UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant |

|

☒ |

| |

|

|

| Filed by a party other than the Registrant |

|

☐ |

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive Proxy Statement |

| |

|

| ☒ |

Definitive Additional Materials |

| |

|

| ☐ |

Soliciting Material under §240.14a-12 |

| |

|

FaZe Holdings Inc. |

|

|

| |

|

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that

apply):

| ☒ |

No fee required |

| |

|

| ☐ |

Fee paid previously with preliminary materials. |

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

As

previously disclosed, on October 20, 2023, FaZe Holdings Inc., a Delaware corporation (“FaZe”), entered into an Agreement

and Plan of Merger (the “Merger Agreement”) with GameSquare Holdings, Inc., a British Columbia corporation (“GameSquare”),

and GameSquare Merger Sub I, Inc., a Delaware corporation (“Merger Sub”), pursuant to which, subject

to the terms and conditions set forth in the Merger Agreement, Merger Sub will merge with and into FaZe (the “Merger”),

with FaZe surviving such Merger as a wholly-owned subsidiary of GameSquare. In connection with the Merger, FaZe filed with the

U.S. Securities and Exchange Commission (the “SEC”) a definitive proxy statement on January 26, 2024 (the “Definitive

Proxy Statement”).

Following

the filing of the Definitive Proxy Statement and prior to the filing of this supplement to the Definitive Proxy Statement (the

“Supplement”), two lawsuits relating to the Merger were filed: Robert Scott v. FaZe Holdings Inc. et al., Case

No. 24-cv-00671-VEC (S.D.N.Y. January 30, 2024) and Matthew Jones v. FaZe Holdings Inc., et al, Case No. 24-cv-00126-UNA (D. Del.

February 1, 2024) (collectively, the “Actions”). Further, since the filing of the Definitive Proxy Statement on

January 26, 2024, FaZe also received from purported Company stockholders five demand letters relating to the Merger

(cumulatively, the “Demand Letters” and together with the Actions, the “Matters”). The Matters

allege, among other things, that the defendants named therein violated Sections 14(a) and 20(a) of the Securities Exchange Act of

1934, as amended, and Rule 14a-9 promulgated thereunder because the Definitive Proxy Statement allegedly omits or misstates certain

material information. The Actions seek, among other things, injunctive relief preventing the consummation of the Merger, rescission

of the Merger if it is consummated, and attorneys’ fees.

FaZe

believes that the claims asserted in the Matters are without merit and that no supplemental disclosure is required under applicable law.

However, in order to moot unmeritorious disclosure claims, to avoid the risk of the Matters delaying or adversely affecting the Merger

and to minimize the costs, risks and uncertainties inherent in litigation, without admitting any liability or wrongdoing, FaZe has determined

to voluntarily supplement the Definitive Proxy Statement as described in this Supplement. Nothing in this Supplement shall be deemed an

admission of the legal necessity or materiality under applicable laws of any of the disclosures set forth herein. To the contrary, FaZe

specifically denies all allegations in the Matters, including allegations that any additional disclosure was or is required, and believes

that the supplemental disclosures contained herein are immaterial.

The

Actions are not expected to affect the timing of FaZe’s special meeting of stockholders to be held for the purpose of voting upon,

among other things, the Merger, which is scheduled to be held on February 16, 2024, or the amount of the consideration to be paid to FaZe’s

stockholders in connection with the Merger.

AMENDED AND SUPPLEMENTAL

DISCLOSURES

The

following supplemental information should be read in conjunction with the disclosures contained in the Definitive Proxy Statement, which

in turn should be read in its entirety. All page references are to the Definitive Proxy Statement and terms used below, unless otherwise

defined, shall have the meanings ascribed to such terms in the Definitive Proxy Statement. For clarity, new text added to the Definitive

Proxy Statement is shown in bold, underlined text.

