false000117764800011776482024-08-052024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 05, 2024 |

ENANTA PHARMACEUTICALS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35839 |

04-3205099 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

500 Arsenal Street |

|

Watertown, Massachusetts |

|

02472 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 607-0800 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

ENTA |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 5, 2024, Enanta Pharmaceuticals, Inc. announced via press release its results for the fiscal quarter ended June 30, 2024. A copy of Enanta's press release is hereby furnished to the Commission and incorporated by reference herein as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

ENANTA PHARMACEUTICALS, INC. |

|

|

|

|

Date: |

August 5, 2024 |

By: |

/s/ Paul J. Mellett |

|

|

|

Paul J. Mellett

Chief Financial and Administrative Officer |

Exhibit 99.1

Enanta Pharmaceuticals Reports Financial Results for its Fiscal Third Quarter

•Announces Completion of Enrollment of RSVPEDs, a Phase 2 Study of Zelicapavir in Pediatric Respiratory Syncytial Virus (RSV) Patients; On Track to Report Topline Data in Q4 2024

•Announces Completion of EDP-323 Phase 2a Challenge Study in RSV; On Track to Report Topline Data in Late Q3 2024

•Operations Supported by Cash and Marketable Securities Totaling $272.6 Million at June 30, 2024, as well as Continuing Retained Royalties

WATERTOWN, Mass., August 5, 2024 – Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA), a clinical-stage biotechnology company dedicated to creating small molecule drugs for virology and immunology indications, today reported financial results for its fiscal third quarter ended June 30, 2024.

“We are thrilled to announce that we have completed enrollment of RSVPEDs, our first-in-pediatrics study of zelicapavir, an N-protein inhibitor, and anticipate reporting topline data next quarter. We thank all the patients, caregivers and investigators involved in this important study for pediatric health,” said Jay R. Luly, Ph.D., President and Chief Executive Officer at Enanta Pharmaceuticals. “This is a key milestone in the ongoing advancement of our robust clinical RSV portfolio, aimed at addressing the significant unmet need in populations at high risk for severe outcomes from RSV. As we advance two potentially first-in-class oral antiviral replication inhibitors with differentiated mechanisms of action, our potent L-protein inhibitor, EDP-323, has completed the Phase 2a human challenge study and we remain on track to announce topline data this quarter.”

Fiscal Third Quarter Ended June 30, 2024 Financial Results

Total revenue for the three months ended June 30, 2024 was $18.0 million and consisted of royalty revenue from worldwide net sales of AbbVie’s hepatitis C virus (HCV) regimen MAVYRET®/MAVIRET® (glecaprevir/pibrentasvir), compared to $18.9 million for the three months ended June 30, 2023.

A portion (54.5%) of Enanta’s ongoing royalty revenue from AbbVie’s net sales of MAVYRET®/MAVIRET® is paid to OMERS, one of Canada’s largest defined benefit pension plans, pursuant to a royalty sale transaction affecting royalties earned after June 2023. For financial reporting purposes, the transaction was treated as debt, with the upfront purchase payment of $200.0 million recorded as a liability. Each quarter, Enanta records 100% of the royalty earned as revenue and then amortizes the debt liability proportionally as 54.5% of the cash royalty payments are paid to OMERS through June 30, 2032 subject to a cap of 1.42 times the purchase payment, after which point 100% of the cash royalty payments will

be retained by Enanta. Interest expense from the royalty sale was $2.4 million for the three months ended June 30, 2024.

Research and development expenses totaled $28.7 million for the three months ended June 30, 2024, compared to $43.0 million for the three months ended June 30, 2023. The decrease was primarily due to a decrease in costs associated with Enanta’s COVID-19 program, as the company announced previously that plans to pursue any future COVID-19 efforts would be in the context of a collaboration. This decrease was partially offset by increased costs associated with Enanta’s immunology programs.

General and administrative expenses totaled $13.4 million for the three months ended June 30, 2024, compared to $12.6 million for the three months ended June 30, 2023. The increase was primarily due to an increase in legal expenses related to the company’s patent infringement lawsuit against Pfizer.

Enanta recorded income tax benefit of $0.4 million for the three months ended June 30, 2024, due to interest earned on a pending $28.0 million federal income tax refund, compared to an income tax expense of $4.2 million for the three months ended June 30, 2023, driven by the receipt of the $200.0 million from the royalty sale agreement in April 2023 which was taxable for federal and state purposes.

Net loss for the three months ended June 30, 2024 was $22.7 million, or a loss of $1.07 per diluted common share, compared to a net loss of $39.1 million, or a loss of $1.86 per diluted common share, for the corresponding period in 2023.

Enanta’s cash, cash equivalents and short-term and long-term marketable securities totaled $272.6 million at June 30, 2024. Enanta expects that its current cash, cash equivalents and marketable securities and its continuing portion of cash from future royalty revenue, should be sufficient to meet the anticipated cash requirements of its existing business and development programs through the third quarter of fiscal 2027.

