false000117764800011776482024-11-252024-11-250001177648dei:FormerAddressMember2024-11-252024-11-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 25, 2024 |

ENANTA PHARMACEUTICALS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35839 |

04-3205099 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4 Kingsbury Avenue |

|

Watertown, Massachusetts |

|

02472 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 607-0800 |

|

|

500 Arsenal Street |

Watertown, Massachusetts 02472 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

ENTA |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 25, 2024, Enanta Pharmaceuticals, Inc. announced via press release its results for the fiscal quarter and year-ended September 30, 2024. A copy of Enanta's press release is hereby furnished to the Commission and incorporated by reference herein as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

ENANTA PHARMACEUTICALS, INC. |

|

|

|

|

Date: |

November 25, 2024 |

By: |

/s/ Paul J. Mellett |

|

|

|

Paul J. Mellett

Chief Financial and Administrative Officer |

Exhibit 99.1

Enanta Pharmaceuticals Reports Financial Results for its Fiscal Fourth Quarter and Year-Ended September 30, 2024

•On Track to Report Topline Results for RSVPEDs, a Phase 2 Study of Zelicapavir in Infants and Children Infected with Respiratory Syncytial Virus (RSV), in December

•Announced Positive Topline Results for EDP-323 in a Phase 2a Human Challenge Study of Healthy Adults Infected with RSV

•Expands Immunology Portfolio with the Introduction of a New Discovery Program Focused on STAT6 Inhibition and the Nomination of EPS-1421, a Potent and Selective KIT Inhibitor Development Candidate

•Operations Supported by Cash and Marketable Securities Totaling $248.2 Million at September 30, 2024, as well as Continuing Retained Royalties

WATERTOWN, Mass., November 25, 2024 – Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA), a clinical-stage biotechnology company dedicated to creating small molecule drugs for virology and immunology indications, today reported financial results for its fiscal fourth quarter and year-ended September 30, 2024.

“Our fiscal fourth quarter was an exciting time for Enanta as we announced positive data from a Phase 2a human challenge study of EDP-323, our RSV L-inhibitor. We believe these results are among the strongest ever reported for an antiviral in an RSV challenge study, and significantly unlock further promise of our RSV program, in addition to advancing our leadership role in the RSV treatment landscape,” said Jay R. Luly, Ph.D., President and Chief Executive Officer at Enanta Pharmaceuticals. “With results from our RSVPEDs study of zelicapavir, our RSV N-inhibitor, expected in December, we could potentially have two of the leading clinical candidates for the treatment of RSV with different mechanisms of action, providing us with important optionality. The results of these studies will guide our decisions as we work to develop first-in-disease and best-in-class treatments for patients suffering from RSV.”

Dr. Luly added, “We also made notable progress in advancing and expanding our immunology portfolio with the nomination of EPS-1421 as our lead development candidate for our KIT inhibition program. We are excited about the potential for potent and selective, oral, small molecule inhibitors for the treatment of chronic spontaneous urticaria and possibly other mast cell driven diseases. We are also pleased to introduce our second discovery stage program to develop oral STAT6 inhibitors for the treatment of type 2 immune driven diseases, with an initial focus on the treatment of atopic dermatitis, and future expansion opportunities in asthma and other indications. With multiple ongoing programs in both virology and immunology, we are committed to advancing our pipeline to help patients and to create value for shareholders.”

Fiscal Fourth Quarter and Year-Ended September 30, 2024 Financial Results

Total revenue was $14.6 million for the three months ended September 30, 2024, which consisted of royalty revenue derived from worldwide net sales of AbbVie’s hepatitis C virus (HCV) regimen MAVYRET®/MAVIRET®, compared to royalty revenue of $18.9 million for the three months ended September 30, 2023. For the twelve months ended September 30, 2024, total revenue was $67.6 million compared to $79.2 million for the same period in 2023. The decrease in the quarter and in year-over-year revenue is due to a decline in AbbVie’s sales of MAVYRET®/MAVIRET®.

A portion (54.5%) of Enanta’s ongoing royalty revenue from AbbVie’s net sales of MAVYRET®/MAVIRET® is paid to OMERS, one of Canada’s largest defined benefit pension plans, pursuant to a royalty sale transaction affecting royalties earned after June 2023. For financial reporting purposes, the transaction was treated as debt, with the upfront purchase payment of $200.0 million recorded as a liability. Each quarter, Enanta records 100% of the royalty earned as revenue and then amortizes the debt liability proportionally as 54.5% of the cash royalty payments are paid to OMERS through June 30, 2032, subject to a cap of 1.42 times the purchase payment, after which point 100% of the cash royalty payments will be retained by Enanta. Interest expense was $2.6 million for the three months ended September 30, 2024 and $10.9 million for the twelve months ended September 30, 2024. This compares to interest expense of $3.2 million for the three months ended September 30, 2023 and $5.1 million for the twelve months ended September 30, 2023.

