0001370637false12/3100013706372024-06-132024-06-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

FORM 8-K

_____________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 13, 2024

ETSY, INC.

(Exact name of registrant as specified in its charter)

_____________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-36911 | | 20-4898921 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

117 Adams Street

Brooklyn, New York 11201

(Address of principal executive offices, including zip code)

(718) 880-3660

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_____________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | ETSY | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. □

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As further described in Item 5.07 of this Current Report on Form 8-K (this “Report”), at the 2024 Annual Meeting of Stockholders of Etsy, Inc. (“Etsy”) held on June 13, 2024 (the “Annual Meeting”), Etsy’s stockholders, upon recommendation of the Board of Directors of Etsy (the "Board of Directors"), approved Etsy’s 2024 Equity Incentive Plan (the “Plan”).

A description of the Plan is set forth in Etsy’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on April 22, 2024 in the section entitled “Proposal 4: Approval of 2024 Equity Incentive Plan,” which description is incorporated herein by reference. The description is qualified in its entirety by reference to the full text of the Plan, a copy of which is filed as Exhibit 10.1 to this Report and incorporated herein by reference.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On June 13, 2024, the Board of Directors approved the filing of a Certificate of Change of Registered Agent and/or Registered Office (the “Certificate of Change”) with the Secretary of State of the State of Delaware to change Etsy’s registered agent to United Agent Group Inc. and its registered office to 1521 Concord Pike, Suite 201, Wilmington, New Castle County, Delaware 19803. A copy of the Certificate of Change is attached as Exhibit 3.1 to this Report and is incorporated herein by reference.

Item 5.07. Submission of Matters to a Vote of Security Holders.

The following is a description of each proposal that stockholders voted on at the Annual Meeting, as well as the number of votes cast.

| | |

| Proposal 1 - Election of Directors |

Each of the Class III director nominees to the Board of Directors was elected to serve until Etsy's 2027 Annual Meeting of Stockholders and until his or her successor has been elected and qualified or until he or she resigns, dies, or is removed from the Board of Directors.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director Name | | Votes For | | Votes Against | | Abstentions | | Broker Non-Votes |

| Marla Blow | | 68,317,493 | | 17,214,264 | | 39,856 | | 12,723,292 |

| Gary S. Briggs | | 68,008,627 | | 17,518,540 | | 44,446 | | 12,723,292 |

| Melissa Reiff | | 66,203,328 | | 19,328,150 | | 40,135 | | 12,723,292 |

| | |

| Proposal 2 - Advisory Vote on Named Executive Officer Compensation |

Stockholders approved, on an advisory basis, the compensation of Etsy's named executive officers.

| | | | | | | | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstentions | | Broker Non-Votes |

| 50,582,890 | | 34,881,064 | | 107,659 | | 12,723,292 |

| | |

| Proposal 3 - Ratification of the Appointment of Independent Registered Public Accounting Firm |

Stockholders ratified the appointment of PricewaterhouseCoopers LLP as Etsy’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

| | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstentions |

| 96,960,953 | | 1,260,787 | | 73,165 |

| | |

| Proposal 4 - Vote to approve our 2024 Equity Incentive Plan |

Stockholders approved Etsy's 2024 Equity Incentive Plan.

| | | | | | | | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstentions | | Broker Non-Votes |

| 53,575,118 | | 31,918,221 | | 78,274 | | 12,723,292 |

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

ETSY, INC.

By: /s/ Colin Stretch

Colin Stretch

Chief Legal Officer

Dated: June 18, 2024

STATE OF DELAWARE

CERTIFICATE OF CHANGE OF REGISTERED AGENT

AND/OR REGISTERED OFFICE

The corporation organized and existing under the General Corporation Law of the State of Delaware, hereby certifies as follows:

1. The name of the corporation is Etsy, Inc.

2. The Registered Office of the corporation in the State of Delaware is changed to 1521 Concord Pike, Suite 201, in the City of Wilmington, County of New Castle Zip Code 19803. The name of the Registered Agent as such address upon whom process against this Corporation may be served is United Agent Group Inc.

3. The foregoing change to the registered office/agent was adopted by a resolution of the Board of Directors of the corporation.

By: /s/ Lynn Horwitz

Authorized Officer

Name: Lynn Horwitz

Print or Type

ETSY, INC.

2024 EQUITY INCENTIVE PLAN

(As Amended and Restated Effective June 13, 2024)

ETSY, INC.

2024 EQUITY INCENTIVE PLAN

ARTICLE 1. INTRODUCTION.

The Plan was originally effective as of the Original Effective Date and is hereby amended and restated effective as of the Stockholder Approval Date. The purpose of the Plan is to promote the long-term success of the Company and the creation of stockholder value by (a) linking Service Providers’ interests directly to stockholder interests through increased stock ownership; (b) attracting, motivating, and retaining key Service Providers; and (c) encouraging Service Providers to focus on long-range corporate objectives. The Plan seeks to achieve this purpose by providing for Awards in the form of Options (which may constitute ISOs or NSOs), SARs, Restricted Shares, Stock Units, and Performance Cash Awards.

ARTICLE 2. ADMINISTRATION.

2.1 General. The Plan will be administered by the Board or the Compensation Committee (the “Committee”), to the extent the Board delegates such authority to the Committee.

2.2 Section 16. To the extent desirable to qualify transactions hereunder as exempt under Exchange Act Rule 16b-3, such transactions will be approved by the entire Board or a committee of two or more “non-employee directors” within the meaning of Exchange Act Rule 16b-3.

2.3 Powers of Administrator. Subject to the terms of the Plan, the Administrator shall have the authority to (a) select the Service Providers who are to receive Awards under the Plan; (b) determine the type, number, vesting requirements, and other features and conditions of such Awards; (c) determine whether and to what extent any Performance Goals have been attained; (d) interpret the Plan and Awards granted under the Plan; (e) make, amend, and rescind rules relating to the Plan and Awards granted under the Plan, including rules relating to sub-plans established for the purposes of satisfying applicable foreign laws or for qualifying for favorable tax treatment under applicable foreign laws; (f) impose such restrictions, conditions, or limitations as it determines appropriate as to the timing and manner of any resales by a Participant of any Common Shares issued pursuant to an Award, including restrictions under an insider trading policy and restrictions as to the use of a specified brokerage firm for such resales; and (g) make all other decisions relating to the operation of the Plan and Awards granted under the Plan.

