false

0001839360

0001839360

2023-12-19

2023-12-19

0001839360

FAZE:CommonStockParValue0.0001PerShareMember

2023-12-19

2023-12-19

0001839360

FAZE:WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockMember

2023-12-19

2023-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 19, 2023

FAZE HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40083 |

|

84-2081659 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

720 N. Cahuenga Blvd.

Los Angeles, California 90038

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (818) 688-6373

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| |

|

|

|

|

| Common stock, par value $0.0001 per share |

|

FAZE |

|

The Nasdaq Stock Market |

| |

|

|

|

|

| Warrants, each whole warrant exercisable for one share of common stock |

|

FAZEW |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry Into a Material Definitive Agreement.

Merger Agreement Amendment

As previously disclosed,

on October 19, 2023, FaZe Holdings Inc., a Delaware corporation (“FaZe”), entered into an Agreement and Plan of Merger

(the “Merger Agreement”), with GameSquare Holdings, Inc., a British Columbia corporation (“GameSquare”),

and GameSquare Merger Sub I, Inc., a Delaware corporation and wholly owned subsidiary of GameSquare (“Merger Sub”),

pursuant to which, subject to the terms and conditions set forth in the Merger Agreement, Merger Sub will merge with and into FaZe (the

“Merger”), with FaZe surviving such Merger as a wholly-owned subsidiary of GameSquare. The Merger Agreement contained,

among other things, mutual termination rights for FaZe and GameSquare in the event the Merger is not completed by December 31, 2023 (the

“End Date”).

On December 19, 2023, GameSquare,

FaZe and Merger Sub entered into a First Amendment to Agreement and Plan of Merger (the “Amendment”), pursuant to which

the End Date was extended from December 31, 2023 to February 15, 2024. Other than as expressly modified by the Amendment, the Merger Agreement

(which was filed as Exhibit 2.1 to the Current Report on Form 8-K filed by FaZe with the Securities and Exchange Commission (the “SEC”)

on October 20, 2023) remains in full force and effect.

The foregoing description

of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, which

is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Important Additional Information about the

Merger and Related Transactions and Where to Find It

FaZe, its directors and certain

executive officers are participants in the solicitation of proxies from stockholders in connection with the proposed Merger. On December

11, 2023, GameSquare filed with the SEC a Registration Statement on Form F-4 (the “F-4”), which includes a preliminary

proxy statement/prospectus relating to the proposed Merger. GameSquare and certain of its directors and executive officers may also be

deemed to be participants in the solicitation of proxies from the stockholders of FaZe in connection with the Merger. In connection with

the proposed Merger, upon the effectiveness of the F-4, FaZe intends to mail the definitive proxy statement/prospectus to its stockholders,

to be used at the meeting of FaZe’s stockholders to approve the proposed Merger and related matters. INVESTORS AND SECURITY HOLDERS

OF FAZE ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS, ANY AMENDMENTS THERETO AND OTHER RELEVANT DOCUMENTS THAT WILL BE

FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT FAZE,

GAMESQUARE AND THE MERGER. When available, the definitive proxy statement/prospectus and other relevant materials for the Merger will

be mailed to stockholders of FaZe as of the record date established for voting on the proposed Merger. Investors and security holders

will also be able to obtain copies of the definitive proxy statement/prospectus and other documents containing important information about

each of the companies once such documents are filed with the SEC, without charge, at the SEC’s web site at www.sec.gov.

Forward-Looking Statements

This Current Report on Form

8-K contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking

statements”) within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995.

All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and

projections as at the date of this Current Report on Form 8-K. Any statement that involves discussions with respect to predictions, expectations,

beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”,

or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “expects”,

“plans”, “projects”, “budget”, “scheduled”, “forecasts”, “estimates”,

“believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results

“may” or “could”, “would”, “might” or “will” be taken to occur or be achieved)

are not statements of historical fact and accordingly are forward-looking statements. In this Current Report on Form 8-K, forward-looking

statements relate, among other things, to: the anticipated timing for closing the Merger, the combined company’s future performance

and revenue; continued growth and profitability of the combined company; and the combined company’s ability to execute its business

plans and achieve certain cost synergies. These forward-looking statements are provided only to provide information currently available

to FaZe and GameSquare and are not intended to serve as and must not be relied on by any investor as, a guarantee, assurance or definitive

statement of fact or probability. Forward-looking statements are necessarily based upon a number of estimates and assumptions which include,

but are not limited to: the satisfaction of conditions precedent (including shareholder approvals) to the consummation of the proposed

Merger, the combined company being able to complete and successfully integrate acquisitions, the combined company being able to grow its

business, execute its business plan or achieve projected cost synergies, the combined company being able to recognize and capitalize on

opportunities and the combined company continuing to retain and attract qualified personnel to supports its development requirements.

