Achieves Another Quarter of Sequential

Growth Driven by Record STT-MRAM Revenue

Everspin Technologies, Inc. (NASDAQ: MRAM), the market leader in

MRAM, today announced financial results for the second quarter

ended June 30, 2020.

Second Quarter and Recent Highlights

- Total revenue increased 37% year-over-year and 17% sequentially

to $11.8 million

- Operating expenses declined 18% over the prior year period

- GAAP loss improved to $1.3 million, or ($0.07) per share, and

non-GAAP loss to $0.4 million, or ($0.02), compared to $3.7

million, or ($0.21) per share, and $2.9 million, or ($0.17) per

share, respectively, in the second quarter of 2019

- Achieved positive adjusted EBITDA of $0.2 million, compared to

a negative ($2.2) million in the year-ago quarter

- Appointed Daniel Berenbaum CFO bringing strong semiconductor

finance and Wall Street experience to the executive team

- Ended quarter with cash and equivalents of $12.9 million

“We extended our momentum into the second quarter, achieving the

fourth consecutive quarter of growth including record revenue from

the ramp of our 1Gb STT-MRAM product,” stated Kevin Conley,

Everspin’s President and CEO. “A significant contributor to this

growth was our ability to respond to a surge in demand from our OEM

customers that supply the data center market.

“Entering the third quarter, we are seeing a delay of customers’

new product introduction plans, resulting in reduced visibility and

expectations for the quarter. Despite these current market

challenges, we remain encouraged about our future growth

opportunities, growing pipeline of business and improved financial

positioning.”

Second Quarter 2020 Results

Total revenue for the second quarter of 2020 was $11.8 million,

an increase of 17% from the $10.1 million last quarter and 37% over

the $8.6 million reported in the second quarter of 2019.

Gross margin for the second quarter of 2020 was 43.9%, compared

to 52.9% in the prior quarter and 46.5% in the second quarter of

2019.

GAAP operating expenses for the second quarter of 2020 decreased

to $6.3 million, compared to $6.9 million in the first quarter of

2020 and $7.6 million in the second quarter of 2019. On a non-GAAP

basis, operating expenses for the second quarter of 2020 were $5.4

million, compared to $6.2 million in the prior quarter and $6.8

million in the year-ago quarter.

GAAP net loss for the second quarter of 2020 was $1.3 million,

or ($0.07) per share, based on 18.7 million weighted-average shares

outstanding. This compares to a net loss of $1.7 million, or

($0.10) per share, in the first quarter of 2020 and a net loss of

$3.7 million, or ($0.21) per share, in the second quarter of

2019.

On a non-GAAP basis, net loss for the second quarter of 2020 was

$0.4 million, or ($0.02) per share, compared to a net loss of $1.0

million, or ($0.05) per share, in the prior quarter, and a net loss

of $2.9 million, or ($0.17) per share, in the second quarter of

2019.

Adjusted EBITDA for the second quarter of 2020 improved to a

positive $0.2 million, compared to a negative ($0.3) million last

quarter and a negative ($2.2) million in the prior year period.

Cash and cash equivalents as of June 30, 2020 were $12.9

million, compared to $14.0 million at the end of the first quarter

of 2020.

Business Outlook

For the third quarter of 2020, Everspin expects total revenue of

between $10.0 million and $10.8 million, compared to $9.2 million

in the year-ago quarter. GAAP net loss is expected to range between

($0.11) and ($0.05) per share. Excluding stock-based compensation

expense of $0.05 per share, non-GAAP net loss is expected to range

between a loss of ($0.06) per share and breakeven.

Conference Call

Everspin will host a conference call for analysts and investors

today at 5:00 p.m. Eastern Time. Interested participants can access

the call by dialing 1-844-889-7788 and providing passcode 3958179.

International callers may join the call by dialing +1-661-378-9932, using the same code.

The call will also be available as a live and archived webcast in

the Investor Relations section of the company’s website at

investor.everspin.com.

A telephone replay of the conference call will be available

approximately two hours after the call through August 13, 2020. The

replay can be accessed by dialing 1-855-859-2056 and using the

passcode 3958179. International callers should dial +1-404-537-3406

and enter the same passcode at the prompt.

