0000922621false00009226212023-10-242023-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of Earliest Event Reported): | October 24, 2023 |

| | | | | | | | |

| ERIE INDEMNITY COMPANY | |

| (Exact name of registrant as specified in its charter) | |

| | | | | | | | | | | | | | | | | | | | |

| Pennsylvania | | 0-24000 | | 25-0466020 | |

| (State or other jurisdiction | | (Commission | | (IRS Employer | |

| of incorporation) | | File Number) | | Identification No.) | |

| | | | | | | | | | | | | | | | | | | | |

| 100 Erie Insurance Place, | Erie, | Pennsylvania | | 16530 | |

| (Address of principal executive offices) | | (Zip Code) | |

| | | | | | | | | | | | | | |

| Registrant’s telephone number, including area code: | 814 | 870-2000 | |

| | | | | | | | |

| Not applicable | |

| Former name or former address, if changed since last report | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Class A common stock, | stated value $0.0292 per share | | ERIE | | NASDAQ Stock Market, LLC |

| (Title of each class) | | (Trading Symbol) | | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 26, 2023, Erie Indemnity Company (the “Company”) issued a press release announcing financial results for the quarter and nine months ended September 30, 2023. Copies of the press release and financial information are attached hereto and are incorporated herein by reference as Exhibit 99.1 and Exhibit 99.2, respectively.

On October 27, 2023 at 10:00 a.m. the Company will provide a pre-recorded Webcast that is complementary to the press release announcing financial results for the quarter and nine months ended September 30, 2023.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) Departure of Executive Vice President

On October 24, 2023, Lorianne Feltz informed the Company of her intention to retire as Executive Vice President of Claims & Customer Service on May 30, 2024. Feltz, 54, has served as Executive Vice President of Claims & Customer Service since 2016. She has worked at the Company for 34 years, holding numerous positions of increasing responsibility throughout her tenure. The Company will immediately begin a search for her replacement.

Item 5.05 Amendments to the Registrant's Code of Ethics, or Waiver of a Provision of the Code of Ethics.

(a) Revised Code of Conduct

On October 24, 2023, the Board of Directors approved a revised Code of Conduct applicable to all directors, officers and employees of the Company. The revisions update the Company's existing Code of Conduct that was effective January 1, 2016. The effective date for the revised Code of Conduct is November 1, 2023. A copy of the revised Code of Conduct is attached as Exhibit 14.1 and may be viewed on the Company's website at: http://www.erieinsurance.com. In addition to the Code of Conduct, the Company also maintains a Code of Ethics for Senior Financial Officers which contains additional obligations for the Company's Chief Financial Officer, Controller and other persons performing similar functions.

Item 9.01 Financial Statements and Exhibits.

Exhibit 14.1 Code of Conduct

Exhibit 99.1 Press Release

Exhibit 99.2 Financial Information

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

Exhibit Index

| | | | | | | | |

| | | |

| Exhibit No. | | Description |

| | |

| 14.1 | | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | | |

| | | Erie Indemnity Company |

| | | | | |

| October 26, 2023 | | By: | | /s/ Julie M. Pelkowski |

| | | | |

| | | | | Name: Julie M. Pelkowski |

| | | | | Title: Executive Vice President & CFO |

Code of Conduct Fall 2023

– Founder H.O. Hirt as near perfect as near perfect protection, serviceas is humanly possible, provide our Policyholders with and to do so at the To lowest possible cost “ ”

1 Table of Contents Introduction � � � � � � � � � � � � � � � � � � � � � � � � � � � � 2 Why do we have a Code? � � � � � � � � � � � � � � � � � � � � � � � � 2 How does our Code apply to me? � � � � � � � � � � � � � � � � 2 Messages from ERIE � � � � � � � � � � � � � � � � � � � 3 Our Employees � � � � � � � � � � � � � � � � � � � � � � � � � 4 What are my responsibilities under our Code? � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 4 Ethical Decision Making: Four Pillars � � � � � � � � � � � � � � 5 Conflicts of Interest � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 6 Gifts & Entertainment � � � � � � � � � � � � � � � � � � � � � � � � � � � 6 Our Culture � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 7 Environmental, Social & Governance � � � � � � � � � � � � � 8 Diversity, Equity & Inclusion � � � � � � � � � � � � � � � � � � � � � � 8 Harassment Free Workplace � � � � � � � � � � � � � � � � � � � � � 9 Safety in Our Workplace � � � � � � � � � � � � � � � � � � � � � � � � 10 Our Stakeholders � � � � � � � � � � � � � � � � � � � � � � � 11 Insider Information � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 11 Anti-Bribery � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 11 Fair Competition � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �12 Customer Service & Fair Claims Handling � � � � � � � � �13 Our Agency Force � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �13 Our Assets � � � � � � � � � � � � � � � � � � � � � � � � � � � � �14 ERIE’s Assets � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �14 Privacy & Information Security � � � � � � � � � � � � � � � � � � �14 Records Management � � � � � � � � � � � � � � � � � � � � � � � � � � �16 Intellectual Property � � � � � � � � � � � � � � � � � � � � � � � � � � � � �17 Financial Statements � � � � � � � � � � � � � � � � � � � � � � � � � � � �17 Our Reputation � � � � � � � � � � � � � � � � � � � � � � � � �18 Communication with the Public � � � � � � � � � � � � � � � � � �18 Social Media � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �18 Political Activity � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �19 Our Conduct � � � � � � � � � � � � � � � � � � � � � � � � � � 20 What happens if someone violates our Code? � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 20 What will happen after I make a report? � � � � � � � � � �21 What happens if the company becomes the subject of an investigation? � � � � � � � � � � � � � � � � � �21 Conclusion � � � � � � � � � � � � � � � � � � � � � � � � � � � � 22 Closing Thoughts � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 22 Key Contacts � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 23

Introduction Why do we have a Code? At Erie Insurance (“ERIE”) we believe in doing the right thing as stated in our Founding Purpose: “To provide Policyholders with as near perfect protection, as near perfect service as is humanly possible and to do so at the lowest possible cost�” We value ethical business conduct, accountability, respectful treatment and teamwork� We have a Code of Conduct (“Code”) because it provides a roadmap to help us act not only in compliance with laws and regulations, but also in the spirit of our purpose and values� Our Code helps us to clearly understand how to deliver on our promise to do the right thing� How does our Code apply to me? All those who work for ERIE have a responsibility to understand and follow our Code� Those who interact with ERIE or do work on behalf of ERIE are expected to uphold the values stated in our Code� Our Code applies to all Employees, including officers, and the Board of Directors� Everyone associated with ERIE has an obligation to demonstrate ethical behavior that is consistent with our Code� This includes our Agents, contractors, vendors and others with whom we do business� Our Code does not address every legal or ethical situation, but it helps guide us by supporting our good judgment when we have questions� When we have more specific questions about laws or policies, we can consult additional resources� These resources include: • Employee Handbook • Privacy & Information Security Handbook • Company policies, standards, and manuals available on the company intranet • Online compliance courses 2 “The ERIE is Above all in SERVICE®” – H.O. Hirt Call the ERIE Ethicsline at 1 (866) 469-5708 or visit erieinsurance.ethicspoint.com for Anonymous Reporting 24/7.