2.4 Delegation to Other Person or Body. The Board or the Committee may delegate to one or more persons or bodies the authority to do one or more of the following to the extent permitted by applicable law: (i) designate recipients, other than Executive Officers, of Awards, provided that no person or body may be delegated authority to grant an Award to themselves; (ii) determine the number of Common Shares subject to such Awards; and (iii) determine the terms of such Awards; provided, however, that the Board or Committee action regarding such delegation will fix the terms of such delegation in accordance with applicable law, including without limitation Sections 152 and 157 of the Delaware General Corporation Law. Unless provided otherwise in the Board or Committee action regarding such delegation, each Award granted pursuant to this section will be granted on the applicable form of Award Agreement most recently approved for use by the Board or the Committee, with any modifications necessary to incorporate or reflect the terms of such Award. Notwithstanding anything to the contrary herein, neither the Board nor any Committee may delegate to any person or body (who is not a Non-Employee Director or that is not comprised solely of Non-Employee Directors, respectively) the authority to determine the Fair Market Value of the Common Shares.

2.5 Effect of Administrator’s Decisions. The Administrator’s decisions, determinations and interpretations shall be final and binding on all Participants and any other holders of Awards.

2.6 Governing Law. The Plan shall be governed by, and construed in accordance with, the laws of the State of Delaware (except its choice-of-law provisions).

ARTICLE 3. SHARES AVAILABLE FOR GRANTS.

3.1 Basic Limitation. Common Shares issued pursuant to the Plan may be authorized but unissued shares or treasury shares. The aggregate number of Common Shares reserved for grant and issuance under the Plan (the “Share Reserve”) is equal to the sum of (i) 8,000,000 Common Shares, plus (ii) the Prior Plans’ Returning Shares, as such shares become available from time to time, provided that in no event shall the Share Reserve exceed 20,182,314 Common Shares (which is the sum of (x) the 8,000,000 Common Shares set forth above, plus (y) the aggregate number of Common Shares that, as of March 31, 2024, are subject to (1) outstanding awards granted under the 2006 Plan, or (2) outstanding Awards granted under the Plan). This Article 3.1 does not limit the granting of Awards and, for clarity, the Share Reserve is a limit on the number of Common Shares that may be issued pursuant to the Plan. The numerical limitations in this Article 3.1 shall be subject to adjustment pursuant to Article 9. For the avoidance of doubt, subject to the other provisions of this Article 3, Common Shares issued pursuant to Awards under the Plan granted from April 1, 2024 through the Stockholder Approval Date shall reduce the number of Common Shares that may be issued under the Plan, as amended and restated hereby.

3.2 Shares Returned to Reserve. To the extent that Options, SARs, or Stock Units are forfeited or expire for any other reason before being exercised or settled in full, the Common Shares subject to such Options, SARs, or Stock Units shall again become available for issuance under the Plan. If SARs are exercised or Stock Units are settled, then only the number of Common Shares (if any) actually issued to the Participant upon exercise of such SARs or settlement of such Stock Units, as applicable, shall reduce the number available under Article 3.1 and the balance shall again become available for issuance under the Plan. If Restricted Shares or Common Shares issued upon the exercise of Options are reacquired by the Company pursuant to a forfeiture provision, repurchase right, or for any other reason, then such Common Shares shall again become available for issuance under the Plan. Common Shares applied to pay the Exercise Price of Options or to satisfy tax withholding obligations related to any Award shall again become available for issuance under the Plan. To the extent that an Award is settled in cash rather than Common Shares, the cash settlement shall not reduce the number of Shares available for issuance under the Plan.

3.3 Awards Not Reducing Share Reserve in Article 3.1. Any dividend equivalents paid or credited under the Plan with respect to Stock Units shall not be applied against the number of Common Shares that may be issued under the Plan, whether or not such dividend equivalents are converted into Stock Units. In addition, Common Shares subject to Substitute Awards granted by the Company shall not reduce the number of Common Shares that may be issued under Article 3.1, nor shall shares subject to Substitute Awards again be available for Awards under the Plan in the event of any forfeiture, expiration or cash settlement of such Substitute Awards.

3.4 Code Section 422 Limit. Subject to adjustment in accordance with Article 9, no more than 20,182,314 Common Shares may be issued under the Plan upon the exercise of ISOs.

ARTICLE 4. ELIGIBILITY AND LIMITATIONS.

4.1 Incentive Stock Options. Only Employees who are common-law employees of the Company, a Parent or a Subsidiary shall be eligible for the grant of ISOs. In addition, an Employee who owns more than 10% of the total combined voting power of all classes of outstanding stock of the Company or any of its Parents or Subsidiaries

shall not be eligible for the grant of an ISO unless the additional requirements set forth in Code Section 422(c)(5) are satisfied.

4.2 Other Awards. Awards other than ISOs may only be granted to Service Providers.

4.3 Non-Employee Director Compensation Limit. The aggregate value of all compensation granted or paid, as applicable, to any individual for service as a Non-Employee Director with respect to any fiscal year, including Awards granted and cash fees paid by the Company to such Non-Employee Director for his or her service as a Non-Employee Director, will not exceed (i) $750,000 in total value or (ii) in the event such Non-Employee Director is first appointed or elected to the Board during such fiscal year, $1,000,000 in total value, in each case calculating the value of any equity awards based on the grant date fair value of such equity awards for financial reporting purposes.

ARTICLE 5. OPTIONS.

5.1 Stock Option Agreement. Each grant of an Option under the Plan shall be evidenced by a Stock Option Agreement between the Optionee and the Company. Such Option shall be subject to all applicable terms of the Plan and may be subject to any other terms that are not inconsistent with the Plan. The Stock Option Agreement shall specify whether the Option is intended to be an ISO or an NSO. The provisions of the various Stock Option Agreements entered into under the Plan need not be identical.

5.2 Number of Shares. Each Stock Option Agreement shall specify the number of Common Shares subject to the Option, which number shall adjust in accordance with Article 9.

5.3 Exercise Price. Each Stock Option Agreement shall specify the Exercise Price, which shall not be less than 100% of the Fair Market Value of a Common Share on the date of grant. The preceding sentence shall not apply to an Option that is a Substitute Award granted in a manner that would satisfy the requirements of Code Section 409A and, if applicable, Code Section 424(a).

