Esperion (NASDAQ: ESPR) today reported financial results for the

fourth quarter and full year ended December 31, 2024, and provided

a business update.

“The significant progress we and our partners achieved

throughout 2024 has formed a strong foundation that empowers us to

enter the new year with a bold vision centered around three

strategic pillars for building a blockbuster company: continued

revenue growth, operating profitability, and portfolio expansion

and pipeline advancement,” said Sheldon Koenig, President and CEO

of Esperion. “We expect to drive further revenue growth and reach

operating profitability through durable growth of our bempedoic

acid products in the U.S. and Europe and through global expansion

into key markets with large patient populations, such as Japan. Our

significantly strengthened balance sheet and capital structure

supports plans to expand our portfolio with the potential

acquisition or in-licensing of cardiometabolic products that are

synergistic with our commercial call point.”

“In tandem, we will broaden our reach and impact with the

development of our triple combination products, which will offer

physicians and patients the flexibility of a suite of options that

include monotherapy and polypill therapies. We believe these next

generation combinations represent the future of preventative

cardiovascular care as supported by clinical publications that

highlight their enhanced efficacy. In addition, we are advancing

our innovative clinical development pipeline to address other

urgent unmet medical needs and look forward to showcasing our

progress and plans at our upcoming R&D Day in April,” added

Sheldon Koenig.

Fourth Quarter and Full Year 2024 Key Accomplishments

and Recent Highlights

Driving U.S. and Global Growth and Striving for

Profitability

In the U.S., strong prescription demand and increasing physician

adoption continue to drive durable revenue growth. At the same

time, our global partners are making significant progress driving

international revenue by bringing our bempedoic acid products to

patients around the world. Many patients cannot reach their

low-density lipoprotein cholesterol (LDL-C) goals and, as a result,

are at risk of cardiovascular (CV) disease or a CV event, such as a

heart attack. Our products are now approved in 39 countries

globally, further expanding access to those in need. Together,

these factors fuel sustained business momentum, enhance operational

efficiency, and pave the way to long-term profitability.

Advancing the U.S. Commercial Strategy

- Achieved double-digit quarter-to-quarter prescription growth

since the launch of the expanded label, driven by broader adoption

and increased prescriber confidence.

- Expanded payer access, with updated management criteria now

covering more than 173 million lives across commercial insurance

and Medicare and Medicaid plans.

- Effective January 29, 2025, NEXLETOL® (bempedoic acid) and

NEXLIZET® (bempedoic acid and ezetimibe) were added to the U.S.

Department of Defense Uniform Formulary as preferred agents for

their nine million lives covered.

- Increased prescription volume, with approximately 8% growth in

new to brand prescriptions and a 12% increase in total retail

prescription equivalents in the fourth quarter compared to the

third quarter of 2024.

- Expanded prescriber base, with 10% more healthcare

practitioners writing prescriptions in Q4 2024, now totaling over

25,000 prescribers.

- Esperion has initiated development of two triple combination

products in the U.S. with bempedoic acid, ezetimibe, and either

atorvastatin or rosuvastatin. Based on published literature, the

Company believes the triple combination products may offer LDL-C

lowering in excess of 60%. This level of efficacy would rival both

existing and emerging injectable and oral therapies.

Global Expansion:

- The Company’s partner in Japan, Otsuka Pharmaceutical Co., Ltd.

(Otsuka) has submitted a New Drug Application to the Japanese

Ministry of Health, Labour and Welfare for the manufacture and sale

of bempedoic acid in Japan for the treatment of

hypercholesterolemia and familial hypercholesterolemia. Otsuka

expects approval and National Health Insurance pricing in the

second half of 2025.

- Esperion’s European partner (DSE) continues to successfully

market NILEMDO® (bempedoic acid) and NUSTENDI® (bempedoic

acid and ezetimibe) and has demonstrated strong revenue growth,

which provides increasing royalty revenue and further validates the

global potential for Esperion’s bempedoic acid products worldwide.