Messages from ERIE Our commitment to being Above all in SERVICE is one we take seriously in all aspects of our business� How we uphold that promise matters, and our Code of Conduct serves as a guidepost for doing so in the right ways� Our Code provides the ethical and professional standards for how we do business� It offers clear direction for making decisions and taking actions that are legal, fair and aligned with our purpose and core values� Being Above all in SERVICE, practicing the Golden Rule and sharing the ERIE Family Spirit aren’t just words; they guide everything we do and are key to our success� - Tim NeCastro, President & CEO When H�O� Hirt called it our purpose to provide Policyholders “with as near perfect protection as possible,” he was thinking about the protection that an insurance policy offers individuals and families� But along with “near perfect” protection and service, we also have a duty to be “near perfect” in how we handle decisions and actions that have legal, ethical or professional consequences� Our Code is one way we equip our Employees, Agents, contractors and vendors with the information and resources they need to meet this very important commitment� - Tom Hagen, Chairman of the Board When you face an ethical decision in business, Founder H�O� Hirt’s guidance that “simple common sense, mixed with just plain decency” still rings true� It’s possible you will face a situation where your choices have ethical or legal consequences and the right choice may not seem simple or clear� ERIE’s Compliance Department is here not only to help establish and maintain an environment of compliance and ethics, but to also provide guidance when those choices are not clear� Many other areas of the company play a role in protecting ERIE and our reputation, including Human Resources, Internal Audit, Law and Public Relations� But most important are leaders and Employees like you� Take time to read and understand our Code of Conduct, which reflects what ERIE considers to be legal and ethical behavior� When you’re unsure how to handle a particular situation, understand there are resources available to you� Ask questions� Speak up� And know you can always reach out to me or anyone else in the Compliance Department for further guidance� - Debra Mack, Vice President, Compliance & Ethics 3

4 Our Employees What are my responsibilities under our Code? We are all responsible to “be above all” when it comes to our Code� This means reading our Code, taking time to understand it and asking questions if they arise� Depending on your role at ERIE, you may have different responsibilities under our Code� For example: Employee Responsibilities • Comply with all laws, rules, regulations and court orders� • Know and follow our Code and company policies� • Conduct business truthfully and fairly� • Demonstrate professional behavior at all times� • Exhibit responsible financial management� • Never use a business relationship or company asset for personal gain� • Ask questions� Use the Four Pillars of Ethical Decision Making on the next page to guide you when you are unsure of a situation� • Report actual or suspected violations of our Code or company policies� • Notify your leader and your Employee Relations Consultant (ERC) or HR Business Partner (HRBP) if you are charged with or convicted of a misdemeanor or a felony� Refer to ERIE’s Employee Improprieties Policy for more information� Leader Responsibilities • Lead by example� • Demonstrate a commitment to comply with all laws, rules, regulations and court orders� • Establish and maintain procedures in your work area that are consistent with our Code� • Listen to Employees’ ethical concerns and take action to report these concerns� • Explain the options to Employees on how to report concerns and encourage them to do so� • Guide Employees through the Four Pillars of Ethical Decision Making described in the next section� • Never influence an Employee to behave or act in a way that is not consistent with our Code or company policies� • Establish and follow controls in your area that protect company assets� • Protect Employees from retaliation for reporting concerns by following the Anti-Retaliation Policy� • Demonstrate accountability and responsibility� • Notify your ERC or HRBP if you or an Employee who reports to you becomes aware of, are charged with, or are convicted of a misdemeanor or felony� Refer to ERIE’s Employee Improprieties Policy for more information� If an Employee in the insurance industry is convicted of a felony, federal law requires felonies to be reported to certain regulatory entities. Employees are required to contact their ERC or HRBP to disclose this information. Call the ERIE Ethicsline at 1 (866) 469-5708 or visit erieinsurance.ethicspoint.com for Anonymous Reporting 24/7.

Ethical Decision Making: Four Pillars When you are faced with situations that are confusing and perhaps do not feel “right,” consider these questions: • Is this action legal? • Is this action ethical? • Is this action in line with our Code and company policies? • Is this action upholding ERIE’s reputation? If you answered “no” to any of these questions: STOP and report the situation to any of the following resources: • Your leader or any ERIE leader • The Compliance Department • Your ERC or HRBP • Any of the Key Contacts at the end of our Code • ERIE Ethicsline

6 Conflicts of Interest A conflict of interest arises when our personal interests interfere, or even appear to interfere, with the Company’s interests� We all have a responsibility to protect ERIE and preserve our reputation for fairness and professionalism by avoiding conflicts of interest and disclosing anything that could appear to be a conflict� While having a conflict of interest is not necessarily a violation of our Code, a failure to disclose a potential conflict is always a violation� Did you know? A conflict can occur on or off the job� For example, a conflict could occur during the course of a second job, an outside activity, a financial investment or endeavor, or any interest that could influence your work and work-related decisions� A conflict of interest can also come from the actions of family members, if their actions or involvements could affect your business decisions� Review our Conflict of Interest and Outside Employment Policy for more information� Be Above All • Understand how to identify a conflict of interest� • Update your conflicts of interest form if something changes� • Avoid interests, activities or relationships that interfere with ERIE Customers' and/or shareholders’ best interests or with your ability to be fair and unbiased� • Never work for a competitor while you are an ERIE Employee� • Never process or service your own policy or claim, or the policy or claim of a family member or friend� • Review the conflicts of interest form document for further guidance� • Discuss any potential conflicts of interest with your leader or Compliance if you are unsure or need guidance� Gifts & Entertainment At ERIE, we should always use good judgment and only give or receive gifts and entertainment when we know that doing so will not compromise our ability to make objective business decisions� ERIE’s Gifts and Entertainment Policy provides guidance for us to follow� Remember that if a reasonable observer could question the particular gift or entertainment, even if it is acceptable per our policy, you should pause and seek advice from Compliance before accepting it� Be Above All • Be mindful that any gifts or entertainment given or received from business contacts should be aligned with our Gift and Entertainment Policy� See the policy job aid for more guidance� • Avoid situations that could reflect poorly on ERIE, such as giving or receiving inappropriate gifts or forms of entertainment� • Be sensitive to third party gift policies and do not offer anything that might violate those policies� Gifts of cash or cash equivalents, such as gift cards or gift certificates are never acceptable. Call the ERIE Ethicsline at 1 (866) 469-5708 or visit erieinsurance.ethicspoint.com for Anonymous Reporting 24/7.