5.4 Exercisability and Term. Each Stock Option Agreement shall specify the date or event when all or any installment of the Option is to become vested and/or exercisable. The Stock Option Agreement shall also specify the term of the Option; provided that, except to the extent necessary to comply with applicable foreign law, the term of an Option shall in no event exceed 10 years from the date of grant. A Stock Option Agreement may provide for accelerated vesting and/or exercisability upon certain specified events and may provide for expiration prior to the end of its term in the event of the termination of the Optionee’s Service.

5.5 Death of Optionee. After an Optionee’s death, any vested and exercisable Options held by such Optionee may be exercised by his or her beneficiary or beneficiaries. Each Optionee may designate one or more beneficiaries for this purpose by filing the prescribed form with the Company. A beneficiary designation may be changed by filing the prescribed form with the Company at any time before the Optionee’s death. If no beneficiary was designated or if no designated beneficiary survives the Optionee, then any vested and exercisable Options held by the Optionee may be exercised by his or her estate.

5.6 No Repricing of Options. The Administrator shall not have the authority to (i) reduce the Exercise Price of any outstanding Option or (ii) cancel any outstanding Option that has an Exercise Price (per share) greater than the then-current Fair Market Value of a Common Share in exchange for cash or other Awards under the Plan, unless the stockholders of the Company have approved such an action within 12 months prior to such an event. The foregoing notwithstanding, no modification of an Option shall, without the consent of the Optionee, impair his or her rights or obligations under such Option.

5.7 Payment for Option Shares. The entire Exercise Price of Common Shares issued upon exercise of Options shall be payable in cash or cash equivalents at the time when such Common Shares are purchased. In addition, the Administrator may, in its sole discretion and to the extent permitted by applicable law, accept payment of all or a portion of the Exercise Price through any one or a combination of the following forms or methods:

(a)Subject to any conditions or limitations established by the Administrator, by surrendering, or attesting to the ownership of, Common Shares that are already owned by the Optionee with a Fair Market Value on the date of surrender equal to the aggregate exercise price of the Common Shares as to which such Option will be exercised;

(b)By delivering (on a form prescribed by the Company) an irrevocable direction to a securities broker approved by the Company to sell all or part of the Common Shares being purchased under the Plan and to deliver all or part of the sales proceeds to the Company;

(c)Subject to such conditions and requirements as the Administrator may impose from time to time, through a net exercise procedure; or

(d)Through any other form or method consistent with applicable laws, regulations, and rules.

ARTICLE 6. STOCK APPRECIATION RIGHTS.

6.1 SAR Agreement. Each grant of a SAR under the Plan shall be evidenced by a SAR Agreement between the Optionee and the Company. Such SAR shall be subject to all applicable terms of the Plan and may be subject to any other terms that are not inconsistent with the Plan. The provisions of the various SAR Agreements entered into under the Plan need not be identical.

6.2 Number of Shares. Each SAR Agreement shall specify the number of Common Shares to which the SAR pertains, which number shall adjust in accordance with Article 9.

6.3 Exercise Price. Each SAR Agreement shall specify the Exercise Price, which shall in no event be less than 100% of the Fair Market Value of a Common Share on the date of grant. The preceding sentence shall not apply to a SAR that is a Substitute Award granted in a manner that would satisfy the requirements of Code Section 409A.

6.4 Exercisability and Term. Each SAR Agreement shall specify the date when all or any installment of the SAR is to become vested and exercisable. The SAR Agreement shall also specify the term of the SAR; provided that except to the extent necessary to comply with applicable foreign law, the term of a SAR shall not exceed 10 years from the date of grant. A SAR Agreement may provide for accelerated vesting and exercisability upon certain specified events and may provide for expiration prior to the end of its term in the event of the termination of the Optionee’s Service.

6.5 Exercise of SARs. Upon exercise of a SAR, the Optionee (or any person having the right to exercise the SAR after his or her death) shall receive from the Company (a) Common Shares, (b) cash or (c) a combination of Common Shares and cash, as the Administrator shall determine. The amount of cash and/or the Fair Market Value of Common Shares received upon exercise of SARs shall, in the aggregate, not exceed the amount by which the Fair Market Value (on the date of surrender) of the Common Shares subject to the SARs exceeds the Exercise Price. If, on the date when a SAR expires, the Exercise Price is less than the Fair Market Value on such date but any portion of such SAR has not been exercised or surrendered, then such SAR shall automatically be deemed to be exercised as

of such date with respect to such portion. A SAR Agreement may also provide for an automatic exercise of the SAR on an earlier date.

6.6 Death of Optionee. After an Optionee’s death, any vested and exercisable SARs held by such Optionee may be exercised by his or her beneficiary or beneficiaries. Each Optionee may designate one or more beneficiaries for this purpose by filing the prescribed form with the Company. A beneficiary designation may be changed by filing the prescribed form with the Company at any time before the Optionee’s death. If no beneficiary was designated or if no designated beneficiary survives the Optionee, then any vested and exercisable SARs held by the Optionee at the time of his or her death may be exercised by his or her estate.

6.7 No Repricing of SARs. The Administrator shall not have the authority to (i) reduce the Exercise Price of any outstanding SAR or (ii) cancel any outstanding SAR that has an Exercise Price (per share) greater than the then-current Fair Market Value of a Common Share in exchange for cash or other Awards under the Plan, unless the stockholders of the Company have approved such an action within 12 months prior to such an event. The foregoing notwithstanding, no modification of a SAR shall, without the consent of the Optionee, impair his or her rights or obligations under such SAR.

ARTICLE 7. RESTRICTED SHARES.

7.1 Restricted Stock Agreement. Each grant of Restricted Shares under the Plan shall be evidenced by a Restricted Stock Agreement between the recipient and the Company. Such Restricted Shares shall be subject to all applicable terms of the Plan and may be subject to any other terms that are not inconsistent with the Plan. The provisions of the various Restricted Stock Agreements entered into under the Plan need not be identical.

7.2 Payment for Awards. Restricted Shares may be sold or awarded under the Plan for such consideration as the Administrator may determine, including (without limitation) cash, cash equivalents, property, cancellation of other equity awards, full-recourse promissory notes, past services and future services, and such other methods of payment as are permitted by applicable law.

7.3 Vesting Conditions. Each Award of Restricted Shares may or may not be subject to vesting and/or other conditions as the Administrator may determine. Vesting shall occur, in full or in installments, upon satisfaction of the conditions specified in the Restricted Stock Agreement. Such conditions, at the Administrator’s discretion, may include one or more Performance Goals. A Restricted Stock Agreement may provide for accelerated vesting upon certain specified events.

