.

Noninterest Expense

Noninterest expense totaled $21.0 million for the first quarter

of 2024, compared to $20.1 million for the fourth quarter of 2023,

and $21.0 million for the first quarter of 2023, representing

increases of 4.8% and 0.3%, respectively. The increase of $1.0

million compared to the linked quarter was due primarily to higher

salaries and employee benefits and marketing expenses.

The increase in salaries and employee benefits was due primarily

to annual resets on certain employee benefits, payroll taxes and

incentive compensation accruals, as well as annual merit increases

and new hires, partially offset by lower small business incentive

compensation and lower medical claims. The increase in marketing

expenses was due mainly to higher advertising, media and

sponsorship costs.

Income Taxes

The Company recorded income tax expense of $0.4 million and an

effective tax rate of 7.6% for the first quarter of 2024, compared

to income tax benefits of $0.6 million and $2.3 million for the

fourth and first quarters of 2023, respectively.

Loans and Credit Quality

Total loans as of March 31, 2024 were $3.9 billion, an increase

of $69.6 million, or 1.8%, compared to December 31, 2023, and an

increase of $302.6 million, or 8.4%, compared to March 31, 2023.

Total commercial loan balances were $3.1 billion as of March 31,

2024, an increase of $75.2 million, or 2.5%, compared to December

31, 2023, and an increase of $275.4 million, or 9.8%, compared to

March 31, 2023. Compared to the linked quarter, the increase in

commercial loan balances was driven primarily by growth in higher

yielding construction, small business lending and franchise finance

balances. These items were partially offset by decreases in the

fixed-rate public finance and healthcare finance portfolios.

Total consumer loan balances were $793.4 million as of March 31,

2024, a decrease of $3.5 million, or 0.4%, compared to December 31,

2023, and an increase of $37.1 million, or 4.9%, compared to March

31, 2023. The slight decline compared to the linked quarter was due

primarily to a decrease in the residential mortgage portfolio,

partially offset by an increase in the trailers portfolio.

Total delinquencies 30 days or more past due were 0.53% of total

loans as of March 31, 2024, compared to 0.31% at December 31, 2023,

and 0.13% as of March 31, 2023. The increase during the first

quarter of 2024 was due primarily to an increase in delinquencies

in the small business lending and franchise finance portfolios,

some of which was due to the timing of principal and interest

payments. Subsequent to quarter end, payments were received from a

number of borrowers and as of the date of this release,

delinquencies 30 days or more past due declined to 0.32% of total

loans, relatively consistent with the linked quarter.

Nonperforming loans were 0.33% of total loans as of March 31,

2024, compared to 0.26% as of both December 31, 2023 and March 31,

2023. Nonperforming loans totaled $13.1 million at March 31, 2024,

up from $10.0 million at December 31, 2023. The increase in

nonperforming loans was due primarily to an increase in

nonperforming small business lending loans and, to a lesser extent,

an increase in nonperforming residential mortgage loans.

The allowance for credit losses (“ACL”) as a percentage of total

loans was 1.05% as of March 31, 2024, compared to 1.01% as of

December 31, 2023, and 1.02% as of March 31, 2023. The increase in

the ACL reflects the addition of specific reserves on nonperforming

small business lending loans, as well as growth in certain loan

portfolios, partially offset by the positive impact of economic

data on forecasted loss rates and qualitative factors on other

portfolios.

Net charge-offs of $0.5 million were recognized during the first

quarter of 2024, resulting in net charge-offs to average loans of

0.05%, compared to $1.2 million, or 0.12%, for the fourth quarter

of 2023, and $7.2 million, or 0.82%, for the first quarter of 2023.

Net charge-offs in the first quarter of 2024 were driven primarily

by small business and consumer lending.

The provision for credit losses in the first quarter of 2024 was

$2.4 million, compared to $3.6 million for the fourth quarter of

2023, and $9.4 million for the first quarter of 2023. The provision

for the first quarter of 2024 was driven primarily by specific

reserves, growth in certain loan portfolios and net charge-offs,

partially offset by the positive impact of economic forecasts on

other portfolios.

