UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

|

|

|

|

|

|

|

|

|

|

|

SEC FILE NUMBER

|

|

|

|

FORM 12b-25

|

|

0-24230

|

|

|

|

|

CUSIP NUMBER

|

|

|

|

|

|

29268T300

|

NOTIFICATION OF LATE FILING

(Check one)

☐ Form 10-K ☐ Form 20-F ☐ Form 11-K

☒

Form 10-Q

☐ Form 10-D ☐ Form N-SAR ☐ Form N-CSR

For Period Ended: March 31, 2019

☐ Transition Report on Form 10-K

☐ Transition Report on Form 20-F

☐ Transition Report on Form 11-K

☐ Transition Report on Form 10-Q

☐ Transition Report on Form N-SAR

For the Transition Period Ended:

|

|

|

|

|

Read Instructions (on back page) Before Preparing Form. Please Print or Type.

|

|

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

|

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I - REGISTRANT INFORMATION

Energy Focus, Inc.

(Full Name of Registrant)

(Former Name if Applicable)

32000 Aurora Road, Suite B

(Address of Principal Executive Office (

Street and Number

))

Solon, Ohio 44139

(City, State and Zip Code)

PART II - RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

|

|

|

|

|

|

|

|

(a)

|

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

|

|

|

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or

|

|

|

|

|

|

☐

|

|

Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

|

|

|

|

(c)

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III - NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

Energy Focus, Inc. (the “Company”) has determined that it is unable to file its Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2019 within the prescribed time period for the following reasons.

As previously announced on April 11, 2019, Plante & Moran, PLLC, the Company’s independent registered public accounting firm, declined to stand for reappointment for the fiscal year ending December 31, 2019. The Company initiated a request for proposal process to identify its auditors for 2019. A successor firm has not yet been engaged. The Company will be unable to file its first quarter 2019 Form 10-Q until such time that the successor firm has been engaged and has completed its review of the results for the quarter in accordance with Rules 10-01(d) and 8-03 of SEC Regulation S-X.

PART IV - OTHER INFORMATION

|

|

|

|

(1)

|

Name and telephone number of person to contact in regard to this notification

|

|

|

|

|

|

|

|

|

|

James Tu

|

|

(440)

|

|

715-1300

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

|

|

|

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). ☒ Yes ☐ No

|

|

|

|

|

(3)

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? ☒ Yes ☐ No

|

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

The Company notes for purposes of Question 3, that for the fiscal quarter ended March 31, 2018, it previously reported net sales of $4.7 million and a net loss of $2.4 million. The Company’s preliminary net sales estimate for the fiscal quarter ended March 31, 2019 is approximately $3.1 million to $3.2 million. In addition, preliminary net loss for the fiscal quarter ended March 31, 2019 is estimated to be approximately $2.6 million to $2.7 million. These estimates are subject to revision based on the outcome of the review of the Company’s financial statements as described above. The Company’s final results may differ materially from these estimates.

Forward-looking statements

Forward-looking statements in this Form 12b-25 are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Generally, these statements can be identified by the use of words such as “believes,” “estimates,” “anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “could,” “would” and similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include all matters that are not historical facts and include statements regarding our current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies, capital expenditures and the industry in which we operate. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Although we base these forward-looking statements on assumptions that we believe are reasonable when made, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and industry developments may differ materially from statements made in or suggested by the forward-looking statements contained in this release. We believe that important factors that could cause our actual results to differ materially from forward-looking statements include, but are not limited to: (i) our history of operating losses and our ability to effectively implement cost-cutting measures and generate sufficient cash from operations or receive sufficient financing, on acceptable terms, to continue our operations; (ii) our reliance on a limited number of customers, in particular our historical sales of products for the U.S. Navy, for a significant portion of our revenue, and our ability to maintain or grow such sales levels; (iii) the entrance of new competitors in our target markets; (iv) general economic conditions in the United States and in other markets in which we sell our products; (v) our ability to implement and manage our growth plans to

diversify our customer base, increase sales, and control expenses; (vi) our ability to increase demand in our targeted markets and to manage sales cycles that are difficult to predict and may span several quarters; (vii) the timing of large customer orders and significant expenses, and fluctuations between demand and capacity, as we invest in growth opportunities; (viii) our dependence on military maritime customers and on the levels of government funding available to such customers, as well as funding resources of our other customers in the public sector and commercial markets; (ix) market acceptance of LED lighting technology; (x) our ability to respond to new lighting technologies and market trends, and fulfill our warranty obligations with safe and reliable products; (xi) any delays we may encounter in making new products available or fulfilling customer specifications; (xii) our ability to compete effectively against companies with greater resources, lower cost structures, or more rapid development efforts; (xiii) our ability to protect our intellectual property rights and other confidential information, and manage infringement claims by others; (xiv) the impact of any type of legal inquiry, claim, or dispute; (xv) our reliance on a limited number of third-party suppliers, our ability to obtain critical components and finished products from such suppliers on acceptable terms, and the impact of our fluctuating demand on the stability of such suppliers; (xvi) our ability to timely and efficiently transport products from our third-party suppliers to our facility by ocean marine channels; (xvii) our ability to successfully scale our network of sales representatives, agents, and distributors to match the sales reach of larger, established competitors; (xviii) any flaws or defects in our products or in the manner in which they are used or installed; (xix) our compliance with government contracting laws and regulations, through both direct and indirect sale channels, as well as other laws, such as those relating to the environment and health and safety; (xx) risks inherent in international markets, such as economic and political uncertainty, changing regulatory and tax requirements, currency fluctuations and potential tariffs and other barriers to international trade; (xxi) our ability to attract and retain qualified personnel, and to do so in a timely manner; and (xxii) our ability to maintain effective internal controls and otherwise comply with our obligations as a public company and under Nasdaq listing standards.

Energy Focus, Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date

|

May 15, 2019

|

By

|

/s/ James Tu

|

|

|

|

|

Name: James Tu

|

|

|

|

|

Title: Chairman, Chief Executive Officer and

|

|

|

|

|

President and interim Chief Financial Officer

|

INSTRUCTION: The form may be signed by an executive officer of the registrant or by any other duly authorized representative. The name and title of the person signing the form shall be typed or printed beneath the signature. If the statement is signed on behalf of the registrant by an authorized representative (other than an executive officer), evidence of the representative’s authority to sign on behalf of the registrant shall be filed with the form.

ATTENTION

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

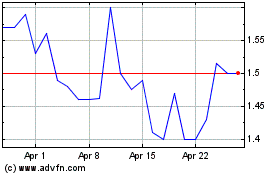

Energy Focus (NASDAQ:EFOI)

Historical Stock Chart

From Aug 2024 to Sep 2024

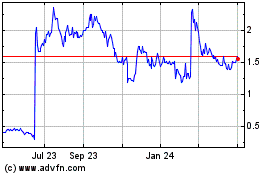

Energy Focus (NASDAQ:EFOI)

Historical Stock Chart

From Sep 2023 to Sep 2024