7.4 Voting and Dividend Rights. The holders of Restricted Shares awarded under the Plan shall have the same voting, dividend, and other rights as the Company’s other stockholders, unless the Administrator otherwise provides. A Restricted Stock Agreement, however, may require that any cash dividends paid on Restricted Shares (a) be accumulated and paid when such Restricted Shares vest, or (b) be invested in additional Restricted Shares. Such additional Restricted Shares shall be subject to the same conditions and restrictions as the shares subject to the Stock Award with respect to which the dividends were paid. In addition, unless the Administrator provides otherwise, if any dividends or other distributions are paid in Common Shares, such Common Shares shall be subject to the same restrictions on transferability and forfeitability as the Restricted Shares with respect to which they were paid.

ARTICLE 8. STOCK UNITS.

8.1 Stock Unit Agreement. Each grant of Stock Units under the Plan shall be evidenced by a Stock Unit Agreement between the recipient and the Company. Such Stock Units shall be subject to all applicable terms of the

Plan and may be subject to any other terms that are not inconsistent with the Plan. The provisions of the various Stock Unit Agreements entered into under the Plan need not be identical.

8.2 Payment for Awards. To the extent that an Award is granted in the form of Stock Units, no cash consideration shall be required of the Award recipients.

8.3 Vesting Conditions. Each Award of Stock Units may or may not be subject to vesting, as determined by the Administrator. Vesting shall occur, in full or in installments, upon satisfaction of the conditions specified in the Stock Unit Agreement. Such conditions, at the Administrator’s discretion, may include one or more Performance Goals. A Stock Unit Agreement may provide for accelerated vesting upon certain specified events.

8.4 Voting and Dividend Rights. The holders of Stock Units shall have no voting rights. Prior to settlement or forfeiture, Stock Units awarded under the Plan may, at the Administrator’s discretion, provide for a right to dividend equivalents. Such right entitles the holder to be credited with an amount equal to all cash dividends paid on one Common Share while the Stock Unit is outstanding. Dividend equivalents may be converted into additional Stock Units. Settlement of dividend equivalents may be made in the form of cash, in the form of Common Shares, or in a combination of both. Prior to distribution, any dividend equivalents shall be subject to the same conditions and restrictions as the Stock Units to which they attach.

8.5 Form and Time of Settlement of Stock Units. Settlement of vested Stock Units may be made in the form of (a) cash, (b) Common Shares, or (c) any combination of both, as determined by the Administrator. The actual number of Stock Units eligible for settlement may be larger or smaller than the number included in the original Award, based on predetermined performance factors, including Performance Goals. Methods of converting Stock Units into cash may include (without limitation) a method based on the average Fair Market Value of Common Shares over a series of trading days. Vested Stock Units shall be settled in such manner and at such time(s) as specified in the Stock Unit Agreement. Until an Award of Stock Units is settled, the number of such Stock Units shall be subject to adjustment pursuant to Article 9.

8.6 Death of Recipient. Any Stock Units that become payable after the recipient’s death shall be distributed to the recipient’s beneficiary or beneficiaries. Each recipient of Stock Units under the Plan may designate one or more beneficiaries for this purpose by filing the prescribed form with the Company. A beneficiary designation may be changed by filing the prescribed form with the Company at any time before the Award recipient’s death. If no beneficiary was designated or if no designated beneficiary survives the Award recipient, then any Stock Units that become payable after the recipient’s death shall be distributed to the recipient’s estate.

8.7 Modification or Assumption of Stock Units. Within the limitations of the Plan, the Administrator may modify or assume outstanding stock units or may accept the cancellation of outstanding stock units (whether granted by the Company or by another issuer) in return for the grant of new Stock Units for the same or a different number of shares or in return for the grant of a different type of Award. The foregoing notwithstanding, no modification of a Stock Unit shall, without the consent of the Participant, impair his or her rights or obligations under such Stock Unit.

8.8 Creditors’ Rights. A holder of Stock Units shall have no rights other than those of a general creditor of the Company. Stock Units represent an unfunded and unsecured obligation of the Company, subject to the terms and conditions of the applicable Stock Unit Agreement.

ARTICLE 9. ADJUSTMENTS; DISSOLUTIONS AND LIQUIDATIONS; CORPORATE TRANSACTIONS.

9.1 Adjustments. In the event of a subdivision of the outstanding Common Shares, a declaration of a dividend payable in Common Shares, a combination or consolidation of the outstanding Common Shares (by reclassification or otherwise) into a lesser number of Common Shares or any other increase or decrease in the number of issued Common Shares effected without receipt of consideration by the Company, proportionate adjustments shall automatically be made to the following:

(a)The number and kind of shares available for issuance under Article 3, including the numerical share limits in Articles 3.1 and 3.4;

(b)The number and kind of shares covered by each outstanding Option, SAR, and Stock Unit; or

(c)The Exercise Price applicable to each outstanding Option and SAR, and the repurchase price, if any, applicable to Restricted Shares.

In the event of a declaration of an extraordinary dividend payable in a form other than Common Shares in an amount that has a material effect on the price of Common Shares, a recapitalization, a spin-off, or a similar occurrence, the Administrator may make such adjustments as it, in its sole discretion, deems appropriate to the foregoing. Any adjustment in the number of shares subject to an Award under this Article 9.1 shall be rounded down to the nearest whole share, although the Administrator in its sole discretion may make a cash payment in lieu of a fractional share. Except as provided in this Article 9, a Participant shall have no rights by reason of any issuance by the Company of stock of any class or securities convertible into stock of any class, any subdivision or consolidation of shares of stock of any class, the payment of any stock dividend, or any other increase or decrease in the number of shares of stock of any class.

9.2 Dissolution or Liquidation. To the extent not previously exercised or settled, Options, SARs, and Stock Units shall terminate immediately prior to the dissolution or liquidation of the Company.

