First Internet Bank “Optimizes” Do More Business Checking

October 12 2023 - 9:10AM

Business Wire

Enhancing its already feature-rich business banking account,

First Internet Bank announced today the addition of Balance

Optimizer to Do More Business™ Checking. Balance Optimizer enables

business owners to seamlessly move money between Do More Business

Checking and a First Internet Bank Business Money Market or

Business Savings account to earn higher-yield interest.

“Given our entrepreneurial roots, our goal when we launched Do

More Business Checking was to offer an account that allows business

owners to do more with less effort,” said Kevin Quinn, Senior Vice

President, Consumer and Business Banking. “Balance Optimizer

enables customers to earn more on excess funds, while meeting their

daily cash needs without constant oversight. That leaves our

customers with more time to grow their business, while we manage

the daily cash sweeps.”

Balance Optimizer allows customers to establish and maintain a

daily target balance in their Do More Business Checking account.

Funds exceeding the target balance are automatically moved to a

First IB Business Money Market/Business Savings account. If funds

fall below the target balance, money is transferred back into the

checking account.

With Do More Business Checking, business owners are able to earn

interest, make unlimited transactions and gain access to a

dedicated customer success team. Customers can also link all of

their personal and business accounts – even those at other

financial institutions – for a comprehensive overview of their

finances. Do More Business Checking provides greater day-to-day

monetary control, including insight into spending trends by

category, simplified budgeting and seamless funds transfer between

accounts.

For more information about First Internet Bank’s Do More

Business Checking with Balance Optimizer, please visit

firstib.com.

About First Internet Bank

First Internet Bank opened for business in 1999 as an industry

pioneer in the branchless delivery of banking services. With assets

of $4.9 billion as of June 30, 2023, the Bank provides consumer and

small business deposits, consumer loans and specialty finance

services nationally. The Bank also offers commercial real estate

loans, commercial and industrial loans, SBA financing and treasury

management services. Additional information about the Bank,

including its products and services, is available at firstib.com.

The Bank is a wholly-owned subsidiary of First Internet Bancorp

(Nasdaq: INBK). First Internet Bank is a Member FDIC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231012530026/en/

Investor Relations: Paula Deemer Director of Corporate

Administration (317) 428-4628 investors@firstib.com

BLASTmedia for First Internet Bank: Spencer Hotz

firstib@blastmedia.com

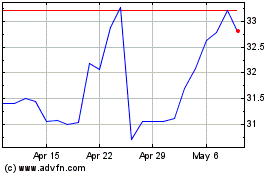

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Nov 2024 to Dec 2024

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Dec 2023 to Dec 2024