Form 8-K - Current report

February 01 2024 - 8:39AM

Edgar (US Regulatory)

0001805077FALSE00018050772024-01-312024-01-310001805077us-gaap:CommonStockMember2024-01-312024-01-310001805077us-gaap:WarrantMember2024-01-312024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 31, 2024

EOS ENERGY ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39291 | | 84-4290188 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

3920 Park Avenue

Edison, New Jersey 08820

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (732) 225-8400

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | EOSE | | The Nasdaq Stock Market LLC |

| Warrants, each exercisable for one share of common stock | | EOSEW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On January 31, 2024, HI-POWER, LLC (“Hi-Power”), a wholly-owned subsidiary of Eos Energy Enterprises, Inc. (“Eos”), entered into a Pricing Agreement (“Pricing Agreement”) with SHPP US LLC (“Sabic”) to govern the pricing terms for sales of certain resin (the “Product”) to Hi-Power authorized purchasers by Sabic. Pursuant to the Pricing Agreement, Sabic has provided certain pricing commitments in exchange for serving as Hi-Power’s exclusive supplier of the Products. As Hi-Power’s exclusive supplier, Hi-Power has agreed to require that its authorized suppliers purchase 100% of Hi-Power’s requirement of Product from Sabic.

The Pricing Agreement also contains certain minimum purchase volume requirements, in exchange for which Sabic granted HI-POWER and/or its authorized suppliers the exclusive right to purchase the Product within the market space of zinc-bromine bi-polar electrodes for use in stationary utility storage. The Pricing Agreement expires on December 31, 2028.

Item 7.01 Regulation FD Disclosure.

On February 1, 2024, Eos issued a press release announcing the entry into the Pricing Agreement. A copy of the press release is attached as Exhibit 99.1 to this Report and is hereby incorporated by reference herein.

The information furnished under this Item 7.01 and in the accompanying Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number | | Description of Document |

| | | |

| 10.1*+ | | |

| 99.1 | | |

| 104 | | Cover page of this Current Report on Form 8-K formatted in Inline XBRL |

* Certain confidential portions of this exhibit have been redacted pursuant to Item 601(b)(10)(iv) of Regulation S-K. These redacted terms have been marked in this exhibit at the appropriate place with three asterisks. An unredacted copy of the exhibit will be furnished supplementally to the SEC or its staff upon request.

+ Certain schedules and exhibits to this agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted exhibit or schedule will be furnished supplementally to the SEC or its staff upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| EOS ENERGY ENTERPRISES, INC. |