Research and development expenses were $30.8 million for the three months ended September 30, 2024, compared to $36.2 million for the three months ended September 30, 2023. For the twelve months ended September 30, 2024, research and development expenses were $131.5 million compared to $163.5 million for the same period in 2023. The decrease in the quarter and in year-over-year research and development expenses is primarily due to a decrease in costs associated with Enanta’s COVID-19 program as the company announced previously that plans to pursue any further COVID-19 efforts would be in the context of collaborations. These decreases were partially offset by increased costs associated with Enanta’s immunology programs.

General and administrative expenses totaled $13.7 million for the three months ended September 30, 2024, compared to $13.8 million for the three months ended September 30, 2023. For the twelve months ended September 30, 2024, general and administrative expenses were $57.9 million compared to $52.9 million in 2023. The increase in year-over-year general and administrative expenses was due to an increase in legal fees related to the company’s patent infringement suit against Pfizer.

Interest and investment income, net, totaled $3.2 million for the three months ended September 30, 2024, compared to $4.7 million for the three months ended September 30, 2023. The decrease was due to lower cash and investment balances year-over-year. For the twelve months ended September 30, 2024, interest and investment income, net, totaled $14.8 million compared to $11.4 million in 2023. The increase was due to an increase in average invested cash due to receipt of $200.0 million from OMERS in April 2023 as well as changes in interest rates year-over-year.

Enanta recorded an income tax benefit of $0.4 million for the three months ended September 30, 2024, compared to an income tax benefit of $1.4 million for the three months ended September 30, 2023. Enanta recorded an income tax benefit of $1.7 million for the twelve months ended September 30, 2024, compared to an income tax expense of $2.8 million for the twelve months ended September 30, 2023. The income tax benefit during 2024 was due to interest earned on a pending $28.7 million federal income tax refund. Despite recording a loss before taxes during the twelve months ended September 30, 2023, Enanta recorded tax expense driven by the receipt of the $200.0 million from OMERS, which is treated as income for Federal and State income tax purposes.

Net loss for the three months ended September 30, 2024, was $28.8 million, or a loss of $1.36 per diluted common share, compared to a net loss of $28.1 million, or a loss of $1.33 per diluted common share, for the corresponding period in 2023. For the twelve months ended September 30, 2024, net loss was $116.0 million, or a loss of $5.48 per diluted common share, compared to a net loss of $133.8 million, or loss of $6.38 per diluted common share for the corresponding period in 2023.

Enanta’s cash, cash equivalents and marketable securities totaled $248.2 million at September 30, 2024. Enanta expects that its current cash, cash equivalents and short-term marketable securities, as well as its continuing retained portion of royalty revenue, will continue to be sufficient to meet the anticipated cash requirements of its existing business and development programs into fiscal 2027.

Virology

RSV

•Enanta is progressing multiple clinical programs comprising a robust antiviral portfolio aimed at treating populations at high-risk for serious outcomes from RSV infection. This includes zelicapavir, Enanta’s lead, oral N-protein inhibitor, and EDP-323, its oral L-protein inhibitor, both of which received Fast Track designation from the U.S. Food and Drug Administration (FDA).

oZelicapavir is being evaluated in two Phase 2 clinical trials in high-risk pediatric and adult populations.

▪Enrollment is complete in RSVPEDs, a first-in-pediatrics Phase 2, randomized, double-blind, placebo-controlled study of zelicapavir in hospitalized and non-hospitalized RSV patients that are 28 days to three years of age. The company is on track to report topline data in December 2024.

▪RSVHR is a Phase 2b, randomized, double-blind, placebo-controlled study of zelicapavir in adults with RSV infection who are at high risk of complications, including age over 65 years and/or those with congestive heart failure, chronic obstructive pulmonary disease or asthma. Enrollment in RSVHR is progressing, and the company is targeting enrollment completion in the current Northern Hemisphere RSV season.

oEnanta’s second clinical RSV candidate, EDP-323, is a novel oral, direct-acting antiviral selectively targeting the RSV L-protein.

▪In September 2024, Enanta announced positive topline results for EDP-323 in a Phase 2a challenge study of healthy adults infected with RSV. Treatment with

EDP-323 achieved statistically significant (p=<0.0001) reductions in both viral load and clinical symptoms compared to placebo. Overall, EDP-323 was generally well-tolerated and demonstrated a favorable safety profile that was comparable to placebo over 5 days of dosing through Day 28 of follow-up. There were no serious adverse events and no discontinuations of EDP-323. With these positive results the company has a potential second approach for treating RSV that may offer a best-in-disease opportunity. Pending RSVPEDs data results, Enanta will provide next steps for EDP-323 and its RSV program.