Capital

As of March 31, 2024, total shareholders’ equity was $366.7

million, an increase of $3.9 million, or 1.1%, compared to December

31, 2023, and an increase of $11.2 million, or 3.1%, compared to

March 31, 2023. The increase in shareholders’ equity during the

first quarter of 2024 compared to the linked quarter was due

primarily to the net income earned during the quarter, partially

offset by a slight increase in accumulated other comprehensive

loss. Book value per common share increased to $42.37 as of March

31, 2024, up from $41.97 as of December 31, 2023, and $39.76 as of

March 31, 2023. Tangible book value per share was $41.83 as of

March 31, 2024, up from $41.43 as of December 31, 2023, and $39.23

as of March 31, 2023.

In connection with its previously announced stock repurchase

program, the Company repurchased 10,500 shares of its common stock

during the first quarter of 2024 at an average price of $26.94 per

share. The Company has repurchased $41.7 million of stock under its

authorized programs since November of 2021.

The following table presents the Company’s and the Bank’s

regulatory and other capital ratios as of March 31, 2024.

As of March 31, 2024

Company

Bank

Total shareholders' equity to assets

6.87%

8.39%

Tangible common equity to tangible assets

1

6.79%

8.31%

Tier 1 leverage ratio 2

7.33%

8.92%

Common equity tier 1 capital ratio 2

9.52%

11.60%

Tier 1 capital ratio 2

9.52%

11.60%

Total risk-based capital ratio 2

13.18%

12.66%

1 This information represents a non-GAAP

financial measure. For a discussion of non-GAAP financial measures,

see the section below entitled "Non-GAAP Financial Measures."

2 Regulatory capital ratios are

preliminary pending filing of the Company's and the Bank's

regulatory reports.

Conference Call and Webcast

The Company will host a conference call and webcast at 2:00 p.m.

Eastern Time on Thursday, April 25, 2024 to discuss its quarterly

financial results. The call can be accessed via telephone at (888)

259-6580; access code: 28021175. A recorded replay can be accessed

through May 25, 2024 by dialing (877) 674-7070; access code:

021175.

Additionally, interested parties can listen to a live webcast of

the call on the Company's website at www.firstinternetbancorp.com.

An archived version of the webcast will be available in the same

location shortly after the live call has ended.

About First Internet Bancorp

First Internet Bancorp is a financial holding company with

assets of $5.3 billion as of March 31, 2024. The Company’s

subsidiary, First Internet Bank, opened for business in 1999 as an

industry pioneer in the branchless delivery of banking services.

First Internet Bank provides consumer and small business deposit,

SBA financing, franchise finance, consumer loans, and specialty

finance services nationally as well as commercial real estate

loans, construction loans, commercial and industrial loans, and

treasury management services on a regional basis. First Internet

Bancorp’s common stock trades on the Nasdaq Global Select Market

under the symbol “INBK”. Additional information about the Company

is available at www.firstinternetbancorp.com and additional

information about First Internet Bank, including its products and

services, is available at www.firstib.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including statements with respect to

the financial condition, results of operations, trends in lending

policies and loan programs, plans and prospective business

partnerships, objectives, future performance and business of the

Company. Forward-looking statements are generally identifiable by

the use of words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “growth,” “help,” :improve,” “may,”

“ongoing,” “opportunities,” “pending,” “plan,” “position,”

“preliminary,” “remain,” “should,” “thereafter,” “well-positioned,”

“will,” or other similar expressions. Forward-looking statements

are not a guarantee of future performance or results, are based on

information available at the time the statements are made and

involve known and unknown risks, uncertainties and other factors

that could cause actual results to differ materially from the

information in the forward-looking statements. Such statements are

subject to certain risks and uncertainties including: our business

and operations and the business and operations of our vendors and

customers: general economic conditions, whether national or

regional, and conditions in the lending markets in which we

participate that may have an adverse effect on the demand for our

loans and other products; our credit quality and related levels of

nonperforming assets and loan losses, and the value and salability

of the real estate that is the collateral for our loans. Other

factors that may cause such differences include: failures or

breaches of or interruptions in the communications and information

systems on which we rely to conduct our business; failure of our

plans to grow our commercial and industrial, construction, SBA, and

franchise finance loan portfolios; competition with national,

regional and community financial institutions; the loss of any key

members of senior management; the anticipated impacts of inflation

and rising interest rates on the general economy; risks relating to

the regulation of financial institutions; and other factors

identified in reports we file with the U.S. Securities and Exchange

Commission. All statements in this press release, including

forward-looking statements, speak only as of the date they are

made, and the Company undertakes no obligation to update any

statement in light of new information or future events.