About Everspin Technologies

Everspin Technologies, Inc. is the world’s leading provider of

Magnetoresistive RAM (MRAM). Everspin MRAM delivers the industry’s

most robust, highest performance non-volatile memory for Industrial

IoT, Data Center, and other mission-critical applications where

data persistence is paramount. Headquartered in Chandler, Arizona,

Everspin provides commercially available MRAM solutions to a large

and diverse customer base. For more information, visit

www.everspin.com. NASDAQ: MRAM.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking statements regarding

future results that involve risks and uncertainties that could

cause actual results or events to differ materially from the

expectations disclosed in the forward-looking statements,

including, but not limited to the statements made under the caption

“Business Outlook.” Actual results could differ materially from

these forward-looking statements as a result of certain factors,

including, without limitation, the risks set forth in Everspin’s

Form 10-Qs filed with the Securities and Exchange Commission on May

8, 2020, and August 6, 2020, under the caption “Risk Factors.”

Subsequent events may cause these expectations to change, and

Everspin disclaims any obligations to update or alter these

forward-looking statements in the future, whether as a result of

new information, future events or otherwise.

EVERSPIN TECHNOLOGIES,

INC.

Condensed Balance

Sheets

(In thousands, except share

and per share amounts)

(Unaudited)

June 30,

December 31,

2020

2019

Assets

Current assets:

Cash and cash equivalents

$

12,916

$

14,487

Accounts receivable, net

7,339

5,799

Inventory

8,368

7,863

Prepaid expenses and other current

assets

501

539

Total current assets

29,124

28,688

Property and equipment, net

2,908

3,479

Right-of-use assets

2,985

3,132

Other assets

73

73

Total assets

$

35,090

$

35,372

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

2,074

$

2,873

Accrued liabilities

1,392

2,727

Current portion of long-term debt

1,073

670

Operating lease liabilities

1,546

1,582

Other liabilities

44

42

Total current liabilities

6,129

7,894

Long-term debt, net of current portion

6,893

7,149

Operating lease liabilities, net of

current portion

1,656

1,840

Total liabilities

14,678

16,883

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.0001 par value per

share; 5,000,000 shares authorized; no shares issued and

outstanding as of June 30, 2020 and December 31, 2019

—

—

Common stock, $0.0001 par value per share;

100,000,000 shares authorized; 18,869,775 and 18,081,753 shares

issued and outstanding as of June 30, 2020 and December 31,

2019

2

2

Additional paid-in capital

172,098

167,149

Accumulated deficit

(151,688

)

(148,662

)

Total stockholders’ equity

20,412

18,489

Total liabilities and stockholders’

equity

$

35,090

$

35,372

EVERSPIN TECHNOLOGIES,

INC.

Condensed Statements of

Operations and Comprehensive Loss

(In thousands, except share

and per share amounts)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2020

2019

2020

2019

Product sales

$

10,927

$

8,003

$

20,562

$

17,026

Licensing, royalty, and other revenue

899

643

1,372

1,646

Total revenue

11,826

8,646

21,934

18,672

Cost of sales

6,635

4,627

11,392

9,868

Gross profit

5,191

4,019

10,542

8,804

Operating expenses:1

Research and development

2,774

3,519

5,804

7,517

General and administrative

2,448

2,856

5,248

6,451

Sales and marketing

1,056

1,239

2,159

2,603

Total operating expenses

6,278

7,614

13,211

16,571

Loss from operations

(1,087

)

(3,595

)

(2,669

)

(7,767

)

Interest expense

(172

)

(186

)

(344

)

(397

)

Other (expense) income, net

(35

)

111

(13

)

238

Net loss and comprehensive loss

$

(1,294

)

$

(3,670

)

$

(3,026

)

$

(7,926

)

Net loss per common share, basic and

diluted

$

(0.07

)

$

(0.21

)

$

(0.16

)

$

(0.46

)

Weighted-average shares used to compute

net loss per common share, basic and diluted

18,747,124

17,137,338

18,585,339

17,117,777

1Operating expenses include stock-based

compensation as follows:

Research and development

$

194

$

161

$

356

$

308

General and administrative

646

556

1,231

1,065

Sales and marketing

78

81

136

129

Total stock-based compensation

$

918

$

798

$

1,723

$

1,502

EVERSPIN TECHNOLOGIES,

INC.