- DSE’s royalty revenue increased 9% sequentially to $9.7 million

reflecting continued momentum in European sales of NILEMDO and

NUSTENDI.

- The Company recently partnered with CSL Seqirus to

commercialize NEXLETOL and NEXLIZET in Australia and New Zealand.

Under the terms of the agreement, Esperion received an upfront

payment and is eligible for near-term milestones along with a

profitable transfer price on product sales.

- Esperion entered into a licensing agreement with Neopharm

Israel for the exclusive rights to commercialize NEXLETOL and

NEXLIZET in Israel and expects to file an NDA for marketing

approval in Israel in the first half of 2025.

- The Company filed New Drug Submissions (NDSs) to Health Canada

for NEXLETOL and NEXLIZET and anticipates market approval in the

fourth quarter of 2025.

Financials

“During 2024, we executed two transformational financial

transactions that fundamentally reshaped our capital structure,

providing us with enhanced operational and financial flexibility.

These improvements, coupled with our fortified balance sheet,

empower us to focus on investing in our three pillars for growth to

build a leading global biopharmaceutical powerhouse,” stated Ben

Halladay, Chief Financial Officer of Esperion.

- Entered into a Royalty Purchase Agreement with OMERS Life

Sciences (OMERS), under which Esperion received

approximately $304.7 million in cash from OMERS in exchange

for 100% interest, subject to a cap, of Esperion’s

expected royalty entitlement on DSE net sales of bempedoic

acid products in the European territories. OMERS will receive a

tiered royalty ranging from 15-25% of net bempedoic acid product

sales in Europe, until it has received an aggregate amount equal to

1.7x its investment. Thereafter, all future royalty payments from

DSE royalties will revert back to Esperion. Proceeds from the

Royalty Purchase Agreement facilitated early payout and termination

of the Oberland secured facility, removing all liens and covenants

associated with that agreement.

- Closed on a series of financing transactions that support the

Company’s repayment of a portion of its existing $265 million

convertible debt facility. The transactions included a $150 million

senior secured term loan facility led by funds managed by Athyrium

Capital Management, LP and joined by funds managed by HealthCare

Royalty, and a new $100 million Convertible Note with accredited

investors. The Company used the proceeds from the Loan and

approximately $60 million of the proceeds from the Note to repay

$210 million of the existing convertible debt with the remaining

net proceeds of $26.5 million to be used for general operating

purposes.

Portfolio Expansion and Pipeline

Advancement

Our commitment to R&D strengthens all three strategic

pillars – revenue growth, portfolio expansion, and pipeline

advancement. With a strengthened balance sheet, we are positioned

to in-license or acquire synergistic cardiometabolic assets while

advancing our clinical pipeline.

R&D Pipeline

- The Company is exploring its novel insights into ACLY biology

and the therapeutic role these next-generation inhibitors can play

in multiple life-threatening diseases including rare and chronic

liver and kidney diseases.

- Esperion will announce a lead indication, declare a candidate

for development and share more about its clinical development plans

at an R&D Day on April 24, 2025.

Publications and Presentations

Publications

- Bempedoic Acid for Prevention of Cardiovascular Events in

People With Obesity: A CLEAR Outcomes Subset Analysis

- Published in the Journal of the American Heart Association

(JAHA) and previously presented by Dr. Harold Bays, MD at the 2024

American College of Cardiology Scientific Sessions.

- Nearly 45% of patients in CLEAR Outcomes had obesity (body mass

index greater than or equal to 30 kg/m2) at the start of the

study.

- In this analysis, not only was bempedoic acid a safe and

well-tolerated option, but patients with obesity treated with

bempedoic acid were 23% less likely to experience MACE-4 (CV death,

nonfatal myocardial infarction (MI), nonfatal stroke, or coronary

revascularization) compared to placebo.

- Especially in the age of GLP1 agonist weight loss, there is

need to educate that reduction of weight has little impact on a

patient’s lipid profile. This analysis demonstrates bempedoic acid

is a viable therapeutic option to manage LDL-C and CV risk in this

patient population.