Non-GAAP Financial Measures

This press release contains financial information determined by

methods other than in accordance with U.S. generally accepted

accounting principles (“GAAP”). Non-GAAP financial measures,

specifically tangible common equity, tangible assets, tangible book

value per common share, tangible common equity to tangible assets,

average tangible common equity, return on average tangible common

equity, total interest income – FTE, net interest income – FTE, net

interest margin – FTE, adjusted total revenue, adjusted noninterest

income, adjusted noninterest expense, adjusted income before income

taxes, adjusted income tax provision (benefit), adjusted net

income, adjusted diluted earnings per share, adjusted return on

average assets, adjusted return on average shareholders’ equity and

adjusted return on average tangible common equity are used by the

Company’s management to measure the strength of its capital and

analyze profitability, including its ability to generate earnings

on tangible capital invested by its shareholders. Although

management believes these non-GAAP measures are useful to investors

by providing a greater understanding of its business, they should

not be considered a substitute for financial measures determined in

accordance with GAAP, nor are they necessarily comparable to

non-GAAP performance measures that may be presented by other

companies. Reconciliations of these non-GAAP financial measures to

the most directly comparable GAAP financial measures are included

in the table at the end of this release under the caption

“Reconciliation of Non-GAAP Financial Measures.”

First Internet Bancorp Summary Financial Information

(unaudited) Dollar amounts in thousands, except per share data

Three Months Ended March 31, December

31, March 31,

2024

2023

2023

Net income (loss)

$

5,181

$

4,143

$

(3,017

)

Per share and share information Earnings (loss) per

share - basic

$

0.60

$

0.48

$

(0.33

)

Earnings (loss) per share - diluted

0.59

0.48

(0.33

)

Dividends declared per share

0.06

0.06

0.06

Book value per common share

42.37

41.97

39.76

Tangible book value per common share 1

41.83

41.43

39.23

Common shares outstanding

8,655,854

8,644,451

8,943,477

Average common shares outstanding: Basic

8,679,429

8,683,331

9,024,072

Diluted

8,750,297

8,720,078

9,024,072

Performance ratios Return on average assets

0.40

%

0.32

%

(0.26

%)

Return on average shareholders' equity

5.64

%

4.66

%

(3.37

%)

Return on average tangible common equity1

5.71

%

4.72

%

(3.41

%)

Net interest margin

1.66

%

1.58

%

1.76

%

Net interest margin - FTE1,2

1.75

%

1.68

%

1.89

%

Capital ratios3 Total shareholders' equity to assets

6.87

%

7.02

%

7.53

%

Tangible common equity to tangible assets1

6.79

%

6.94

%

7.44

%

Tier 1 leverage ratio

7.33

%

7.33

%

8.10

%

Common equity tier 1 capital ratio

9.52

%

9.60

%

10.30

%

Tier 1 capital ratio

9.52

%

9.60

%

10.30

%

Total risk-based capital ratio

13.18

%

13.23

%

14.13

%

Asset quality Nonperforming loans

$

13,050

$

9,962

$

9,221

Nonperforming assets

13,425

10,354

9,346

Nonperforming loans to loans

0.33

%

0.26

%

0.26

%

Nonperforming assets to total assets

0.25

%

0.20

%

0.20

%

Allowance for credit losses - loans to: Loans

1.05

%

1.01

%

1.02

%

Nonperforming loans

313.3

%

389.2

%

400.0

%

Net charge-offs to average loans

0.05

%

0.12

%

0.82

%

Average balance sheet information Loans

$

3,889,667

$

3,799,211

$

3,573,827

Total securities

703,509

$

683,468

$

585,270

Other earning assets

434,118

$

500,733

$

331,294

Total interest-earning assets

5,030,216

$

4,984,133

$

4,499,782

Total assets

5,207,936

$

5,154,285

$

4,647,156

Noninterest-bearing deposits

113,341

$

123,351

$

134,988

Interest-bearing deposits

3,987,009

$

3,935,519

$

3,411,969

Total deposits

4,100,350

$

4,058,870

$

3,546,957

Shareholders' equity

369,371

$

353,037

$

363,273

1 Refer to "Non-GAAP Financial Measures" section above and

"Reconciliation of Non-GAAP Financial Measures" below 2 On a

fully-taxable equivalent ("FTE") basis assuming a 21% tax rate 3

Regulatory capital ratios are preliminary pending filing of the

Company's regulatory reports

First Internet Bancorp

Condensed Consolidated Balance Sheets (unaudited, except for

December 31, 2023) Dollar amounts in thousands

March

31, December 31, March 31,

2024

2023

2023

Assets Cash and due from banks

$

6,638

$

8,269

$

27,741

Interest-bearing deposits

474,626

397,629

276,231

Securities available-for-sale, at fair value

482,431

474,855

395,833

Securities held-to-maturity, at amortized cost, net of allowance

for credit losses

235,738

227,153

210,761

Loans held-for-sale

22,589

22,052

18,144

Loans

3,909,804

3,840,220

3,607,242

Allowance for credit losses - loans

(40,891

)