Our Culture What do we mean when we say “ethical”? Being ethical at ERIE means doing the right thing even when no one is looking� You can do this by upholding our Core Values and following our Code of Conduct to help you� 7 Executive Leadership members (left image) from left to right: Brian Bolash, EVP, Secy & Gen Counsel; Sean Dugan, EVP, HR & Corporate Services; Lorianne Feltz, EVP, Claims & Customer Service; Doug Smith, EVP, Sales & Products; Julie Pelkowski, EVP & CFO; Parthasarathy Srinivasa, EVP & CIO; Tim NeCastro, President & CEO.

8 Environmental, Social & Governance We act in the best interest of our Employees, our communities, and our planet� Environmental and social criteria are considered in our business processes to make them sustainable and responsible� ERIE employs sound governance for better decision making and positive business impact� ERIE demonstrates good corporate citizenship when we support our communities through partnerships with others and by following our Founder H�O� Hirt’s tradition of giving generously� We remain committed to helping those around us by donating our time, talent, and financial resources� Be Above All • Recognize the importance of sustainable actions and share in ERIE’s strategic initiatives to make a positive impact on the environment� • Consider supporting our communities and those in need through the Erie Insurance Giving Network� • Volunteer your time and talent by participating in ERIE Service Corps events and skills-based opportunities with our nonprofit partners� Diversity, Equity & Inclusion We contribute to a positive work environment by valuing the diversity of experiences and perspectives� At ERIE, we define diversity as all the ways, visible or invisible, that each of us is unique� Our inclusive environment makes it possible for all Employees to make the most of opportunities, take ownership of performance, and realize their full potential� We prohibit and do not tolerate discrimination in our workplace� ERIE employs qualified people based on their ability to do their job� Did you know? The law is designed to protect individuals from discrimination based on certain characteristics� These characteristics include, but are not limited to, age, ancestry, citizenship, color, disability, gender identity, genetic information, military status, marital status, national origin, race, religion, sex, sexual orientation, pregnancy or breastfeeding� Be Above All • Make employment-related decisions such as recruiting, hiring, firing or promoting based on the individual’s qualifications, performance and capabilities to succeed in the job� • Never treat any individual differently or make employment-related decisions based on characteristics protected by the law� • Remember, diversity includes all the ways we are different including different perspectives or working styles� We have a responsibility to work collaboratively and respectfully with one another� Call the ERIE Ethicsline at 1 (866) 469-5708 or visit erieinsurance.ethicspoint.com for Anonymous Reporting 24/7.

9 Harassment Free Workplace At ERIE, we all have an obligation to treat one another with dignity and respect� ERIE strictly prohibits harassment, in any form, and will not tolerate disrespectful behavior or remarks� By fostering a culture of dignity and respect, we provide an environment where all team members are free to share ideas and work together to achieve better results� Did you know? When people hear the word harassment, they often think first of sexual harassment� But the term “harassment” actually refers to any conduct that is unwelcome or personally offensive to another individual� This includes threats, acts of violence, bullying and intimidation� Read ERIE’s Anti-Harassment Policy for more details� Be Above All • Consistently treat your colleagues with respect, even when there are business pressures or differences of opinion� • Refuse to act in a way that could threaten, bully or intimidate others� • Act professionally at all times, in person and online� • Speak up if you see someone being harassed or believe you are being harassed� • If someone tells you that your behavior is offensive or unwelcome, take responsibility, apologize and stop the behavior� Question: I overheard an offensive joke. Most of the group was laughing, but I wasn’t. Should I tell them I was offended? Answer: Yes, if you are comfortable doing so. Offensive or unwelcome behavior has no place in our workplace. If you are uncomfortable confronting the person(s) telling the joke, talk to your leader or any ERIE leader, or any of the other contacts listed throughout our Code. Our founder believed that all representatives of ERIE should conduct themselves according to the “Golden Rule,” treating others as you would like to be treated.

10 Safety in Our Workplace At ERIE we are committed to providing a safe and healthy work environment� We strive to maintain a workplace free of unsafe conditions, unsafe acts, violence or threats of violence� Read our Workplace Violence Policy for more information� Be Above All • Maintain an atmosphere of professionalism, courtesy and mutual respect for emotional well-being� • Do not tolerate threats of violence, harassment, or violent or intimating words, messages or acts� • If someone makes a threat or you believe someone may be considering a violent action, report it immediately� • Never bring weapons into ERIE buildings and follow the state specific guidance in the Employee Handbook regarding weapons in vehicles and parking lots� • Never report to work under the influence of illegal drugs or alcohol� Read our Drug and Alcohol Policy for more information� If you are at a company event, use good judgement if alcohol is being served� If you see something, say something. Call Security at Home Office ext. 2700. Call the ERIE Ethicsline at 1 (866) 469-5708 or visit erieinsurance.ethicspoint.com for Anonymous Reporting 24/7.