- Characteristics and Outcomes of Patients With and Without

Statin-Associated Muscle Symptoms Treated with Bempedoic Acid in

the CLEAR Outcomes Trial

- Published in the Journal of Clinical Lipidology (JCL) and

previously presented by Ulrich Laufs, MD, PhD at the 2024 American

Heart Association Scientific Sessions.

- This post-hoc analysis assessed baseline differences in statin

intolerance symptoms and whether these influenced the clinical

course during CLEAR Outcomes, the largest prospective database of

patients with statin intolerance to date.

- The nature of statin intolerance symptoms at baseline (e.g.

muscle symptoms only, non-muscle adverse effects, or both) had no

effect on the cardiovascular efficacy of bempedoic acid.

- Patients who reported statin-associated muscle symptoms at

baseline experienced higher rates of discontinuation and skeletal

muscle symptoms, but rates were not greater in patients treated

with bempedoic acid. 30% of patients who had attempted statin

rechallenge during CLEAR Outcomes did not remain on the statin at

the end of the trial, highlighting the challenges of statin use in

some patients.

Presentations

Two CLEAR Outcomes post-hoc analyses were accepted as poster

presentations at the 2025 American College of Cardiology’s Annual

Scientific Sessions (ACC.25) in Chicago, Illinois.

- Efficacy and Safety of Bempedoic Acid in Patients ≥ 75 Years:

Analysis of CLEAR Outcomes

- This post-hoc analysis of CLEAR Outcomes evaluates the efficacy

and safety of bempedoic acid in patients aged 75 years and older

(15% of the trial population).

- Across novel lipid-lowering therapies, data in older patients

has been vastly limited, this analysis provides evidence for use of

bempedoic acid in this patient population.

- Impact of Adjunctive Lipid-Modifying Therapy in the CLEAR

Outcomes Trial

- Background lipid-modifying therapy was started or intensified

after randomization in 9.4% of bempedoic acid and 15.6% of placebo

patients in the CLEAR Outcomes trial. There is potential the

effects of bempedoic acid were diminished with the addition of more

background lipid-modifying therapies in the placebo group.

- This prespecified analysis evaluates the impact of adding or

intensifying background lipid-lowering therapies to patients with

statin intolerance at high CV risk over the 3.4 year median

duration of follow-up in the CLEAR Outcomes trial.

Fourth Quarter and Fiscal Year 2024 Financial

Results

Revenue

- Total revenue for the three months and full year ended December

31, 2024, was $69.1 million and $332.3 million, respectively,

compared to $32.3 million and $116.3 million for the comparable

periods in 2023, an increase of 114% and 186%, respectively.

- U.S. net product revenue for the three months and full year

ended December 31, 2024, was $31.6 million and $115.7 million,

respectively, compared to $20.8 million and $78.3 million for the

comparable periods in 2023, an increase of 52% and 48%,

respectively, driven by retail prescription growth of 50% and

45%.

- Collaboration revenue for the three months and full year ended

December 31, 2024, was $37.6 million and $216.6 million, compared

to $11.5 million and $38.0 million for the comparable periods in

2023, an increase of 227% and 470%, respectively, driven by

increases in royalty sales within our partner territories, product

sales to our collaboration partners from our supply agreements, a

one-time milestone recognized from Otsuka upon their JNDA

submission in the three months ended December 31, 2024, and revenue

recognized from our Settlement Agreement with DSE in the first half

of 2024.

R&D Expenses

- Research and development expenses for the three months and full

year ended December 31, 2024, were $11.0 million and $46.2 million,

compared to $17.7 million and $86.1 million for the comparable

periods in 2023, a decrease of 38% and 46%, respectively.

- The decrease was primarily related to the close-out of our

CLEAR Outcomes study and lower compensation costs.