(38,774

)

(36,879

)

Net loans

3,868,913

3,801,446

3,570,363

Accrued interest receivable

26,809

26,746

22,322

Federal Home Loan Bank of Indianapolis stock

28,350

28,350

28,350

Cash surrender value of bank-owned life insurance

41,154

40,882

40,105

Premises and equipment, net

73,231

73,463

74,248

Goodwill

4,687

4,687

4,687

Servicing asset

11,760

10,567

7,312

Other real estate owned

375

375

106

Accrued income and other assets

63,366

51,098

45,116

Total assets

$

5,340,667

$

5,167,572

$

4,721,319

Liabilities Noninterest-bearing deposits

$

130,760

$

123,464

$

140,449

Interest-bearing deposits

4,143,008

3,943,509

3,481,841

Total deposits

4,273,768

4,066,973

3,622,290

Advances from Federal Home Loan Bank

574,936

614,934

614,929

Subordinated debt

104,915

104,838

104,608

Accrued interest payable

3,382

3,848

2,592

Accrued expenses and other liabilities

16,927

14,184

21,328

Total liabilities

4,973,928

4,804,777

4,365,747

Shareholders' equity Voting common stock

184,720

184,700

189,202

Retained earnings

212,121

207,470

197,623

Accumulated other comprehensive loss

(30,102

)

(29,375

)

(31,253

)

Total shareholders' equity

366,739

362,795

355,572

Total liabilities and shareholders' equity

$

5,340,667

$

5,167,572

$

4,721,319

First Internet Bancorp Condensed Consolidated Statements

of Income (unaudited) Dollar amounts in thousands, except per

share data

Three Months Ended March 31,

December 31, March 31,

2024

2023

2023

Interest income Loans

$

55,435

$

52,690

$

43,843

Securities - taxable

5,694

5,447

3,606

Securities - non-taxable

969

962

798

Other earning assets

6,067

7,173

3,786

Total interest income

68,165

66,272

52,033

Interest expense Deposits

42,129

41,078

27,270

Other borrowed funds

5,302

5,387

5,189

Total interest expense

47,431

46,465

32,459

Net interest income

20,734

19,807

19,574

Provision for credit losses

2,448

3,594

9,415

Net interest income after provision for credit losses

18,286

16,213

10,159

Noninterest income Service charges and fees

220

216

209

Loan servicing revenue

1,323

1,134

785

Loan servicing asset revaluation

(434

)

(793

)

(55

)

Mortgage banking activities

-

-

76

Gain on sale of loans

6,536

6,028

4,061

Other

702

816

370

Total noninterest income

8,347

7,401

5,446

Noninterest expense Salaries and employee benefits

11,796

11,055

11,794

Marketing, advertising and promotion

736

518

844

Consulting and professional fees

853

893

926

Data processing

564

493

659

Loan expenses

1,445

1,371

1,977

Premises and equipment

2,826

2,846

2,777

Deposit insurance premium

1,145

1,334

543

Other

1,658

1,546

1,434

Total noninterest expense

21,023

20,056

20,954

Income (loss) before income taxes

5,610

3,558

(5,349

)

Income tax provision (benefit)

429

(585

)

(2,332

)

Net income (loss)

$

5,181

$

4,143

$

(3,017

)

Per common share data Earnings (loss) per share -

basic

$

0.60

$

0.48

$

(0.33

)

Earnings (loss) per share - diluted

$

0.59

$

0.48

$

(0.33

)