9.3 Corporate Transactions. Unless otherwise provided in an Award Agreement or unless otherwise expressly provided by the Administrator at the time of grant of an Award, the following provisions will apply to Awards in the event of a merger, consolidation, or a Change in Control (other than one described in Article 14.8(d)) (a “Corporate Transaction”):

(a)In the event of a Corporate Transaction, any surviving corporation or acquiring corporation (or the surviving or acquiring corporation’s parent company) may assume or continue any or all Awards outstanding under the Plan or may substitute similar awards for Awards outstanding under the Plan (including but not limited to, awards to acquire the same consideration paid to the stockholders of the Company pursuant to the Corporate Transaction), and any reacquisition or repurchase rights held by the Company in respect of Common Stock issued pursuant to Awards may be assigned by the Company to the successor of the Company (or the successor’s parent company, if any), in connection with such Corporate Transaction. A surviving corporation or acquiring corporation (or its parent) may choose to assume or continue only a portion of an Award or substitute a similar award for only a portion of an Award, or may choose to assume or continue the Awards held by some, but not all Participants. The terms of any assumption, continuation, or substitution will be set by the Administrator; provided, that, if within three (3) months before and twelve (12) months following such Corporate Transaction, the Participant’s Service with the Company is terminated by the surviving corporation or acquiring corporation without Cause or by the Participant for Good Reason, such Award, to the extent then outstanding, shall become fully vested and exercisable upon such termination of Service. For purposes hereof, “Good Reason” has, with respect to a Participant, to the extent applicable, the meaning ascribed to such term in

any written agreement between the Participant and the Company defining such term, or, in the Executive Severance Plan if the Participant is a participant in the Executive Severance Plan.

(b)In the event of a Corporate Transaction in which the surviving corporation or acquiring corporation (or its parent company) does not assume or continue such outstanding Awards or substitute similar awards for such outstanding Awards, then with respect to Awards that have not been assumed, continued, or substituted and that are held by Participants whose Service has not terminated prior to the effective time of the Corporate Transaction (referred to as the “Current Participants”), the vesting of such Awards (and, with respect to Options and SARs, the time when such Awards may be exercised) will be accelerated in full to a date prior to the effective time of such Corporate Transaction (contingent upon the effectiveness of the Corporate Transaction) as the Administrator determines (or, if the Administrator does not determine such a date, to the date that is five days prior to the effective time of the Corporate Transaction), and such Awards will terminate if not exercised (if applicable) at or prior to the effective time of the Corporate Transaction, and any reacquisition or repurchase rights held by the Company with respect to such Awards will lapse (contingent upon the effectiveness of the Corporate Transaction). Unless otherwise provided in the applicable Award Agreement, with respect to the vesting of performance-based Awards that will accelerate upon the occurrence of a Corporate Transaction pursuant to this subsection (b) and that have multiple vesting levels depending on the level of performance, the vesting of such performance-based Awards will accelerate at 100% of the target level upon the occurrence of the Corporate Transaction. With respect to the vesting of Awards that will accelerate upon the occurrence of a Corporate Transaction pursuant to this subsection (b) and are settled in the form of a cash payment, such cash payment will be made no later than 30 days following the occurrence of the Corporate Transaction or such later date as required to comply with Code Section 409A.

(c)In the event of a Corporate Transaction in which the surviving corporation or acquiring corporation (or its parent company) does not assume or continue such outstanding Awards or substitute similar awards for such outstanding Awards, then with respect to Awards that have not been assumed, continued, or substituted and that are held by persons other than Current Participants, such Awards will terminate if not exercised (if applicable) prior to the occurrence of the Corporate Transaction; provided, however, that any reacquisition or repurchase rights held by the Company with respect to such Awards will not terminate and may continue to be exercised notwithstanding the Corporate Transaction.

(d)Notwithstanding the foregoing, any or all Awards may be cancelled in exchange for a payment to the Participant with respect to each share subject to the portion of the Award that is vested or becomes vested as of the effective time of the transaction equal to the excess of (A) the value, as determined by the Administrator in its absolute discretion, of the property (including cash) received by the holder of a Common Share as a result of the transaction, over (if applicable) (B) the per-share Exercise Price of such Award (such excess, if any, the “Spread”). Such payment shall be made in the form of cash, cash equivalents, or securities of the surviving entity or its parent having a value equal to the Spread. In addition, any escrow, holdback, earn-out, or similar provisions in the transaction agreement may apply to such payment to the same extent and in the same manner as such provisions apply to the holders of Common Shares, but only to the extent the application of such provisions does not adversely affect the status of the Award as exempt from Code Section 409A. If the Spread applicable to an Award (whether or not vested) is zero or a negative number, then the Award may be cancelled without making a payment to the Participant. In the event that a Stock Unit is subject to Code Section 409A, the payment described in this

clause (d) shall be made on the settlement date specified in the applicable Stock Unit Agreement, provided that settlement may be accelerated in accordance with Treasury Regulation Section 1.409A-3(j)(4).

Any action taken under this Article 9.3 shall either preserve an Award’s status as exempt from Code Section 409A or comply with Code Section 409A.

ARTICLE 10. OTHER AWARDS.

10.1 Performance Cash Awards. A Performance Cash Award is a cash award that may be granted subject to the attainment of specified Performance Goals during a Performance Period. A Performance Cash Award may also require the completion of a specified period of continuous Service. The length of the Performance Period, the Performance Goals to be attained during the Performance Period, and the degree to which the Performance Goals have been attained shall be determined conclusively by the Administrator. Each Performance Cash Award shall be set forth in a written agreement or in a resolution duly adopted by the Administrator which shall contain provisions determined by the Administrator and not inconsistent with the Plan. The terms of various Performance Cash Awards need not be identical.

10.2 Awards Under Other Plans. The Company may grant awards under other plans or programs. To the extent so designated by the Administrator, such awards may be settled in the form of Common Shares issued under this Plan, in which case, such Common Shares shall be treated for all purposes under the Plan like Common Shares issued in settlement of Stock Units and shall, when issued, reduce the number of Common Shares available under Article 3.

ARTICLE 11. LIMITATION ON RIGHTS.

11.1 Retention Rights. Neither the Plan nor any Award granted under the Plan shall be deemed to give any individual a right to remain a Service Provider. The Company and its Parents, Subsidiaries, and Affiliates reserve the right to terminate the Service of any Service Provider at any time, with or without Cause, subject to applicable laws, the Company’s certificate of incorporation and by-laws and a written employment agreement (if any).

11.2 Stockholders’ Rights. Except as set forth in Article 7.4 or 8.4 above, a Participant shall have no dividend rights, voting rights, or other rights as a stockholder with respect to any Common Shares covered by his or her Award prior to the time when a stock certificate for such Common Shares is issued or, if applicable, the time when he or she becomes entitled to receive such Common Shares by filing any required notice of exercise and paying any required Exercise Price. No adjustment shall be made for cash dividends or other rights for which the record date is prior to such time, except as expressly provided in the Plan.