Selling, General and Administrative (SG&A) Expenses

- Selling, general and administrative expenses for the three

months and full year ended December 31, 2024, were $36.9 million

and $163.1 million, compared to $45.4 million and $142.5 million

for the comparable periods in 2023, a decrease of 19% and an

increase of 14%, respectively.

- The decrease quarter over quarter from 2023 was primarily

related to increased legal litigation expenses reflecting one-time

legal expenses related to legal resolution, partially offset by

increased compensation costs related to the ramp up of our sales

force associated with our commercial launch and promotional

costs.

- The increase year over year was primarily related to the ramp

up of our sales force associated with our commercial launch in

addition to bonus payments and promotional costs.

Net Loss. The Company had net losses of $21.3 million and $51.7

million for the three and full year ended December 31, 2024,

compared to net losses of $56.3 million and $209.2 million for the

comparable periods in 2023, respectively.

Loss Per Share. Basic and diluted net losses per share was $0.11

for the fourth quarter ended December 31, 2024, and $0.28 for the

full year ended December 31, 2024, compared to basic and diluted

net losses per share of $0.50 and $2.03, for the comparable periods

in 2023, respectively.

Cash and Cash Equivalents. As of December 31, 2024, cash and

cash equivalents totaled $144.8 million compared to $82.2 million

as of December 31, 2023.

The Company ended the fourth quarter 2024 with approximately

195.9 million shares of common stock outstanding, excluding 2.0

million treasury shares.

2025 Financial Outlook

The Company expects full year 2025 operating expenses to be in

the range of $215 million to $235 million, including approximately

$15 million in non-cash expenses related to stock compensation.

Conference Call and Webcast InformationEsperion

will host a conference call and webcast at 8:00 a.m. ET to discuss

the financial results and business progress.

A live audio webcast can be accessed on the investor and media

section of the Esperion website. The webcast replay will be

available approximately two hours after completion of the call and

will be archived on the Company's website for approximately 90

days.

INDICATION NEXLIZET and NEXLETOL are

indicated:

- The bempedoic acid component of NEXLIZET and NEXLETOL is

indicated to reduce the risk of myocardial infarction and coronary

revascularization in adults who are unable to take recommended

statin therapy (including those not taking a statin) with:

- established cardiovascular disease (CVD), or

- at high risk for a CVD event but without established CVD.

- As an adjunct to diet:

- NEXLIZET, alone or in combination with other LDL-C lowering

therapies, to reduce LDL-C in adults with primary hyperlipidemia,

including HeFH.

- NEXLETOL, in combination with other LDL-C lowering therapies,

or alone when concomitant LDL-C lowering therapy is not possible,

to reduce LDL-C in adults with primary hyperlipidemia, including

HeFH.

IMPORTANT SAFETY INFORMATIONNEXLIZET and

NEXLETOL are contraindicated in patients with a prior

hypersensitivity to bempedoic acid or ezetimibe or any of the

excipients. Serious hypersensitivity reactions including

anaphylaxis, angioedema, rash, and urticaria have been

reported.

Hyperuricemia: Bempedoic acid, a component of NEXLIZET and

NEXLETOL, may increase blood uric acid levels, which may lead to

gout. Hyperuricemia may occur early in treatment and persist

throughout treatment, returning to baseline following

discontinuation of treatment. Assess uric acid levels periodically

as clinically indicated. Monitor for signs and symptoms of

hyperuricemia, and initiate treatment with urate-lowering drugs as

appropriate.

Tendon Rupture: Bempedoic acid, a component of NEXLIZET and

NEXLETOL, is associated with an increased risk of tendon rupture or

injury. Tendon rupture may occur more frequently in patients over

60 years of age, in those taking corticosteroid or fluoroquinolone

drugs, in patients with renal failure, and in patients with

previous tendon disorders. Discontinue NEXLIZET or NEXLETOL at the

first sign of tendon rupture. Consider alternative therapy in

patients who have a history of tendon disorders or tendon

rupture.