Immunology

•Today, Enanta announced the expansion of its immunology portfolio which is focused on designing and developing highly potent and selective, oral small molecule inhibitors for the treatment of inflammatory diseases, by targeting key drivers of the type 2 immune response.

▪Enanta nominated EPS-1421 as its lead development candidate. EPS-1421 is a novel, potent and selective oral inhibitor of KIT, designed to treat chronic spontaneous urticaria and potentially other indications by depleting mast cells, thereby addressing a primary driver of these diseases.

▪EPS-1421 inhibits KIT with nanomolar potency in both binding and cellular assays and is highly selective for KIT versus other kinases. Further, EPS-1421 has demonstrated good in vitro and in vivo ADME properties preclinically. The company expects to conduct scale-up activities and IND enabling studies in 2025.

▪The company’s second discovery program is aimed at developing oral STAT6 inhibitors for the treatment of type 2 immune driven diseases and will initially focus on atopic dermatitis and potentially other indications by blocking the IL-4/IL-13 signaling pathway, thereby addressing a primary driver of these diseases.

▪Currently, Enanta is advancing novel, potent and selective oral inhibitors of STAT6. The company’s prototype inhibitors demonstrate potent activity and high selectivity for STAT6 over other STATs in both biochemical and cellular assays. Enanta continues to evaluate multiple compounds in preclinical studies and expects to conduct lead optimization activities for this program in 2025.

Corporate

•Enanta will not be holding a conference call with today’s fiscal fourth quarter and year-end update. The company will provide its next update with the release of the RSVPEDs study results, expected in December 2024.

About Enanta Pharmaceuticals, Inc.

Enanta is using its robust, chemistry-driven approach and drug discovery capabilities to become a leader in the discovery and development of small molecule drugs with an emphasis on indications in virology

and immunology. Enanta’s clinical programs are currently focused on respiratory syncytial virus (RSV) and its earlier-stage immunology pipeline aims to develop treatments for inflammatory diseases by targeting key drivers of the type 2 immune response, including KIT and STAT6 inhibition.

Glecaprevir, a protease inhibitor discovered by Enanta, is part of one of the leading treatment regimens for curing chronic hepatitis c virus (HCV) infection and is sold by AbbVie in numerous countries under the tradenames MAVYRET® (U.S.) and MAVIRET® (ex-U.S.) (glecaprevir/pibrentasvir). A portion of Enanta’s royalties from HCV products developed under its collaboration with AbbVie contribute ongoing funding to Enanta’s operations. Please visit www.enanta.com for more information.

Forward Looking Statements

This press release contains forward-looking statements, including statements with respect to the prospects for advancement of Enanta’s clinical programs in RSV and its preclinical programs targeting KIT and STAT6 inhibition. Statements that are not historical facts are based on management’s current expectations, estimates, forecasts and projections about Enanta’s business and the industry in which it operates and management’s beliefs and assumptions. The statements contained in this release are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed in such forward-looking statements. Important factors and risks that may affect actual results include: the impact of development, regulatory and marketing efforts of others with respect to vaccines and competitive treatments for RSV; the discovery and development risks of Enanta’s programs in virology and immunology; Enanta’s lack of clinical development experience; Enanta’s need to attract and retain senior management and key research and development personnel; Enanta’s need to obtain and maintain patent protection for its product candidates and avoid potential infringement of the intellectual property rights of others; and other risk factors described or referred to in “Risk Factors” in Enanta’s Form 10-K for the fiscal year ended September 30, 2023, and any other periodic reports filed more recently with the Securities and Exchange Commission. Enanta cautions investors not to place undue reliance on the forward-looking statements contained in this release. These statements speak only as of the date of this release, and Enanta undertakes no obligation to update or revise these statements, except as may be required by law.

Media and Investors Contact:

Jennifer Viera

jviera@enanta.com

#

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENANTA PHARMACEUTICALS, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|