| | |

| Dated: February 1, 2024 | By: | /s/ Nathan Kroeker |

| | Name: | Nathan Kroeker |

| | Title: | Chief Financial Officer |

1 Classification: Confidential January 31, 2024 Attn: Garrett Dutkiewicz HI-POWER, LLC (“HI-POWER” or “Buyer”) 200 Braddock Ave Turtle Creek, PA Re: Pricing Agreement for SABIC LNP STAT-KON™ and NORYL™-Branded PPE Resins (the “Agreement”) Dear Garrett, This Agreement, together with the attachments, which are incorporated herein by reference, set forth the pricing terms that govern the sale of LNP STAT-KON and NORYL-branded PPE resins for the purpose molding of tanks, lids and terminal mounting brackets (the “Product(s)”) listed on Attachment A by SHPP US LLC or by a local Affiliate of SHPP Holding BV (“SABIC” or “SHPP”) to HI-POWER’s third party processors (“Authorized Purchasers”) listed on Attachment B. HI-POWER and SHPP may be referred to individually as a “Party” and collectively as the “Parties.” I. Term and Termination. This Agreement shall be effective as of the date on which both Parties have executed this Agreement and terminate on December 31, 2028, unless earlier terminated in accordance with this paragraph or paragraph IV below. The Parties may terminate this Agreement in whole or in part at any time upon *** written notice to the non-terminating Party for any or no reason. If a Party acts in material breach of its obligation under this Agreement, the non-breaching Party may terminate this Agreement by sending a written notice to the breaching Party, such notice to be effective immediately. II. OEM Pricing. Prices set forth in Attachment A are only applicable to direct shipments of Product from SHPP to HI-POWER Authorized Purchasers. III. Change of Conditions. Performance of this Agreement is contingent upon meeting the requirements of the Parties in an economical and reasonable manner. Either Party may request adjustments to this Agreement if, in its sole judgment, conditions have changed significantly since the commencement of the Agreement, including, without limitation: *** IV. Requirements, Exclusivity. 1. SHPP shall be the exclusive manufacturer and supplier of Product to HI-POWER via its Authorized Purchasers. 2. Subject to the terms of this section, from January 1, 2024 to December 31, 2026, SHPP agrees that HI-POWER shall have the exclusive right to purchase LNP STAT-KON grade FG000Z – BKNAT from SHPP (the “Sales Exclusivity Period”) within the market space of zinc -bromine bi-polar electrodes to be used in stationary utility storage. HI-POWER’s aforementioned exclusive right to purchase for the Sales Exclusivity Period is: (1) global in scope and not limited to a single jurisdiction; and (2) conditioned upon HI-POWER’s Authorized Purchasers – in the aggregate – meeting annual minimum purchase volumes of LNP STAT-KON grade FG000Z as follows: Calendar Year Annual Minimum Purchase Volume (kg) 2024 *** 2025 *** 2026 *** If HI-POWER’s Authorized Purchasers do not meet an Annual Minimum Purchase Volume listed above for a given calendar year, then in the first quarter of the immediately succeeding calendar year, SHPP reserves the right, in its sole discretion, to review and adjust the Sales Exclusivity Period, up to and including immediate termination.

2 Classification: Confidential 3. HI-POWER agrees to direct its Authorized Purchasers to procure one hundred percent (100%) of their current Product requirements for HI-POWER exclusively from SHPP for the term of the Agreement. *** SHPP agrees to produce and deliver Product to Authorized Purchasers in sufficient quantity and quality in accordance with the terms and provisions of the agreement concluded between SHPP and each Authorized Purchaser. If SHPP is not able to make sufficient quantities of Product available to Authorized Purchasers, then Authorized Purchasers shall be free to purchase Product or alternative material from third parties and be excused from requirements provisions set forth herein for as long as a shortage exists. V. Miscellaneous. 1. Affiliates. Affiliate means, in relation to a Party, any individual or entity that at any time controls, is controlled by, or is under common control with, such party, with "control" meaning directly or indirectly owning a majority equity interest in, or otherwise having the power to direct the business affairs of, the controlled entity. 2. Integration. This Agreement supersedes all previous agreements and understandings between the Parties with respect to the subject matter herein, and may not be modified except by a written document, which expressly states the intention of the Parties to modify this Agreement or any part thereof, and signed by the duly authorized representatives of the Parties. 3. Waiver. Any delay or failure in the exercise of any right under this Agreement shall not represent a waiver or forbearance of such right and shall not prejudice the future exercise of such right. The rights provided for herein are cumulative and not exclusive of any rights provided by law. 4. Governing Law. This Agreement shall be governed exclusively by, and interpreted exclusively in accordance with, the laws of the State of New York and Federal District Courts located in New York, New York. [Signature page follows] Agreed to and signed by: HI-POWER, LLC SHPP US LLC By: By: Name: Name: Title: Title: Date: Date:

Eos Energy Enterprises Join Forces with SABIC Specialties to Produce a Specialty Light- Weight, Conductive Composite Thermoplastic for Eos Z3TM Battery Multiyear supply agreement supports scaling Eos’s Z3 battery production and reducing battery module cost as part of Project AMAZE TURTLE CREEK, Pa., Feb. 01, 2024 — Eos Energy Enterprises, Inc. (NASDAQ: EOSE) ("Eos" or the “Company”), a leading provider of safe, scalable, efficient, and sustainable zinc-based long duration energy storage systems, today entered a multiyear agreement with SABIC Specialties’ US business unit, SHPP US LLC, a Saudi Basic Industries Corporation (“SABIC”) affiliate, to supply conductive composite thermoplastic for the Eos Z3 battery module. Over the past four years, Eos and SABIC worked collaboratively to develop a solution using one of SABIC’s new resin materials to replace the titanium used in prior Eos battery iterations. “Over the past six years, we’ve worked hard to take Eos from a research company to an operating company. Moving from the lab to small-scale production, and now to manufacturing at scale, requires partners who bring a mix of scale and expertise,” said Joe Mastrangelo, CEO of Eos. “Our entrepreneurial spirit allows us to find creative ways to drive down cost and improve battery performance. In working closely with SABIC Specialties, we specified an innovative new material that we believe can be produced at scale in the United States.” Eos and SABIC Specialties began collaborating on this new light-weight material in 2019 and took several years of research and development to finalize a solution. The SABIC-developed and patented material supports detailed requirements provided by Eos’s application technology team. The Eos Z3 battery module weighs 80% less than prior product generations and allows streamlined manufacturing, while achieving lower cost and higher performance. “We are driven to enable progress and a carbon neutral future together with our customers. Innovation in batteries is key for the energy transition.” said Darpan Parikh, Director, Sales and Supply Chain, Americas, SABIC Specialties. “Working together with Eos has been instrumental to help us push the boundaries of material science to improve their application’s performance and manufacturing process.” “Scaling toward profitability is priority number one for us, and finding new materials and manufacturing processes to drive down cost moves us closer to this goal,” said Francis Richey, Senior Vice President of Research and Development at Eos. “On top of that cost benefit, replacing titanium with conductive composite thermoplastic also improves the overall performance of the battery, reduces weight and overall processing time.” This is the second major supply chain partnership announced by Eos in 2024, as the Company continues on its path to profitability outlined in its Dec. 12 Strategic Outlook. About Eos Energy Enterprises Eos Energy Enterprises is a leading provider of safe, scalable, and sustainable zinc-based battery storage systems. With a mission to deliver energy storage solutions that are efficient, reliable, and environmentally friendly, Eos is at the forefront of revolutionizing the global energy storage landscape. Eos’ pioneering technology offers a cost-effective and scalable alternative to

2 other stationary storage systems, enabling a clean energy future with improved grid reliability and resilience. About SABIC Specialties’ US Business Unit, SHPP US LLC SABIC Specialties’ US business unit, SHPP US LLC, is a fully owned affiliate company of SABIC. SABIC Specialties is set to work on the hard, difficult endeavors in technology that bring a fundamental progress to the way we travel, communicate, work and live. SABIC Specialties provides unique high performing resins, specialty chemicals, and functional compounds, to markets such as Telecommunications, Industrial Equipment, Infrastructure, Energy, Building & Construction, Healthcare, Electronics, Mass Transportation and Automotive. SABIC is a global diversified chemicals company, headquartered in Riyadh, Saudi Arabia. It manufactures on a global scale in the Americas, Europe, Middle East and Asia Pacific, making distinctly different kinds of products: chemicals, commodity and high-performance plastics, agri- nutrients and metals. SABIC recorded a net profit of SR 16.53 billion (US$ 4.41 billion) in 2022. Sales revenues for 2022 totaled SR 198.47 billion (US$ 52.92 billion). Total assets stood at SR 313 billion (US$ 83.46 billion) at the end of 2022. Production in 2022 stood at 61 million metric tons. The company has more than 31,000 employees worldwide and operates in around 50 countries. Fostering innovation and a spirit of ingenuity, SABIC has 9,948 patents and pending applications, and has significant research resources with innovation hubs in five key geographies – USA, Europe, Middle East, South Asia and North Asia. Forward Looking Statements Except for the historical information contained herein, the matters set forth in this press release are forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding cost reduction initiatives, including their timing and impact on financial performance, the development of efficient manufacturing processes at scale, improved product performance, and statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions. The words "anticipate," "believe," "continue," "could," "estimate," "expect," "intends," "may," "might," "plan," "possible," "potential," "predict," "project," "should," "would" and similar expressions may identify forward- looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are based on our management’s beliefs, as well as assumptions made by, and information currently available to, them. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. Factors which may cause actual results to differ materially from current expectations include, but are not limited to: changes adversely affecting the business in which we are engaged; our ability to forecast trends accurately; our ability to generate cash, service indebtedness and incur additional indebtedness; our ability to raise financing in the future; our customer’s ability to secure project financing; the amount of final tax credits available to our customers or to Eos Energy Enterprises, Inc. pursuant to the Inflation Reduction Act; uncertainties around our ability to secure conditional commitment in a timely manner or at all, or final approval of a loan from