Reconciliation of GAAP and

Non-GAAP Financial Information

(In thousands, except share

and per share amounts)

(Unaudited)

Three Months Ended

Jun 30, 2020

Mar 31, 2020

Jun 30, 2019

Reconciliation of GAAP and non-GAAP

operating expenses

GAAP operating expenses

$

6,278

$

6,933

$

7,614

Reconciling item included in research and

development

Stock-based compensation

160

137

133

Reconciling item included in selling,

general and administrative

Stock-based compensation

724

643

636

Total reconciling items included in

operating expenses

884

780

769

Non-GAAP operating expenses

$

5,394

$

6,153

$

6,845

GAAP NET INCOME (LOSS)

$

(1,294

)

$

(1,732

)

$

(3,670

)

Reconciling items included in operating

expenses

884

780

769

Non-GAAP net income (loss)

$

(410

)

$

(951

)

$

(2,901

)

Non-GAAP net income (loss) per share,

basic and diluted

$

(0.02

)

$

(0.05

)

$

(0.17

)

Weighted average shares to compute net

loss per common share, basic and diluted

18,747

18,056

17,137

EVERSPIN TECHNOLOGIES,

INC.

Reconciliation of Adjusted

EBITDA

(In thousands)

(Unaudited)

Three Months Ended

Jun 30, 2020

Mar 31, 2020

Jun 30, 2019

Adjusted EBITDA reconciliation:

Net loss

$

(1,294

)

$

(1,732

)

$

(3,670

)

Depreciation and amortization

404

409

483

Stock-based compensation expense

918

805

798

Interest Expense

172

172

186

Adjusted EBITDA

$

200

$

(346

)

$

(2,203

)

Our management and board of directors use

Non-GAAP operating expenses, Non-GAAP net income (loss) and

Adjusted EBITDA to understand and evaluate our operating

performance and trends, to prepare and approve our annual budget

and to develop short-term and long-term operating and financing

plans.

EVERSPIN TECHNOLOGIES,

INC.

Condensed Statement of Cash

Flows

(In thousands)

(Unaudited)

Six Months Ended June

30,

2020

2019

Cash flows from operating

activities

Net loss

$

(3,026

)

$

(7,926

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

813

876

Loss on disposal of property and

equipment

—

20

Stock-based compensation

1,723

1,502

Non-cash gain on warrant revaluation

7

—

Non-cash interest expense

147

153

Changes in operating assets and

liabilities:

Accounts receivable

(1,540

)

1,658

Inventory

(505

)

133

Prepaid expenses and other current

assets

38

200

Accounts payable

(776

)

(456

)

Accrued liabilities

(1,008

)

(907

)

Lease liabilities

(73

)

(43

)

Net cash used in operating activities

(4,200

)

(4,790

)

Cash flows from investing

activities

Purchases of property and equipment

(277

)

(461

)

Net cash used in investing activities

(277

)

(461

)

Cash flows from financing

activities

Payments on debt

—

(3,000

)

Payments on finance lease obligation

(5

)

(5

)

Proceeds from exercise of stock options

and purchase of shares in employee stock purchase plan

827

150

Proceeds from issuance of common stock in

at-the-market offering, net of issuance costs

2,084

—

Net cash provided by (used in) financing

activities

2,906

(2,855

)

Net decrease in cash and cash

equivalents

(1,571

)

(8,106

)

Cash and cash equivalents at beginning of

period

14,487

23,379

Cash and cash equivalents at end of

period

$

12,916

$

15,273

Supplementary cash flow

information:

Interest paid

$

197

$

257

Operating cash flows paid for operating

leases

$

862

$

837

Financing cash flows paid for finance

leases

$

5

$

5

Non-cash investing and financing

activities:

Right-of-use assets obtained in exchange

for new operating leases

$

—

$

23

Increase of right-of-use asset and lease

liability due to lease modification

$

545

$

—

Purchase of property and equipment in

accounts payable and accrued liabilities

$

22

$

27

Bonus settled in shares of common

stock

$

315

$

—

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200806006014/en/

Company Contact: Daniel Berenbaum, CFO T: 480-347-1099 E:

daniel.berenbaum@everspin.com

Investor Relations Contact: Leanne K. Sievers, President

Shelton Group Investor Relations T: 949-224-3874 E:

sheltonir@sheltongroup.com

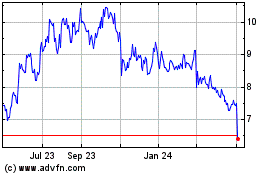

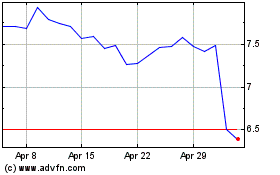

Everspin Technologies (NASDAQ:MRAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Everspin Technologies (NASDAQ:MRAM)

Historical Stock Chart

From Apr 2023 to Apr 2024