Virology

RSV

•Enanta is progressing multiple clinical programs comprising a robust antiviral portfolio aimed at treating populations at high-risk for serious outcomes from RSV infection. This includes zelicapavir, Enanta’s lead, oral N-protein inhibitor, and EDP-323, its oral L-protein inhibitor.

oZelicapavir is being evaluated in two Phase 2 clinical trials in high-risk pediatric and adult populations.

▪Enrollment is now complete in RSVPEDs, a first-in-pediatrics Phase 2, randomized, double-blind, placebo-controlled study of zelicapavir in hospitalized and non-hospitalized RSV patients that are 28 days to three years of age. Enanta anticipates reporting topline data in the fourth quarter of 2024.

▪RSVHR is a Phase 2b, randomized, double-blind, placebo-controlled study of zelicapavir in adults with RSV infection who are at high risk of complications, including the elderly and/or those with congestive heart failure, chronic

obstructive pulmonary disease or asthma. Enrollment in RSVHR is progressing, and the company is targeting enrollment completion in the upcoming Northern Hemisphere RSV season.

oEnanta completed its Phase 2a challenge study of EDP-323 and is on track to announce topline data in late third quarter. This randomized, double-blind, placebo-controlled, human challenge study evaluated the safety, pharmacokinetics, and changes in viral load measurements and symptoms in healthy adult subjects who were infected with RSV.

Immunology

•Enanta continues to advance its initial immunology program aimed at developing KIT inhibitors to treat chronic spontaneous urticaria (CSU), a highly debilitating inflammatory skin disease characterized by severe and recurrent hives that can last for years. Enanta's goal is to address the significant unmet need in CSU treatment by developing an oral KIT inhibitor therapy that targets mast cells, which play a crucial role in the disease, and potentially other mast cell driven diseases.

oPreclinical optimization of Enanta’s potent and selective oral KIT inhibitors is ongoing. The company continues to evaluate multiple compounds with the goal of nominating a best-in-class clinical candidate in the fourth quarter of 2024.

•Enanta plans to expand its presence in immunology with the introduction of a second program in the fourth quarter of 2024.

Corporate

•Enanta will not be holding a conference call with today’s quarterly update. The company will provide its next update with the release of the EDP-323 challenge study results, expected in late third quarter of 2024.

Upcoming Events and Presentations

•H.C. Wainwright Annual Global Investment Conference, September 10, 2024

•Baird Global Healthcare Conference, September 11, 2024

•Cantor Global Healthcare Conference, September 17, 2024

•Enanta plans to issue its full year and fiscal fourth quarter financial results press release on November 25, 2024.

About Enanta Pharmaceuticals, Inc.

Enanta is using its robust, chemistry-driven approach and drug discovery capabilities to become a leader in the discovery and development of small molecule drugs with an emphasis on indications in virology and immunology. Enanta’s research and development programs are currently focused on respiratory syncytial virus (RSV) and chronic spontaneous urticaria (CSU) and the company has previously advanced clinical-stage compounds for SARS-CoV-2 (COVID-19) and chronic hepatitis B virus (HBV) infection.

Glecaprevir, a protease inhibitor discovered by Enanta, is part of one of the leading treatment regimens for curing chronic hepatitis c virus (HCV) infection and is sold by AbbVie in numerous countries under the tradenames MAVYRET® (U.S.) and MAVIRET® (ex-U.S.) (glecaprevir/pibrentasvir). A portion of Enanta’s royalties from HCV products developed under its collaboration with AbbVie contribute ongoing funding to Enanta’s operations. Please visit www.enanta.com for more information.

Forward Looking Statements

This press release contains forward-looking statements, including statements with respect to the prospects for advancement of Enanta’s clinical programs in RSV and its preclinical program in CSU. Statements that are not historical facts are based on management’s current expectations, estimates, forecasts and projections about Enanta’s business and the industry in which it operates and management’s beliefs and assumptions. The statements contained in this release are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed in such forward-looking statements. Important factors and risks that may affect actual results include: the impact of development, regulatory and marketing efforts of others with respect to vaccines and competitive treatments for RSV and CSU; the discovery and development risks of Enanta’s programs in virology and immunology; Enanta’s lack of clinical development experience; Enanta’s need to attract and retain senior management and key research and development personnel; Enanta’s need to obtain and maintain patent protection for its product candidates and avoid potential infringement of the intellectual property rights of others; and other risk factors described or referred to in “Risk Factors” in Enanta’s Form 10-K for the fiscal year ended September 30, 2023, and any other periodic reports filed more recently with the Securities and Exchange Commission. Enanta cautions investors not to place undue reliance on the forward-looking statements contained in this release. These statements speak only as of the date of this release, and Enanta undertakes no obligation to update or revise these statements, except as may be required by law.

