First Internet Bank Streamlines New Digital Business Account Opening

July 20 2023 - 10:31AM

Business Wire

First Internet Bank announced today it has launched a new

business account opening process. The streamlined user experience

enables business owners to open and fund accounts online in

minutes, improving conversion rates, reducing support calls and

boosting customer satisfaction.

With software powered by Narmi, coupled with re-engineered back

office processes, First Internet Bank has decreased the time needed

to open a new business account by 65%. Additionally, checking and

savings applicants are now two times likelier to complete the

application and fund the new account, compared to the previous

process.

“We are committed to providing a world-class banking service to

business owners,” said Nicole Lorch, President and Chief Operating

Officer of First Internet Bank. “Our new account opening experience

is efficient, compliant and, more importantly, sets a better tone

for the banking relationship with our business customers.”

“We're beyond thrilled to be partnering with First Internet

Bank, an institution that has consistently demonstrated innovation

and adaptability in a rapidly changing industry. Together, we're

transforming how businesses engage with banking services - making

it quicker, easier, and entirely digital. This is a pivotal step

towards a more accessible and convenient financial future for

businesses," said Nikhil Lakhanpal, Co-Founder of Narmi.

Narmi’s platform offers integrated Know Your Customer (KYC) and

Know Your Business (KYB) decisioning engines powered by Alloy. This

allows their banking partners to gain greater processing efficiency

by removing the need for banks to utilize multiple systems to

verify submitted documents in order to help mitigate fraudulent

applications.

For more information about First Internet Bank visit

firstib.com, for Narmi visit narmi.com.

About First Internet Bank

First Internet Bank opened for business in 1999 as an industry

pioneer in the branchless delivery of banking services. With assets

of $4.7 billion as of March 31, 2023, the Bank provides consumer

and small business deposits, consumer loans and specialty finance

services nationally. The Bank also offers commercial real estate

loans, commercial and industrial loans, SBA financing and treasury

management services. Additional information about the Bank,

including its products and services, is available at firstib.com.

The Bank is a wholly-owned subsidiary of First Internet Bancorp

(Nasdaq: INBK). First Internet Bank is a Member FDIC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230720550330/en/

First Internet Bank Investors/Analysts Media Paula Deemer

Director of Corporate Administration (317) 428-4628

investors@firstib.com

BLASTmedia for First Internet Bank Spencer Hotz

firstib@blastmedia.com

Narmi Audrey Song (443) 987-1469 audrey@narmi.com

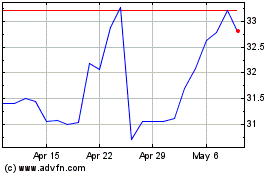

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Dec 2024 to Jan 2025

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Jan 2024 to Jan 2025