The first full paragraph

on page 51 of the Definitive Proxy Statement is amended and supplemented, and a new paragraph is added immediately following the first

paragraph, as follows:

On January 22, 2023,

Mr. Shribman sent an electronic correspondence to Lee Trink, FaZe’s then chief executive officer and Kyron Johnson, FaZe’s

general counsel, proposing the formation of a special committee of the Board to explore strategic opportunities available to FaZe, including

a capital raise, sale or a merger, which special committee was briefly formed, as a matter of convenience and efficiency to manage

the exploration of various strategic alternatives and communications with a potentially wide array of third parties.

On

February 7, 2023, upon the recommendation of Mr. Shribman and following discussion

among the members of the FaZe Board, the FaZe Board unanimously adopted resolutions establishing a special committee, authorizing it to

manage on behalf of FaZe the exploration and examination of potential strategic alternatives for FaZe, including a potential sale of FaZe’s

equity or assets or a business combination, to consult with management of FaZe and its advisers regarding a potential strategic transaction,

and to make recommendations to the full FaZe Board regarding any such potential strategic transaction. The FaZe Board appointed Daniel

Shribman, as chairperson of the special committee, and Angela Dalton and Andre Fernandez as the other members of the special committee,

none of whom received any additional compensation in connection with their service on the special committee. The special committee was

not formed due to any potential conflicts of interest.

The second full paragraph

on page 51 of the Definitive Proxy Statement is amended and supplemented as follows:

As

summarized in Mr. Shribman’s electronic correspondence on February 21, 2023, FaZe pro-actively sought out discussions

with various investment banks, including United Community Bank, RBC Bank, Moelis & Company, Guggenheim Partners and LionTree.

However, no meaningful indication of interest was made by any of the investment banks. Also, during the period from February of

2023 through May of 2023, FaZe entered into mutual confidentiality agreements with two potential strategic bidders and two financial sponsors;

none of such confidentiality agreements contained standstill provisions restricting any of the counterparties from presenting an unsolicited

proposal to FaZe.

The fifth full paragraph

on page 51 of the Definitive Proxy Statement is amended and supplemented as follows:

On

May 8, 2023, after further consideration and deliberation, the FaZe Board determined that, with the lack of interest from any

of the investment banks contacted, and in light of the viable potential strategic alternatives available to FaZe having narrowed, the

efficiency rationale for the establishment of the special committee was no longer present, and therefore resolved

to dissolve its special committee on the basis that, unless and until a need arises due to apparent conflicts or otherwise, all matters

regarding strategic initiatives would be presented to the full FaZe Board. The FaZe Board convened on May 8, 2023, to discuss various

matters including a transaction proposal by Messrs. Oliveira, Bengston, Shat and Abdelfattah (the “FaZe Founders”).

The FaZe Founders, none of whom served on the FaZe Board, presented a term sheet to the FaZe Board that did not involve

an acquisition of FaZe nor an infusion of capital into FaZe but would involve the issuance of equity awards to certain executives

and key personnel and provide the FaZe Founders with a one-year option to purchase FaZe.

The first paragraph

on page 52 of the Definitive Proxy Statement is amended and supplemented as follows:

On June 5, 2023,

the FaZe Board discussed a letter of intent received from Party B regarding a potential $20 million equity investment in FaZe, with

$10 million being paid at closing and an additional $10 million being paid a year later, and presented to the FaZe Board, a new

proposal from Party C to acquire FaZe at an $80 million cash purchase price (approximately $1.06 per share) but subject to, among

other things, a condition that the talent agree to promote the acquirer’s cryptocurrency, and the updated IOI from GameSquare

along with the detailed post-business combination plan requested of GameSquare senior management. The FaZe Board carefully considered

Party B’s proposal, and while the FaZe Board found the initial proposal had merit, they noted the need to carefully evaluate the

terms of the proposal before moving forward. In their review of Party C’s proposal, the FaZe Board expressed their reservations

for the opportunity citing various factors including the urgent timeline of the proposed deal, the FaZe Board’s belief that

the talent would not sufficiently support the acquirer’s cryptocurrency and thus FaZe would not be able to satisfy the acquirer’s

condition, and a misalignment on expectations of the two parties. The FaZe Board went on to deliberate the GameSquare IOI, deciding

that further discussions were necessary to reach a mutually beneficial arrangement satisfactory to both GameSquare and FaZe.