Media and Investors Contact:

Jennifer Viera

jviera@enanta.com

#

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENANTA PHARMACEUTICALS, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|

UNAUDITED |

|

(in thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

17,971 |

|

|

$ |

18,892 |

|

|

$ |

53,028 |

|

|

$ |

60,272 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

28,742 |

|

|

|

42,987 |

|

|

|

100,698 |

|

|

|

127,357 |

|

General and administrative |

|

13,414 |

|

|

|

12,618 |

|

|

|

44,167 |

|

|

|

39,092 |

|

Total operating expenses |

|

42,156 |

|

|

|

55,605 |

|

|

|

144,865 |

|

|

|

166,449 |

|

Loss from operations |

|

(24,185 |

) |

|

|

(36,713 |

) |

|

|

(91,837 |

) |

|

|

(106,177 |

) |

Interest expense |

|

|

|

(2,355 |

) |

|

|

(1,997 |

) |

|

|

(8,359 |

) |

|

|

(1,997 |

) |

Interest and investment income, net |

|

3,487 |

|

|

|

3,866 |

|

|

|

11,594 |

|

|

|

6,696 |

|

Loss before income taxes |

|

(23,053 |

) |

|

|

(34,844 |

) |

|

|

(88,602 |

) |

|

|

(101,478 |

) |

Income tax benefit (expense) |

|

395 |

|

|

|

(4,221 |

) |

|

|

1,380 |

|

|

|

(4,231 |

) |

Net loss |

$ |

(22,658 |

) |

|

$ |

(39,065 |

) |

|

$ |

(87,222 |

) |

|

$ |

(105,709 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(1.07 |

) |

|

$ |

(1.86 |

) |

|

$ |

(4.12 |

) |

|

$ |

(5.05 |

) |

|

Diluted |

$ |

(1.07 |

) |

|

$ |

(1.86 |

) |

|

$ |

(4.12 |

) |

|

$ |

(5.05 |

) |

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

21,180 |

|

|

|

21,054 |

|

|

|

21,145 |

|

|

|

20,939 |

|

|

Diluted |

|

21,180 |

|

|

|

21,054 |

|

|

|

21,145 |

|

|

|

20,939 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENANTA PHARMACEUTICALS, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

UNAUDITED |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

|

September 30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

35,775 |

|

|

$ |

85,388 |

|

|

Short-term marketable securities |

|

194,310 |

|

|

|

284,522 |

|

|

Accounts receivable |

|

8,176 |

|

|

|

8,614 |

|

|

Prepaid expenses and other current assets |

|

15,260 |

|

|

|

13,263 |

|

|

Income tax receivable |

|

32,455 |

|

|

|

31,004 |

|

|

Short-term restricted cash |

|

608 |

|

|

|

— |

|

|

|

Total current assets |

|

286,584 |

|

|

|

422,791 |

|

Long-term marketable securities |

|

42,510 |

|

|

|

- |

|

Property and equipment, net |

|

25,051 |

|

|

|

11,919 |

|

Operating lease, right-of-use assets |

|

41,211 |

|

|

|

22,794 |

|

Long-term restricted cash |

|

3,360 |

|

|

|

3,968 |

|

Other long-term assets |

|

105 |

|

|

|

803 |

|

|

|

Total assets |

$ |

398,821 |

|

|

$ |

462,275 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

10,675 |

|

|

$ |

4,097 |

|

|

Accrued expenses and other current liabilities |

|

12,830 |

|

|

|

18,339 |

|

|

Liability related to the sale of future royalties |

|

32,295 |

|

|

|

35,076 |

|

|

Operating lease liabilities |

|

2,431 |

|

|

|

5,275 |

|

|

|

Total current liabilities |

|

58,231 |

|

|

|

62,787 |

|

Liability related to the sale of future royalties, net of current portion |

|

141,889 |

|

|

|

159,429 |

|

Operating lease liabilities, net of current portion |

|

48,136 |

|

|

|

21,238 |

|

Series 1 nonconvertible preferred stock |

|

1,423 |

|

|

|

1,423 |

|

Other long-term liabilities |

|

227 |

|

|

|

663 |

|

|

|

Total liabilities |

|

249,906 |

|

|

|

245,540 |

|

Total stockholders' equity |

|

148,915 |

|

|

|

216,735 |

|

|

|

Total liabilities and stockholders' equity |

$ |

398,821 |

|

|

$ |

462,275 |

|

|

|

|

|

|

|

|

|

|

v3.24.2.u1

Document And Entity Information

|

Aug. 05, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 05, 2024

|

| Entity Registrant Name |

ENANTA PHARMACEUTICALS, INC.

|

| Entity Central Index Key |

0001177648

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-35839

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

04-3205099

|

| Entity Address, Address Line One |

500 Arsenal Street

|

| Entity Address, City or Town |

Watertown

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02472

|

| City Area Code |

(617)

|

| Local Phone Number |

607-0800

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

ENTA

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

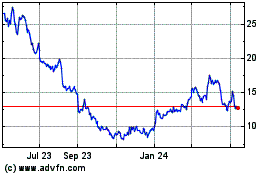

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Oct 2024 to Nov 2024

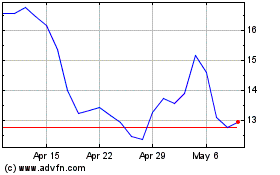

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Nov 2023 to Nov 2024