The most common adverse reactions in the primary hyperlipidemia

trials of bempedoic acid, a component of NEXLIZET and NEXLETOL, in

≥2% of patients and greater than placebo were upper respiratory

tract infection, muscle spasms, hyperuricemia, back pain, abdominal

pain or discomfort, bronchitis, pain in extremity, anemia, and

elevated liver enzymes.

Adverse reactions reported in ≥2% of patients treated with

ezetimibe (a component of NEXLIZET) and at an incidence greater

than placebo in clinical trials were upper respiratory tract

infection, diarrhea, arthralgia, sinusitis, pain in extremity,

fatigue, and influenza.

In the primary hyperlipidemia trials of NEXLIZET, the most

commonly reported adverse reactions (incidence ≥3% and greater than

placebo) observed with NEXLIZET, but not observed in clinical

trials of bempedoic acid or ezetimibe, were urinary tract

infection, nasopharyngitis, and constipation.

The most common adverse reactions in the cardiovascular outcomes

trial for bempedoic acid, a component of NEXLIZET and NEXLETOL, at

an incidence of ≥2% and 0.5% greater than placebo were

hyperuricemia, renal impairment, anemia, elevated liver enzymes,

muscle spasms, gout, and cholelithiasis.

Discontinue NEXLIZET or NEXLETOL when pregnancy is recognized

unless the benefits of therapy outweigh the potential risks to the

fetus. Because of the potential for serious adverse reactions in a

breast-fed infant, breastfeeding is not recommended during

treatment with NEXLIZET or NEXLETOL.

Report pregnancies to Esperion Therapeutics, Inc. Adverse Event

reporting line at 1-833-377-7633.

Please see full Prescribing Information for NEXLIZET and

NEXLETOL.

About Esperion TherapeuticsEsperion

Therapeutics, Inc. is a commercial stage biopharmaceutical company

focused on bringing new medicines to market that address unmet

needs of patients and healthcare professionals. The Company

developed and is commercializing the only U.S. Food and Drug

Administration (FDA) approved oral, once-daily, non-statin

medicines for patients who are at risk for cardiovascular disease

and are struggling with elevated low density lipoprotein

cholesterol (LDL-C). These medications are supported by the nearly

14,000 patient CLEAR Cardiovascular Outcomes Trial. Esperion

continues to build on its success with its next generation program

which is focused on developing ATP citrate lyase inhibitors

(ACLYi). New insights into the structure and function of ACLYi

fully enables rational drug design and the opportunity to develop

highly potent and specific inhibitors with allosteric

mechanisms.

Esperion continues to evolve into a leading global

biopharmaceutical company through commercial execution,

international partnerships and collaborations and advancement of

its pre-clinical pipeline. For more information, visit esperion.com

and esperionscience.com and follow Esperion on LinkedIn and X.

Forward-Looking StatementsThis press release

contains forward-looking statements that are made pursuant to the

safe harbor provisions of the federal securities laws, including

statements regarding marketing strategy and commercialization

plans, current and planned operational expenses, future operations,

commercial products, clinical development, including the timing,

designs and plans for the CLEAR Outcomes study and its results,

plans for potential future product candidates, financial condition

and outlook, including expected cash runway, and other statements

containing the words “anticipate,” “believe,” “estimate,” “expect,”

“intend,” “may,” “plan,” “predict,” “project,” “suggest,” “target,”

“potential,” “will,” “would,” “could,” “should,” “continue,” and

similar expressions. Any express or implied statements contained in

this press release that are not statements of historical fact may

be deemed to be forward-looking statements. Forward-looking

statements involve risks and uncertainties that could cause

Esperion’s actual results to differ significantly from those

projected, including, without limitation, the net sales,

profitability, and growth of Esperion’s commercial products,

clinical activities and results, supply chain, commercial

development and launch plans, the outcomes and anticipated benefits

of legal proceedings and settlements, and the risks detailed in

Esperion’s filings with the Securities and Exchange Commission. Any

forward-looking statements contained in this press release speak

only as of the date hereof, and Esperion disclaims any obligation

or undertaking to update or revise any forward-looking statements

contained in this press release, other than to the extent required

by law.