The sixth paragraph

on page 52 of the Definitive Proxy Statement is amended and supplemented as follows:

During

the FaZe Board’s July 5, 2023 meeting, Mr. Shribman informed the FaZe Board of his telephonic conversations with Party

A’s chief executive officer, who had conveyed to Mr. Shribman that Party A was not ready to submit any form of proposal to

FaZe and would not be ready in the near future. The FaZe Board continued to discuss the proposed GameSquare transaction and concerns around

a certain FaZe Founder’s reluctance to accept the transaction. After careful consideration and to prevent the preemptive disclosure

of the confidential terms of the proposal, the FaZe Board determined it would be in the best interests of FaZe and its stockholders to

modify the IOI, so the commencement of the exclusivity period would commence on the date that three of the four FaZe Founders executed

employment agreements with GameSquare, which conditioned had been satisfied by July 5, which would allow for the commencement of

the 45-day no shop period. During this no-shop period, FaZe and GameSquare undertook their respective business and legal due

diligence of each other, and no post-transaction employment or compensation terms for FaZe’s current management were discussed at

any time prior to the execution of the Merger Agreement.

The seventh paragraph

on page 52 of the Definitive Proxy Statement is amended and supplemented as follows:

On

August 9, 2023, the FaZe Board convened to discuss, among other things, updates on the proposed transaction with GameSquare, the

ongoing conversations with Party A regarding a proposal and a new letter of interest from Party D. The FaZe Board reviewed Party

D’s letter of interest with respect to an all cash acquisition of FaZe at a per share purchase price of $0.35 to $0.40 per

share and instructed Mr. Lewin to follow up with Party D. The FaZe Board also directed Mr. Levinsohn to continue

conversations with Party A regarding a potential proposal and directed Sullivan & Triggs to take appropriate subsequent steps

in the potential GameSquare transaction.

The third paragraph

on page 64 of the Definitive Proxy Statement is amended and supplemented as follows:

Selected Precedent Transactions

Analysis

Current Capital reviewed

and analyzed certain financial metrics associated with selected precedent merger and acquisition transactions that Current Capital deemed

relevant for purposes of this analysis. These transactions involved precedent transactions of less than $500 million in the esports, premium

content, gaming and gambling, and branding and licensing sectors. Current Capital calculated, among other things and to the extent publicly

available, certain implied change-of-control transaction multiples for the selected precedent merger and acquisition transactions (based

on each company’s publicly available financial filings and certain other publicly available information), which are summarized in

the table below:

| ($ in millions) | |

| |

| |

| |

| | |

| |

| Announcement Date | |

Closing Date | |

Acquiror | |

Target | |

Transaction Size | | |

TEV/Revenue1 | |

| December-22 | |

April-23 | |

GameSquare | |

Engine Gaming and Media | |

$ | 41 | | |

| 0.7 | x |

| October-21 | |

December-21 | |

EBET | |

Karamba | |

$ | 76 | | |

| 1.0 | x |

| June-21 | |

July-21 | |

Skillz | |

Aarki | |

$ | 150 | | |

| 5.0 | x |

| August-20 | |

August-20 | |

Enthusiast Gaming | |

Omnia Media | |

$ | 34 | | |

| 0.6 | x |

| January-20 | |

February-20 | |

Penn National | |

Barstool Sports | |

$ | 450 | | |

| 3.0 | x |

| July-18 | |

July-18 | |

IZEA | |

TapInfluence | |

$ | 7 | | |

| 1.2 | x |

| | |

| |

| |

| |

| | | |

| | |

| Mean | |

| |

| |

| |

$ | 126 | | |

| 1.9 | x |

| Median | |

| |

| |

| |

$ | 58 | | |

| 1.1 | x |

| 1 | Forward revenue estimate in the year the target was acquired,

per S&P Capital IQ, SEC filings, and publicly available reports and research. |

The third paragraph

on page 65 of the Definitive Proxy Statement is amended and supplemented as follows:

Illustrative Discounted

Cash Flow Analyses

Current Capital performed

illustrative discounted cash flow (“DCF”) analyses of each of FaZe and GameSquare on a standalone basis, based

on their respective projected standalone unlevered free cash flows and an estimate of their respective terminal values at the end of the

projection horizon.