11 Insider Information We comply with all laws and company policies that prohibit us from trading in ERIE’s securities based on “inside information” that we learn of through the course of our job� This includes information about ERIE as well as information about our Customers, business partners or any other third parties� Did you know? Insider trading is the purchase or sale of a publicly traded security by someone who has material nonpublic information about the company issuing the security� For example, material information might include news of an expansion, a new strategic direction for a company or a change in corporate leadership� Be Above All • Never use material nonpublic information for your own financial gain� • Never provide a “tip” and pass on material nonpublic information to another person� • If you are giving a presentation to an outside group, make sure the details of the presentation do not disclose confidential or restricted ERIE information� • If you are questioning whether a securities transaction is appropriate, given your role at ERIE, see ERIE’s Securities Trades by Company Personnel Policy or talk to the Law Division before you proceed� Anti-Bribery At ERIE we conduct business fairly and do not give anyone anything of value in an attempt to gain an unfair business advantage� We prohibit bribery and kickbacks anywhere we do business� Agents and other third parties who work on our behalf should conduct themselves with the same level of integrity� Bribery and kickbacks are not just wrong, they are often illegal, and failure to comply with our Anti-Bribery and Anti-Corruption Policy can carry significant fines or even criminal charges for individuals and for ERIE� Did you know? Most laws define a bribe or kickback as any kind of money, fee, commission, credit, gift, gratuity, travel benefit, entertainment or compensation that is provided, with the hopes of improperly obtaining business or receiving favorable treatment from a government official� Be Above All • Never promise or give someone something that has value to them in an attempt to secure an unfair business advantage� • Decline offers of discounts on personal products or services from third parties who may be making the offer with the hope of receiving favorable treatment from you, or from ERIE in a future transaction� • Record all payments and transactions accurately, and never try to conceal the true nature of an expense� • Remember that ERIE may be held liable for the actions of our Agents and third parties, so it is important to alert your leader if something does not seem right� Our Stakeholders

12 Fair Competition We secure business based on our commitment to be Above all in SERVICE®� We make sure that our actions are ethical and in compliance with antitrust and unfair practice laws� Did you know? Antitrust and unfair competition laws are intended to protect consumers from corporate practices that might limit the free market and restrict their access to competitive products at competitive prices� Refer to the Antitrust Policy for a more detailed list of guidelines to avoid violations� Be Above All • Know how antitrust and competition laws apply to your job requirements� • Do not discuss any confidential ERIE information with competitors or others, and do not discuss competitors’ confidential information� • Do not collect information about competitors through illegal means, such as theft, spying, bribery or breach of a confidentiality agreement or contractual agreement� • Be careful about your conversations when attending trade association meetings where you may have contact with competitors� Stick to discussing general business practices and not ERIE-specific confidential company information� • When researching or requesting information from competitors for business purposes, identify yourself as an ERIE Employee� • Any requests by you to connect with another person or entity online for business purposes must not be misleading, deceptive or misrepresent a relationship with, or connection to, ERIE� Call the ERIE Ethicsline at 1 (866) 469-5708 or visit erieinsurance.ethicspoint.com for Anonymous Reporting 24/7.

13 Customer Service & Fair Claims Handling We treat our Customers and claimants respectfully and fairly every step of the way, from marketing to sales and service, to the underwriting and rating of each policy� We settle claims fairly, promptly and in good faith� Be Above All • Align your actions with ERIE’s Founding Purpose� • Always treat the Customer fairly and provide as near perfect service as is humanly possible� • Understand and follow company policies, laws and regulations that apply to the work you do� • Use ERIE’s underwriting guidelines and rules consistently� • Follow all ERIE claims handling policies and procedures� Our Agency Force Our Agents are a reflection of ERIE� Fostering relationships with trustworthy and dependable Agents enables us to provide near perfect service� Did you know? ERIE sells insurance exclusively through independent Agents� By entering into agency agreements, our Agents agree to follow ERIE’s business practices and all laws and regulations that apply to them as independent Agents� Agents are not Employees; rather, they are the face of ERIE in the community, and we value strong relationships with our Agents� Be Above All • If you work directly with our Agents, be sure to communicate and demonstrate ERIE’s standards for doing business legally and ethically� • The actions of our Agents reflect on our reputation� If you observe or suspect misconduct of an Agent, notify Compliance�

14 ERIE’s Assets At ERIE, our shareholders and Customers depend on us to use our assets responsibly� We all play a role in helping to protect ERIE assets from theft, loss and misuse� This includes everything from correctly reporting business expenses to protecting ERIE’s property� Did you know? Our assets include more than just physical property� ERIE assets include items such as our reputation, money, checks, records and documents, data and information, intellectual property, buildings and grounds, company vehicles, office equipment, furniture and our computer network� Be Above All • Use ERIE’s assets thoughtfully and responsibly� • Never use ERIE assets or resources for personal gain� • Report all expenses accurately and timely� • Obtain appropriate approvals for all contracts or purchases� If you are a senior financial officer, you have greater responsibilities and must follow our Code of Ethics for Senior Financial Officers� Privacy & Information Security At ERIE, we are responsible for protecting all restricted, confidential and nonpublic personally identifiable information, no matter whether it belongs to ERIE, our Employees, Customers or any third party� We must understand and uphold the rules and regulations that apply to this information� We must also be cautious not to disclose this information to others who are not authorized to receive it or who do not have a business need to know the information� Whether we are working in an office, in the field or remotely, we must all take proper steps to preserve the information that is gathered while performing our work� Privacy sets rules for accessing, using and sharing information� Information Security has administrative, technical and physical safeguards in place to protect the confidentiality, integrity and availability of this information, and lower the risk of cyberattacks, data breaches, and other threats� We must be vigilant and follow the company policies and standards to do our part to uphold, not only the law, but the trust of all with whom we do business� Read our Privacy & Information Security Handbook for more information on our policies and standards� Our Assets Call the ERIE Ethicsline at 1 (866) 469-5708 or visit erieinsurance.ethicspoint.com for Anonymous Reporting 24/7.

15 Be Above All • Carefully protect all information that is in your care� If you have doubts, treat it with the highest level of security and handle it accordingly� • Never access or process your own policy or claim, that of a friend or family member, even if you are assigned to work on it� Alert your leader to have the work reassigned� • Access information only if you are authorized to do so, and if you need to use the information to do your job� • Know when you can share personal data and when you can’t� Never give someone information if you are not sure that you should be sharing it� • Shield information from the view of others, and do not lose, misplace or leave behind any information where any unauthorized individuals could access it� • Report any loss or breach of personal information to your leader, Privacy, Information Security or the ERIE Ethicsline as soon as possible� You may also use this form: Report a Privacy Incident—Unauthorized Access, Use or Disclosure of Information� • Remember that you have an obligation to protect information, even if you no longer work for ERIE� Question: My friend asked me to look something up to make sure it was documented properly on their claim. Is this okay? Answer: No. Viewing the information outside of the scope of your job duties is a violation of our Code. Just because we have access to information, doesn’t make it acceptable to view it for non-work related purposes. If you are assigned to work on that claim, you are required to alert your leader and ask that the work be reassigned.