Dividends declared per share

$

0.06

$

0.06

$

0.06

All periods presented have been reclassified to conform to

the current period classification

First Internet Bancorp

Average Balances and Rates (unaudited) Dollar amounts in

thousands

Three Months Ended March 31,

2024 December 31, 2023 March 31, 2023

Average Interest/ Yield/ Average

Interest/ Yield/ Average Interest/

Yield/ Balance Dividends Cost

Balance Dividends Cost Balance

Dividends Cost Assets Interest-earning

assets Loans, including loans held-for-sale1

$

3,892,589

$

55,435

5.73

%

$

3,799,932

$

52,690

5.50

%

$

3,583,218

$

43,843

4.96

%

Securities - taxable

627,216

5,694

3.65

%

611,664

5,447

3.53

%

511,923

3,606

2.86

%

Securities - non-taxable

76,293

969

5.11

%

71,804

962

5.32

%

73,347

798

4.41

%

Other earning assets

434,118

6,067

5.62

%

500,733

7,173

5.68

%

331,294

3,786

4.63

%

Total interest-earning assets

5,030,216

68,165

5.45

%

4,984,133

66,272

5.28

%

4,499,782

52,033

4.69

%

Allowance for credit losses - loans

(38,611

)

(36,792

)

(35,075

)

Noninterest-earning assets

216,331

206,944

182,449

Total assets

$

5,207,936

$

5,154,285

$

4,647,156

Liabilities Interest-bearing liabilities

Interest-bearing demand deposits

$

415,106

$

2,091

2.03

%

$

382,427

$

1,646

1.71

%

$

333,642

$

900

1.09

%

Savings accounts

22,521

48

0.86

%

22,394

48

0.85

%

38,482

82

0.86

%

Money market accounts

1,217,966

12,671

4.18

%

1,225,781

12,739

4.12

%

1,377,600

12,300

3.62

%

BaaS - brokered deposits

85,366

931

4.39

%

62,098

685

4.38

%

14,741

138

3.80

%

Certificates and brokered deposits

2,246,050

26,388

4.73

%

2,242,819

25,960

4.59

%

1,647,504

13,850

3.41

%

Total interest-bearing deposits

3,987,009

42,129

4.25

%

3,935,519

41,078

4.14

%

3,411,969

27,270

3.24

%

Other borrowed funds

716,735

5,302

2.98

%

719,733

5,387

2.97

%

719,499

5,189

2.92

%

Total interest-bearing liabilities

4,703,744

47,431

4.06

%

4,655,252

46,465

3.96

%

4,131,468

32,459

3.19

%

Noninterest-bearing deposits

113,341

123,351

134,988

Other noninterest-bearing liabilities

21,480

22,645

17,427

Total liabilities

4,838,565

4,801,248

4,283,883

Shareholders' equity

369,371

353,037

363,273

Total liabilities and shareholders' equity

$

5,207,936

$

5,154,285

$

4,647,156

Net interest income

$

20,734

$

19,807

$

19,574

Interest rate spread

1.39

%

1.32

%

1.50

%

Net interest margin

1.66

%

1.58

%

1.76

%

Net interest margin - FTE2,3

1.75

%

1.68

%

1.89

%

1 Includes nonaccrual loans 2 On a fully-taxable equivalent

("FTE") basis assuming a 21% tax rate 3 Refer to "Non-GAAP

Financial Measures" section above and "Reconciliation of Non-GAAP

Financial Measures" below

First Internet Bancorp Loans

and Deposits (unaudited) Dollar amounts in thousands

March 31, 2024 December 31, 2023 March 31,

2023 Amount Percent Amount Percent

Amount Percent Commercial loans

Commercial and industrial

$

133,897

3.4

%

$

129,349

3.4

%

$

113,198

3.1

%

Owner-occupied commercial real estate

57,787

1.5

%

57,286

1.5

%

59,643

1.7

%

Investor commercial real estate

128,276

3.3

%

132,077

3.4

%

142,174

3.9

%

Construction

325,597

8.3

%

261,750

6.8

%

158,147

4.4

%

Single tenant lease financing

941,597

24.1

%

936,616

24.4

%

952,533

26.4

%

Public finance

498,262

12.7

%

521,764

13.6

%

604,898

16.8

%

Healthcare finance

213,332

5.5

%

222,793

5.8

%

256,670

7.1

%

Small business lending

239,263

6.1

%

218,506

5.7

%

136,382

3.8

%

Franchise finance

543,122

13.9

%

525,783

13.7

%

382,161

10.6

%

Total commercial loans

3,081,133

78.8

%

3,005,924

78.3

%

2,805,806

77.8

%