11.3 Regulatory Requirements. Any other provision of the Plan notwithstanding, the obligation of the Company to issue Common Shares under the Plan shall be subject to all applicable laws, rules, and regulations and such approval by any regulatory body as may be required. The Company reserves the right to restrict, in whole or in part, the delivery of Common Shares pursuant to any Award prior to the satisfaction of all legal requirements relating to the issuance of such Common Shares, to their registration, qualification, or listing, or to an exemption from registration, qualification, or listing. The inability of the Company to obtain authority from any regulatory body having jurisdiction, which authority is deemed by the Company’s counsel to be necessary to the lawful issuance and sale of any Common Shares hereunder, will relieve the Company of any liability in respect of the failure to issue or sell such Common Shares as to which such requisite authority will not have been obtained.

11.4 Transferability of Awards. The Administrator may, in its sole discretion, permit transfer of an Award in a manner consistent with applicable law. Unless otherwise determined by the Administrator, Awards shall be transferable by a Participant only by (a) beneficiary designation, (b) a will, or (c) the laws of descent and distribution; provided that, in any event, an ISO may only be transferred by will or by the laws of descent and distribution and may be exercised during the lifetime of the Optionee only by the Optionee or by the Optionee’s guardian or legal representative.

11.5 Other Conditions and Restrictions on Common Shares. Any Common Shares issued under the Plan shall be subject to such forfeiture conditions, rights of repurchase, rights of first refusal, other transfer restrictions, and such other terms and conditions as the Administrator may determine. Such conditions and restrictions shall be set forth in the applicable Award Agreement and shall apply in addition to any restrictions that may apply to holders of Common Shares generally. In addition, Common Shares issued under the Plan shall be subject to such conditions and restrictions imposed either by applicable law or by Company policy, as adopted from time to time, designed to ensure compliance with applicable law or laws with which the Company determines in its sole discretion to comply including in order to maintain any statutory, regulatory or tax advantage.

11.6 Clawback. All Awards granted under the Plan will be subject to recoupment in accordance with any clawback policy that the Company has or is required to adopt pursuant to the listing standards of any national securities exchange or association on which the Company’s securities are listed or as is otherwise required by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other applicable law and any clawback policy that the Company otherwise has adopted or adopts, to the extent applicable and permissible under applicable law. In addition, the Administrator may impose such other clawback, recovery, or recoupment provisions in an Award Agreement as the Administrator determines necessary or appropriate, including, but not limited to, a reacquisition right in respect of previously acquired Common Shares or other cash or property upon the occurrence of Cause. No recovery of compensation under such a clawback policy will be an event giving rise to a Participant’s right to voluntarily terminate employment upon a “resignation for good reason,” or for a “constructive termination” or any similar term under any plan of or agreement with the Company.

ARTICLE 12. TAXES.

12.1 General. It is a condition to each Award under the Plan that a Participant or his or her successor shall make arrangements satisfactory to the Company for the satisfaction of any federal, state, local, or foreign withholding tax obligations that arise in connection with any Award granted under the Plan. The Company shall not be required to issue any Common Shares or make any cash payment under the Plan unless such obligations are satisfied.

12.2 Share Withholding. To the extent that applicable law subjects a Participant to tax withholding obligations, the Administrator may, in its sole discretion, satisfy any withholding obligation relating to an Award by any of the following means or by a combination of such means: (i) causing the Participant to tender a cash payment; (ii) withholding Common Shares from the Common Shares issued or otherwise issuable to the Participant in connection with the Award (provided that for tax purposes, the Participant will be deemed to have been issued the full number of shares subject to the Award, notwithstanding that a number of the shares is held back solely for the purpose of paying the withholding obligations); (iii) withholding cash from an Award settled in cash; (iv) withholding payment from any amounts otherwise payable to the Participant; (v) by allowing the Participant to effectuate a “cashless exercise” pursuant to a program developed under Regulation T as promulgated by the Federal Reserve Board; or (vi) any other method determined by the Administrator. The Company and/or its Affiliate may withhold or account for withholding obligations by considering statutory or other withholding rates, including minimum or maximum rates applicable in a Participant’s jurisdiction. Such Common Shares shall be valued on the

date when they are withheld or surrendered. Any payment of taxes by assigning Common Shares to the Company may be subject to restrictions including any restrictions required by SEC, accounting or other rules.

12.3 Section 409A Matters. Except as otherwise expressly set forth in an Award Agreement, it is intended that Awards granted under the Plan either be exempt from, or comply with, the requirements of Code Section 409A. To the extent an Award is subject to Code Section 409A (a “409A Award”), the terms of the Plan, the Award and any written agreement governing the Award shall be interpreted to comply with the requirements of Code Section 409A so that the Award is not subject to additional tax or interest under Code Section 409A, unless the Administrator expressly provides otherwise. A 409A Award shall be subject to such additional rules and requirements as specified by the Administrator from time to time in order for it to comply with the requirements of Code Section 409A. In this regard, if any amount under a 409A Award is payable upon a “separation from service” to an individual who is considered a “specified employee” (as each term is defined under Code Section 409A), then no such payment shall be made prior to the date that is the earlier of (i) six months and one day after the Participant’s separation from service or (ii) the Participant’s death, but only to the extent such delay is necessary to prevent such payment from being subject to Code Section 409A(a)(1).

12.4 Limitation on Liability. Neither the Company nor any person serving as Administrator shall have any liability to a Participant in the event an Award held by the Participant fails to achieve its intended characterization under applicable tax law.

ARTICLE 13. FUTURE OF THE PLAN.

13.1 Term of the Plan. The Plan, as set forth herein, shall become effective on the Stockholder Approval Date, subject to approval of the Company’s stockholders under Article 13.3 below. No ISOs may be granted after the tenth anniversary of the Adoption Date. For the avoidance of doubt, between the Adoption Date and the date the Plan, as amended and restated hereby, is approved by the stockholders of the Company, the Plan as in effect immediately prior to the Adoption Date shall remain in full force and effect, with the ability to make grants thereunder subject to the terms thereof.

13.2 Amendment or Termination. The Administrator may, at any time and for any reason, amend or terminate the Plan. No Awards shall be granted under the Plan after the termination thereof. The termination of the Plan, or any amendment thereof, shall not affect any Award previously granted under the Plan.