16 Records Management We are careful to create records that clearly and accurately reflect our intentions, actions and decisions� We maintain records responsibly, in line with regulations and ERIE’s Records Retention Schedule� See ERIE’s Records Retention Policy for more information� Did you know? There may be times when ERIE needs to hold onto records because of potential litigation or investigation� When there is a legal hold order in place, records must be retained even if their retention period has expired� If you have received a legal hold order email notice from the Law Division, or if you have heard about the possibility of litigation or an investigation, you must hold onto all records that may be related regardless of your opinion about the information contained in those records� See ERIE’s Legal Hold Policy for more information� Do not destroy or discard anything that may be related to the legal hold until the hold is released� Be Above All • Exercise good judgment when creating any professional communication and recognize that any email or message may be read in the future by someone without the benefit of context� • Keep records for the appropriate period of time under ERIE’s Records Retention Schedule� • Follow instructions to hold records and cease any normal record destruction when required to do so by a legal hold, or if you learn that the records may be relevant to a case or claim� If in doubt, contact the Law Division� Call the ERIE Ethicsline at 1 (866) 469-5708 or visit erieinsurance.ethicspoint.com for Anonymous Reporting 24/7.

17 Intellectual Property We value the knowledge and intellectual contribution of our Employees� Our intellectual property is critical to our success as a company and we must safeguard it at all times� We also protect the intellectual property of third parties� Did you know? Intellectual property is made up of assets each of us create and contribute in our daily work� For the most part, these assets are intangible, meaning, not physical objects, but ideas, concepts or rights� Here are some examples of intellectual property that we might encounter working for ERIE: Trademarks and service marks—are ways ERIE, and other companies, identify their products to make them stand out in the market� Some examples include: our ERIE service mark, the cupola logo and product or service brand names� Copyrights—are the rights we have to reproduce, distribute and display the written, graphic and audiovisual works that we create, such as policy forms and marketing materials� Trade secrets and proprietary information—are information that ERIE classifies as confidential and restricted� Some examples include underwriting guidelines, claims handling procedures, investment plans, strategic plans, Customer lists, custom software and computer coding designs� See ERIE’s Information Classifications segment in our Privacy & Information Security Handbook for more information� Patents—are federally-granted rights that prevent others from using company products and processes� Be Above All • Understand how to identify intellectual property and how to protect it� • Be mindful of copyrights that belong to others� Don’t copy, download, distribute, use or display materials that may be subject to copyright without permission of the copyright owner� See ERIE’s Copyright Policy for more information� • Contact the Law Division with any questions or guidance on recognizing when something is ERIE’s intellectual property, how to use ERIE’s intellectual property, or if you think ERIE’s intellectual property (or someone else’s) has been misused� Financial Statements At ERIE, we maintain accurate and complete accounts and have internal controls in place to ensure that we provide timely, accurate and transparent financial statements when filed or otherwise disclosed to the public� If we find discrepancies, we investigate and work quickly to resolve them� Be Above All • Be accurate and follow all company policies and internal control procedures when recording transactions� • Never intentionally falsify or misrepresent the facts of a transaction� • Exercise good judgment and follow corporate guidelines when preparing or approving expense reports� • Report any concerns about internal controls or the accuracy or integrity of ERIE’s financial statements or disclosures to one of the key contacts listed at the end of our Code�

18 Communication with the Public Our shareholders and Customers rely on us to be truthful and to uphold our values and Founding Purpose� This includes being honest, clear and accurate when we communicate to the public and the media about ERIE� Only certain individuals within ERIE have permission to speak on ERIE’s behalf� See ERIE’s Media Policy for more information� Be Above All • If you receive an inquiry from the public, including the media, contact Strategic Communications� • If you receive an inquiry from a regulator or government agency, contact Compliance or Government Relations� • Do not share internal ERIE information online or on social media, as this may result in an unintended public disclosure� Social Media We must exercise good judgment when using social media, regardless of whether our use is for business or personal reasons� See ERIE’s Employee Social Media Policy for more information� Be Above All • Social media is generally a public forum, and posts and comments might be viewed or read by anyone� Regardless of the context, you are personally responsible and accountable for your communications in social media� • Never disclose confidential information about ERIE or any of our Customers or business partners while using social media� • Remember, you are an extension of ERIE and your actions should reflect our core values and be legal, ethical and in alignment with company policies� • You should be respectful of potential readers and colleagues, and not post or share anything that others may perceive as obscene, threatening, harassing or discriminatory� Our Reputation Question: I was approached by a local news station while walking to my car and they asked me if I would comment on behalf of ERIE. Should I agree to make a comment? Answer: No. If you are not authorized to speak on behalf of ERIE within the scope of your job duties, you should never make a statement on behalf of ERIE. Call the ERIE Ethicsline at 1 (866) 469-5708 or visit erieinsurance.ethicspoint.com for Anonymous Reporting 24/7.

19 Political Activity To protect our interests and the interests of the insurance industry, ERIE participates in government relations and political engagement activities with elected officials and regulators� In doing this, ERIE observes all lobbying laws and regulations that apply to corporate political activity� Our nonpartisan political action committees serve as important vehicles to advocate for the insurance industry� Only selected ERIE Employees in the Law Division are designated to speak on behalf of ERIE regarding our position on pending legislation� All others should not speak on behalf of ERIE in this regard� Be Above All • If you participate in personal political activities, do not use ERIE’s assets to support those activities, and do not solicit contributions from fellow Employees� • Avoid making statements on political issues that could appear to be speaking for ERIE, such as mentioning ERIE’s name or your job title� • If you participate in corporate political activity on ERIE’s behalf, know and follow the laws and regulations that govern this process� • If you have questions, contact the SVP of Law or VP of Government Relations�

20 What happens if someone violates our Code? We all have a responsibility to uphold our Code and to raise concerns of suspected or actual violations� All violations will be investigated, and appropriate action will be taken, which may include corrective action, up to and including termination of employment or the business relationship� Speak Up What: Speaking up means looking out for ERIE, for each other and for our Customers� It means being responsible for recognizing illegal, unethical, unsafe or unprofessional behavior, as well as other violations of our Code or company policies� If you are an ERIE leader: it also means promoting a culture which encourages Employees to ask questions and report concerns� When we speak up we foster an environment which helps maintain a high ethical standard of conduct� When: Trust yourself� If it doesn’t feel right, it probably isn’t� Reporting concerns can help us identify issues early when it’s still possible to prevent damage to our business and reputation� How: ERIE has several different ways you can speak up if you have a question, concern or need to report misconduct� To speak up, contact: • Your leader or any ERIE leader • The Compliance Department • Your ERC or HRBP • Any of the Key Contacts at the end of our Code • ERIE Ethicsline ERIE Ethicsline is a service provided by an independent third party which you may use to make reports� This service includes a telephone hotline and a website where you can report concerns� You may choose to remain anonymous when reporting� Our Conduct Call the ERIE Ethicsline at 1 (866) 469-5708 or visit erieinsurance.ethicspoint.com for Anonymous Reporting 24/7.