In performing its discounted

cash flow analyses:

● Current Capital utilized

financial forecasts that were provided and approved for Current Capital’s use by FaZe’s senior management.

● Current Capital used

a discount rate range of 15.0% – 18.0%, based on its estimate of the weighted average cost of capital of each of FaZe and GameSquare

(which was estimated based on Current Capital’s (i) investment banking and capital markets judgment and experience in valuing

companies similar to FaZe and GameSquare and (ii) application of the capital asset pricing model, which requires certain (a) general inputs

such as the prospective US equity risk premium and the corresponding risk-free rate and (b) company-specific inputs such as the subject

company’s forward-looking equity beta reference range, the subject company’s assumed forward-looking capital structure and

the corresponding blended cost of debt, the subject company’s prospective marginal cash income tax rate and, as applicable, the

appropriate size/liquidity premium for the subject company).

● In estimating the

terminal value of each of FaZe and GameSquare, Current Capital used a reference range of terminal EV/terminal year revenue multiples of

1.5x – 3.0x. Utilizing an assumed revenue multiple of 2x, Current Capital calculated the undiscounted terminal value of FaZe

to be $104.7 million and of GameSquare to be $121.4 million.

The

first paragraph on page 70 of the Definitive Proxy Statement is amended and supplemented as follows:

Summary of the FaZe

Financial Projections

The

following table presents certain unaudited prospective financial information of FaZe prepared by FaZe management for FaZe’s fiscal

years ending 2023 through 2028, which we refer to as the “FaZe Projections.”

| (in millions) | |

Q42023E | | |

FY2024E | | |

FY2025E | | |

FY2026E | | |

FY2027E | | |

FY2028E | |

| Revenue | |

$ | 10.6 | | |

$ | 50.0 | | |

$ | 64.5 | | |

$ | 81.2 | | |

$ | 98.4 | | |

$ | 108.2 | |

| Adjusted EBITDA(1) | |

$ | (8.1 | ) | |

$ | (27.0 | ) | |

$ | (24.7 | ) | |

$ | (21.2 | ) | |

$ | (17.7 | ) | |

$ | (10.8 | ) |

| Unlevered free cash flow(2) | |

$ | (8.2 | ) | |

$ | (28.2 | ) | |

$ | (25.9 | ) | |

$ | (22.4 | ) | |

$ | (18.9 | ) | |

$ | (12.0 | ) |

| Unlevered net income (loss)(3) | |

$ | (8.5 | ) | |

$ | (27.5 | ) | |

$ | (25.2 | ) | |

$ | (21.7 | ) | |

$ | (18.2 | ) | |

$ | (11.4 | ) |

| Depreciation and amortization | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.6 | | |

$ | 0.6 | |

| Capital expenditures | |

$ | (0.2 | ) | |

$ | (1.2 | ) | |

$ | (1.2 | ) | |

$ | (1.2 | ) | |

$ | (1.2 | ) | |

$ | (1.2 | ) |

| Change in working capital | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | |

| (1) |

Adjusted EBITDA, a non-GAAP financial measure, refers to earnings before interest, tax, depreciation and amortization, excluding the impact of acquisition-related expenses and other non-operating items, but including stock-based compensation (“SBC”) expense. |

| (2) |

Unlevered free cash flow, a non-GAAP financial measure, refers to non-GAAP operating income less taxes, less change in net working capital, less capital expenditures, plus depreciation and amortization. SBC expense is included in operating income which is treated as a cash expense in this table. |

| (3) |

Unlevered net income, a non-GAAP financial measure, refers to Adjusted EBITDA less taxes, depreciation and amortization multiplied by the difference of one minus FaZe’s projected tax rate; for purposes of this transaction, Current Capital was instructed by FaZe’s management to use a tax rate of 0%. |

FORWARD LOOKING STATEMENTS:

This

Supplement contains “forward-looking statements” within the meaning of the “safe harbor” provisions of

the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may discuss goals, intentions and expectations

as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs and involve numerous

risks and uncertainties that could cause actual results to differ materially from expectations. Forward-looking statements speak only

as of the date they are made or as of the dates indicated in the statements and should not be relied upon as predictions of future events,

as there can be no assurance that the events or circumstances reflected in these statements will be achieved or will occur. These

forward-looking statements generally are identified by the words “budget,” “could,” “forecast,” “future,”

“might,” “outlook,” “plan,” “possible,” “potential,” “predict,”

“project,” “seem,” “seek,” “strive,” “would,” “should,” “may,”

“believe,” “intend,” “expects,” “estimates,” “will,” “continue,”

“increase,” and/or similar expressions that concern strategy, plans or intentions, but the absence of these words does not

mean that a statement is not forward-looking. Such statements are made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and are based on management’s belief or interpretation of information currently available.

Forward-looking

statements are based on various assumptions and subject to various risks, whether or not identified herein, and on the current expectations

of management and are not predictions of actual performance. These risks include, among other things: failure to obtain applicable stockholder

approvals in a timely manner or otherwise; failure to satisfy other closing conditions to the transaction or to complete the transaction

on anticipated terms and timing; risks that the businesses will not be integrated successfully or that the combined company will not realize

expected benefits, cost savings, accretion, synergies and/or growth, or that such benefits may take longer to realize than expected; the

risk that disruptions from the transaction will harm business plans and operations; risks relating to unanticipated costs of integration;

significant transaction and/or integration costs, or difficulties in connection with the transaction and/or unknown or inestimable liabilities;

restrictions during the pendency of the transaction that may impact the ability to pursue certain business opportunities or strategic

transactions; the potential impact of the consummation of the transaction on FaZe’s, GameSquare’s or the combined company’s

relationships with suppliers, customers, employers and regulators and demand for the combined company’s products and services. A

more fulsome discussion of the risks related to the proposed transaction is included in the Definitive Proxy Statement.

Additional

Information and Where to Find It

FaZe

filed the Definitive Proxy Statement with the SEC on January 26, 2024 in connection with the solicitation of proxies to approve the Merger,

which was sent or provided to FaZe’s stockholders. In connection with the proposed transaction, GameSquare has filed with

the SEC a registration statement on Form F-4 that includes the Definitive Proxy Statement and that also constitutes a prospectus with

respect to shares of GameSquare’s common stock to be issued in the proposed transaction. Each of GameSquare and FaZe may also file

other relevant documents with the SEC regarding the proposed transaction. This communication is not a substitute for the Definitive Proxy

Statement or any other document that GameSquare or FaZe may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE

PROXY STATEMENT (INCLUDING ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND ANY OTHER

RELEVANT DOCUMENTS THAT ARE OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND

IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER AND RELATED MATTERS. Investors

and security holders may obtain free copies of the proxy statement/prospectus and other documents containing important information about

GameSquare, FaZe and the proposed Merger, through the website maintained by the SEC at www.sec.gov.

Participants

in the Solicitation

GameSquare, FaZe and

certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect

of the proposed transaction. Information about the directors and executive officers of Game and FaZe, including a description of their

direct or indirect interests, by security holdings or otherwise, is set forth in the proxy statement/prospectus and other relevant materials

filed with the SEC regarding the proposed transaction. You may obtain free copies of these documents using the source indicated above.

5

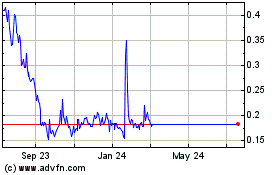

FaZe (NASDAQ:FAZE)

Historical Stock Chart

From Nov 2024 to Dec 2024

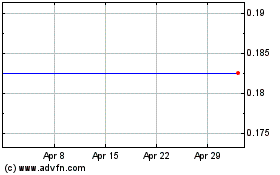

FaZe (NASDAQ:FAZE)

Historical Stock Chart

From Dec 2023 to Dec 2024