These assumptions, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause

the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors

include, but are not limited to: FaZe’s and GameSquare’s ability to complete the contemplated Merger and the Parent Financing

(as defined in the Merger Agreement), the combined company’s ability to achieve its objectives, the combined company’s successful

execution of its growth strategy, the ability of the combined company to obtain future financings or complete offerings on acceptable

terms, the consummation of the planned $10 million private placement of public equity by GameSquare in connection with the contemplated

transaction, failure to leverage the combined company’s portfolio across entertainment and media platforms, dependence on the combined

company’s key personnel and general business, economic, competitive, political and social uncertainties, including impact of the

COVID-19 pandemic and any variants. These risk factors are not intended to represent a complete list of the factors that could affect

FaZe and GameSquare, which factors are discussed in FaZe’s recent publicly filed quarterly report on Form 10-Q and annual report

on Form 10-K, filed with the SEC on August 14, 2023 and April 4, 2023 respectively, and in GameSquare’s most recent publicly filed

annual report on Form 20-F filed with the SEC on December 29, 2022 and its 20-F/A filed with the SEC on December 20, 2023. There can be

no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from

those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements and0 information

contained in this Current Report on Form 8-K. Neither FaZe nor GameSquare assumes any obligation to update the forward-looking statements

of beliefs, opinions, projections, or other factors, should they change, except as required by law.

No Offer or Solicitation

This communication shall

not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Merger.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities pursuant to the proposed

transactions or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would

be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall

be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or a valid exemption from registration

thereunder.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: December 22, 2023

| |

FAZE HOILDINGS INC. |

| |

|

| |

By: |

/s/ Christoph Pachler |

| |

|

Christoph Pachler |

| |

|

Interim Chief Executive Officer |

3

Exhibit 2.1

FIRST AMENDMENT

TO

AGREEMENT AND PLAN OF MERGER

This First Amendment to Agreement

and Plan of Merger (this “Amendment”) is made and entered into as of December 19, 2023 by and among GameSquare Holdings,

Inc., a British Columbia corporation (“Parent”), GameSquare Merger Sub I, Inc., a Delaware corporation and a wholly

owned Subsidiary of Parent (“Merger Sub”), and FaZe Holdings Inc., a Delaware corporation (the “Company”).

Each capitalized term used but not otherwise defined herein shall have the meaning set forth in that certain Agreement and Plan of Merger,

dated as of October 19, 2023 (the “Merger Agreement”), by and among Parent, Merger Sub and the Company.

WHEREAS, pursuant to Section

7.06 of the Merger Agreement, the Merger Agreement may be amended by an instrument in writing signed on behalf of each of Parent, Merger

Sub and the Company; and

WHEREAS, the parties hereto

wish to modify the End Date as set forth in the Merger Agreement.

NOW, THEREFORE, for good and

valuable consideration, the parties hereto intending to be legally bound hereby agree as follows:

1. Section

7.02(a). The reference to “December 31, 2023” in Section 7.02(a) of the Merger Agreement is hereby deleted and replaced

with “February 15, 2024”.

2. Full

Force and Effect. Except as otherwise expressly set forth in this Amendment, the terms and provisions of the Merger Agreement shall

continue unmodified and in full force and effect.

3. Execution;

Governing Law. This Amendment may be executed in any number of counterparts, all of which together shall constitute one Amendment.

One or more counterparts of this Amendment may be delivered via facsimile or electronic transmission (emailed PDF or DocuSign) and shall

have the same effect as an original counterpart hereof. This Amendment shall be governed by and construed in accordance with the laws

of the State of Delaware.

[Signatures Follow]

IN WITNESS WHEREOF, the undersigned

executed this Amendment as of the date first above written.

| |

COMPANY: |

| |

FAZE HOLDINGS INC. |

| |

|

| |

By: |

/s/ Christoph Pachler |

| |

Name: |

Christoph Pachler |

| |

Title: |

Authorized Signatory |

| |

|

| |

PARENT: |

| |

GAMESQUARE HOLDINGS, INC. |

| |

|

| |

By: |

/s/ Justin Kenna |

| |

Name: |

Justin Kenna |

| |

Title: |

Chief Executive Officer |

| |

|

| |

MERGER SUB: |

| |

GAMESQUARE MERGER SUB I, INC. |

| |

|

| |

By: |

/s/ Justin Kenna |

| |

Name: |

Justin Kenna |

| |

Title: |

Chief Executive Officer |

[Signature Page to First Amendment to Agreement

and Plan of Merger]

v3.23.4

Cover

|

Dec. 19, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 19, 2023

|

| Entity File Number |

001-40083

|

| Entity Registrant Name |

FAZE HOLDINGS INC.

|

| Entity Central Index Key |

0001839360

|

| Entity Tax Identification Number |

84-2081659

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

720 N. Cahuenga Blvd.

|

| Entity Address, City or Town |

Los Angeles

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90038

|

| City Area Code |

818

|

| Local Phone Number |

688-6373

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

FAZE

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each whole warrant exercisable for one share of common stock |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of common stock

|

| Trading Symbol |

FAZEW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FAZE_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FAZE_WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

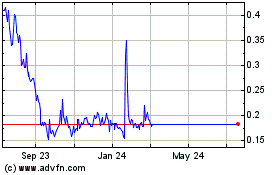

FaZe (NASDAQ:FAZE)

Historical Stock Chart

From Nov 2024 to Dec 2024

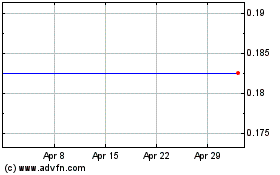

FaZe (NASDAQ:FAZE)

Historical Stock Chart

From Dec 2023 to Dec 2024