21 What will happen after I make a report? ERIE will take your report seriously and you will not be retaliated against for making an honest report� ERIE will not discipline, discriminate or retaliate against anyone who reports a concern in good faith, or who cooperates in any investigation or inquiry regarding such conduct, even if the allegation is proven to be unsubstantiated� ERIE will also do everything possible to protect the confidentiality of individuals who make a report or participate in an investigation� ERIE will only share information about individual reports with those who need to know to carry out the investigation� If misconduct is discovered, appropriate corrective action will be taken� What happens if the company becomes the subject of an investigation? If ERIE becomes the subject of an investigation, it is important that we maintain a positive and respectful working relationship with regulators, auditors and other entities� We may be asked to help coordinate these investigations� If so, we must respond honestly, completely and timely� Compliance and Law will help guide us through those investigations� Call Ethicsline Information Recorded Investigated Routed to Restricted ERIE Leaders Appropriate Action Taken

22 Closing Thoughts Thank you for taking time to read ERIE’s Code of Conduct� It can take considerable time and effort to build an environment of trust with each other, our Agents, our Policyholders, our vendor partners and the local communities we serve� Unfortunately, it can literally take just a moment to lose that trust� We understand that mistakes can happen, and we will work through those together as a team� However, when we neglect to act with honesty and integrity, we run the risk of not keeping the trust that has been built, thus potentially impacting ERIE’s reputation� Please view our Code as a resource to help guide you through moments of uncertainty and to serve as an aid to help you handle ethical dilemmas successfully� In addition, please remember to inform appropriate company personnel if you become aware of or observe questionable behavior or transactions� While our Code may not have all the answers, it can at least point you in the direction of other resources available to you� If you still have questions, please do not hesitate to contact the Compliance Department, Human Resources, or any of the key contacts listed on the next page, for additional guidance or direction� ERIE is a great company made up of great Employees, all of whom do great things each and every day� All the people and organizations we serve count on us to do the right thing� Thank you for your continued commitment to doing just that! - Debra Mack, Vice President, Compliance & Ethics Conclusion “Simple common sense mixed with plain decency.” – H.O. Hirt Call the ERIE Ethicsline at 1 (866) 469-5708 or visit erieinsurance.ethicspoint.com for Anonymous Reporting 24/7.

23 Key Contacts Debra Mack Vice President, Compliance & Ethics Debra�Mack@erieinsurance�com (814) 870-4685 Pamela Pesta Vice President, Corporate Internal Audit Officer Pamela�Pesta@erieinsurance�com (814) 870-2460 James Nealon III Senior Vice President, Law James�NealonIII@erieinsurance�com (814) 870-3183 Karen Skarupski Senior Vice President, Human Resources Karen�Skarupski@erieinsurance�com (814) 870-3319 ERIE Ethicsline erieinsurance�ethicspoint�com 1 (866) 469-5708

OFP99 11/23 This Code is a statement of ERIE’s compliance and ethics requirements. However, it is not a complete statement of ERIE policies. Certain ERIE policies are linked in this document for individuals internal to ERIE to review. These links are for ease of reference. This Code does not create an employment or third-party contract. While we are all responsible to comply with our Code, in rare occasions, our Executive Officers or Directors may receive a waiver of certain obligations. Only our Board of Directors or its delegated committee can grant such a waiver and if approved, the waiver will be disclosed to our Shareholders as required by laws and regulations.

Erie Indemnity Reports Third Quarter 2023 Results

Net Income per Diluted Share was $2.51 for the Quarter and $6.41 for the Nine Months of 2023

Erie, Pa., October 26, 2023 - Erie Indemnity Company (NASDAQ: ERIE) today announced financial results for the quarter and nine months ending September 30, 2023. Net income was $131.0 million, or $2.51 per diluted share, in the third quarter of 2023, compared to $84.3 million, or $1.61 per diluted share, in the third quarter of 2022. Net income was $335.1 million, or $6.41 per diluted share, in the first nine months of 2023, compared to $233.1 million, or $4.46 per diluted share, in the first nine months of 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

| 3Q and Nine Months 2023 | | | | |

| | |

| | | | | | | | | |

| (in thousands) | 3Q'23 | 3Q'22 | | | 2023 | 2022 | | | |

| Operating income | $ | 148,471 | | $ | 106,472 | | | | | $ | 393,172 | | $ | 294,784 | | | | | |

| Investment income (loss) | 12,302 | | (571) | | | | | 19,197 | | 344 | | | | | |

| Interest expense and other (income), net | (3,001) | | (447) | | | | | (9,643) | | 637 | | | | | |

| Income before income taxes | 163,774 | | 106,348 | | | | | 422,012 | | 294,491 | | | | | |

| Income tax expense | 32,734 | | 22,035 | | | | | 86,879 | | 61,412 | | | | | |

| Net income | $ | 131,040 | | $ | 84,313 | | | | | $ | 335,133 | | $ | 233,079 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Operating income before taxes increased $42.0 million, or 39.4 percent, in the third quarter of 2023 compared to the third quarter of 2022.

•Management fee revenue - policy issuance and renewal services increased $97.4 million, or 17.7 percent, in the third quarter of 2023 compared to the third quarter of 2022.

•Management fee revenue - administrative services increased $1.5 million, or 10.2 percent, in the third quarter of 2023 compared to the third quarter of 2022.

•Cost of operations - policy issuance and renewal services

◦Commissions increased $44.6 million in the third quarter of 2023 compared to the third quarter of 2022, primarily driven by the growth in direct and affiliated assumed written premium, partially offset by a decrease in agent incentive compensation.