Consumer loans Residential mortgage

390,009

10.0

%

395,648

10.3

%

392,062

10.9

%

Home equity

22,753

0.6

%

23,669

0.6

%

26,160

0.7

%

Trailers

191,353

4.9

%

188,763

4.9

%

172,640

4.8

%

Recreational vehicles

145,475

3.7

%

145,558

3.8

%

128,307

3.6

%

Other consumer loans

43,847

1.1

%

43,293

1.1

%

37,186

1.0

%

Total consumer loans

793,437

20.3

%

796,931

20.7

%

756,355

21.0

%

Net deferred loan fees, premiums, discounts and other1

35,234

0.9

%

37,365

1.0

%

45,081

1.2

%

Total loans

$

3,909,804

100.0

%

$

3,840,220

100.0

%

$

3,607,242

100.0

%

March 31, 2024 December 31, 2023

March 31, 2023 Amount Percent Amount

Percent Amount Percent Deposits

Noninterest-bearing deposits

$

130,760

3.1

%

$

123,464

3.0

%

$

140,449

3.9

%

Interest-bearing demand deposits

423,529

9.9

%

402,976

9.9

%

351,641

9.7

%

Savings accounts

23,554

0.6

%

21,364

0.5

%

32,762

0.9

%

Money market accounts

1,251,230

29.2

%

1,248,319

30.8

%

1,254,013

34.6

%

BaaS - brokered deposits

107,911

2.5

%

74,401

1.8

%

25,725

0.7

%

Certificates of deposits

1,738,996

40.7

%

1,605,156

39.5

%

1,170,094

32.3

%

Brokered deposits

597,788

14.0

%

591,293

14.5

%

647,606

17.9

%

Total deposits

$

4,273,768

100.0

%

$

4,066,973

100.0

%

$

3,622,290

100.0

%

1 Includes carrying value adjustments of $26.9 million,

$27.8 million and $31.5 million related to terminated interest rate

swaps associated with public finance loans as of March 31, 2024,

December 31, 2023 and March 31, 2023, respectively.

First

Internet Bancorp Reconciliation of Non-GAAP Financial

Measures Dollar amounts in thousands, except per share data

Three Months Ended March 31,

December 31, March 31,

2024

2023

2023

Total equity - GAAP

$

366,739

$

362,795

$

355,572

Adjustments: Goodwill

(4,687

)

(4,687

)

(4,687

)

Tangible common equity

$

362,052

$

358,108

$

350,885

Total assets - GAAP

$

5,340,667

$

5,167,572

$

4,721,319

Adjustments: Goodwill

(4,687

)

(4,687

)

(4,687

)

Tangible assets

$

5,335,980

$

5,162,885

$

4,716,632

Common shares outstanding

8,655,854

8,644,451

8,943,477

Book value per common share

$

42.37

$

41.97

$

39.76

Effect of goodwill

(0.54

)

(0.54

)

(0.53

)

Tangible book value per common share

$

41.83

$

41.43

$

39.23

Total shareholders' equity to assets

6.87

%

7.02

%

7.53

%

Effect of goodwill

(0.08

%)

(0.08

%)

(0.09

%)

Tangible common equity to tangible assets

6.79

%

6.94

%

7.44

%

Total average equity - GAAP

$

369,371

$

353,037

$

363,273

Adjustments: Average goodwill

(4,687

)

(4,687

)

(4,687

)

Average tangible common equity

$

364,684

$

348,350

$

358,586

Return on average shareholders' equity

5.64

%

4.66

%

(3.37

%)

Effect of goodwill

0.07

%

0.06

%

(0.04

%)

Return on average tangible common equity

5.71

%

4.72

%

(3.41

%)

Total interest income

$

68,165

$

66,272

$

52,033

Adjustments: Fully-taxable equivalent adjustments1

1,190

1,238

1,383

Total interest income - FTE

$

69,355

$

67,510

$

53,416

Net interest income

$

20,734

$

19,807

$

19,574

Adjustments: Fully-taxable equivalent adjustments1

1,190

1,238

1,383

Net interest income - FTE

$

21,924

$

21,045

$

20,957

Net interest margin

1.66

%

1.58

%

1.76

%

Effect of fully-taxable equivalent adjustments1

0.09

%

0.10

%

0.13

%

Net interest margin - FTE

1.75

%

1.68

%

1.89

%

1 Assuming a 21% tax rate

First Internet Bancorp

Reconciliation of Non-GAAP Financial Measures Dollar amounts

in thousands, except per share data

Three Months

Ended March 31, December 31, March

31,

2024

2023

2023

Total revenue - GAAP

$

29,081

$

27,208

$

25,020

Adjustments: Mortgage-related revenue

-

-

(65

)