UNAUDITED |

|

(in thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

14,607 |

|

|

$ |

18,932 |

|

|

$ |

67,635 |

|

|

$ |

79,204 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

30,778 |

|

|

|

36,167 |

|

|

|

131,476 |

|

|

|

163,524 |

|

General and administrative |

|

13,683 |

|

|

|

13,795 |

|

|

|

57,850 |

|

|

|

52,887 |

|

Total operating expenses |

|

44,461 |

|

|

|

49,962 |

|

|

|

189,326 |

|

|

|

216,411 |

|

Loss from operations |

|

(29,854 |

) |

|

|

(31,030 |

) |

|

|

(121,691 |

) |

|

|

(137,207 |

) |

Interest expense |

|

|

|

(2,581 |

) |

|

|

(3,151 |

) |

|

|

(10,940 |

) |

|

|

(5,148 |

) |

Interest and investment income, net |

|

3,249 |

|

|

|

4,664 |

|

|

|

14,843 |

|

|

|

11,360 |

|

Loss before income taxes |

|

(29,186 |

) |

|

|

(29,517 |

) |

|

|

(117,788 |

) |

|

|

(130,995 |

) |

Income tax benefit (expense) |

|

363 |

|

|

|

1,410 |

|

|

|

1,743 |

|

|

|

(2,821 |

) |

Net loss |

$ |

(28,823 |

) |

|

$ |

(28,107 |

) |

|

$ |

(116,045 |

) |

|

$ |

(133,816 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(1.36 |

) |

|

$ |

(1.33 |

) |

|

$ |

(5.48 |

) |

|

$ |

(6.38 |

) |

|

Diluted |

$ |

(1.36 |

) |

|

$ |

(1.33 |

) |

|

$ |

(5.48 |

) |

|

$ |

(6.38 |

) |

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

21,190 |

|

|

|

21,057 |

|

|

|

21,157 |

|

|

|

20,969 |

|

|

Diluted |

|

21,190 |

|

|

|

21,057 |

|

|

|

21,157 |

|

|

|

20,969 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENANTA PHARMACEUTICALS, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

UNAUDITED |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

37,233 |

|

|

$ |

85,388 |

|

|

Short-term marketable securities |

|

210,953 |

|

|

|

284,522 |

|

|

Accounts receivable |

|

6,646 |

|

|

|

8,614 |

|

|

Prepaid expenses and other current assets |

|

12,413 |

|

|

|

13,263 |

|

|

Income tax receivable |

|

31,999 |

|

|

|

31,004 |

|

|

Short-term restricted cash |

|

608 |

|

|

|

— |

|

|

|

Total current assets |

|

299,852 |

|

|

|

422,791 |

|

Property and equipment, net |

|

32,688 |

|

|

|

11,919 |

|

Operating lease, right-of-use assets |

|

40,658 |

|

|

|

22,794 |

|

Long-term restricted cash |

|

3,360 |

|

|

|

3,968 |

|

Other long-term assets |

|

94 |

|

|

|

803 |

|

|

|

Total assets |

$ |

376,652 |

|

|

$ |

462,275 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

8,002 |

|

|

$ |

4,097 |

|

|

Accrued expenses and other current liabilities |

|

13,547 |

|

|

|

18,339 |

|

|

Liability related to the sale of future royalties |

|

34,462 |

|

|

|

35,076 |

|

|

Operating lease liabilities |

|

1,524 |

|

|

|

5,275 |

|

|

|

Total current liabilities |

|

57,535 |

|

|

|

62,787 |

|

Liability related to the sale of future royalties, net of current portion |

|

134,779 |

|

|

|

159,429 |

|

Operating lease liabilities, net of current portion |

|

53,943 |

|

|

|

21,238 |

|

Series 1 nonconvertible preferred stock |

|

1,350 |

|

|

|

1,423 |

|

Other long-term liabilities |

|

231 |

|

|

|

663 |

|

|

|

Total liabilities |

|

247,838 |

|

|

|

245,540 |

|

Total stockholders' equity |

|

128,814 |

|

|

|

216,735 |

|

|

|

Total liabilities and stockholders' equity |

$ |

376,652 |

|

|

$ |

462,275 |

|

|

|

|

|

|

|

|

|

|

v3.24.3

Document And Entity Information

|

Nov. 25, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 25, 2024

|

| Entity Registrant Name |

ENANTA PHARMACEUTICALS, INC.

|

| Entity Central Index Key |

0001177648

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-35839

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

04-3205099

|

| Entity Address, Address Line One |

4 Kingsbury Avenue

|

| Entity Address, City or Town |

Watertown

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02472

|

| City Area Code |

(617)

|

| Local Phone Number |

607-0800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

ENTA

|

| Security Exchange Name |

NASDAQ

|

| Former Address [Member] |

|

| Document Information [Line Items] |

|

| Entity Address, Address Line One |

500 Arsenal Street

|

| Entity Address, City or Town |

Watertown

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02472

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

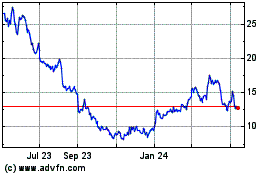

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Oct 2024 to Nov 2024

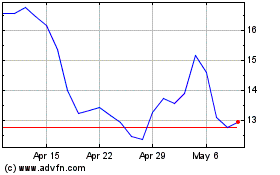

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Nov 2023 to Nov 2024