◦Non-commission expense increased $12.7 million in the third quarter of 2023 compared to the third quarter of 2022. Underwriting and policy processing expense increased $2.8 million primarily due to increased underwriting report costs. Information technology costs increased $0.9 million primarily due to increased professional fees. Administrative and other costs increased $9.7 million primarily due to an increase in personnel costs and professional fees. Personnel costs were impacted by increased compensation including higher estimated costs for incentive plan awards, partially offset by lower pension costs due to an increase in the discount rate compared to 2022. Increases in incentive plan costs

were driven by improved direct written premiums and policies in force growth and a higher company stock price at September 30, 2023 compared to September 30, 2022.

Income from investments before taxes totaled $12.3 million in the third quarter of 2023 compared to loss from investments before taxes of $0.6 million in the third quarter of 2022. Net investment income was $14.6 million in the third quarter of 2023 compared to $5.8 million in the third quarter of 2022. Net investment income included less than $0.1 million of limited partnership losses in the third quarter of 2023 compared to $4.6 million in the third quarter of 2022. Net realized and unrealized losses on investments were $2.2 million in the third quarter of 2023 compared to $6.2 million in the third quarter of 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months 2023 Highlights |

Operating income before taxes increased $98.4 million, or 33.4 percent, in the first nine months of 2023 compared to the first nine months of 2022.

•Management fee revenue - policy issuance and renewal services increased $256.3 million, or 16.2 percent, in the first nine months of 2023 compared to the first nine months of 2022.

•Management fee revenue - administrative services increased $3.5 million, or 8.1 percent, in the first nine months of 2023 compared to the first nine months of 2022.

•Cost of operations - policy issuance and renewal services

◦Commissions increased $115.9 million in the first nine months of 2023 compared to the first nine months of 2022, primarily driven by the growth in direct and affiliated assumed written premium, partially offset by a decrease in agent incentive compensation.

◦Non-commission expense increased $45.7 million in first the nine months of 2023 compared to the first nine months of 2022. Underwriting and policy processing expense increased $9.1 million primarily due to increased underwriting report, personnel, and postage costs. Information technology costs increased $15.7 million primarily due to increased professional fees, hardware and software costs, and personnel costs. Administrative and other costs increased $20.3 million primarily due to an increase in personnel costs. Personnel costs were impacted by increased compensation including higher estimated costs for incentive plan awards, partially offset by lower pension costs due to an increase in the discount rate compared to 2022. Increases in incentive plan costs were driven by improved direct written premiums and policies in force growth and a higher company stock price at September 30, 2023 compared to September 30, 2022.

Income from investments before taxes totaled $19.2 million in the first nine months of 2023 compared to $0.3 million in the first nine months of 2022. Net investment income was $30.4 million in the first nine months of 2023 compared to $24.6 million in the first nine months of 2022. Net investment income included $10.7 million of limited partnership losses in the first nine months of 2023 compared to $2.2 million in the first nine months 2022. Net realized and unrealized losses on investments were $9.2 million in the first nine months of 2023 compared to $23.8 million in the first nine months of 2022.

Webcast Information

Indemnity has scheduled a pre-recorded audio broadcast on the Web for 10:00 AM ET on October 27, 2023. Investors may access the pre-recorded audio broadcast by logging on to www.erieinsurance.com.

Erie Insurance Group

According to A.M. Best Company, Erie Insurance Group, based in Erie, Pennsylvania, is the 12th largest homeowners insurer, 12th largest automobile insurer and 13th largest commercial lines insurer in the United States based on direct premiums written. Founded in 1925, Erie Insurance is a Fortune 500 company and the 19th largest property/casualty insurer in the United States based on total lines net premium written. Rated A+ (Superior) by A.M. Best, ERIE has more than 6 million policies in force and operates in 12 states and the District of Columbia.

News releases and more information are available on ERIE's website at www.erieinsurance.com.

***

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995:

Statements contained herein that are not historical fact are forward-looking statements and, as such, are subject to risks and uncertainties that could cause actual events and results to differ, perhaps materially, from those discussed herein. Forward-looking statements relate to future trends, events or results and include, without limitation, statements and assumptions on which such statements are based that are related to our plans, strategies, objectives, expectations, intentions, and adequacy of resources. Examples of forward-looking statements are discussions relating to premium and investment income, expenses, operating results, and compliance with contractual and regulatory requirements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Among the risks and uncertainties, in addition to those set forth in our filings with the Securities and Exchange Commission, that could cause actual results and future events to differ from those set forth or contemplated in the forward-looking statements include the following:

•dependence upon our relationship with the Erie Insurance Exchange ("Exchange") and the management fee under the agreement with the subscribers at the Exchange;

•dependence upon our relationship with the Exchange and the growth of the Exchange, including:

◦general business and economic conditions;

◦factors affecting insurance industry competition;

◦dependence upon the independent agency system; and

◦ability to maintain our reputation;

•dependence upon our relationship with the Exchange and the financial condition of the Exchange, including:

◦the Exchange's ability to maintain acceptable financial strength ratings;

◦factors affecting the quality and liquidity of the Exchange's investment portfolio;

◦changes in government regulation of the insurance industry;

◦litigation and regulatory actions;

◦emergence of significant unexpected events, including pandemics and inflation;

◦emerging claims and coverage issues in the industry; and

◦severe weather conditions or other catastrophic losses, including terrorism;

•costs of providing policy issuance and renewal services to the Exchange under the subscriber's agreement;

•ability to attract and retain talented management and employees;

•ability to ensure system availability and effectively manage technology initiatives;

•difficulties with technology or data security breaches, including cyber attacks;

•ability to maintain uninterrupted business operations;

•outcome of pending and potential litigation;

•factors affecting the quality and liquidity of our investment portfolio; and

•our ability to meet liquidity needs and access capital.

A forward-looking statement speaks only as of the date on which it is made and reflects our analysis only as of that date. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changes in assumptions, or otherwise.