Adjusted total revenue

$

29,081

$

27,208

$

24,955

Noninterest income - GAAP

$

8,347

$

7,401

$

5,446

Adjustments: Mortgage-related revenue

-

-

(65

)

Adjusted noninterest income

$

8,347

$

7,401

$

5,381

Noninterest expense - GAAP

$

21,023

$

20,056

$

20,954

Adjustments: Mortgage-related costs

-

-

(3,052

)

Adjusted noninterest expense

$

21,023

$

20,056

$

17,902

Income (loss) before income taxes - GAAP

$

5,610

$

3,558

$

(5,349

)

Adjustments:1 Mortgage-related revenue

-

-

(65

)

Mortgage-related costs

-

-

3,052

Partial charge-off of C&I participation loan

-

-

6,914

Adjusted income before income taxes

$

5,610

$

3,558

$

4,552

Income tax provision (benefit) - GAAP

$

429

$

(585

)

$

(2,332

)

Adjustments:1 Mortgage-related revenue

-

-

(14

)

Mortgage-related costs

-

-

641

Partial charge-off of C&I participation loan

-

-

1,452

Adjusted income tax provision (benefit)

$

429

$

(585

)

$

(253

)

Net income (loss) - GAAP

$

5,181

$

4,143

$

(3,017

)

Adjustments: Mortgage-related revenue

-

-

(51

)

Mortgage-related costs

-

-

2,411

Partial charge-off of C&I participation loan

-

-

5,462

Adjusted net income

$

5,181

$

4,143

$

4,805

1 Assuming a 21% tax rate

First Internet Bancorp

Reconciliation of Non-GAAP Financial Measures Dollar amounts

in thousands, except per share data

Three Months

Ended March 31, December 31, March

31,

2024

2023

2023

Diluted average common shares outstanding

8,750,297

8,720,078

9,024,072

Diluted earnings (loss) per share - GAAP

$

0.59

$

0.48

$

(0.33

)

Adjustments: Effect of mortgage-related revenue

-

-

(0.01

)

Effect of mortgage-related costs

-

-

0.27

Effect of partial charge-off of C&I participation loan

-

-

0.60

Adjusted diluted earnings per share

$

0.59

$

0.48

$

0.53

Return on average assets

0.40

%

0.32

%

(0.26

%)

Effect of mortgage-related revenue

0.00

%

0.00

%

0.00

%

Effect of mortgage-related costs

0.00

%

0.00

%

0.21

%

Effect of partial charge-off of C&I participation loan

0.00

%

0.00

%

0.48

%

Adjusted return on average assets

0.40

%

0.32

%

0.43

%

Return on average shareholders' equity

5.64

%

4.66

%

(3.37

%)

Effect of mortgage-related revenue

0.00

%

0.00

%

(0.06

%)

Effect of mortgage-related costs

0.00

%

0.00

%

2.69

%

Effect of partial charge-off of C&I participation loan

0.00

%

0.00

%

6.10

%

Adjusted return on average shareholders' equity

5.64

%

4.66

%

5.36

%

Return on average tangible common equity

5.71

%

4.72

%

(3.41

%)

Effect of mortgage-related revenue

0.00

%

0.00

%

(0.06

%)

Effect of mortgage-related costs

0.00

%

0.00

%

2.73

%

Effect of partial charge-off of C&I participation loan

0.00

%

0.00

%

6.18

%

Adjusted return on average tangible common equity

5.71

%

4.72

%

5.44

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240422407933/en/

Investors/Analysts Paula Deemer

Director of Corporate Administration (317) 428-4628

investors@firstib.com

Media BLASTmedia for First Internet

Bank Zach Weismiller firstib@blastmedia.com

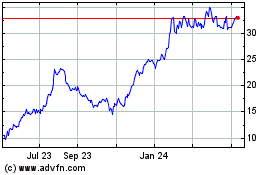

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Nov 2024 to Dec 2024

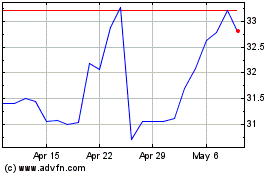

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Dec 2023 to Dec 2024