3 the Department of Energy, the Loan Programs Office, or the timing of funding and the final size of any loan if approved; the possibility of a government shutdown while we remain in the due diligence phase with the U.S. Department of Energy Loan Programs Office or while we await notice of a decision regarding the issuance of a loan from the Department Energy Loan Programs Office; our ability to develop efficient manufacturing processes to scale and to forecast related costs and efficiencies accurately; our ability to reduce costs; fluctuations in our revenue and operating results; competition from existing or new competitors; the failure to convert firm order backlog and pipeline to revenue; risks associated with security breaches in our information technology systems; risks related to legal proceedings or claims; risks associated with evolving energy policies in the United States and other countries and the potential costs of regulatory compliance; risks associated with changes to U.S. trade environment; risks resulting from the impact of global pandemics, including the novel coronavirus, Covid-19; our ability to maintain the listing of our shares of common stock on NASDAQ; our ability to grow our business and manage growth profitably, maintain relationships with customers and suppliers and retain our management and key employees; risks related to adverse changes in general economic conditions, including inflationary pressures and increased interest rates; risk from supply chain disruptions and other impacts of geopolitical conflict; changes in applicable laws or regulations; and other risks and uncertainties. The forward- looking statements contained in this press release are also subject to additional risks, uncertainties, and factors, including those more fully described in the Company’s most recent filings with the Securities and Exchange Commission, including the Company’s most recent Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K, including those under the heading “Risk Factors” therein, and other factors identified in Eos’s prior and future SEC filings with the SEC, available at www.sec.gov. Further information on potential risks that could affect actual results will be included in the subsequent periodic and current reports and other filings that the Company makes with the Securities and Exchange Commission from time to time. Moreover, the Company operates in a very competitive and rapidly changing environment, and new risks and uncertainties may emerge that could have an impact on the forward-looking statements contained in this press release. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as required by law, the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Contacts Investors: ir@eose.com Media: media@eose.com

v3.24.0.1

Cover

|

Jan. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 31, 2024

|

| Document Information [Line Items] |

|

| Entity Registrant Name |

EOS ENERGY ENTERPRISES, INC.

|

| Entity Central Index Key |

0001805077

|

| Amendment Flag |

false

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39291

|

| Entity Tax Identification Number |

84-4290188

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3920 Park Avenue

|

| Entity Address, City or Town |

Edison

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08820

|

| City Area Code |

732

|

| Local Phone Number |

225-8400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

EOSE

|

| Security Exchange Name |

NASDAQ

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of common stock

|

| Trading Symbol |

EOSEW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

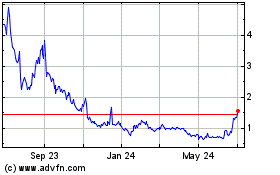

Eos Energy Enterprises (NASDAQ:EOSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

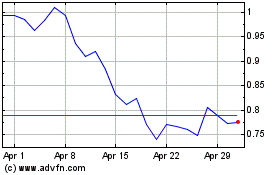

Eos Energy Enterprises (NASDAQ:EOSE)

Historical Stock Chart

From Apr 2023 to Apr 2024