Exhibit 99.2

Erie Indemnity Company

Statements of Operations

(dollars in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (Unaudited) | | (Unaudited) |

| Operating revenue | | | | | | | | |

| Management fee revenue - policy issuance and renewal services | | $ | 649,049 | | | $ | 551,666 | | | $ | 1,840,478 | | | $ | 1,584,213 | |

| Management fee revenue - administrative services | | 16,151 | | | 14,657 | | | 46,976 | | | 43,446 | |

| Administrative services reimbursement revenue | | 187,118 | | | 168,653 | | | 544,411 | | | 492,655 | |

| Service agreement revenue | | 6,620 | | | 6,260 | | | 19,408 | | | 19,175 | |

| Total operating revenue | | 858,938 | | | 741,236 | | | 2,451,273 | | | 2,139,489 | |

| | | | | | | | |

| Operating expenses | | | | | | | | |

| Cost of operations - policy issuance and renewal services | | 523,349 | | | 466,111 | | | 1,513,690 | | | 1,352,050 | |

| Cost of operations - administrative services | | 187,118 | | | 168,653 | | | 544,411 | | | 492,655 | |

| | | | | | | | |

| Total operating expenses | | 710,467 | | | 634,764 | | | 2,058,101 | | | 1,844,705 | |

| Operating income | | 148,471 | | | 106,472 | | | 393,172 | | | 294,784 | |

| | | | | | | | |

| Investment income | | | | | | | | |

| Net investment income | | 14,642 | | | 5,834 | | | 30,360 | | | 24,606 | |

| Net realized and unrealized investment losses | | (2,227) | | | (6,230) | | | (9,246) | | | (23,833) | |

| Net impairment losses recognized in earnings | | (113) | | | (175) | | | (1,917) | | | (429) | |

| | | | | | | | |

| Total investment income (loss) | | 12,302 | | | (571) | | | 19,197 | | | 344 | |

| | | | | | | | |

| Interest expense | | — | | | 115 | | | — | | | 2,009 | |

| Other income | | 3,001 | | | 562 | | | 9,643 | | | 1,372 | |

| Income before income taxes | | 163,774 | | | 106,348 | | | 422,012 | | | 294,491 | |

| Income tax expense | | 32,734 | | | 22,035 | | | 86,879 | | | 61,412 | |

| Net income | | $ | 131,040 | | | $ | 84,313 | | | $ | 335,133 | | | $ | 233,079 | |

| | | | | | | | |

| | | | | | | | |

| Net income per share | | | | | | | | |

| Class A common stock – basic | | $ | 2.81 | | | $ | 1.81 | | | $ | 7.20 | | | $ | 5.00 | |

| Class A common stock – diluted | | $ | 2.51 | | | $ | 1.61 | | | $ | 6.41 | | | $ | 4.46 | |

| Class B common stock – basic and diluted | | $ | 422 | | | $ | 272 | | | $ | 1,079 | | | $ | 751 | |

| | | | | | | | |

| | | | | | | | |

| Weighted average shares outstanding – Basic | | | | | | | | |

| Class A common stock | | 46,189,037 | | | 46,189,025 | | | 46,188,962 | | | 46,188,878 | |

| Class B common stock | | 2,542 | | | 2,542 | | | 2,542 | | | 2,542 | |

| | | | | | | | |

| Weighted average shares outstanding – Diluted | | | | | | | | |

| Class A common stock | | 52,299,369 | | | 52,296,411 | | | 52,298,655 | | | 52,297,685 | |

| Class B common stock | | 2,542 | | | 2,542 | | | 2,542 | | | 2,542 | |

| | | | | | | | |

| Dividends declared per share | | | | | | | | |

| Class A common stock | | $ | 1.19 | | | $ | 1.11 | | | $ | 3.57 | | | $ | 3.33 | |

| Class B common stock | | $ | 178.50 | | | $ | 166.50 | | | $ | 535.50 | | | $ | 499.50 | |

Erie Indemnity Company

Statements of Financial Position

(in thousands)

| | | | | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| | (Unaudited) | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 102,873 | | | $ | 142,090 | |

| Available-for-sale securities | | 69,822 | | | 24,267 | |

| | | | |

| Receivables from Erie Insurance Exchange and affiliates, net | | 620,683 | | | 524,937 | |

| Prepaid expenses and other current assets | | 71,480 | | | 79,201 | |

| | | | |

| Accrued investment income | | 8,968 | | | 8,301 | |

| Total current assets | | 873,826 | | | 778,796 | |

| | | | |

| Available-for-sale securities, net | | 845,415 | | | 870,394 | |

| Equity securities | | 79,516 | | | 72,560 | |

| | | | |

| Fixed assets, net | | 434,975 | | | 413,874 | |

| Agent loans, net | | 59,544 | | | 60,537 | |

| | | | |

| Defined benefit pension plan | | 65,163 | | | 0 | |

| Other assets | | 36,110 | | | 43,295 | |

| Total assets | | $ | 2,394,549 | | | $ | 2,239,456 | |

| | | | |

| Liabilities and shareholders' equity | | | | |

| Current liabilities: | | | | |

| Commissions payable | | $ | 357,614 | | | $ | 300,028 | |

| Agent bonuses | | 50,252 | | | 95,166 | |

| Accounts payable and accrued liabilities | | 165,797 | | | 165,915 | |

| Dividends payable | | 55,419 | | | 55,419 | |

| Contract liability | | 40,831 | | | 36,547 | |

| Deferred executive compensation | | 11,000 | | | 12,036 | |

| | | | |

| | | | |

| | | | |

| Total current liabilities | | 680,913 | | | 665,111 | |

| | | | |

| Defined benefit pension plans | | 27,744 | | | 51,224 | |

| | | | |

| Contract liability | | 19,653 | | | 17,895 | |

| Deferred executive compensation | | 18,547 | | | 13,724 | |

| Deferred income taxes, net | | 11,045 | | | 14,075 | |

| Other long-term liabilities | | 24,758 | | | 29,019 | |

| Total liabilities | | 782,660 | | | 791,048 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Shareholders’ equity | | 1,611,889 | | | 1,448,408 | |

| Total liabilities and shareholders’ equity | | $ | 2,394,549 | | | $ | 2,239,456 | |

Document and Entity Information

|

Oct. 24, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 24, 2023

|

| Entity Registrant Name |

ERIE INDEMNITY COMPANY

|

| Entity Incorporation, State or Country Code |

PA

|

| Entity File Number |

0-24000

|

| Entity Tax Identification Number |

25-0466020

|

| Entity Address, Address Line One |

100 Erie Insurance Place,

|

| Entity Address, City or Town |

Erie,

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

16530

|

| City Area Code |

814

|

| Local Phone Number |

870-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock,

|

| Trading Symbol |

ERIE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000922621

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

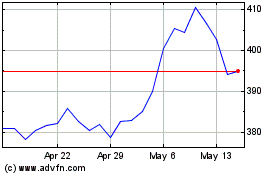

Erie Indemnity (NASDAQ:ERIE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Erie Indemnity (NASDAQ:ERIE)

Historical Stock Chart

From Jul 2023 to Jul 2024