13.3 Stockholder Approval. To the extent required by applicable law, the Plan will be subject to the approval of the Company’s stockholders within 12 months of the Adoption Date. An amendment of the Plan shall be subject to the approval of the Company’s stockholders only to the extent required by applicable laws, regulations, or rules.

ARTICLE 14. DEFINITIONS.

14.1 “Administrator” means the Board or the Compensation Committee administering the Plan in accordance with Article 2.

14.2 “Adoption Date” means April 16, 2024, which is the date that this Plan, as amended and restated hereby, was adopted by the Board.

14.3 “Affiliate” means any entity other than a Subsidiary, if the Company and/or one or more Subsidiaries own not less than 50% of such entity.

14.4 “Award” means any award granted under the Plan, including as an Option, a SAR, a Restricted Share, a Stock Unit or a Performance Cash Award.

14.5 “Award Agreement” means a Stock Option Agreement, an SAR Agreement, a Restricted Stock Agreement, a Stock Unit Agreement or such other agreement evidencing an Award granted under the Plan.

14.6 “Board” means the Company’s Board of Directors, as constituted from time to time.

14.7 “Cause” has the meaning ascribed to such term in any written agreement between the Participant and the Company defining such term, or, in the absence of such an agreement: (i) unauthorized use or disclosure of the Company’s confidential information or trade secrets; (ii) breach of any material terms of any material agreement between the Participant and the Company; (iii) material failure to comply with the Company’s written policies or rules; (iv) conviction of, or plea of “guilty” or “no contest” to, a felony under the laws of the United States or any State, or any crime involving dishonesty, fraud, or moral turpitude; (v) gross negligence or willful misconduct in the scope of the Participant’s employment; (vi) continuing failure to perform assigned duties after receiving written notification of the failure from the Board; or (vii) failure to cooperate in good faith with a governmental or internal investigation of the Company or its directors, officers, or employees, if the Company has requested the Participant’s cooperation. The determination that a termination of the Participant’s Service is either for Cause or without Cause will be made by the Board with respect to Participants who are Executive Officers and by the Company’s Chief Executive Officer with respect to Participants who are not Executive Officers. Any determination by the Company that the Service of a Participant was terminated with or without Cause for the purposes of outstanding Awards held by such Participant will have no effect upon any determination of the rights or obligations of the Company or such Participant for any other purpose.

14.8 “Change in Control” means:

(a)Any “person” (as such term is used in Sections 13(d) and 14(d) of the Exchange Act) becomes the “beneficial owner” (as defined in Rule 13d-3 of the Exchange Act), directly or indirectly, of securities of the Company representing more than fifty percent (50%) of the total voting power represented by the Company’s then-outstanding voting securities;

(b)The consummation of the sale or disposition by the Company of all or substantially all of the Company’s assets;

(c)The consummation of a merger or consolidation of the Company with or into any other entity, other than a merger or consolidation which would result in the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity or its parent) more than fifty percent (50%) of the total voting power represented by the voting securities of the Company or such surviving entity or its parent outstanding immediately after such merger or consolidation; or

(d)Individuals who are members of the Board (the “Incumbent Board”) cease for any reason to constitute at least a majority of the members of the Board over a period of 12 months; provided, however, that if the appointment or election (or nomination for election) of any new Board member was approved or recommended by a majority vote of the members of the Incumbent Board then still in office, such new member shall, for purposes of this Plan, be considered as a member of the Incumbent Board.

A transaction shall not constitute a Change in Control if its sole purpose is to change the state of the Company’s incorporation or to create a holding company that will be owned in substantially the same proportions by the persons who held the Company’s securities immediately before such transaction. In addition, if a Change in Control constitutes a payment event with respect to any Award which provides for a deferral of compensation and is subject to Code Section 409A, then notwithstanding anything to the contrary in the Plan or applicable Award

Agreement the transaction with respect to such Award must also constitute a “change in control event” as defined in Treasury Regulation Section 1.409A-3(i)(5) to the extent required by Code Section 409A.

14.9 “Code” means the Internal Revenue Code of 1986, as amended.

14.10 “Committee” means the Compensation Committee of the Board.

14.11 “Common Share” means one share of the common stock of the Company.

14.12 “Company” means Etsy, Inc., a Delaware corporation.

14.13 “Consultant” means a consultant or adviser who provides bona fide services to the Company, a Parent, a Subsidiary, or an Affiliate as an independent contractor and who qualifies as a consultant or advisor under Instruction A.1.(a)(1) of Form S-8 under the Securities Act or any successor thereto.

14.14 “Employee” means a common-law employee of the Company, a Parent, a Subsidiary or an Affiliate.

14.15 “Exchange Act” means the Securities Exchange Act of 1934, as amended.

14.16 “Executive Officer” means each “officer” of the Company as defined in Rule 16a-1(f) promulgated under the Exchange Act. The determination as to an individual’s status as an Executive Officer shall be made by the Board and such determination shall be final, conclusive and binding on such individual and all other interested persons.

14.17 “Exercise Price,” in the case of an Option, means the amount for which one Common Share may be purchased upon exercise of such Option, as specified in the applicable Stock Option Agreement. “Exercise Price,” in the case of a SAR, means an amount, as specified in the applicable SAR Agreement, which is subtracted from the Fair Market Value of one Common Share in determining the amount payable upon exercise of such SAR.

14.18 “Fair Market Value” means the closing price of a Common Share on any established stock exchange or a national market system on the applicable date or, if the applicable date is not a trading day, on the last trading day prior to the applicable date, as reported in a source that the Administrator deems reliable. If Common Shares are not traded on an established stock exchange or a national market system, the Fair Market Value shall be determined by the Administrator in good faith on such basis as it deems appropriate. The Administrator’s determination shall be conclusive and binding on all persons.

14.19 “ISO” means an incentive stock option described in Code Section 422(b).

14.20 “Non-Employee Director” means a member of the Board who is not an Employee.

14.21 “NSO” means a stock option not described in Code Sections 422 or 423.

14.22 “Option” means an ISO or NSO granted under the Plan and entitling the holder to purchase Common Shares.

14.23 “Optionee” means an individual or estate holding an Option or SAR.

14.24 “Original Effective Date” means March 4, 2015.

14.25 “Parent” means any corporation (other than the Company) in an unbroken chain of corporations ending with the Company, if each of the corporations other than the Company owns stock possessing 50% or more of the total combined voting power of all classes of stock in one of the other corporations in such chain. A corporation that attains the status of a Parent on a date after the adoption of the Plan shall be considered a Parent commencing as of such date.