Esperion Contact Information:Investors: Alina

Veneziainvestorrelations@esperion.com (734) 887-3903

Media: Tiffany Aldrich corporateteam@esperion.com (616)

443-8438

|

ESPERION Therapeutics, Inc.Balance

Sheet Data(In

thousands)(Unaudited) |

| |

December 31,2024 |

|

December 31,2023 |

|

Cash and cash equivalents |

$ |

144,761 |

|

|

$ |

82,248 |

|

|

Working capital |

|

91,765 |

|

|

|

44,841 |

|

|

Total assets |

|

343,821 |

|

|

|

205,796 |

|

|

Royalty sale liability |

|

293,610 |

|

|

|

— |

|

|

Revenue interest liability |

|

— |

|

|

|

274,778 |

|

|

Convertible notes, net of issuance costs |

|

151,320 |

|

|

|

261,596 |

|

|

Long-term debt |

|

140,971 |

|

|

|

— |

|

|

Common stock |

|

196 |

|

|

|

118 |

|

|

Accumulated deficit |

|

(1,601,029 |

) |

|

|

(1,549,284 |

) |

|

Total stockholders' deficit |

|

(388,722 |

) |

|

|

(454,994 |

) |

| |

|

|

|

|

|

|

|

|

ESPERION Therapeutics, Inc.Statement

of Operations(In thousands, except share and per

share data)(Unaudited) |

|

|

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenues: |

|

|

|

|

|

|

|

|

Product sales, net |

$ |

31,561 |

|

|

$ |

20,760 |

|

|

$ |

115,725 |

|

|

$ |

78,335 |

|

|

Collaboration revenue |

37,552 |

|

|

11,490 |

|

|

216,589 |

|

|

37,999 |

|

| Total Revenues |

69,113 |

|

|

32,250 |

|

|

332,314 |

|

|

116,334 |

|

| |

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Cost of goods sold |

25,631 |

|

|

11,452 |

|

|

68,601 |

|

|

43,267 |

|

|

Research and development |

10,977 |

|

|

17,742 |

|

|

46,238 |

|

|

86,107 |

|

|

Selling, general and administrative |

36,925 |

|

|

45,423 |

|

|

163,073 |

|

|

142,523 |

|

| Total operating expenses |

73,533 |

|

|

74,617 |

|

|

277,912 |

|

|

271,897 |

|

| |

|

|

|

|

|

|

|

| Income (loss) from

operations |

(4,420 |

) |

|

(42,367 |

) |

|

54,402 |

|

|

(155,563 |

) |

| |

|

|

|

|

|

|

|

| Interest expense |

(16,422 |

) |

|

(15,057 |

) |

|

(59,251 |

) |

|

(58,976 |

) |

| Loss on extinguishment of debt

and exchange transaction |

(1,683 |

) |

|

— |

|

|

(54,918 |

) |

|

— |

|

| Other income, net |

1,207 |

|

|

1,080 |

|

|

8,022 |

|

|

5,291 |

|

| Net loss |

$ |

(21,318 |

) |

|

$ |

(56,344 |

) |

|

$ |

(51,745 |

) |

|

$ |

(209,248 |

) |

| |

|

|

|

|

|

|

|

| Net loss per common share –

basic and diluted |

$ |

(0.11 |

) |

|

$ |

(0.50 |

) |

|

$ |

(0.28 |

) |

|

$ |

(2.03 |

) |

| |

|

|

|

|

|

|

|

| Weighted-average shares

outstanding – basic and diluted |

195,566,916 |

|

|

112,403,358 |

|

|

187,181,856 |

|

|

103,106,616 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

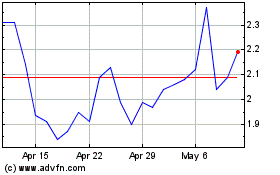

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From Mar 2024 to Mar 2025