14.26 “Participant” means an individual or estate holding an Award.

14.27 “Performance Cash Award” means an award of cash granted under Article 10.1 of the Plan.

14.28 “Performance Criteria” means the one or more criteria that the Administrator will select for purposes of establishing the Performance Goals for a Performance Period. The Performance Criteria that will be used to establish such Performance Goals may be based on any one of, or combination of, the following as determined by the Administrator: budget performance; buyer acquisition, retention and/or growth; cash flow; cash flow return on investment; comparisons with various stock market indices; costs & expenses, including reduction of both; earnings or earnings per share (including earnings before taxes, earnings before interest and taxes, earnings before interest, taxes and depreciation, or earnings before interest, taxes, depreciation, and amortization, including adjusted measures); employee satisfaction and/or retention; free cash flow or free cash flow per share; gross margin; gross profits; headcount; market share; net income (before or after taxes); operating income or EBIT (Earnings before Interest and Taxes) on a GAAP or non-GAAP basis; operating or EBIT margin; return on assets, investment or capital employed; return on equity or average stockholders’ equity; revenue (gross or net); GMS (Gross Merchandise Sales); seller acquisition, retention and/or growth; member satisfaction; stockholders’ equity; stock price return relative to market indices and/or peer group; total stockholder return; working capital; and other measures of performance selected by the Administrator whether or not listed herein. Any of the above metrics may be measured either in absolute terms, compared to any incremental increase or decrease or compared to results of a peer group, to market performance indicators or to market indices.

14.29 “Performance Goal” means a goal established by the Administrator for the applicable Performance Period based on one or more of the Performance Criteria. Depending on the Performance Criteria used, a Performance Goal may be expressed in terms of overall Company performance or the performance of a business unit, division, Subsidiary, Affiliate or an individual. A Performance Goal may be measured either in absolute terms or relative to the performance of one or more comparable companies or one or more relevant indices. The Administrator may adjust the results under any Performance Criterion to exclude any of the following events that occurs during a Performance Period: (a) asset write-downs; (b) litigation, claims, judgments, or settlements; (c) the effect of changes in tax laws, accounting principles or other laws or provisions affecting reported results; (d) accruals for reorganization and restructuring programs; (e) mergers or acquisitions; (f) exchange rate effects for non-U.S. dollar denominated net sales and operating earnings; (g) statutory adjustments to corporate tax rates; or (h) any other items as the Administrator deems necessary or appropriate.

14.30 “Performance Period” means a period of time selected by the Administrator over which the attainment of one or more Performance Goals will be measured for the purpose of determining a Participant’s right to a Performance Cash Award or an Award of Restricted Shares or Stock Units that vests based on the achievement of Performance Goals. Performance Periods may be of varying and overlapping duration, at the discretion of the Administrator.

14.31 “Plan” means this Etsy, Inc. 2024 Equity Incentive Plan, as amended from time to time.

14.32 “Prior Plans’ Returning Shares” means the following Common Shares subject to (i) any outstanding award granted under the Company’s 2006 Stock Plan, as amended (the “2006 Plan”), or (ii) any

outstanding Award granted under the Plan prior to the Stockholder Approval Date, that, in either case, following the Stockholder Approval Date: (A) are not issued because such award or any portion thereof expires or otherwise terminates without all of the Common Shares covered by such award having been issued; (B) are not issued because such award or any portion thereof is settled in cash; (C) are forfeited back to or repurchased by the Company because of the failure to meet a contingency or condition required for the vesting of such Common Shares; (D) are withheld or reacquired to satisfy the exercise, strike or purchase price with respect to such award; or (E) are withheld or reacquired to satisfy a tax withholding obligation with respect to such award.

14.33 “Restricted Share” means a Common Share awarded under the Plan.

14.34 “Restricted Stock Agreement” means the agreement between the Company and the recipient of a Restricted Share that contains the terms, conditions, and restrictions pertaining to such Restricted Share.

14.35 “SAR” means a stock appreciation right granted under the Plan.

14.36 “SAR Agreement” means the agreement between the Company and an Optionee that contains the terms, conditions and restrictions pertaining to his or her SAR.

14.37 “Securities Act” means the Securities Act of 1933, as amended.

14.38 “Service” means service as an Employee, Non-Employee Director, or Consultant.

14.39 “Service Provider” means any individual who is an Employee, Non-Employee Director, or Consultant.

14.40 “Stock Award” means any award of an Option, a SAR, a Restricted Share or a Stock Unit under the Plan.

14.41 “Stockholder Approval Date” means June 13, 2024, the date of the Company’s 2024 annual meeting of stockholders.

14.42 “Stock Option Agreement” means the agreement between the Company and an Optionee that contains the terms, conditions, and restrictions pertaining to his or her Option.

14.43 “Stock Unit” means a bookkeeping entry representing the equivalent of one Common Share, as awarded under the Plan.

14.44 “Stock Unit Agreement” means the agreement between the Company and the recipient of a Stock Unit that contains the terms, conditions, and restrictions pertaining to such Stock Unit.

14.45 “Subsidiary” means any corporation (other than the Company) in an unbroken chain of corporations beginning with the Company, if each of the corporations other than the last corporation in the unbroken chain owns stock possessing 50% or more of the total combined voting power of all classes of stock in one of the other corporations in such chain. A corporation that attains the status of a Subsidiary on a date after the adoption of the Plan shall be considered a Subsidiary commencing as of such date.

14.46 “Substitute Awards” means Awards or Common Shares issued by the Company in assumption of, or substitution or exchange for, Awards previously granted, or the right or obligation to make future awards, in each case by a corporation acquired by the Company or any Affiliate or with which the Company or any Affiliate combines to the extent permitted by NASDAQ Marketplace Rule 5635 or any successor thereto.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

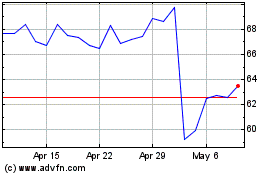

Etsy (NASDAQ:ETSY)

Historical Stock Chart

From May 2024 to Jun 2024

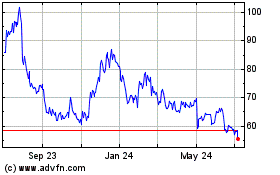

Etsy (NASDAQ:ETSY)

Historical Stock Chart

From Jun 2023 to Jun 2024